Key Insights

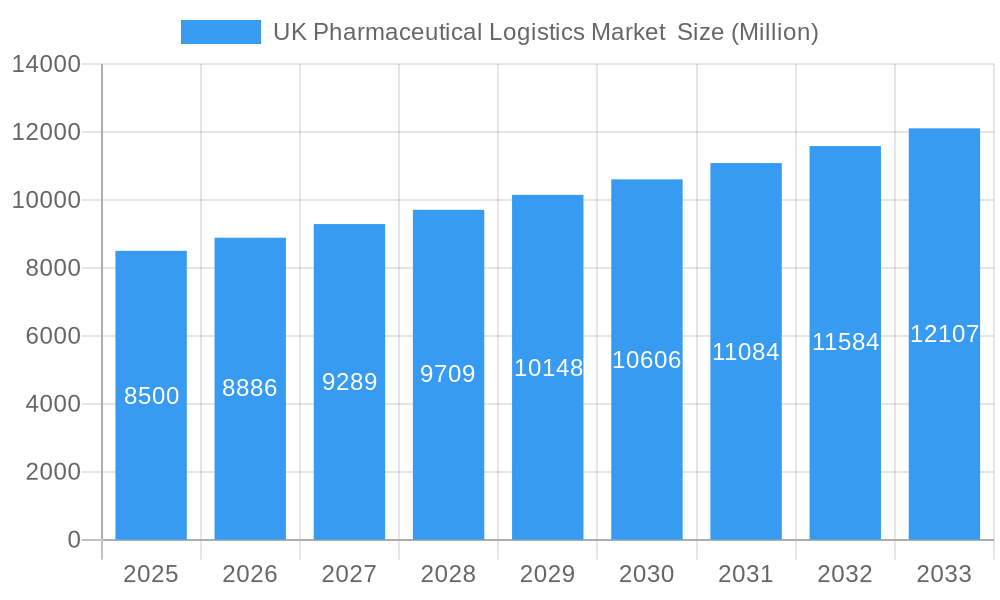

The UK pharmaceutical logistics market is projected to experience significant growth, driven by a base market size of £107.6 billion in 2025. With a forecasted Compound Annual Growth Rate (CAGR) of 6%, the market is expected to expand considerably by 2033. Key growth drivers include the escalating demand for advanced cold chain solutions, crucial for maintaining the integrity of biopharmaceuticals and temperature-sensitive medications. The rapid expansion of the biopharmaceutical sector, particularly in biologics, necessitates specialized handling and stringent temperature control throughout the supply chain, acting as a primary catalyst. Furthermore, the growing generic drugs segment, supported by cost-containment initiatives and increased patient access to affordable treatments, contributes to higher volumes of pharmaceutical goods requiring efficient logistics. Road transportation is anticipated to lead due to its flexibility and last-mile delivery advantages, while air and sea freight will remain vital for international distribution of high-value and time-sensitive pharmaceuticals.

UK Pharmaceutical Logistics Market Market Size (In Billion)

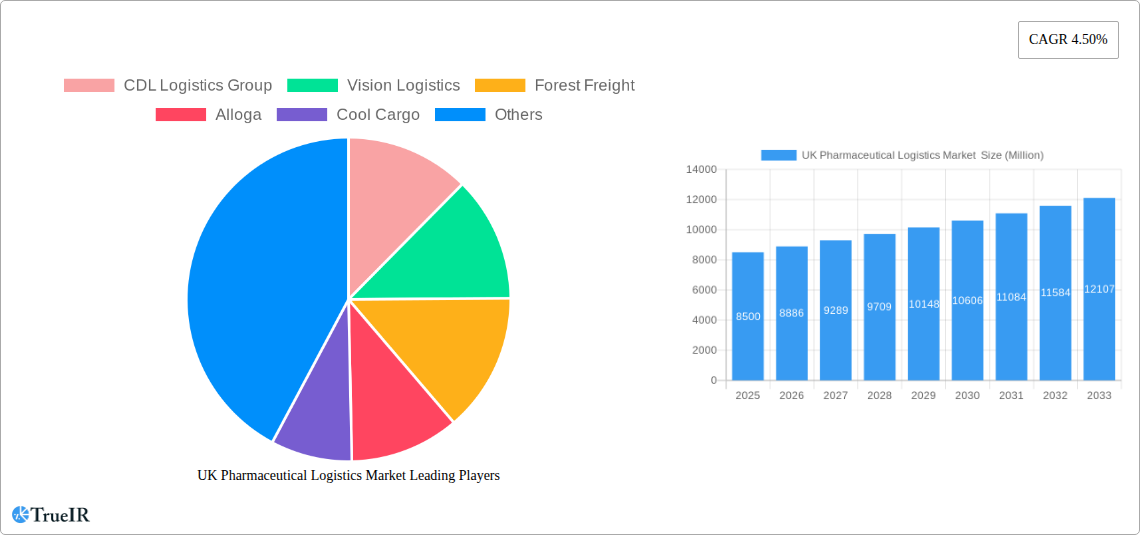

Despite the positive outlook, certain challenges require strategic attention. Increasing operational costs, particularly for maintaining specialized cold chain infrastructure and advanced tracking systems, pose a significant hurdle. The complex regulatory environment for pharmaceutical distribution, both domestically and internationally, adds compliance layers that can impact operational efficiency and increase overheads. Nevertheless, technological advancements in supply chain visibility, real-time temperature monitoring, and automation are providing solutions to enhance efficiency and mitigate risks. Leading companies such as CDL Logistics Group, Vision Logistics, and Alliance Healthcare are actively investing in these technologies to maintain a competitive advantage and meet the dynamic needs of pharmaceutical manufacturers and distributors, ensuring the secure and timely delivery of essential medicines.

UK Pharmaceutical Logistics Market Company Market Share

UK Pharmaceutical Logistics Market: Comprehensive Insights and Future Projections (2019-2033)

This in-depth report offers a dynamic and SEO-optimized analysis of the UK Pharmaceutical Logistics Market. Leveraging high-volume keywords such as "pharmaceutical logistics UK," "cold chain logistics," "healthcare supply chain," and "drug distribution," this study provides unparalleled insights for industry stakeholders. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this report dissects market structure, trends, opportunities, dominant segments, product analysis, key drivers, challenges, leading players, significant milestones, and future outlook. Delve into the critical factors shaping the UK's pharmaceutical logistics landscape, from regulatory impacts to technological advancements and evolving consumer preferences.

UK Pharmaceutical Logistics Market Market Structure & Competitive Landscape

The UK pharmaceutical logistics market is characterized by a moderately concentrated structure, driven by the stringent requirements for handling sensitive and high-value pharmaceutical products. Innovation is largely propelled by the need for advanced temperature control solutions, real-time tracking, and enhanced security to ensure product integrity and compliance with strict regulatory frameworks. Key innovation drivers include the adoption of IoT for temperature monitoring, blockchain for supply chain transparency, and advanced analytics for route optimization. Regulatory impacts, such as the Medicines and Healthcare products Regulatory Agency (MHRA) guidelines, play a pivotal role in shaping operational standards and investment in compliant infrastructure. Product substitutes are limited due to the specialized nature of pharmaceutical logistics, but the emergence of specialized third-party logistics (3PL) providers offers an alternative to in-house logistics management for many pharmaceutical companies. End-user segmentation reveals a strong reliance on pharmaceutical manufacturers, wholesalers, and research institutions. Mergers and acquisitions (M&A) trends are notable, with larger players consolidating to achieve economies of scale and expand their service offerings. For instance, the acquisition of Bomi Group by UPS in November 2022, with an undisclosed value in millions, highlights the strategic importance of expanding cold chain capabilities and European network reach. The total M&A volume in the historical period is estimated at over 500 million GBP, reflecting significant industry consolidation.

UK Pharmaceutical Logistics Market Market Trends & Opportunities

The UK pharmaceutical logistics market is poised for substantial growth, driven by an increasing demand for specialized healthcare logistics solutions and evolving patient care models. The market size is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period of 2025–2033, reaching an estimated value of over 8,000 million GBP by 2033. This growth is underpinned by several key trends. The escalating prevalence of chronic diseases and an aging population necessitate a robust and efficient supply chain for a wider range of medications, including temperature-sensitive biologics and vaccines. Technological advancements are transforming the landscape, with the increasing adoption of automation in warehousing, AI-powered demand forecasting, and sophisticated track-and-trace systems enhancing visibility and reducing inefficiencies. Consumer preferences are shifting towards personalized medicine and home healthcare, creating opportunities for direct-to-patient delivery services that require precise temperature control and timely delivery. The competitive dynamics are intensifying, with a focus on specialized services such as cold chain logistics for vaccines and biologics, and last-mile delivery solutions for complex pharmaceuticals. Market penetration rates for advanced logistics technologies are steadily increasing, with over 70% of major pharmaceutical companies investing in digital supply chain solutions. The push towards sustainability is also creating opportunities for eco-friendly logistics practices, including optimized routing and the use of electric vehicles. The integration of digital platforms for order management and inventory tracking is becoming a standard expectation, further driving market expansion. The increasing complexity of drug formulations and the rise of specialized therapies, such as gene and cell therapies, demand highly specialized logistics capabilities that are currently in high demand.

Dominant Markets & Segments in UK Pharmaceutical Logistics Market

Within the UK pharmaceutical logistics market, Cold Chain Transport stands out as the dominant operation, driven by the increasing prevalence of biologics, vaccines, and temperature-sensitive drugs. The demand for maintaining precise temperature ranges, often between 2°C and 8°C or even ultra-low temperatures, necessitates specialized infrastructure and handling protocols. The Biopharma application segment is also a significant growth engine, as the development and distribution of advanced biopharmaceuticals, including monoclonal antibodies and recombinant proteins, require stringent cold chain management. The market for generic drugs, while substantial in volume, often relies on more standard logistics, but its sheer scale still contributes significantly to overall market activity. Branded drugs, particularly specialty pharmaceuticals, increasingly require temperature-controlled environments, further bolstering the cold chain segment.

In terms of transportation, Roadways remain the backbone of pharmaceutical logistics within the UK due to their flexibility and reach for last-mile delivery and inter-city distribution. However, Airways play a crucial role for urgent shipments and international distribution of high-value, time-sensitive pharmaceuticals. The UK, as a single country market, exhibits strong demand due to its advanced healthcare system and significant pharmaceutical manufacturing and research base. Key growth drivers for these dominant segments include:

- Infrastructure: The continuous investment in temperature-controlled warehousing, specialized reefer vehicles, and cold chain packaging solutions. The presence of strategically located hubs and distribution centers across the UK facilitates efficient transportation.

- Policies: Stringent regulatory adherence by bodies like the MHRA ensures the demand for high-quality, compliant logistics services. Government initiatives supporting the life sciences sector indirectly boost logistics demand.

- Technological Integration: The adoption of IoT sensors for real-time temperature monitoring, GPS tracking for fleet management, and data analytics for optimizing delivery routes and inventory levels.

- Increasing Biologics Market: The global and UK rise in the development and use of biologics, requiring complex cold chain handling, is a primary driver.

- E-commerce Growth in Pharma: The expanding trend of online pharmacies and direct-to-patient delivery necessitates efficient and secure last-mile cold chain logistics.

UK Pharmaceutical Logistics Market Product Analysis

The UK pharmaceutical logistics market is experiencing innovation driven by advancements in drug formulation and delivery systems. The logistical demands for Generic Drugs are relatively stable, focusing on efficiency and cost-effectiveness. However, Branded Drugs, particularly specialty pharmaceuticals and biologics, are driving the need for highly specialized logistics. Innovations in cold chain packaging, such as advanced insulated containers and phase-change materials, are crucial for maintaining product integrity. The integration of real-time temperature monitoring via IoT devices provides unprecedented visibility and control, mitigating risks associated with temperature excursions. Furthermore, advancements in last-mile delivery, including the use of temperature-controlled vans and smart lockers, are enhancing the accessibility and reliability of pharmaceutical distribution.

Key Drivers, Barriers & Challenges in UK Pharmaceutical Logistics Market

Key Drivers: The UK pharmaceutical logistics market is propelled by several key factors. Technologically, the adoption of IoT for real-time monitoring and AI for demand forecasting enhances efficiency and reduces waste. Economically, the growing healthcare expenditure and the increasing demand for pharmaceuticals, particularly biologics and specialty drugs, fuel market growth. Policy-driven factors, such as government support for the life sciences sector and stringent regulatory requirements for drug handling, necessitate high-quality logistics services. The expansion of direct-to-patient delivery models also represents a significant growth catalyst, requiring specialized last-mile solutions.

Barriers & Challenges: Despite strong growth prospects, the market faces several challenges. Regulatory complexities and evolving compliance standards, including those related to Brexit and international trade, can pose significant hurdles. Supply chain disruptions, exacerbated by geopolitical events and global health crises, can impact product availability and delivery timelines. Competitive pressures from a growing number of specialized logistics providers and the need for significant capital investment in temperature-controlled infrastructure and technology are also key restraints. The cost of maintaining stringent cold chain conditions can be substantial, impacting profit margins.

Growth Drivers in the UK Pharmaceutical Logistics Market Market

The UK pharmaceutical logistics market's growth is fundamentally driven by the expansion of the pharmaceutical industry itself, particularly in the biologics and specialty drug sectors. Technological advancements are a major catalyst, with investments in IoT, AI, and automation promising enhanced efficiency, visibility, and reduced errors in the supply chain. Economic factors, such as increasing healthcare spending and the growing demand for advanced treatments, directly translate into higher logistics volumes. Furthermore, supportive government policies aimed at fostering innovation in the life sciences sector indirectly bolster the demand for sophisticated logistics services. The shift towards more personalized medicine and the increasing prevalence of home healthcare services also create a demand for agile and reliable last-mile delivery solutions.

Challenges Impacting UK Pharmaceutical Logistics Market Growth

The UK pharmaceutical logistics market grapples with several significant challenges. Navigating complex and evolving regulatory landscapes, particularly post-Brexit trade regulations and strict adherence to Good Distribution Practice (GDP) guidelines, requires constant vigilance and investment. Supply chain vulnerabilities, exposed by global events, highlight the need for greater resilience and contingency planning. Competitive pressures are intensifying as more specialized logistics providers enter the market, driving down margins. The high capital expenditure required for maintaining state-of-the-art cold chain facilities, advanced tracking technologies, and specialized transportation fleets presents a substantial barrier to entry and operational cost. Ensuring workforce training and retention for specialized handling of sensitive pharmaceuticals is also a persistent challenge.

Key Players Shaping the UK Pharmaceutical Logistics Market Market

- CDL Logistics Group

- Vision Logistics

- Forest Freight

- Alloga

- Cool Cargo

- Dynamic Medical Logistics

- Alliance Healthcare

- Circle Express UK

- DFS Worldwide

- Kammac

Significant UK Pharmaceutical Logistics Market Industry Milestones

- November 2022: UPS acquired Bomi Group, a global healthcare logistics company. This strategic acquisition significantly expanded UPS Healthcare's network in Europe and Latin America, adding temperature-controlled facilities across 14 countries and over 3,000 skilled professionals. The move aimed to bolster scale, expertise, and end-to-end global healthcare logistics capabilities, especially crucial for time- and temperature-sensitive pharmaceutical and biologic treatments.

- March 2022: AbbVie acquired Syndesi Therapeutics SA, a clinical-stage biotechnology company. This acquisition, involving an upfront payment of USD 130 million with potential contingent payments up to USD 870 million, granted AbbVie access to Syndesi's advanced SV2A modulators, including its flagship drug SDI-118. The deal significantly enhanced AbbVie's neuroscience product portfolio.

Future Outlook for UK Pharmaceutical Logistics Market Market

The future outlook for the UK pharmaceutical logistics market is exceptionally promising, driven by continuous innovation and evolving healthcare demands. Growth catalysts include the increasing adoption of advanced technologies like AI and blockchain for enhanced supply chain transparency and efficiency. The sustained growth of the biologics and personalized medicine sectors will continue to necessitate specialized cold chain capabilities. Strategic opportunities lie in the expansion of direct-to-patient delivery services and the development of more sustainable logistics practices. Market potential is further amplified by the ongoing investment in research and development within the UK's robust life sciences sector, ensuring a consistent pipeline of innovative pharmaceuticals requiring sophisticated logistical support. The market is expected to see further consolidation and strategic partnerships as companies strive to offer end-to-end solutions and leverage economies of scale.

UK Pharmaceutical Logistics Market Segmentation

-

1. Product

- 1.1. Generic Drugs

- 1.2. Branded Drugs

-

2. Operation

- 2.1. Cold Chain Transport

- 2.2. Non-cold Chain Transport

-

3. Application

- 3.1. Biopharma

- 3.2. Chemical Pharma

-

4. Transportation

- 4.1. Airways

- 4.2. Railways

- 4.3. Roadways

- 4.4. Seaways

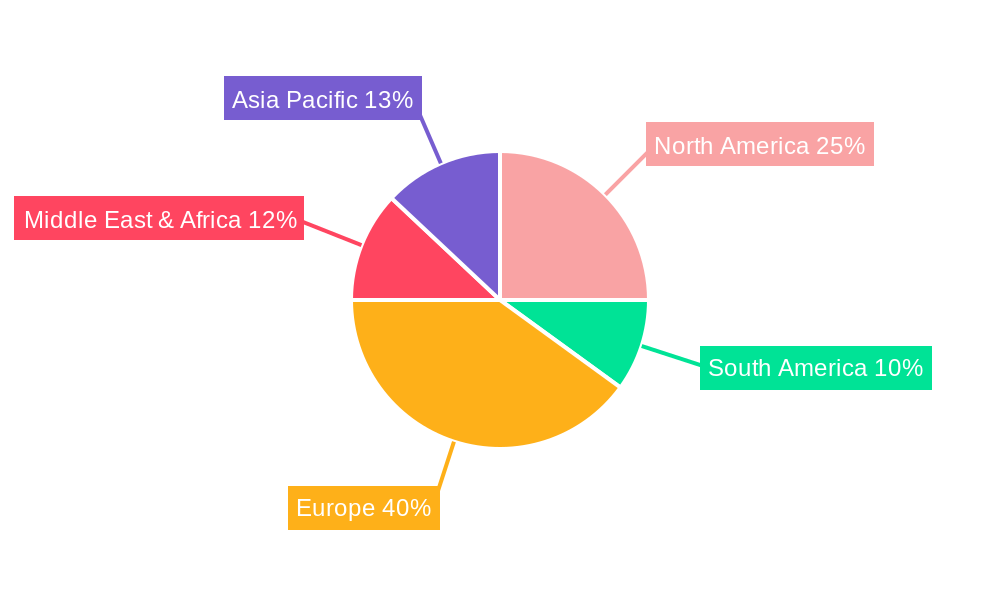

UK Pharmaceutical Logistics Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Pharmaceutical Logistics Market Regional Market Share

Geographic Coverage of UK Pharmaceutical Logistics Market

UK Pharmaceutical Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing global trade activities; Infrastructure Development is on rise

- 3.3. Market Restrains

- 3.3.1. Manufacturers' lack of control over logistics services and also increasing logistical costs

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Cold Chain Logistics in the Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Pharmaceutical Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Generic Drugs

- 5.1.2. Branded Drugs

- 5.2. Market Analysis, Insights and Forecast - by Operation

- 5.2.1. Cold Chain Transport

- 5.2.2. Non-cold Chain Transport

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Biopharma

- 5.3.2. Chemical Pharma

- 5.4. Market Analysis, Insights and Forecast - by Transportation

- 5.4.1. Airways

- 5.4.2. Railways

- 5.4.3. Roadways

- 5.4.4. Seaways

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America UK Pharmaceutical Logistics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Generic Drugs

- 6.1.2. Branded Drugs

- 6.2. Market Analysis, Insights and Forecast - by Operation

- 6.2.1. Cold Chain Transport

- 6.2.2. Non-cold Chain Transport

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Biopharma

- 6.3.2. Chemical Pharma

- 6.4. Market Analysis, Insights and Forecast - by Transportation

- 6.4.1. Airways

- 6.4.2. Railways

- 6.4.3. Roadways

- 6.4.4. Seaways

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. South America UK Pharmaceutical Logistics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Generic Drugs

- 7.1.2. Branded Drugs

- 7.2. Market Analysis, Insights and Forecast - by Operation

- 7.2.1. Cold Chain Transport

- 7.2.2. Non-cold Chain Transport

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Biopharma

- 7.3.2. Chemical Pharma

- 7.4. Market Analysis, Insights and Forecast - by Transportation

- 7.4.1. Airways

- 7.4.2. Railways

- 7.4.3. Roadways

- 7.4.4. Seaways

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Europe UK Pharmaceutical Logistics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Generic Drugs

- 8.1.2. Branded Drugs

- 8.2. Market Analysis, Insights and Forecast - by Operation

- 8.2.1. Cold Chain Transport

- 8.2.2. Non-cold Chain Transport

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Biopharma

- 8.3.2. Chemical Pharma

- 8.4. Market Analysis, Insights and Forecast - by Transportation

- 8.4.1. Airways

- 8.4.2. Railways

- 8.4.3. Roadways

- 8.4.4. Seaways

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East & Africa UK Pharmaceutical Logistics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Generic Drugs

- 9.1.2. Branded Drugs

- 9.2. Market Analysis, Insights and Forecast - by Operation

- 9.2.1. Cold Chain Transport

- 9.2.2. Non-cold Chain Transport

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Biopharma

- 9.3.2. Chemical Pharma

- 9.4. Market Analysis, Insights and Forecast - by Transportation

- 9.4.1. Airways

- 9.4.2. Railways

- 9.4.3. Roadways

- 9.4.4. Seaways

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Asia Pacific UK Pharmaceutical Logistics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Generic Drugs

- 10.1.2. Branded Drugs

- 10.2. Market Analysis, Insights and Forecast - by Operation

- 10.2.1. Cold Chain Transport

- 10.2.2. Non-cold Chain Transport

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Biopharma

- 10.3.2. Chemical Pharma

- 10.4. Market Analysis, Insights and Forecast - by Transportation

- 10.4.1. Airways

- 10.4.2. Railways

- 10.4.3. Roadways

- 10.4.4. Seaways

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 CDL Logistics Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Vision Logistics

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Forest Freight

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Alloga

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Cool Cargo

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Dynamic Medical Logistics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Alliance Healthcare

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Circle Express UK**List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 DFS Worldwide

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Kammac

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 CDL Logistics Group

List of Figures

- Figure 1: Global UK Pharmaceutical Logistics Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America UK Pharmaceutical Logistics Market Revenue (billion), by Product 2025 & 2033

- Figure 3: North America UK Pharmaceutical Logistics Market Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America UK Pharmaceutical Logistics Market Revenue (billion), by Operation 2025 & 2033

- Figure 5: North America UK Pharmaceutical Logistics Market Revenue Share (%), by Operation 2025 & 2033

- Figure 6: North America UK Pharmaceutical Logistics Market Revenue (billion), by Application 2025 & 2033

- Figure 7: North America UK Pharmaceutical Logistics Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America UK Pharmaceutical Logistics Market Revenue (billion), by Transportation 2025 & 2033

- Figure 9: North America UK Pharmaceutical Logistics Market Revenue Share (%), by Transportation 2025 & 2033

- Figure 10: North America UK Pharmaceutical Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 11: North America UK Pharmaceutical Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: South America UK Pharmaceutical Logistics Market Revenue (billion), by Product 2025 & 2033

- Figure 13: South America UK Pharmaceutical Logistics Market Revenue Share (%), by Product 2025 & 2033

- Figure 14: South America UK Pharmaceutical Logistics Market Revenue (billion), by Operation 2025 & 2033

- Figure 15: South America UK Pharmaceutical Logistics Market Revenue Share (%), by Operation 2025 & 2033

- Figure 16: South America UK Pharmaceutical Logistics Market Revenue (billion), by Application 2025 & 2033

- Figure 17: South America UK Pharmaceutical Logistics Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: South America UK Pharmaceutical Logistics Market Revenue (billion), by Transportation 2025 & 2033

- Figure 19: South America UK Pharmaceutical Logistics Market Revenue Share (%), by Transportation 2025 & 2033

- Figure 20: South America UK Pharmaceutical Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 21: South America UK Pharmaceutical Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe UK Pharmaceutical Logistics Market Revenue (billion), by Product 2025 & 2033

- Figure 23: Europe UK Pharmaceutical Logistics Market Revenue Share (%), by Product 2025 & 2033

- Figure 24: Europe UK Pharmaceutical Logistics Market Revenue (billion), by Operation 2025 & 2033

- Figure 25: Europe UK Pharmaceutical Logistics Market Revenue Share (%), by Operation 2025 & 2033

- Figure 26: Europe UK Pharmaceutical Logistics Market Revenue (billion), by Application 2025 & 2033

- Figure 27: Europe UK Pharmaceutical Logistics Market Revenue Share (%), by Application 2025 & 2033

- Figure 28: Europe UK Pharmaceutical Logistics Market Revenue (billion), by Transportation 2025 & 2033

- Figure 29: Europe UK Pharmaceutical Logistics Market Revenue Share (%), by Transportation 2025 & 2033

- Figure 30: Europe UK Pharmaceutical Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Europe UK Pharmaceutical Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East & Africa UK Pharmaceutical Logistics Market Revenue (billion), by Product 2025 & 2033

- Figure 33: Middle East & Africa UK Pharmaceutical Logistics Market Revenue Share (%), by Product 2025 & 2033

- Figure 34: Middle East & Africa UK Pharmaceutical Logistics Market Revenue (billion), by Operation 2025 & 2033

- Figure 35: Middle East & Africa UK Pharmaceutical Logistics Market Revenue Share (%), by Operation 2025 & 2033

- Figure 36: Middle East & Africa UK Pharmaceutical Logistics Market Revenue (billion), by Application 2025 & 2033

- Figure 37: Middle East & Africa UK Pharmaceutical Logistics Market Revenue Share (%), by Application 2025 & 2033

- Figure 38: Middle East & Africa UK Pharmaceutical Logistics Market Revenue (billion), by Transportation 2025 & 2033

- Figure 39: Middle East & Africa UK Pharmaceutical Logistics Market Revenue Share (%), by Transportation 2025 & 2033

- Figure 40: Middle East & Africa UK Pharmaceutical Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East & Africa UK Pharmaceutical Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific UK Pharmaceutical Logistics Market Revenue (billion), by Product 2025 & 2033

- Figure 43: Asia Pacific UK Pharmaceutical Logistics Market Revenue Share (%), by Product 2025 & 2033

- Figure 44: Asia Pacific UK Pharmaceutical Logistics Market Revenue (billion), by Operation 2025 & 2033

- Figure 45: Asia Pacific UK Pharmaceutical Logistics Market Revenue Share (%), by Operation 2025 & 2033

- Figure 46: Asia Pacific UK Pharmaceutical Logistics Market Revenue (billion), by Application 2025 & 2033

- Figure 47: Asia Pacific UK Pharmaceutical Logistics Market Revenue Share (%), by Application 2025 & 2033

- Figure 48: Asia Pacific UK Pharmaceutical Logistics Market Revenue (billion), by Transportation 2025 & 2033

- Figure 49: Asia Pacific UK Pharmaceutical Logistics Market Revenue Share (%), by Transportation 2025 & 2033

- Figure 50: Asia Pacific UK Pharmaceutical Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 51: Asia Pacific UK Pharmaceutical Logistics Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UK Pharmaceutical Logistics Market Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Global UK Pharmaceutical Logistics Market Revenue billion Forecast, by Operation 2020 & 2033

- Table 3: Global UK Pharmaceutical Logistics Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global UK Pharmaceutical Logistics Market Revenue billion Forecast, by Transportation 2020 & 2033

- Table 5: Global UK Pharmaceutical Logistics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global UK Pharmaceutical Logistics Market Revenue billion Forecast, by Product 2020 & 2033

- Table 7: Global UK Pharmaceutical Logistics Market Revenue billion Forecast, by Operation 2020 & 2033

- Table 8: Global UK Pharmaceutical Logistics Market Revenue billion Forecast, by Application 2020 & 2033

- Table 9: Global UK Pharmaceutical Logistics Market Revenue billion Forecast, by Transportation 2020 & 2033

- Table 10: Global UK Pharmaceutical Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United States UK Pharmaceutical Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada UK Pharmaceutical Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico UK Pharmaceutical Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Global UK Pharmaceutical Logistics Market Revenue billion Forecast, by Product 2020 & 2033

- Table 15: Global UK Pharmaceutical Logistics Market Revenue billion Forecast, by Operation 2020 & 2033

- Table 16: Global UK Pharmaceutical Logistics Market Revenue billion Forecast, by Application 2020 & 2033

- Table 17: Global UK Pharmaceutical Logistics Market Revenue billion Forecast, by Transportation 2020 & 2033

- Table 18: Global UK Pharmaceutical Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Brazil UK Pharmaceutical Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Argentina UK Pharmaceutical Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of South America UK Pharmaceutical Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global UK Pharmaceutical Logistics Market Revenue billion Forecast, by Product 2020 & 2033

- Table 23: Global UK Pharmaceutical Logistics Market Revenue billion Forecast, by Operation 2020 & 2033

- Table 24: Global UK Pharmaceutical Logistics Market Revenue billion Forecast, by Application 2020 & 2033

- Table 25: Global UK Pharmaceutical Logistics Market Revenue billion Forecast, by Transportation 2020 & 2033

- Table 26: Global UK Pharmaceutical Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 27: United Kingdom UK Pharmaceutical Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Germany UK Pharmaceutical Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: France UK Pharmaceutical Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Italy UK Pharmaceutical Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Spain UK Pharmaceutical Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Russia UK Pharmaceutical Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Benelux UK Pharmaceutical Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Nordics UK Pharmaceutical Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe UK Pharmaceutical Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Global UK Pharmaceutical Logistics Market Revenue billion Forecast, by Product 2020 & 2033

- Table 37: Global UK Pharmaceutical Logistics Market Revenue billion Forecast, by Operation 2020 & 2033

- Table 38: Global UK Pharmaceutical Logistics Market Revenue billion Forecast, by Application 2020 & 2033

- Table 39: Global UK Pharmaceutical Logistics Market Revenue billion Forecast, by Transportation 2020 & 2033

- Table 40: Global UK Pharmaceutical Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 41: Turkey UK Pharmaceutical Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Israel UK Pharmaceutical Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: GCC UK Pharmaceutical Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: North Africa UK Pharmaceutical Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: South Africa UK Pharmaceutical Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East & Africa UK Pharmaceutical Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: Global UK Pharmaceutical Logistics Market Revenue billion Forecast, by Product 2020 & 2033

- Table 48: Global UK Pharmaceutical Logistics Market Revenue billion Forecast, by Operation 2020 & 2033

- Table 49: Global UK Pharmaceutical Logistics Market Revenue billion Forecast, by Application 2020 & 2033

- Table 50: Global UK Pharmaceutical Logistics Market Revenue billion Forecast, by Transportation 2020 & 2033

- Table 51: Global UK Pharmaceutical Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 52: China UK Pharmaceutical Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 53: India UK Pharmaceutical Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Japan UK Pharmaceutical Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 55: South Korea UK Pharmaceutical Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: ASEAN UK Pharmaceutical Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 57: Oceania UK Pharmaceutical Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 58: Rest of Asia Pacific UK Pharmaceutical Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Pharmaceutical Logistics Market ?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the UK Pharmaceutical Logistics Market ?

Key companies in the market include CDL Logistics Group, Vision Logistics, Forest Freight, Alloga, Cool Cargo, Dynamic Medical Logistics, Alliance Healthcare, Circle Express UK**List Not Exhaustive, DFS Worldwide, Kammac.

3. What are the main segments of the UK Pharmaceutical Logistics Market ?

The market segments include Product, Operation, Application, Transportation.

4. Can you provide details about the market size?

The market size is estimated to be USD 107.6 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing global trade activities; Infrastructure Development is on rise.

6. What are the notable trends driving market growth?

Increasing Demand for Cold Chain Logistics in the Sector.

7. Are there any restraints impacting market growth?

Manufacturers' lack of control over logistics services and also increasing logistical costs.

8. Can you provide examples of recent developments in the market?

November 2022: UPS has acquired Bomi Group, a global healthcare logistics company. With this acquisition, the UPS Healthcare network in Europe and Latin America will gain access to temperature-controlled facilities in 14 countries and over 3,000 highly qualified Bomi Group team members. The acquisition will increase scale and expertise in Europe and Latin America as well as improve end-to-end global healthcare logistics capabilities. For customers of the Bomi Group, joining the UPS team will result in an even more seamless and intelligent worldwide network. Additionally, the acquisition will be crucial for the delivery of pharmaceutical and biologic treatments, which increasingly call for time- and temperature-sensitive logistics.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Pharmaceutical Logistics Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Pharmaceutical Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Pharmaceutical Logistics Market ?

To stay informed about further developments, trends, and reports in the UK Pharmaceutical Logistics Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence