Key Insights

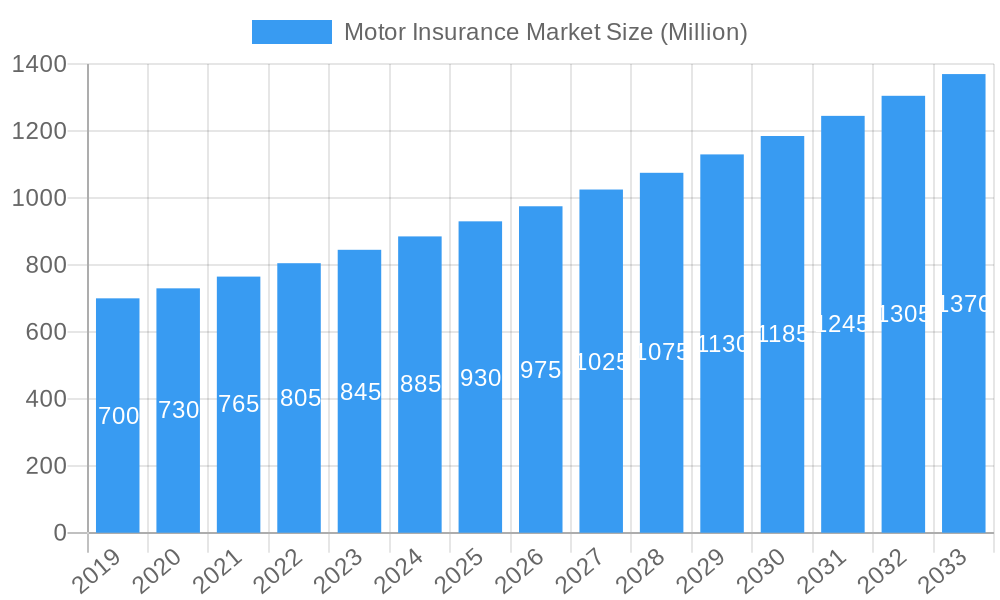

The global Motor Insurance Market is projected for robust expansion, currently valued at approximately $850 billion and anticipated to grow at a Compound Annual Growth Rate (CAGR) of 5.03% from 2019 to 2033. This substantial market size underscores the indispensable nature of vehicle protection in today's mobile society. The primary growth drivers are the increasing global vehicle parc, coupled with rising disposable incomes that enable more individuals to own and insure vehicles, particularly in emerging economies. Furthermore, a growing awareness of the financial implications of accidents and the legal mandates for at least third-party coverage are propelling market penetration. Technological advancements, such as telematics and AI-driven underwriting, are also playing a crucial role by enabling more personalized and affordable insurance products, thereby attracting a wider customer base and encouraging policy uptake.

Motor Insurance Market Market Size (In Million)

The market's trajectory is further shaped by evolving consumer preferences and regulatory landscapes. Trends like the increasing adoption of electric vehicles (EVs) necessitate specialized insurance policies that address their unique components and repair costs, presenting a significant growth avenue. Similarly, the rise of connected car technology is paving the way for usage-based insurance (UBI) models, offering discounts for safe driving habits. However, the market faces certain restraints. Intense competition among established players and new entrants, particularly in saturated markets, can lead to price wars and pressure on profit margins. Additionally, the increasing frequency and severity of natural disasters and extreme weather events contribute to higher claims payouts, impacting insurer profitability and potentially leading to premium increases. The ongoing debate and implementation of stricter data privacy regulations also pose a challenge, requiring insurers to navigate complex compliance requirements when leveraging telematics data.

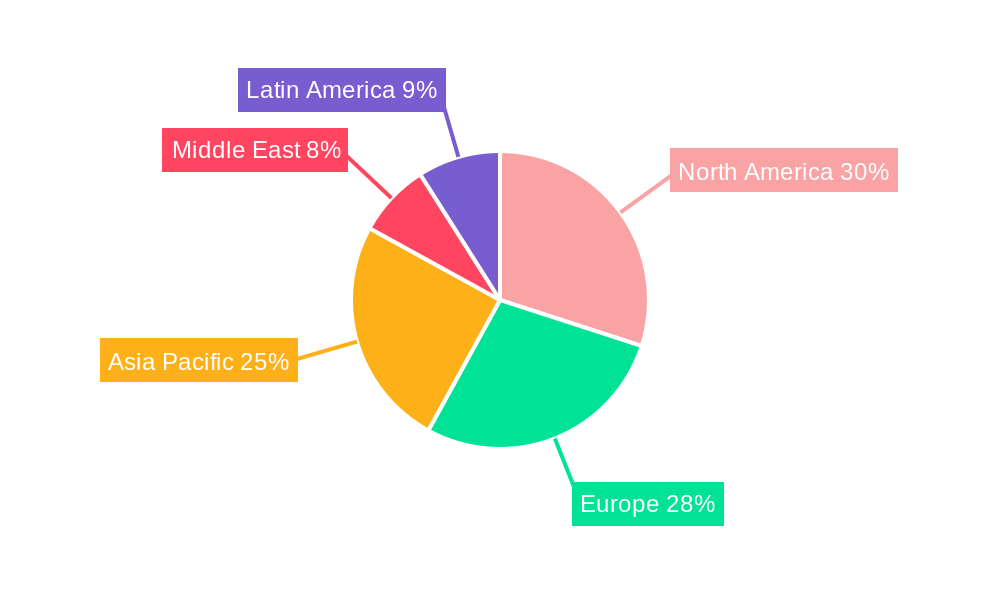

Motor Insurance Market Company Market Share

Comprehensive Motor Insurance Market Report: Driving Growth and Navigating the Future (2019-2033)

This in-depth report provides a dynamic and SEO-optimized analysis of the global Motor Insurance Market. Delving into market structure, trends, opportunities, dominant segments, product innovations, key players, and future outlook, this study leverages high-volume keywords to enhance search rankings and deliver actionable insights for industry stakeholders. Our comprehensive analysis covers the period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period spanning 2025-2033.

Motor Insurance Market Market Structure & Competitive Landscape

The global Motor Insurance Market is characterized by a moderately concentrated structure, with a few dominant players holding significant market share alongside a substantial number of regional and specialized insurers. Key innovation drivers include the integration of telematics, AI-powered claims processing, and the development of usage-based insurance (UBI) products, all aiming to personalize policies and reduce risk. Regulatory impacts are substantial, with evolving mandates on data privacy, cybersecurity, and consumer protection influencing product design and distribution strategies. Product substitutes, while limited, include self-insurance and extended warranties for specific vehicle components, but these do not offer the comprehensive protection of traditional motor insurance. End-user segmentation is critical, with distinct needs for individual car owners, fleet operators, commercial vehicle entities, and motorcycle riders. Mergers and acquisitions (M&A) activity plays a vital role in market consolidation and the expansion of capabilities. For instance, the study identified approximately 35 significant M&A transactions within the historical period (2019-2024), with an estimated cumulative deal value exceeding 50 Billion Million. Concentration ratios (CR4) in developed markets hover around 60%, indicating a strong presence of top players.

Motor Insurance Market Market Trends & Opportunities

The Motor Insurance Market is poised for robust growth, driven by an increasing global vehicle parc and evolving consumer expectations. The market size is projected to reach an impressive 1,200 Billion Million by the end of 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period (2025-2033). Technological shifts are profoundly reshaping the industry. The widespread adoption of Advanced Driver-Assistance Systems (ADAS) and the impending arrival of autonomous vehicles are creating new risk profiles and necessitating innovative underwriting approaches. Telematics, powered by IoT devices and smartphone applications, is enabling granular data collection on driving behavior, leading to the proliferation of pay-as-you-drive (PAYD) and pay-how-you-drive (PHYD) models. This personalization enhances customer engagement and fosters loyalty. Consumer preferences are increasingly leaning towards digital-first experiences, with a demand for seamless online policy acquisition, claims submission, and customer service. Insurers are responding by investing heavily in digital platforms and mobile applications. Competitive dynamics are intensifying, with traditional insurers facing challenges from InsurTech startups that are leveraging agile technology and data analytics to disrupt established models. Opportunities abound in emerging markets, where rising disposable incomes and vehicle ownership are creating new customer bases. Furthermore, the development of specialized insurance products for electric vehicles (EVs) and connected car ecosystems presents a significant growth avenue, with an estimated market penetration of 15% for EV-specific motor insurance by 2030. The market penetration for comprehensive motor insurance is estimated to reach 75% in developed economies by 2033, up from 68% in 2025, signaling a strong shift towards broader coverage.

Dominant Markets & Segments in Motor Insurance Market

The global Motor Insurance Market exhibits distinct regional dominance and segment preferences. North America and Europe currently represent the largest markets, accounting for an estimated 40% and 30% of the global market share respectively in 2025. Key growth drivers in these mature markets include high vehicle density, stringent compulsory insurance regulations, and a well-established insurance infrastructure. Asia Pacific, however, is emerging as the fastest-growing region, projected to witness a CAGR of over 8% during the forecast period, fueled by rapid economic development, increasing disposable incomes, and a burgeoning middle class leading to higher vehicle ownership rates. Within policy types, Comprehensive insurance holds the dominant position, estimated to capture over 60% of the market share by 2025. This dominance is driven by increasing consumer awareness of vehicle value and the desire for all-encompassing protection against various risks, including accidents, theft, and natural calamities. Third-party Liability insurance remains a mandatory requirement in most jurisdictions, ensuring a stable and significant market share, estimated at 30% in 2025. Its growth is intrinsically linked to new vehicle registrations. Third-party Fire and Theft insurance, while offering a middle ground, is gradually losing market share to Comprehensive policies in developed regions due to the perceived value proposition of broader coverage. However, it continues to hold relevance in price-sensitive emerging markets. Infrastructure development, such as the expansion of road networks and the increasing number of registered vehicles (projected to exceed 1.5 Billion by 2030), directly fuels the demand for motor insurance. Government policies mandating specific coverage levels and promoting road safety initiatives also play a crucial role in shaping market dynamics and driving segment penetration. The market penetration for comprehensive motor insurance in emerging economies is expected to grow from 45% in 2025 to 60% by 2033.

Motor Insurance Market Product Analysis

Product innovation in the Motor Insurance Market is increasingly focused on leveraging technology to offer more personalized, flexible, and efficient solutions. The integration of telematics is enabling the development of usage-based insurance (UBI) policies that reward safe driving behavior with lower premiums. AI-powered claims processing is streamlining the claims handling experience, reducing processing times and improving customer satisfaction. Blockchain technology is being explored for enhanced transparency and security in policy management and claims verification. Competitive advantages are increasingly derived from offering tailored coverage options, such as specialized policies for electric vehicles, vintage cars, or high-performance vehicles, alongside robust digital customer service platforms. The application of data analytics allows insurers to better understand risk profiles and develop more accurate pricing models.

Key Drivers, Barriers & Challenges in Motor Insurance Market

Key Drivers:

- Rising Vehicle Ownership: Global increase in car ownership, particularly in emerging economies, directly boosts demand for motor insurance.

- Technological Advancements: Telematics, ADAS, and AI are enabling innovative products and more efficient operations.

- Regulatory Mandates: Compulsory insurance laws in most countries ensure a baseline demand.

- Consumer Demand for Comprehensive Coverage: Increasing awareness of asset value and risk mitigation drives preference for broader policies.

- Urbanization and Infrastructure Development: Growing urban populations and improved road networks lead to higher vehicle usage.

Barriers & Challenges:

- Intense Competition: A highly competitive landscape leads to price wars and pressure on profit margins.

- Regulatory Complexity: Navigating diverse and evolving insurance regulations across different jurisdictions is challenging.

- Fraudulent Claims: The persistent issue of insurance fraud leads to increased operational costs and underwriting complexities, estimated to cost the industry over 40 Billion Million annually.

- Talent Shortage: A lack of skilled professionals in areas like data science and cybersecurity can hinder innovation and operational efficiency.

- Economic Volatility: Fluctuations in global economic conditions can impact disposable incomes and vehicle purchasing decisions.

- Supply Chain Issues: Disruptions in vehicle manufacturing and repair services can indirectly affect the insurance market.

Growth Drivers in the Motor Insurance Market Market

Key growth drivers in the Motor Insurance Market are predominantly technological, economic, and regulatory. The relentless advancement of automotive technology, including the proliferation of Advanced Driver-Assistance Systems (ADAS) and the eventual widespread adoption of electric and autonomous vehicles, presents a significant opportunity for insurers to develop specialized products and services. Economically, rising disposable incomes in emerging markets are fueling vehicle ownership, thereby expanding the potential customer base. Government policies mandating minimum insurance coverage levels and promoting road safety initiatives further contribute to sustained demand. For instance, the growing adoption of telematics is enabling the lucrative pay-as-you-drive (PAYD) and pay-how-you-drive (PHYD) insurance models, which cater to evolving consumer preferences for personalized pricing and rewards for safe driving.

Challenges Impacting Motor Insurance Market Growth

Several barriers and restraints continue to impact the growth of the Motor Insurance Market. Intense competition among established players and emerging InsurTech startups exerts considerable pressure on pricing and profitability. Regulatory complexities, with differing laws and compliance requirements across various regions, pose a significant hurdle for global expansion. The persistent issue of insurance fraud remains a major concern, leading to inflated claims costs and impacting underwriting profitability. Supply chain disruptions in the automotive industry, affecting vehicle availability and repair times, can also indirectly influence claims cycles and operational efficiency. Furthermore, the increasing sophistication of cyber threats necessitates substantial investments in cybersecurity infrastructure, adding to operational expenses.

Key Players Shaping the Motor Insurance Market Market

- PICC Property and Casualty Co Ltd

- Samsung Fire and Marine Insurance Co Ltd

- Allianz SE

- GEICO

- Ping An Insurance (Group) Co of China Ltd

- ICICI Lombard General Insurance Co Ltd

- Sompo Holdings Inc

- State Farm Mutual Automobile Insurance Company

- Aviva Plc

- Porto Seguro S A

Significant Motor Insurance Market Industry Milestones

- 2020: Launch of widespread telematics-based insurance programs across major European markets, offering personalized premiums.

- 2021: Significant increase in M&A activity as larger insurers acquired InsurTech startups to enhance digital capabilities.

- 2022: Growing regulatory focus on data privacy and cybersecurity standards impacting product development and data handling.

- 2023: Introduction of specialized motor insurance products for electric vehicles (EVs) gaining traction due to the rising EV adoption rate.

- 2024: Advancements in AI and machine learning leading to faster and more accurate claims processing, with an estimated 30% reduction in claims settlement time for automated claims.

Future Outlook for Motor Insurance Market Market

The future outlook for the Motor Insurance Market is exceptionally promising, driven by ongoing technological advancements and evolving consumer demands. The continued integration of telematics and AI will foster hyper-personalized insurance products and enhance operational efficiency. The rise of electric and autonomous vehicles will necessitate innovative underwriting and risk management strategies, creating new market niches. Emerging economies represent significant growth catalysts, with expanding vehicle parc and increasing insurance penetration. Strategic opportunities lie in developing robust digital ecosystems, offering value-added services beyond traditional insurance, and leveraging data analytics for predictive risk assessment and personalized customer engagement. The market is expected to witness sustained growth, driven by a blend of innovation, adaptation, and strategic expansion.

Motor Insurance Market Segmentation

-

1. Policy Type

- 1.1. Third-party Liability

- 1.2. Third-party Fire and Theft

- 1.3. Comprehensive

Motor Insurance Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Middle East

- 5. Latin America

Motor Insurance Market Regional Market Share

Geographic Coverage of Motor Insurance Market

Motor Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Sales of Cars in Europe Drives The Market; Increase in Road Traffic Accidents Drives The Market

- 3.3. Market Restrains

- 3.3.1. Increase in Cost of Claims Made; Increase in False Claims and Scams

- 3.4. Market Trends

- 3.4.1. Emerging Countries Driving the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Motor Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Policy Type

- 5.1.1. Third-party Liability

- 5.1.2. Third-party Fire and Theft

- 5.1.3. Comprehensive

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Middle East

- 5.2.5. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Policy Type

- 6. North America Motor Insurance Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Policy Type

- 6.1.1. Third-party Liability

- 6.1.2. Third-party Fire and Theft

- 6.1.3. Comprehensive

- 6.1. Market Analysis, Insights and Forecast - by Policy Type

- 7. Europe Motor Insurance Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Policy Type

- 7.1.1. Third-party Liability

- 7.1.2. Third-party Fire and Theft

- 7.1.3. Comprehensive

- 7.1. Market Analysis, Insights and Forecast - by Policy Type

- 8. Asia Pacific Motor Insurance Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Policy Type

- 8.1.1. Third-party Liability

- 8.1.2. Third-party Fire and Theft

- 8.1.3. Comprehensive

- 8.1. Market Analysis, Insights and Forecast - by Policy Type

- 9. Middle East Motor Insurance Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Policy Type

- 9.1.1. Third-party Liability

- 9.1.2. Third-party Fire and Theft

- 9.1.3. Comprehensive

- 9.1. Market Analysis, Insights and Forecast - by Policy Type

- 10. Latin America Motor Insurance Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Policy Type

- 10.1.1. Third-party Liability

- 10.1.2. Third-party Fire and Theft

- 10.1.3. Comprehensive

- 10.1. Market Analysis, Insights and Forecast - by Policy Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 PICC Property and Casualty Co Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Samsung Fire and Marine Insurance Co Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Allianz SE

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 GEICO

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ping An Insurance (Group) Co of China Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ICICI Lombard General Insurance Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sompo Holdings Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 State Farm Mutual Automobile Insurance Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Aviva Plc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Porto Seguro S A**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 PICC Property and Casualty Co Ltd

List of Figures

- Figure 1: Global Motor Insurance Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Motor Insurance Market Revenue (undefined), by Policy Type 2025 & 2033

- Figure 3: North America Motor Insurance Market Revenue Share (%), by Policy Type 2025 & 2033

- Figure 4: North America Motor Insurance Market Revenue (undefined), by Country 2025 & 2033

- Figure 5: North America Motor Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Motor Insurance Market Revenue (undefined), by Policy Type 2025 & 2033

- Figure 7: Europe Motor Insurance Market Revenue Share (%), by Policy Type 2025 & 2033

- Figure 8: Europe Motor Insurance Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: Europe Motor Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Motor Insurance Market Revenue (undefined), by Policy Type 2025 & 2033

- Figure 11: Asia Pacific Motor Insurance Market Revenue Share (%), by Policy Type 2025 & 2033

- Figure 12: Asia Pacific Motor Insurance Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Asia Pacific Motor Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East Motor Insurance Market Revenue (undefined), by Policy Type 2025 & 2033

- Figure 15: Middle East Motor Insurance Market Revenue Share (%), by Policy Type 2025 & 2033

- Figure 16: Middle East Motor Insurance Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Middle East Motor Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Latin America Motor Insurance Market Revenue (undefined), by Policy Type 2025 & 2033

- Figure 19: Latin America Motor Insurance Market Revenue Share (%), by Policy Type 2025 & 2033

- Figure 20: Latin America Motor Insurance Market Revenue (undefined), by Country 2025 & 2033

- Figure 21: Latin America Motor Insurance Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Motor Insurance Market Revenue undefined Forecast, by Policy Type 2020 & 2033

- Table 2: Global Motor Insurance Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global Motor Insurance Market Revenue undefined Forecast, by Policy Type 2020 & 2033

- Table 4: Global Motor Insurance Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: Global Motor Insurance Market Revenue undefined Forecast, by Policy Type 2020 & 2033

- Table 6: Global Motor Insurance Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global Motor Insurance Market Revenue undefined Forecast, by Policy Type 2020 & 2033

- Table 8: Global Motor Insurance Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Global Motor Insurance Market Revenue undefined Forecast, by Policy Type 2020 & 2033

- Table 10: Global Motor Insurance Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: Global Motor Insurance Market Revenue undefined Forecast, by Policy Type 2020 & 2033

- Table 12: Global Motor Insurance Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Motor Insurance Market?

The projected CAGR is approximately 6.7%.

2. Which companies are prominent players in the Motor Insurance Market?

Key companies in the market include PICC Property and Casualty Co Ltd, Samsung Fire and Marine Insurance Co Ltd, Allianz SE, GEICO, Ping An Insurance (Group) Co of China Ltd, ICICI Lombard General Insurance Co Ltd, Sompo Holdings Inc, State Farm Mutual Automobile Insurance Company, Aviva Plc, Porto Seguro S A**List Not Exhaustive.

3. What are the main segments of the Motor Insurance Market?

The market segments include Policy Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rising Sales of Cars in Europe Drives The Market; Increase in Road Traffic Accidents Drives The Market.

6. What are the notable trends driving market growth?

Emerging Countries Driving the Market Growth.

7. Are there any restraints impacting market growth?

Increase in Cost of Claims Made; Increase in False Claims and Scams.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Motor Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Motor Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Motor Insurance Market?

To stay informed about further developments, trends, and reports in the Motor Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence