Key Insights

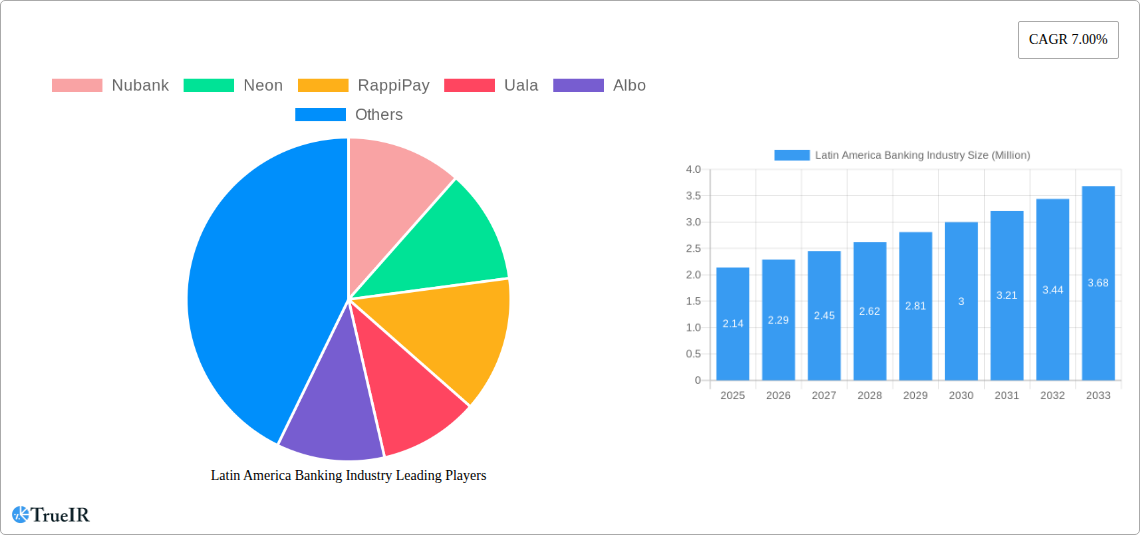

The Latin America banking industry is poised for significant expansion, driven by increasing digital adoption and the growing demand for agile financial solutions. The market is projected to reach USD 2.14 Million in 2025 and is expected to grow at a robust CAGR of 7.00%, indicating a dynamic and evolving landscape. Key growth accelerators include the widespread adoption of API-based Banking-as-a-Service (BaaS) platforms, which enable seamless integration of financial services into non-banking applications, and the expansion of cloud-based BaaS offerings that provide scalability and cost-efficiency. Fintech corporations and Non-Banking Financial Companies (NBFCs) are emerging as primary drivers of this transformation, leveraging BaaS to offer innovative products and reach underserved segments of the population. The "Others" segment, likely encompassing burgeoning digital wallets and payment platforms, also plays a crucial role in shaping the market.

Latin America Banking Industry Market Size (In Million)

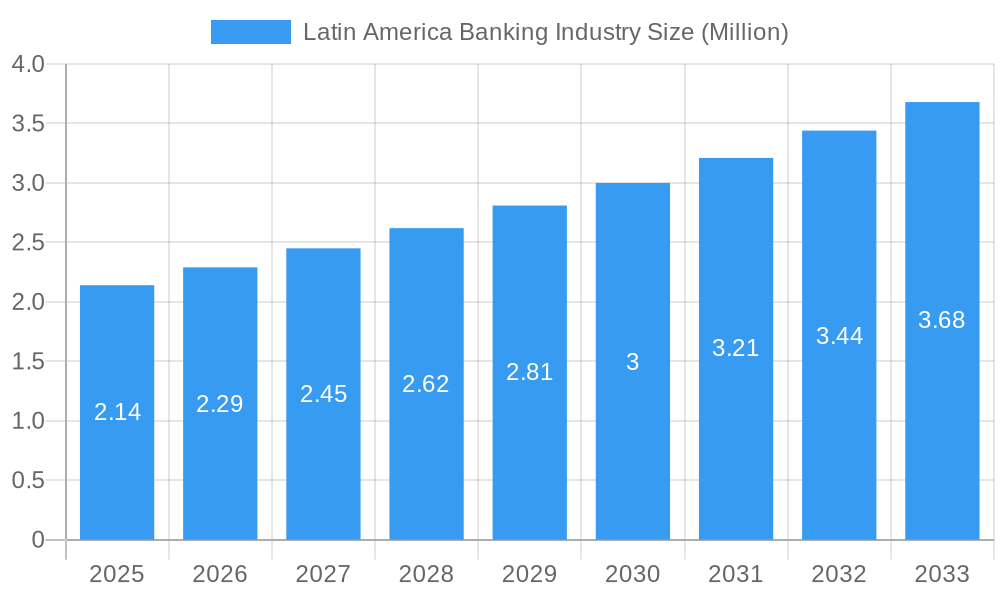

The competitive environment is characterized by the presence of both established players and agile newcomers, with companies like Nubank, Neon, and RappiPay spearheading the digital revolution. While large enterprises are adopting BaaS to enhance their existing services, small and medium enterprises (SMEs) are increasingly turning to these solutions for accessible and affordable financial tools. However, challenges such as regulatory hurdles and the need for robust cybersecurity infrastructure may temper rapid growth. The report forecasts a strong trajectory for the Latin America BaaS market, with a particular emphasis on countries like Brazil, Mexico, and Colombia, which are leading the charge in digital financial innovation. The period from 2019 to 2033, with a focus on the forecast period of 2025-2033, highlights a sustained upward trend in market value and adoption.

Latin America Banking Industry Company Market Share

This comprehensive report offers an in-depth analysis of the Latin America banking industry, forecasting its trajectory from 2019 to 2033. With a base year of 2025 and a forecast period extending to 2033, this study provides actionable insights for stakeholders navigating this dynamic sector. We meticulously examine key players such as Nubank, Neon, RappiPay, Uala, Albo, Broxel, Maximo, Cuenca, Klar, and Banco Original SA, among others, understanding their strategic positioning and contribution to market evolution. The report delves into critical segments including API-Based BaaS, Cloud-Based BaaS platforms, Professional and Managed Services, and caters to a diverse enterprise landscape encompassing Large Enterprises, Small and Medium Enterprises, Banks, Fintech Corporations/NBFCs, and other end-users.

Latin America Banking Industry Market Structure & Competitive Landscape

The Latin America banking industry is characterized by an evolving market concentration, driven by rapid technological advancements and increasing digital adoption. Regulatory frameworks, while progressively adapting to fintech innovations, continue to shape competitive dynamics, influencing new entrant strategies and existing player responses. Product substitution is increasingly evident as neobanks and BaaS providers offer compelling alternatives to traditional banking services. End-user segmentation highlights a growing demand for tailored financial solutions from both established financial institutions and burgeoning fintech corporations, with Small and Medium Enterprises (SMEs) emerging as a key growth segment seeking accessible and cost-effective banking services. Mergers and acquisitions (M&A) activity, though not exhaustively detailed, is projected to increase as larger players seek to acquire innovative technologies or expand their market reach, further consolidating the landscape. The market exhibits a moderate concentration, with a few dominant players and a significant number of agile challengers, creating a vibrant yet competitive environment.

Latin America Banking Industry Market Trends & Opportunities

The Latin America banking industry is poised for substantial growth, driven by an increasing digital penetration and a burgeoning unbanked and underbanked population. The market size is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 12% over the forecast period, reaching an estimated value exceeding 500 Million by 2033. This expansion is fueled by significant technological shifts, including the widespread adoption of cloud-based infrastructure and the increasing integration of API-based Banking-as-a-Service (BaaS) solutions. Consumer preferences are rapidly evolving towards seamless, mobile-first digital banking experiences, demanding personalized services, faster transaction times, and greater financial inclusion. Competitive dynamics are intensifying, with traditional banks investing heavily in digital transformation to counter the agile strategies of fintech corporations and neobanks. Opportunities abound in developing innovative digital payment solutions, offering embedded finance through BaaS platforms, and expanding financial literacy programs to tap into previously underserved segments. The increasing demand for open banking initiatives is also creating fertile ground for collaboration and new service development. Furthermore, the growing adoption of AI and machine learning in fraud detection, risk assessment, and customer service will redefine operational efficiencies and customer engagement. The push for greater financial inclusion across the region presents a significant long-term growth catalyst.

Dominant Markets & Segments in Latin America Banking Industry

The dominant market within the Latin America banking industry is undeniably Brazil, driven by its large population, robust economy, and early adoption of digital financial services. Mexico follows closely, with its rapidly expanding fintech ecosystem and government initiatives promoting financial inclusion.

Key Growth Drivers by Segment:

- Component: Platform

- API-Based BaaS: Infrastructure development and regulatory support for open banking are key drivers. The ability of APIs to enable seamless integration between different financial services providers is crucial for innovation.

- Cloud-Based BaaS: Scalability, cost-efficiency, and enhanced data security provided by cloud solutions are accelerating adoption. The increasing need for flexible and resilient IT infrastructure is paramount.

- Service:

- Professional Service: The demand for expert consultation in digital transformation, regulatory compliance, and technology implementation is a significant growth driver.

- Managed Service: Outsourcing IT operations and security to specialized providers allows financial institutions to focus on core competencies, driving demand for managed services.

- Enterprise:

- Large Enterprise: These entities are leveraging BaaS for expanding their service portfolios and improving operational efficiency, often driven by competitive pressures.

- Small and Medium Enterprise (SME): Access to affordable, digital banking solutions and credit is a primary growth driver for SMEs, addressing a historically underserved market.

- End User:

- Fintech Corporations/ NBFC: These entities are at the forefront of innovation, utilizing BaaS to rapidly launch new products and services, fueling market growth.

- Banks: Traditional banks are increasingly adopting BaaS to enhance their digital offerings, modernize legacy systems, and compete effectively in the evolving financial landscape.

The dominance of these segments is underpinned by supportive government policies, a growing digital-savvy consumer base, and the increasing realization of the cost and efficiency benefits offered by these modern financial solutions.

Latin America Banking Industry Product Analysis

The Latin America banking industry is witnessing a surge in product innovation, primarily centered around digital-first solutions. API-based BaaS platforms are enabling a new wave of embedded finance, allowing non-financial companies to seamlessly integrate financial services into their offerings. Cloud-based BaaS solutions provide scalability and agility for financial institutions and fintechs alike. Innovations include advanced digital wallets, P2P payment systems, instant credit facilities, and AI-powered personalized financial advice. Competitive advantages are derived from speed of deployment, cost-effectiveness, enhanced user experience, and the ability to cater to previously unbanked or underbanked populations.

Key Drivers, Barriers & Challenges in Latin America Banking Industry

Key Drivers:

- Technological Advancements: The proliferation of smartphones and increasing internet penetration are fundamental drivers. The adoption of cloud computing and AI technologies are further accelerating innovation and service delivery.

- Economic Growth & Financial Inclusion: A growing middle class and a significant unbanked population represent immense untapped potential, driving demand for accessible financial services.

- Regulatory Support: Governments are increasingly enacting supportive regulations for fintech and digital banking, fostering innovation and competition.

Barriers & Challenges:

- Regulatory Hurdles: Navigating diverse and evolving regulatory landscapes across different countries can be complex and costly, posing a significant restraint.

- Cybersecurity Threats: The increasing reliance on digital platforms heightens the risk of cyberattacks, requiring substantial investment in robust security measures.

- Digital Literacy and Trust: While growing, digital literacy remains a barrier in some segments, and building trust in digital financial services is crucial for widespread adoption. Supply chain issues for technological infrastructure can also impact expansion.

Growth Drivers in the Latin America Banking Industry Market

The Latin America banking industry's growth is propelled by several key factors. Technologically, the widespread availability of smartphones and improving internet infrastructure facilitate the adoption of digital banking services. Economic tailwinds, including a growing middle class and a substantial unbanked population seeking financial inclusion, create a vast market opportunity. Regulatory environments are increasingly becoming more favorable, with governments actively promoting fintech innovation and open banking initiatives. These combined forces are creating an environment ripe for the expansion of digital payment solutions, BaaS platforms, and innovative lending products.

Challenges Impacting Latin America Banking Industry Growth

Despite significant growth potential, the Latin America banking industry faces several challenges. Regulatory complexities and inconsistencies across various countries can hinder seamless expansion and compliance. Cybersecurity threats continue to be a major concern, necessitating ongoing investment in advanced security measures and robust data protection protocols. Furthermore, varying levels of digital literacy and established trust issues within certain demographics can slow down the adoption of new digital financial services, impacting market penetration rates in some regions.

Key Players Shaping the Latin America Banking Industry Market

- Nubank

- Neon

- RappiPay

- Uala

- Albo

- Broxel

- Maximo

- Cuenca

- Klar

- Banco Original SA

Significant Latin America Banking Industry Industry Milestones

- July 2023: Uala, the Latin American multi-banking fintech, announced a partnership with Western Union. This partnership will enable users of the application to receive money on their smartphones from other users across the globe.

- January 2023: Nubank, a digital financial service platform, secured a loan of over USD 150 Million from IFC. This will help the company to strengthen its operations and expand access to financial services in Colombia.

Future Outlook for Latin America Banking Industry Market

The future outlook for the Latin America banking industry is exceptionally positive, marked by sustained innovation and expansion. Strategic opportunities lie in the further development of embedded finance solutions, leveraging BaaS to integrate financial services into diverse consumer and business platforms. The increasing demand for personalized financial products and AI-driven advisory services will continue to shape market offerings. Continued investment in financial inclusion initiatives will unlock significant untapped market potential, especially in rural and underserved communities. The ongoing digital transformation of traditional financial institutions, coupled with the agile innovation of fintechs, will foster a highly competitive yet collaborative ecosystem, driving market growth and enhancing customer experiences for years to come.

Latin America Banking Industry Segmentation

-

1. Component

- 1.1. Platform

-

1.2. Service

- 1.2.1. Professional Service

- 1.2.2. Managed Service

-

2. Type

- 2.1. API-Based BaaS

- 2.2. Cloud-Based BaaS

-

3. Enterprise

- 3.1. Large Enterprise

- 3.2. Small and Medium Enterprise

-

4. End User

- 4.1. Banks

- 4.2. Fintech Corporations/ NBFC

- 4.3. Others

Latin America Banking Industry Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Banking Industry Regional Market Share

Geographic Coverage of Latin America Banking Industry

Latin America Banking Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise of Internet of Things Devices is Driving The Market; Rise in Cloud Computing Technology is Driving The Market

- 3.3. Market Restrains

- 3.3.1. Rise of Internet of Things Devices is Driving The Market; Rise in Cloud Computing Technology is Driving The Market

- 3.4. Market Trends

- 3.4.1. Rise in Latin America Fintech Funding as a Driver

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Banking Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Platform

- 5.1.2. Service

- 5.1.2.1. Professional Service

- 5.1.2.2. Managed Service

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. API-Based BaaS

- 5.2.2. Cloud-Based BaaS

- 5.3. Market Analysis, Insights and Forecast - by Enterprise

- 5.3.1. Large Enterprise

- 5.3.2. Small and Medium Enterprise

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Banks

- 5.4.2. Fintech Corporations/ NBFC

- 5.4.3. Others

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Nubank

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Neon

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 RappiPay

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Uala

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Albo

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Broxel

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Maximo

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Cuenca

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Klar

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Banco Original SA**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Nubank

List of Figures

- Figure 1: Latin America Banking Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Latin America Banking Industry Share (%) by Company 2025

List of Tables

- Table 1: Latin America Banking Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 2: Latin America Banking Industry Volume Billion Forecast, by Component 2020 & 2033

- Table 3: Latin America Banking Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Latin America Banking Industry Volume Billion Forecast, by Type 2020 & 2033

- Table 5: Latin America Banking Industry Revenue Million Forecast, by Enterprise 2020 & 2033

- Table 6: Latin America Banking Industry Volume Billion Forecast, by Enterprise 2020 & 2033

- Table 7: Latin America Banking Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Latin America Banking Industry Volume Billion Forecast, by End User 2020 & 2033

- Table 9: Latin America Banking Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 10: Latin America Banking Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 11: Latin America Banking Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 12: Latin America Banking Industry Volume Billion Forecast, by Component 2020 & 2033

- Table 13: Latin America Banking Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Latin America Banking Industry Volume Billion Forecast, by Type 2020 & 2033

- Table 15: Latin America Banking Industry Revenue Million Forecast, by Enterprise 2020 & 2033

- Table 16: Latin America Banking Industry Volume Billion Forecast, by Enterprise 2020 & 2033

- Table 17: Latin America Banking Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 18: Latin America Banking Industry Volume Billion Forecast, by End User 2020 & 2033

- Table 19: Latin America Banking Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Latin America Banking Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 21: Brazil Latin America Banking Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Brazil Latin America Banking Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Argentina Latin America Banking Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Argentina Latin America Banking Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Chile Latin America Banking Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Chile Latin America Banking Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Colombia Latin America Banking Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Colombia Latin America Banking Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Mexico Latin America Banking Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Mexico Latin America Banking Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Peru Latin America Banking Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Peru Latin America Banking Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Venezuela Latin America Banking Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Venezuela Latin America Banking Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Ecuador Latin America Banking Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Ecuador Latin America Banking Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 37: Bolivia Latin America Banking Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Bolivia Latin America Banking Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: Paraguay Latin America Banking Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Paraguay Latin America Banking Industry Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Banking Industry?

The projected CAGR is approximately 7.00%.

2. Which companies are prominent players in the Latin America Banking Industry?

Key companies in the market include Nubank, Neon, RappiPay, Uala, Albo, Broxel, Maximo, Cuenca, Klar, Banco Original SA**List Not Exhaustive.

3. What are the main segments of the Latin America Banking Industry?

The market segments include Component, Type, Enterprise, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.14 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise of Internet of Things Devices is Driving The Market; Rise in Cloud Computing Technology is Driving The Market.

6. What are the notable trends driving market growth?

Rise in Latin America Fintech Funding as a Driver.

7. Are there any restraints impacting market growth?

Rise of Internet of Things Devices is Driving The Market; Rise in Cloud Computing Technology is Driving The Market.

8. Can you provide examples of recent developments in the market?

July 2023: Uala, the Latin American multi-banking fintech, announced a partnership with Western Union. This partnership will enable users of the application to receive money on their smartphones from other users across the globe.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Banking Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Banking Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Banking Industry?

To stay informed about further developments, trends, and reports in the Latin America Banking Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence