Key Insights

The global Agriculture Logistics Market is projected to experience substantial growth, reaching an estimated $414.57 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 9.6% through 2033. This expansion is driven by increasing global food demand, technological advancements in agriculture, and the growing need for efficient handling of perishable goods. Innovations like precision agriculture and IoT-enabled supply chains are boosting efficiency and reducing post-harvest losses, further stimulating market expansion. A heightened focus on sustainable practices and specialized logistics for temperature-sensitive products, including advanced cold chain solutions, are also key contributors to market evolution. Small and Medium Enterprises (SMEs) are increasingly leveraging efficient logistics to enhance competitiveness and market reach, driving demand for customized solutions.

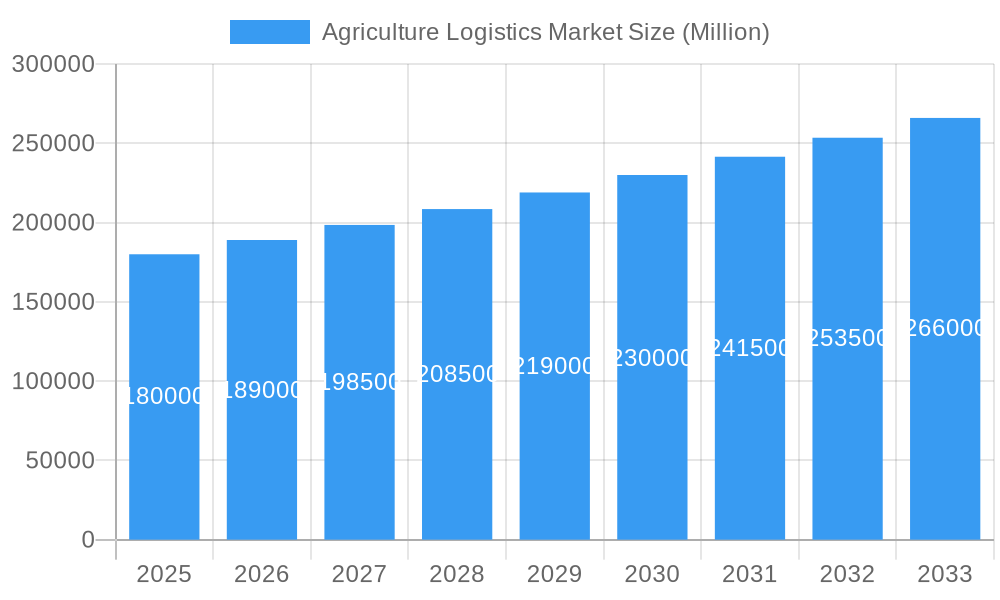

Agriculture Logistics Market Market Size (In Billion)

Key growth catalysts include the widespread adoption of cold chain logistics, essential for preserving the quality and extending the shelf life of fresh produce and agricultural commodities. Supportive government initiatives focused on rural infrastructure development and agricultural trade promotion are also significant. Market challenges include the high cost of specialized infrastructure, particularly for cold chain operations, and the risk of product spoilage due to inadequate handling and transportation. Fluctuating fuel prices and complex international regulations present additional operational hurdles. Nevertheless, strategic alliances between agricultural producers, logistics providers, and technology firms are fostering innovation for more resilient and efficient agricultural supply chains, with notable development and investment in regions like Asia Pacific and North America.

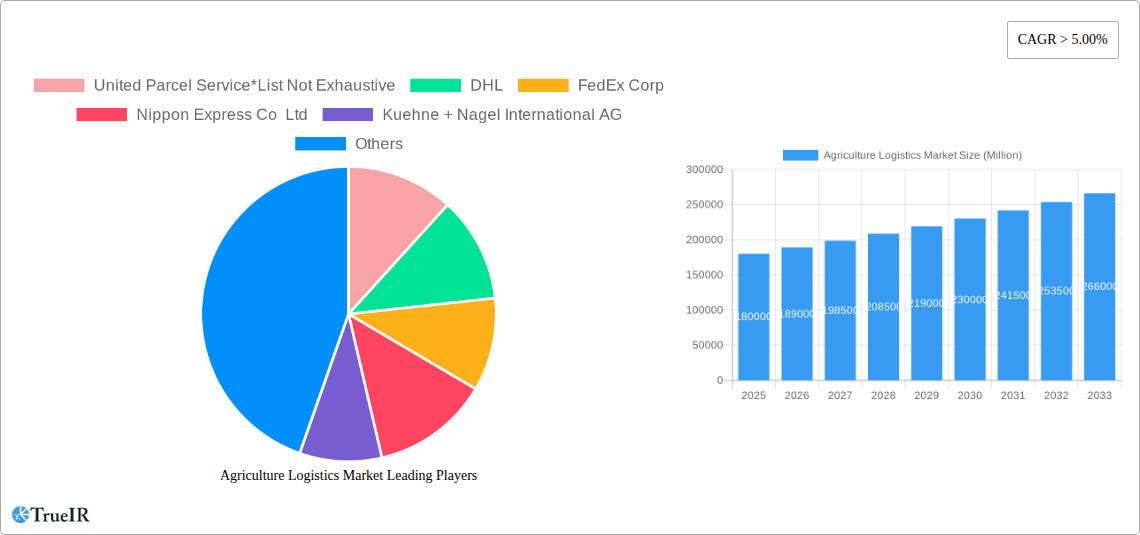

Agriculture Logistics Market Company Market Share

This comprehensive report offers an in-depth analysis of the Agriculture Logistics Market, a critical sector experiencing rapid evolution due to rising global food demand, technological advancements, and expanding e-commerce. Covering the study period of 2019–2033, with a base year of 2025, this research provides actionable insights for stakeholders aiming to navigate the complexities of agricultural supply chain management, farm-to-fork logistics, and food commodity transportation. Explore critical trends, market segmentation across transportation, warehousing, and value-added services, and the pivotal role of both small and medium enterprises (SMEs) and large enterprises. Discover key growth drivers, emerging opportunities, and the competitive landscape shaped by industry giants like United Parcel Service, DHL, FedEx Corp, Nippon Express Co Ltd, Kuehne + Nagel International AG, CEVA Logistics, The Maersk Group, C H Robinson, Bollore Logistics, and Blue Yonder. This report is your essential guide to understanding and capitalizing on the dynamic global agriculture logistics market.

Agriculture Logistics Market Market Structure & Competitive Landscape

The Agriculture Logistics Market exhibits a moderately consolidated structure, with leading players holding significant market share. The concentration ratio is influenced by substantial capital investments required for specialized infrastructure, advanced technology adoption, and extensive distribution networks. Innovation drivers are primarily focused on enhancing supply chain efficiency, reducing post-harvest losses, and ensuring the integrity of perishable agricultural products. This includes advancements in cold chain logistics, real-time tracking, and specialized packaging solutions. Regulatory impacts, while varying by region, often revolve around food safety standards, transportation regulations for agricultural commodities, and trade policies, creating both opportunities and challenges for market participants. Product substitutes are limited for primary agricultural logistics due to the unique handling requirements of fresh produce, grains, and other farm products; however, advancements in preservation technologies and alternative transportation methods are emerging. End-user segmentation into Small and Medium Enterprises (SMEs) and Large Enterprises reveals distinct needs: SMEs often seek cost-effective, flexible solutions, while large enterprises demand integrated, end-to-end logistics services. Merger and Acquisition (M&A) trends are noticeable as larger players seek to expand their geographical reach, acquire specialized capabilities, or consolidate market presence. Approximately USD 5,000 million in M&A activities were observed in the historical period, indicating strategic consolidation.

- Market Concentration: Moderate to high, driven by capital intensity.

- Innovation Drivers: Cold chain efficiency, real-time tracking, specialized packaging, sustainable logistics.

- Regulatory Impacts: Food safety, transportation compliance, international trade agreements.

- Product Substitutes: Limited for core agricultural products, but emerging in related services.

- End-User Segmentation: SMEs (cost-conscious, flexible) vs. Large Enterprises (integrated, end-to-end).

- M&A Trends: Strategic acquisitions for market expansion and capability enhancement.

Agriculture Logistics Market Market Trends & Opportunities

The Agriculture Logistics Market is poised for substantial growth, driven by an escalating global population and the consequent surge in demand for food products. The market size is projected to expand significantly, with an estimated CAGR of 6.5% from 2025 to 2033. This growth is intrinsically linked to technological shifts that are revolutionizing farm-to-table logistics. The adoption of IoT sensors for real-time monitoring of temperature, humidity, and location in transit is becoming increasingly prevalent, minimizing spoilage and ensuring product quality. Advanced analytics and AI are optimizing route planning, inventory management, and demand forecasting, leading to enhanced operational efficiency and reduced costs. Blockchain technology is also emerging as a key enabler, offering enhanced traceability and transparency across the supply chain, which is crucial for food safety and regulatory compliance.

Consumer preferences are evolving, with a growing emphasis on sustainably sourced, organic, and ethically produced agricultural products. This trend is creating opportunities for logistics providers who can offer specialized services that cater to these demands, such as eco-friendly transportation options and transparent sourcing documentation. The rise of direct-to-consumer (DTC) models for agricultural produce, facilitated by e-commerce platforms, is further reshaping the logistics landscape. This necessitates agile and responsive last-mile delivery solutions capable of handling smaller, more frequent shipments of perishable goods.

Competitive dynamics are intensifying, with established logistics giants investing heavily in their agricultural logistics capabilities and new entrants focusing on niche solutions. Key opportunities lie in the development of integrated cold chain solutions, particularly in emerging economies with developing infrastructure. The expansion of precision agriculture technologies also creates a demand for specialized logistics services that can support the timely delivery of inputs and the efficient collection of harvests. Furthermore, the growing focus on reducing food waste presents a significant opportunity for logistics companies to offer innovative solutions that optimize inventory and minimize transit times, thereby contributing to a more sustainable food system. The global agriculture logistics market, valued at an estimated USD 850,000 million in 2025, is projected to reach approximately USD 1,400,000 million by 2033, demonstrating robust growth.

Dominant Markets & Segments in Agriculture Logistics Market

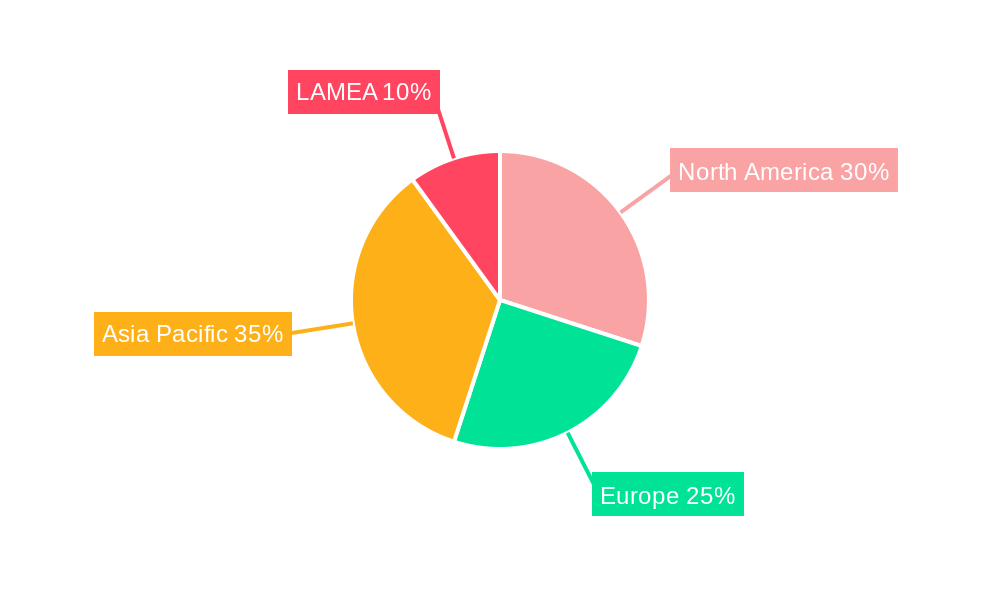

The Agriculture Logistics Market demonstrates significant dominance in specific regions and segments, driven by a confluence of factors including advanced infrastructure, supportive government policies, and high agricultural output. Globally, North America and Europe currently lead the market, owing to their well-established transportation networks, sophisticated cold chain capabilities, and high consumer demand for a wide variety of agricultural products. However, the Asia-Pacific region is emerging as a rapidly growing dominant market, propelled by its massive agricultural production, increasing domestic consumption, and significant investments in logistics infrastructure to support its burgeoning economies. Countries like China, India, and Vietnam are pivotal in this growth trajectory.

Within the Service segmentation, Transportation represents the largest segment, accounting for an estimated 55% of the market share in 2025. This is a direct consequence of the inherent need to move vast quantities of agricultural produce from farms to processing facilities, distribution centers, and ultimately to consumers. Key growth drivers in this segment include the increasing volume of international trade in agricultural commodities, the demand for faster and more reliable transit times for perishable goods, and the development of specialized transport modes like refrigerated trucks, reefer containers, and air cargo for high-value produce.

Warehousing, representing approximately 30% of the market share, is also a critical component. The growth in this segment is fueled by the need for efficient storage solutions, including temperature-controlled warehouses, silos for grain storage, and facilities for processing and packaging. The expansion of e-commerce in the food sector also drives demand for strategically located, technologically advanced distribution centers.

Value-added Services, holding the remaining 15% of the market share, encompasses activities like packaging, labeling, sorting, quality inspection, and customization. This segment is experiencing robust growth as stakeholders seek to enhance product appeal, meet specific market requirements, and reduce waste through optimized handling.

In terms of End-User segmentation, Large Enterprises currently command a larger market share, estimated at 65% in 2025. This is attributed to their higher volumes of production and distribution, their capacity to invest in sophisticated logistics solutions, and their need for integrated, end-to-end supply chain management. They often partner with large, full-service logistics providers to optimize their global operations. However, the Small and Medium Enterprises (SMEs) segment is experiencing a faster growth rate, estimated at XX% CAGR, as they increasingly leverage specialized third-party logistics (3PL) providers and technological solutions to compete and expand their reach. Government initiatives supporting SMEs and the growth of online marketplaces for agricultural products are key drivers for this segment’s expansion.

- Dominant Regions: North America, Europe, and rapidly growing Asia-Pacific.

- Leading Service Segment: Transportation (approx. 55% market share), driven by trade volumes and perishability.

- Key Warehousing Drivers: Cold chain infrastructure, e-commerce distribution centers.

- Value-Added Services Growth: Driven by product customization and market-specific needs.

- End-User Dominance: Large Enterprises (approx. 65% market share) due to scale.

- SME Growth Catalysts: Third-party logistics adoption, e-commerce platforms, government support.

Agriculture Logistics Market Product Analysis

Innovations in agriculture logistics are largely centered on enhancing the efficiency, safety, and sustainability of moving agricultural products from origin to consumption. Key product advancements include the development of advanced cold chain solutions, such as temperature-controlled containers with real-time monitoring capabilities, insulated packaging materials that extend shelf life, and smart refrigeration systems for both transport and warehousing. The integration of IoT and AI-powered tracking systems provides unprecedented visibility into the supply chain, allowing for proactive management of potential disruptions and ensuring product integrity. Furthermore, the introduction of specialized vehicles and handling equipment optimized for various agricultural commodities, from delicate fruits to bulk grains, improves operational efficiency and reduces product damage. These innovations are designed to meet the stringent requirements of a diverse product portfolio, including fresh produce, dairy, meat, and processed foods, offering competitive advantages through reduced spoilage, improved traceability, and enhanced compliance with food safety standards.

Key Drivers, Barriers & Challenges in Agriculture Logistics Market

Key Drivers propelling the Agriculture Logistics Market include the surging global demand for food, driven by population growth and rising incomes, which necessitates more efficient and extensive supply chains. Technological advancements, particularly in cold chain management, real-time tracking, and data analytics, are critical enablers for reducing post-harvest losses and improving product quality. Government initiatives promoting agricultural trade and investment in logistics infrastructure also play a significant role. Furthermore, the growing consumer preference for fresh, sustainably sourced, and traceable food products creates a demand for specialized logistics solutions.

Barriers and Challenges impacting growth include the inherent perishability of many agricultural products, which demands stringent temperature control and rapid transit. The underdeveloped logistics infrastructure in many developing regions poses a significant hurdle. Regulatory complexities, including varying food safety standards, customs procedures, and transportation laws across different countries, can create bottlenecks. Supply chain disruptions, stemming from unpredictable weather events, geopolitical instability, or pandemics, further exacerbate the challenges. High operational costs associated with specialized equipment, fuel, and labor also present a restraint, especially for smaller players. Competitive pressures among logistics providers can also impact profitability, particularly in commoditized segments.

Growth Drivers in the Agriculture Logistics Market Market

The Agriculture Logistics Market is primarily propelled by the ever-increasing global demand for food, a direct consequence of a growing world population and rising disposable incomes. This fundamental driver necessitates enhanced efficiency and reach within the agricultural supply chain. Technological innovation is another significant growth catalyst. Advancements in cold chain technology, including sophisticated temperature-controlled containers and real-time monitoring systems, are crucial for minimizing spoilage of perishable goods and ensuring product quality from farm to fork. The widespread adoption of IoT devices for tracking and data analytics provides unprecedented visibility into the supply chain, enabling better inventory management and route optimization, thereby reducing transit times and costs. Government policies and investments aimed at improving agricultural infrastructure, streamlining trade processes, and promoting food security are also instrumental in driving market expansion. Furthermore, the growing consumer consciousness regarding food origin, sustainability, and safety is creating a demand for traceable and ethically sourced products, pushing logistics providers to adopt more transparent and responsible practices.

Challenges Impacting Agriculture Logistics Market Growth

The Agriculture Logistics Market faces several significant challenges that can impede its growth trajectory. The inherent perishability of a vast array of agricultural products presents a constant challenge, demanding precise and consistent temperature control throughout the supply chain. Failure to maintain these conditions can lead to substantial product spoilage and financial losses. Regulatory complexities across international borders, including diverse food safety standards, customs regulations, and transportation laws, can create significant operational hurdles and delays. Furthermore, many regions, particularly in emerging economies, suffer from underdeveloped logistics infrastructure, including inadequate road networks, limited cold storage facilities, and inefficient port operations, which hampers the smooth flow of goods. Supply chain disruptions, whether caused by adverse weather events, geopolitical instability, or unforeseen global health crises, can have a cascading effect, impacting availability and prices. The high operational costs associated with specialized equipment, energy consumption for refrigeration, and skilled labor can also be a significant restraint, particularly for smaller enterprises.

Key Players Shaping the Agriculture Logistics Market Market

- United Parcel Service

- DHL

- FedEx Corp

- Nippon Express Co Ltd

- Kuehne + Nagel International AG

- CEVA Logistics

- The Maersk Group

- C H Robinson

- Bollore Logistics

- Blue Yonder

Significant Agriculture Logistics Market Industry Milestones

- January 2023: Deutsche Post DHL Group announced a USD 137 million investment plan for the U.S. domestic and cross-border e-commerce market. This strategic move aims to capitalize on the projected exponential growth of the global B2C e-commerce market for cross-border shipments, which is anticipated to surge from USD 400 billion in 2022 to a staggering USD 1 trillion globally by 2030.

- June 2022: CEVA Logistics inaugurated a new 14,000-square-meter facility in the Philippines. This expansion is designed to bolster the company's capabilities in the dynamic Southeast Asian market, specifically catering to the electronics and food & beverage (F&B) sectors. The warehouse offers a comprehensive suite of services, including warehousing, distribution, and value-added services such as picking and packing, labeling, bundling, re-work, tax stamping, and digital bottle printing.

Future Outlook for Agriculture Logistics Market Market

The future outlook for the Agriculture Logistics Market is exceptionally promising, driven by sustained global population growth and an increasing demand for diverse food products. Key growth catalysts include the accelerated adoption of digital technologies, such as AI, blockchain, and IoT, which will further enhance supply chain visibility, efficiency, and traceability. The expansion of cold chain infrastructure, particularly in emerging markets, will be crucial for reducing post-harvest losses and meeting the growing demand for perishable goods. E-commerce penetration in the food sector will continue to drive the need for agile and responsive last-mile delivery solutions. Opportunities also lie in the development of sustainable logistics practices, including the use of alternative fuels and optimized routing to minimize carbon footprints. Strategic partnerships and collaborations between agricultural producers, logistics providers, and technology companies will be instrumental in addressing complex supply chain challenges and unlocking new market potential in the coming years.

Agriculture Logistics Market Segmentation

-

1. Service

- 1.1. Transportation

- 1.2. Warehousing

- 1.3. Value-added Services

-

2. End-User

- 2.1. Small and Medium Enterprises (SMEs)

- 2.2. Large Enterprises

Agriculture Logistics Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. France

- 2.3. United Kingdom

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. SouthKorea

- 3.4. India

- 3.5. Rest of Asia Pacific

-

4. LAMEA

- 4.1. Brazil

- 4.2. South Africa

- 4.3. GCC

- 4.4. Rest of LAMEA

Agriculture Logistics Market Regional Market Share

Geographic Coverage of Agriculture Logistics Market

Agriculture Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. E-commerce Boom; Same-day and Next-day Delivery

- 3.3. Market Restrains

- 3.3.1. Regulatory Challenges; Infrastructure Limitations

- 3.4. Market Trends

- 3.4.1. Increasing Importance of Logistics Management in the U.S.’s Largest Crop Production

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Agriculture Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Transportation

- 5.1.2. Warehousing

- 5.1.3. Value-added Services

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Small and Medium Enterprises (SMEs)

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. LAMEA

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. North America Agriculture Logistics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Transportation

- 6.1.2. Warehousing

- 6.1.3. Value-added Services

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Small and Medium Enterprises (SMEs)

- 6.2.2. Large Enterprises

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. Europe Agriculture Logistics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Transportation

- 7.1.2. Warehousing

- 7.1.3. Value-added Services

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Small and Medium Enterprises (SMEs)

- 7.2.2. Large Enterprises

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Asia Pacific Agriculture Logistics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Transportation

- 8.1.2. Warehousing

- 8.1.3. Value-added Services

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Small and Medium Enterprises (SMEs)

- 8.2.2. Large Enterprises

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. LAMEA Agriculture Logistics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Transportation

- 9.1.2. Warehousing

- 9.1.3. Value-added Services

- 9.2. Market Analysis, Insights and Forecast - by End-User

- 9.2.1. Small and Medium Enterprises (SMEs)

- 9.2.2. Large Enterprises

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 United Parcel Service*List Not Exhaustive

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 DHL

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 FedEx Corp

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Nippon Express Co Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Kuehne + Nagel International AG

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 CEVA Logistics

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 The Maersk Group

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 C H Robinson

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Bollore Logistics

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Blue Yonder

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 United Parcel Service*List Not Exhaustive

List of Figures

- Figure 1: Global Agriculture Logistics Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Agriculture Logistics Market Revenue (billion), by Service 2025 & 2033

- Figure 3: North America Agriculture Logistics Market Revenue Share (%), by Service 2025 & 2033

- Figure 4: North America Agriculture Logistics Market Revenue (billion), by End-User 2025 & 2033

- Figure 5: North America Agriculture Logistics Market Revenue Share (%), by End-User 2025 & 2033

- Figure 6: North America Agriculture Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Agriculture Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Agriculture Logistics Market Revenue (billion), by Service 2025 & 2033

- Figure 9: Europe Agriculture Logistics Market Revenue Share (%), by Service 2025 & 2033

- Figure 10: Europe Agriculture Logistics Market Revenue (billion), by End-User 2025 & 2033

- Figure 11: Europe Agriculture Logistics Market Revenue Share (%), by End-User 2025 & 2033

- Figure 12: Europe Agriculture Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Agriculture Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Agriculture Logistics Market Revenue (billion), by Service 2025 & 2033

- Figure 15: Asia Pacific Agriculture Logistics Market Revenue Share (%), by Service 2025 & 2033

- Figure 16: Asia Pacific Agriculture Logistics Market Revenue (billion), by End-User 2025 & 2033

- Figure 17: Asia Pacific Agriculture Logistics Market Revenue Share (%), by End-User 2025 & 2033

- Figure 18: Asia Pacific Agriculture Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Agriculture Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: LAMEA Agriculture Logistics Market Revenue (billion), by Service 2025 & 2033

- Figure 21: LAMEA Agriculture Logistics Market Revenue Share (%), by Service 2025 & 2033

- Figure 22: LAMEA Agriculture Logistics Market Revenue (billion), by End-User 2025 & 2033

- Figure 23: LAMEA Agriculture Logistics Market Revenue Share (%), by End-User 2025 & 2033

- Figure 24: LAMEA Agriculture Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 25: LAMEA Agriculture Logistics Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Agriculture Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 2: Global Agriculture Logistics Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 3: Global Agriculture Logistics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Agriculture Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 5: Global Agriculture Logistics Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 6: Global Agriculture Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Agriculture Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Agriculture Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Agriculture Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Agriculture Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 11: Global Agriculture Logistics Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 12: Global Agriculture Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Germany Agriculture Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: France Agriculture Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Agriculture Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Agriculture Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Global Agriculture Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 18: Global Agriculture Logistics Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 19: Global Agriculture Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 20: China Agriculture Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Japan Agriculture Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: SouthKorea Agriculture Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: India Agriculture Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Agriculture Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Global Agriculture Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 26: Global Agriculture Logistics Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 27: Global Agriculture Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 28: Brazil Agriculture Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: South Africa Agriculture Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: GCC Agriculture Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of LAMEA Agriculture Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Agriculture Logistics Market?

The projected CAGR is approximately 9.6%.

2. Which companies are prominent players in the Agriculture Logistics Market?

Key companies in the market include United Parcel Service*List Not Exhaustive, DHL, FedEx Corp, Nippon Express Co Ltd, Kuehne + Nagel International AG, CEVA Logistics, The Maersk Group, C H Robinson, Bollore Logistics, Blue Yonder.

3. What are the main segments of the Agriculture Logistics Market?

The market segments include Service, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 414.57 billion as of 2022.

5. What are some drivers contributing to market growth?

E-commerce Boom; Same-day and Next-day Delivery.

6. What are the notable trends driving market growth?

Increasing Importance of Logistics Management in the U.S.’s Largest Crop Production.

7. Are there any restraints impacting market growth?

Regulatory Challenges; Infrastructure Limitations.

8. Can you provide examples of recent developments in the market?

January 2023: Deutsche Post DHL Group announced a USD 137 million investment plan for the U.S. domestic and cross-border e-commerce market. The Group's objective is to exploit the global B2C e-commerce market for shipments crossing borders which is expected to grow from USD 400 billion in 2022 to a total global volume of USD 1 trillion in 2020.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Agriculture Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Agriculture Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Agriculture Logistics Market?

To stay informed about further developments, trends, and reports in the Agriculture Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence