Key Insights

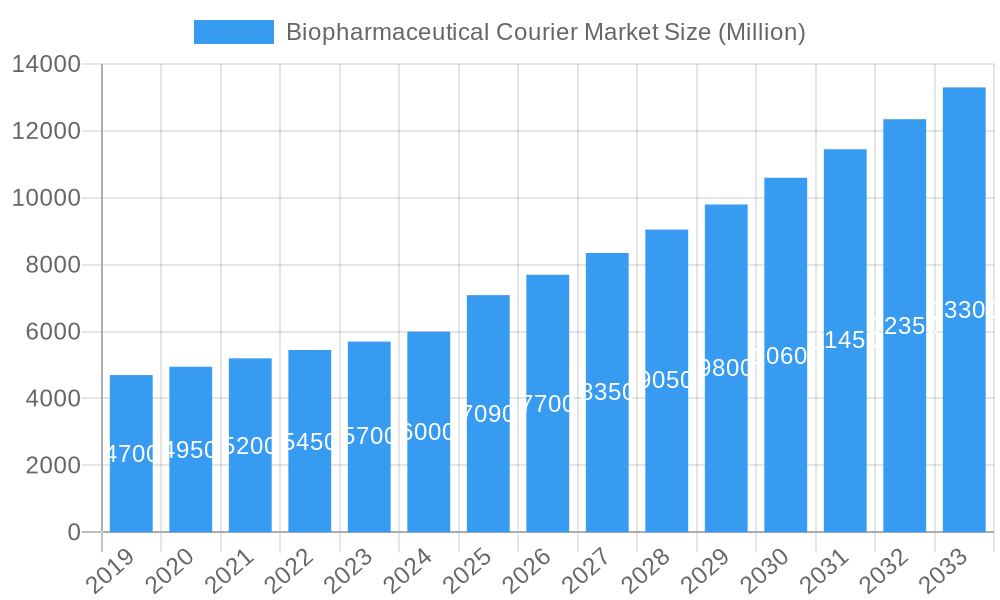

The global biopharmaceutical courier market is experiencing robust expansion, driven by the increasing demand for specialized logistics solutions to transport temperature-sensitive and high-value biological products. Valued at an estimated $7.09 billion in 2025, the market is projected to grow at a compound annual growth rate (CAGR) of 8.83% throughout the forecast period of 2025-2033. This significant growth is fueled by several key drivers, including the burgeoning biopharmaceutical industry's reliance on efficient cold chain logistics for the delivery of vaccines, biologics, cell and gene therapies, and diagnostic samples. The expanding pipeline of biopharmaceutical drugs, coupled with advancements in biotechnology, necessitates sophisticated supply chain management that can maintain product integrity from origin to destination. Furthermore, the increasing prevalence of chronic diseases and a growing aging global population are contributing to a higher demand for these specialized treatments, thereby stimulating the need for reliable biopharmaceutical courier services.

Biopharmaceutical Courier Market Market Size (In Billion)

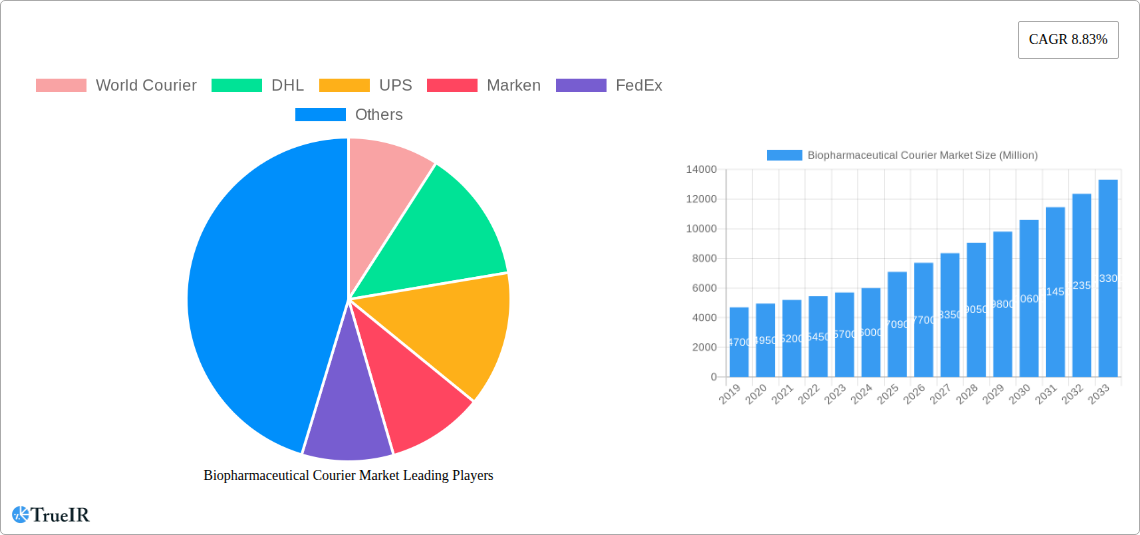

The market's segmentation highlights the diverse needs within the industry. Services such as specialized transportation, secure storage, protective packaging, and accurate labeling are paramount. The business landscape is predominantly B2B, serving pharmaceutical companies, contract research organizations (CROs), and academic institutions, with a growing B2C component for direct-to-patient therapies. Both domestic and international shipments are critical, with cold chain operations representing a substantial and growing segment due to the inherent temperature sensitivity of biopharmaceutical products. Key players like World Courier, DHL, UPS, Marken, FedEx, LifeConEx, and Cryoport are actively investing in infrastructure and technology to meet these evolving demands. Emerging trends include the adoption of advanced tracking technologies, real-time temperature monitoring, and the development of specialized packaging solutions to ensure the safe and compliant delivery of life-saving therapies across the globe.

Biopharmaceutical Courier Market Company Market Share

Biopharmaceutical Courier Market: Comprehensive Analysis and Forecast (2019-2033)

Unlock critical insights into the rapidly evolving Biopharmaceutical Courier Market, a vital sector supporting the global healthcare ecosystem. This in-depth report analyzes market dynamics from 2019 to 2033, with a base year of 2025, providing an indispensable resource for stakeholders navigating cold chain logistics, pharmaceutical transportation, and specialty courier services. Explore market size, growth trends, key players, and future opportunities with actionable intelligence.

Biopharmaceutical Courier Market Market Structure & Competitive Landscape

The Biopharmaceutical Courier Market is characterized by a dynamic and moderately concentrated competitive landscape. Key players like World Courier, DHL, UPS, Marken, FedEx, and LifeConEx command significant market share, alongside approximately 73 other companies, including specialists such as Cryoport and QuickSTAT. Innovation drivers are primarily fueled by the increasing complexity of biologics, the demand for specialized temperature-controlled shipments, and advancements in tracking and monitoring technologies. Regulatory impacts, particularly stringent Good Distribution Practices (GDP) and evolving customs requirements for temperature-sensitive products, significantly shape operational strategies. Product substitutes are limited within the specialized biopharmaceutical logistics domain, with most alternatives lacking the required temperature control and security measures. End-user segmentation is predominantly B2B, serving pharmaceutical manufacturers, research institutions, and contract research organizations (CROs), with a smaller but growing B2C segment for direct-to-patient therapies. Mergers and acquisitions (M&A) trends, driven by the need for expanded global networks and enhanced cold chain capabilities, are notable. For instance, recent M&A activities have focused on integrating specialized cold chain providers to bolster service offerings. The concentration ratio is estimated to be around XX% for the top five players.

Biopharmaceutical Courier Market Market Trends & Opportunities

The Biopharmaceutical Courier Market is experiencing robust growth, projected to reach a market size of approximately USD 100 Million by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025–2033. This expansion is propelled by several intersecting trends and emerging opportunities. A significant trend is the escalating demand for cold chain logistics, driven by the growing pipeline and market approval of temperature-sensitive biologics, vaccines, and advanced therapies like cell and gene therapies. These products necessitate precise temperature control throughout their journey from manufacturing to patient administration, creating a continuous need for specialized cold chain packaging, temperature-controlled transportation, and real-time monitoring solutions.

Technological shifts are another major influencer. The adoption of IoT sensors, blockchain for enhanced supply chain transparency, and AI-powered route optimization are becoming increasingly critical for ensuring product integrity and compliance. These technologies offer real-time data on temperature, humidity, and location, mitigating risks of temperature excursions and improving overall supply chain efficiency. Furthermore, the rise of personalized medicine and decentralized clinical trials is reshaping biopharmaceutical logistics requirements. This necessitates flexible and agile courier services capable of handling smaller, more frequent shipments to diverse patient locations, both domestically and internationally.

Consumer preferences, or rather end-user demands, are evolving towards greater reliability, visibility, and speed. Pharmaceutical companies are increasingly prioritizing courier partners that offer end-to-end supply chain solutions, robust quality management systems, and a proven track record in handling high-value, temperature-sensitive pharmaceuticals. The geographic expansion of pharmaceutical manufacturing and R&D, particularly in emerging markets, presents significant opportunities for biopharmaceutical courier services to establish and expand their global networks. The increasing complexity of biopharmaceutical products, such as monoclonal antibodies and recombinant proteins, further amplifies the need for specialized handling and transportation expertise. The market penetration rate for advanced cold chain solutions is expected to increase from XX% in 2025 to YY% by 2033, reflecting the growing importance of these capabilities.

Dominant Markets & Segments in Biopharmaceutical Courier Market

The Biopharmaceutical Courier Market exhibits distinct patterns of dominance across various segments, driven by a confluence of infrastructure, regulatory frameworks, and market demand.

Dominant Service Segment: Transportation is the largest segment within the Biopharmaceutical Courier Market. This dominance stems from the fundamental necessity of moving temperature-sensitive drugs and biologics from manufacturing sites to distribution hubs, hospitals, and research facilities. The intricate requirements of cold chain transportation, including specialized reefer trucks, aircraft, and temperature-controlled containers, contribute significantly to its market share. Storage services, including qualified cold chain warehousing and temperature-monitored depots, also hold substantial importance, particularly for inventory management and regional distribution. Packaging and Labeling services, while critical for product integrity, represent a smaller but vital component, focusing on the development and application of advanced insulation materials and temperature indicators.

Dominant Business Model: The B2B segment overwhelmingly dominates the Biopharmaceutical Courier Market. Pharmaceutical manufacturers, biotech companies, CROs, and research institutions are the primary clients, requiring specialized logistics for their products. The B2C segment, while nascent, is showing promising growth, driven by the increasing prevalence of home-based therapies, direct-to-patient drug delivery for clinical trials, and specialty pharmaceuticals.

Dominant Destination: International destinations represent a larger and more complex market segment for biopharmaceutical courier services. The globalization of pharmaceutical research, manufacturing, and patient access necessitates seamless cross-border cold chain logistics, often involving multiple modes of transport and navigating diverse regulatory landscapes. Domestic services are crucial for regional distribution and last-mile delivery, but the intricate nature of international supply chains and the higher value of global biopharmaceutical trade contribute to its larger market share.

Dominant Type of Operation: Cold Chain operations are the defining characteristic and the largest segment of the Biopharmaceutical Courier Market. The inherent instability of many biological products at ambient temperatures mandates rigorous temperature control throughout the supply chain. This requires specialized equipment, stringent protocols, and highly trained personnel. While Non Cold Chain services exist for less sensitive pharmaceutical products, the growth trajectory and market value are predominantly driven by the sophisticated demands of cold chain logistics.

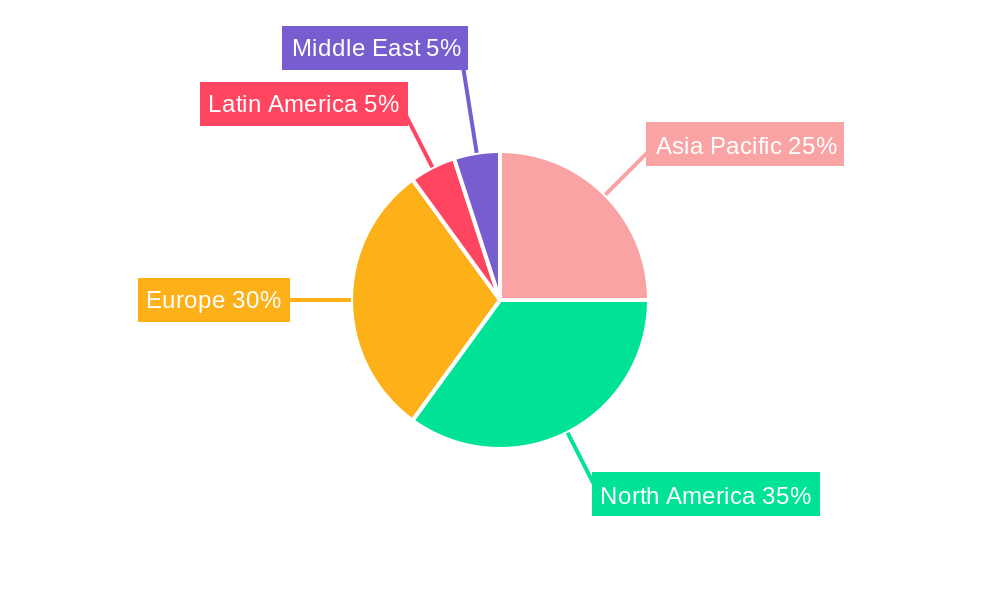

The growth drivers for these dominant segments include increasing global pharmaceutical R&D investment, a rising incidence of chronic diseases requiring advanced therapies, and supportive government policies aimed at fostering life sciences industries and ensuring secure drug supply chains. For instance, the expansion of biopharmaceutical manufacturing hubs in regions like Europe and Asia, coupled with the growing demand for specialized oncology and immunology drugs, fuels the demand for robust international cold chain transportation and storage solutions.

Biopharmaceutical Courier Market Product Analysis

Product innovations in the Biopharmaceutical Courier Market are centered on enhancing the integrity and security of temperature-sensitive shipments. This includes the development of advanced active and passive cold chain packaging solutions that offer extended temperature stability and greater resistance to external environmental factors. Innovations in real-time temperature monitoring and data logging technologies, often integrated with IoT devices and cloud-based platforms, provide end-to-end visibility and immediate alerts for temperature excursions. Furthermore, the evolution of specialized containers designed for specific temperature ranges (e.g., -20°C, -80°C, and cryogenic) caters to the diverse needs of biologics, vaccines, and cell and gene therapies. The competitive advantage lies in the ability of courier services to offer validated, compliant, and cost-effective solutions that minimize product loss and ensure patient safety.

Key Drivers, Barriers & Challenges in Biopharmaceutical Courier Market

The Biopharmaceutical Courier Market is propelled by several key drivers, including the escalating global demand for biologics and advanced therapies, the expansion of pharmaceutical R&D and manufacturing, and advancements in cold chain technologies. The increasing complexity of drugs requiring strict temperature control and the growing trend of direct-to-patient drug delivery further fuel market growth.

Key challenges and restraints in the Biopharmaceutical Courier Market include the high cost of specialized cold chain infrastructure and equipment, stringent and evolving regulatory requirements (e.g., GDP compliance), and the constant threat of temperature excursions leading to product spoilage. Supply chain disruptions, geopolitical instability, and the need for highly trained personnel also pose significant challenges. The competitive pressure from established players and emerging niche providers can also impact pricing and market accessibility. The estimated financial impact of temperature excursions annually is in the range of USD X Million.

Growth Drivers in the Biopharmaceutical Courier Market Market

The Biopharmaceutical Courier Market is experiencing significant growth driven by several factors. The increasing prevalence of chronic diseases and the resulting demand for advanced biologics and specialty pharmaceuticals are primary catalysts. Technological advancements, particularly in cold chain packaging and real-time temperature monitoring solutions, enable the safe and efficient transport of highly sensitive products. Furthermore, the growing global footprint of pharmaceutical manufacturing and research, coupled with supportive government initiatives to bolster the life sciences sector, creates a fertile ground for market expansion. The shift towards personalized medicine and decentralized clinical trials also necessitates agile and specialized biopharmaceutical logistics.

Challenges Impacting Biopharmaceutical Courier Market Growth

Several barriers and restraints are impacting the growth of the Biopharmaceutical Courier Market. The substantial capital investment required for establishing and maintaining robust cold chain infrastructure is a significant hurdle. Navigating complex and varying international regulatory landscapes, including GDP guidelines, adds to operational challenges and costs. Supply chain vulnerabilities, exacerbated by global events, and the risk of product integrity breaches due to temperature excursions can lead to substantial financial losses estimated at USD X Billion annually. Intense competition among established logistics providers and specialized niche players also exerts pressure on pricing and service differentiation, making market entry and expansion complex.

Key Players Shaping the Biopharmaceutical Courier Market Market

- World Courier

- DHL

- UPS

- Marken

- FedEx

- LifeConEx

- Cryoport

- QuickSTAT

Significant Biopharmaceutical Courier Market Industry Milestones

- September 2023: Astellas Pharma, one of the largest pharmaceutical manufacturers in Europe, announced plans to construct a new EUR 330 million (USD 354.32 million) plant in the County Kerry, Ireland town of Tralee. The plant is expected to open in 2028, subject to planning consent, and Astellas plans to begin construction in 2024. This signifies an expansion in manufacturing capacity, directly impacting the demand for associated logistics services.

- September 2023: Avalon Pharma, Saudi Arabia’s largest pharmaceutical company by market value, announced plans to expand its production capacity and diversify its portfolio. The USD 26.7 billion Avalon 4 plant in Riyadh, Saudi Arabia, is dedicated to producing advanced oncology drugs and generic injectables. This expansion in a key emerging market highlights the growing need for specialized biopharmaceutical courier services in the region.

Future Outlook for Biopharmaceutical Courier Market Market

The future outlook for the Biopharmaceutical Courier Market is exceptionally promising, driven by sustained growth in the biologics and specialty pharmaceuticals sectors. Strategic opportunities lie in the expanding global reach of pharmaceutical manufacturing, particularly in emerging markets, and the increasing adoption of advanced therapies like cell and gene therapies, which demand highly specialized cold chain logistics. Further investment in technological innovation, including AI-driven route optimization, enhanced real-time monitoring, and sustainable packaging solutions, will be crucial for competitive advantage. The market potential is significant, with an anticipated growth trajectory fueled by an aging global population, rising healthcare expenditures, and continuous breakthroughs in medical research. The market is projected to reach approximately USD 150 Million by 2033.

Biopharmaceutical Courier Market Segmentation

-

1. Services

- 1.1. Transportation

- 1.2. Storage

- 1.3. Packaging, and Labeling

-

2. Business

- 2.1. B2B

- 2.2. B2C

-

3. Destination

- 3.1. Domestic

- 3.2. International

-

4. Type of Operation

- 4.1. Cold Chain

- 4.2. Non Cold Chain

Biopharmaceutical Courier Market Segmentation By Geography

- 1. Asia Pacific

- 2. North America

- 3. Europe

- 4. Latin America

- 5. Middle East

Biopharmaceutical Courier Market Regional Market Share

Geographic Coverage of Biopharmaceutical Courier Market

Biopharmaceutical Courier Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.83% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. E-commerce Boom driving the market; Increasing demand from healthcare sector driving the market

- 3.3. Market Restrains

- 3.3.1. Regulatory challenges affecting the market; Infrastructure limitations hindering the growth of the market

- 3.4. Market Trends

- 3.4.1. Immense Growth Projection for the Cold Chain Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Biopharmaceutical Courier Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Transportation

- 5.1.2. Storage

- 5.1.3. Packaging, and Labeling

- 5.2. Market Analysis, Insights and Forecast - by Business

- 5.2.1. B2B

- 5.2.2. B2C

- 5.3. Market Analysis, Insights and Forecast - by Destination

- 5.3.1. Domestic

- 5.3.2. International

- 5.4. Market Analysis, Insights and Forecast - by Type of Operation

- 5.4.1. Cold Chain

- 5.4.2. Non Cold Chain

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Asia Pacific

- 5.5.2. North America

- 5.5.3. Europe

- 5.5.4. Latin America

- 5.5.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. Asia Pacific Biopharmaceutical Courier Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Services

- 6.1.1. Transportation

- 6.1.2. Storage

- 6.1.3. Packaging, and Labeling

- 6.2. Market Analysis, Insights and Forecast - by Business

- 6.2.1. B2B

- 6.2.2. B2C

- 6.3. Market Analysis, Insights and Forecast - by Destination

- 6.3.1. Domestic

- 6.3.2. International

- 6.4. Market Analysis, Insights and Forecast - by Type of Operation

- 6.4.1. Cold Chain

- 6.4.2. Non Cold Chain

- 6.1. Market Analysis, Insights and Forecast - by Services

- 7. North America Biopharmaceutical Courier Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Services

- 7.1.1. Transportation

- 7.1.2. Storage

- 7.1.3. Packaging, and Labeling

- 7.2. Market Analysis, Insights and Forecast - by Business

- 7.2.1. B2B

- 7.2.2. B2C

- 7.3. Market Analysis, Insights and Forecast - by Destination

- 7.3.1. Domestic

- 7.3.2. International

- 7.4. Market Analysis, Insights and Forecast - by Type of Operation

- 7.4.1. Cold Chain

- 7.4.2. Non Cold Chain

- 7.1. Market Analysis, Insights and Forecast - by Services

- 8. Europe Biopharmaceutical Courier Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Services

- 8.1.1. Transportation

- 8.1.2. Storage

- 8.1.3. Packaging, and Labeling

- 8.2. Market Analysis, Insights and Forecast - by Business

- 8.2.1. B2B

- 8.2.2. B2C

- 8.3. Market Analysis, Insights and Forecast - by Destination

- 8.3.1. Domestic

- 8.3.2. International

- 8.4. Market Analysis, Insights and Forecast - by Type of Operation

- 8.4.1. Cold Chain

- 8.4.2. Non Cold Chain

- 8.1. Market Analysis, Insights and Forecast - by Services

- 9. Latin America Biopharmaceutical Courier Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Services

- 9.1.1. Transportation

- 9.1.2. Storage

- 9.1.3. Packaging, and Labeling

- 9.2. Market Analysis, Insights and Forecast - by Business

- 9.2.1. B2B

- 9.2.2. B2C

- 9.3. Market Analysis, Insights and Forecast - by Destination

- 9.3.1. Domestic

- 9.3.2. International

- 9.4. Market Analysis, Insights and Forecast - by Type of Operation

- 9.4.1. Cold Chain

- 9.4.2. Non Cold Chain

- 9.1. Market Analysis, Insights and Forecast - by Services

- 10. Middle East Biopharmaceutical Courier Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Services

- 10.1.1. Transportation

- 10.1.2. Storage

- 10.1.3. Packaging, and Labeling

- 10.2. Market Analysis, Insights and Forecast - by Business

- 10.2.1. B2B

- 10.2.2. B2C

- 10.3. Market Analysis, Insights and Forecast - by Destination

- 10.3.1. Domestic

- 10.3.2. International

- 10.4. Market Analysis, Insights and Forecast - by Type of Operation

- 10.4.1. Cold Chain

- 10.4.2. Non Cold Chain

- 10.1. Market Analysis, Insights and Forecast - by Services

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 World Courier

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 DHL

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 UPS

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Marken

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 FedEx

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 LifeConEx**List Not Exhaustive 7 3 Other Companie

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Cryoport

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 QuickSTAT

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 World Courier

List of Figures

- Figure 1: Global Biopharmaceutical Courier Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Biopharmaceutical Courier Market Revenue (Million), by Services 2025 & 2033

- Figure 3: Asia Pacific Biopharmaceutical Courier Market Revenue Share (%), by Services 2025 & 2033

- Figure 4: Asia Pacific Biopharmaceutical Courier Market Revenue (Million), by Business 2025 & 2033

- Figure 5: Asia Pacific Biopharmaceutical Courier Market Revenue Share (%), by Business 2025 & 2033

- Figure 6: Asia Pacific Biopharmaceutical Courier Market Revenue (Million), by Destination 2025 & 2033

- Figure 7: Asia Pacific Biopharmaceutical Courier Market Revenue Share (%), by Destination 2025 & 2033

- Figure 8: Asia Pacific Biopharmaceutical Courier Market Revenue (Million), by Type of Operation 2025 & 2033

- Figure 9: Asia Pacific Biopharmaceutical Courier Market Revenue Share (%), by Type of Operation 2025 & 2033

- Figure 10: Asia Pacific Biopharmaceutical Courier Market Revenue (Million), by Country 2025 & 2033

- Figure 11: Asia Pacific Biopharmaceutical Courier Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: North America Biopharmaceutical Courier Market Revenue (Million), by Services 2025 & 2033

- Figure 13: North America Biopharmaceutical Courier Market Revenue Share (%), by Services 2025 & 2033

- Figure 14: North America Biopharmaceutical Courier Market Revenue (Million), by Business 2025 & 2033

- Figure 15: North America Biopharmaceutical Courier Market Revenue Share (%), by Business 2025 & 2033

- Figure 16: North America Biopharmaceutical Courier Market Revenue (Million), by Destination 2025 & 2033

- Figure 17: North America Biopharmaceutical Courier Market Revenue Share (%), by Destination 2025 & 2033

- Figure 18: North America Biopharmaceutical Courier Market Revenue (Million), by Type of Operation 2025 & 2033

- Figure 19: North America Biopharmaceutical Courier Market Revenue Share (%), by Type of Operation 2025 & 2033

- Figure 20: North America Biopharmaceutical Courier Market Revenue (Million), by Country 2025 & 2033

- Figure 21: North America Biopharmaceutical Courier Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe Biopharmaceutical Courier Market Revenue (Million), by Services 2025 & 2033

- Figure 23: Europe Biopharmaceutical Courier Market Revenue Share (%), by Services 2025 & 2033

- Figure 24: Europe Biopharmaceutical Courier Market Revenue (Million), by Business 2025 & 2033

- Figure 25: Europe Biopharmaceutical Courier Market Revenue Share (%), by Business 2025 & 2033

- Figure 26: Europe Biopharmaceutical Courier Market Revenue (Million), by Destination 2025 & 2033

- Figure 27: Europe Biopharmaceutical Courier Market Revenue Share (%), by Destination 2025 & 2033

- Figure 28: Europe Biopharmaceutical Courier Market Revenue (Million), by Type of Operation 2025 & 2033

- Figure 29: Europe Biopharmaceutical Courier Market Revenue Share (%), by Type of Operation 2025 & 2033

- Figure 30: Europe Biopharmaceutical Courier Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Europe Biopharmaceutical Courier Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Latin America Biopharmaceutical Courier Market Revenue (Million), by Services 2025 & 2033

- Figure 33: Latin America Biopharmaceutical Courier Market Revenue Share (%), by Services 2025 & 2033

- Figure 34: Latin America Biopharmaceutical Courier Market Revenue (Million), by Business 2025 & 2033

- Figure 35: Latin America Biopharmaceutical Courier Market Revenue Share (%), by Business 2025 & 2033

- Figure 36: Latin America Biopharmaceutical Courier Market Revenue (Million), by Destination 2025 & 2033

- Figure 37: Latin America Biopharmaceutical Courier Market Revenue Share (%), by Destination 2025 & 2033

- Figure 38: Latin America Biopharmaceutical Courier Market Revenue (Million), by Type of Operation 2025 & 2033

- Figure 39: Latin America Biopharmaceutical Courier Market Revenue Share (%), by Type of Operation 2025 & 2033

- Figure 40: Latin America Biopharmaceutical Courier Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Latin America Biopharmaceutical Courier Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East Biopharmaceutical Courier Market Revenue (Million), by Services 2025 & 2033

- Figure 43: Middle East Biopharmaceutical Courier Market Revenue Share (%), by Services 2025 & 2033

- Figure 44: Middle East Biopharmaceutical Courier Market Revenue (Million), by Business 2025 & 2033

- Figure 45: Middle East Biopharmaceutical Courier Market Revenue Share (%), by Business 2025 & 2033

- Figure 46: Middle East Biopharmaceutical Courier Market Revenue (Million), by Destination 2025 & 2033

- Figure 47: Middle East Biopharmaceutical Courier Market Revenue Share (%), by Destination 2025 & 2033

- Figure 48: Middle East Biopharmaceutical Courier Market Revenue (Million), by Type of Operation 2025 & 2033

- Figure 49: Middle East Biopharmaceutical Courier Market Revenue Share (%), by Type of Operation 2025 & 2033

- Figure 50: Middle East Biopharmaceutical Courier Market Revenue (Million), by Country 2025 & 2033

- Figure 51: Middle East Biopharmaceutical Courier Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Biopharmaceutical Courier Market Revenue Million Forecast, by Services 2020 & 2033

- Table 2: Global Biopharmaceutical Courier Market Revenue Million Forecast, by Business 2020 & 2033

- Table 3: Global Biopharmaceutical Courier Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 4: Global Biopharmaceutical Courier Market Revenue Million Forecast, by Type of Operation 2020 & 2033

- Table 5: Global Biopharmaceutical Courier Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Biopharmaceutical Courier Market Revenue Million Forecast, by Services 2020 & 2033

- Table 7: Global Biopharmaceutical Courier Market Revenue Million Forecast, by Business 2020 & 2033

- Table 8: Global Biopharmaceutical Courier Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 9: Global Biopharmaceutical Courier Market Revenue Million Forecast, by Type of Operation 2020 & 2033

- Table 10: Global Biopharmaceutical Courier Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global Biopharmaceutical Courier Market Revenue Million Forecast, by Services 2020 & 2033

- Table 12: Global Biopharmaceutical Courier Market Revenue Million Forecast, by Business 2020 & 2033

- Table 13: Global Biopharmaceutical Courier Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 14: Global Biopharmaceutical Courier Market Revenue Million Forecast, by Type of Operation 2020 & 2033

- Table 15: Global Biopharmaceutical Courier Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Biopharmaceutical Courier Market Revenue Million Forecast, by Services 2020 & 2033

- Table 17: Global Biopharmaceutical Courier Market Revenue Million Forecast, by Business 2020 & 2033

- Table 18: Global Biopharmaceutical Courier Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 19: Global Biopharmaceutical Courier Market Revenue Million Forecast, by Type of Operation 2020 & 2033

- Table 20: Global Biopharmaceutical Courier Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Biopharmaceutical Courier Market Revenue Million Forecast, by Services 2020 & 2033

- Table 22: Global Biopharmaceutical Courier Market Revenue Million Forecast, by Business 2020 & 2033

- Table 23: Global Biopharmaceutical Courier Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 24: Global Biopharmaceutical Courier Market Revenue Million Forecast, by Type of Operation 2020 & 2033

- Table 25: Global Biopharmaceutical Courier Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Global Biopharmaceutical Courier Market Revenue Million Forecast, by Services 2020 & 2033

- Table 27: Global Biopharmaceutical Courier Market Revenue Million Forecast, by Business 2020 & 2033

- Table 28: Global Biopharmaceutical Courier Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 29: Global Biopharmaceutical Courier Market Revenue Million Forecast, by Type of Operation 2020 & 2033

- Table 30: Global Biopharmaceutical Courier Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Biopharmaceutical Courier Market?

The projected CAGR is approximately 8.83%.

2. Which companies are prominent players in the Biopharmaceutical Courier Market?

Key companies in the market include World Courier, DHL, UPS, Marken, FedEx, LifeConEx**List Not Exhaustive 7 3 Other Companie, Cryoport, QuickSTAT.

3. What are the main segments of the Biopharmaceutical Courier Market?

The market segments include Services, Business, Destination, Type of Operation.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.09 Million as of 2022.

5. What are some drivers contributing to market growth?

E-commerce Boom driving the market; Increasing demand from healthcare sector driving the market.

6. What are the notable trends driving market growth?

Immense Growth Projection for the Cold Chain Segment.

7. Are there any restraints impacting market growth?

Regulatory challenges affecting the market; Infrastructure limitations hindering the growth of the market.

8. Can you provide examples of recent developments in the market?

September 2023: Astellas Pharma, one of the largest pharmaceutical manufacturers in Europe, announced plans to construct a new EUR 330 million (USD 354.32 million) plant in the County Kerry, Ireland town of Tralee. The plant is expected to open in 2028, subject to planning consent, and Astellas plans to begin construction in 2024.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Biopharmaceutical Courier Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Biopharmaceutical Courier Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Biopharmaceutical Courier Market?

To stay informed about further developments, trends, and reports in the Biopharmaceutical Courier Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence