Key Insights

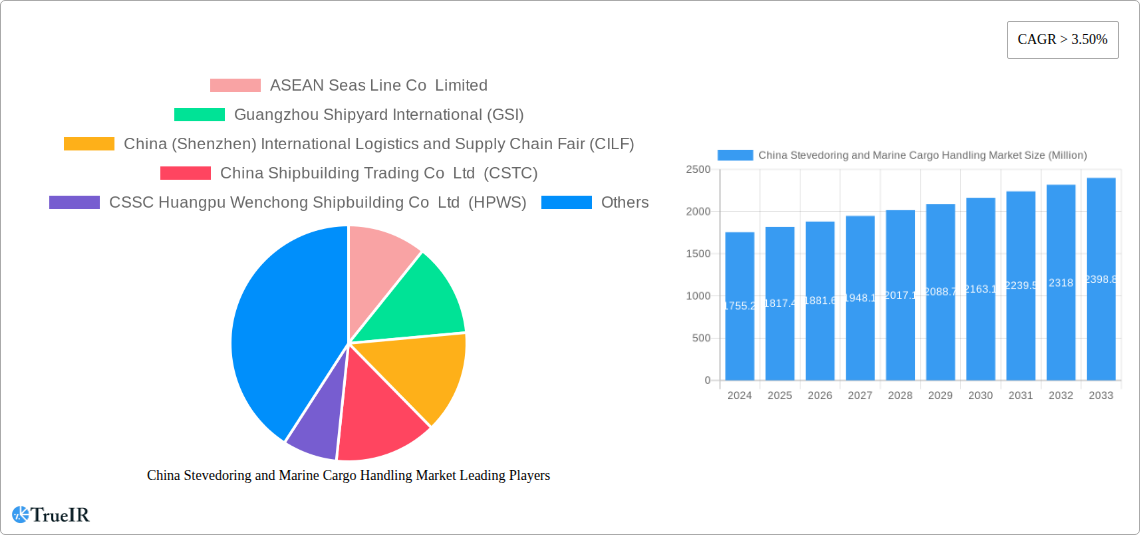

The China Stevedoring and Marine Cargo Handling Market is poised for steady expansion, projected to reach $1755.2 million in 2024 with a Compound Annual Growth Rate (CAGR) of 3.5% over the forecast period of 2025-2033. This growth is underpinned by several critical drivers, including the nation's robust manufacturing output and its pivotal role in global trade. The increasing volume of both bulk and containerized cargo processed through its extensive port infrastructure fuels the demand for efficient stevedoring and handling services. China's commitment to modernizing its port facilities and implementing advanced logistics solutions further propels market expansion. Emerging trends like the adoption of automation, digitalization of port operations, and the development of smart ports are enhancing efficiency and capacity, directly contributing to market growth. The expanding e-commerce sector and the growing demand for specialized cargo handling for oversized or project-based shipments are also key contributors to the market's positive trajectory.

China Stevedoring and Marine Cargo Handling Market Market Size (In Billion)

While the market benefits from strong governmental support for trade and infrastructure development, it faces certain restraints. These include the potential for fluctuating global trade policies, rising operational costs due to labor and energy prices, and the ongoing need for significant capital investment in advanced equipment and technology. However, the segmentation of the market, with stevedoring and cargo and handling transportation holding significant shares, offers diverse opportunities. The dominance of containerized cargo handling, driven by international trade patterns, is expected to continue. Key players like China Ocean Shipping Company, CSSC Huangpu Wenchong Shipbuilding Co Ltd, and Guangzhou Shipyard International are instrumental in shaping the competitive landscape, with ongoing investments in capacity enhancement and technological upgrades. The market's resilience and adaptability to evolving trade dynamics position it for sustained growth in the coming years.

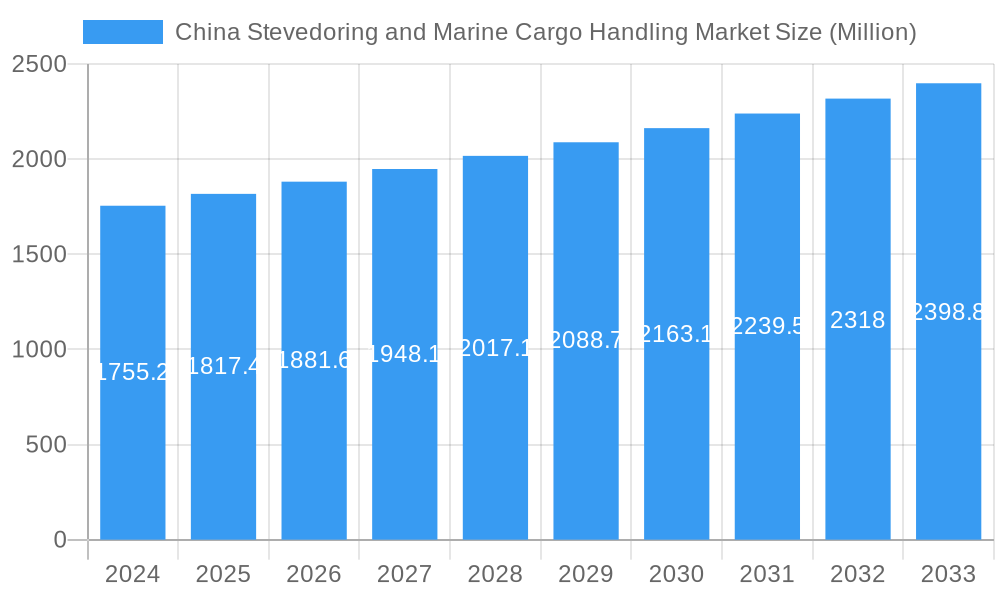

China Stevedoring and Marine Cargo Handling Market Company Market Share

Here's the SEO-optimized report description for the China Stevedoring and Marine Cargo Handling Market, designed for immediate use:

This comprehensive report offers an in-depth analysis of the China Stevedoring and Marine Cargo Handling Market, a critical sector powering global trade and logistics. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this study provides unparalleled insights into market dynamics, competitive landscapes, and future trajectories. Leveraging high-volume keywords such as "China cargo handling," "maritime logistics China," "stevedoring services China," and "port operations China," this report is essential for stakeholders seeking to capitalize on this rapidly evolving market.

China Stevedoring and Marine Cargo Handling Market Market Structure & Competitive Landscape

The China Stevedoring and Marine Cargo Handling Market exhibits a dynamic and evolving market structure. While market concentration can vary across different port clusters and service specializations, there is a discernible trend towards consolidation driven by the need for efficiency and technological integration. Innovation drivers include the adoption of automation, digitalization of port operations, and the development of smart port solutions to enhance turnaround times and reduce operational costs. Regulatory impacts are significant, with government policies aimed at optimizing port efficiency, environmental sustainability, and national trade facilitation playing a crucial role in shaping market entry and operational standards. Product substitutes, while limited in core stevedoring functions, can emerge in the form of alternative logistics routes or shifts in cargo origination and destination. End-user segmentation is primarily driven by cargo type and industry, with significant demand from manufacturing, agriculture, and energy sectors. Mergers and acquisitions (M&A) trends are indicative of strategic moves by larger players to expand their geographical reach, service portfolios, and technological capabilities. For instance, the period has seen strategic alliances and acquisitions aimed at integrating supply chain solutions. The China bulk cargo handling sector, alongside containerized cargo handling in China, are key areas influencing M&A activity.

China Stevedoring and Marine Cargo Handling Market Market Trends & Opportunities

The China Stevedoring and Marine Cargo Handling Market is experiencing robust growth, projected to expand significantly over the forecast period. The market size is estimated to reach hundreds of billions of US dollars, driven by China's pivotal role in global trade and its continuous investment in port infrastructure. Technological shifts are a paramount trend, with the increasing adoption of automation, artificial intelligence (AI), and the Internet of Things (IoT) revolutionizing port operations in China. These advancements are not only improving efficiency and reducing labor costs but also enhancing safety and sustainability. Consumer preferences are evolving, with a growing demand for faster, more transparent, and integrated logistics solutions. This is pushing service providers to offer value-added services beyond basic handling, such as warehousing, multimodal transportation, and supply chain management. Competitive dynamics are intensifying, with both domestic and international players vying for market share. The China maritime logistics sector is characterized by a mix of large state-owned enterprises and increasingly sophisticated private operators. Opportunities abound in the development of smart ports, the expansion of green shipping initiatives, and the integration of digital platforms to streamline cargo flow and customs procedures. The increasing volume of China container throughput and the demand for efficient China bulk cargo handling present substantial growth avenues. Furthermore, the Belt and Road Initiative continues to stimulate trade flows, creating new demand for Chinese port services. The CAGR is expected to be in the high single digits, underscoring the market's dynamism.

Dominant Markets & Segments in China Stevedoring and Marine Cargo Handling Market

The China Stevedoring and Marine Cargo Handling Market is dominated by several key regions and segments. Geographically, the coastal regions, particularly the Yangtze River Delta, Pearl River Delta, and Bohai Rim, represent the most significant hubs for stevedoring and marine cargo handling activities due to their dense industrial base and extensive port networks. These areas are crucial for containerized cargo handling in China and the import/export of bulk cargo in China.

Type Segment Dominance:

- Stevedoring: This core segment consistently holds a substantial market share, encompassing all aspects of loading and unloading vessels. The efficiency and scale of stevedoring operations directly impact the competitiveness of Chinese ports.

- Cargo and Handling Transportation: This segment is closely linked to stevedoring, involving the movement of cargo within the port premises and its onward transportation via various modes. Its growth is intrinsically tied to the overall trade volume.

- Others: This segment includes specialized services like container stuffing/de-stuffing, warehousing, and value-added services, which are gaining prominence as ports aim to become comprehensive logistics hubs.

Cargo Type Segment Dominance:

- Containerized Cargo: This is a leading segment, driven by the immense volume of manufactured goods traded globally. China's position as the "world's factory" ensures continuous high demand for efficient container handling in China. Ports are continuously investing in advanced container terminals and automated systems.

- Bulk Cargo: This segment remains vital, encompassing raw materials like coal, iron ore, grains, and oil. China's industrial and energy needs drive significant bulk cargo handling volumes, with dedicated terminals and specialized equipment in place.

- Other Cargo: This category includes a diverse range of goods, such as project cargo, vehicles, and break-bulk cargo. While smaller in volume compared to containers and bulk, these specialized handling requirements offer niche opportunities.

Key Growth Drivers in Dominant Segments:

- Infrastructure Development: Continuous investment in port expansion, deepening of channels, and construction of new terminals, especially for large container vessels and bulk carriers.

- Technological Advancement: Implementation of automation, AI-powered logistics, and smart port technologies to enhance efficiency and reduce costs in stevedoring and handling.

- Government Policies: Supportive policies promoting trade facilitation, green port initiatives, and the development of logistics clusters.

- Trade Volume Growth: China's sustained role in international trade, coupled with initiatives like the Belt and Road, fuels the demand for all cargo types.

The dominance of these segments is a testament to China's manufacturing prowess, its significant consumption of raw materials, and its strategic importance in global supply chains. The continuous innovation and investment in these areas by major players like Qingdao Port International Limited and entities involved in China bulk cargo handling are key to maintaining this dominance.

China Stevedoring and Marine Cargo Handling Market Product Analysis

The China Stevedoring and Marine Cargo Handling Market is characterized by a suite of services rather than distinct physical products. Innovations are focused on enhancing the efficiency, safety, and sustainability of these services. This includes the deployment of automated container cranes, autonomous guided vehicles (AGVs) for yard operations, and advanced terminal operating systems (TOS) integrated with AI for predictive analytics and route optimization. Applications span the entire cargo lifecycle, from vessel berthing and cargo transfer to warehousing and onward distribution. Competitive advantages are derived from speed of service, cost-effectiveness, precision in handling, and the ability to manage diverse cargo types. The market fit is strong for solutions that reduce turnaround times for vessels, minimize cargo damage, and align with evolving environmental regulations, such as the push for green maritime logistics in China.

Key Drivers, Barriers & Challenges in China Stevedoring and Marine Cargo Handling Market

Key Drivers: The China Stevedoring and Marine Cargo Handling Market is propelled by several significant drivers. Foremost is China's sustained economic growth and its pivotal role in global manufacturing and trade, ensuring consistent high volumes of marine cargo handling. Technological advancements, including automation, AI, and digitalization of port operations, are crucial for improving efficiency and reducing operational costs, leading to enhanced competitiveness. Government initiatives, such as the development of smart ports and the promotion of green shipping, also act as powerful catalysts. The ongoing expansion and modernization of port infrastructure, including the construction of deep-water berths and advanced terminal facilities, are fundamental to accommodating larger vessels and increasing throughput.

Barriers & Challenges: Despite the strong growth trajectory, the market faces notable barriers and challenges. Intense competition among a large number of operators, particularly in well-developed port clusters, can lead to price pressures and reduced profit margins. Regulatory complexities and evolving environmental standards require continuous investment in compliance and sustainable practices, which can be a significant hurdle. Supply chain disruptions, whether due to geopolitical events, pandemics, or natural disasters, pose a constant threat to operational stability and cargo flow. Furthermore, the substantial capital investment required for upgrading port infrastructure and adopting advanced technologies can be a barrier to entry and expansion for smaller players. The skilled labor requirement for operating and maintaining advanced equipment also presents a challenge.

Growth Drivers in the China Stevedoring and Marine Cargo Handling Market Market

The China Stevedoring and Marine Cargo Handling Market is fueled by several key drivers. Technologically, the pervasive adoption of automation, AI-driven optimization, and IoT for real-time tracking is revolutionizing port efficiency and reducing operational costs. Economically, China's continued status as a global manufacturing hub, coupled with increasing domestic consumption and robust international trade, ensures a steady and growing volume of China cargo handling. Regulatory factors, such as government support for smart port development, free trade zones, and initiatives promoting green shipping, provide a conducive environment for growth. The expansion of the Belt and Road Initiative also opens new trade routes and volumes, directly benefiting Chinese port services.

Challenges Impacting China Stevedoring and Marine Cargo Handling Market Growth

Challenges impacting the China Stevedoring and Marine Cargo Handling Market include intense competition, leading to potential price wars and squeezed profit margins. Regulatory complexities and the need to comply with increasingly stringent environmental standards necessitate significant ongoing investment in sustainable practices and technologies. Global supply chain vulnerabilities, exposed by recent events, highlight the risks of disruptions and the need for enhanced resilience in maritime logistics China. Furthermore, the substantial capital outlay required for modernizing infrastructure and adopting cutting-edge technologies can act as a barrier, especially for smaller enterprises. The availability of a skilled workforce capable of operating and maintaining advanced automated systems also poses a challenge.

Key Players Shaping the China Stevedoring and Marine Cargo Handling Market Market

- ASEAN Seas Line Co Limited

- Guangzhou Shipyard International (GSI)

- China (Shenzhen) International Logistics and Supply Chain Fair (CILF)

- China Shipbuilding Trading Co Ltd (CSTC)

- CSSC Huangpu Wenchong Shipbuilding Co Ltd (HPWS)

- Qingdao Port International Limited

- Taizhou Sanfu Ship Engineering Co Ltd

- China Merchants Jinling Shipyard (Weihai) Co Ltd

- Shenzhen Yihaitong Global Supply Chain Management Co Ltd

- China Ocean Shipping Company

Significant China Stevedoring and Marine Cargo Handling Market Industry Milestones

- July 2022: China's first indigenously developed offshore oil and gas extraction facility, subsea 'Xmas Tree' system, was put into operation in the Yingge Sea, south China's Hainan Province. This milestone signifies advancements in China's offshore energy capabilities, indirectly influencing the demand for specialized marine cargo handling and port services for offshore equipment. The system is capable of producing approximately 200 million cubic meters of natural gas per year, as per China National Offshore Oil Corporation (CNOOC).

- May 2022: The world's first LNG dual-fuel ultra-large crude oil tanker, YUAN RUI YANG, successfully completed its maiden voyage after unloading cargo in Vietnam. This event marked a significant step for COSCO SHIPPING Energy in promoting LNG as the primary fuel for ultra-large crude oil tankers, highlighting China's commitment to exploring green, low-carbon, and sustainable maritime energy transportation, impacting future fuel handling and infrastructure at ports.

Future Outlook for China Stevedoring and Marine Cargo Handling Market Market

The China Stevedoring and Marine Cargo Handling Market is poised for continued robust growth, driven by ongoing investments in port modernization and the increasing adoption of smart technologies. Strategic opportunities lie in the further development of automated terminals, the expansion of value-added logistics services, and the integration of digital platforms to create seamless supply chains. The market's potential is further amplified by China's unwavering position in global trade and its commitment to sustainable maritime practices. The shift towards green shipping and the expansion of e-commerce logistics will create new demand segments. Stakeholders can anticipate a dynamic landscape where innovation, efficiency, and sustainability will be paramount for success in China's maritime logistics sector.

China Stevedoring and Marine Cargo Handling Market Segmentation

-

1. Type

- 1.1. Stevedoring

- 1.2. Cargo and handling transportation

- 1.3. Others

-

2. Cargo Type

- 2.1. Bulk Cargo

- 2.2. Containerized Cargo

- 2.3. Other Cargo

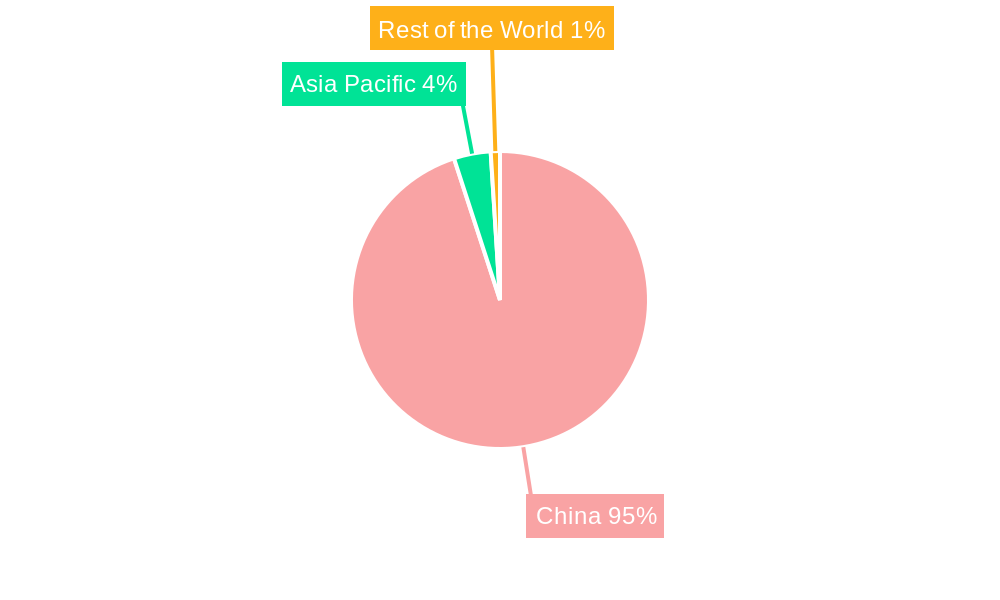

China Stevedoring and Marine Cargo Handling Market Segmentation By Geography

- 1. China

China Stevedoring and Marine Cargo Handling Market Regional Market Share

Geographic Coverage of China Stevedoring and Marine Cargo Handling Market

China Stevedoring and Marine Cargo Handling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing volume of international trade4.; The rise of trade agreements between nations

- 3.3. Market Restrains

- 3.3.1. 4.; Surge in fuel costs affecting the market4.; Increasing trade tension

- 3.4. Market Trends

- 3.4.1. China’s increasing investments in the ocean freight shipping industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Stevedoring and Marine Cargo Handling Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Stevedoring

- 5.1.2. Cargo and handling transportation

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Cargo Type

- 5.2.1. Bulk Cargo

- 5.2.2. Containerized Cargo

- 5.2.3. Other Cargo

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ASEAN Seas Line Co Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Guangzhou Shipyard International (GSI)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 China (Shenzhen) International Logistics and Supply Chain Fair (CILF)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 China Shipbuilding Trading Co Ltd (CSTC)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 CSSC Huangpu Wenchong Shipbuilding Co Ltd (HPWS)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Qingdao Port International Limited**List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Taizhou Sanfu Ship Engineering Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 China Merchants Jinling Shipyard (Weihai) Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Shenzhen Yihaitong Global Supply Chain Management Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 China Ocean Shipping Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 ASEAN Seas Line Co Limited

List of Figures

- Figure 1: China Stevedoring and Marine Cargo Handling Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: China Stevedoring and Marine Cargo Handling Market Share (%) by Company 2025

List of Tables

- Table 1: China Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: China Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Cargo Type 2020 & 2033

- Table 3: China Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: China Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: China Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Cargo Type 2020 & 2033

- Table 6: China Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Stevedoring and Marine Cargo Handling Market?

The projected CAGR is approximately 3.5%.

2. Which companies are prominent players in the China Stevedoring and Marine Cargo Handling Market?

Key companies in the market include ASEAN Seas Line Co Limited, Guangzhou Shipyard International (GSI), China (Shenzhen) International Logistics and Supply Chain Fair (CILF), China Shipbuilding Trading Co Ltd (CSTC), CSSC Huangpu Wenchong Shipbuilding Co Ltd (HPWS), Qingdao Port International Limited**List Not Exhaustive, Taizhou Sanfu Ship Engineering Co Ltd, China Merchants Jinling Shipyard (Weihai) Co Ltd, Shenzhen Yihaitong Global Supply Chain Management Co Ltd, China Ocean Shipping Company.

3. What are the main segments of the China Stevedoring and Marine Cargo Handling Market?

The market segments include Type, Cargo Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing volume of international trade4.; The rise of trade agreements between nations.

6. What are the notable trends driving market growth?

China’s increasing investments in the ocean freight shipping industry.

7. Are there any restraints impacting market growth?

4.; Surge in fuel costs affecting the market4.; Increasing trade tension.

8. Can you provide examples of recent developments in the market?

July 2022: China's first indigenously developed offshore oil and gas extraction facility, subsea 'Xmas Tree' system, was put into operation in the Yingge Sea, south China's Hainan Province. The system is able to produce about 200 million cubic meters of natural gas per year, according to China National Offshore Oil Corporation (CNOOC).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Stevedoring and Marine Cargo Handling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Stevedoring and Marine Cargo Handling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Stevedoring and Marine Cargo Handling Market?

To stay informed about further developments, trends, and reports in the China Stevedoring and Marine Cargo Handling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence