Key Insights

The Japan agricultural machinery market, valued at $3.9 billion in 2025, is poised for robust expansion. Driven by advancements in precision farming and automation, the demand for sophisticated machinery is escalating, boosting efficiency and crop yields. The aging agricultural demographic necessitates the adoption of labor-saving technologies, further stimulating market growth. While a declining agricultural workforce presents a challenge, government initiatives focused on modernization and technological adoption are effectively mitigating this impact. The market is segmented by product type (tractors, planting, harvesting, irrigation machinery), horsepower (below 20HP to above 50HP), and tractor type (utility, row crop, compact utility, and others). Tractors hold a dominant position, with higher horsepower segments experiencing accelerated growth due to their suitability for large-scale operations. The increasing adoption of efficient irrigation and precision planting technologies indicates a positive outlook for these segments. Key industry players, including Kubota, Mahindra & Mahindra, and Deere & Company, are strategically investing in research and development and expanding their product offerings to meet the evolving needs of Japanese farmers. Intense competition exists between domestic and international companies vying for market share.

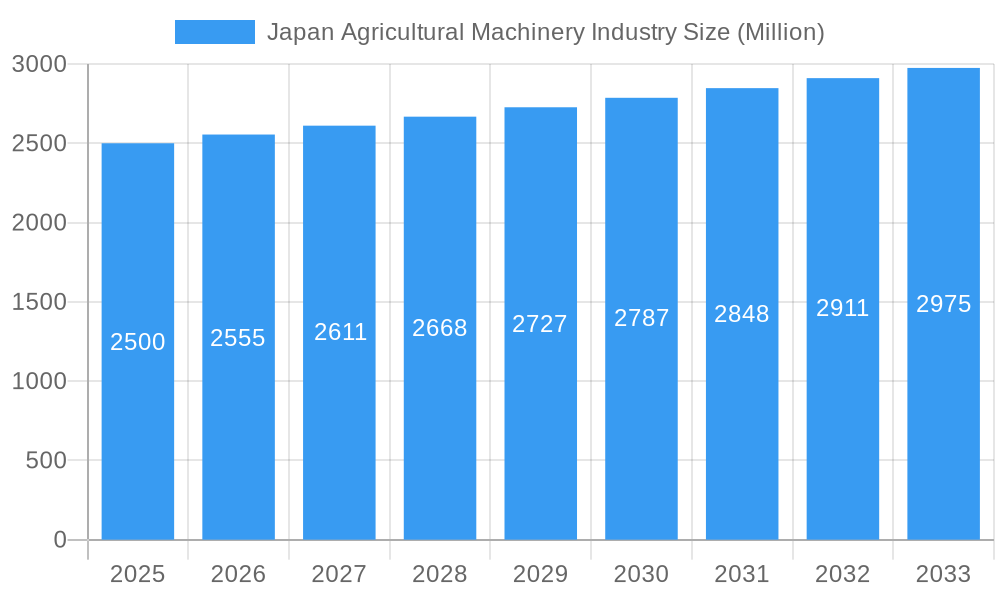

Japan Agricultural Machinery Industry Market Size (In Billion)

Despite positive trends, the market encounters certain restraints, notably the high initial investment costs of advanced machinery, which can be a barrier for small-scale farmers. Additionally, Japan's mountainous terrain presents logistical challenges for machinery usage and maintenance. However, ongoing government subsidies and financing options aim to overcome these obstacles and encourage wider adoption. The forecast period of 2025-2033 anticipates continued, moderate growth, fueled by technological innovation and government support. The projected CAGR of 5.51% reflects the balanced interplay of these driving and restraining forces. Regional variations within Japan, influenced by diverse agricultural practices and land characteristics, will continue to shape market dynamics.

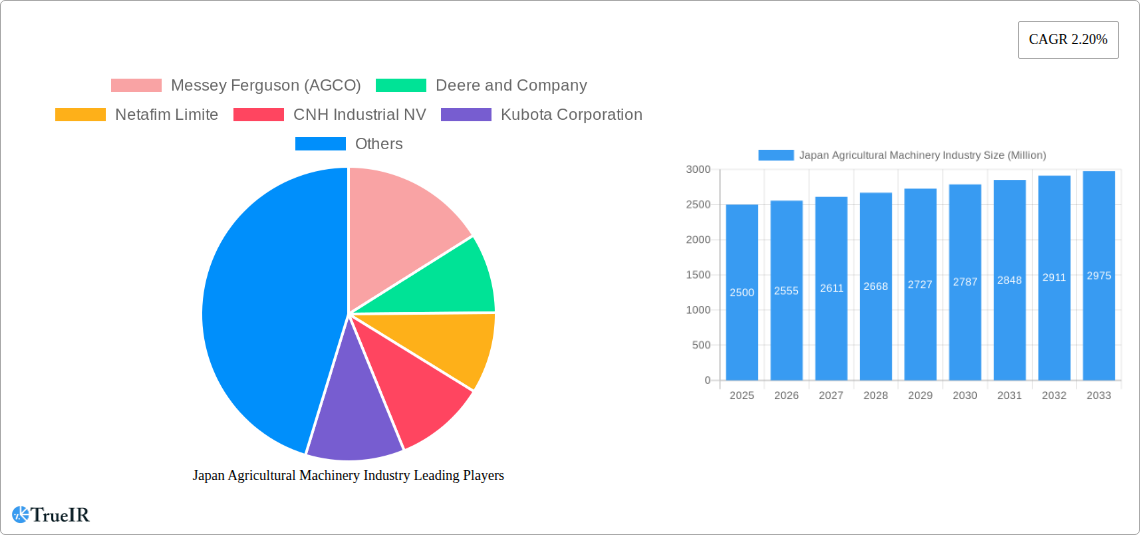

Japan Agricultural Machinery Industry Company Market Share

Japan Agricultural Machinery Industry: A Comprehensive Market Report (2019-2033)

This dynamic report provides a detailed analysis of the Japan Agricultural Machinery industry, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period 2019-2033, with a focus on 2025, this report leverages extensive market research to forecast future trends and opportunities within this dynamic sector. Expect comprehensive data on market size, segmentation, competitive landscape, technological advancements, and key growth drivers.

Japan Agricultural Machinery Industry Market Structure & Competitive Landscape

The Japanese agricultural machinery market exhibits a moderately concentrated structure, with key players like Kubota Corporation holding significant market share. However, the presence of global giants such as Deere & Company and CNH Industrial NV introduces competitive intensity. Innovation, driven by automation and precision farming technologies, is a major driver, alongside evolving regulatory landscapes focusing on sustainability and efficiency. Product substitutes, though limited, include manual labor and older machinery, posing a challenge to market growth. End-users are primarily comprised of large-scale farms and smaller family-owned operations, with their varying needs impacting product demand. Mergers and acquisitions (M&A) activity has been relatively modest in recent years, with an estimated xx Million USD in M&A volume during 2019-2024, indicating potential for future consolidation. The Herfindahl-Hirschman Index (HHI) for the market is estimated at xx, suggesting a moderately concentrated market.

- Market Concentration: Moderately concentrated, with key players holding significant shares.

- Innovation Drivers: Automation, precision agriculture, and sustainability technologies.

- Regulatory Impacts: Increasing focus on environmental regulations and farm efficiency.

- Product Substitutes: Manual labor, older machinery (limited impact).

- End-User Segmentation: Large-scale farms and smaller family-owned operations.

- M&A Trends: Relatively low activity (xx Million USD during 2019-2024), but potential for future consolidation.

Japan Agricultural Machinery Industry Market Trends & Opportunities

The Japan agricultural machinery market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven by several key factors. The market size in 2025 is estimated at xx Million USD, expected to reach xx Million USD by 2033. Technological advancements, such as autonomous tractors and precision farming tools, are transforming the industry. Consumer preferences are shifting towards increased efficiency, reduced labor costs, and environmentally friendly solutions. Intensifying competition is spurring innovation and price optimization. The market penetration rate of advanced technologies, like GPS-guided machinery, is currently at xx% and projected to reach xx% by 2033. Opportunities exist in developing sustainable and efficient machinery, catering to the growing demand for food security and reduced environmental impact. Government initiatives promoting technological adoption within the agricultural sector also contribute to positive market growth.

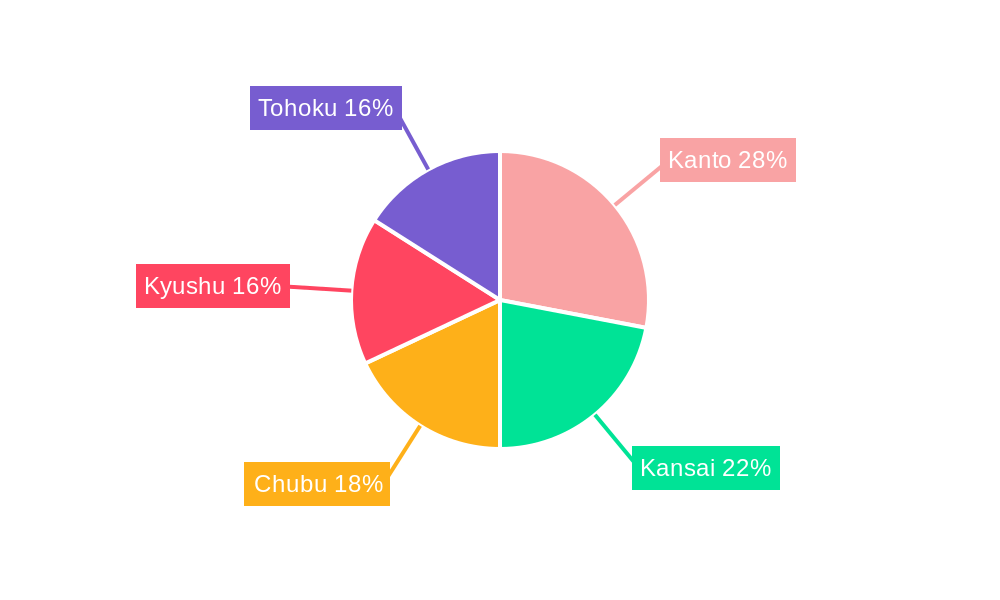

Dominant Markets & Segments in Japan Agricultural Machinery Industry

Tractors represent the dominant product type within the Japanese agricultural machinery market, with the 'Above 50 HP' segment demonstrating the strongest growth trajectory, driven by large-scale farming operations. Within tractor types, Utility Tractors and Row Crop Tractors hold the largest market shares. The Hokkaido region demonstrates the highest market demand for agricultural machinery due to its large-scale farming practices and favorable climatic conditions. Ploughing and Cultivating Machinery, along with Harvesting Machinery, also hold significant market shares.

- Key Growth Drivers:

- Increasing demand for efficient and high-output machinery.

- Government support for agricultural technology adoption.

- Growing emphasis on sustainable farming practices.

- Expansion of large-scale farming operations.

- Favorable climatic conditions in key agricultural regions.

The market for irrigation machinery is experiencing moderate growth, fuelled by water scarcity concerns and the need for efficient irrigation techniques.

Japan Agricultural Machinery Industry Product Analysis

The Japanese agricultural machinery market is characterized by a diverse range of products, with a strong emphasis on technological innovation. Tractors, ranging from compact utility models to high-horsepower machines, dominate the market. Recent advancements include autonomous tractors, precision planting and harvesting equipment, and GPS-guided machinery. These innovations enhance efficiency, reduce labor costs, and improve overall farm productivity, aligning perfectly with the evolving needs of modern Japanese agriculture.

Key Drivers, Barriers & Challenges in Japan Agricultural Machinery Industry

Key Drivers:

- Technological advancements: Automation, precision farming, and data analytics.

- Government initiatives: Subsidies and policies supporting agricultural modernization.

- Increasing labor costs: Driving demand for automated solutions.

Key Challenges:

- High initial investment costs for advanced technology.

- Aging farming population and labor shortages.

- Supply chain disruptions affecting component availability.

- xx% decrease in government subsidies (predicted).

Growth Drivers in the Japan Agricultural Machinery Industry Market

Technological advancements, especially in automation and precision agriculture, are key growth drivers. Government support through subsidies and incentives for modernization further accelerates market expansion. Rising labor costs and a shrinking agricultural workforce create a strong impetus for adopting labor-saving machinery.

Challenges Impacting Japan Agricultural Machinery Industry Growth

High initial investment costs for advanced machinery present a major barrier, particularly for smaller farms. An aging farming population and labor shortages limit the workforce capable of operating and maintaining sophisticated equipment. Supply chain vulnerabilities, especially concerning imported components, can disrupt production and increase costs.

Key Players Shaping the Japan Agricultural Machinery Industry Market

- AGCO Corp (including Massey Ferguson)

- Deere and Company

- CNH Industrial NV

- Kubota Corporation

- Mahindra & Mahindra Ltd

- Kukje Machinery Company Limited

- Kubota Tractor Corp

- Agrale

- Yanmar Company Limited

- Netafim Limite

Significant Japan Agricultural Machinery Industry Industry Milestones

- November 2021: John Deere updated its 6R Tractor lineup, introducing models with increased horsepower and advanced features. This enhanced product offering strengthened Deere's position within the high-horsepower tractor segment.

- January 2022: John Deere unveiled a fully autonomous tractor, signifying a major leap in automation technology for large-scale farming. This launch has the potential to redefine farming practices in Japan.

- October 2022: Kubota opened a Global Institute of Technology in Osaka, focusing on R&D for new products tailored to regional needs. This signifies a commitment to technological innovation within the Japanese market.

Future Outlook for Japan Agricultural Machinery Industry Market

The Japanese agricultural machinery market is poised for continued growth, fueled by technological innovation, government support, and evolving farming practices. Opportunities abound in developing sustainable and efficient machinery, catering to the demand for food security and environmental responsibility. The increasing adoption of precision agriculture techniques and automation will further drive market expansion, creating significant opportunities for industry players. The market is expected to witness further consolidation, with larger players potentially acquiring smaller companies to expand their market share.

Japan Agricultural Machinery Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Japan Agricultural Machinery Industry Segmentation By Geography

- 1. Japan

Japan Agricultural Machinery Industry Regional Market Share

Geographic Coverage of Japan Agricultural Machinery Industry

Japan Agricultural Machinery Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.51% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming

- 3.3. Market Restrains

- 3.3.1. Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns

- 3.4. Market Trends

- 3.4.1. The Need to Increase Farm Productivity Triggers the Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Agricultural Machinery Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Messey Ferguson (AGCO)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Deere and Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Netafim Limite

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CNH Industrial NV

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kubota Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mahindra & Mahindra Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kukje Machinery Company Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kubota Tractor Corp

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 AGCO Corp

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Agrale

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Yanmar Company Limited

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Messey Ferguson (AGCO)

List of Figures

- Figure 1: Japan Agricultural Machinery Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Japan Agricultural Machinery Industry Share (%) by Company 2025

List of Tables

- Table 1: Japan Agricultural Machinery Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Japan Agricultural Machinery Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 3: Japan Agricultural Machinery Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 4: Japan Agricultural Machinery Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 5: Japan Agricultural Machinery Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 6: Japan Agricultural Machinery Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 7: Japan Agricultural Machinery Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 8: Japan Agricultural Machinery Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 9: Japan Agricultural Machinery Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 10: Japan Agricultural Machinery Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 11: Japan Agricultural Machinery Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 12: Japan Agricultural Machinery Industry Volume Kiloton Forecast, by Region 2020 & 2033

- Table 13: Japan Agricultural Machinery Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 14: Japan Agricultural Machinery Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 15: Japan Agricultural Machinery Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 16: Japan Agricultural Machinery Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 17: Japan Agricultural Machinery Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 18: Japan Agricultural Machinery Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Japan Agricultural Machinery Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Japan Agricultural Machinery Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 21: Japan Agricultural Machinery Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 22: Japan Agricultural Machinery Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 23: Japan Agricultural Machinery Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Japan Agricultural Machinery Industry Volume Kiloton Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Agricultural Machinery Industry?

The projected CAGR is approximately 5.51%.

2. Which companies are prominent players in the Japan Agricultural Machinery Industry?

Key companies in the market include Messey Ferguson (AGCO), Deere and Company, Netafim Limite, CNH Industrial NV, Kubota Corporation, Mahindra & Mahindra Ltd, Kukje Machinery Company Limited, Kubota Tractor Corp, AGCO Corp, Agrale, Yanmar Company Limited.

3. What are the main segments of the Japan Agricultural Machinery Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.9 billion as of 2022.

5. What are some drivers contributing to market growth?

Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming.

6. What are the notable trends driving market growth?

The Need to Increase Farm Productivity Triggers the Demand.

7. Are there any restraints impacting market growth?

Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns.

8. Can you provide examples of recent developments in the market?

October 2022: Kubota company opened the Global Institute of Technology in Osaka, Japan which aims to increase research and development for new product developments per the region's business landscape and needs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Agricultural Machinery Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Agricultural Machinery Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Agricultural Machinery Industry?

To stay informed about further developments, trends, and reports in the Japan Agricultural Machinery Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence