Key Insights

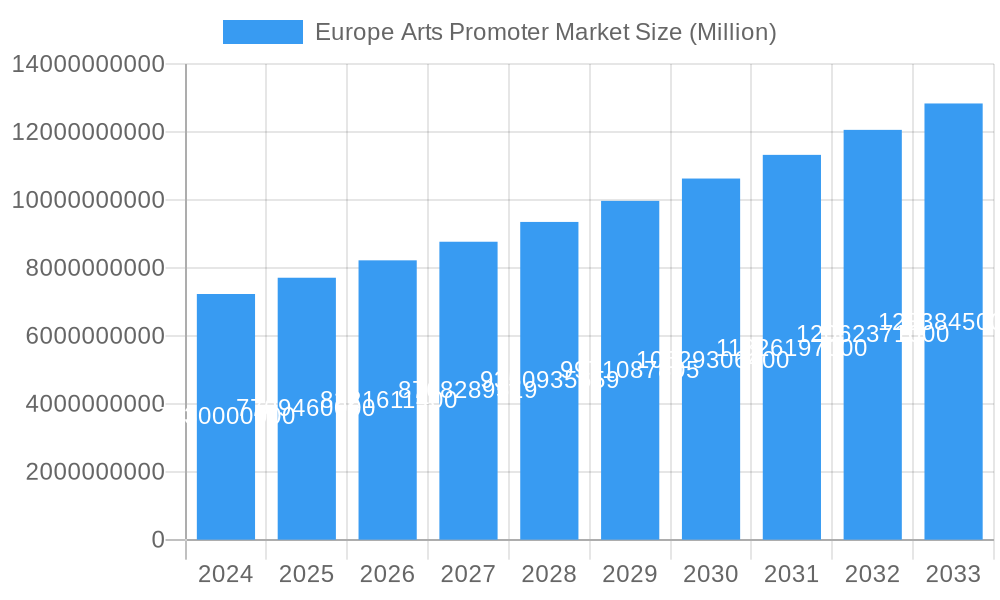

The European Arts Promoter Market is poised for robust growth, projected to reach $7.23 billion by 2024, expanding at a compound annual growth rate (CAGR) of 6.62% through 2033. This expansion is fueled by a confluence of factors, including increasing public engagement with cultural events, a rise in art tourism across Europe, and the growing influence of digital platforms in promoting and distributing art. The market's dynamism is further underscored by diverse revenue streams, with media rights and merchandising emerging as significant contributors alongside traditional ticket sales and corporate sponsoring. Leading companies such as Sothebys, Christies, and Art Basel are at the forefront, orchestrating a vibrant ecosystem of exhibitions, auctions, and artistic showcases that attract a global audience. The European region, with established art hubs in the United Kingdom, France, Germany, and Italy, continues to be a dominant force, demonstrating a sustained appetite for both classical and contemporary artistic expressions.

Europe Arts Promoter Market Market Size (In Billion)

Navigating this expanding landscape, art promoters are increasingly leveraging innovative strategies to enhance audience reach and engagement. The growing segment of visual arts, encompassing painting and sculpture, is expected to drive considerable revenue, supported by a burgeoning appreciation for unique artistic creations. While the market benefits from strong underlying demand and emerging revenue models, it also faces potential headwinds. These include fluctuating economic conditions that can impact discretionary spending on arts and culture, as well as the evolving regulatory frameworks governing intellectual property and digital content rights. Despite these challenges, the overarching trend points towards continued innovation and strategic partnerships as promoters seek to capitalize on the enduring appeal of the arts and solidify their presence in this lucrative market.

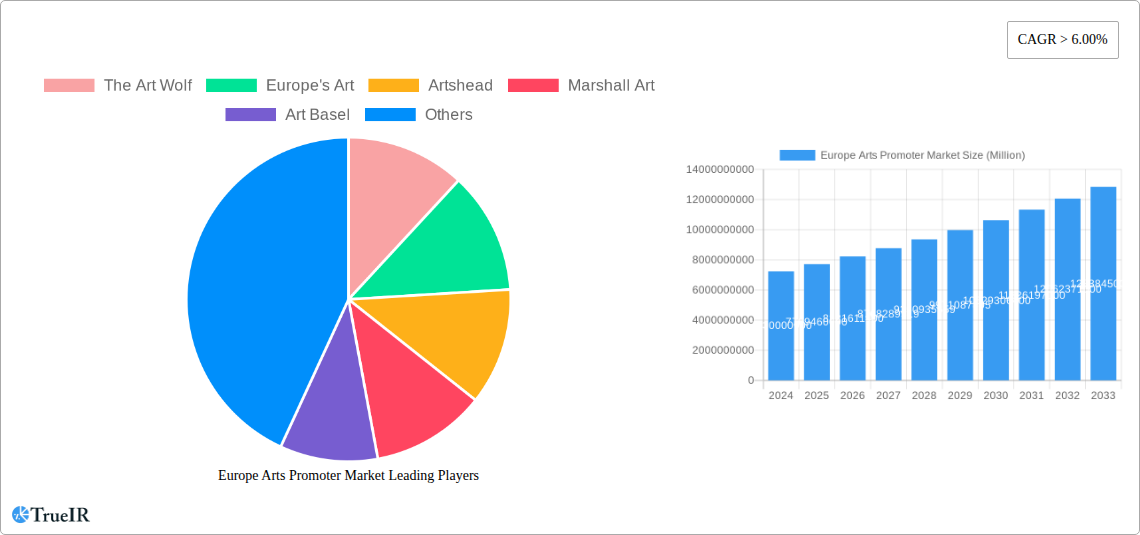

Europe Arts Promoter Market Company Market Share

This in-depth report provides a definitive analysis of the Europe Arts Promoter Market, offering critical insights for stakeholders navigating this dynamic and evolving industry. Covering the historical period from 2019 to 2024 and projecting growth through 2033, with a base and estimated year of 2025, this report delves into market structure, competitive dynamics, emerging trends, dominant segments, product analysis, key drivers, challenges, and future outlook. With an estimated market size projected to reach billions, this study is essential for understanding the strategic landscape and identifying lucrative opportunities within the European arts promotion sector.

Europe Arts Promoter Market Market Structure & Competitive Landscape

The Europe Arts Promoter Market is characterized by a moderately fragmented structure, with a significant presence of both established global players and agile niche promoters. The market concentration is influenced by the high capital requirements for large-scale exhibitions and auctions, as well as the specialized knowledge needed to identify and manage artistic talent. Innovation is a key driver, with promoters continuously seeking novel ways to engage audiences, leverage digital platforms, and curate unique art experiences. Regulatory impacts, primarily concerning copyright, import/export of artworks, and event permits, can influence market entry and operational efficiency. Product substitutes include digital art platforms, virtual exhibitions, and other forms of entertainment, though physical art promotion maintains a strong appeal for its tangible and experiential value. The end-user segmentation primarily comprises art collectors, galleries, museums, corporate sponsors, and the general public attending exhibitions and events. Merger and acquisition (M&A) trends are evident as companies seek to consolidate market share, expand their artist rosters, and enhance their service offerings. For instance, the June 2023 merger of Maestro Arts with Sullivan Sweetland exemplifies this trend, creating a larger entity with expanded project capacity and artist support. The market is projected to witness further consolidation as larger entities aim to capture a greater share of the multi-billion dollar European arts promotion landscape.

Europe Arts Promoter Market Market Trends & Opportunities

The Europe Arts Promoter Market is poised for substantial growth, driven by a confluence of factors including increasing disposable incomes, a burgeoning interest in cultural tourism, and the growing prominence of digital engagement strategies. The market size is projected to expand at a robust Compound Annual Growth Rate (CAGR) over the forecast period, driven by an estimated market value in the billions. Technological shifts are playing a pivotal role, with promoters increasingly adopting AI-powered curation tools, augmented reality (AR) and virtual reality (VR) for immersive exhibitions, and sophisticated data analytics to understand and cater to audience preferences. Consumer preferences are evolving, with a rising demand for unique, experiential art events, a greater appreciation for emerging artists, and a growing inclination towards sustainable art practices. The competitive dynamics are intensifying, pushing promoters to differentiate themselves through exclusive artist representation, innovative event formats, and curated online marketplaces. Opportunities abound in leveraging the increasing digitalization of art consumption, developing cross-border promotional strategies, and tapping into the burgeoning market for digital art and NFTs. The market penetration rates are expected to rise as more individuals and institutions actively participate in the art ecosystem. The global appeal of European art, coupled with strategic promotional efforts, is expected to propel the market's expansion, with significant revenue streams anticipated from tickets, sponsorships, media rights, and merchandising, all contributing to a multi-billion dollar market.

Dominant Markets & Segments in Europe Arts Promoter Market

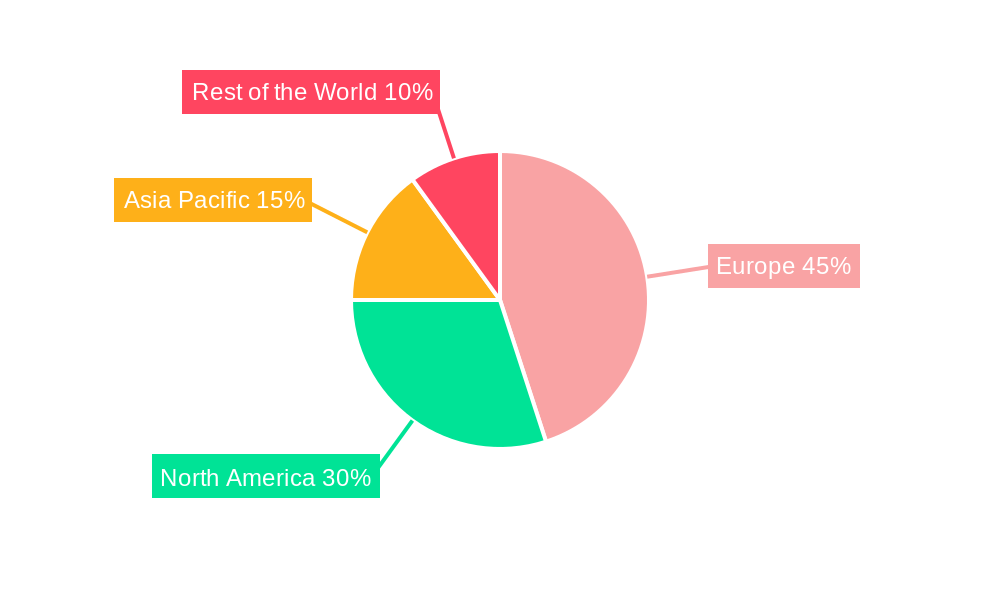

The Europe Arts Promoter Market exhibits distinct dominance across several regions and segments. Geographically, countries with established art historical legacies and robust cultural infrastructure, such as the United Kingdom, France, Germany, and Italy, are leading the market. These nations benefit from a strong presence of world-renowned museums, galleries, and a deep-seated appreciation for the arts, fostering a fertile ground for art promotion activities. The dominance is further amplified by supportive government policies, substantial public and private investment in cultural heritage, and a well-developed tourism sector that attracts global art enthusiasts.

Within the Type segment, Visual Art and Fine Arts collectively represent the largest share. This encompasses a broad spectrum of artistic expressions, including:

- Painting: Continues to be a cornerstone of the art market, with significant demand for both established masters and contemporary artists.

- Sculpture: Growing in prominence, with large-scale installations and public art projects gaining traction and requiring specialized promotional efforts.

- Visual Art: A broad category that includes contemporary art, photography, digital art, and mixed media, offering diverse promotional avenues.

- Fine Arts: Encompasses traditional art forms and is consistently supported by a discerning collector base.

- Other Types: Includes niche art forms, performance art, and emerging artistic expressions that present unique promotional challenges and opportunities.

In terms of Revenue Source, the market is driven by a diversified portfolio:

- Tickets: Crucial for exhibitions, fairs, and art-related events, directly impacting promoter revenue.

- Sponsoring: Corporate sponsorship remains a vital income stream, with companies investing in art to enhance brand visibility and corporate social responsibility.

- Media Rights: Increasingly important with the digital surge, encompassing broadcasting rights for auctions, documentaries, and online streaming of art events.

- Merchandising: Offers ancillary revenue through branded products, publications, and exclusive art-related merchandise, contributing to the overall multi-billion dollar revenue.

The growth drivers for regional dominance include significant infrastructure development for exhibition spaces, favorable policies encouraging arts and cultural exchange, and the presence of major international art fairs that act as significant market catalysts. The continued influx of both domestic and international visitors fuels demand for ticketed events and related services.

Europe Arts Promoter Market Product Analysis

The Europe Arts Promoter Market is characterized by a diverse array of offerings, from organizing high-profile international art fairs and exhibitions to managing individual artist careers and facilitating the sale of artworks. Product innovations are centered around enhancing audience engagement and accessibility. This includes the integration of augmented reality (AR) for virtual gallery tours, interactive digital displays that provide deeper insights into artworks, and AI-driven recommendation engines that personalize art discovery for consumers. The competitive advantage for promoters lies in their ability to curate unique experiences, secure exclusive artist representation, and leverage robust marketing strategies to reach a global audience. The market's success hinges on the effective promotion and sale of various art forms, including paintings, sculptures, and digital art, all contributing to a multi-billion dollar industry.

Key Drivers, Barriers & Challenges in Europe Arts Promoter Market

Key Drivers:

- Growing Cultural Tourism: Europe's rich artistic heritage attracts millions of tourists, creating a sustained demand for art exhibitions and events.

- Increasing Disposable Income: Rising affluence in key European nations allows a larger segment of the population to engage with and invest in art.

- Digitalization of Art Consumption: The adoption of online platforms for art viewing, buying, and promotion is expanding market reach and accessibility.

- Government Support and Investment: Many European governments actively support the arts through funding, grants, and cultural initiatives, fostering a conducive environment for promoters.

- Emergence of New Art Forms: The rise of digital art, NFTs, and immersive experiences creates new avenues for promotion and revenue generation, contributing to the multi-billion dollar market.

Barriers & Challenges:

- High Operational Costs: Organizing large-scale exhibitions and international art fairs involves significant investment in venue rental, logistics, insurance, and marketing.

- Regulatory Complexities: Navigating diverse national regulations concerning art import/export, taxation, and event permits can be challenging and time-consuming.

- Economic Volatility: Economic downturns can impact consumer spending on discretionary items like art and reduce corporate sponsorship budgets.

- Intense Competition: The market is competitive, with numerous established and emerging players vying for artist representation, collector attention, and market share.

- Logistical Challenges: The transportation and insurance of high-value artworks, especially across borders, pose significant logistical and financial risks, impacting the multi-billion dollar industry.

Growth Drivers in the Europe Arts Promoter Market Market

The Europe Arts Promoter Market is propelled by several key growth drivers. Technologically, the widespread adoption of digital platforms for marketing, virtual exhibitions, and online sales is significantly expanding market reach and accessibility. Economically, increasing disposable incomes across Europe and a growing segment of high-net-worth individuals are fueling demand for art acquisition and attendance at cultural events. Regulatory factors, such as government initiatives to promote cultural heritage and support for the arts through grants and tax incentives, create a more favorable operating environment. The increasing global interest in European art and culture, coupled with the growth of art tourism, also serves as a significant catalyst, driving the multi-billion dollar market forward.

Challenges Impacting Europe Arts Promoter Market Growth

Despite strong growth potential, the Europe Arts Promoter Market faces several challenges. Regulatory complexities, including varying import/export laws and tax regimes across European nations, can create significant hurdles for promoters operating internationally. Supply chain issues, particularly concerning the secure and timely transportation of artworks, can lead to increased costs and potential damage. Competitive pressures are intense, with a crowded market demanding continuous innovation and differentiation to capture market share. The economic sensitivity of the art market, where discretionary spending can be curtailed during downturns, also poses a risk to revenue streams. These factors collectively impact the overall growth trajectory of the multi-billion dollar industry.

Key Players Shaping the Europe Arts Promoter Market Market

- The Art Wolf

- Europe's Art

- Artshead

- Marshall Art

- Art Basel

- Perrotin

- Sothebys

- MTArtAgency

- David Wade Fine Art

- Christies

Significant Europe Arts Promoter Market Industry Milestones

- June 2023: Maestro Arts, a United Kingdom-based art promoter, joined forces with Sullivan Sweetland, resulting in the establishment of a mid-sized artist management company. This strategic merger enhanced their ability to support emerging artistic talent, execute ambitious projects, and significantly expand their roster of artists while increasing their project capacity.

- June 2023: A late-life masterpiece by the Austrian artist Gustav Klimt was sold by the European art promoter Sotheby's for an astonishing USD 108.4 million, setting a new record as the most expensive artwork ever auctioned in Europe.

Future Outlook for Europe Arts Promoter Market Market

The future outlook for the Europe Arts Promoter Market is exceptionally promising, driven by continued economic recovery, a resurgent interest in cultural experiences post-pandemic, and ongoing digital innovation. Strategic opportunities lie in expanding into emerging art markets within Europe, leveraging AI for personalized art curation and marketing, and developing more immersive and interactive art experiences. The growing demand for sustainable and ethically sourced art also presents a significant growth catalyst. Promoters who can effectively navigate the evolving digital landscape, cater to a diverse and global audience, and offer unique, value-driven art experiences are poised to capture a substantial share of this multi-billion dollar market. The market is expected to see sustained growth as art continues to be a significant cultural and economic driver in Europe.

Europe Arts Promoter Market Segmentation

-

1. Type

- 1.1. Sculpture

- 1.2. Painting

- 1.3. Visual Art

- 1.4. Fine Arts

- 1.5. Other Types

-

2. Revenue Source

- 2.1. Media Rights

- 2.2. Merchandising

- 2.3. Tickets

- 2.4. Sponsoring

Europe Arts Promoter Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Arts Promoter Market Regional Market Share

Geographic Coverage of Europe Arts Promoter Market

Europe Arts Promoter Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.62% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 United Kingdom

- 3.2.2 France and Germany Driving the Market

- 3.3. Market Restrains

- 3.3.1 United Kingdom

- 3.3.2 France and Germany Driving the Market

- 3.4. Market Trends

- 3.4.1. Rising High Net Worth Individuals In Europe

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Arts Promoter Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Sculpture

- 5.1.2. Painting

- 5.1.3. Visual Art

- 5.1.4. Fine Arts

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Revenue Source

- 5.2.1. Media Rights

- 5.2.2. Merchandising

- 5.2.3. Tickets

- 5.2.4. Sponsoring

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 The Art Wolf

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Europe's Art

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Artshead

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Marshall Art

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Art Basel

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Perrotin

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sothebys

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 MTArtAgency

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 David Wade Fine Art

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Christies**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 The Art Wolf

List of Figures

- Figure 1: Europe Arts Promoter Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Europe Arts Promoter Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Arts Promoter Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Europe Arts Promoter Market Revenue undefined Forecast, by Revenue Source 2020 & 2033

- Table 3: Europe Arts Promoter Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Europe Arts Promoter Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Europe Arts Promoter Market Revenue undefined Forecast, by Revenue Source 2020 & 2033

- Table 6: Europe Arts Promoter Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Arts Promoter Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Arts Promoter Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: France Europe Arts Promoter Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Arts Promoter Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Arts Promoter Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Arts Promoter Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Arts Promoter Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Arts Promoter Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Arts Promoter Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Arts Promoter Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Arts Promoter Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Arts Promoter Market?

The projected CAGR is approximately 6.62%.

2. Which companies are prominent players in the Europe Arts Promoter Market?

Key companies in the market include The Art Wolf, Europe's Art, Artshead, Marshall Art, Art Basel, Perrotin, Sothebys, MTArtAgency, David Wade Fine Art, Christies**List Not Exhaustive.

3. What are the main segments of the Europe Arts Promoter Market?

The market segments include Type, Revenue Source.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

United Kingdom. France and Germany Driving the Market.

6. What are the notable trends driving market growth?

Rising High Net Worth Individuals In Europe.

7. Are there any restraints impacting market growth?

United Kingdom. France and Germany Driving the Market.

8. Can you provide examples of recent developments in the market?

June 2023: Maestro Arts, a United Kingdom-based art promoter, joined forces with Sullivan Sweetland, resulting in the establishment of a mid-sized artist management company. This strategic merger enhanced their ability to support emerging artistic talent, execute ambitious projects, and significantly expand their roster of artists while increasing their project capacity.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Arts Promoter Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Arts Promoter Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Arts Promoter Market?

To stay informed about further developments, trends, and reports in the Europe Arts Promoter Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence