Key Insights

The Peruvian insurance market, encompassing both Life and Non-Life segments, is projected for substantial expansion. The market is expected to reach a size of $5.5 billion by 2024, driven by a Compound Annual Growth Rate (CAGR) of 8.11%. This growth is fueled by increasing consumer awareness of financial security, a rising middle class, and a supportive regulatory environment. The Life insurance sector, covering individual and group policies, will see consistent demand driven by long-term financial planning and employer-sponsored benefits. The Non-Life segment, including Fire, Motor, Marine, and Health insurance, will benefit from economic activity, infrastructure development, and the need for protection against unforeseen risks.

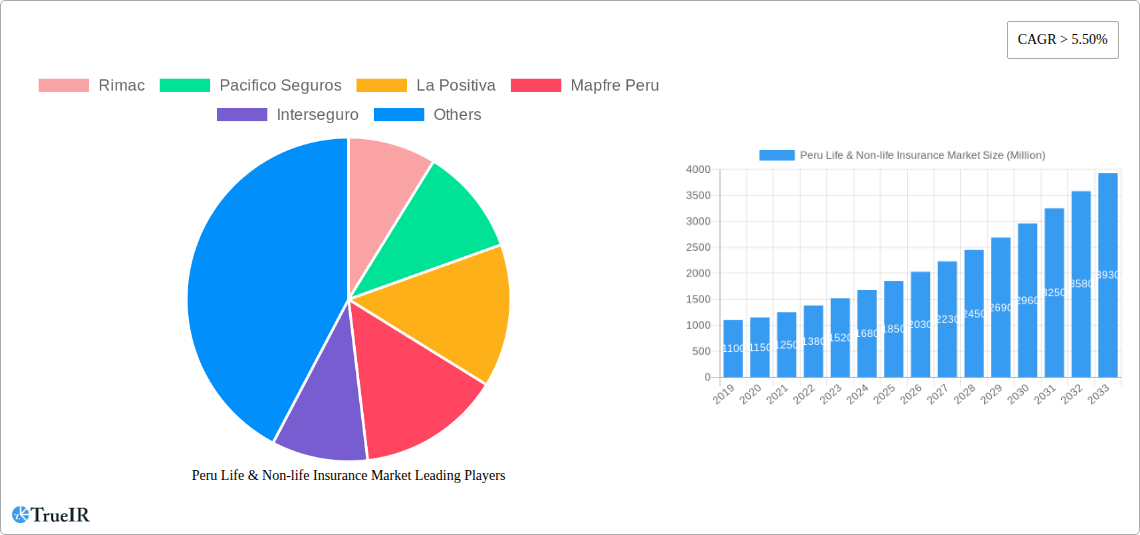

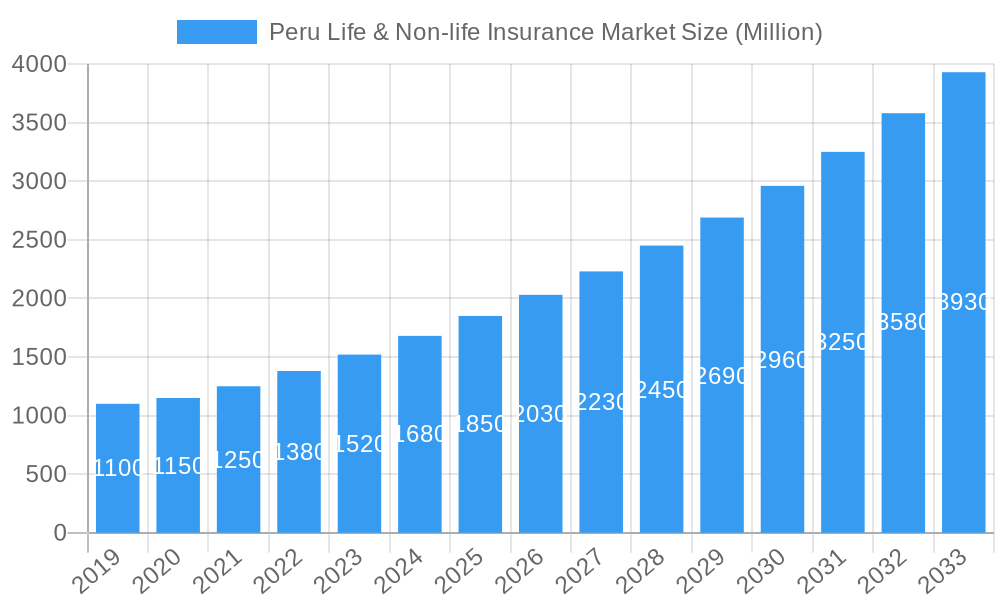

Peru Life & Non-life Insurance Market Market Size (In Billion)

Emerging trends like digitalization and InsurTech are transforming distribution, customer experience, and product personalization. Banks are anticipated to enhance their role as distribution partners. However, the market faces challenges from potential economic volatility and underinsurance. Despite these, leading players such as Rimac, Mapfre Peru, and Interseguro are actively innovating, positioning the Peruvian insurance landscape for dynamic growth through demographic shifts, economic progress, and technological integration.

Peru Life & Non-life Insurance Market Company Market Share

Peru Life & Non-life Insurance Market Analysis & Forecast (2019–2033)

This comprehensive report offers a dynamic analysis of the Peru Life & Non-life Insurance Market. Covering the period from 2019 to 2033, with a base year of 2024, it examines market structure, competitive dynamics, key trends, dominant segments, product innovation, growth drivers, challenges, and future outlook. Gain deep insights into this evolving market through detailed data and analysis.

Peru Life & Non-life Insurance Market Market Structure & Competitive Landscape

The Peru Life & Non-life Insurance Market is characterized by a moderate concentration of key players, with established entities like Rimac, Pacifico Seguros, and Mapfre Peru holding significant market share. Innovation in this sector is primarily driven by digital transformation initiatives, enhanced customer experience platforms, and the development of tailored insurance products catering to evolving consumer needs. Regulatory frameworks, overseen by bodies like the Superintendencia de Banca, Seguros y AFP (SBS), play a crucial role in shaping market dynamics, ensuring solvency, and protecting policyholders. Product substitutes, such as savings accounts and government social security programs, present a competitive landscape that insurers must navigate. End-user segmentation is diverse, encompassing individuals, SMEs, and large corporations seeking comprehensive life and non-life coverage. Mergers and acquisitions (M&A) activity, while not consistently high, has seen strategic moves by major players to consolidate market presence and expand service offerings, as exemplified by FID Peru SA's acquisition of a majority stake in La Positiva Seguros y Reaseguros SA in January 2019. The competitive intensity is further heightened by new entrants and a growing demand for specialized insurance solutions.

Peru Life & Non-life Insurance Market Market Trends & Opportunities

The Peru Life & Non-life Insurance Market is poised for substantial growth, driven by increasing financial literacy, a burgeoning middle class, and a heightened awareness of risk management. Market size is projected to expand significantly, with a compound annual growth rate (CAGR) of approximately 8.5% estimated for the forecast period. Technological shifts are revolutionizing the insurance landscape, with a strong emphasis on digital platforms for policy acquisition, claims processing, and customer service. Insurtech startups are also playing a vital role in driving innovation, offering personalized products and efficient solutions. Consumer preferences are evolving towards more flexible, on-demand, and digitally accessible insurance products. This includes a growing demand for parametric insurance, cyber insurance, and specialized health and life coverages. Competitive dynamics are intensifying, with established players investing heavily in digital infrastructure and customer engagement strategies to retain and attract policyholders. Opportunities abound in areas such as microinsurance for underserved populations, comprehensive health insurance packages addressing the nation's healthcare needs, and innovative motor insurance products incorporating telematics. The increasing adoption of digital payment systems and the growing penetration of smartphones are further enabling insurers to reach a wider audience and streamline operations. Furthermore, a robust economic outlook and government initiatives promoting financial inclusion present fertile ground for market expansion. The evolving regulatory environment, while sometimes presenting challenges, also fosters a more transparent and competitive market, encouraging greater innovation and customer-centricity.

Dominant Markets & Segments in Peru Life & Non-life Insurance Market

The Life Insurance segment, particularly Individual Life Insurance, is a dominant force within the Peru Life & Non-life Insurance Market. This dominance is fueled by increasing disposable incomes, a growing awareness of financial planning for individuals and families, and a desire for security against unforeseen events. The introduction of innovative life insurance products with savings and investment components further enhances their appeal.

- Individual Life Insurance Growth Drivers:

- Rising per capita income and financial literacy.

- Increased demand for retirement planning and wealth accumulation products.

- Government initiatives promoting financial inclusion and long-term savings.

- Growing popularity of hybrid products offering both protection and investment benefits.

The Non-Life Insurance sector also exhibits significant strength, with Health Insurance and Motor Insurance emerging as key growth areas. The increasing strain on public healthcare systems drives demand for private health insurance, offering access to better medical facilities and treatments. Similarly, a growing vehicle parc and stringent traffic regulations necessitate comprehensive motor insurance policies.

Health Insurance Growth Drivers:

- Overburdened public healthcare infrastructure.

- Rising healthcare costs and demand for specialized medical treatments.

- Corporate adoption of health insurance as an employee benefit.

- Increased awareness of preventative healthcare.

Motor Insurance Growth Drivers:

- Expanding automotive market and increasing vehicle ownership.

- Stricter enforcement of mandatory third-party liability insurance.

- Technological advancements in vehicles, leading to higher repair costs.

- Introduction of usage-based and telematics-driven insurance policies.

The Distribution Channel landscape is undergoing a transformation, with Banks and Other Distribution Channels (including online aggregators and direct-to-consumer platforms) gaining prominence alongside traditional Agency networks. Banks leverage their existing customer relationships to cross-sell insurance products, offering convenience and trust. Digital channels are crucial for reaching younger demographics and providing a seamless customer journey.

Banks as Distribution Channels Growth Drivers:

- Established customer trust and loyalty.

- Convenient one-stop-shop for financial services.

- Targeted cross-selling opportunities based on customer financial profiles.

Other Distribution Channels (Digital/Online) Growth Drivers:

- Increasing internet penetration and smartphone adoption.

- Demand for transparent pricing and easy policy comparison.

- Enhanced customer experience through user-friendly interfaces.

- Agility in offering personalized and niche insurance products.

Peru Life & Non-life Insurance Market Product Analysis

Product innovation in the Peru Life & Non-life Insurance Market is characterized by a shift towards customer-centric solutions and leveraging technology for enhanced value. Companies are introducing flexible life insurance policies that integrate savings and investment components, catering to a broader range of financial goals. In non-life, there's a growing emphasis on specialized coverage such as cyber insurance for businesses and parametric insurance for agricultural risks, providing payouts based on predefined triggers. Technological advancements are enabling the development of usage-based motor insurance and personalized health plans based on individual risk profiles. These innovations aim to offer competitive advantages by increasing policy relevance, improving risk management capabilities for policyholders, and fostering stronger customer loyalty.

Key Drivers, Barriers & Challenges in Peru Life & Non-life Insurance Market

Key Drivers:

- Economic Growth & Rising Incomes: A growing economy and increasing disposable incomes directly translate to higher demand for insurance products as individuals and businesses seek financial security.

- Increased Awareness of Risk Management: Natural disasters, health concerns, and economic volatility have heightened public awareness regarding the importance of insurance protection.

- Digital Transformation & Insurtech: The adoption of digital technologies and the emergence of insurtech firms are driving innovation, improving accessibility, and enhancing customer experience.

- Government Support & Regulatory Frameworks: Supportive government policies promoting financial inclusion and a stable regulatory environment foster market growth and investor confidence.

Barriers & Challenges:

- Low Insurance Penetration: Despite growth, the overall insurance penetration in Peru remains relatively low compared to regional and global averages, indicating significant untapped potential but also a challenge in reaching mass market adoption.

- Price Sensitivity: Consumers can be highly price-sensitive, requiring insurers to balance competitive pricing with robust coverage and service offerings.

- Fraud and Misrepresentation: Instances of insurance fraud and misrepresentation pose a significant challenge, leading to increased operational costs and potentially impacting premium rates for honest policyholders.

- Talent Acquisition and Development: The need for skilled professionals in areas like actuarial science, data analytics, and digital marketing can be a constraint for some insurers.

- Economic Instability: Fluctuations in the Peruvian economy or broader global economic downturns can negatively impact consumer spending on insurance products.

Growth Drivers in the Peru Life & Non-life Insurance Market Market

Key drivers propelling the Peru Life & Non-life Insurance Market include sustained economic development leading to higher disposable incomes, consequently boosting the demand for life and non-life insurance products. A growing emphasis on financial literacy and a greater understanding of risk management among the population are significant catalysts. The ongoing digital transformation within the insurance sector, encompassing mobile applications, online policy purchasing, and AI-driven claims processing, is enhancing accessibility and customer engagement. Furthermore, government initiatives aimed at financial inclusion and promoting long-term savings are creating a more favorable environment for insurance penetration. Innovative product development, such as tailored health plans and microinsurance solutions, is also playing a crucial role in expanding the market reach.

Challenges Impacting Peru Life & Non-life Insurance Market Growth

The Peru Life & Non-life Insurance Market faces several challenges that could impede its growth trajectory. Regulatory complexities and the need for continuous adaptation to evolving compliance requirements can pose hurdles for insurers. Supply chain issues, particularly in relation to global economic disruptions or specific industry dependencies, might affect the availability or cost of certain insurance-related services or components. Intense competitive pressures from both established players and emerging Insurtech companies necessitate constant innovation and efficient operational management. Furthermore, instances of insurance fraud and misrepresentation can lead to increased claims costs and impact profitability. Addressing these challenges effectively will be critical for sustained and robust market expansion.

Key Players Shaping the Peru Life & Non-life Insurance Market Market

- Rimac

- Pacifico Seguros

- La Positiva

- Mapfre Peru

- Interseguro

- Protecta

- Cardif

- Ohio National Vida

- Chubb Seguros

- Crecer Seguros

Significant Peru Life & Non-life Insurance Market Industry Milestones

- March 2020: RIMAC Seguros, with 1.8 million customers, announced a 3-year digital transformation agreement with Kyndryl, migrating mission-critical IT systems to Microsoft Azure, aiming to boost its digital presence and customer base.

- January 2019: FID Peru SA completed its acquisition of a majority stake (51%) in La Positiva Seguros y Reaseguros SA, purchasing 194,224,590 shares.

Future Outlook for Peru Life & Non-life Insurance Market Market

The future outlook for the Peru Life & Non-life Insurance Market is exceptionally bright, driven by a confluence of favorable factors. Continued economic growth, coupled with increasing per capita income, will fuel greater demand for a wider array of insurance products. The digital revolution, spearheaded by Insurtech innovation, will continue to enhance accessibility, personalize offerings, and optimize operational efficiency, thereby reaching previously underserved segments. Strategic alliances between insurers and financial institutions, along with the expansion of online distribution channels, will broaden market reach. Opportunities lie in developing specialized products catering to emerging risks, such as climate change impacts and cybersecurity threats, as well as enhancing offerings in health, life, and pension insurance to meet the evolving needs of Peru's growing population. The market is poised for sustained expansion, driven by innovation, evolving consumer preferences, and a conducive regulatory environment.

Peru Life & Non-life Insurance Market Segmentation

-

1. Insurance Type

-

1.1. Life insurance

- 1.1.1. Individual

- 1.1.2. Group

-

1.2. Non-Life Insurance

- 1.2.1. Fire

- 1.2.2. Motor

- 1.2.3. Marine

- 1.2.4. Health

- 1.2.5. Others

-

1.1. Life insurance

-

2. Distribution Channel

- 2.1. Direct

- 2.2. Agency

- 2.3. Banks

- 2.4. Other Distribution Channels

Peru Life & Non-life Insurance Market Segmentation By Geography

- 1. Peru

Peru Life & Non-life Insurance Market Regional Market Share

Geographic Coverage of Peru Life & Non-life Insurance Market

Peru Life & Non-life Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.11% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Introduction of Compulsory Life Insurance for Employees

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Peru Life & Non-life Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 5.1.1. Life insurance

- 5.1.1.1. Individual

- 5.1.1.2. Group

- 5.1.2. Non-Life Insurance

- 5.1.2.1. Fire

- 5.1.2.2. Motor

- 5.1.2.3. Marine

- 5.1.2.4. Health

- 5.1.2.5. Others

- 5.1.1. Life insurance

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Direct

- 5.2.2. Agency

- 5.2.3. Banks

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Peru

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Rimac

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Pacifico Seguros

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 La Positiva

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mapfre Peru

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Interseguro

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Protecta

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cardif

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ohio National Vida

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Chubb Seguros

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Crecer Seguros**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Rimac

List of Figures

- Figure 1: Peru Life & Non-life Insurance Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Peru Life & Non-life Insurance Market Share (%) by Company 2025

List of Tables

- Table 1: Peru Life & Non-life Insurance Market Revenue billion Forecast, by Insurance Type 2020 & 2033

- Table 2: Peru Life & Non-life Insurance Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Peru Life & Non-life Insurance Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Peru Life & Non-life Insurance Market Revenue billion Forecast, by Insurance Type 2020 & 2033

- Table 5: Peru Life & Non-life Insurance Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Peru Life & Non-life Insurance Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Peru Life & Non-life Insurance Market?

The projected CAGR is approximately 8.11%.

2. Which companies are prominent players in the Peru Life & Non-life Insurance Market?

Key companies in the market include Rimac, Pacifico Seguros, La Positiva, Mapfre Peru, Interseguro, Protecta, Cardif, Ohio National Vida, Chubb Seguros, Crecer Seguros**List Not Exhaustive.

3. What are the main segments of the Peru Life & Non-life Insurance Market?

The market segments include Insurance Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.5 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Introduction of Compulsory Life Insurance for Employees.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

On March 2020, RIMAC Seguros, a leading insurance company in Peru with 1.8 million customers along with Kyndryl, the world's largest IT infrastructure services provider announced a 3-year agreement to accelerate the company's digital transformation with the migration of its mission-critical IT systems and business applications to Microsoft Azure. This would increase the disgital presence of the company and boosting the coustmer base.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Peru Life & Non-life Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Peru Life & Non-life Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Peru Life & Non-life Insurance Market?

To stay informed about further developments, trends, and reports in the Peru Life & Non-life Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence