Key Insights

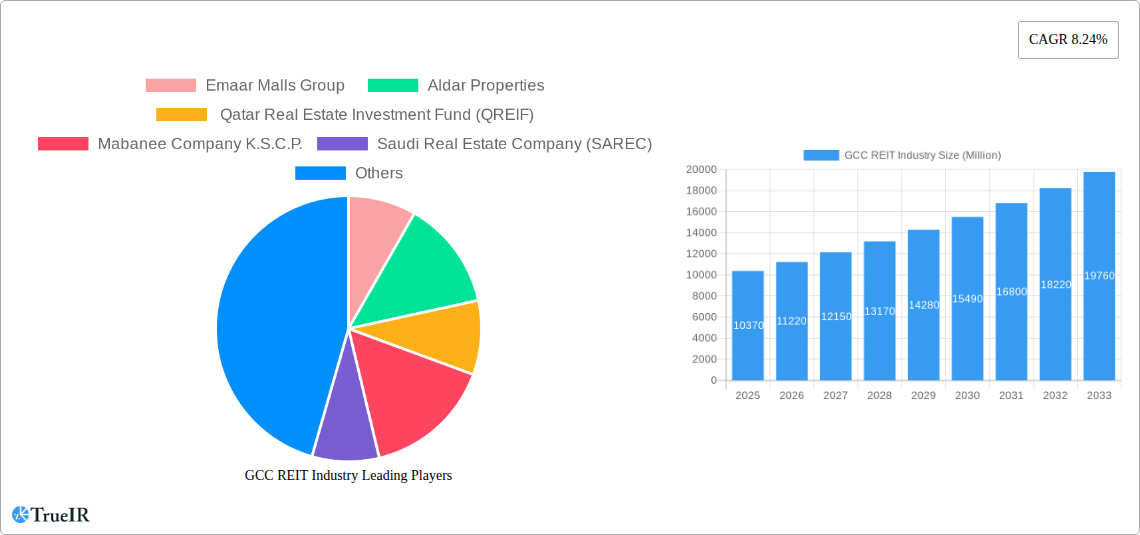

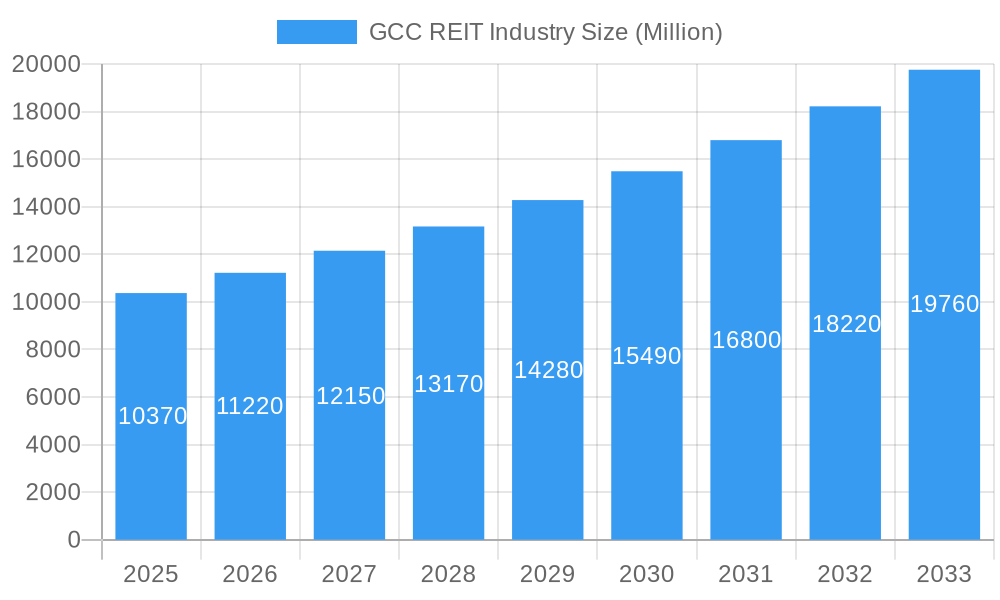

The GCC REIT (Real Estate Investment Trust) industry is experiencing robust growth, driven by factors such as increasing urbanization, rising disposable incomes, and supportive government initiatives promoting real estate investment. The market, valued at $10.37 billion in 2025, is projected to expand at a compound annual growth rate (CAGR) of 8.24% from 2025 to 2033. This growth is fueled by strong demand for diversified investment vehicles, particularly in a region experiencing significant infrastructure development and tourism growth. The segment breakdown reveals a diverse market, with Commercial REITs currently holding the largest share, followed by Residential and Industrial & Logistics REITs. Equity REITs represent a larger portion of the investment type compared to Mortgage REITs, reflecting investor preference for direct ownership in properties. Key players like Emaar Malls Group, Aldar Properties, and QREIF are shaping the market landscape through strategic acquisitions, development projects, and innovative investment strategies. The growth trajectory is expected to remain positive, however, potential restraints such as fluctuating oil prices and global economic uncertainties could influence the pace of expansion.

GCC REIT Industry Market Size (In Billion)

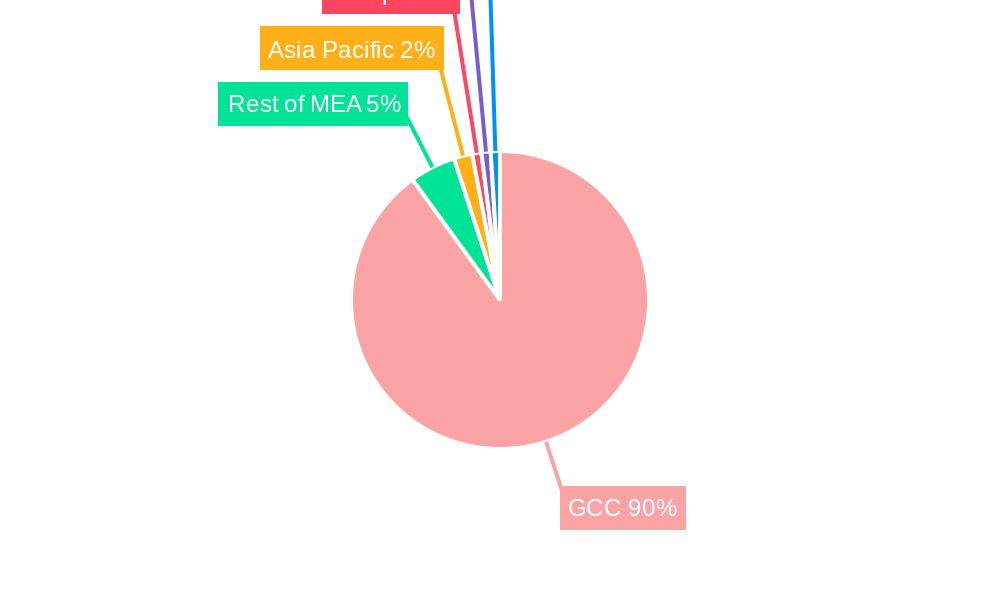

The regional distribution of the GCC REIT market shows a concentration within the Gulf Cooperation Council (GCC) nations themselves, with the UAE and Saudi Arabia acting as major hubs. However, international investment is also playing a role, and diversification into other regions within the Middle East and Africa (MEA) is anticipated as the market matures. The projected CAGR of 8.24% suggests a significant increase in market size over the forecast period (2025-2033). This positive outlook reflects the long-term growth potential of the region's real estate sector and the increasing appeal of REITs as a stable and attractive investment option. Furthermore, ongoing government efforts to improve transparency and regulation within the REIT market will further stimulate investor confidence and encourage market expansion.

GCC REIT Industry Company Market Share

GCC REIT Industry Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the GCC REIT industry, offering invaluable insights for investors, stakeholders, and industry professionals. Covering the period from 2019 to 2033, with a base year of 2025, this study meticulously examines market trends, competitive dynamics, and future growth potential. The report leverages extensive data and analysis to provide a clear picture of this rapidly evolving sector. The market size is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx%.

GCC REIT Industry Market Structure & Competitive Landscape

The GCC REIT market exhibits a moderately concentrated structure, with a few key players dominating the landscape. The Herfindahl-Hirschman Index (HHI) for 2024 is estimated at xx, indicating a moderately concentrated market. Innovation is driven primarily by technological advancements in property management, ESG investing trends, and the development of niche REIT products catering to specialized sectors like healthcare and logistics. Regulatory changes, particularly those related to REIT regulations in Saudi Arabia and the UAE, have significantly influenced market dynamics. Substitutes for REITs include direct real estate investments and other investment vehicles, impacting market share. The end-user segmentation comprises both institutional and individual investors, with institutional investors currently holding a larger market share. M&A activity has been significant, with xx Million in transactions recorded between 2019 and 2024.

- Market Concentration: Moderately concentrated, HHI (2024) estimated at xx.

- Innovation Drivers: Technology, ESG investing, niche REIT products.

- Regulatory Impacts: Significant influence from Saudi Arabia and UAE regulatory changes.

- Product Substitutes: Direct real estate investment, alternative investment vehicles.

- End-User Segmentation: Institutional and individual investors.

- M&A Trends: xx Million in transactions (2019-2024).

GCC REIT Industry Market Trends & Opportunities

The GCC REIT market is experiencing a period of dynamic evolution and significant expansion. This growth is underpinned by robust demographic shifts, including rapid urbanization and a rising middle class with increasing disposable incomes, coupled with proactive government initiatives aimed at diversifying economies and attracting foreign investment. The market, poised for substantial uplift, is projected to grow from an estimated [Insert Current Market Size] Million in 2025 to a formidable [Insert Projected Market Size] Million by 2033, demonstrating a compelling Compound Annual Growth Rate (CAGR) of approximately [Insert CAGR]%. The integration of technological advancements, particularly in the realm of proptech, is revolutionizing property management, investment platforms, and data analytics, leading to enhanced operational efficiencies and a more streamlined investment experience. Consumer preferences are increasingly leaning towards properties that offer sustainability credentials and are integrated with cutting-edge technology, influencing investment strategies and asset allocation. The competitive landscape is becoming more intense, marked by the strategic expansion of established players and the innovative entry of new entities. Market penetration is steadily increasing across key segments, with particular momentum in commercial and residential real estate. Emerging opportunities abound in the development of specialized REITs focusing on niche sectors such as logistics, healthcare, and data centers, alongside the leveraging of advanced technology to create more transparent and accessible investment vehicles, and the catering to the escalating demand for green and smart real estate solutions.

Dominant Markets & Segments in GCC REIT Industry

The UAE and Saudi Arabia are the dominant markets, driven by robust economic growth and supportive government initiatives. Within property types, Commercial REITs hold the largest market share, followed by Residential REITs. Equity REITs dominate the investment type segment.

- Key Growth Drivers:

- UAE: Strong economic growth, favorable regulatory environment, strategic infrastructure projects.

- Saudi Arabia: New REIT regime, increased capital inflows, diversification of the economy.

- Commercial REITs: High demand for office and retail spaces in major cities.

- Residential REITs: Growing population and increasing urbanization.

- Equity REITs: Greater investor preference for direct ownership of real estate assets.

GCC REIT Industry Product Analysis

Product innovation within the GCC REIT industry is characterized by a strategic focus on developing specialized REITs designed to meet distinct investor needs and capitalize on emerging property sub-sectors. This includes a notable rise in Sharia-compliant REITs, catering to a significant segment of the investor base, and an increasing emphasis on REITs that focus on sustainable and environmentally conscious developments, aligning with regional and global ESG mandates. The primary drivers of competitive advantage are centered on offering diversified portfolios that mitigate risk, the presence of highly experienced and reputable management teams with a proven track record, and the ability to deliver attractive and consistent returns to investors. The incorporation of advanced technological solutions plays a pivotal role in enhancing transparency and operational efficiency across all facets of property management and investment processes, ultimately bolstering investor confidence and improving the overall market fit of these investment products.

Key Drivers, Barriers & Challenges in GCC REIT Industry

Key Drivers: Accelerating urbanization across the region, a growing middle class with expanding disposable incomes, and robust governmental support through favorable policies and economic diversification initiatives (e.g., the well-established Saudi REIT regime, and similar frameworks being developed in other GCC nations). Furthermore, rapid advancements in proptech are driving innovation and operational efficiencies.

Challenges: Navigating regulatory complexities, particularly the need for greater harmonization of REIT regulations across different GCC jurisdictions. Supply chain disruptions, stemming from global events, can impact construction timelines and development costs. The market faces intense competition from both established REIT players and agile new entrants. Additionally, market volatility influenced by global economic uncertainties presents a persistent challenge, with some analyses suggesting a potential impact of approximately [Insert Percentage]% on growth by 2028.

Growth Drivers in the GCC REIT Industry Market

The GCC REIT Industry Market is propelled by a confluence of powerful growth drivers. The ongoing and rapid urbanization across the GCC region, coupled with a burgeoning middle class exhibiting increasing disposable income, creates a sustained demand for real estate assets. Crucially, governmental support for the development and expansion of the REIT sector, as part of broader economic diversification strategies, provides a stable and encouraging regulatory environment. Moreover, the continuous adoption of technological advancements in property management, alongside the introduction of innovative and flexible REIT structures, is significantly fueling market expansion and attracting a wider range of investors.

Challenges Impacting GCC REIT Industry Growth

Challenges include the relatively nascent nature of the market in some GCC countries, regulatory inconsistencies across the region, potential supply chain disruptions, and intense competition from both established players and new entrants. Economic downturns and fluctuating global financial conditions can cause market volatility and threaten growth.

Key Players Shaping the GCC REIT Industry Market

- Emaar Malls Group

- Aldar Properties

- Qatar Real Estate Investment Fund (QREIF)

- Mabanee Company K.S.C.P.

- Saudi Real Estate Company (SAREC)

- Mall of Oman

- National Real Estate Company (NREC)

- [Add New Player Name 1]

- [Add New Player Name 2]

Significant GCC REIT Industry Industry Milestones

- November 2016: Riyad REIT, the first REIT, listed in Saudi Arabia.

- January 2021: Dubai Financial Market (DFM) begins trading in REITs.

- September 2022: Saudi Arabia introduces a formal REIT regime.

- July 2022: 17 additional REITs listed in Saudi Arabia following Riyad REIT's listing.

Future Outlook for GCC REIT Industry Market

The GCC REIT industry is poised for continued expansion, driven by long-term economic growth, supportive government policies, and increasing investor interest. Strategic opportunities exist in developing niche REITs, leveraging technology, and expanding into new markets. The market's potential is substantial, given the region's urbanization trends and the growing demand for modern, sustainable real estate.

GCC REIT Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

GCC REIT Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

GCC REIT Industry Regional Market Share

Geographic Coverage of GCC REIT Industry

GCC REIT Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.24% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Fund Inflows is Driving the ETF Market

- 3.3. Market Restrains

- 3.3.1. Underlying Fluctuations and Risks are Restraining the Market

- 3.4. Market Trends

- 3.4.1. Growing Asset Allocation to Real Estate by Large Investors in The Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global GCC REIT Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. South America

- 5.6.3. Europe

- 5.6.4. Middle East & Africa

- 5.6.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America GCC REIT Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. South America GCC REIT Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Europe GCC REIT Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Middle East & Africa GCC REIT Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Asia Pacific GCC REIT Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Emaar Malls Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Aldar Properties

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Qatar Real Estate Investment Fund (QREIF)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Mabanee Company K.S.C.P.

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Saudi Real Estate Company (SAREC)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mall of Oman

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 National Real Estate Company (NREC)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Emaar Malls Group

List of Figures

- Figure 1: Global GCC REIT Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America GCC REIT Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 3: North America GCC REIT Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 4: North America GCC REIT Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 5: North America GCC REIT Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 6: North America GCC REIT Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 7: North America GCC REIT Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 8: North America GCC REIT Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 9: North America GCC REIT Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 10: North America GCC REIT Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 11: North America GCC REIT Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 12: North America GCC REIT Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: North America GCC REIT Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America GCC REIT Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 15: South America GCC REIT Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 16: South America GCC REIT Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 17: South America GCC REIT Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 18: South America GCC REIT Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 19: South America GCC REIT Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 20: South America GCC REIT Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 21: South America GCC REIT Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 22: South America GCC REIT Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 23: South America GCC REIT Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 24: South America GCC REIT Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: South America GCC REIT Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe GCC REIT Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 27: Europe GCC REIT Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 28: Europe GCC REIT Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 29: Europe GCC REIT Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 30: Europe GCC REIT Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 31: Europe GCC REIT Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 32: Europe GCC REIT Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 33: Europe GCC REIT Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 34: Europe GCC REIT Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 35: Europe GCC REIT Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 36: Europe GCC REIT Industry Revenue (Million), by Country 2025 & 2033

- Figure 37: Europe GCC REIT Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Middle East & Africa GCC REIT Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 39: Middle East & Africa GCC REIT Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 40: Middle East & Africa GCC REIT Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 41: Middle East & Africa GCC REIT Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 42: Middle East & Africa GCC REIT Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 43: Middle East & Africa GCC REIT Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 44: Middle East & Africa GCC REIT Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 45: Middle East & Africa GCC REIT Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 46: Middle East & Africa GCC REIT Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 47: Middle East & Africa GCC REIT Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 48: Middle East & Africa GCC REIT Industry Revenue (Million), by Country 2025 & 2033

- Figure 49: Middle East & Africa GCC REIT Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific GCC REIT Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 51: Asia Pacific GCC REIT Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 52: Asia Pacific GCC REIT Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 53: Asia Pacific GCC REIT Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 54: Asia Pacific GCC REIT Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 55: Asia Pacific GCC REIT Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 56: Asia Pacific GCC REIT Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 57: Asia Pacific GCC REIT Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 58: Asia Pacific GCC REIT Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 59: Asia Pacific GCC REIT Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 60: Asia Pacific GCC REIT Industry Revenue (Million), by Country 2025 & 2033

- Figure 61: Asia Pacific GCC REIT Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global GCC REIT Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Global GCC REIT Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Global GCC REIT Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Global GCC REIT Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Global GCC REIT Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Global GCC REIT Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Global GCC REIT Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Global GCC REIT Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Global GCC REIT Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Global GCC REIT Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Global GCC REIT Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Global GCC REIT Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States GCC REIT Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Canada GCC REIT Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Mexico GCC REIT Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global GCC REIT Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 17: Global GCC REIT Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 18: Global GCC REIT Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Global GCC REIT Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Global GCC REIT Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 21: Global GCC REIT Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Brazil GCC REIT Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Argentina GCC REIT Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of South America GCC REIT Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global GCC REIT Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 26: Global GCC REIT Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 27: Global GCC REIT Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 28: Global GCC REIT Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 29: Global GCC REIT Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 30: Global GCC REIT Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: United Kingdom GCC REIT Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany GCC REIT Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: France GCC REIT Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Italy GCC REIT Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Spain GCC REIT Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Russia GCC REIT Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Benelux GCC REIT Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Nordics GCC REIT Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of Europe GCC REIT Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Global GCC REIT Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 41: Global GCC REIT Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 42: Global GCC REIT Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 43: Global GCC REIT Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 44: Global GCC REIT Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 45: Global GCC REIT Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 46: Turkey GCC REIT Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Israel GCC REIT Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: GCC GCC REIT Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: North Africa GCC REIT Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: South Africa GCC REIT Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Rest of Middle East & Africa GCC REIT Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Global GCC REIT Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 53: Global GCC REIT Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 54: Global GCC REIT Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 55: Global GCC REIT Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 56: Global GCC REIT Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 57: Global GCC REIT Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 58: China GCC REIT Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 59: India GCC REIT Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Japan GCC REIT Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 61: South Korea GCC REIT Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: ASEAN GCC REIT Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 63: Oceania GCC REIT Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Rest of Asia Pacific GCC REIT Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the GCC REIT Industry?

The projected CAGR is approximately 8.24%.

2. Which companies are prominent players in the GCC REIT Industry?

Key companies in the market include Emaar Malls Group , Aldar Properties , Qatar Real Estate Investment Fund (QREIF) , Mabanee Company K.S.C.P., Saudi Real Estate Company (SAREC) , Mall of Oman , National Real Estate Company (NREC) .

3. What are the main segments of the GCC REIT Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.37 Million as of 2022.

5. What are some drivers contributing to market growth?

Fund Inflows is Driving the ETF Market.

6. What are the notable trends driving market growth?

Growing Asset Allocation to Real Estate by Large Investors in The Region.

7. Are there any restraints impacting market growth?

Underlying Fluctuations and Risks are Restraining the Market.

8. Can you provide examples of recent developments in the market?

In September 2022, Saudi Arabia introduced a real estate investment trust (REIT) regime. In November 2016, Riyad REIT was the first REIT to be listed in Saudi Arabia (and only the second REIT to be listed in the Middle East), which was followed by another 17 REITs up to July 2022, with a number of them also increasing their capital to acquire additional assets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "GCC REIT Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the GCC REIT Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the GCC REIT Industry?

To stay informed about further developments, trends, and reports in the GCC REIT Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence