Key Insights

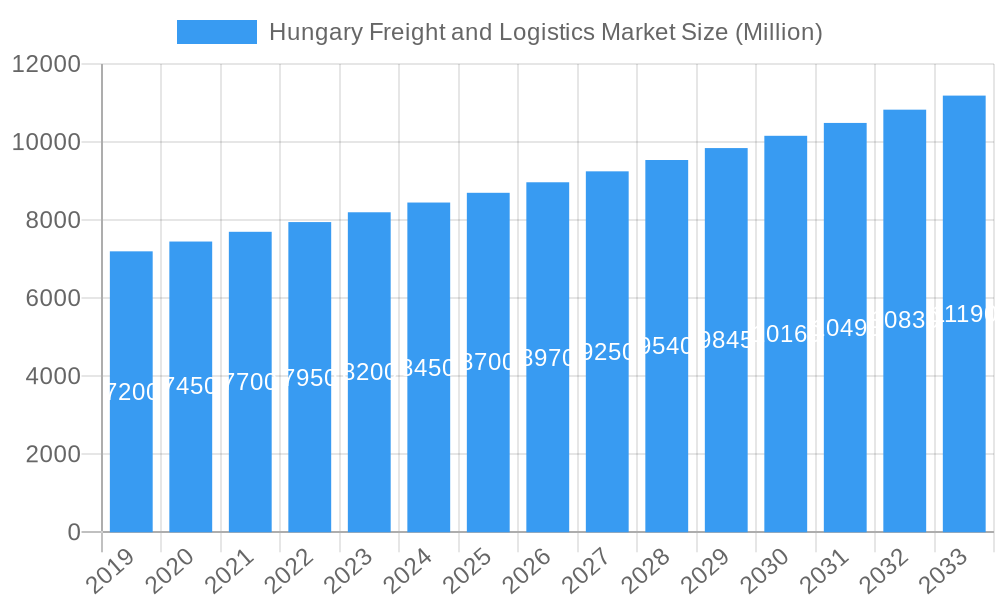

The Hungary freight and logistics market is poised for significant expansion, driven by robust economic activity and strategic investments in infrastructure. With an estimated market size of approximately $8,500 million in 2025 and a projected Compound Annual Growth Rate (CAGR) exceeding 6.00%, the sector is set to witness substantial value creation throughout the forecast period ending in 2033. Key growth catalysts include the burgeoning manufacturing and automotive sectors, which rely heavily on efficient and reliable freight transport services. Furthermore, the increasing integration of Hungary into global supply chains, coupled with government initiatives aimed at improving logistics infrastructure, will continue to fuel market expansion. The demand for multimodal transportation, encompassing road, rail, and inland waterways, is expected to rise as businesses seek cost-effective and sustainable shipping solutions. Value-added services, such as warehousing and freight forwarding, are also critical components of this growth, offering integrated solutions that enhance supply chain efficiency.

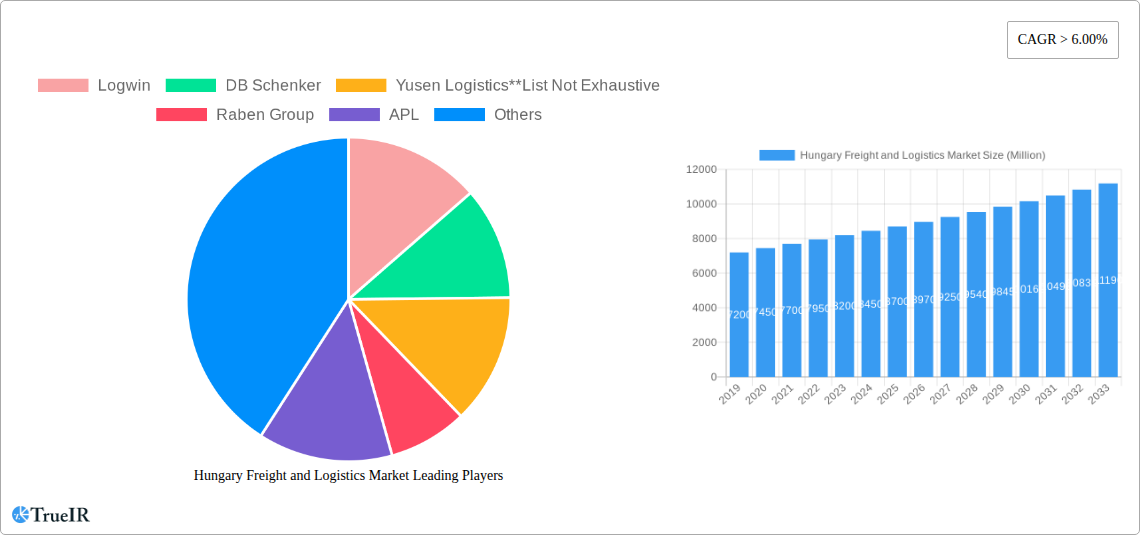

Hungary Freight and Logistics Market Market Size (In Billion)

The market's trajectory is further shaped by emerging trends like digitalization and the adoption of advanced technologies in logistics operations. These advancements are improving visibility, optimizing routes, and enhancing overall operational efficiency. However, the sector faces certain restraints, including the escalating costs of fuel and labor, as well as the need for continuous investment in modernizing infrastructure and fleet. Regulatory hurdles and environmental concerns also present challenges that necessitate adaptive strategies. Nevertheless, the inherent strengths of Hungary as a central European logistics hub, coupled with its strategic location and skilled workforce, provide a fertile ground for sustained growth. Companies like DB Schenker, CEVA Logistics, and Logwin are actively expanding their presence and service offerings, indicating a competitive landscape focused on innovation and customer-centric solutions. The ongoing development of specialized logistics services for industries like oil and gas, mining, and agriculture will also contribute to the market's diversification and overall value.

Hungary Freight and Logistics Market Company Market Share

Hungary Freight and Logistics Market: Comprehensive Analysis and Future Projections (2019-2033)

This in-depth report provides a detailed examination of the Hungary freight and logistics market, encompassing market structure, trends, dominant segments, product analysis, growth drivers, challenges, key players, and future outlook. Leveraging high-volume SEO keywords such as "Hungary logistics market," "Hungarian freight transport," "Central Europe logistics," "road freight Hungary," "warehousing Hungary," and "automotive logistics Hungary," this analysis is designed to capture industry attention and improve search engine rankings. The study period spans from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, supported by historical data from 2019 to 2024. All monetary values are presented in millions of USD.

Hungary Freight and Logistics Market Market Structure & Competitive Landscape

The Hungary freight and logistics market exhibits a moderately concentrated structure, with a mix of large international players and smaller domestic providers. Key companies such as Logwin, DB Schenker, Yusen Logistics (List Not Exhaustive), Raben Group, APL, CEVA Logistics, Cargill, NEC Logistics, Rhenus Logistics, and Austromar are actively shaping the competitive landscape. Innovation drivers are primarily focused on technological advancements in supply chain management, automation in warehousing, and the adoption of sustainable logistics solutions. Regulatory impacts, while generally supportive of trade, include evolving environmental standards and customs procedures. Product substitutes are limited within core freight and logistics services, but efficiency gains in one segment can indirectly impact others. End-user segmentation reveals strong demand from the Manufacturing and Automotive sector, followed by Retail, and Oil and Gas. Mergers and acquisitions (M&A) are a significant trend, with recent activities indicating a drive towards market consolidation and enhanced service offerings. The top 5 players are estimated to hold approximately 55-65% of the market share, demonstrating a degree of consolidation. M&A volumes are projected to grow by 8-12% annually in the forecast period, driven by the pursuit of scale and integrated supply chain solutions.

Hungary Freight and Logistics Market Market Trends & Opportunities

The Hungary freight and logistics market is poised for significant expansion, driven by robust economic growth, increasing foreign direct investment, and Hungary's strategic position as a logistics hub within Central Europe. Market size is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 6.5% to 7.5% during the forecast period (2025-2033), reaching an estimated market value of over USD 20,000 Million by 2033. Technological shifts are playing a pivotal role, with the adoption of digital platforms for freight management, real-time tracking, and predictive analytics gaining traction. Artificial intelligence (AI) and machine learning are being integrated to optimize route planning, warehouse operations, and demand forecasting, leading to enhanced efficiency and reduced operational costs. Consumer preferences are increasingly geared towards faster delivery times, greater transparency in shipment tracking, and more flexible delivery options, pushing logistics providers to innovate and adapt their service portfolios. Competitive dynamics are characterized by intense price competition, a focus on service quality, and a growing emphasis on specialized logistics solutions for sectors like automotive, pharmaceuticals, and e-commerce. Opportunities abound for logistics providers who can offer integrated, end-to-end supply chain solutions, leverage advanced technologies, and implement sustainable practices. The burgeoning e-commerce sector in Hungary presents a substantial opportunity for last-mile delivery and fulfillment services, with an estimated market penetration rate of over 70% for online retail. Furthermore, the ongoing development of infrastructure, including road networks and intermodal transport facilities, is creating fertile ground for increased efficiency and capacity.

Dominant Markets & Segments in Hungary Freight and Logistics Market

Within the Hungary freight and logistics market, Freight Transport, particularly Road Freight, stands out as the dominant segment, accounting for an estimated 60-65% of the total market value. This dominance is driven by several key factors:

- Infrastructure: Hungary boasts a well-developed road network, facilitating efficient domestic and cross-border transportation. Continuous investments in highway upgrades and border crossing improvements further bolster this segment.

- Policies: Government initiatives promoting trade and transit, alongside favorable EU regulations, support road freight operations.

- Flexibility and Accessibility: Road transport offers unparalleled flexibility and door-to-door delivery capabilities, making it ideal for a wide range of goods and industries.

- Manufacturing and Automotive Sector: This end-user segment is a primary driver for road freight, demanding timely and reliable transportation of raw materials, components, and finished vehicles. The automotive industry alone represents an estimated 30-35% of the total freight volume.

Warehousing is the second most significant segment, capturing approximately 20-25% of the market. Key growth drivers include:

- E-commerce Boom: The rapid growth of online retail necessitates extensive warehousing and fulfillment centers to manage inventory and facilitate efficient delivery.

- Strategic Location: Hungary's central European location makes it an attractive hub for distribution and storage, serving both domestic and international markets.

- Technological Advancements: Investment in automated warehouses, smart inventory management systems, and cold storage facilities is enhancing efficiency and capacity.

Freight Forwarding constitutes about 10-15% of the market. Its importance lies in its role in coordinating complex international shipments and optimizing multimodal transport. The growth in this segment is linked to the increasing volume of international trade facilitated by Hungary's membership in the EU.

Value-added Services and Other Functions represent the remaining portion, encompassing services like cross-docking, packaging, labeling, and reverse logistics. While smaller individually, these services are crucial for providing comprehensive supply chain solutions and catering to specific client needs.

The Manufacturing and Automotive end-user segment remains the largest consumer of freight and logistics services in Hungary, estimated at over 40% of the market demand. This is followed by the Retail sector, driven by both traditional retail and the burgeoning e-commerce landscape, accounting for approximately 25% of the demand. The Oil and Gas and Construction sectors also contribute significantly, albeit with more cyclical demand patterns.

Hungary Freight and Logistics Market Product Analysis

The Hungary freight and logistics market is characterized by a continuous evolution of service offerings driven by technological innovation and evolving customer demands. Key product innovations include the development of advanced tracking and tracing systems leveraging IoT devices and blockchain technology for enhanced supply chain transparency and security. AI-powered route optimization software is reducing transit times and fuel consumption, while automated warehousing solutions, including robotic picking and automated guided vehicles (AGVs), are significantly increasing operational efficiency and throughput. The competitive advantage for market players lies in their ability to offer integrated, end-to-end solutions that encompass multimodal transport, sophisticated warehousing, and value-added services tailored to specific industry needs, such as temperature-controlled logistics for the pharmaceutical and food sectors, and just-in-time delivery for the automotive industry.

Key Drivers, Barriers & Challenges in Hungary Freight and Logistics Market

Key Drivers: The Hungarian freight and logistics market is propelled by several key forces. Technologically, the adoption of digitalization, AI, and automation in warehousing and transport management is enhancing efficiency and cost-effectiveness. Economically, strong GDP growth, increasing FDI, and a robust manufacturing sector, particularly automotive, are driving demand for freight services. Policy-wise, Hungary's strategic location within the EU, coupled with government support for infrastructure development and trade facilitation, creates a favorable operating environment. The expansion of e-commerce is a significant growth catalyst, demanding more sophisticated and faster delivery networks.

Barriers & Challenges: Significant challenges impact the market. Regulatory complexities, including evolving environmental standards and cross-border compliance, can create hurdles. Supply chain disruptions, such as global shortages of shipping containers and port congestion, continue to pose risks. Competitive pressures, especially in road freight, lead to price wars that can impact profitability. Labor shortages in skilled logistics personnel are also a growing concern, affecting operational capacity and service quality. For instance, the cost of fuel, a significant operational expense, can fluctuate unpredictably, impacting transport costs. The estimated impact of supply chain disruptions on delivery times can range from 10-20% on average.

Growth Drivers in the Hungary Freight and Logistics Market Market

Key growth drivers in the Hungary freight and logistics market are multifaceted. Technologically, the ongoing digitalization of supply chains, including the adoption of IoT for real-time tracking and predictive analytics, is enhancing operational efficiency and visibility. Economically, sustained foreign direct investment in manufacturing, particularly in the automotive and electronics sectors, is boosting demand for inbound and outbound logistics services. Policy-driven factors, such as ongoing investments in national infrastructure, including road and rail networks, and favorable EU trade agreements, facilitate smoother and more cost-effective cross-border movements. The burgeoning e-commerce market further fuels demand for last-mile delivery and warehousing solutions.

Challenges Impacting Hungary Freight and Logistics Market Growth

Challenges impacting Hungary freight and logistics market growth include the increasing complexity of global supply chains, leading to heightened risks of disruption. Regulatory hurdles, such as evolving environmental mandates and customs procedures, require continuous adaptation. Competitive pressures within the road freight segment often lead to intense price competition, squeezing profit margins. Furthermore, a persistent shortage of skilled labor, particularly truck drivers and warehouse personnel, poses a significant operational constraint, potentially impacting service delivery timelines and overall capacity. The unpredictable nature of energy prices also presents a considerable financial challenge for transportation companies.

Key Players Shaping the Hungary Freight and Logistics Market Market

- Logwin

- DB Schenker

- Yusen Logistics

- Raben Group

- APL

- CEVA Logistics

- Cargill

- NEC Logistics

- Rhenus Logistics

- Austromar

Significant Hungary Freight and Logistics Market Industry Milestones

- December 2022: Dachser acquired the remaining 50 percent of its Hungarian joint ventures, Liegl & DACHSER Szállítmányozási és Logisztikai Kft. and Liegl & DACHSER ASL Hungary Kft. This move significantly consolidated Dachser's presence in Hungary, integrating its European Logistics, Food Logistics, and Air & Sea Logistics business lines. The acquisition is expected to enhance service integration and operational efficiency for Dachser's Hungarian operations, which employed 394 people across seven locations and generated approximately USD 130 Million in revenue in 2021.

- May 2022: SPAR Hungary made substantial investments in its logistics network to boost efficiency. The company invested over USD 9.4 Million in transportation and logistics developments in 2021 and an additional USD 12.3 Million in 2022. These investments are crucial for modernizing its distribution capabilities and supporting its expanding retail operations, directly impacting the demand for warehousing and freight transport services.

Future Outlook for Hungary Freight and Logistics Market Market

The future outlook for the Hungary freight and logistics market is exceptionally promising, driven by continued economic integration within the EU, ongoing technological advancements, and the persistent growth of e-commerce. Strategic opportunities lie in expanding multimodal transport solutions to leverage Hungary's inland waterway and rail infrastructure, thereby enhancing sustainability and reducing costs. The development of smart logistics hubs and fulfillment centers equipped with advanced automation and data analytics capabilities will be critical for meeting the increasing demands for speed and efficiency. Furthermore, logistics providers focusing on specialized services, such as cold chain logistics for pharmaceuticals and temperature-sensitive food products, and tailored solutions for the thriving automotive sector, are well-positioned for sustained growth. The market is anticipated to experience a CAGR of 6.5-7.5% from 2025-2033, indicating robust expansion and significant potential for investment and innovation.

Hungary Freight and Logistics Market Segmentation

-

1. Function

-

1.1. Freight Transport

- 1.1.1. Road

- 1.1.2. Shipping and Inland Water

- 1.1.3. Air

- 1.1.4. Rail

- 1.2. Freight Forwarding

- 1.3. Warehousing

- 1.4. Value-added Services and Other Functions

-

1.1. Freight Transport

-

2. End User

- 2.1. Manufacturing and Automotive

- 2.2. Oil and Gas

- 2.3. Mining and Quarrying

- 2.4. Agriculture, Fishing, and Forestry

- 2.5. Construction

- 2.6. Distribu

- 2.7. Other En

Hungary Freight and Logistics Market Segmentation By Geography

- 1. Hungary

Hungary Freight and Logistics Market Regional Market Share

Geographic Coverage of Hungary Freight and Logistics Market

Hungary Freight and Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 6.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing volume of international trade4.; The rise of trade agreements between nations

- 3.3. Market Restrains

- 3.3.1. 4.; Surge in fuel costs affecting the market4.; Increasing trade tension

- 3.4. Market Trends

- 3.4.1. Rise in E-commerce Sector is Driving The Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Hungary Freight and Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Function

- 5.1.1. Freight Transport

- 5.1.1.1. Road

- 5.1.1.2. Shipping and Inland Water

- 5.1.1.3. Air

- 5.1.1.4. Rail

- 5.1.2. Freight Forwarding

- 5.1.3. Warehousing

- 5.1.4. Value-added Services and Other Functions

- 5.1.1. Freight Transport

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Manufacturing and Automotive

- 5.2.2. Oil and Gas

- 5.2.3. Mining and Quarrying

- 5.2.4. Agriculture, Fishing, and Forestry

- 5.2.5. Construction

- 5.2.6. Distribu

- 5.2.7. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Hungary

- 5.1. Market Analysis, Insights and Forecast - by Function

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Logwin

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DB Schenker

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Yusen Logistics**List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Raben Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 APL

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 CEVA Logistics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cargill

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 NEC Logistics

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Rhenus Logistics

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Austromar

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Logwin

List of Figures

- Figure 1: Hungary Freight and Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Hungary Freight and Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Hungary Freight and Logistics Market Revenue Million Forecast, by Function 2020 & 2033

- Table 2: Hungary Freight and Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Hungary Freight and Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Hungary Freight and Logistics Market Revenue Million Forecast, by Function 2020 & 2033

- Table 5: Hungary Freight and Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Hungary Freight and Logistics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hungary Freight and Logistics Market?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the Hungary Freight and Logistics Market?

Key companies in the market include Logwin, DB Schenker, Yusen Logistics**List Not Exhaustive, Raben Group, APL, CEVA Logistics, Cargill, NEC Logistics, Rhenus Logistics, Austromar.

3. What are the main segments of the Hungary Freight and Logistics Market?

The market segments include Function, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing volume of international trade4.; The rise of trade agreements between nations.

6. What are the notable trends driving market growth?

Rise in E-commerce Sector is Driving The Market.

7. Are there any restraints impacting market growth?

4.; Surge in fuel costs affecting the market4.; Increasing trade tension.

8. Can you provide examples of recent developments in the market?

December 2022: Dachser (a German freight company) acquired the remaining 50 percent of the shares in its Hungarian joint ventures, "Liegl & DACHSER Szállítmányozási és Logisztikai Kft." (transport and storage of industrial goods and food products) and "Liegl & DACHSER ASL Hungary Kft." (air and sea freight). Dachser is active in Hungary with its European Logistics, Food Logistics, and Air & Sea Logistics business lines. The company employs 394 people at seven locations. The country organization's revenue amounted to about EUR 120 million (USD 130 million) in 2021.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hungary Freight and Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hungary Freight and Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hungary Freight and Logistics Market?

To stay informed about further developments, trends, and reports in the Hungary Freight and Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence