Key Insights

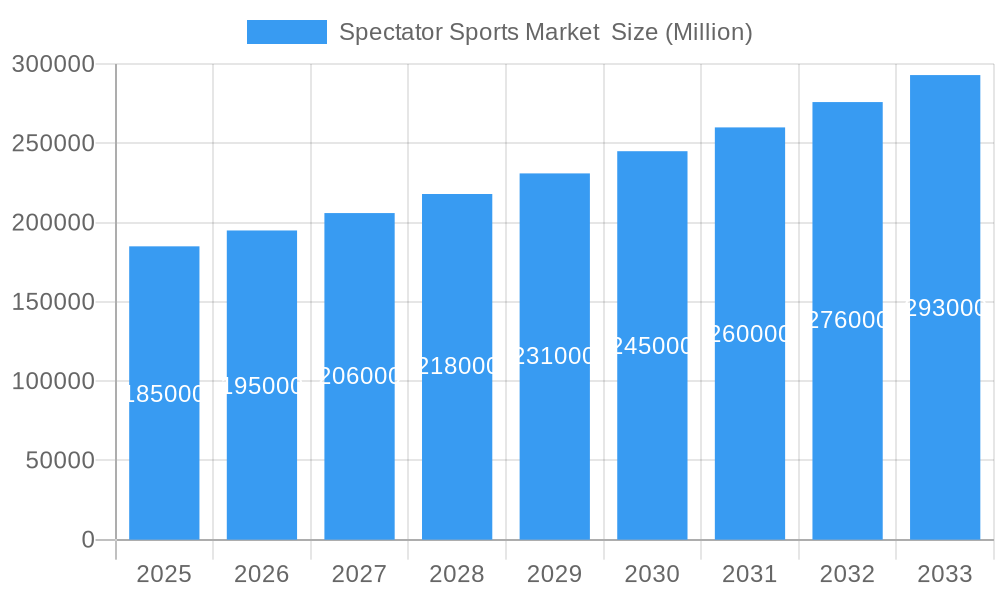

The global spectator sports market is projected to reach $186.15 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 6%. This expansion is attributed to rising disposable incomes, growing global sports fandom, and substantial investments in sports infrastructure and media rights. The proliferation of digital streaming platforms and the increasing engagement with esports are expanding the appeal and accessibility of spectator sports, drawing in new demographics and revenue streams. Ticketing, media rights, and sponsorship are key revenue drivers, with media rights and sponsorship anticipated to dominate market growth. Technological advancements in broadcasting are also enhancing the fan viewing experience globally.

Spectator Sports Market Market Size (In Billion)

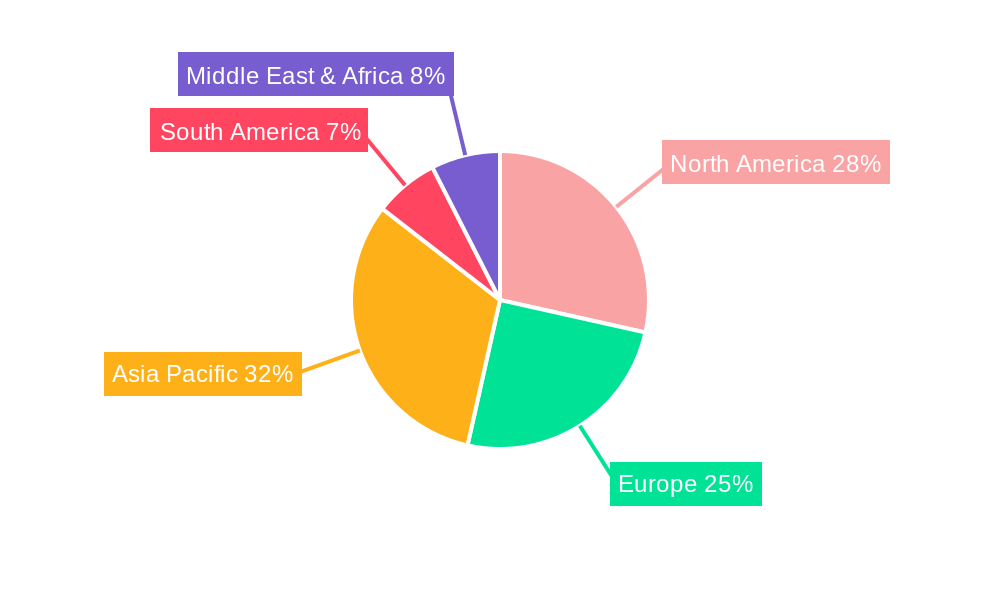

The spectator sports market features a fragmented yet intensely competitive landscape. While traditional sports such as football, basketball, and cricket maintain strong viewership, emerging sports and niche events are gaining traction. Geographically, the Asia Pacific region, led by China and India, is a significant growth engine due to its large population and developing sports culture. North America and Europe are mature, consistent markets benefiting from established leagues and high per capita spending on sports entertainment. Evolving fan engagement strategies, including fantasy sports and interactive digital content, are vital for audience retention and growth within this competitive entertainment sector.

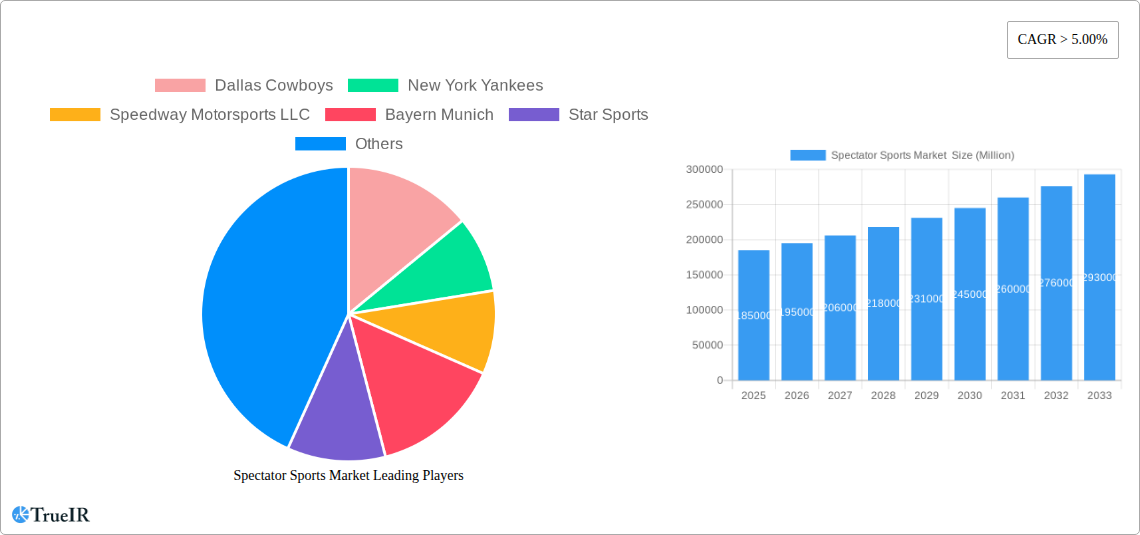

Spectator Sports Market Company Market Share

Spectator Sports Market: In-Depth Analysis and Future Projections (2019-2033)

This comprehensive report provides an exhaustive analysis of the global spectator sports market, offering critical insights into its structure, trends, dominant segments, and future outlook. Leveraging high-volume keywords such as "sports market analysis," "media rights valuation," "sponsorship deals," "fan engagement technology," and "live sports streaming," this report is engineered for maximum SEO impact and to engage industry professionals seeking actionable intelligence. Our study covers the historical period from 2019 to 2024, with a base year of 2025 and a detailed forecast extending to 2033. The estimated market value for 2025 is projected to be in the tens of billions of dollars, driven by robust growth across all revenue streams and segments.

Spectator Sports Market Market Structure & Competitive Landscape

The spectator sports market is characterized by a dynamic and evolving competitive landscape, with a moderate to high degree of concentration in certain segments. Major players like Dallas Cowboys, New York Yankees, Speedway Motorsports LLC, Bayern Munich, and broadcasters such as Star Sports, Sony Sports Network, and streaming platforms like Fubo and JioCinema exert significant influence. Innovation is a key driver, particularly in areas like fan engagement technology, data analytics provided by firms like Sportradar, and enhanced viewing experiences through emerging platforms. Regulatory frameworks, including broadcasting rights, anti-trust laws, and international sports governance, significantly shape market dynamics. Product substitutes, while present in the form of other entertainment options, are increasingly challenged by the immersive and social nature of live sports. End-user segmentation reveals distinct preferences based on demographics, geographic location, and sport affiliation. Mergers and acquisitions (M&A) are a recurring theme, with a notable volume of transactions aimed at consolidating market share, acquiring new technologies, or expanding geographic reach. For instance, recent M&A activities have focused on the acquisition of media rights and the integration of streaming services. The overall market concentration, as measured by the Herfindahl-Hirschman Index for key segments, indicates that while some areas are dominated by a few large entities, others offer greater fragmentation and opportunity for new entrants.

Spectator Sports Market Market Trends & Opportunities

The global spectator sports market is poised for substantial growth, with a projected Compound Annual Growth Rate (CAGR) of xx% over the forecast period. This expansion is fueled by a confluence of factors, including an escalating demand for live sports content, technological advancements in broadcasting and fan engagement, and the increasing commercialization of sports. Market penetration rates are climbing as more consumers embrace digital platforms for accessing sports. The market size is projected to reach over a trillion dollars by 2033, underscoring its immense economic significance.

Technological shifts are fundamentally reshaping how fans interact with sports. High-definition broadcasting, virtual reality (VR) and augmented reality (AR) experiences, and advanced data analytics are creating more immersive and personalized viewing opportunities. The rise of over-the-top (OTT) streaming services, exemplified by platforms like Fubo and JioCinema, has democratized access to a wider array of sports, catering to niche fan bases and offering flexible subscription models. This digital transformation is also opening up new revenue streams through targeted advertising and e-commerce integration, as seen with FanCode’s strategic partnership with Google Cloud.

Consumer preferences are evolving rapidly. Fans are no longer content with passive viewing; they seek interactive experiences, behind-the-scenes access, and opportunities to connect with athletes and fellow supporters. This has led to a surge in demand for fantasy sports, sports betting (where legally permitted), and social media engagement around sporting events. The increasing global appeal of sports like cricket and basketball, alongside traditional powerhouses like football (soccer), is broadening the market's reach and attracting new audiences.

Competitive dynamics are intensifying as traditional media giants, digital platforms, and sports organizations vie for eyeballs and revenue. Strategic partnerships, such as FuboTV Inc.’s collaboration with the Cleveland Guardians, are crucial for expanding subscriber bases and securing content rights. The consolidation of media rights by major broadcasters and streaming services, coupled with increasing sponsorship investments from global brands, further defines the competitive landscape. Opportunities abound for companies that can leverage data analytics to personalize fan experiences, develop innovative monetization strategies, and navigate the complex regulatory environments of different regions. The market is also witnessing a growing emphasis on sustainability and social responsibility initiatives within sports, presenting opportunities for brands that align with these values.

Dominant Markets & Segments in Spectator Sports Market

The spectator sports market exhibits significant dominance within specific regions and segments, driven by a complex interplay of cultural affinity, infrastructure development, and supportive policies. North America and Europe continue to be leading markets, largely due to established sports leagues, robust media infrastructure, and high disposable incomes. However, the Asia-Pacific region, particularly countries with a strong passion for cricket and emerging interest in other sports, is witnessing rapid growth and is poised to become a major force.

Dominant Sports Segments:

- Cricket: This segment holds immense sway in countries like India, Australia, and the United Kingdom, contributing significantly to media rights and sponsorship revenues. The extensive fan base and the commercial appeal of major tournaments like the ICC Cricket World Cup are key growth drivers.

- Basketball: With the global reach of leagues like the NBA and growing popularity in Europe and Asia, basketball is a consistently dominant sport. Its appeal is enhanced by the global recognition of star players and the increasing availability of professional leagues in diverse regions.

- Football (Soccer): Undoubtedly the world's most popular sport, football commands massive global viewership and revenue streams from media rights, sponsorships, and ticketing. Major leagues in Europe, such as the English Premier League and La Liga, along with global events like the FIFA World Cup, solidify its dominant position.

- Baseball: A traditional powerhouse, particularly in North America, baseball continues to generate substantial revenue through ticket sales, media rights, and merchandise, driven by leagues like Major League Baseball (MLB).

Dominant Revenue Sources:

- Media Rights: This is the largest and most rapidly growing revenue stream in the spectator sports market. The insatiable demand for live sports content from broadcasters and streaming platforms drives up the value of media rights deals significantly. The proliferation of digital platforms and the fragmentation of viewership have led to more complex and lucrative media rights negotiations.

- Sponsorship: Global brands continue to invest heavily in sports sponsorships to enhance brand visibility, connect with target audiences, and drive consumer engagement. Major events, teams, and athletes attract substantial sponsorship revenues, with an increasing focus on digital and experiential sponsorships.

- Tickets: While impacted by global events, ticket sales remain a fundamental revenue source for live sports. The demand for attending major sporting events, coupled with premium seating and hospitality options, contributes significantly to the revenue of sports organizations.

- Merchandising: The sale of official team merchandise, apparel, and memorabilia represents a consistent revenue stream, leveraging the strong brand loyalty of sports fans. The growing e-commerce presence for sports merchandise has further expanded its reach and impact.

The growth in these segments is propelled by several factors, including the development of world-class sporting infrastructure, favorable government policies promoting sports development and investment, and the increasing professionalization of sports management. Furthermore, the digitalization of fan engagement and the ability to broadcast to a global audience have amplified the market reach and revenue potential of popular sports and their associated revenue streams.

Spectator Sports Market Product Analysis

The spectator sports market's product offering encompasses the live sporting events themselves, along with a sophisticated ecosystem of related media rights, fan engagement platforms, and merchandise. Technological advancements are continuously enhancing these products. Innovations include high-definition and ultra-high-definition broadcasting, immersive augmented and virtual reality experiences for at-home viewers, and AI-powered analytics that provide deeper insights into game performance and player statistics. Streaming platforms like Fubo and JioCinema have revolutionized content delivery, offering a wider array of live sports and on-demand content than ever before. The competitive advantage lies in the ability to deliver exclusive content, personalize viewing experiences, and foster a sense of community among fans through interactive features and social media integration. Sportradar's advanced data solutions are a prime example of a product that enhances analytical capabilities and betting integrity, adding significant value to the ecosystem.

Key Drivers, Barriers & Challenges in Spectator Sports Market

Key Drivers: The spectator sports market is propelled by several powerful forces. The increasing global appeal and accessibility of sports, facilitated by digital broadcasting and streaming technologies, are primary growth catalysts. Growing disposable incomes in emerging economies are leading to higher spending on sports entertainment. Technological innovation, particularly in fan engagement and content delivery, creates new revenue streams and enhances viewer experiences. Furthermore, significant investments in sports infrastructure and the growing commercialization of sports leagues and events attract substantial sponsorship and media rights deals. The emotional connection fans have with their favorite teams and athletes remains an enduring driver of engagement and expenditure.

Barriers & Challenges: Despite strong growth, the market faces significant challenges. Regulatory complexities and varying legal frameworks across different regions, especially concerning media rights and sports betting, can impede expansion. Supply chain issues, though less prominent than in manufacturing, can affect the distribution of merchandise and event logistics. Intense competitive pressure from other forms of entertainment and the constant need to innovate to retain audience attention are significant hurdles. The rising cost of acquiring media rights and hosting major events also poses a financial challenge for many entities. Moreover, ensuring athlete welfare and managing the reputational risks associated with scandals or controversies are ongoing concerns that can impact public perception and commercial viability. The economic impact of unforeseen global events, as witnessed in recent years, can also disrupt event schedules and revenue generation.

Growth Drivers in the Spectator Sports Market Market

Key growth drivers in the spectator sports market are predominantly technological, economic, and policy-driven. Technologically, the proliferation of high-speed internet and mobile devices has enabled widespread access to live sports streaming platforms such as Fubo and JioCinema, creating new avenues for revenue. Economically, rising disposable incomes in developing nations translate into increased consumer spending on sports entertainment. Globally, major sporting events continue to attract substantial investment from brands seeking enhanced visibility and consumer engagement, boosting sponsorship revenues. Policy-wise, governments that actively promote sports development through infrastructure investment and favorable regulations create a conducive environment for market expansion. The increasing professionalization of sports management also contributes to more efficient commercialization and revenue generation.

Challenges Impacting Spectator Sports Market Growth

Several barriers and restraints temper the growth of the spectator sports market. Regulatory complexities, including differing broadcast rights laws and anti-trust regulations across jurisdictions, present significant hurdles. Supply chain issues, particularly concerning the timely delivery of merchandise and event-related materials, can impact operational efficiency. Competitive pressures are intense, not just from within the sports industry but also from other entertainment sectors vying for consumers' leisure time and spending. The rising costs of broadcasting rights and athlete salaries place financial strain on leagues and teams. Furthermore, the potential for disruption from unforeseen global events, such as pandemics, can severely impact event revenues and fan attendance. Maintaining fan engagement in an increasingly digital landscape also requires continuous innovation and adaptation to evolving consumer preferences.

Key Players Shaping the Spectator Sports Market Market

- Dallas Cowboys

- New York Yankees

- Speedway Motorsports LLC

- Bayern Munich

- Star Sports

- FanCode

- Fubo

- Sony Sports Network

- Sportradar

- JioCinema

Significant Spectator Sports Market Industry Milestones

- May 2023: FuboTV Inc. partnered with the Cleveland Guardians, offering Guardians' fans extended free trials to its extensive sports, news, and entertainment programming. This move underscores Fubo's commitment to providing comprehensive sports coverage, being the only live TV streaming platform to feature every Nielsen-rated sports channel and boasting over 175 live networks.

- February 2023: Fancode entered a strategic partnership with Google Cloud. This collaboration aims to leverage data-driven insights to enhance fan engagement and optimize the distribution of mainstream sports content, solidifying Fancode's position as a leading sports streaming and e-commerce platform and fostering deeper connections with sports aficionados.

Future Outlook for Spectator Sports Market Market

The future outlook for the spectator sports market is exceptionally promising, characterized by sustained growth driven by ongoing technological integration and expanding global reach. Strategic opportunities lie in the continued evolution of digital streaming services, offering more personalized and interactive fan experiences. The market will likely witness further innovations in areas such as virtual and augmented reality, which promise to transform how fans consume live events. Increased investment in emerging markets, coupled with the growing popularity of niche sports, will diversify revenue streams. The development of advanced data analytics will enable more sophisticated monetization strategies, from targeted advertising to enhanced sponsorship activations. As fan engagement becomes increasingly central, the ability to build strong digital communities and offer exclusive content will be paramount for success. The market is expected to adapt and thrive by embracing new technologies and catering to the evolving preferences of a global fan base.

Spectator Sports Market Segmentation

-

1. Sports

- 1.1. Badminton

- 1.2. Baseball

- 1.3. Basketball

- 1.4. Cricket

- 1.5. Cycling

- 1.6. Hockey

- 1.7. Other Sports

-

2. Revenue Source

- 2.1. Tickets

- 2.2. Media Rights

- 2.3. Sponsorship

- 2.4. Merchandising

Spectator Sports Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Spectator Sports Market Regional Market Share

Geographic Coverage of Spectator Sports Market

Spectator Sports Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Number of Sports Events Organized Globally; Increasing digital platforms raising sport spectators

- 3.3. Market Restrains

- 3.3.1. Increase in Number of Sports Events Organized Globally; Increasing digital platforms raising sport spectators

- 3.4. Market Trends

- 3.4.1. Rising In Global Sports Events

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Spectator Sports Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sports

- 5.1.1. Badminton

- 5.1.2. Baseball

- 5.1.3. Basketball

- 5.1.4. Cricket

- 5.1.5. Cycling

- 5.1.6. Hockey

- 5.1.7. Other Sports

- 5.2. Market Analysis, Insights and Forecast - by Revenue Source

- 5.2.1. Tickets

- 5.2.2. Media Rights

- 5.2.3. Sponsorship

- 5.2.4. Merchandising

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Sports

- 6. North America Spectator Sports Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Sports

- 6.1.1. Badminton

- 6.1.2. Baseball

- 6.1.3. Basketball

- 6.1.4. Cricket

- 6.1.5. Cycling

- 6.1.6. Hockey

- 6.1.7. Other Sports

- 6.2. Market Analysis, Insights and Forecast - by Revenue Source

- 6.2.1. Tickets

- 6.2.2. Media Rights

- 6.2.3. Sponsorship

- 6.2.4. Merchandising

- 6.1. Market Analysis, Insights and Forecast - by Sports

- 7. South America Spectator Sports Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Sports

- 7.1.1. Badminton

- 7.1.2. Baseball

- 7.1.3. Basketball

- 7.1.4. Cricket

- 7.1.5. Cycling

- 7.1.6. Hockey

- 7.1.7. Other Sports

- 7.2. Market Analysis, Insights and Forecast - by Revenue Source

- 7.2.1. Tickets

- 7.2.2. Media Rights

- 7.2.3. Sponsorship

- 7.2.4. Merchandising

- 7.1. Market Analysis, Insights and Forecast - by Sports

- 8. Europe Spectator Sports Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Sports

- 8.1.1. Badminton

- 8.1.2. Baseball

- 8.1.3. Basketball

- 8.1.4. Cricket

- 8.1.5. Cycling

- 8.1.6. Hockey

- 8.1.7. Other Sports

- 8.2. Market Analysis, Insights and Forecast - by Revenue Source

- 8.2.1. Tickets

- 8.2.2. Media Rights

- 8.2.3. Sponsorship

- 8.2.4. Merchandising

- 8.1. Market Analysis, Insights and Forecast - by Sports

- 9. Middle East & Africa Spectator Sports Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Sports

- 9.1.1. Badminton

- 9.1.2. Baseball

- 9.1.3. Basketball

- 9.1.4. Cricket

- 9.1.5. Cycling

- 9.1.6. Hockey

- 9.1.7. Other Sports

- 9.2. Market Analysis, Insights and Forecast - by Revenue Source

- 9.2.1. Tickets

- 9.2.2. Media Rights

- 9.2.3. Sponsorship

- 9.2.4. Merchandising

- 9.1. Market Analysis, Insights and Forecast - by Sports

- 10. Asia Pacific Spectator Sports Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Sports

- 10.1.1. Badminton

- 10.1.2. Baseball

- 10.1.3. Basketball

- 10.1.4. Cricket

- 10.1.5. Cycling

- 10.1.6. Hockey

- 10.1.7. Other Sports

- 10.2. Market Analysis, Insights and Forecast - by Revenue Source

- 10.2.1. Tickets

- 10.2.2. Media Rights

- 10.2.3. Sponsorship

- 10.2.4. Merchandising

- 10.1. Market Analysis, Insights and Forecast - by Sports

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Dallas Cowboys

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 New York Yankees

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Speedway Motorsports LLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bayern Munich

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Star Sports

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 FanCode

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Fubo

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Sony Sports Network

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sportradar

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 JioCinema**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Dallas Cowboys

List of Figures

- Figure 1: Global Spectator Sports Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Spectator Sports Market Revenue (billion), by Sports 2025 & 2033

- Figure 3: North America Spectator Sports Market Revenue Share (%), by Sports 2025 & 2033

- Figure 4: North America Spectator Sports Market Revenue (billion), by Revenue Source 2025 & 2033

- Figure 5: North America Spectator Sports Market Revenue Share (%), by Revenue Source 2025 & 2033

- Figure 6: North America Spectator Sports Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Spectator Sports Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Spectator Sports Market Revenue (billion), by Sports 2025 & 2033

- Figure 9: South America Spectator Sports Market Revenue Share (%), by Sports 2025 & 2033

- Figure 10: South America Spectator Sports Market Revenue (billion), by Revenue Source 2025 & 2033

- Figure 11: South America Spectator Sports Market Revenue Share (%), by Revenue Source 2025 & 2033

- Figure 12: South America Spectator Sports Market Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Spectator Sports Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Spectator Sports Market Revenue (billion), by Sports 2025 & 2033

- Figure 15: Europe Spectator Sports Market Revenue Share (%), by Sports 2025 & 2033

- Figure 16: Europe Spectator Sports Market Revenue (billion), by Revenue Source 2025 & 2033

- Figure 17: Europe Spectator Sports Market Revenue Share (%), by Revenue Source 2025 & 2033

- Figure 18: Europe Spectator Sports Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Spectator Sports Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Spectator Sports Market Revenue (billion), by Sports 2025 & 2033

- Figure 21: Middle East & Africa Spectator Sports Market Revenue Share (%), by Sports 2025 & 2033

- Figure 22: Middle East & Africa Spectator Sports Market Revenue (billion), by Revenue Source 2025 & 2033

- Figure 23: Middle East & Africa Spectator Sports Market Revenue Share (%), by Revenue Source 2025 & 2033

- Figure 24: Middle East & Africa Spectator Sports Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Spectator Sports Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Spectator Sports Market Revenue (billion), by Sports 2025 & 2033

- Figure 27: Asia Pacific Spectator Sports Market Revenue Share (%), by Sports 2025 & 2033

- Figure 28: Asia Pacific Spectator Sports Market Revenue (billion), by Revenue Source 2025 & 2033

- Figure 29: Asia Pacific Spectator Sports Market Revenue Share (%), by Revenue Source 2025 & 2033

- Figure 30: Asia Pacific Spectator Sports Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Spectator Sports Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Spectator Sports Market Revenue billion Forecast, by Sports 2020 & 2033

- Table 2: Global Spectator Sports Market Revenue billion Forecast, by Revenue Source 2020 & 2033

- Table 3: Global Spectator Sports Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Spectator Sports Market Revenue billion Forecast, by Sports 2020 & 2033

- Table 5: Global Spectator Sports Market Revenue billion Forecast, by Revenue Source 2020 & 2033

- Table 6: Global Spectator Sports Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Spectator Sports Market Revenue billion Forecast, by Sports 2020 & 2033

- Table 11: Global Spectator Sports Market Revenue billion Forecast, by Revenue Source 2020 & 2033

- Table 12: Global Spectator Sports Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Spectator Sports Market Revenue billion Forecast, by Sports 2020 & 2033

- Table 17: Global Spectator Sports Market Revenue billion Forecast, by Revenue Source 2020 & 2033

- Table 18: Global Spectator Sports Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Spectator Sports Market Revenue billion Forecast, by Sports 2020 & 2033

- Table 29: Global Spectator Sports Market Revenue billion Forecast, by Revenue Source 2020 & 2033

- Table 30: Global Spectator Sports Market Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Spectator Sports Market Revenue billion Forecast, by Sports 2020 & 2033

- Table 38: Global Spectator Sports Market Revenue billion Forecast, by Revenue Source 2020 & 2033

- Table 39: Global Spectator Sports Market Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Spectator Sports Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spectator Sports Market ?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the Spectator Sports Market ?

Key companies in the market include Dallas Cowboys, New York Yankees, Speedway Motorsports LLC, Bayern Munich, Star Sports, FanCode, Fubo, Sony Sports Network, Sportradar, JioCinema**List Not Exhaustive.

3. What are the main segments of the Spectator Sports Market ?

The market segments include Sports, Revenue Source.

4. Can you provide details about the market size?

The market size is estimated to be USD 186.15 billion as of 2022.

5. What are some drivers contributing to market growth?

Increase in Number of Sports Events Organized Globally; Increasing digital platforms raising sport spectators.

6. What are the notable trends driving market growth?

Rising In Global Sports Events.

7. Are there any restraints impacting market growth?

Increase in Number of Sports Events Organized Globally; Increasing digital platforms raising sport spectators.

8. Can you provide examples of recent developments in the market?

May 2023: FuboTV Inc., the foremost sports-oriented live TV streaming platform in the United States, announced its partnership with the Cleveland Guardians. This collaboration grants Guardians' enthusiasts the exciting opportunity to access Fubo's premier sports, news, and entertainment programming through an extended free trial. FuboTV boasts an impressive collection of over 175 live sports, news, and entertainment networks, making it the sole live TV streaming platform to feature every Nielsen-rated sports channel.February 2023: The sports streaming and e-commerce platform Fancode entered into a strategic partnership with Google Cloud. This collaboration aims to bolster its services with a data-driven approach, thereby enhancing fan engagement and optimizing the distribution of mainstream sports content. By doing so, Fancode is committed to strengthening its rapport with sports aficionados and fostering more immersive fan experiences.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spectator Sports Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spectator Sports Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spectator Sports Market ?

To stay informed about further developments, trends, and reports in the Spectator Sports Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence