Key Insights

The North America Same Day Delivery Market is projected for significant expansion, with an estimated market size of $14.41 billion by 2025. The market is expected to grow at a Compound Annual Growth Rate (CAGR) of approximately 21.5% through 2033. This robust growth is driven by escalating consumer demand for immediate gratification, amplified by the burgeoning e-commerce sector. The convenience and speed of same-day delivery are reshaping consumer habits, compelling businesses to invest in agile logistics and last-mile solutions. Key growth catalysts include the increasing adoption of mobile commerce, the demand for instant product access, and the competitive imperative for retailers to offer superior delivery experiences. Technological advancements in route optimization, real-time tracking, and AI integration are enhancing operational efficiency and reducing delivery times. Furthermore, the pandemic-induced surge in online shopping has permanently elevated consumer expectations, solidifying same-day delivery as a premium service.

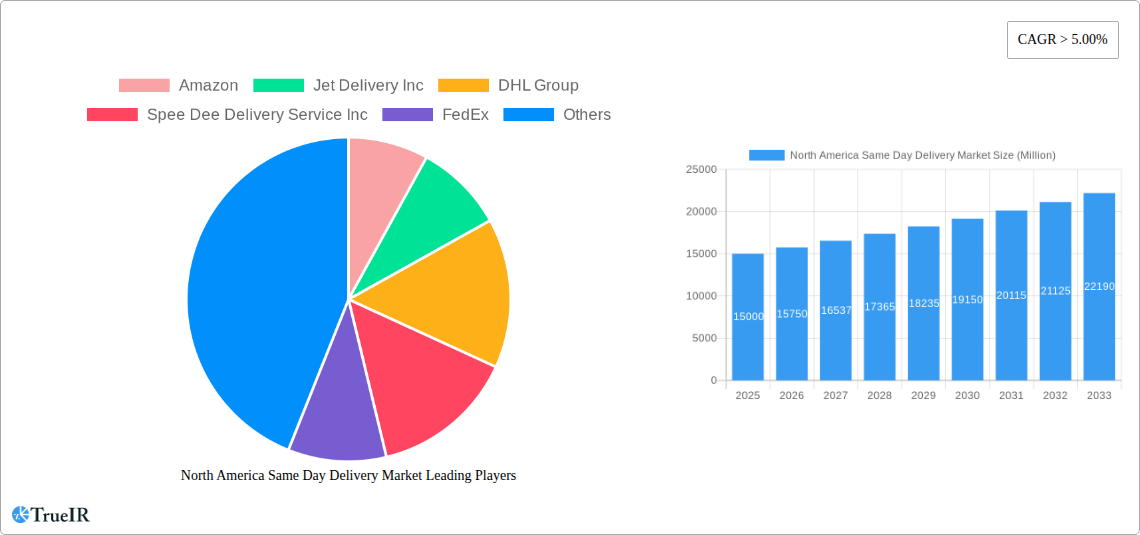

North America Same Day Delivery Market Market Size (In Billion)

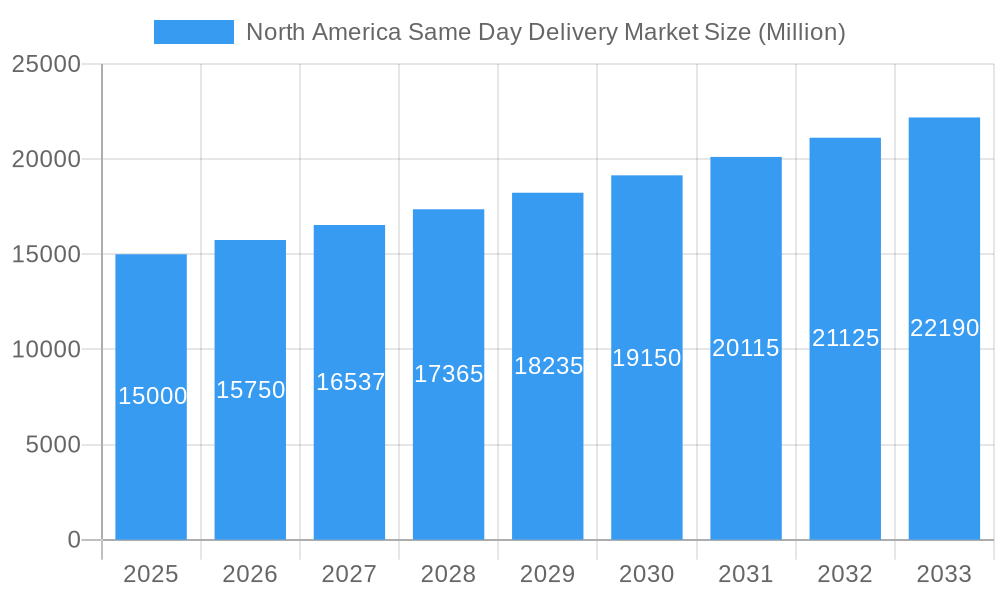

Market segmentation reveals a dynamic landscape. Road transport leads delivery methods due to its cost-effectiveness and flexibility in urban and suburban areas, while air freight is vital for expedited cross-country shipments. Same-day services are increasingly utilized for heavyweight shipments, indicating an expanding scope of prompt delivery capabilities. Domestic demand is paramount, with international same-day delivery gaining traction despite its inherent complexities. E-commerce remains the primary end-user, with significant growth also observed in the healthcare sector for critical medical supplies and pharmaceuticals, and in the BFSI sector for urgent document delivery. Manufacturing and wholesale/retail trade are also adopting these services to optimize supply chains and meet immediate client needs. Leading players such as Amazon, DHL Group, FedEx, and UPS are making substantial infrastructure and technology investments to capture market share in this highly competitive environment.

North America Same Day Delivery Market Company Market Share

This comprehensive market research report offers a definitive analysis of the North America Same Day Delivery Market, forecasting its trajectory from 2019 to 2033. With a base year of 2025 and detailed historical analysis from 2019-2024, the report provides invaluable insights into current market dynamics and future growth prospects. Explore key trends, dominant segments, competitive strategies, and emerging opportunities within this rapidly evolving sector.

North America Same Day Delivery Market Market Structure & Competitive Landscape

The North America Same Day Delivery Market exhibits a dynamic competitive landscape characterized by a blend of established logistics giants and agile, niche players. Market concentration is moderate, with a few key companies holding significant market share, particularly in the e-commerce fulfillment segment. Innovation is a primary driver, fueled by advancements in route optimization software, drone technology, and localized fulfillment centers. Regulatory frameworks, while generally supportive of e-commerce growth, can present localized challenges regarding traffic, zoning, and labor. Product substitutes, such as scheduled next-day delivery, exist but are increasingly being outpaced by the demand for instant gratification. End-user segmentation reveals a strong reliance on the e-commerce sector, with significant contributions from healthcare and manufacturing for urgent medical supplies and critical parts, respectively. Mergers and acquisitions (M&A) activity is ongoing as larger players seek to expand their geographical reach and technological capabilities. For instance, in 2023, XLT Pack and Ship Services opened a new service center, potentially indicating consolidation or expansion strategies by smaller entities. The market is estimated to be worth approximately $55,000 Million in the base year of 2025.

North America Same Day Delivery Market Market Trends & Opportunities

The North America Same Day Delivery Market is poised for substantial growth, driven by a confluence of evolving consumer expectations and technological advancements. The market is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 12.5% from 2025 to 2033, reaching an estimated market size of over $150,000 Million by 2033. This robust growth is intrinsically linked to the pervasive shift towards online shopping, where immediate gratification has become a key differentiator. Consumers are increasingly accustomed to the convenience of receiving goods within hours of placing an order, placing immense pressure on retailers and logistics providers to adapt. Technological innovation is at the forefront of this transformation. Advanced route optimization algorithms, real-time tracking systems, and the strategic deployment of micro-fulfillment centers closer to urban centers are enabling faster and more efficient deliveries. The integration of AI for demand forecasting and inventory management further streamlines the same-day delivery process. The rise of on-demand delivery platforms and the expansion of services by major players like Amazon, which has delivered 1 billion packages from its US Same-Day sites as of December 2023, underscore this trend. Amazon's continuous expansion of its same-day delivery facilities, including a new 200,000-square-foot site in Westborough, Massachusetts, in December 2023, highlights a commitment to bolstering infrastructure for rapid fulfillment. The increasing adoption of electric vehicles and autonomous delivery technologies also presents significant future opportunities to enhance sustainability and reduce operational costs. Furthermore, the growing demand for specialized same-day services in sectors like healthcare (for critical medications and medical supplies) and manufacturing (for urgent spare parts) opens up new avenues for market penetration. The competitive dynamics are intensifying, with companies vying for market share through service quality, speed, and cost-effectiveness. Opportunities also lie in emerging markets and underserved regions, where the establishment of localized delivery networks can address unmet needs, as exemplified by XLT Pack and Ship Services opening a center in James Town, Virginia in July 2023, to serve an area lacking such facilities.

Dominant Markets & Segments in North America Same Day Delivery Market

The North America Same Day Delivery Market is a complex ecosystem with distinct dominant segments and geographic focal points. Road transport unequivocally dominates the Mode of Transport segment, accounting for an estimated 85% of all same-day deliveries due to its cost-effectiveness and flexibility for last-mile logistics. Air transport, while critical for longer distances or exceptionally time-sensitive shipments, represents a smaller but vital portion. The Shipment Weight segment is heavily influenced by Light Weight Shipments, which comprise the majority of e-commerce orders, such as apparel, electronics, and consumables. Medium and Heavy Weight Shipments are growing in importance, particularly for B2B deliveries and large retail items, requiring specialized handling and larger vehicles. Domestic deliveries are the primary focus, representing an estimated 90% of the market volume. International same-day delivery is a nascent but emerging segment, primarily for high-value documents or urgent medical supplies.

The End User Industry landscape is overwhelmingly shaped by E-Commerce, which is projected to drive over 60% of same-day delivery volumes. The Wholesale and Retail Trade (Offline) sector is also a significant contributor, leveraging same-day delivery for local customer fulfillment and stock replenishment. The Healthcare industry is a rapidly growing segment, demanding urgent delivery of pharmaceuticals, medical equipment, and lab samples. Manufacturing relies on same-day delivery for critical spare parts and just-in-time inventory management, mitigating production downtime. Financial Services (BFSI) utilizes same-day delivery for high-security document transport.

Geographically, the United States represents the largest and most mature market, driven by its vast e-commerce penetration, advanced logistics infrastructure, and high consumer demand for speed. Key metropolitan areas like New York, Los Angeles, Chicago, and Dallas are hubs for same-day delivery operations. Canada also presents a significant and growing market, with increasing adoption of e-commerce and same-day delivery services, particularly in major urban centers like Toronto, Montreal, and Vancouver. Mexico’s market is rapidly expanding, fueled by increasing internet access and a growing middle class, though infrastructure challenges remain.

Key Growth Drivers by Segment:

- Mode of Transport (Road): Infrastructure development, efficient traffic management, and advancements in fleet management technology.

- Shipment Weight (Light Weight): Explosive growth of e-commerce, increasing consumer purchasing power for smaller, everyday items.

- Destination (Domestic): Ubiquitous internet access, strong domestic retail presence, and consumer preference for rapid fulfillment.

- End User Industry (E-Commerce): Proliferation of online marketplaces, competitive pressure to offer faster delivery options, and a desire for instant gratification.

- End User Industry (Healthcare): Aging population, increasing demand for home healthcare, and the need for rapid delivery of life-saving medications.

North America Same Day Delivery Market Product Analysis

The North America Same Day Delivery Market is characterized by a range of service innovations focused on speed, reliability, and customization. Core offerings include on-demand delivery for e-commerce orders, urgent medical supplies, and critical business documents. Technological advancements are central to product development, with sophisticated route optimization software, real-time tracking portals, and dedicated mobile applications enhancing user experience and operational efficiency. Companies are also investing in specialized fleet management and expanding their network of strategically located micro-fulfillment centers to reduce transit times. The competitive advantage lies in the ability to offer a seamless, transparent, and exceptionally fast delivery experience, catering to the growing consumer demand for immediacy and the business need for operational agility.

Key Drivers, Barriers & Challenges in North America Same Day Delivery Market

Key Drivers:

The North America Same Day Delivery Market is propelled by several key factors. The exponential growth of e-commerce is the primary driver, with consumers increasingly prioritizing speed and convenience. Technological advancements in route optimization, AI-powered logistics, and real-time tracking significantly enhance operational efficiency and delivery speed. Furthermore, evolving consumer expectations for immediate gratification are creating a strong demand for same-day services across various industries. Government initiatives supporting e-commerce and logistics infrastructure also play a crucial role. The market was valued at approximately $40,000 Million in the historical period of 2019.

Barriers & Challenges:

Despite strong growth, the market faces significant challenges. High operational costs, including labor, fuel, and vehicle maintenance, can impact profitability, especially for smaller players. Traffic congestion in urban areas can lead to delivery delays, undermining the "same-day" promise. Regulatory hurdles, such as zoning laws and labor regulations, can also create complexities. Supply chain disruptions, as witnessed during global events, can severely impact the ability to fulfill same-day orders. Intense competitive pressure from established giants like Amazon, FedEx, and UPS, along with numerous smaller aggregators, necessitates continuous innovation and cost management. The market encountered an estimated XX% increase in operational costs in the historical period of 2021 due to supply chain issues.

Growth Drivers in the North America Same Day Delivery Market Market

The North America Same Day Delivery Market is experiencing robust growth driven by several interconnected factors. The relentless expansion of the e-commerce sector, coupled with increasing consumer demand for instant gratification, forms the bedrock of this growth. Technological innovations, including advanced route optimization algorithms, AI-driven logistics platforms, and real-time tracking systems, are empowering logistics providers to achieve unprecedented levels of efficiency and speed. Furthermore, strategic investments in localized fulfillment centers and micro-warehousing are bringing inventory closer to end consumers, significantly reducing transit times. Policy support for e-commerce and logistics infrastructure development also contributes to a favorable market environment.

Challenges Impacting North America Same Day Delivery Market Growth

Several significant challenges are impacting the growth trajectory of the North America Same Day Delivery Market. High operational costs, encompassing labor, fuel, and fleet management, can erode profit margins, particularly for businesses operating on thin margins. Traffic congestion in urban centers poses a persistent threat to delivery timelines, often leading to delays and customer dissatisfaction. Navigating complex regulatory landscapes, including varying state and local ordinances related to transportation and labor, adds operational friction. Furthermore, supply chain vulnerabilities and unforeseen disruptions can severely hinder the ability to maintain consistent same-day delivery capabilities. Intense competitive pressures from dominant players necessitate continuous investment in technology and service quality.

Key Players Shaping the North America Same Day Delivery Market Market

- Amazon

- Jet Delivery Inc

- DHL Group

- Spee Dee Delivery Service Inc

- FedEx

- Fastfrate Group

- United Parcel Service of America Inc (UPS)

- USP

- International Distributions Services (including GLS)

- OnTrac

- Aramex

- DTDC Express Limited

Significant North America Same Day Delivery Market Industry Milestones

- December 2023: Amazon has delivered 1 billion packages from Same-Day sites in the United States, underscoring the scale and success of its rapid fulfillment strategy. The integrated nature of these sites for quick deliveries, fulfillment, and sorting further enhances efficiency.

- December 2023: Amazon launched its second same-day delivery facility in Massachusetts, a 200,000-square-foot custom-built site in Westborough, expanding its capacity to serve towns and cities in Central Massachusetts. This move signifies a continued commitment to geographic expansion and service enhancement.

- July 2023: XLT Pack and Ship Services opened a service center in James Town, Virginia, addressing a gap in available packing and shipping services in the area. This initiative, offering services through Spee-Dee Delivery Service Inc. and other companies, highlights the ongoing expansion of localized, accessible delivery solutions.

Future Outlook for North America Same Day Delivery Market Market

The future outlook for the North America Same Day Delivery Market remains exceptionally bright, driven by sustained demand for instant fulfillment and ongoing technological advancements. The market is expected to witness continuous innovation in drone delivery, autonomous vehicles, and hyper-localized micro-fulfillment networks, further optimizing speed and cost-effectiveness. The growing adoption of same-day delivery services by sectors beyond e-commerce, such as healthcare and manufacturing, will create new avenues for growth. Strategic partnerships and consolidations are likely to shape the competitive landscape as companies strive to enhance their service offerings and geographical reach. The market is projected to reach approximately $150,000 Million by 2033, reflecting a robust CAGR of 12.5% from 2025.

North America Same Day Delivery Market Segmentation

-

1. Mode Of Transport

- 1.1. Air

- 1.2. Road

- 1.3. Others

-

2. Shipment Weight

- 2.1. Heavy Weight Shipments

- 2.2. Light Weight Shipments

- 2.3. Medium Weight Shipments

-

3. Destination

- 3.1. Domestic

- 3.2. International

-

4. End User Industry

- 4.1. E-Commerce

- 4.2. Financial Services (BFSI)

- 4.3. Healthcare

- 4.4. Manufacturing

- 4.5. Primary Industry

- 4.6. Wholesale and Retail Trade (Offline)

- 4.7. Others

North America Same Day Delivery Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Same Day Delivery Market Regional Market Share

Geographic Coverage of North America Same Day Delivery Market

North America Same Day Delivery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 21.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising E-commerce Sector to Boost the International CEP Market in China; Increasing Volume of Parcel Shipments in China

- 3.3. Market Restrains

- 3.3.1. Poor infrastructure and higher logistics costs; Lack of control of manufacturers on logistics services

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Same Day Delivery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mode Of Transport

- 5.1.1. Air

- 5.1.2. Road

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Shipment Weight

- 5.2.1. Heavy Weight Shipments

- 5.2.2. Light Weight Shipments

- 5.2.3. Medium Weight Shipments

- 5.3. Market Analysis, Insights and Forecast - by Destination

- 5.3.1. Domestic

- 5.3.2. International

- 5.4. Market Analysis, Insights and Forecast - by End User Industry

- 5.4.1. E-Commerce

- 5.4.2. Financial Services (BFSI)

- 5.4.3. Healthcare

- 5.4.4. Manufacturing

- 5.4.5. Primary Industry

- 5.4.6. Wholesale and Retail Trade (Offline)

- 5.4.7. Others

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Mode Of Transport

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Amazon

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Jet Delivery Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DHL Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Spee Dee Delivery Service Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 FedEx

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Fastfrate Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 United Parcel Service of America Inc (UPS)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 USP

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 International Distributions Services (including GLS)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 OnTrac

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Aramex

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 DTDC Express Limited

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Amazon

List of Figures

- Figure 1: North America Same Day Delivery Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Same Day Delivery Market Share (%) by Company 2025

List of Tables

- Table 1: North America Same Day Delivery Market Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 2: North America Same Day Delivery Market Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 3: North America Same Day Delivery Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 4: North America Same Day Delivery Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 5: North America Same Day Delivery Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: North America Same Day Delivery Market Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 7: North America Same Day Delivery Market Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 8: North America Same Day Delivery Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 9: North America Same Day Delivery Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 10: North America Same Day Delivery Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United States North America Same Day Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada North America Same Day Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico North America Same Day Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Same Day Delivery Market?

The projected CAGR is approximately 21.5%.

2. Which companies are prominent players in the North America Same Day Delivery Market?

Key companies in the market include Amazon, Jet Delivery Inc, DHL Group, Spee Dee Delivery Service Inc, FedEx, Fastfrate Group, United Parcel Service of America Inc (UPS), USP, International Distributions Services (including GLS), OnTrac, Aramex, DTDC Express Limited.

3. What are the main segments of the North America Same Day Delivery Market?

The market segments include Mode Of Transport, Shipment Weight, Destination, End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.41 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising E-commerce Sector to Boost the International CEP Market in China; Increasing Volume of Parcel Shipments in China.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Poor infrastructure and higher logistics costs; Lack of control of manufacturers on logistics services.

8. Can you provide examples of recent developments in the market?

December 2023: Amazon has delivered 1 billion packages from Same-Day sites in the United States. The same-day delivery facilities are designed for quick deliveries, fulfillment, and sorting all from one site making delivering customer packages even faster.December 2023: Amazon has launched 2nd same-day delivery facility in Massachusetts for certain towns and cities in Central Massachusetts. It is a 200,000-square-foot, custom-built site launched in Westborough. It was a part of its plan to expand its same-day delivery services in Massachusetts.July 2023: XLT Pack and Ship Services opened a service center in James Town, Virginia, where there were no packing and shipping centers available. It offers packing and shipping services through Spee-Dee Delivery Service Inc. and other companies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Same Day Delivery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Same Day Delivery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Same Day Delivery Market?

To stay informed about further developments, trends, and reports in the North America Same Day Delivery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence