Key Insights

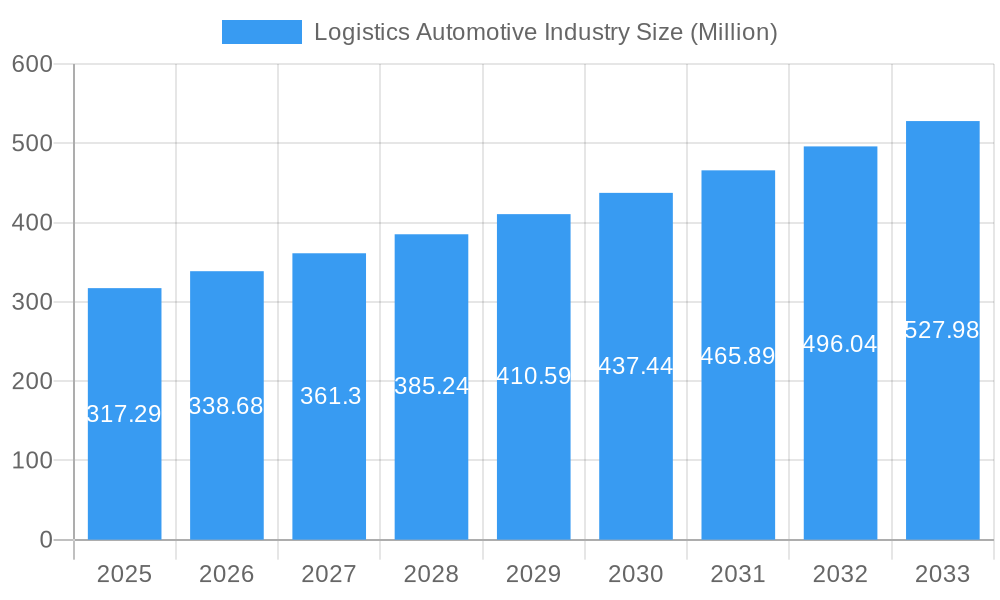

The global Automotive Logistics market is projected to experience robust growth, with a current market size of $317.29 million and a projected Compound Annual Growth Rate (CAGR) of 6.65% over the forecast period of 2025-2033. This expansion is primarily fueled by increasing global vehicle production and sales, alongside a growing demand for efficient and sophisticated supply chain solutions within the automotive sector. Key drivers include the continuous evolution of automotive manufacturing processes, the rise of electric vehicles (EVs) necessitating specialized logistics for batteries and components, and the increasing complexity of global supply chains. Furthermore, the demand for just-in-time (JIT) delivery and optimized inventory management for both finished vehicles and auto components is a significant growth catalyst. The market is witnessing a strong emphasis on technological integration, such as AI-powered route optimization, real-time tracking, and warehouse automation, to enhance efficiency and reduce operational costs.

Logistics Automotive Industry Market Size (In Million)

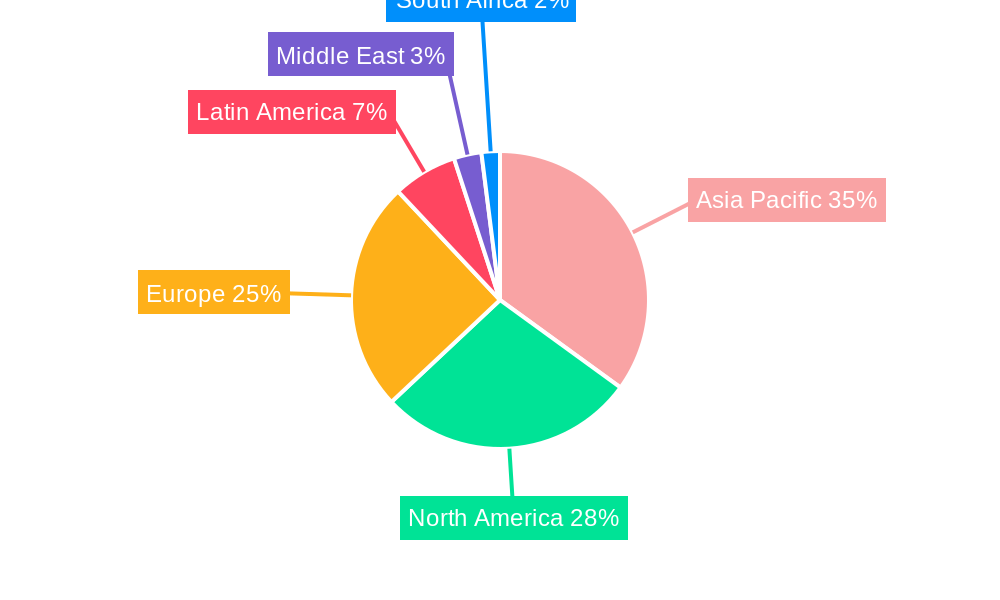

The market is segmented into various services, with Transportation and Warehousing forming the core offerings, supported by a range of Other Services that cater to specialized needs like customs clearance, inspection, and assembly. The type of goods handled spans Finished Vehicles and Auto Components, with an increasing focus on specialized logistics for EV batteries and charging infrastructure. Geographically, the Asia Pacific region, driven by the manufacturing prowess of China and India, is expected to lead market share. North America and Europe also represent substantial markets, influenced by established automotive industries and the ongoing transition to electric mobility. Restraints include rising fuel costs, geopolitical instability impacting trade routes, and the need for significant capital investment in advanced logistics infrastructure. However, the overarching trend towards digitalization, sustainability initiatives within logistics, and the growing sophistication of the automotive supply chain are poised to overcome these challenges, ensuring a dynamic and expanding market.

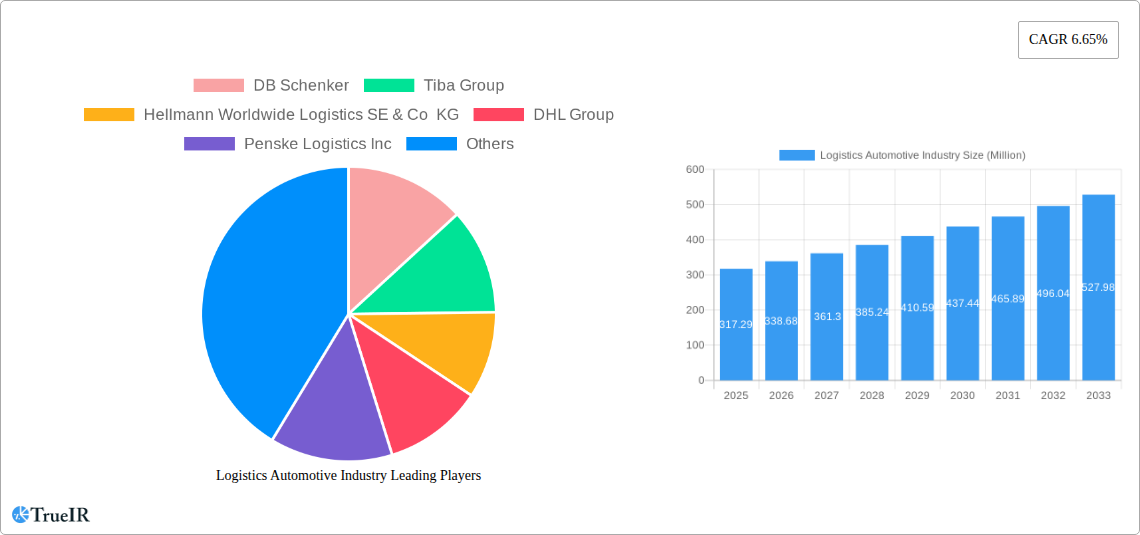

Logistics Automotive Industry Company Market Share

This comprehensive report delves into the dynamic and evolving landscape of the automotive logistics industry, a critical sector supporting global vehicle and component supply chains. Spanning a study period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, this analysis provides deep insights into market structure, trends, key players, and future outlook. Leveraging high-volume keywords such as "automotive logistics," "supply chain management," "finished vehicle transport," "auto parts logistics," and "global automotive shipping," this report is designed for optimal SEO performance and immediate engagement with industry stakeholders.

Logistics Automotive Industry Market Structure & Competitive Landscape

The automotive logistics market exhibits a moderately consolidated structure, with several global giants and regional specialists vying for market share. Innovation drivers are primarily focused on enhancing supply chain visibility, optimizing delivery times, and reducing operational costs through technological adoption. Regulatory impacts, while varying by region, often focus on emissions standards, trade agreements, and safety protocols for vehicle transportation. Product substitutes are limited within the core logistics services, but advancements in alternative logistics models and localized manufacturing could influence future demand. End-user segmentation is diverse, encompassing Original Equipment Manufacturers (OEMs), Tier 1, Tier 2, and Tier 3 auto component suppliers, and aftermarket service providers. Mergers and acquisitions (M&A) are a significant trend, with companies consolidating to achieve greater economies of scale and expand their service portfolios. Notable M&A activities indicate a strong drive for integration. The market concentration ratio is estimated to be around 60% among the top 10 players. M&A volumes in the historical period (2019-2024) are projected to exceed 100 Million transactions.

Logistics Automotive Industry Market Trends & Opportunities

The global automotive logistics market is projected to witness substantial growth, driven by increasing vehicle production volumes, the expansion of electric vehicle (EV) manufacturing, and the intricate demands of globalized supply chains. The market size is anticipated to surge from an estimated 500 Million in the base year 2025 to over 800 Million by 2033, reflecting a Compound Annual Growth Rate (CAGR) of approximately 6%. Technological shifts are revolutionizing the sector, with the adoption of AI, IoT, blockchain, and advanced analytics for real-time tracking, predictive maintenance, route optimization, and warehouse automation. These technologies are instrumental in addressing the complexities of automotive supply chain management. Consumer preferences are increasingly leaning towards faster delivery times, greater transparency, and more sustainable logistics solutions, pushing service providers to innovate and invest in greener transportation methods and efficient warehousing. Competitive dynamics are intensifying, with a strong emphasis on value-added services, specialized logistics solutions for EVs, and end-to-end supply chain integration. Market penetration rates for advanced logistics technologies are steadily increasing, creating significant opportunities for early adopters and innovators in areas like autonomous delivery vehicles and smart warehousing. The rise of e-commerce for auto parts also presents a growing segment demanding specialized fulfillment and last-mile delivery strategies.

Dominant Markets & Segments in Logistics Automotive Industry

The Transportation segment is the dominant force within the logistics automotive industry, accounting for an estimated 65% of the market share. This dominance is fueled by the sheer volume and complexity of moving finished vehicles and auto components across continents.

- Key Growth Drivers for Transportation:

- Increasing Global Vehicle Production: Rising demand for automobiles worldwide directly correlates with the need for robust transportation networks.

- Emergence of Electric Vehicles (EVs): The growing production and sales of EVs necessitate specialized transportation solutions, including battery handling and charging infrastructure integration.

- Complex Global Supply Chains: The interconnected nature of automotive manufacturing requires efficient and reliable multimodal transportation services (sea, air, road, rail).

- Trade Policies and Agreements: Favorable trade environments facilitate the cross-border movement of vehicles and parts, boosting transportation demand.

Within Type, Finished Vehicle logistics continues to hold a significant share, driven by the direct delivery of new cars to dealerships and customers. However, the Auto Components segment is experiencing robust growth due to the intricate network of suppliers and the continuous need for just-in-time delivery to manufacturing plants.

- Market Dominance Analysis:

- Transportation Services: The need for international shipping, port handling, and inland distribution of vehicles and parts makes transportation the backbone of the industry. Companies like DB Schenker, DHL Group, and Kuehne + Nagel International AG lead in this domain due to their extensive global networks and specialized fleets. The volume of finished vehicles transported annually is estimated to be over 100 Million units, with auto components logistics supporting this volume with trillions of components moved.

- Finished Vehicle Logistics: This segment is characterized by specialized carriers, enclosed transport options, and stringent quality control to prevent damage during transit. The demand for premium delivery experiences is also shaping this segment.

- Auto Components Logistics: This segment is driven by the need for precision, efficiency, and cost-effectiveness, often involving complex inventory management and a high frequency of deliveries. The integration of advanced tracking and inventory systems is crucial here.

Logistics Automotive Industry Product Analysis

Product innovations in automotive logistics are increasingly focused on enhancing efficiency, transparency, and sustainability. This includes the development of smart containers with real-time tracking and condition monitoring for sensitive components and finished vehicles. Advanced route optimization software, powered by AI and machine learning, is crucial for minimizing transit times and fuel consumption. The competitive advantage lies in offering integrated end-to-end solutions that encompass warehousing, transportation, customs clearance, and last-mile delivery. Furthermore, specialized handling solutions for electric vehicle batteries, a key innovation, are becoming paramount, offering improved safety and compliance. The market fit for these innovations is high, addressing the growing demands for speed, reliability, and environmental responsibility in the automotive supply chain.

Key Drivers, Barriers & Challenges in Logistics Automotive Industry

Key Drivers: The logistics automotive industry is propelled by several key drivers, including the relentless growth in global vehicle production, particularly in emerging markets. The burgeoning electric vehicle segment demands specialized logistics solutions, acting as a significant growth catalyst. Technological advancements, such as AI-powered route optimization and IoT-enabled supply chain visibility, are crucial for enhancing efficiency. Favorable trade policies and government initiatives promoting manufacturing and logistics infrastructure further bolster the market.

Key Barriers & Challenges: Supply chain disruptions, exacerbated by geopolitical events and natural disasters, pose a significant challenge. Regulatory complexities and varying compliance standards across different regions can impede seamless operations. Intense competition and pressure on freight rates can impact profitability, with an estimated 20% of logistics providers facing significant margin squeeze. The need for substantial capital investment in specialized fleets, technology, and infrastructure also presents a barrier for smaller players. Managing the complex logistics of battery transportation for EVs, with stringent safety regulations, is an emerging challenge.

Growth Drivers in the Logistics Automotive Industry Market

The logistics automotive industry market is experiencing robust growth driven by several pivotal factors. The increasing global demand for vehicles, coupled with the rapid expansion of the electric vehicle (EV) market, necessitates advanced and specialized logistics solutions. Technological advancements, including the widespread adoption of AI for route optimization and predictive analytics, alongside IoT for real-time supply chain visibility, are critical enablers. Furthermore, supportive government policies and infrastructure development projects in key automotive manufacturing hubs worldwide contribute significantly to market expansion. The ongoing globalization of supply chains also fuels the demand for efficient international freight forwarding and multimodal transportation services.

Challenges Impacting Logistics Automotive Industry Growth

Despite the positive growth trajectory, the logistics automotive industry faces considerable challenges that can impede its progress. Persistent global supply chain disruptions, ranging from semiconductor shortages to port congestion, continue to create bottlenecks and increase lead times. Navigating the complex web of international trade regulations, tariffs, and customs procedures across diverse markets presents a significant hurdle. The increasing environmental scrutiny and stricter emission standards require substantial investment in greener logistics solutions and alternative fuels. Moreover, the intense competitive landscape and the constant pressure to reduce costs can strain profit margins for logistics providers. The sheer complexity of managing a global automotive supply chain, from raw materials to finished vehicles, remains a formidable operational challenge.

Key Players Shaping the Logistics Automotive Industry Market

- DB Schenker

- Tiba Group

- Hellmann Worldwide Logistics SE & Co KG

- DHL Group

- Penske Logistics Inc

- Kuehne + Nagel International AG

- BLG Logistics Group AG & Co KG

- CFR Rinkens

- CEVA Logistics

- Expeditors

- APL Logistics Ltd

- XPO Logistics Inc

- GEFCO SA

- Panalpina

- Bollore Logistics

- Kerry Logistics Network Ltd

- Ryder System Inc

- DSV Panalpina AS

Significant Logistics Automotive Industry Industry Milestones

- December 2022: Delhivery's acquisition of Algorhythm Tech Pvt Ltd for USD 17.99 Million (INR 14.9 crores) significantly expands its integrated supply chain solutions portfolio, signaling a strategic move towards enhancing its technological capabilities in logistics.

- August 2022: Bolloré Logistics' acquisition of Lynair Logistics in Australia marks a strategic expansion of its Pacific region footprint, integrating experienced personnel and strengthening its service offering in a key growth market.

Future Outlook for Logistics Automotive Industry Market

The future outlook for the logistics automotive industry is exceptionally promising, driven by sustained growth in vehicle production, the accelerating shift towards electric vehicles, and the increasing demand for integrated, technology-driven supply chain solutions. Strategic opportunities lie in the development of specialized logistics for EV batteries, the implementation of predictive analytics for proactive risk management, and the expansion of digital platforms for enhanced supply chain visibility and collaboration. The market potential is immense for logistics providers who can offer agile, sustainable, and cost-effective services that meet the evolving needs of the global automotive sector. Investments in automation, AI, and green logistics will be key differentiators in capturing future market share.

Logistics Automotive Industry Segmentation

-

1. Service

- 1.1. Transportation

- 1.2. Warehous

- 1.3. Other Services

-

2. Type

- 2.1. Finished Vehicle

- 2.2. Auto Components

- 2.3. Other Types

Logistics Automotive Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. India

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. Italy

- 3.4. Russia

- 3.5. France

- 3.6. Rest of Europe

-

4. Latin America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of Latin America

- 5. Middle East

-

6. South Africa

- 6.1. United Arab Emirates

- 6.2. Saudi Arabia

- 6.3. Rest of Middle East

Logistics Automotive Industry Regional Market Share

Geographic Coverage of Logistics Automotive Industry

Logistics Automotive Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.65% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rise In Agriculture Sector and Food Industry4.; Rise In Pharmaceutical Industry

- 3.3. Market Restrains

- 3.3.1. 4.; Cost Constraints4.; Infrastructure Accessibility

- 3.4. Market Trends

- 3.4.1. Positive Outlook for the Automotive Sales and Production Demands Efficient Logistics Services

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Logistics Automotive Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Transportation

- 5.1.2. Warehous

- 5.1.3. Other Services

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Finished Vehicle

- 5.2.2. Auto Components

- 5.2.3. Other Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.3.6. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Asia Pacific Logistics Automotive Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Transportation

- 6.1.2. Warehous

- 6.1.3. Other Services

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Finished Vehicle

- 6.2.2. Auto Components

- 6.2.3. Other Types

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. North America Logistics Automotive Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Transportation

- 7.1.2. Warehous

- 7.1.3. Other Services

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Finished Vehicle

- 7.2.2. Auto Components

- 7.2.3. Other Types

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Europe Logistics Automotive Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Transportation

- 8.1.2. Warehous

- 8.1.3. Other Services

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Finished Vehicle

- 8.2.2. Auto Components

- 8.2.3. Other Types

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. Latin America Logistics Automotive Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Transportation

- 9.1.2. Warehous

- 9.1.3. Other Services

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Finished Vehicle

- 9.2.2. Auto Components

- 9.2.3. Other Types

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. Middle East Logistics Automotive Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service

- 10.1.1. Transportation

- 10.1.2. Warehous

- 10.1.3. Other Services

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Finished Vehicle

- 10.2.2. Auto Components

- 10.2.3. Other Types

- 10.1. Market Analysis, Insights and Forecast - by Service

- 11. South Africa Logistics Automotive Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Service

- 11.1.1. Transportation

- 11.1.2. Warehous

- 11.1.3. Other Services

- 11.2. Market Analysis, Insights and Forecast - by Type

- 11.2.1. Finished Vehicle

- 11.2.2. Auto Components

- 11.2.3. Other Types

- 11.1. Market Analysis, Insights and Forecast - by Service

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 DB Schenker

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Tiba Group

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Hellmann Worldwide Logistics SE & Co KG

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 DHL Group

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Penske Logistics Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Kuehne + Nagel International AG

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 BLG Logistics Group AG & Co KG

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 CFR Rinkens**List Not Exhaustive

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 CEVA Logistics

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Expeditors

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 APL Logistics Ltd

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 XPO Logistics Inc

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 GEFCO SA

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 Panalpina

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.15 Bollore Logistics

- 12.2.15.1. Overview

- 12.2.15.2. Products

- 12.2.15.3. SWOT Analysis

- 12.2.15.4. Recent Developments

- 12.2.15.5. Financials (Based on Availability)

- 12.2.16 Kerry Logistics Network Ltd

- 12.2.16.1. Overview

- 12.2.16.2. Products

- 12.2.16.3. SWOT Analysis

- 12.2.16.4. Recent Developments

- 12.2.16.5. Financials (Based on Availability)

- 12.2.17 Ryder System Inc

- 12.2.17.1. Overview

- 12.2.17.2. Products

- 12.2.17.3. SWOT Analysis

- 12.2.17.4. Recent Developments

- 12.2.17.5. Financials (Based on Availability)

- 12.2.18 DSV Panalpina AS

- 12.2.18.1. Overview

- 12.2.18.2. Products

- 12.2.18.3. SWOT Analysis

- 12.2.18.4. Recent Developments

- 12.2.18.5. Financials (Based on Availability)

- 12.2.1 DB Schenker

List of Figures

- Figure 1: Global Logistics Automotive Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Logistics Automotive Industry Revenue (Million), by Service 2025 & 2033

- Figure 3: Asia Pacific Logistics Automotive Industry Revenue Share (%), by Service 2025 & 2033

- Figure 4: Asia Pacific Logistics Automotive Industry Revenue (Million), by Type 2025 & 2033

- Figure 5: Asia Pacific Logistics Automotive Industry Revenue Share (%), by Type 2025 & 2033

- Figure 6: Asia Pacific Logistics Automotive Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: Asia Pacific Logistics Automotive Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Logistics Automotive Industry Revenue (Million), by Service 2025 & 2033

- Figure 9: North America Logistics Automotive Industry Revenue Share (%), by Service 2025 & 2033

- Figure 10: North America Logistics Automotive Industry Revenue (Million), by Type 2025 & 2033

- Figure 11: North America Logistics Automotive Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: North America Logistics Automotive Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Logistics Automotive Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Logistics Automotive Industry Revenue (Million), by Service 2025 & 2033

- Figure 15: Europe Logistics Automotive Industry Revenue Share (%), by Service 2025 & 2033

- Figure 16: Europe Logistics Automotive Industry Revenue (Million), by Type 2025 & 2033

- Figure 17: Europe Logistics Automotive Industry Revenue Share (%), by Type 2025 & 2033

- Figure 18: Europe Logistics Automotive Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Logistics Automotive Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Logistics Automotive Industry Revenue (Million), by Service 2025 & 2033

- Figure 21: Latin America Logistics Automotive Industry Revenue Share (%), by Service 2025 & 2033

- Figure 22: Latin America Logistics Automotive Industry Revenue (Million), by Type 2025 & 2033

- Figure 23: Latin America Logistics Automotive Industry Revenue Share (%), by Type 2025 & 2033

- Figure 24: Latin America Logistics Automotive Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Logistics Automotive Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Logistics Automotive Industry Revenue (Million), by Service 2025 & 2033

- Figure 27: Middle East Logistics Automotive Industry Revenue Share (%), by Service 2025 & 2033

- Figure 28: Middle East Logistics Automotive Industry Revenue (Million), by Type 2025 & 2033

- Figure 29: Middle East Logistics Automotive Industry Revenue Share (%), by Type 2025 & 2033

- Figure 30: Middle East Logistics Automotive Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East Logistics Automotive Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: South Africa Logistics Automotive Industry Revenue (Million), by Service 2025 & 2033

- Figure 33: South Africa Logistics Automotive Industry Revenue Share (%), by Service 2025 & 2033

- Figure 34: South Africa Logistics Automotive Industry Revenue (Million), by Type 2025 & 2033

- Figure 35: South Africa Logistics Automotive Industry Revenue Share (%), by Type 2025 & 2033

- Figure 36: South Africa Logistics Automotive Industry Revenue (Million), by Country 2025 & 2033

- Figure 37: South Africa Logistics Automotive Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Logistics Automotive Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Global Logistics Automotive Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 3: Global Logistics Automotive Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Logistics Automotive Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 5: Global Logistics Automotive Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Logistics Automotive Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: China Logistics Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Japan Logistics Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: India Logistics Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: South Korea Logistics Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Logistics Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Logistics Automotive Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 13: Global Logistics Automotive Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Logistics Automotive Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United States Logistics Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Logistics Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Mexico Logistics Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Logistics Automotive Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 19: Global Logistics Automotive Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 20: Global Logistics Automotive Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: United Kingdom Logistics Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Germany Logistics Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Italy Logistics Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia Logistics Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France Logistics Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Rest of Europe Logistics Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Global Logistics Automotive Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 28: Global Logistics Automotive Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 29: Global Logistics Automotive Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Brazil Logistics Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Argentina Logistics Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Rest of Latin America Logistics Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Global Logistics Automotive Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 34: Global Logistics Automotive Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 35: Global Logistics Automotive Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Logistics Automotive Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 37: Global Logistics Automotive Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 38: Global Logistics Automotive Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 39: United Arab Emirates Logistics Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Saudi Arabia Logistics Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East Logistics Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Logistics Automotive Industry?

The projected CAGR is approximately 6.65%.

2. Which companies are prominent players in the Logistics Automotive Industry?

Key companies in the market include DB Schenker, Tiba Group, Hellmann Worldwide Logistics SE & Co KG, DHL Group, Penske Logistics Inc, Kuehne + Nagel International AG, BLG Logistics Group AG & Co KG, CFR Rinkens**List Not Exhaustive, CEVA Logistics, Expeditors, APL Logistics Ltd, XPO Logistics Inc, GEFCO SA, Panalpina, Bollore Logistics, Kerry Logistics Network Ltd, Ryder System Inc, DSV Panalpina AS.

3. What are the main segments of the Logistics Automotive Industry?

The market segments include Service, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 317.29 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rise In Agriculture Sector and Food Industry4.; Rise In Pharmaceutical Industry.

6. What are the notable trends driving market growth?

Positive Outlook for the Automotive Sales and Production Demands Efficient Logistics Services.

7. Are there any restraints impacting market growth?

4.; Cost Constraints4.; Infrastructure Accessibility.

8. Can you provide examples of recent developments in the market?

December 2022: Delhivery, a provider of logistics services, announced the acquisition of Algorhythm Tech Pvt Ltd of Pune for INR 14.9 crores (USD 17.99 Million) in an all-cash purchase to expand its integrated supply chain solutions portfolio. By the end of January 2023, Delhivery anticipates the acquisition to be completed. At this point, Algorhythm Tech will function as a fully-owned subsidiary of the logistics company based in Gurugram.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Logistics Automotive Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Logistics Automotive Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Logistics Automotive Industry?

To stay informed about further developments, trends, and reports in the Logistics Automotive Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence