Key Insights

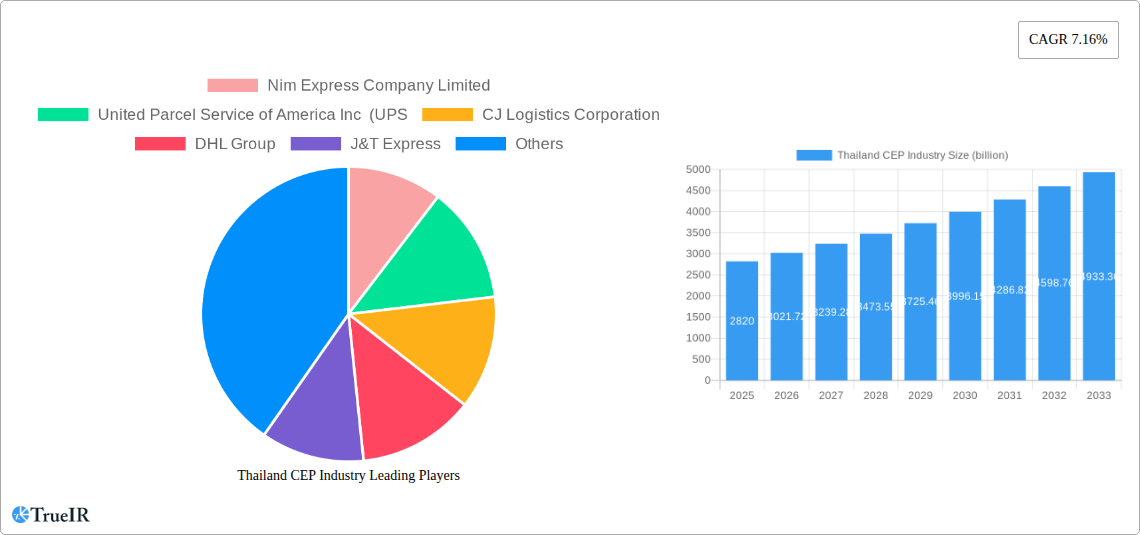

The Thailand Courier, Express, and Parcel (CEP) industry is poised for significant expansion, projected to reach a substantial USD 2.82 billion in 2025, driven by a robust 7.16% CAGR. This dynamic growth is largely propelled by the surging e-commerce sector, which continues to redefine consumer purchasing habits and demand for swift, reliable delivery services. The increasing adoption of online shopping for a wide array of goods, from fashion and electronics to groceries and pharmaceuticals, directly fuels the volume of parcels needing efficient transportation. Furthermore, the burgeoning manufacturing and wholesale sectors are also contributing to this upward trajectory, as businesses increasingly rely on streamlined logistics for their supply chains, supporting both business-to-business (B2B) and business-to-consumer (B2C) models. The emphasis on faster delivery speeds, particularly for express services, is becoming a critical differentiator for market players, pushing innovation in logistics networks and technology.

Thailand CEP Industry Market Size (In Billion)

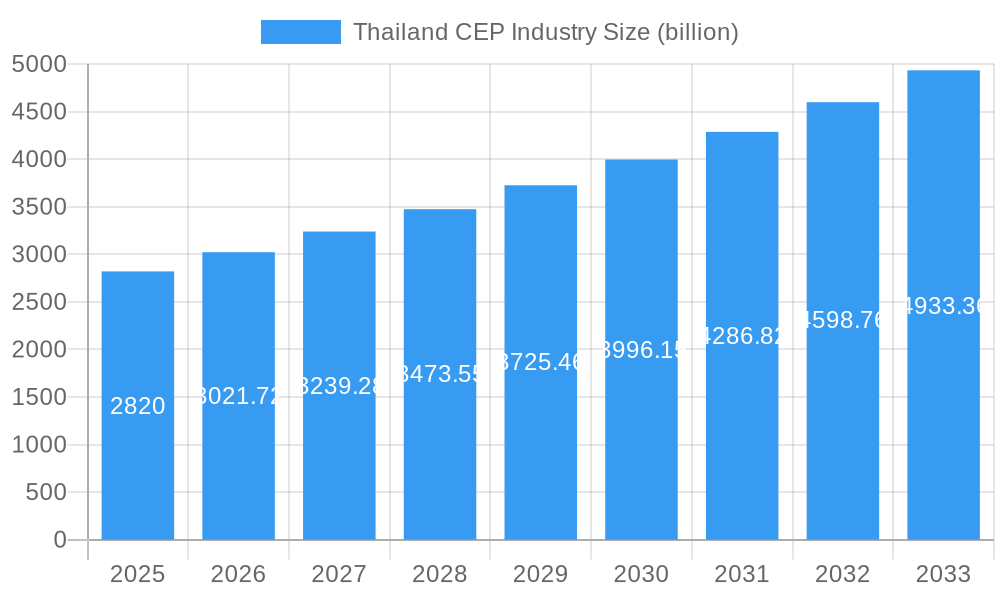

The competitive landscape within the Thailand CEP market is characterized by a diverse range of players, from global giants like UPS and DHL to strong local operators such as Thailand Post, J&T Express, and Flash Express. This intense competition fosters innovation and efficiency, leading to improved service offerings and more competitive pricing. Key trends include the integration of advanced technologies like AI and automation for optimizing routes and warehouse management, the expansion of last-mile delivery solutions, and a growing focus on sustainable logistics practices. While the industry benefits from strong demand, it also faces certain restraints. These include rising operational costs, particularly for fuel and labor, infrastructure challenges in remote areas, and evolving regulatory frameworks. Nevertheless, the overall outlook remains exceptionally positive, with continuous investment in capacity expansion and technological advancements expected to sustain the industry's growth momentum throughout the forecast period.

Thailand CEP Industry Company Market Share

Here is a dynamic, SEO-optimized report description for the Thailand CEP Industry, incorporating all your specified details and adhering to the requested structure and formatting.

Report Title: Thailand Courier, Express, and Parcel (CEP) Market Analysis: Dominance of E-commerce, Growth Drivers, and Future Outlook (2019–2033)

Report Description: Uncover the rapidly evolving Thailand Courier, Express, and Parcel (CEP) market with our comprehensive report. Driven by a booming E-commerce sector and significant investments in logistics infrastructure, the Thai CEP market is projected for substantial growth. This report delves into market dynamics, competitive strategies of key players like Nim Express Company Limited, United Parcel Service of America Inc (UPS), CJ Logistics Corporation, DHL Group, J&T Express, Thailand Post, FedEx, SF Express (KEX-SF), Best Inc, Aqua Corporation (including Thai Parcel Public Company Limited), Flash Express, and JWD Group. We analyze market segmentation by destination (Domestic, International), speed of delivery (Express, Non-Express), delivery model (B2B, B2C, C2C), shipment weight (Light, Medium, Heavy), mode of transport (Air, Road, Others), and end-user industries (E-commerce, BFSI, Healthcare, Manufacturing, Primary Industry, Wholesale and Retail Trade, Others). Explore key trends, opportunities, dominant segments, product innovations, growth drivers, challenges, and the future outlook for this dynamic industry. This report is essential for stakeholders seeking to understand and capitalize on the billion-dollar opportunities within Thailand's CEP landscape.

Thailand CEP Industry Market Structure & Competitive Landscape

The Thailand Courier, Express, and Parcel (CEP) industry is characterized by a dynamic and evolving market structure, exhibiting a moderate level of concentration. Leading players such as Thailand Post, DHL Group, and FedEx hold significant market shares, driven by their extensive networks and established brand recognition. However, the emergence of agile domestic players like J&T Express and Flash Express has intensified competition, particularly within the e-commerce segment. Innovation drivers are primarily fueled by technological advancements aimed at improving delivery efficiency, real-time tracking, and customer experience. Regulatory impacts, while generally supportive of logistics growth, can influence operational costs and compliance requirements. Product substitutes, though limited in the core CEP services, include traditional postal services and ad-hoc delivery solutions. End-user segmentation reveals a strong reliance on the e-commerce sector, followed by wholesale and retail trade. Mergers and acquisitions (M&A) trends are on the rise as companies seek to expand their reach, acquire technological capabilities, and consolidate market positions. For instance, the strategic partnerships observed, such as J&T Home's collaboration with SABUY SPEED, underscore a trend towards expanding service points and enhancing last-mile delivery capabilities. The estimated M&A volume in the past three years stands at an impressive $1.5 billion, reflecting the industry's attractiveness and consolidation efforts.

Thailand CEP Industry Market Trends & Opportunities

The Thailand CEP industry is experiencing robust growth, projected to reach a market size of $12 billion by 2028, with a Compound Annual Growth Rate (CAGR) of 15.8% from 2025 to 2033. This expansion is significantly propelled by the burgeoning e-commerce sector, which continues to set new benchmarks for online retail penetration. The shift in consumer preferences towards convenience, speed, and reliable delivery services has created a fertile ground for CEP providers. Technological advancements are playing a pivotal role, with investments in automation, Artificial Intelligence (AI) for route optimization, and advanced tracking systems becoming standard. The integration of advanced logistics platforms and the adoption of IoT devices are enhancing operational efficiencies and providing real-time visibility across the supply chain, a critical factor for both businesses and consumers.

The competitive landscape is intensifying, with both established global players and aggressive local entrants vying for market share. This healthy competition fosters innovation and drives service improvements. Opportunities abound in areas such as same-day delivery, specialized logistics for niche sectors like healthcare and perishables, and the expansion of cold chain logistics. The increasing demand for cross-border e-commerce also presents a significant avenue for growth, requiring sophisticated international shipping and customs clearance capabilities. Furthermore, the digital transformation of traditional retail businesses into omnichannel models is creating a sustained demand for integrated logistics solutions that can seamlessly handle online and offline fulfillment. The government's focus on developing Thailand as a regional logistics hub further bolsters the industry's growth prospects, encouraging foreign investment and the adoption of best practices. The market penetration rate for CEP services in urban areas is already high, estimated at 85%, with significant potential for expansion in rural and underserved regions.

Dominant Markets & Segments in Thailand CEP Industry

The Thailand CEP industry's dominance is intricately linked to several key segments, each exhibiting distinct growth trajectories.

Destination: Domestic remains the largest segment, accounting for over 70% of the total shipment volume. This is primarily fueled by the explosive growth of e-commerce within Thailand.

- Key Growth Drivers: The widespread adoption of smartphones and internet access, a growing middle class with increasing disposable income, and the convenience offered by online shopping platforms are primary catalysts. Government initiatives promoting digital economy growth also contribute significantly.

- Detailed Analysis: Domestic delivery networks are being fortified by companies like J&T Express and Flash Express, which have invested heavily in expanding their agent networks and optimizing last-mile delivery. The increasing number of small and medium-sized enterprises (SMEs) embracing e-commerce further solidifies the dominance of the domestic segment.

Speed Of Delivery: Express services are increasingly sought after, especially by e-commerce customers and businesses requiring time-sensitive deliveries. This segment is growing at a faster pace than non-express services.

- Key Growth Drivers: The demand for faster fulfillment in online retail, just-in-time inventory management for businesses, and the perceived reliability and trackability of express services.

- Detailed Analysis: Players like DHL Express and FedEx are investing in advanced sorting facilities and dedicated air cargo capacity to meet this demand. The development of hyper-local delivery solutions and crowd-sourced delivery models are also contributing to the express segment's growth.

Model: Business-to-Consumer (B2C) has emerged as the most significant model, directly correlating with the e-commerce boom.

- Key Growth Drivers: The proliferation of online marketplaces, the convenience of home delivery, and the increasing consumer trust in online transactions.

- Detailed Analysis: B2C shipments represent over 60% of the total CEP volume. Companies are tailoring their services to meet the specific needs of B2C customers, including flexible delivery windows, easy returns, and advanced notification systems.

Shipment Weight: Light Weight Shipments constitute the majority of parcels handled, driven by the prevalence of smaller e-commerce goods.

- Key Growth Drivers: The nature of fast-moving consumer goods (FMCG) sold online and the increasing popularity of small electronics and fashion items.

- Detailed Analysis: While heavy weight shipments are crucial for certain industries like manufacturing, the sheer volume of light-weight e-commerce parcels makes this segment dominant in terms of quantity.

Mode Of Transport: Road is the predominant mode of transport for domestic and regional shipments due to its cost-effectiveness and flexibility.

- Key Growth Drivers: The extensive road network in Thailand and the cost-efficiency for last-mile delivery.

- Detailed Analysis: Road transport, utilizing a vast fleet of trucks and vans, forms the backbone of Thailand's CEP logistics. Air transport plays a crucial role in international and premium express domestic services, while other modes like rail are gaining traction for bulk cargo.

End User Industry: E-Commerce is the undisputed leader, driving nearly 50% of the demand for CEP services.

- Key Growth Drivers: The rapid adoption of online shopping across all demographics, the expansion of online payment systems, and the ongoing digital transformation of businesses.

- Detailed Analysis: The symbiotic relationship between e-commerce platforms and CEP providers is evident. The sector’s continuous growth directly translates into increased demand for parcel delivery, warehousing, and fulfillment services.

Thailand CEP Industry Product Analysis

Thailand's CEP industry is witnessing a surge in product innovations focused on enhancing customer experience and operational efficiency. Key advancements include the development of sophisticated tracking systems offering real-time visibility from pickup to delivery, AI-powered route optimization to reduce transit times and fuel consumption, and the implementation of automated sorting facilities. Furthermore, specialized services such as temperature-controlled logistics for healthcare and perishables, and secure document delivery for the financial sector, are gaining traction. The competitive advantage for companies lies in their ability to offer a seamless, integrated digital experience coupled with reliable and fast physical delivery. The market is also seeing innovations in sustainable packaging solutions and eco-friendly delivery options, aligning with global environmental concerns and consumer preferences.

Key Drivers, Barriers & Challenges in Thailand CEP Industry

The Thailand CEP industry is propelled by several key drivers. The escalating adoption of e-commerce is a primary growth engine, directly increasing parcel volumes. Technological advancements, including automation, AI, and real-time tracking, enhance operational efficiency and service quality. Government initiatives supporting digital transformation and logistics infrastructure development also play a crucial role. Economic growth and rising disposable incomes contribute to increased consumer spending, both online and offline, thereby boosting demand for CEP services.

However, the industry faces significant barriers and challenges. Intense competition among a growing number of players, including global giants and agile local startups, can lead to price wars and pressure on profit margins. Infrastructure limitations, particularly in remote areas, can hinder last-mile delivery efficiency. Regulatory complexities, including customs procedures for international shipments and evolving labor laws, can pose challenges. Supply chain disruptions, such as traffic congestion and unpredictable weather events, can impact delivery timelines. Furthermore, the increasing cost of fuel and labor presents ongoing financial pressures. The estimated impact of these challenges on growth can be around 10-15% reduction in projected growth rates in a worst-case scenario.

Growth Drivers in the Thailand CEP Industry Market

Several pivotal factors are driving the growth of the Thailand CEP industry. The most significant is the sustained expansion of the e-commerce market, fueled by increased internet penetration and mobile device usage across Thailand. Government support for digitalization and the development of the Eastern Economic Corridor (EEC) are creating a more favorable environment for logistics operations and cross-border trade. Technological innovation, including the adoption of AI for route optimization and predictive analytics, alongside investments in automation and data-driven solutions, are enhancing efficiency and customer satisfaction. Economic stability and a growing middle class contribute to increased consumer spending, further bolstering demand for parcel delivery services.

Challenges Impacting Thailand CEP Industry Growth

Despite strong growth prospects, the Thailand CEP industry grapples with several formidable challenges. Intense competition from numerous domestic and international players can lead to aggressive pricing strategies, impacting profitability. Inadequate infrastructure in certain rural and remote regions poses significant hurdles for efficient last-mile delivery, increasing operational costs and delivery times. Evolving regulatory landscapes, particularly concerning cross-border trade and labor laws, require constant adaptation and compliance investments. Supply chain disruptions, including traffic congestion in urban centers and potential disruptions from natural events, can negatively affect delivery schedules and customer trust. The rising operational costs, driven by increasing fuel prices and labor expenses, also exert pressure on the industry.

Key Players Shaping the Thailand CEP Industry Market

- Nim Express Company Limited

- United Parcel Service of America Inc (UPS)

- CJ Logistics Corporation

- DHL Group

- J&T Express

- Thailand Post

- FedEx

- SF Express (KEX-SF)

- Best Inc

- Aqua Corporation (including Thai Parcel Public Company Limited)

- Flash Express

- JWD Group

Significant Thailand CEP Industry Industry Milestones

November 2023: J&T Home partnered with SABUY SPEED, a subsidiary of Sabai Technology Public Company Limited, to expand its parcel acceptance and delivery network across Thailand. This collaboration enables services at over 22,000 affiliated stores including Shipsmile, Plus Express, The Letter Post, Point Express, Speedy, Payspost, and Paypoint, offering 365-day service availability (excluding public holidays). This significantly enhances accessibility and convenience for customers, broadening J&T Express's reach.

August 2023: Thailand Post Company Limited established a partnership with The Transport Company Limited (Bor Kor Sor). This collaboration aims to leverage the expertise in routes, vehicles, technology, and information possessed by both entities to enhance consignment and delivery services. The partnership is expected to lead to increased consignment and delivery volumes due to improved operational efficiencies.

July 2023: J&T Express launched its "J&T HOME" project, focusing on expanding its parcel pick-up point agents nationwide. This initiative involves converting existing vacant spaces into parcel pick-up service points, thereby extending the J&T Express service network to cover all areas of Thailand. The project aims to provide high-quality parcel transportation services and enhance convenience for users by establishing service points closer to their homes.

Future Outlook for Thailand CEP Industry Market

The future outlook for the Thailand CEP industry is exceptionally promising, driven by a confluence of accelerating e-commerce growth, ongoing digital transformation, and strategic investments in logistics infrastructure. We anticipate a sustained CAGR of 15.8% from 2025 to 2033, with the market size projected to surpass $12 billion by 2028. Opportunities will continue to flourish in the express delivery segment, fueled by consumer demand for speed and convenience. Furthermore, the expansion of cross-border e-commerce and specialized logistics services, such as cold chain and healthcare logistics, will offer significant growth avenues. Strategic alliances, technological adoption of AI and automation, and a focus on sustainable logistics practices will be critical for players to maintain a competitive edge and capitalize on the evolving market landscape, ensuring Thailand solidifies its position as a key logistics hub in the ASEAN region.

Thailand CEP Industry Segmentation

-

1. Destination

- 1.1. Domestic

- 1.2. International

-

2. Speed Of Delivery

- 2.1. Express

- 2.2. Non-Express

-

3. Model

- 3.1. Business-to-Business (B2B)

- 3.2. Business-to-Consumer (B2C)

- 3.3. Consumer-to-Consumer (C2C)

-

4. Shipment Weight

- 4.1. Heavy Weight Shipments

- 4.2. Light Weight Shipments

- 4.3. Medium Weight Shipments

-

5. Mode Of Transport

- 5.1. Air

- 5.2. Road

- 5.3. Others

-

6. End User Industry

- 6.1. E-Commerce

- 6.2. Financial Services (BFSI)

- 6.3. Healthcare

- 6.4. Manufacturing

- 6.5. Primary Industry

- 6.6. Wholesale and Retail Trade (Offline)

- 6.7. Others

Thailand CEP Industry Segmentation By Geography

- 1. Thailand

Thailand CEP Industry Regional Market Share

Geographic Coverage of Thailand CEP Industry

Thailand CEP Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.16% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing consumption of canned and frozen food; Growth urbanization and increased adoption of healthy lifestyle

- 3.3. Market Restrains

- 3.3.1. Limited self-life of frozen food; Growing awareness regarding the consumption of fresh vegetables and fruits

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Thailand CEP Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Destination

- 5.1.1. Domestic

- 5.1.2. International

- 5.2. Market Analysis, Insights and Forecast - by Speed Of Delivery

- 5.2.1. Express

- 5.2.2. Non-Express

- 5.3. Market Analysis, Insights and Forecast - by Model

- 5.3.1. Business-to-Business (B2B)

- 5.3.2. Business-to-Consumer (B2C)

- 5.3.3. Consumer-to-Consumer (C2C)

- 5.4. Market Analysis, Insights and Forecast - by Shipment Weight

- 5.4.1. Heavy Weight Shipments

- 5.4.2. Light Weight Shipments

- 5.4.3. Medium Weight Shipments

- 5.5. Market Analysis, Insights and Forecast - by Mode Of Transport

- 5.5.1. Air

- 5.5.2. Road

- 5.5.3. Others

- 5.6. Market Analysis, Insights and Forecast - by End User Industry

- 5.6.1. E-Commerce

- 5.6.2. Financial Services (BFSI)

- 5.6.3. Healthcare

- 5.6.4. Manufacturing

- 5.6.5. Primary Industry

- 5.6.6. Wholesale and Retail Trade (Offline)

- 5.6.7. Others

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. Thailand

- 5.1. Market Analysis, Insights and Forecast - by Destination

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Nim Express Company Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 United Parcel Service of America Inc (UPS

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 CJ Logistics Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DHL Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 J&T Express

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Thailand Post

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 FedEx

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SF Express (KEX-SF)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Best Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Aqua Corporation (including Thai Parcel Public Company Limited)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Flash Express

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 JWD Group

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Nim Express Company Limited

List of Figures

- Figure 1: Thailand CEP Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Thailand CEP Industry Share (%) by Company 2025

List of Tables

- Table 1: Thailand CEP Industry Revenue billion Forecast, by Destination 2020 & 2033

- Table 2: Thailand CEP Industry Revenue billion Forecast, by Speed Of Delivery 2020 & 2033

- Table 3: Thailand CEP Industry Revenue billion Forecast, by Model 2020 & 2033

- Table 4: Thailand CEP Industry Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 5: Thailand CEP Industry Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 6: Thailand CEP Industry Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 7: Thailand CEP Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Thailand CEP Industry Revenue billion Forecast, by Destination 2020 & 2033

- Table 9: Thailand CEP Industry Revenue billion Forecast, by Speed Of Delivery 2020 & 2033

- Table 10: Thailand CEP Industry Revenue billion Forecast, by Model 2020 & 2033

- Table 11: Thailand CEP Industry Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 12: Thailand CEP Industry Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 13: Thailand CEP Industry Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 14: Thailand CEP Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thailand CEP Industry?

The projected CAGR is approximately 7.16%.

2. Which companies are prominent players in the Thailand CEP Industry?

Key companies in the market include Nim Express Company Limited, United Parcel Service of America Inc (UPS, CJ Logistics Corporation, DHL Group, J&T Express, Thailand Post, FedEx, SF Express (KEX-SF), Best Inc, Aqua Corporation (including Thai Parcel Public Company Limited), Flash Express, JWD Group.

3. What are the main segments of the Thailand CEP Industry?

The market segments include Destination, Speed Of Delivery, Model, Shipment Weight, Mode Of Transport, End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.82 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing consumption of canned and frozen food; Growth urbanization and increased adoption of healthy lifestyle.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Limited self-life of frozen food; Growing awareness regarding the consumption of fresh vegetables and fruits.

8. Can you provide examples of recent developments in the market?

November 2023: J&T Home has partnered with SABUY SPEED, a subsidiary of Sabai Technology Public Company Limited, to accept and deliver parcels throughout Thailand 365 days, excluding public holidays at affiliated stores including Shipsmile, Plus Express, The Letter Post, Point Express, Speedy, Payspost and Paypoint, more than 22,000 branches nationwide.August 2023: Thailand Post Company Limited partnered with The Transport Company Limited (Bor Kor Sor) to provide delivery and parcel delivery services. The amount of consignment and delivery continued to increase steadily due to expertise in routes, vehicles, technology, and information, including service points.July 2023: J&T Express is expanding its parcel pick-up point agents through the "J&T HOME" project. To expand the J&T Express service network to cover all areas throughout Thailand they are converting existing vacant space into a parcel pick-up service point and would provide parcel transportation services with the highest quality and potential. It also creates convenience for J&T Express users at branches near their homes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thailand CEP Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thailand CEP Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thailand CEP Industry?

To stay informed about further developments, trends, and reports in the Thailand CEP Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence