Key Insights

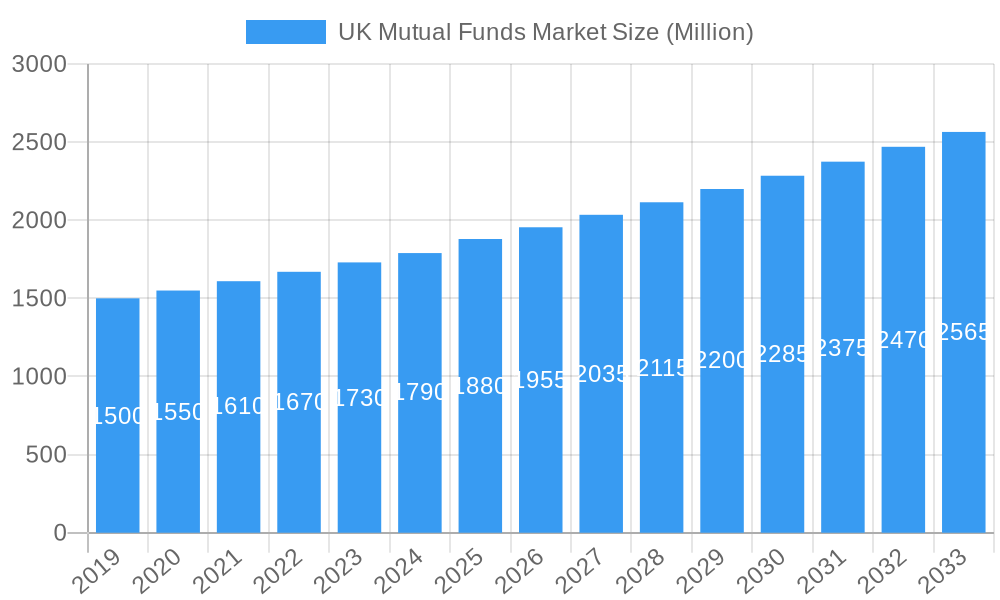

The UK mutual funds market is poised for steady expansion, projected to reach \$1.88 billion, with a Compound Annual Growth Rate (CAGR) of 3.87% between 2019 and 2033. This growth is primarily driven by an increasing demand for diversified investment options and a rising awareness among retail investors regarding wealth creation and financial planning. Key trends shaping the market include the growing popularity of ESG (Environmental, Social, and Governance) funds, offering socially conscious investment avenues, and the continued digital transformation of financial services, making mutual fund investments more accessible through online platforms and robo-advisors. Furthermore, a robust regulatory environment in the UK, aimed at investor protection and market transparency, fosters confidence and encourages participation. The market benefits from a diverse investor base, with households and monetary financial institutions being significant contributors. The ongoing shift towards passive investing, particularly through index funds and ETFs, also presents both opportunities and challenges for active fund managers, influencing product development and fee structures.

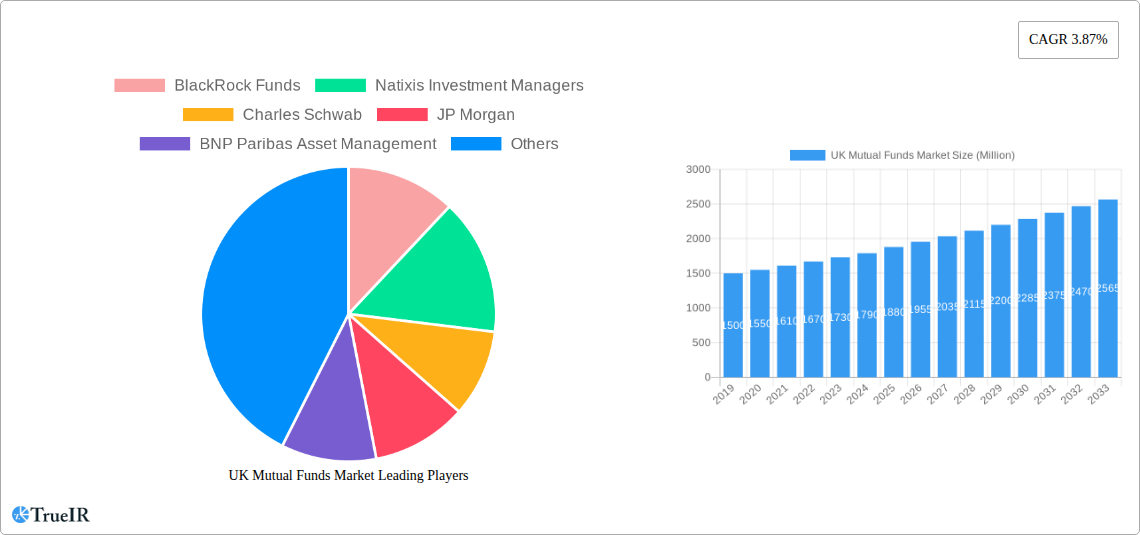

UK Mutual Funds Market Market Size (In Billion)

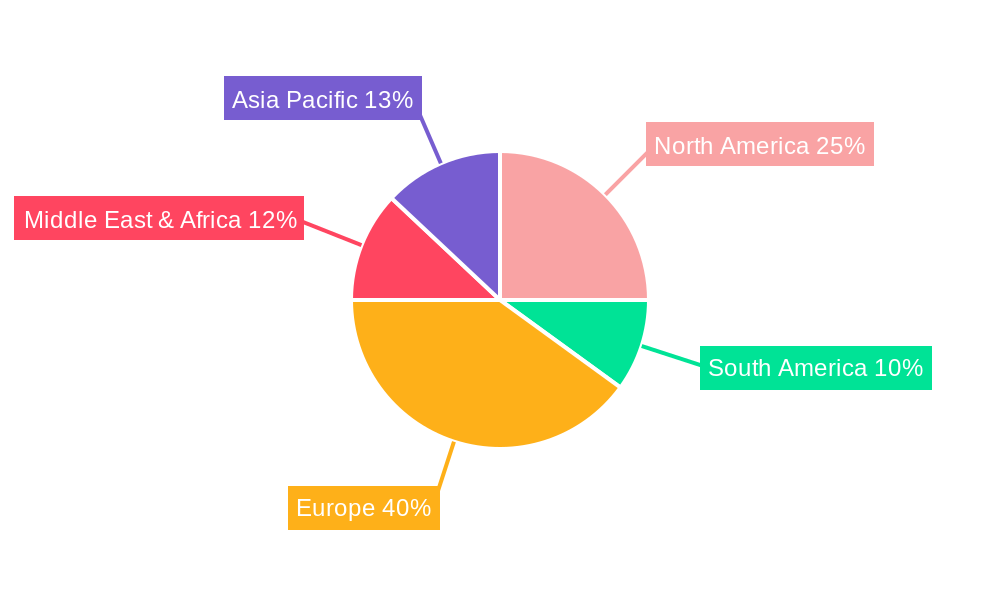

The UK mutual funds market's trajectory will be shaped by several influencing factors. On the demand side, an aging population and a growing need for retirement planning are expected to bolster investment in mutual funds. Simultaneously, evolving investor preferences towards simpler, more cost-effective investment solutions will continue to drive innovation in product offerings. However, the market is not without its restraints. Economic uncertainties, such as inflation and interest rate fluctuations, can impact fund performance and investor sentiment. Competitive pressures from alternative investment vehicles and the increasing cost of regulatory compliance also pose challenges for asset managers. Geographically, Europe, with the United Kingdom as a central hub, is expected to dominate the market share, leveraging its sophisticated financial infrastructure and a substantial pool of sophisticated investors. The increasing integration of technology, including AI-powered advisory services, will further refine the investment experience, aiming to democratize access to sophisticated investment strategies and enhance overall market liquidity.

UK Mutual Funds Market Company Market Share

UK Mutual Funds Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a dynamic and SEO-optimized analysis of the UK Mutual Funds Market. Leveraging high-volume keywords and detailed quantitative and qualitative insights, this report is designed to engage industry professionals, investors, and stakeholders. Explore market structure, competitive dynamics, emerging trends, dominant segments, product innovations, key drivers, challenges, and the future outlook of this vital financial sector. The study period spans from 2019 to 2033, with a base and estimated year of 2025, and a forecast period covering 2025-2033. The historical period analyzed is 2019-2024.

UK Mutual Funds Market Market Structure & Competitive Landscape

The UK Mutual Funds Market is characterized by a moderately concentrated structure, with a significant portion of assets under management (AUM) held by a few dominant players. In 2024, the top 5 firms are estimated to control over 60% of the market share, reflecting a concentration ratio that underscores the competitive intensity. Innovation is a key driver, with asset managers continuously launching new fund products to meet evolving investor demands for ESG-compliant investments, thematic funds, and passively managed index funds. Regulatory impacts, such as ongoing reviews of fund fees and disclosure requirements by the Financial Conduct Authority (FCA), continue to shape market strategies and product development. Product substitutes include exchange-traded funds (ETFs), alternative investment funds, and direct investments, all of which exert pressure on traditional mutual fund offerings. End-user segmentation reveals a strong reliance on institutional investors, particularly Insurers & Pension Funds and Monetary Financial Institutions, alongside a growing retail investor base, primarily Households. Merger and acquisition (M&A) trends have seen strategic consolidation, with an estimated £500 Million in M&A deals in the past two years, as firms seek to enhance scale, diversify product offerings, and acquire technological capabilities.

UK Mutual Funds Market Market Trends & Opportunities

The UK Mutual Funds Market is poised for robust growth, with an estimated market size expansion from £1,500 Billion in 2024 to over £2,200 Billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 4.5% during the forecast period. Technological shifts are profoundly impacting the industry, with the adoption of AI and machine learning for portfolio management, data analytics, and customer service enhancing operational efficiency and product customization. Digitalization of investment platforms and robo-advisory services are democratizing access to investment opportunities, leading to increased market penetration rates among retail investors. Consumer preferences are increasingly leaning towards sustainable and ethical investing, with a significant surge in demand for Environmental, Social, and Governance (ESG) funds, creating substantial opportunities for fund managers to develop and market specialized ESG portfolios. The competitive dynamics are intensifying, with both established players and emerging fintech firms vying for market share. Opportunities lie in catering to the growing demand for retirement solutions, personalized investment strategies, and innovative products that address specific demographic needs. The shift towards passive investing continues, yet active managers are finding renewed relevance by offering alpha generation and specialized thematic strategies. The market penetration rate for mutual funds among the UK adult population is expected to rise from 35% in 2024 to 45% by 2033, driven by financial literacy initiatives and accessible investment platforms. The increasing availability of alternative data sources is also enabling more sophisticated investment research and product development, further fueling market expansion.

Dominant Markets & Segments in UK Mutual Funds Market

Within the UK Mutual Funds Market, the Equity fund type currently holds the largest market share, accounting for approximately 40% of total AUM in 2024, driven by investor appetite for capital appreciation. Following closely is Debt funds, representing around 30%, a segment that has seen increased inflows due to fluctuating interest rate environments and a preference for stable income generation. Multi-Asset funds, offering diversification and risk management, capture around 20%, while Money Market funds, primarily utilized for liquidity management, constitute approximately 8%. Other fund types, including alternative and thematic funds, make up the remaining 2%.

From an investor type perspective, Monetary Financial Institutions and Insurers & Pension Funds remain the dominant investors, collectively managing over 55% of the total AUM. These institutional investors benefit from economies of scale and sophisticated investment mandates. Households, representing the retail investor segment, are a growing force, accounting for approximately 25% of the market, with increasing engagement driven by digital platforms and financial advisory services. Non-Financial Corporations and General Government hold smaller but significant portions of the market, around 10% and 5% respectively.

Key growth drivers for Equity funds include the ongoing economic recovery, corporate earnings growth, and investor confidence in UK equity markets. For Debt funds, the appeal lies in predictable income streams and portfolio diversification against equity market volatility. Multi-Asset funds are benefiting from their ability to adapt to changing market conditions and cater to investors seeking a balanced risk-return profile. The increasing focus on infrastructure development and government spending policies are also indirectly boosting investments into funds with exposure to these sectors. The growth in Assets Under Management (AUM) within these dominant segments is projected to continue, driven by favorable macroeconomic conditions and evolving investor preferences for diversified and income-generating assets.

UK Mutual Funds Market Product Analysis

Product innovations in the UK Mutual Funds Market are increasingly focused on thematic investing, sustainable finance, and passive strategies. The launch of UK-specific Target Date fund ranges signifies a move towards more personalized retirement planning solutions. Competitive advantages are being carved out through enhanced ESG integration, offering investors portfolios aligned with their values and potentially outperforming benchmarks through sustainable practices. Technological advancements in AI-driven portfolio construction and data analytics are enabling the creation of more sophisticated and efficient fund products. The market fit for these innovations is strong, driven by growing investor demand for differentiated and outcome-oriented investment solutions that go beyond traditional asset class allocations.

Key Drivers, Barriers & Challenges in UK Mutual Funds Market

Key Drivers:

- Technological Advancements: The adoption of AI, big data analytics, and digital platforms is streamlining operations, improving investor experience, and enabling innovative product development.

- Economic Recovery & Interest Rate Environment: A stable economic outlook and strategic adjustments in interest rates can stimulate investment inflows and enhance the attractiveness of various fund types.

- Regulatory Support for ESG: Government policies and regulatory frameworks encouraging sustainable investments are driving the demand for ESG-compliant mutual funds.

Barriers & Challenges:

- Regulatory Hurdles: Evolving regulatory landscapes, including fee caps and increased disclosure requirements, can impact profitability and necessitate operational adjustments.

- Intense Competition: The market faces intense competition from ETFs, alternative investment vehicles, and in-house pension funds, requiring continuous innovation and cost management.

- Investor Behaviour & Education: Shifting investor sentiment, a lack of financial literacy in certain demographics, and the perception of complexity can act as restraints to wider adoption. Supply chain issues are less relevant for financial services, but operational resilience and cybersecurity remain critical. The estimated impact of increased regulatory compliance costs on operational expenditure is around 2-3% annually.

Growth Drivers in the UK Mutual Funds Market Market

Growth in the UK Mutual Funds Market is propelled by several key factors. Technological innovation, including the widespread adoption of digital investment platforms and robo-advisors, is democratizing access and improving user experience, leading to increased retail participation. Economically, a stable or improving macroeconomic environment, coupled with a favourable interest rate outlook, encourages investment and asset allocation into mutual funds. Regulatory tailwinds, particularly the growing emphasis on and support for Environmental, Social, and Governance (ESG) investing, are significantly driving the development and uptake of sustainable fund offerings. The demand for personalized retirement solutions and the increasing need for diversified investment portfolios are also contributing to sustained growth.

Challenges Impacting UK Mutual Funds Market Growth

Several challenges temper the growth trajectory of the UK Mutual Funds Market. Intensifying competitive pressures from Exchange Traded Funds (ETFs), alternative asset managers, and other investment vehicles necessitates continuous innovation and cost optimization. Regulatory complexities, including evolving compliance requirements and ongoing scrutiny of fund fees, can increase operational burdens and impact profitability. Evolving investor preferences, such as a desire for more transparent and fee-efficient products, also demand strategic adaptation. Furthermore, macroeconomic uncertainties, including inflation concerns and geopolitical risks, can lead to volatility and influence investor confidence, potentially impacting inflows.

Key Players Shaping the UK Mutual Funds Market Market

- BlackRock Funds

- Natixis Investment Managers

- Charles Schwab

- JP Morgan

- BNP Paribas Asset Management

- Fidelity Investments

- State Street Global Advisors

- Capital Group

- BNY Mellon

- Amundi Asset Management

- PIMCO/Allianz

- Legal and General Investments

Significant UK Mutual Funds Market Industry Milestones

- December 2023: BlackRock introduced a UK version of its LifePath Target Date fund range, aiming to compete with similar offerings from Vanguard and Legal & General Investment Management, enhancing retirement planning solutions.

- September 2023: AEW, an affiliate of Natixis IM specializing in real estate investment, unveiled its inaugural place-based impact investing strategy. This strategy leverages real estate's capacity to provide social and community infrastructure by combining investments that target social and environmental impact, broadening the scope of impact investing.

Future Outlook for UK Mutual Funds Market Market

The future outlook for the UK Mutual Funds Market remains positive, driven by a confluence of strategic opportunities and evolving investor demands. The continued emphasis on ESG principles will fuel the growth of sustainable investment products, creating new avenues for asset managers. Technological advancements in AI and data analytics will further enable personalized investment solutions and enhance operational efficiencies. The increasing need for long-term financial planning, particularly in retirement, will sustain demand for diversified mutual fund offerings. Market penetration is expected to deepen, especially among younger demographics, as financial literacy improves and digital investment platforms become more accessible. The estimated market size is projected to exceed £2,500 Billion by 2030, underscoring the sector's resilience and adaptability.

UK Mutual Funds Market Segmentation

-

1. Fund Type

- 1.1. Equity

- 1.2. Debt

- 1.3. Multi-Asset

- 1.4. Money Market

- 1.5. Other Fund Types

-

2. Investor Type

- 2.1. Households

- 2.2. Monetary Financial Institutions

- 2.3. General Government

- 2.4. Non-Financial Corporations

- 2.5. Insurers & Pension Funds

- 2.6. Other Financial Intermediaries

UK Mutual Funds Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Mutual Funds Market Regional Market Share

Geographic Coverage of UK Mutual Funds Market

UK Mutual Funds Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.87% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Personal Wealth is Driving the Market; Retirement Plannings are Driving the Market

- 3.3. Market Restrains

- 3.3.1. Growing Personal Wealth is Driving the Market; Retirement Plannings are Driving the Market

- 3.4. Market Trends

- 3.4.1. Growing Personal Finance Sector is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Mutual Funds Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Fund Type

- 5.1.1. Equity

- 5.1.2. Debt

- 5.1.3. Multi-Asset

- 5.1.4. Money Market

- 5.1.5. Other Fund Types

- 5.2. Market Analysis, Insights and Forecast - by Investor Type

- 5.2.1. Households

- 5.2.2. Monetary Financial Institutions

- 5.2.3. General Government

- 5.2.4. Non-Financial Corporations

- 5.2.5. Insurers & Pension Funds

- 5.2.6. Other Financial Intermediaries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Fund Type

- 6. North America UK Mutual Funds Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Fund Type

- 6.1.1. Equity

- 6.1.2. Debt

- 6.1.3. Multi-Asset

- 6.1.4. Money Market

- 6.1.5. Other Fund Types

- 6.2. Market Analysis, Insights and Forecast - by Investor Type

- 6.2.1. Households

- 6.2.2. Monetary Financial Institutions

- 6.2.3. General Government

- 6.2.4. Non-Financial Corporations

- 6.2.5. Insurers & Pension Funds

- 6.2.6. Other Financial Intermediaries

- 6.1. Market Analysis, Insights and Forecast - by Fund Type

- 7. South America UK Mutual Funds Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Fund Type

- 7.1.1. Equity

- 7.1.2. Debt

- 7.1.3. Multi-Asset

- 7.1.4. Money Market

- 7.1.5. Other Fund Types

- 7.2. Market Analysis, Insights and Forecast - by Investor Type

- 7.2.1. Households

- 7.2.2. Monetary Financial Institutions

- 7.2.3. General Government

- 7.2.4. Non-Financial Corporations

- 7.2.5. Insurers & Pension Funds

- 7.2.6. Other Financial Intermediaries

- 7.1. Market Analysis, Insights and Forecast - by Fund Type

- 8. Europe UK Mutual Funds Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Fund Type

- 8.1.1. Equity

- 8.1.2. Debt

- 8.1.3. Multi-Asset

- 8.1.4. Money Market

- 8.1.5. Other Fund Types

- 8.2. Market Analysis, Insights and Forecast - by Investor Type

- 8.2.1. Households

- 8.2.2. Monetary Financial Institutions

- 8.2.3. General Government

- 8.2.4. Non-Financial Corporations

- 8.2.5. Insurers & Pension Funds

- 8.2.6. Other Financial Intermediaries

- 8.1. Market Analysis, Insights and Forecast - by Fund Type

- 9. Middle East & Africa UK Mutual Funds Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Fund Type

- 9.1.1. Equity

- 9.1.2. Debt

- 9.1.3. Multi-Asset

- 9.1.4. Money Market

- 9.1.5. Other Fund Types

- 9.2. Market Analysis, Insights and Forecast - by Investor Type

- 9.2.1. Households

- 9.2.2. Monetary Financial Institutions

- 9.2.3. General Government

- 9.2.4. Non-Financial Corporations

- 9.2.5. Insurers & Pension Funds

- 9.2.6. Other Financial Intermediaries

- 9.1. Market Analysis, Insights and Forecast - by Fund Type

- 10. Asia Pacific UK Mutual Funds Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Fund Type

- 10.1.1. Equity

- 10.1.2. Debt

- 10.1.3. Multi-Asset

- 10.1.4. Money Market

- 10.1.5. Other Fund Types

- 10.2. Market Analysis, Insights and Forecast - by Investor Type

- 10.2.1. Households

- 10.2.2. Monetary Financial Institutions

- 10.2.3. General Government

- 10.2.4. Non-Financial Corporations

- 10.2.5. Insurers & Pension Funds

- 10.2.6. Other Financial Intermediaries

- 10.1. Market Analysis, Insights and Forecast - by Fund Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 BlackRock Funds

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Natixis Investment Managers

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Charles Schwab

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 JP Morgan

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 BNP Paribas Asset Management

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Fidelity Investments

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 State Street Global Advisors

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Capital Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 BNY Mellon

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Amundi Asset Management

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 PIMCO/Allianz

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Legal and General Investments**List Not Exhaustive

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 BlackRock Funds

List of Figures

- Figure 1: Global UK Mutual Funds Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global UK Mutual Funds Market Volume Breakdown (Trillion, %) by Region 2025 & 2033

- Figure 3: North America UK Mutual Funds Market Revenue (Million), by Fund Type 2025 & 2033

- Figure 4: North America UK Mutual Funds Market Volume (Trillion), by Fund Type 2025 & 2033

- Figure 5: North America UK Mutual Funds Market Revenue Share (%), by Fund Type 2025 & 2033

- Figure 6: North America UK Mutual Funds Market Volume Share (%), by Fund Type 2025 & 2033

- Figure 7: North America UK Mutual Funds Market Revenue (Million), by Investor Type 2025 & 2033

- Figure 8: North America UK Mutual Funds Market Volume (Trillion), by Investor Type 2025 & 2033

- Figure 9: North America UK Mutual Funds Market Revenue Share (%), by Investor Type 2025 & 2033

- Figure 10: North America UK Mutual Funds Market Volume Share (%), by Investor Type 2025 & 2033

- Figure 11: North America UK Mutual Funds Market Revenue (Million), by Country 2025 & 2033

- Figure 12: North America UK Mutual Funds Market Volume (Trillion), by Country 2025 & 2033

- Figure 13: North America UK Mutual Funds Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America UK Mutual Funds Market Volume Share (%), by Country 2025 & 2033

- Figure 15: South America UK Mutual Funds Market Revenue (Million), by Fund Type 2025 & 2033

- Figure 16: South America UK Mutual Funds Market Volume (Trillion), by Fund Type 2025 & 2033

- Figure 17: South America UK Mutual Funds Market Revenue Share (%), by Fund Type 2025 & 2033

- Figure 18: South America UK Mutual Funds Market Volume Share (%), by Fund Type 2025 & 2033

- Figure 19: South America UK Mutual Funds Market Revenue (Million), by Investor Type 2025 & 2033

- Figure 20: South America UK Mutual Funds Market Volume (Trillion), by Investor Type 2025 & 2033

- Figure 21: South America UK Mutual Funds Market Revenue Share (%), by Investor Type 2025 & 2033

- Figure 22: South America UK Mutual Funds Market Volume Share (%), by Investor Type 2025 & 2033

- Figure 23: South America UK Mutual Funds Market Revenue (Million), by Country 2025 & 2033

- Figure 24: South America UK Mutual Funds Market Volume (Trillion), by Country 2025 & 2033

- Figure 25: South America UK Mutual Funds Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America UK Mutual Funds Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe UK Mutual Funds Market Revenue (Million), by Fund Type 2025 & 2033

- Figure 28: Europe UK Mutual Funds Market Volume (Trillion), by Fund Type 2025 & 2033

- Figure 29: Europe UK Mutual Funds Market Revenue Share (%), by Fund Type 2025 & 2033

- Figure 30: Europe UK Mutual Funds Market Volume Share (%), by Fund Type 2025 & 2033

- Figure 31: Europe UK Mutual Funds Market Revenue (Million), by Investor Type 2025 & 2033

- Figure 32: Europe UK Mutual Funds Market Volume (Trillion), by Investor Type 2025 & 2033

- Figure 33: Europe UK Mutual Funds Market Revenue Share (%), by Investor Type 2025 & 2033

- Figure 34: Europe UK Mutual Funds Market Volume Share (%), by Investor Type 2025 & 2033

- Figure 35: Europe UK Mutual Funds Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Europe UK Mutual Funds Market Volume (Trillion), by Country 2025 & 2033

- Figure 37: Europe UK Mutual Funds Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe UK Mutual Funds Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East & Africa UK Mutual Funds Market Revenue (Million), by Fund Type 2025 & 2033

- Figure 40: Middle East & Africa UK Mutual Funds Market Volume (Trillion), by Fund Type 2025 & 2033

- Figure 41: Middle East & Africa UK Mutual Funds Market Revenue Share (%), by Fund Type 2025 & 2033

- Figure 42: Middle East & Africa UK Mutual Funds Market Volume Share (%), by Fund Type 2025 & 2033

- Figure 43: Middle East & Africa UK Mutual Funds Market Revenue (Million), by Investor Type 2025 & 2033

- Figure 44: Middle East & Africa UK Mutual Funds Market Volume (Trillion), by Investor Type 2025 & 2033

- Figure 45: Middle East & Africa UK Mutual Funds Market Revenue Share (%), by Investor Type 2025 & 2033

- Figure 46: Middle East & Africa UK Mutual Funds Market Volume Share (%), by Investor Type 2025 & 2033

- Figure 47: Middle East & Africa UK Mutual Funds Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Middle East & Africa UK Mutual Funds Market Volume (Trillion), by Country 2025 & 2033

- Figure 49: Middle East & Africa UK Mutual Funds Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East & Africa UK Mutual Funds Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Asia Pacific UK Mutual Funds Market Revenue (Million), by Fund Type 2025 & 2033

- Figure 52: Asia Pacific UK Mutual Funds Market Volume (Trillion), by Fund Type 2025 & 2033

- Figure 53: Asia Pacific UK Mutual Funds Market Revenue Share (%), by Fund Type 2025 & 2033

- Figure 54: Asia Pacific UK Mutual Funds Market Volume Share (%), by Fund Type 2025 & 2033

- Figure 55: Asia Pacific UK Mutual Funds Market Revenue (Million), by Investor Type 2025 & 2033

- Figure 56: Asia Pacific UK Mutual Funds Market Volume (Trillion), by Investor Type 2025 & 2033

- Figure 57: Asia Pacific UK Mutual Funds Market Revenue Share (%), by Investor Type 2025 & 2033

- Figure 58: Asia Pacific UK Mutual Funds Market Volume Share (%), by Investor Type 2025 & 2033

- Figure 59: Asia Pacific UK Mutual Funds Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Asia Pacific UK Mutual Funds Market Volume (Trillion), by Country 2025 & 2033

- Figure 61: Asia Pacific UK Mutual Funds Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific UK Mutual Funds Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UK Mutual Funds Market Revenue Million Forecast, by Fund Type 2020 & 2033

- Table 2: Global UK Mutual Funds Market Volume Trillion Forecast, by Fund Type 2020 & 2033

- Table 3: Global UK Mutual Funds Market Revenue Million Forecast, by Investor Type 2020 & 2033

- Table 4: Global UK Mutual Funds Market Volume Trillion Forecast, by Investor Type 2020 & 2033

- Table 5: Global UK Mutual Funds Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global UK Mutual Funds Market Volume Trillion Forecast, by Region 2020 & 2033

- Table 7: Global UK Mutual Funds Market Revenue Million Forecast, by Fund Type 2020 & 2033

- Table 8: Global UK Mutual Funds Market Volume Trillion Forecast, by Fund Type 2020 & 2033

- Table 9: Global UK Mutual Funds Market Revenue Million Forecast, by Investor Type 2020 & 2033

- Table 10: Global UK Mutual Funds Market Volume Trillion Forecast, by Investor Type 2020 & 2033

- Table 11: Global UK Mutual Funds Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global UK Mutual Funds Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 13: United States UK Mutual Funds Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States UK Mutual Funds Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 15: Canada UK Mutual Funds Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada UK Mutual Funds Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 17: Mexico UK Mutual Funds Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico UK Mutual Funds Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 19: Global UK Mutual Funds Market Revenue Million Forecast, by Fund Type 2020 & 2033

- Table 20: Global UK Mutual Funds Market Volume Trillion Forecast, by Fund Type 2020 & 2033

- Table 21: Global UK Mutual Funds Market Revenue Million Forecast, by Investor Type 2020 & 2033

- Table 22: Global UK Mutual Funds Market Volume Trillion Forecast, by Investor Type 2020 & 2033

- Table 23: Global UK Mutual Funds Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global UK Mutual Funds Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 25: Brazil UK Mutual Funds Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Brazil UK Mutual Funds Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 27: Argentina UK Mutual Funds Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Argentina UK Mutual Funds Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America UK Mutual Funds Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America UK Mutual Funds Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 31: Global UK Mutual Funds Market Revenue Million Forecast, by Fund Type 2020 & 2033

- Table 32: Global UK Mutual Funds Market Volume Trillion Forecast, by Fund Type 2020 & 2033

- Table 33: Global UK Mutual Funds Market Revenue Million Forecast, by Investor Type 2020 & 2033

- Table 34: Global UK Mutual Funds Market Volume Trillion Forecast, by Investor Type 2020 & 2033

- Table 35: Global UK Mutual Funds Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global UK Mutual Funds Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 37: United Kingdom UK Mutual Funds Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: United Kingdom UK Mutual Funds Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 39: Germany UK Mutual Funds Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Germany UK Mutual Funds Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 41: France UK Mutual Funds Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: France UK Mutual Funds Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 43: Italy UK Mutual Funds Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Italy UK Mutual Funds Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 45: Spain UK Mutual Funds Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Spain UK Mutual Funds Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 47: Russia UK Mutual Funds Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Russia UK Mutual Funds Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 49: Benelux UK Mutual Funds Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Benelux UK Mutual Funds Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 51: Nordics UK Mutual Funds Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Nordics UK Mutual Funds Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 53: Rest of Europe UK Mutual Funds Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Rest of Europe UK Mutual Funds Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 55: Global UK Mutual Funds Market Revenue Million Forecast, by Fund Type 2020 & 2033

- Table 56: Global UK Mutual Funds Market Volume Trillion Forecast, by Fund Type 2020 & 2033

- Table 57: Global UK Mutual Funds Market Revenue Million Forecast, by Investor Type 2020 & 2033

- Table 58: Global UK Mutual Funds Market Volume Trillion Forecast, by Investor Type 2020 & 2033

- Table 59: Global UK Mutual Funds Market Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Global UK Mutual Funds Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 61: Turkey UK Mutual Funds Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Turkey UK Mutual Funds Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 63: Israel UK Mutual Funds Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Israel UK Mutual Funds Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 65: GCC UK Mutual Funds Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: GCC UK Mutual Funds Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 67: North Africa UK Mutual Funds Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: North Africa UK Mutual Funds Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 69: South Africa UK Mutual Funds Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: South Africa UK Mutual Funds Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 71: Rest of Middle East & Africa UK Mutual Funds Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Rest of Middle East & Africa UK Mutual Funds Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 73: Global UK Mutual Funds Market Revenue Million Forecast, by Fund Type 2020 & 2033

- Table 74: Global UK Mutual Funds Market Volume Trillion Forecast, by Fund Type 2020 & 2033

- Table 75: Global UK Mutual Funds Market Revenue Million Forecast, by Investor Type 2020 & 2033

- Table 76: Global UK Mutual Funds Market Volume Trillion Forecast, by Investor Type 2020 & 2033

- Table 77: Global UK Mutual Funds Market Revenue Million Forecast, by Country 2020 & 2033

- Table 78: Global UK Mutual Funds Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 79: China UK Mutual Funds Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: China UK Mutual Funds Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 81: India UK Mutual Funds Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: India UK Mutual Funds Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 83: Japan UK Mutual Funds Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 84: Japan UK Mutual Funds Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 85: South Korea UK Mutual Funds Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 86: South Korea UK Mutual Funds Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 87: ASEAN UK Mutual Funds Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 88: ASEAN UK Mutual Funds Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 89: Oceania UK Mutual Funds Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 90: Oceania UK Mutual Funds Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 91: Rest of Asia Pacific UK Mutual Funds Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 92: Rest of Asia Pacific UK Mutual Funds Market Volume (Trillion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Mutual Funds Market?

The projected CAGR is approximately 3.87%.

2. Which companies are prominent players in the UK Mutual Funds Market?

Key companies in the market include BlackRock Funds, Natixis Investment Managers, Charles Schwab, JP Morgan, BNP Paribas Asset Management, Fidelity Investments, State Street Global Advisors, Capital Group, BNY Mellon, Amundi Asset Management, PIMCO/Allianz, Legal and General Investments**List Not Exhaustive.

3. What are the main segments of the UK Mutual Funds Market?

The market segments include Fund Type , Investor Type .

4. Can you provide details about the market size?

The market size is estimated to be USD 1.88 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Personal Wealth is Driving the Market; Retirement Plannings are Driving the Market.

6. What are the notable trends driving market growth?

Growing Personal Finance Sector is Driving the Market.

7. Are there any restraints impacting market growth?

Growing Personal Wealth is Driving the Market; Retirement Plannings are Driving the Market.

8. Can you provide examples of recent developments in the market?

In December 2023, BlackRock introduced a UK version of its LifePath Target Date fund range, aiming to compete with similar offerings from Vanguard and Legal & General Investment Management.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Trillion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Mutual Funds Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Mutual Funds Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Mutual Funds Market?

To stay informed about further developments, trends, and reports in the UK Mutual Funds Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence