Key Insights

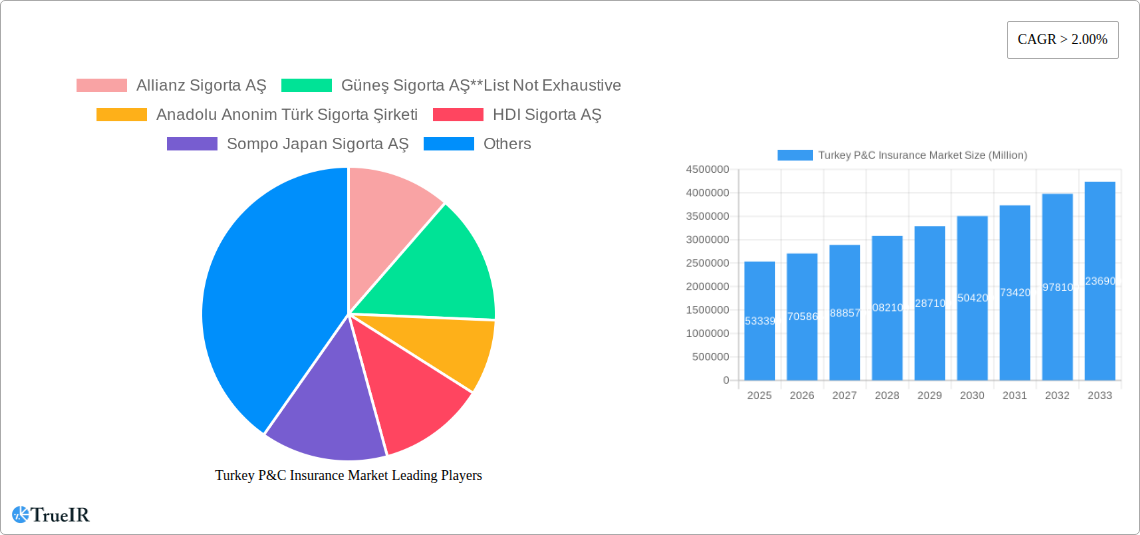

The Turkey Property and Casualty (P&C) Insurance Market is poised for robust expansion, with an estimated market size of $2533.39 billion in 2025, projected to grow at a Compound Annual Growth Rate (CAGR) of 6.79% through 2033. This dynamic growth is propelled by several key drivers. Increasing urbanization and rising disposable incomes are fueling demand for comprehensive home insurance policies, protecting valuable assets against a range of perils. Simultaneously, a burgeoning automotive sector, coupled with a growing awareness of the financial implications of accidents, is driving significant uptake in motor insurance. The market also benefits from a generally favorable economic climate and a growing understanding of the importance of insurance for risk mitigation and financial security across both personal and commercial lines.

Turkey P&C Insurance Market Market Size (In Million)

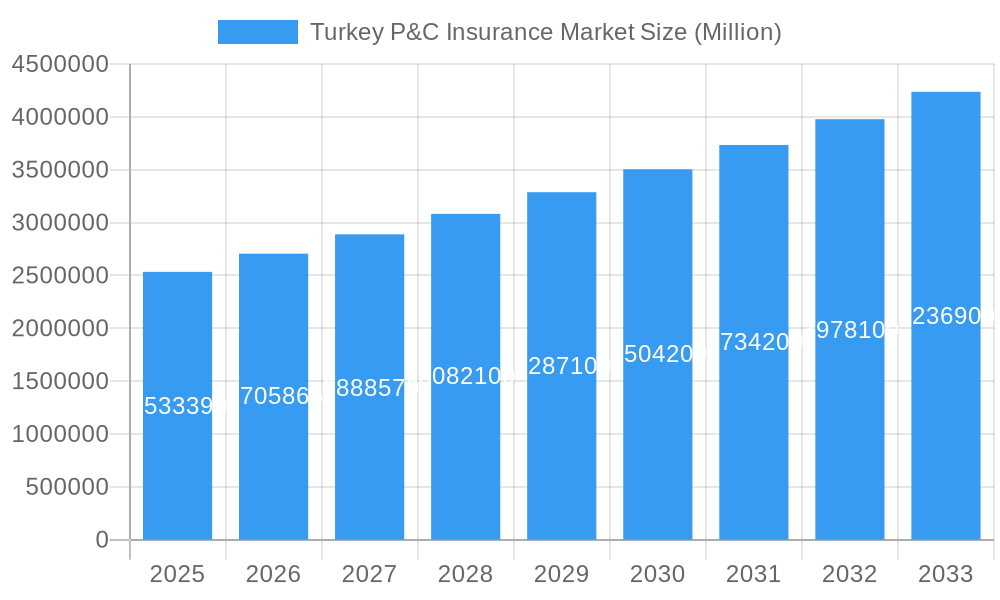

The distribution landscape of the Turkey P&C insurance market is undergoing a significant transformation, with direct channels gaining prominence alongside traditional agency networks. Insurers are investing in digital platforms, online comparison tools, and mobile applications to enhance customer experience and streamline policy acquisition. While agencies continue to play a crucial role, particularly for complex commercial risks and personalized advice, the convenience and accessibility offered by direct-to-consumer models are reshaping customer preferences. The market is also witnessing a rise in innovative insurance products tailored to specific needs, such as cyber insurance, parametric insurance, and usage-based insurance, further stimulating growth and catering to evolving consumer demands. Competition among key players like Allianz Sigorta AŞ, Güneş Sigorta AŞ, Anadolu Anonim Türk Sigorta Şirketi, and HDI Sigorta AŞ is intensifying, leading to more competitive pricing and enhanced service offerings.

Turkey P&C Insurance Market Company Market Share

Turkey P&C Insurance Market: Comprehensive Analysis & Future Outlook (2019-2033)

This in-depth report provides a dynamic and SEO-optimized analysis of the Turkey Property and Casualty (P&C) insurance market. Leveraging high-volume keywords, it offers actionable insights for industry stakeholders. The study spans from 2019 to 2033, with a base and estimated year of 2025, and a forecast period from 2025 to 2033, covering the historical period of 2019–2024.

Turkey P&C Insurance Market Market Structure & Competitive Landscape

The Turkey P&C insurance market exhibits a moderately concentrated structure, characterized by the presence of both large established players and emerging entities. Key innovation drivers stem from digitalization initiatives, a growing demand for customized insurance products, and the increasing adoption of insurtech solutions. Regulatory frameworks, while evolving, continue to shape market dynamics, influencing product development and pricing strategies. Potential product substitutes, such as self-insurance or informal risk-sharing mechanisms, exist but are less prevalent for significant risks. End-user segmentation primarily revolves around individuals seeking protection for personal assets and businesses requiring comprehensive coverage for operational risks. Merger and acquisition (M&A) activities, while not at peak levels, are a strategic tool for market consolidation and expansion. Expected M&A volumes are in the range of several hundred million dollars annually over the forecast period.

- Market Concentration: Moderate, with top 5 players holding approximately 60% market share.

- Innovation Drivers: Digitalization, Insurtech adoption, personalized product offerings.

- Regulatory Impact: Ongoing reforms in consumer protection and solvency requirements.

- Product Substitutes: Limited for catastrophic events and complex business risks.

- End-User Segmentation: Retail (Home, Motor) and Commercial (SME, Corporate).

- M&A Trends: Strategic acquisitions for market share and technological integration.

Turkey P&C Insurance Market Market Trends & Opportunities

The Turkey P&C insurance market is poised for robust growth, driven by increasing disposable incomes, a growing awareness of risk management, and ongoing urbanization. The market size is projected to expand significantly, with an estimated Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period. Technological shifts are profoundly influencing the market, with the proliferation of online distribution channels, the implementation of AI-powered claims processing, and the development of usage-based insurance (UBI) models for motor insurance. Consumer preferences are evolving towards digital-first experiences, greater transparency, and demand for tailored insurance solutions that address specific needs. Competitive dynamics are intensifying, with traditional insurers facing pressure from agile insurtech startups and the potential entry of new players. Market penetration rates, currently at around 15% for P&C products, are expected to rise. Opportunities lie in leveraging data analytics to understand customer behavior, developing innovative products for underserved segments, and enhancing customer engagement through digital platforms. The projected market size for 2025 is in the tens of billions of dollars, with substantial growth expected by 2033.

Dominant Markets & Segments in Turkey P&C Insurance Market

The Motor insurance segment consistently emerges as the dominant force within the Turkey P&C insurance market, accounting for over 40% of the total market revenue. This dominance is fueled by compulsory third-party liability regulations and a large and growing vehicle parc. The Agency distribution channel remains the most significant, facilitating widespread market reach and personalized advice for complex products, generating approximately 50% of the overall premium volume.

Insurance Type Dominance:

- Motor Insurance:

- Key Growth Drivers: Compulsory nature of coverage, increasing vehicle registrations, rising cost of vehicle repairs and parts, government initiatives promoting road safety indirectly boosting awareness.

- Market Dominance: Continues to be the largest segment due to legal mandates and high demand.

- Home Insurance:

- Key Growth Drivers: Growing urbanization, increasing property values, enhanced awareness of natural disaster risks (earthquakes), government incentives for seismic retrofitting encouraging insurance uptake.

- Market Dominance: Significant growth potential driven by increasing homeownership and disaster preparedness.

- Other Insurance Types (Commercial, Health, Travel):

- Key Growth Drivers: Economic diversification, expansion of SMEs, increased international travel, rising healthcare costs, and a growing demand for specialized business risk coverage.

- Market Dominance: Exhibits strong growth as the economy diversifies and business needs become more complex.

Distribution Channel Dominance:

- Agency:

- Key Growth Drivers: Trust and relationship building, expert advice for complex products, extensive network coverage, particularly in non-urban areas.

- Market Dominance: Remains the primary channel due to its established presence and ability to cater to diverse customer needs.

- Bank (Bancassurance):

- Key Growth Drivers: Leveraging existing customer relationships, offering bundled products, convenient purchasing options at the point of sale for other financial products.

- Market Dominance: A rapidly growing channel, especially for simpler insurance products linked to loans and mortgages.

- Direct (Online/Digital):

- Key Growth Drivers: Increasing digital literacy, demand for speed and convenience, competitive pricing, enhanced customer experience through digital platforms.

- Market Dominance: Fastest-growing channel, appealing to a younger demographic and for standardized products.

Turkey P&C Insurance Market Product Analysis

The Turkey P&C insurance market is witnessing a surge in product innovation driven by technological advancements and evolving consumer needs. Key developments include the introduction of parametric insurance solutions for natural disasters, offering instant payouts based on predefined triggers, and the expansion of telematics-based motor insurance that rewards safe driving behavior. Competitive advantages are being built on customization, flexibility, and seamless digital integration, allowing insurers to offer tailored policies that fit individual risk profiles and lifestyles. These innovations are not only enhancing customer satisfaction but also creating new revenue streams and strengthening market positions. The focus on data-driven product development and personalized risk assessment is a significant trend.

Key Drivers, Barriers & Challenges in Turkey P&C Insurance Market

Key Drivers:

- Economic Growth & Urbanization: A growing economy and increasing urban populations lead to higher demand for property and motor insurance.

- Digital Transformation: The adoption of online platforms and insurtech solutions enhances accessibility and efficiency, driving new customer acquisition.

- Regulatory Support: Government initiatives promoting financial literacy and insurance awareness, alongside evolving regulatory frameworks, foster market growth.

- Increased Risk Awareness: Natural disasters and unforeseen events are raising public awareness of the importance of insurance coverage.

Barriers & Challenges:

- Price Sensitivity & Low Penetration: A significant portion of the population remains price-sensitive, and overall insurance penetration is still lower than in developed markets. This poses a challenge for premium growth.

- Regulatory Complexities: Evolving regulations, while beneficial in the long run, can create temporary implementation hurdles and compliance costs for insurers.

- Fraudulent Claims: Persistent issues with fraudulent claims can impact profitability and necessitate robust fraud detection mechanisms, adding to operational costs.

- Talent Shortage: A lack of specialized talent in areas like data analytics and insurtech can hinder innovation and efficient market operations.

Growth Drivers in the Turkey P&C Insurance Market Market

Key growth drivers in the Turkey P&C insurance market are multifaceted. Economically, rising disposable incomes and a growing middle class fuel demand for various insurance products. Technologically, the widespread adoption of digital platforms and insurtech solutions is creating new distribution channels and enhancing customer experience, leading to increased policy uptake. Regulatory factors, such as mandatory insurance requirements and government initiatives promoting financial inclusion, also play a crucial role. For instance, the increasing focus on earthquake preparedness in a seismically active region is driving demand for home insurance.

Challenges Impacting Turkey P&C Insurance Market Growth

Several challenges are impacting the growth of the Turkey P&C insurance market. Regulatory complexities, while aimed at market stability, can sometimes lead to slower product development cycles and increased compliance burdens for insurers. Supply chain issues, particularly concerning the cost and availability of parts for motor vehicle repairs, can indirectly affect motor insurance claims and pricing. Competitive pressures are intensifying, with both established players and new entrants vying for market share, leading to price wars in certain segments. The persistent issue of fraudulent claims also continues to be a significant drain on profitability, requiring continuous investment in fraud detection and prevention technologies.

Key Players Shaping the Turkey P&C Insurance Market Market

- Allianz Sigorta AŞ

- Güneş Sigorta AŞ

- Anadolu Anonim Türk Sigorta Şirketi

- HDI Sigorta AŞ

- Sompo Japan Sigorta AŞ

- Aksigorta AŞ

- Mapfre Sigorta AŞ

- Axa Sigorta AŞ

- Ziraat Sigorta AŞ

- Halk Sigorta AŞ

Significant Turkey P&C Insurance Market Industry Milestones

- February 2022: The Ministry of Health introduced an E-pulse system, providing online health services and enabling citizens to access medical records and schedule teleconsultations, potentially influencing health-related insurance product demand and digital service expectations.

- March 2022: Oman Insurance Company announced its agreement with VHV Reasürans, Turkey (a VHV Group company) to fully sell its insurance operations in Turkey, indicating consolidation and strategic realignments within the market.

Future Outlook for Turkey P&C Insurance Market Market

The future outlook for the Turkey P&C insurance market is highly optimistic, driven by several growth catalysts. Strategic opportunities lie in further leveraging digital channels to reach a wider customer base and enhance service delivery. The increasing demand for personalized and flexible insurance products, coupled with advancements in data analytics and AI, will enable insurers to offer more tailored solutions. Market potential is significant, especially in segments like cyber insurance and specialized commercial lines, as the Turkish economy continues to diversify and adapt to global trends. Continued investment in insurtech and a focus on customer-centricity will be key to unlocking sustained growth and maintaining competitive advantage in the coming years, with projected market expansion into the tens of billions of dollars by 2033.

Turkey P&C Insurance Market Segmentation

-

1. Insurance type

- 1.1. Home

- 1.2. Motor

- 1.3. Other Insurance Types

-

2. Distribution Channels

- 2.1. Direct

- 2.2. Agency

- 2.3. Bank

- 2.4. Other Distribution Channels

Turkey P&C Insurance Market Segmentation By Geography

- 1. Turkey

Turkey P&C Insurance Market Regional Market Share

Geographic Coverage of Turkey P&C Insurance Market

Turkey P&C Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.79% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Sales of Cars in Europe Drives The Market; Increase in Road Traffic Accidents Drives The Market

- 3.3. Market Restrains

- 3.3.1. Increase in Cost of Claims Made; Increase in False Claims and Scams

- 3.4. Market Trends

- 3.4.1. Non-Life Insurance Market is the Highest in the Turkish Insurance Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Turkey P&C Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Insurance type

- 5.1.1. Home

- 5.1.2. Motor

- 5.1.3. Other Insurance Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channels

- 5.2.1. Direct

- 5.2.2. Agency

- 5.2.3. Bank

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Turkey

- 5.1. Market Analysis, Insights and Forecast - by Insurance type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Allianz Sigorta AŞ

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Güneş Sigorta AŞ**List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Anadolu Anonim Türk Sigorta Şirketi

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 HDI Sigorta AŞ

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sompo Japan Sigorta AŞ

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Aksigorta AŞ

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mapfre Sigorta AŞ

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Axa Sigorta AŞ

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ziraat Sigorta AŞ

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Halk Sigorta AŞ

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Allianz Sigorta AŞ

List of Figures

- Figure 1: Turkey P&C Insurance Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Turkey P&C Insurance Market Share (%) by Company 2025

List of Tables

- Table 1: Turkey P&C Insurance Market Revenue undefined Forecast, by Insurance type 2020 & 2033

- Table 2: Turkey P&C Insurance Market Revenue undefined Forecast, by Distribution Channels 2020 & 2033

- Table 3: Turkey P&C Insurance Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Turkey P&C Insurance Market Revenue undefined Forecast, by Insurance type 2020 & 2033

- Table 5: Turkey P&C Insurance Market Revenue undefined Forecast, by Distribution Channels 2020 & 2033

- Table 6: Turkey P&C Insurance Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Turkey P&C Insurance Market?

The projected CAGR is approximately 6.79%.

2. Which companies are prominent players in the Turkey P&C Insurance Market?

Key companies in the market include Allianz Sigorta AŞ, Güneş Sigorta AŞ**List Not Exhaustive, Anadolu Anonim Türk Sigorta Şirketi, HDI Sigorta AŞ, Sompo Japan Sigorta AŞ, Aksigorta AŞ, Mapfre Sigorta AŞ, Axa Sigorta AŞ, Ziraat Sigorta AŞ, Halk Sigorta AŞ.

3. What are the main segments of the Turkey P&C Insurance Market?

The market segments include Insurance type, Distribution Channels.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rising Sales of Cars in Europe Drives The Market; Increase in Road Traffic Accidents Drives The Market.

6. What are the notable trends driving market growth?

Non-Life Insurance Market is the Highest in the Turkish Insurance Industry.

7. Are there any restraints impacting market growth?

Increase in Cost of Claims Made; Increase in False Claims and Scams.

8. Can you provide examples of recent developments in the market?

On Feb 23, 2022: The Ministry of Health introduced an E-pulse system that provided online health services to the Turkish population. This platform allows customers to access their medical records at any time and make appointments for teleconsultations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Turkey P&C Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Turkey P&C Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Turkey P&C Insurance Market?

To stay informed about further developments, trends, and reports in the Turkey P&C Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence