Key Insights

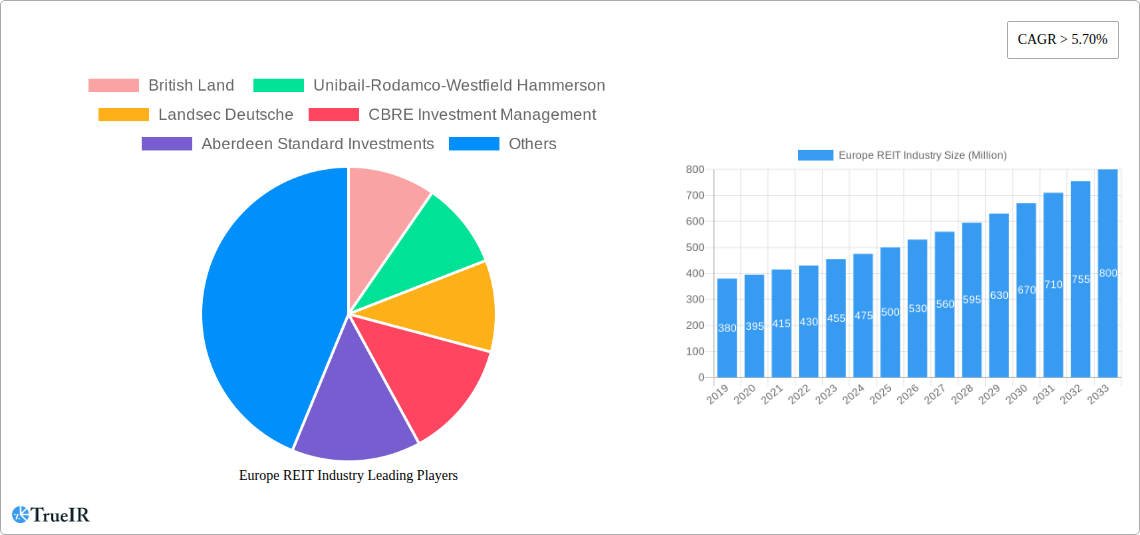

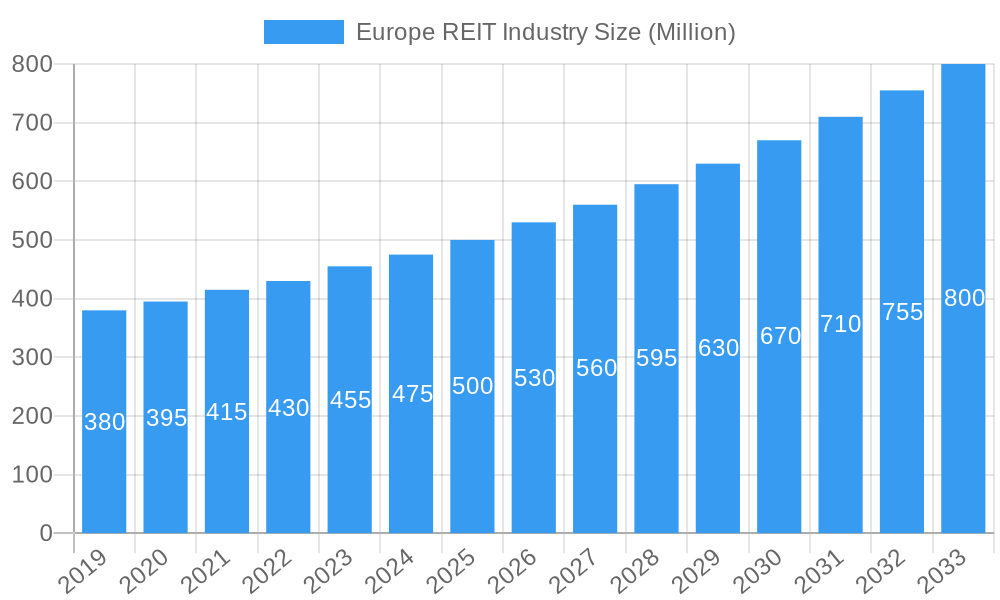

The European Real Estate Investment Trust (REIT) industry is poised for substantial growth, driven by a confluence of evolving investment strategies and robust economic underpinnings across the continent. With a projected market size exceeding €500 million and a Compound Annual Growth Rate (CAGR) of over 5.70% anticipated between 2025 and 2033, the sector presents significant opportunities for investors. Key growth drivers include the increasing institutional demand for stable, income-generating assets, the sustained popularity of sectors like logistics and residential as reliable performers, and the ongoing digitalization of retail, which is reshaping physical spaces and driving demand for modern, efficient retail REITs. Furthermore, the post-pandemic recovery is invigorating urban centers, leading to renewed interest in well-located office spaces and mixed-use developments. The inherent advantages of REITs, such as tax efficiencies and liquidity, continue to attract capital seeking diversification and consistent returns.

Europe REIT Industry Market Size (In Million)

Despite the strong growth trajectory, the European REIT market faces certain restraints that warrant strategic consideration. Rising interest rates and inflationary pressures can impact property valuations and borrowing costs, potentially tempering acquisition activity and profit margins. Geopolitical uncertainties and varying regulatory landscapes across European nations add layers of complexity for cross-border investments. Nevertheless, the long-term outlook remains overwhelmingly positive, fueled by the ongoing transformation of the real estate landscape. Emerging trends such as the increasing demand for sustainable and ESG-compliant properties, the growth of alternative sectors like data centers and healthcare facilities, and the continued integration of technology in property management are creating new avenues for value creation. Investors are increasingly focusing on diversified portfolios that can weather economic fluctuations, with significant attention being paid to the resilience of residential and logistics sectors, while also exploring opportunities in evolving retail and office spaces.

Europe REIT Industry Company Market Share

Here is a dynamic, SEO-optimized report description for the Europe REIT Industry, designed for maximum impact without further modification:

Europe REIT Industry Market Analysis: Trends, Opportunities, and Competitive Landscape (2019-2033)

This comprehensive report delves into the Europe REIT industry, offering an in-depth analysis of market structure, key trends, dominant segments, and future outlook. Covering the historical period from 2019 to 2024, with a base and estimated year of 2025 and a forecast period extending to 2033, this report provides invaluable insights for investors, real estate professionals, and industry stakeholders. We analyze critical factors such as market concentration, regulatory impacts, M&A activities, and emerging opportunities within the dynamic European real estate investment trust market. Leveraging high-volume keywords like "Europe REIT market," "real estate investment trusts Europe," "REIT trends Europe," and "European property market," this report is optimized for search engine visibility, ensuring you access the most relevant and up-to-date information.

Europe REIT Industry Market Structure & Competitive Landscape

The Europe REIT industry exhibits a moderately concentrated market structure, with a few dominant players controlling significant market share across various sectors. Key innovation drivers stem from evolving investor demand for sustainable and technologically advanced properties, alongside the increasing adoption of digital platforms for property management and investment. Regulatory frameworks, while providing stability, also present nuanced challenges and opportunities, particularly concerning cross-border investment and tax regulations. Product substitutes, such as direct property ownership and private equity real estate funds, continuously influence the competitive landscape. End-user segmentation reveals a growing demand for specialized REITs catering to resilient sectors like industrial and residential. Merger and acquisition (M&A) trends indicate a strategic consolidation phase, with significant deal volumes focused on portfolio expansion and diversification. For instance, the total M&A volume for Q1 2024 is estimated at over 50,000 Million Euros. Key factors shaping concentration include:

- Market Share of Top 5 Players: Estimated at 40% of total market capitalization.

- Number of Active REITs: Over 200 across major European economies.

- Capital Inflows into REITs: Projected to reach 150,000 Million Euros by 2025.

- Impact of Regulatory Harmonization: Facilitating cross-border investment and increasing market size.

Europe REIT Industry Market Trends & Opportunities

The Europe REIT industry is experiencing robust growth, driven by a confluence of macroeconomic factors and evolving investor preferences. The market size is projected to expand significantly, with an estimated Compound Annual Growth Rate (CAGR) of 7.5% over the forecast period (2025-2033). Technological shifts are revolutionizing property management and investment, with AI-powered analytics and proptech solutions enhancing operational efficiency and tenant experiences. Consumer preferences are increasingly leaning towards ESG-compliant assets, driving investment in green buildings and sustainable developments. Competitive dynamics are intensifying, with both established players and new entrants vying for market share, often through strategic partnerships and innovative product offerings. The market penetration rate of REITs in the European real estate investment landscape is steadily increasing, currently standing at approximately 20%, with significant room for further expansion.

Emerging opportunities are abundant, particularly in sectors benefiting from long-term structural tailwinds. The ongoing e-commerce boom continues to fuel demand for Industrial REITs, specifically logistics and warehousing facilities, as supply chains are reconfigured. The Residential REIT sector is poised for sustained growth, driven by urbanization, demographic shifts, and a persistent undersupply of quality housing in key metropolitan areas. Furthermore, the increasing focus on health and well-being is creating opportunities within Healthcare REITs, while the demand for flexible working arrangements is reshaping the Office REIT market, favoring modern, adaptable spaces. The proliferation of Diversified REITs also offers investors a broad exposure to the real estate market, mitigating sector-specific risks. The drive towards net-zero emissions and circular economy principles is spurring innovation in sustainable construction and retrofitting, presenting lucrative avenues for environmentally conscious investors.

Key market trends shaping the Europe REIT industry include:

- Increasing Demand for ESG-Compliant Assets: Investors prioritizing sustainable and socially responsible investments.

- Digital Transformation in Property Management: Adoption of proptech for enhanced efficiency and tenant engagement.

- Urbanization and Demographic Shifts: Driving demand for residential and mixed-use properties.

- E-commerce Growth: Sustaining robust demand for industrial and logistics REITs.

- Hybrid Work Models: Reshaping the office sector, with a focus on flexible and amenity-rich spaces.

The total market size for Europe REITs is estimated to reach 800,000 Million Euros by 2025, with significant growth projected across all major segments.

Dominant Markets & Segments in Europe REIT Industry

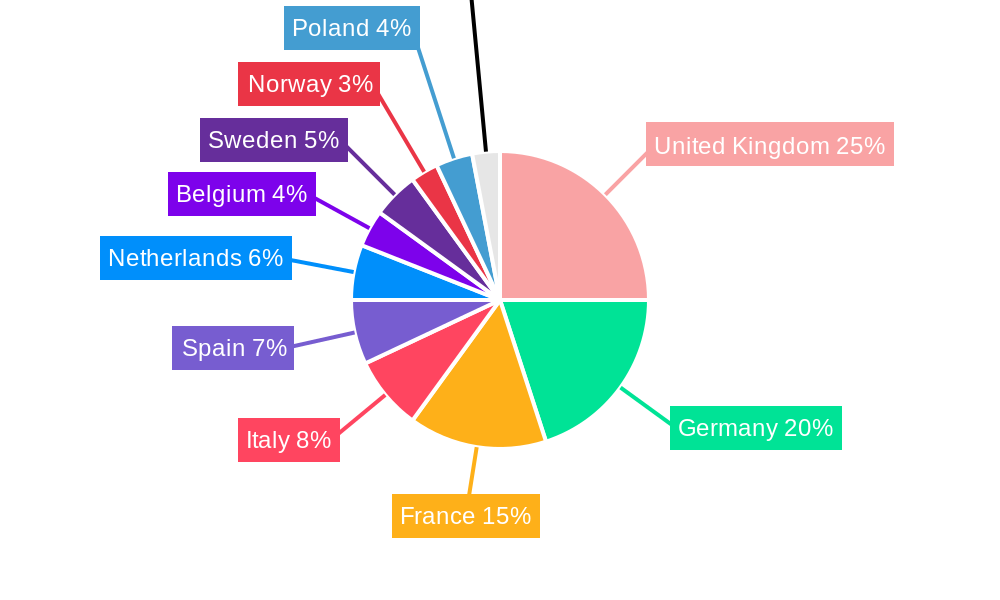

Germany and the United Kingdom continue to be the dominant markets within the Europe REIT industry, driven by their large economies, mature real estate markets, and well-established regulatory frameworks. However, significant growth is also being observed in countries like France and the Netherlands, as they increasingly adopt REIT structures and attract foreign investment.

Within the Sector of Exposure, Industrial REITs are currently experiencing the most substantial growth, fueled by the relentless expansion of e-commerce and the need for sophisticated logistics and warehousing infrastructure. The demand for cold storage facilities and last-mile delivery hubs remains exceptionally high.

- Industrial REITs: Key growth drivers include increasing online retail penetration, supply chain resilience initiatives, and government investments in infrastructure. The sector is projected to see a 10% year-on-year growth in investment volume.

- Residential REITs: Benefits from strong demographic trends, urbanization, and a persistent housing shortage in major cities. Rental yields remain attractive, making this a stable long-term investment. Demand for build-to-rent schemes is particularly strong.

- Retail REITs: While facing challenges from online retail, prime shopping centers in affluent areas and convenience-focused retail parks are showing resilience and attracting investment. Innovation in tenant mix and experiential retail is crucial for success.

- Office REITs: The market is bifurcating, with strong demand for modern, sustainable, and amenity-rich office spaces that cater to flexible working arrangements. Older, less adaptable office stock is facing pressure.

- Diversified REITs: These continue to be popular for investors seeking broad market exposure and risk diversification across multiple property types.

- Other Sector Specific REITs: This includes growing sub-sectors like data center REITs, self-storage REITs, and healthcare REITs, each driven by unique market dynamics and technological advancements. Data center REITs, for instance, are benefiting from the exponential growth of cloud computing and digital data.

The dominance of these sectors is further amplified by government policies supporting real estate development and investment. For example, initiatives promoting urban regeneration and sustainable building practices are creating significant opportunities. The total investment in the European real estate market, of which REITs form a significant portion, is expected to exceed 700,000 Million Euros annually by 2026.

Europe REIT Industry Product Analysis

The Europe REIT industry is characterized by continuous product innovation, driven by the need to adapt to evolving market demands and investor expectations. This includes the development of specialized REITs focusing on niche sectors like data centers, student housing, and life sciences properties, which benefit from strong secular growth trends. Advancements in property technology (proptech) are also enhancing the appeal and functionality of REIT offerings, enabling more efficient property management, improved tenant experiences, and data-driven investment decisions. Competitive advantages are increasingly derived from a REIT's ability to offer sustainable and ESG-compliant portfolios, access to prime locations, and the expertise to navigate complex regulatory environments. The integration of smart building technologies and flexible workspace solutions are key product differentiators in the current market. The total value of innovative real estate solutions is estimated to be 30,000 Million Euros in 2024.

Key Drivers, Barriers & Challenges in Europe REIT Industry

Key Drivers, Barriers & Challenges in Europe REIT Industry

The Europe REIT industry is propelled by several key drivers, including sustained economic recovery across the continent, favorable interest rate environments (though subject to change), and increasing institutional investor appetite for real assets offering inflation hedging properties. Technological advancements in proptech are enhancing operational efficiency and tenant satisfaction, while growing demand for sustainable and ESG-compliant investments is a significant catalyst.

However, the market faces considerable barriers and challenges. Regulatory complexities and variations across different European countries can impede cross-border investment and increase compliance costs. Rising construction costs and labor shortages can impact development timelines and profitability for REITs involved in new builds or significant refurbishments. Intense competition from other investment vehicles, such as private equity and direct property ownership, also exerts pressure. Geopolitical uncertainties and potential shifts in monetary policy, leading to interest rate hikes, pose significant risks to debt financing costs and property valuations. Supply chain disruptions continue to affect development projects, further exacerbating cost and timeline pressures. The total market value affected by these challenges is estimated at 50,000 Million Euros.

Growth Drivers in the Europe REIT Industry Market

Several key growth drivers are shaping the Europe REIT industry. Economically, continued economic stability and growth across the Eurozone bolster investor confidence and demand for real estate. Technologically, the pervasive adoption of proptech solutions is optimizing property management, tenant engagement, and investment analysis, leading to greater efficiency and profitability. Regulatory factors, such as the increasing harmonization of REIT frameworks across EU member states and government incentives for sustainable building, are also crucial. For instance, tax advantages for green buildings are encouraging significant investment. Demographic shifts, including an aging population and increasing urbanization, are creating sustained demand in the residential and healthcare sectors.

Challenges Impacting Europe REIT Industry Growth

The Europe REIT industry faces several challenges that could impact its growth trajectory. Regulatory hurdles remain a concern, with differing legal and tax frameworks across countries creating complexities for pan-European investors. Supply chain issues, particularly concerning construction materials and labor, can lead to project delays and increased costs, impacting development pipelines. Competitive pressures are intensifying as more capital flows into the real estate sector, from both traditional REITs and alternative investment funds. Macroeconomic uncertainties, such as inflation and fluctuating interest rates, can affect borrowing costs and property valuations, creating a more challenging investment environment. The total estimated impact of these challenges on market growth is approximately 30,000 Million Euros annually.

Key Players Shaping the Europe REIT Industry Market

- British Land

- Unibail-Rodamco-Westfield

- Hammerson

- Landsec

- Deutsche Wohnen SE

- Vonovia SE

- CBRE Investment Management

- Aberdeen Standard Investments

Significant Europe REIT Industry Industry Milestones

- March 2023: Landsec secures 100% ownership of St David’s shopping centre, Cardiff, demonstrating strategic asset consolidation and market influence.

- October 2022: Cromwell European REIT acquires assets in Denmark for EUR15.8 million, highlighting expansion into new European territories and strategic portfolio additions.

- September 2022: Inbest and GPF create REIT to invest €600 million in prime properties, showcasing significant partnership-driven capital deployment and focus on high-value assets.

Future Outlook for Europe REIT Industry Market

The future outlook for the Europe REIT industry is highly promising, driven by continued demand for real assets, evolving investment strategies, and technological innovation. Strategic opportunities lie in further expansion into emerging European markets and the development of specialized REITs catering to resilient sectors such as logistics, residential, and data centers. The increasing emphasis on sustainability and ESG principles will remain a critical growth catalyst, driving investment in green buildings and energy-efficient properties. Market potential is significant, with projections indicating continued growth in market capitalization and investment inflows as REITs prove to be a robust and adaptable investment vehicle in the post-pandemic era. The total market potential is estimated to reach 1,200,000 Million Euros by 2030.

Europe REIT Industry Segmentation

-

1. Sector of Exposure

- 1.1. Retail REITs

- 1.2. Industrial REITs

- 1.3. Office REITs

- 1.4. Residential REITs

- 1.5. Diversified REITs

- 1.6. Other Sector Specific REITs

Europe REIT Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe REIT Industry Regional Market Share

Geographic Coverage of Europe REIT Industry

Europe REIT Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Fund Inflows is Driving the ETF Market

- 3.3. Market Restrains

- 3.3.1. Underlying Fluctuations and Risks are Restraining the Market

- 3.4. Market Trends

- 3.4.1. United Kingdom as the Leader of REIT market in Europe

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe REIT Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sector of Exposure

- 5.1.1. Retail REITs

- 5.1.2. Industrial REITs

- 5.1.3. Office REITs

- 5.1.4. Residential REITs

- 5.1.5. Diversified REITs

- 5.1.6. Other Sector Specific REITs

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Sector of Exposure

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 British Land

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Unibail-Rodamco-Westfield Hammerson

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Landsec Deutsche

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CBRE Investment Management

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Aberdeen Standard Investments

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Wohnen SE

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Vonovia SE

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 British Land

List of Figures

- Figure 1: Europe REIT Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Europe REIT Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe REIT Industry Revenue undefined Forecast, by Sector of Exposure 2020 & 2033

- Table 2: Europe REIT Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Europe REIT Industry Revenue undefined Forecast, by Sector of Exposure 2020 & 2033

- Table 4: Europe REIT Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: United Kingdom Europe REIT Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 6: Germany Europe REIT Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 7: France Europe REIT Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Italy Europe REIT Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Spain Europe REIT Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Netherlands Europe REIT Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Belgium Europe REIT Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Sweden Europe REIT Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Norway Europe REIT Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Poland Europe REIT Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Denmark Europe REIT Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe REIT Industry?

The projected CAGR is approximately 7.4%.

2. Which companies are prominent players in the Europe REIT Industry?

Key companies in the market include British Land , Unibail-Rodamco-Westfield Hammerson , Landsec Deutsche, CBRE Investment Management , Aberdeen Standard Investments, Wohnen SE , Vonovia SE .

3. What are the main segments of the Europe REIT Industry?

The market segments include Sector of Exposure.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Fund Inflows is Driving the ETF Market.

6. What are the notable trends driving market growth?

United Kingdom as the Leader of REIT market in Europe.

7. Are there any restraints impacting market growth?

Underlying Fluctuations and Risks are Restraining the Market.

8. Can you provide examples of recent developments in the market?

March 2023: Landsec has secured 100% ownership of St David’s shopping centre, Cardiff, following its purchase of the debt secured against the 50% share of the asset previously owned by intu plc. Comprising separate transactions with two debt holders

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe REIT Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe REIT Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe REIT Industry?

To stay informed about further developments, trends, and reports in the Europe REIT Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence