Key Insights

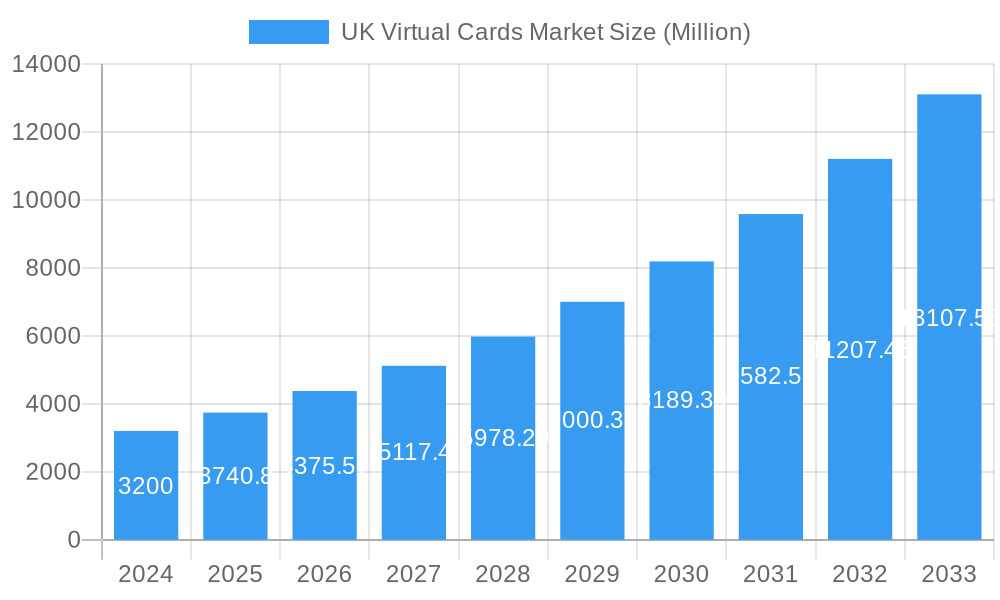

The UK virtual cards market is poised for significant expansion, projecting a robust market size of £3.2 billion in 2024 and an impressive CAGR of 17.1% throughout the forecast period. This rapid growth is primarily fueled by escalating consumer and business adoption of digital payment solutions, driven by convenience, enhanced security features, and the seamless integration with e-commerce platforms. The increasing prevalence of online transactions, coupled with the demand for streamlined payment processes in both personal and corporate settings, acts as a powerful catalyst for virtual card utilization. Furthermore, the evolving regulatory landscape, which often encourages digital innovation, and the continuous development of user-friendly virtual card applications by fintech companies are further accelerating market penetration. The inherent advantages of virtual cards, such as reduced risk of physical card compromise and the ability to set spending limits, are highly appealing to a broad spectrum of users.

UK Virtual Cards Market Market Size (In Billion)

Key market drivers include the burgeoning e-commerce sector, the growing demand for secure and flexible payment methods, and the increasing integration of virtual cards into budgeting and expense management tools. Emerging trends highlight the rise of B2B virtual cards for streamlined business expenses and the growing popularity of B2C remote payment virtual cards for online purchases and subscription services. While the market is largely optimistic, potential restraints could emerge from data security concerns, albeit mitigated by advanced encryption, and the need for continuous consumer education to fully grasp the benefits and usage of virtual cards. The competitive landscape features prominent players like Revolut, Monzo, and Klarna, actively innovating to capture market share by offering enhanced features and user experiences, thus shaping the dynamic trajectory of the UK virtual cards market.

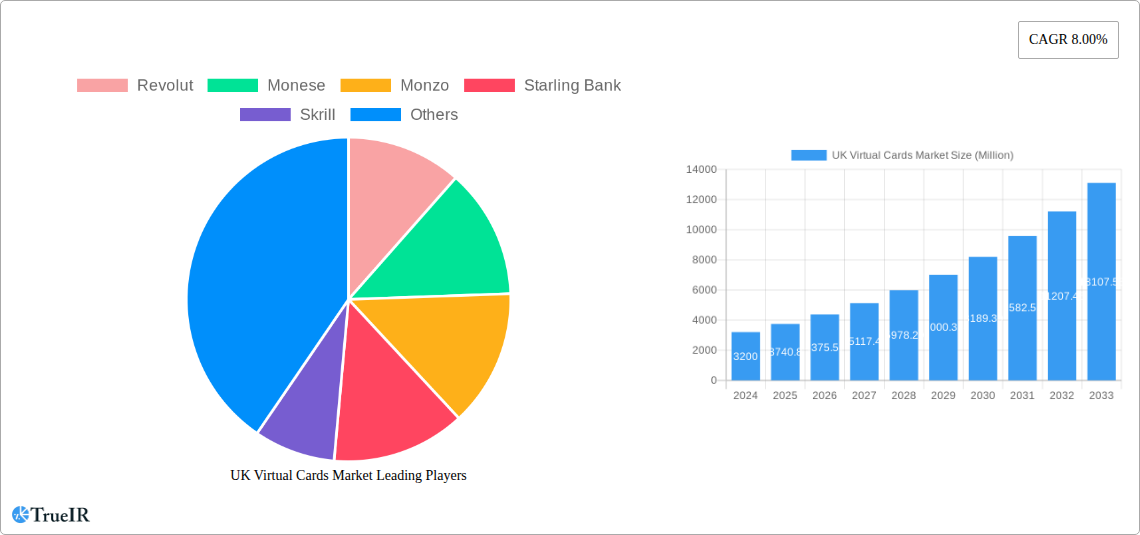

UK Virtual Cards Market Company Market Share

Unlock unparalleled insights into the dynamic UK Virtual Cards Market with this in-depth report. Analyzing the market from 2019 to 2033, with a base year of 2025 and a forecast period spanning 2025-2033, this report leverages high-volume SEO keywords to provide a definitive resource for industry stakeholders. Discover key market drivers, emerging trends, dominant segments, and the competitive landscape shaping the future of virtual card adoption in the UK. Estimated market size in 2025 is expected to reach over £20 billion, with projected growth exceeding a compound annual growth rate (CAGR) of 25% through 2033.

UK Virtual Cards Market Market Structure & Competitive Landscape

The UK Virtual Cards Market exhibits a moderately concentrated structure, with a dynamic interplay between established financial institutions and agile fintech disruptors. Innovation drivers are largely propelled by advancements in payment technologies, evolving consumer demand for seamless digital transactions, and increasing regulatory impetus towards secure and efficient payment solutions. Product substitutes, such as traditional physical cards and alternative payment gateways, are present but are progressively losing ground to the inherent convenience and security offered by virtual cards. End-user segmentation reveals a significant split between Consumer Use and Business Use, each presenting unique adoption patterns and feature requirements. Merger and acquisition (M&A) trends are active, indicating consolidation and strategic expansion within the ecosystem. Over the historical period (2019-2024), an estimated 15 significant M&A activities have occurred, signaling a maturing market. Concentration ratios are closely watched, with the top five players accounting for approximately 55% of the market share in 2024.

- Innovation Drivers:

- Demand for instant issuance and digital-first solutions.

- Enhanced security features like tokenization and dynamic CVVs.

- Integration with mobile wallets and e-commerce platforms.

- Open banking initiatives fostering new payment possibilities.

- Regulatory Impacts:

- PSD2 compliance driving innovation in payment initiation and account information services.

- Data protection regulations (e.g., GDPR) influencing security protocols.

- Government initiatives promoting digital payments and financial inclusion.

- Product Substitutes:

- Physical credit and debit cards.

- Peer-to-peer payment apps.

- Buy Now, Pay Later (BNPL) services.

- M&A Trends:

- Acquisition of technology providers to enhance core offerings.

- Partnerships for expanding service reach and customer base.

- Strategic investments in emerging virtual card functionalities.

UK Virtual Cards Market Market Trends & Opportunities

The UK Virtual Cards Market is experiencing robust growth, projected to reach over £20 billion by 2025 and continue its upward trajectory. This expansion is fueled by a confluence of accelerating technological shifts, evolving consumer preferences, and an increasingly competitive landscape. The market penetration rate for virtual cards is estimated at 35% in 2025, with significant room for further growth. Technological advancements, particularly in AI-driven fraud detection and personalized card management, are enhancing user experience and security, thereby driving adoption. Consumers are increasingly seeking flexible, secure, and instantly available payment solutions for online shopping, subscriptions, and everyday transactions. This surge in demand for digital convenience directly translates into opportunities for virtual card providers.

For businesses, virtual cards offer unparalleled control over employee spending, streamlined expense management, and enhanced security for online procurement. The rise of the gig economy and remote work further amplifies the need for flexible and easily manageable payment tools. Emerging opportunities lie in the integration of virtual cards with loyalty programs, offering personalized rewards and cashback incentives. The development of specialized virtual cards for specific industries, such as travel or hospitality, presents another significant growth avenue. Furthermore, the increasing adoption of contactless payments and the continued digitalization of the retail sector are creating a fertile ground for virtual card solutions that offer a frictionless payment experience at both online and point-of-sale (PoS) terminals. The market is also witnessing a growing interest in disposable virtual cards for one-time online purchases, minimizing the risk of recurring unauthorized charges.

The competitive dynamics are characterized by intense innovation, with companies striving to differentiate through unique features, superior user interfaces, and competitive pricing. Strategic partnerships between fintechs and traditional banks are becoming more prevalent, aiming to leverage existing customer bases and regulatory expertise. The ongoing development of open banking frameworks in the UK is expected to unlock new possibilities for virtual card integration and data utilization, creating a more interconnected and efficient financial ecosystem. The estimated CAGR for the forecast period (2025-2033) is a significant 25%, underscoring the market's immense potential. Opportunities also exist in providing virtual cards for specific use cases like subscription management, allowing users to easily control and cancel recurring payments, and for B2B travel expenses, offering greater oversight and cost control for corporate clients. The ongoing digital transformation across all sectors of the UK economy will continue to be a primary driver for the adoption of virtual card solutions.

Dominant Markets & Segments in UK Virtual Cards Market

The UK Virtual Cards Market is characterized by distinct dominant segments, driven by varying user needs and technological advancements. The B2B Virtual Cards segment is a significant growth engine, driven by the increasing need for enhanced financial control, expense management, and fraud prevention within businesses. These cards empower companies to issue dedicated virtual cards to employees for specific purchases or project budgets, offering granular control over spending limits, merchant restrictions, and transaction approvals. The estimated market share for B2B virtual cards is projected to be over 40% by 2025, with a robust growth trajectory.

The B2C Remote Payment Virtual Cards segment also holds substantial dominance, catering to the burgeoning e-commerce market. These cards are ideal for online shopping, subscription services, and digital content purchases, offering users a secure and convenient alternative to sharing their primary card details online. The ease of creating and managing these virtual cards directly from mobile apps contributes significantly to their popularity. This segment is anticipated to capture approximately 35% of the market share by 2025.

The B2C PoS Virtual Cards segment, while currently smaller, is poised for substantial growth as consumers become more comfortable using their mobile devices for in-store payments. As smartphone adoption increases and contactless payment infrastructure expands, these virtual cards offer a secure and hygienic alternative to physical cards at physical retail locations. Key growth drivers for this segment include the expansion of NFC technology, integration with popular mobile wallets, and consumer demand for contactless transaction methods.

The Consumer Use end-user segment represents a substantial portion of the market, driven by individual preferences for secure online transactions, budgeting tools, and the convenience of digital payments. This segment benefits from the ease of virtual card issuance and management through mobile applications.

Conversely, the Business Use segment is rapidly expanding, fueled by the need for sophisticated expense management, corporate travel solutions, and supplier payments. Businesses are leveraging virtual cards to improve operational efficiency, reduce administrative overhead, and enhance financial visibility.

- Dominant Product Type:

- B2B Virtual Cards: Driven by corporate expense management, procurement automation, and fraud mitigation.

- B2C Remote Payment Virtual Cards: Fuelled by the growth of e-commerce, online subscriptions, and digital service payments.

- Dominant End User:

- Consumer Use: Emphasizing convenience, security for online transactions, and budgeting tools.

- Business Use: Focused on financial control, operational efficiency, and expense management for SMEs and enterprises.

- Key Growth Drivers by Segment:

- B2B: Increased adoption of digital procurement platforms, rise of remote work, demand for granular spending controls.

- B2C Remote Payment: Exponential growth of e-commerce, proliferation of online subscriptions, enhanced security for online transactions.

- B2C PoS: Expansion of contactless payment infrastructure, increasing use of mobile wallets, consumer preference for hygiene and convenience.

- Consumer Use: Demand for budget management tools, simplified online payment experiences, and protection against online fraud.

- Business Use: Need for automated expense reporting, streamlined supplier payments, and improved cash flow management.

UK Virtual Cards Market Product Analysis

UK virtual cards are rapidly evolving, offering a sophisticated suite of features designed for enhanced security, convenience, and control. Innovations include dynamic card numbers that change with each transaction or at set intervals, and one-time use virtual cards to mitigate the risk of recurring unauthorized charges. Application scope is broad, encompassing online shopping, subscription management, business expense allocation, and secure digital wallet integration. Competitive advantages lie in their instant issuance, customizable spending limits, and robust fraud prevention capabilities, offering a superior alternative to traditional physical cards for many digital transactions.

Key Drivers, Barriers & Challenges in UK Virtual Cards Market

The UK Virtual Cards Market is propelled by powerful drivers including the exponential growth of e-commerce, the increasing demand for secure and convenient digital payment solutions, and advancements in financial technology. Regulatory support, such as PSD2, also encourages innovation and adoption. The inherent security benefits, like tokenization and dynamic card numbers, further bolster their appeal.

Conversely, barriers and challenges include the need for widespread consumer education to fully grasp the benefits and security of virtual cards, particularly for the less tech-savvy demographic. Regulatory complexities and evolving compliance requirements can pose challenges for new entrants. While supply chain issues are less direct for virtual cards, the underlying digital infrastructure and processing capabilities are critical. Competitive pressures from established payment networks and the continuous evolution of alternative payment methods also present ongoing challenges. Overcoming these requires a focus on user-friendly interfaces, robust security frameworks, and clear communication of value propositions.

Growth Drivers in the UK Virtual Cards Market Market

Key growth drivers for the UK Virtual Cards Market include the pervasive shift towards digitalization across all economic sectors, making instant and secure online transactions a necessity. Technological advancements in mobile payments, contactless technology, and AI-powered fraud detection systems are enhancing user experience and security, thereby accelerating adoption. Economic factors, such as the increasing reliance on e-commerce for both consumer and business transactions, are creating a fertile ground for virtual card solutions. Regulatory initiatives, like Open Banking, are fostering innovation and integration, opening new avenues for virtual card functionalities.

- Technological: Advancements in AI, tokenization, and mobile payment integration.

- Economic: Growth of e-commerce, digital transformation of businesses, increased reliance on online services.

- Regulatory: PSD2, Open Banking initiatives promoting seamless and secure payment flows.

Challenges Impacting UK Virtual Cards Market Growth

Challenges impacting the UK Virtual Cards Market growth include the inherent inertia of traditional payment methods and the need for significant consumer and business education to fully embrace virtual card technology. Regulatory hurdles and the constant need for adaptation to evolving compliance landscapes can be a restraint for providers. While less of a direct "supply chain" issue, the reliance on robust digital infrastructure and secure data handling is paramount. Competitive pressures from established players and the rapid pace of innovation in the fintech space demand continuous investment and strategic agility from virtual card providers to maintain market share and drive sustained growth.

- Regulatory Complexities: Navigating evolving compliance and data protection laws.

- Competitive Pressures: Intense competition from established financial institutions and innovative fintechs.

- Consumer Education: Bridging the knowledge gap regarding the benefits and security of virtual cards.

Key Players Shaping the UK Virtual Cards Market Market

- Revolut

- Monese

- Monzo

- Starling Bank

- Skrill

- iCard

- US Unlocked

- Klarna

- Pervesk

- Payoneer

Significant UK Virtual Cards Market Industry Milestones

- November 2021: Revolut announced the acquisition of Nobly POS, a highly regarded ePOS software vendor, to expand its offering to the restaurant and hotel sectors. The acquired ePOS system is popular in the UK, USA, and Australia. The acquisition will expand Revolut's offer to serve hospitality SMEs and accelerate the growth of Revolut's Business and Acquiring products.

- April 2021: Monzo offered new features for connected accounts and virtual cards. New features help for more visibility and control over the accounts. Features such as a summary for each account, income transfer, and pending transactions are easily accessible through the app.

Future Outlook for UK Virtual Cards Market Market

The future outlook for the UK Virtual Cards Market is exceptionally positive, characterized by sustained high growth and increasing integration into daily financial activities. Emerging trends such as the proliferation of disposable virtual cards for enhanced online security, personalized virtual card offerings tied to loyalty programs, and the expansion of virtual cards in B2B procurement and expense management will be key growth catalysts. The continued development of open banking and advancements in AI will further streamline functionalities and create more intelligent payment experiences. Strategic opportunities lie in targeting underserved market segments, fostering partnerships with e-commerce platforms and SaaS providers, and continuous innovation in user experience and security features, ensuring the market is set to reach over £100 billion by 2033.

UK Virtual Cards Market Segmentation

-

1. Product Type

- 1.1. B2B Virtual Cards

- 1.2. B2C Remote Payment Virtual Cards

- 1.3. B2C PoS Virtual Cards

-

2. End User

- 2.1. Consumer Use

- 2.2. Business Use

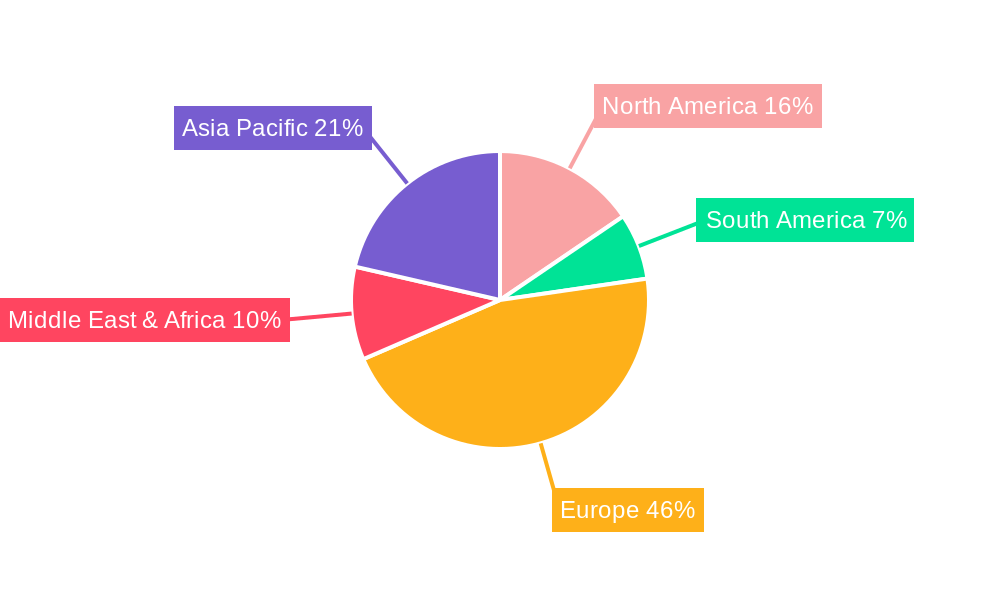

UK Virtual Cards Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Virtual Cards Market Regional Market Share

Geographic Coverage of UK Virtual Cards Market

UK Virtual Cards Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 17.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing Online Payments is Driving the Market for Virtual Cards in United Kingdom

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Virtual Cards Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. B2B Virtual Cards

- 5.1.2. B2C Remote Payment Virtual Cards

- 5.1.3. B2C PoS Virtual Cards

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Consumer Use

- 5.2.2. Business Use

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America UK Virtual Cards Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. B2B Virtual Cards

- 6.1.2. B2C Remote Payment Virtual Cards

- 6.1.3. B2C PoS Virtual Cards

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Consumer Use

- 6.2.2. Business Use

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America UK Virtual Cards Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. B2B Virtual Cards

- 7.1.2. B2C Remote Payment Virtual Cards

- 7.1.3. B2C PoS Virtual Cards

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Consumer Use

- 7.2.2. Business Use

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe UK Virtual Cards Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. B2B Virtual Cards

- 8.1.2. B2C Remote Payment Virtual Cards

- 8.1.3. B2C PoS Virtual Cards

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Consumer Use

- 8.2.2. Business Use

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa UK Virtual Cards Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. B2B Virtual Cards

- 9.1.2. B2C Remote Payment Virtual Cards

- 9.1.3. B2C PoS Virtual Cards

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Consumer Use

- 9.2.2. Business Use

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific UK Virtual Cards Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. B2B Virtual Cards

- 10.1.2. B2C Remote Payment Virtual Cards

- 10.1.3. B2C PoS Virtual Cards

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Consumer Use

- 10.2.2. Business Use

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Revolut

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Monese

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Monzo

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Starling Bank

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Skrill

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 iCard

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 US Unlocked

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Klarna

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Pervesk

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Payoneer**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Revolut

List of Figures

- Figure 1: Global UK Virtual Cards Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America UK Virtual Cards Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 3: North America UK Virtual Cards Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America UK Virtual Cards Market Revenue (undefined), by End User 2025 & 2033

- Figure 5: North America UK Virtual Cards Market Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America UK Virtual Cards Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America UK Virtual Cards Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America UK Virtual Cards Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 9: South America UK Virtual Cards Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: South America UK Virtual Cards Market Revenue (undefined), by End User 2025 & 2033

- Figure 11: South America UK Virtual Cards Market Revenue Share (%), by End User 2025 & 2033

- Figure 12: South America UK Virtual Cards Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America UK Virtual Cards Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe UK Virtual Cards Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 15: Europe UK Virtual Cards Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Europe UK Virtual Cards Market Revenue (undefined), by End User 2025 & 2033

- Figure 17: Europe UK Virtual Cards Market Revenue Share (%), by End User 2025 & 2033

- Figure 18: Europe UK Virtual Cards Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe UK Virtual Cards Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa UK Virtual Cards Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 21: Middle East & Africa UK Virtual Cards Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Middle East & Africa UK Virtual Cards Market Revenue (undefined), by End User 2025 & 2033

- Figure 23: Middle East & Africa UK Virtual Cards Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Middle East & Africa UK Virtual Cards Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa UK Virtual Cards Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific UK Virtual Cards Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 27: Asia Pacific UK Virtual Cards Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Asia Pacific UK Virtual Cards Market Revenue (undefined), by End User 2025 & 2033

- Figure 29: Asia Pacific UK Virtual Cards Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: Asia Pacific UK Virtual Cards Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific UK Virtual Cards Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UK Virtual Cards Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Global UK Virtual Cards Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 3: Global UK Virtual Cards Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global UK Virtual Cards Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 5: Global UK Virtual Cards Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 6: Global UK Virtual Cards Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States UK Virtual Cards Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada UK Virtual Cards Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico UK Virtual Cards Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global UK Virtual Cards Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 11: Global UK Virtual Cards Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 12: Global UK Virtual Cards Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Brazil UK Virtual Cards Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Argentina UK Virtual Cards Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America UK Virtual Cards Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global UK Virtual Cards Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 17: Global UK Virtual Cards Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 18: Global UK Virtual Cards Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: United Kingdom UK Virtual Cards Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Germany UK Virtual Cards Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: France UK Virtual Cards Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Italy UK Virtual Cards Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Spain UK Virtual Cards Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Russia UK Virtual Cards Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Benelux UK Virtual Cards Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Nordics UK Virtual Cards Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe UK Virtual Cards Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global UK Virtual Cards Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 29: Global UK Virtual Cards Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 30: Global UK Virtual Cards Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Turkey UK Virtual Cards Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Israel UK Virtual Cards Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: GCC UK Virtual Cards Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: North Africa UK Virtual Cards Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: South Africa UK Virtual Cards Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa UK Virtual Cards Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Global UK Virtual Cards Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 38: Global UK Virtual Cards Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 39: Global UK Virtual Cards Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: China UK Virtual Cards Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: India UK Virtual Cards Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Japan UK Virtual Cards Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: South Korea UK Virtual Cards Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: ASEAN UK Virtual Cards Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Oceania UK Virtual Cards Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific UK Virtual Cards Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Virtual Cards Market?

The projected CAGR is approximately 17.1%.

2. Which companies are prominent players in the UK Virtual Cards Market?

Key companies in the market include Revolut, Monese, Monzo, Starling Bank, Skrill, iCard, US Unlocked, Klarna, Pervesk, Payoneer**List Not Exhaustive.

3. What are the main segments of the UK Virtual Cards Market?

The market segments include Product Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing Online Payments is Driving the Market for Virtual Cards in United Kingdom.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In November 2021, Revolut announced the acquisition of Nobly POS (www.noblypos.com), a highly regarded ePOS software vendor, to expand its offering to the restaurant and hotel sectors. The acquired ePOS system is popular in the UK, USA, and Australia. The acquisition will expand Revolut's offer to serve hospitality SMEs and accelerate the growth of Revolut's Business and Acquiring products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Virtual Cards Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Virtual Cards Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Virtual Cards Market?

To stay informed about further developments, trends, and reports in the UK Virtual Cards Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence