Key Insights

The Nigerian satellite communications market is projected for robust expansion, with an estimated market size of $0.62 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 20.4%. This growth is primarily driven by escalating demand for broadband internet, particularly in remote regions, alongside significant investments in satellite infrastructure and services. The telecommunications sector's expansion, the proliferation of digital services, and government initiatives aimed at enhancing nationwide connectivity are key growth catalysts. Key contributing segments include maritime communications, defense and government applications, and the rapidly growing media and entertainment sector, all of which depend on satellite technology for extensive and dependable service delivery. The market landscape encompasses a variety of platforms, such as portable, land, maritime, and airborne systems, as well as comprehensive service offerings including ground equipment and technical support. Despite existing challenges like regulatory complexities and the inherent cost of satellite technology, the long-term outlook for the Nigerian satellite communications market remains highly positive, supported by continuous technological advancements and increasing public and private sector investments.

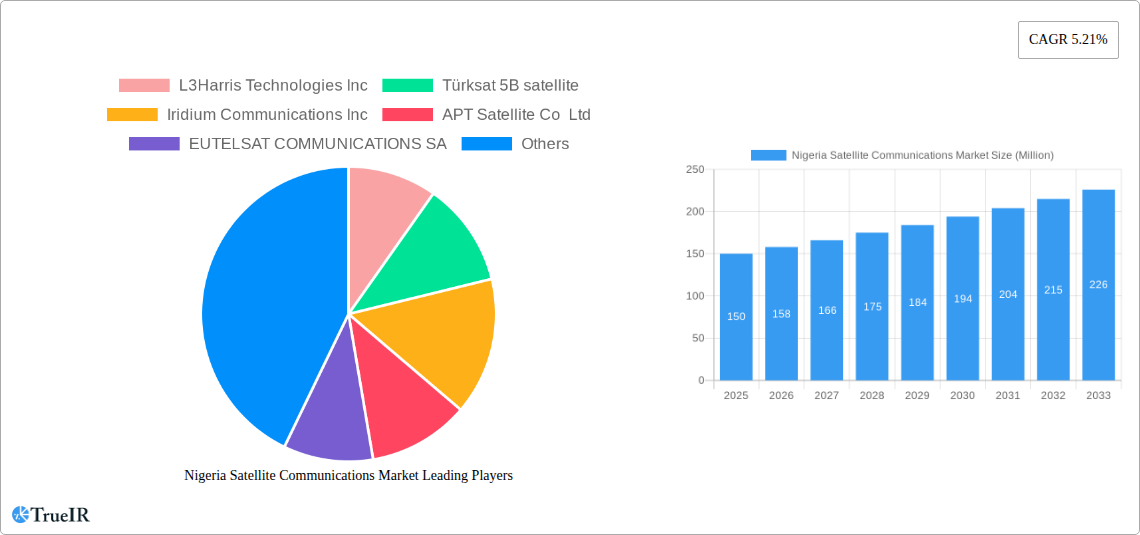

Nigeria Satellite Communications Market Market Size (In Million)

Market segmentation reveals substantial opportunities within specific verticals. Maritime communications are a significant growth driver, essential for Nigeria's extensive maritime operations. Defense and government entities critically rely on secure satellite communication for national security objectives and efficient public service provision. The media and entertainment industry, fueled by the expansion of broadcast and streaming services, represents another major contributor to market growth. The presence of established global players like L3Harris Technologies, Inmarsat, and ViaSat, complemented by regional operators such as Nigcomast, underscores a competitive yet vibrant market environment. Future market expansion will be contingent on addressing infrastructural constraints, refining regulatory frameworks, and fostering collaborative partnerships among government bodies, private enterprises, and international stakeholders to effectively bridge the digital divide and elevate national connectivity. The widespread adoption of High-Throughput Satellite (HTS) technology is anticipated to profoundly influence market growth, offering enhanced capacity and reduced costs, thereby unlocking new avenues for market development.

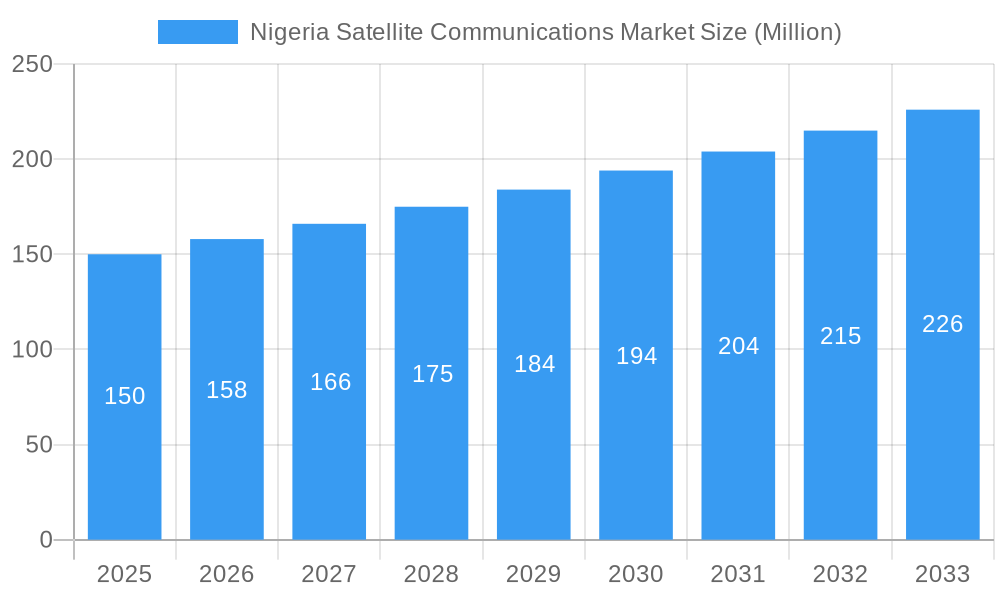

Nigeria Satellite Communications Market Company Market Share

Nigeria Satellite Communications Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the dynamic Nigeria satellite communications market, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period from 2019 to 2033, with a focus on 2025, this report dissects market trends, competitive landscapes, and future growth projections. The Nigerian satellite communications market is poised for significant expansion, driven by technological advancements and increasing demand across diverse sectors. This report is crucial for understanding the opportunities and challenges within this rapidly evolving market. The market is estimated to be worth xx Million in 2025 and is projected to reach xx Million by 2033.

Nigeria Satellite Communications Market Structure & Competitive Landscape

The Nigerian satellite communications market exhibits a moderately concentrated structure, with a handful of major players alongside numerous smaller, regional operators. Market concentration ratios are currently estimated at xx%, indicating moderate competition and room for further market entry. Innovation is driven by the demand for high-throughput satellite (HTS) technology and advancements in broadband satellite services. Regulatory frameworks, while evolving, impact market access and licensing. Key product substitutes include terrestrial fiber optic networks and cellular technologies, although satellite remains essential for remote and underserved areas.

The end-user segmentation is diverse, encompassing maritime, defense and government, enterprises, media and entertainment, and other verticals. Mergers and acquisitions (M&A) activity has been relatively moderate in recent years, with a total M&A volume estimated at xx Million in the last five years. Future M&A activity is anticipated to increase with consolidation and expansion within this market.

- Market Concentration: xx% (2025 Estimate)

- Innovation Drivers: HTS technology, advancements in broadband satellite services

- Regulatory Impacts: Licensing, spectrum allocation

- Product Substitutes: Terrestrial fiber, cellular networks

- End-User Segmentation: Maritime, Defense & Government, Enterprises, Media & Entertainment, Others

- M&A Trends: Moderate activity, estimated xx Million in M&A volume (2020-2024).

Nigeria Satellite Communications Market Trends & Opportunities

The Nigerian satellite communications market is experiencing robust growth, driven by increasing demand for reliable broadband connectivity, particularly in underserved regions. The market size grew at a CAGR of xx% during the historical period (2019-2024) and is projected to continue growing at a CAGR of xx% during the forecast period (2025-2033). Technological shifts towards HTS, low-earth orbit (LEO) constellations, and improved ground segment technologies are enhancing service capabilities and affordability. Consumer preferences lean towards higher bandwidth, lower latency, and cost-effective solutions. Competitive dynamics are characterized by both local and international players vying for market share. Market penetration rates currently stand at approximately xx% and are anticipated to increase significantly by 2033.

Dominant Markets & Segments in Nigeria Satellite Communications Market

The Nigerian satellite communications market is geographically distributed across the country, with significant demand from urban and rural areas. However, the maritime sector currently shows the highest revenue generation. The land segment holds considerable potential, especially with the extension of broadband infrastructure.

Leading Segments:

- By Platform: Maritime (currently dominant), followed by Land. Airborne and Portable segments showing steady growth.

- By End-user Vertical: Maritime (highest revenue), Defense and Government (significant government spending), Enterprises (growing adoption of satellite solutions).

- By Type: Services segment showing stronger growth than Ground Equipment.

Key Growth Drivers:

- Infrastructure Development: Investments in ground infrastructure and satellite-based communication networks.

- Government Initiatives: Policies and regulations promoting digital inclusion and broadband accessibility.

- Economic Growth: Increased demand from various sectors, including energy, telecommunications, and transportation.

Nigeria Satellite Communications Market Product Analysis

Technological advancements in satellite technology, such as HTS and LEO constellations, are driving product innovation. This includes more efficient and cost-effective satellite services with higher bandwidth and lower latency. The market is seeing an increased demand for integrated solutions that combine satellite technology with terrestrial networks to offer seamless connectivity. These advancements are improving market fit by providing reliable and affordable connectivity to a wider range of users.

Key Drivers, Barriers & Challenges in Nigeria Satellite Communications Market

Key Drivers:

- Expanding Broadband Demand: The growing need for reliable broadband access in both urban and rural areas.

- Government Support: Increased investment in infrastructure and supportive policies.

- Technological Advancements: HTS and LEO constellations offer improved performance and cost-effectiveness.

Key Challenges and Restraints:

- Regulatory Hurdles: Complex licensing procedures and spectrum allocation challenges.

- Infrastructure Gaps: Limited ground infrastructure in certain regions restricts market penetration.

- High Capital Expenditure: The high cost of deploying and maintaining satellite infrastructure.

- Power Issues: The lack of reliable electricity in many parts of Nigeria. This issue impacts the viability of ground stations.

Growth Drivers in the Nigeria Satellite Communications Market

The key drivers propelling the growth of the Nigerian satellite communications market include the increasing demand for high-speed internet access, particularly in remote areas; the government's focus on digital inclusion initiatives and infrastructure development; and continuous technological advancements in satellite technology, leading to increased efficiency and affordability.

Challenges Impacting Nigeria Satellite Communications Market Growth

Challenges hindering market growth include the high cost of satellite technology and infrastructure, regulatory complexities related to licensing and spectrum allocation, power supply issues impacting ground station operations and the need to improve digital literacy to encourage wider adoption of satellite communications solutions. These issues create barriers to broader market penetration.

Key Players Shaping the Nigeria Satellite Communications Market

- L3Harris Technologies Inc

- Türksat 5B satellite

- Iridium Communications Inc

- APT Satellite Co Ltd

- EUTELSAT COMMUNICATIONS SA

- Gilat Satellite Networks

- Inmarsat global limited

- AMOS Spacecom

- ViaSat Inc

- Nigcomast

Significant Nigeria Satellite Communications Market Industry Milestones

- May 2023: Nigcomast Ltd partners with NAPET (NNPC subsidiary) to provide satellite monitoring services for critical equipment. This collaboration demonstrates the growing application of satellite technology in Nigeria's energy sector.

- January 2023: SpaceX launches Starlink services in Nigeria, making it the first African country with access to this service. This significantly expands broadband access options across Nigeria.

Future Outlook for Nigeria Satellite Communications Market

The Nigerian satellite communications market is poised for sustained growth, driven by increasing demand for broadband, government initiatives, and technological advancements. Strategic opportunities exist in expanding services to underserved regions and focusing on innovative applications across various sectors. The market's potential for expansion is considerable, particularly with increased investment in infrastructure and regulatory support.

Nigeria Satellite Communications Market Segmentation

-

1. Type

- 1.1. Ground Equipment

- 1.2. Services

-

2. Platform

- 2.1. Portable

- 2.2. Land

- 2.3. Maritime

- 2.4. Airborn3

-

3. End-user Vertical

- 3.1. Maritime

- 3.2. Defense and Government

- 3.3. Enterprises

- 3.4. Media and Entertainment

- 3.5. Other End-user Verticals

Nigeria Satellite Communications Market Segmentation By Geography

- 1. Niger

Nigeria Satellite Communications Market Regional Market Share

Geographic Coverage of Nigeria Satellite Communications Market

Nigeria Satellite Communications Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 20.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defence Satellite Communication Solutions

- 3.3. Market Restrains

- 3.3.1. Cybersecurity Threats to Satellite Communication; Interference in the Transmission of Data

- 3.4. Market Trends

- 3.4.1. Increase in Internet of Things (IoT) and Autonomous Systems is Driving the Nigeria Satellite Communication Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Nigeria Satellite Communications Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Ground Equipment

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Platform

- 5.2.1. Portable

- 5.2.2. Land

- 5.2.3. Maritime

- 5.2.4. Airborn3

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. Maritime

- 5.3.2. Defense and Government

- 5.3.3. Enterprises

- 5.3.4. Media and Entertainment

- 5.3.5. Other End-user Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Niger

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 L3Harris Technologies Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Türksat 5B satellite

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Iridium Communications Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 APT Satellite Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 EUTELSAT COMMUNICATIONS SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Gilat Satellite Networks

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Inmarsat global limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AMOS Spacecom

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ViaSat Inc 7 2 *List Not Exhaustiv

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Nigcomast

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 L3Harris Technologies Inc

List of Figures

- Figure 1: Nigeria Satellite Communications Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Nigeria Satellite Communications Market Share (%) by Company 2025

List of Tables

- Table 1: Nigeria Satellite Communications Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Nigeria Satellite Communications Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 3: Nigeria Satellite Communications Market Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 4: Nigeria Satellite Communications Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Nigeria Satellite Communications Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Nigeria Satellite Communications Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 7: Nigeria Satellite Communications Market Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 8: Nigeria Satellite Communications Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Nigeria Satellite Communications Market?

The projected CAGR is approximately 20.4%.

2. Which companies are prominent players in the Nigeria Satellite Communications Market?

Key companies in the market include L3Harris Technologies Inc, Türksat 5B satellite, Iridium Communications Inc, APT Satellite Co Ltd, EUTELSAT COMMUNICATIONS SA, Gilat Satellite Networks, Inmarsat global limited, AMOS Spacecom, ViaSat Inc 7 2 *List Not Exhaustiv, Nigcomast.

3. What are the main segments of the Nigeria Satellite Communications Market?

The market segments include Type, Platform, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.62 billion as of 2022.

5. What are some drivers contributing to market growth?

Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defence Satellite Communication Solutions.

6. What are the notable trends driving market growth?

Increase in Internet of Things (IoT) and Autonomous Systems is Driving the Nigeria Satellite Communication Market.

7. Are there any restraints impacting market growth?

Cybersecurity Threats to Satellite Communication; Interference in the Transmission of Data.

8. Can you provide examples of recent developments in the market?

May 2023 - Nigcomast Ltd has announced a collaboration with National Petroleum Telecommunications Limited (NAPET), a subsidiary of the Nigerian National Petroleum Company Limited (NNPC). The collaboration will provide satellite monitoring services for critical equipment and services.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Nigeria Satellite Communications Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Nigeria Satellite Communications Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Nigeria Satellite Communications Market?

To stay informed about further developments, trends, and reports in the Nigeria Satellite Communications Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence