Key Insights

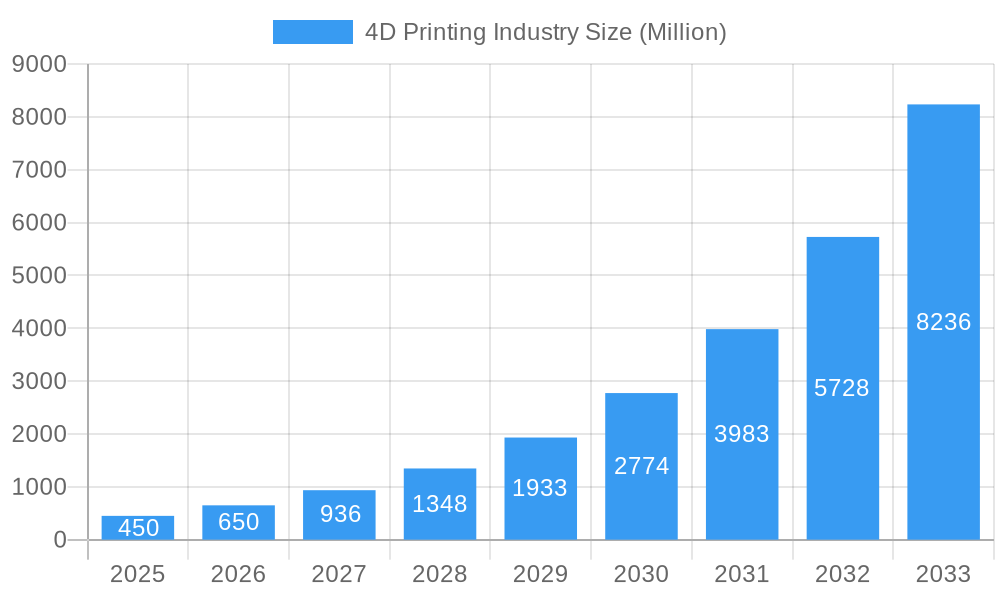

The 4D printing market, valued at $450 million in 2025, is poised for significant growth, exhibiting a remarkable Compound Annual Growth Rate (CAGR) of 44.75% from 2025 to 2033. This explosive expansion is driven by several key factors. Firstly, the increasing demand for customized and complex components across diverse industries like aerospace, automotive, and medical, fuels the adoption of 4D printing's unique capabilities. The ability to create self-assembling and shape-shifting materials opens up new possibilities for product design and functionality, surpassing the limitations of traditional manufacturing processes. Furthermore, advancements in programmable materials, such as programmable carbon fiber, textiles, biomaterials, and wood, are expanding the application range and pushing the technological boundaries of 4D printing. This continuous innovation attracts significant investments and fosters a dynamic competitive landscape. While challenges remain, such as the relatively high cost of materials and the need for specialized expertise, the overall market momentum is undeniable.

4D Printing Industry Market Size (In Million)

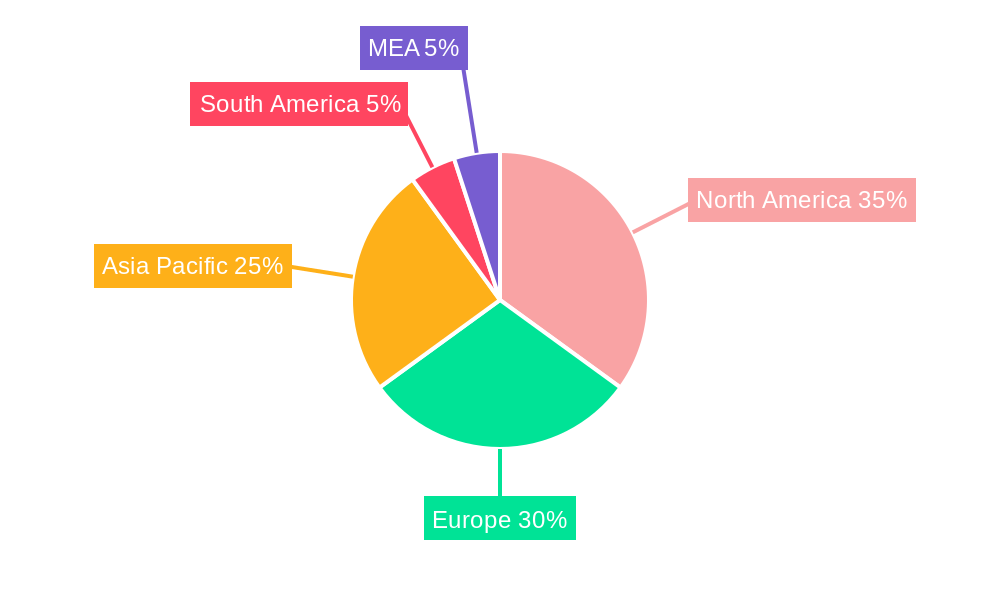

The regional landscape shows a diversified distribution, with North America and Europe currently leading in market share due to established technological infrastructure and high adoption rates within key industries. However, the Asia-Pacific region is projected to experience substantial growth, driven by increasing industrialization, technological advancements, and supportive government initiatives. The various segments, categorized by material type and end-user industry, offer distinct growth opportunities. The medical sector, for example, anticipates significant expansion driven by the need for personalized implants and advanced drug delivery systems. Similarly, the aerospace and defense sector is expected to leverage 4D printing for lightweight, high-performance components, leading to further market expansion. The continued evolution of programmable materials, coupled with falling production costs, will be key drivers in shaping the market’s trajectory during the forecast period.

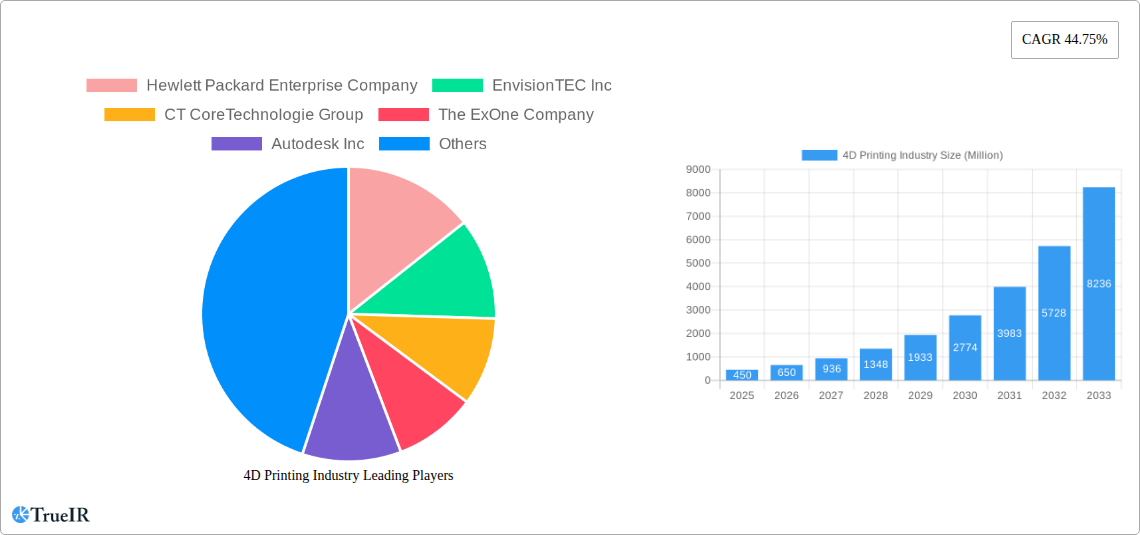

4D Printing Industry Company Market Share

4D Printing Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the 4D printing industry, projecting a market value of $XX Million by 2033. Leveraging extensive research covering the historical period (2019-2024), base year (2025), and forecast period (2025-2033), this report offers invaluable insights for businesses, investors, and researchers seeking to navigate this rapidly evolving sector. The report analyzes key market segments, including programmable materials (carbon fiber, textiles, biomaterials, wood) and end-users (medical, aerospace & defense, automotive, others), identifying significant growth opportunities and challenges. Key players like Hewlett Packard Enterprise, EnvisionTEC, and Stratasys are profiled, providing a competitive landscape analysis. Discover the latest industry developments, including Zortrax's collaboration with ESA for space applications, and gain a clear understanding of future market trends and projections.

4D Printing Industry Market Structure & Competitive Landscape

The 4D printing industry is characterized by a moderately concentrated market structure, with a few dominant players holding significant market share. The Herfindahl-Hirschman Index (HHI) for 2024 is estimated at xx, indicating a moderately concentrated market. However, the landscape is dynamic, marked by continuous innovation and strategic mergers and acquisitions (M&A) activity. The total M&A volume in the sector from 2019 to 2024 reached approximately $XX Million.

Several factors influence the competitive landscape:

- Innovation Drivers: Continuous advancements in material science, software, and printing technologies drive market growth and competition.

- Regulatory Impacts: Government regulations concerning material safety and environmental impact play a crucial role in shaping market dynamics.

- Product Substitutes: Traditional manufacturing methods and emerging additive manufacturing technologies pose competitive pressure.

- End-User Segmentation: The diverse needs of various end-user sectors (medical, aerospace, automotive, etc.) necessitate specialized solutions, creating niche markets.

- M&A Trends: Strategic acquisitions and partnerships are common, contributing to market consolidation and technological advancements.

4D Printing Industry Market Trends & Opportunities

The global 4D printing market is experiencing significant growth, with a projected Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033, driven by increasing demand across various sectors. The market size is estimated at $XX Million in 2025 and is expected to reach $XX Million by 2033. This expansion is fueled by several key trends:

- Technological Advancements: Continuous improvements in printing resolution, material properties, and software capabilities are broadening applications and enhancing efficiency.

- Material Innovation: The development of new programmable materials with enhanced properties expands the possibilities of 4D printing across multiple industries.

- Rising Adoption in Diverse Sectors: Growing adoption across sectors like aerospace, automotive, and healthcare, driven by the need for customized, lightweight, and functional components.

- Increased Investment: Significant investments in research and development are fueling innovation and accelerating market growth.

- Emerging Applications: Expanding applications in areas such as personalized medicine, smart textiles, and flexible electronics further boost market expansion.

- Market Penetration Rates: Market penetration rates are expected to increase significantly in the forecast period, particularly in the medical and aerospace and defense sectors.

Dominant Markets & Segments in 4D Printing Industry

The North American region currently holds a dominant position in the 4D printing market, driven by robust technological advancements, significant investments in R&D, and a strong presence of key players. However, Asia-Pacific is poised for substantial growth due to the increasing adoption in developing economies and favorable government initiatives.

Key Growth Drivers:

- Technological Advancements: Continuous innovation in materials and printing technologies is driving adoption across industries.

- Government Support: Increasing government funding and supportive policies are promoting market growth.

- Industry Collaboration: Partnerships between technology providers and end-users are fostering development and implementation.

Dominant Segments:

- Programmable Biomaterials: This segment demonstrates the highest growth potential due to its wide range of applications in the medical and healthcare sectors. The market value of this segment is projected to reach $XX Million by 2033.

- Aerospace & Defense End-User: This segment shows strong growth due to the high demand for lightweight, durable, and customizable components.

4D Printing Industry Product Analysis

4D printing products are characterized by their ability to change shape or properties in response to external stimuli. Recent innovations focus on improving material properties, expanding the range of programmable materials, and developing advanced software for design and control. This enhances the precision, speed, and versatility of 4D printing, opening up new applications across multiple industries. Competitive advantages arise from superior material properties, software integration, and the ability to offer customized solutions to specific end-user needs.

Key Drivers, Barriers & Challenges in 4D Printing Industry

Key Drivers:

- Technological advancements: Continuous improvement in printing resolution, speed, and material properties.

- Rising demand across sectors: Increased adoption in aerospace, automotive, and medical industries.

- Government support & incentives: Funding for research and development and supportive regulations.

Key Challenges:

- High initial investment costs: The high cost of equipment and materials limits adoption, particularly for smaller companies.

- Supply chain complexities: The specialized nature of materials and equipment creates supply chain vulnerabilities.

- Lack of skilled workforce: A shortage of qualified personnel hinders market growth.

- Regulatory hurdles: Strict regulations surrounding material safety and environmental impact create challenges.

Growth Drivers in the 4D Printing Industry Market

Technological breakthroughs, particularly in material science, are a primary growth driver. Increasing demand from key sectors like aerospace and medicine, coupled with supportive government policies and funding, further accelerate market expansion. The rising need for customized and lightweight components fuels growth.

Challenges Impacting 4D Printing Industry Growth

High initial investment costs remain a significant barrier, limiting adoption. Complex supply chains and the scarcity of skilled labor also pose challenges. Stringent regulatory frameworks related to material safety and environmental impact can slow market expansion. Competition from established manufacturing methods also presents an ongoing obstacle.

Key Players Shaping the 4D Printing Industry Market

- Hewlett Packard Enterprise Company

- EnvisionTEC Inc

- CT CoreTechnologie Group

- The ExOne Company

- Autodesk Inc

- Organovo Holdings Inc

- Materialise NV

- Dassault Systemes SA

- Stratasys Ltd

Significant 4D Printing Industry Milestones

- June 2023: Zortrax, in collaboration with the European Space Agency (ESA), developed 4D printing technology for space applications, utilizing the M300 Dual FDM printer and a modified Z-SUITE software to 3D print structures from shape memory polymers and electrically conductive materials. This milestone highlights the growing use of 4D printing in extreme environments and signifies technological advancements in material science and printing techniques.

Future Outlook for 4D Printing Industry Market

The 4D printing industry is poised for continued expansion, driven by technological innovations, rising demand across various sectors, and supportive government policies. Strategic partnerships and collaborations will further accelerate market growth. The potential for customized solutions and the ability to create complex geometries will unlock new applications, expanding the market's reach across diverse industries. The focus on sustainable and biocompatible materials will also drive future growth.

4D Printing Industry Segmentation

-

1. Type of Programmable Material

- 1.1. Programmable Carbon Fiber

- 1.2. Programmable Textiles

- 1.3. Programmable Bio material

- 1.4. Programmable Wood

-

2. End User

- 2.1. Medical

- 2.2. Aerospace and Defense

- 2.3. Automotive

- 2.4. Other End Users

4D Printing Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

4D Printing Industry Regional Market Share

Geographic Coverage of 4D Printing Industry

4D Printing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 44.75% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Demand for Industry 4.0 and Emergence of Industry 5.0

- 3.3. Market Restrains

- 3.3.1. Wide Availability of Open Source CAM Software

- 3.4. Market Trends

- 3.4.1. Increase in Demand for Industry 4.0 and Emergence of Industry 5.0 to Drive the 4D Printing Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global 4D Printing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Programmable Material

- 5.1.1. Programmable Carbon Fiber

- 5.1.2. Programmable Textiles

- 5.1.3. Programmable Bio material

- 5.1.4. Programmable Wood

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Medical

- 5.2.2. Aerospace and Defense

- 5.2.3. Automotive

- 5.2.4. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type of Programmable Material

- 6. North America 4D Printing Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type of Programmable Material

- 6.1.1. Programmable Carbon Fiber

- 6.1.2. Programmable Textiles

- 6.1.3. Programmable Bio material

- 6.1.4. Programmable Wood

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Medical

- 6.2.2. Aerospace and Defense

- 6.2.3. Automotive

- 6.2.4. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Type of Programmable Material

- 7. Europe 4D Printing Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type of Programmable Material

- 7.1.1. Programmable Carbon Fiber

- 7.1.2. Programmable Textiles

- 7.1.3. Programmable Bio material

- 7.1.4. Programmable Wood

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Medical

- 7.2.2. Aerospace and Defense

- 7.2.3. Automotive

- 7.2.4. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Type of Programmable Material

- 8. Asia Pacific 4D Printing Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type of Programmable Material

- 8.1.1. Programmable Carbon Fiber

- 8.1.2. Programmable Textiles

- 8.1.3. Programmable Bio material

- 8.1.4. Programmable Wood

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Medical

- 8.2.2. Aerospace and Defense

- 8.2.3. Automotive

- 8.2.4. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Type of Programmable Material

- 9. Rest of the World 4D Printing Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type of Programmable Material

- 9.1.1. Programmable Carbon Fiber

- 9.1.2. Programmable Textiles

- 9.1.3. Programmable Bio material

- 9.1.4. Programmable Wood

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Medical

- 9.2.2. Aerospace and Defense

- 9.2.3. Automotive

- 9.2.4. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Type of Programmable Material

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Hewlett Packard Enterprise Company

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 EnvisionTEC Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 CT CoreTechnologie Group

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 The ExOne Company

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Autodesk Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Organovo Holdings Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Materialise NV

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Dassault Systemes SA

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Stratasys Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Hewlett Packard Enterprise Company

List of Figures

- Figure 1: Global 4D Printing Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America 4D Printing Industry Revenue (Million), by Type of Programmable Material 2025 & 2033

- Figure 3: North America 4D Printing Industry Revenue Share (%), by Type of Programmable Material 2025 & 2033

- Figure 4: North America 4D Printing Industry Revenue (Million), by End User 2025 & 2033

- Figure 5: North America 4D Printing Industry Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America 4D Printing Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America 4D Printing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe 4D Printing Industry Revenue (Million), by Type of Programmable Material 2025 & 2033

- Figure 9: Europe 4D Printing Industry Revenue Share (%), by Type of Programmable Material 2025 & 2033

- Figure 10: Europe 4D Printing Industry Revenue (Million), by End User 2025 & 2033

- Figure 11: Europe 4D Printing Industry Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe 4D Printing Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe 4D Printing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific 4D Printing Industry Revenue (Million), by Type of Programmable Material 2025 & 2033

- Figure 15: Asia Pacific 4D Printing Industry Revenue Share (%), by Type of Programmable Material 2025 & 2033

- Figure 16: Asia Pacific 4D Printing Industry Revenue (Million), by End User 2025 & 2033

- Figure 17: Asia Pacific 4D Printing Industry Revenue Share (%), by End User 2025 & 2033

- Figure 18: Asia Pacific 4D Printing Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific 4D Printing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World 4D Printing Industry Revenue (Million), by Type of Programmable Material 2025 & 2033

- Figure 21: Rest of the World 4D Printing Industry Revenue Share (%), by Type of Programmable Material 2025 & 2033

- Figure 22: Rest of the World 4D Printing Industry Revenue (Million), by End User 2025 & 2033

- Figure 23: Rest of the World 4D Printing Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: Rest of the World 4D Printing Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World 4D Printing Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global 4D Printing Industry Revenue Million Forecast, by Type of Programmable Material 2020 & 2033

- Table 2: Global 4D Printing Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Global 4D Printing Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global 4D Printing Industry Revenue Million Forecast, by Type of Programmable Material 2020 & 2033

- Table 5: Global 4D Printing Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global 4D Printing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global 4D Printing Industry Revenue Million Forecast, by Type of Programmable Material 2020 & 2033

- Table 8: Global 4D Printing Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 9: Global 4D Printing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global 4D Printing Industry Revenue Million Forecast, by Type of Programmable Material 2020 & 2033

- Table 11: Global 4D Printing Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 12: Global 4D Printing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global 4D Printing Industry Revenue Million Forecast, by Type of Programmable Material 2020 & 2033

- Table 14: Global 4D Printing Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 15: Global 4D Printing Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the 4D Printing Industry?

The projected CAGR is approximately 44.75%.

2. Which companies are prominent players in the 4D Printing Industry?

Key companies in the market include Hewlett Packard Enterprise Company, EnvisionTEC Inc, CT CoreTechnologie Group, The ExOne Company, Autodesk Inc, Organovo Holdings Inc, Materialise NV, Dassault Systemes SA, Stratasys Ltd.

3. What are the main segments of the 4D Printing Industry?

The market segments include Type of Programmable Material, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.45 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Demand for Industry 4.0 and Emergence of Industry 5.0.

6. What are the notable trends driving market growth?

Increase in Demand for Industry 4.0 and Emergence of Industry 5.0 to Drive the 4D Printing Market.

7. Are there any restraints impacting market growth?

Wide Availability of Open Source CAM Software.

8. Can you provide examples of recent developments in the market?

June 2023 - Zortrax has developed 4D printing technology in cooperation with ESA. For space applications, use the M300 Dual FDM printer and a modified version of Z-SUITE to 3D print structures made of shape memory polymers and electrically conductive materials.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "4D Printing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the 4D Printing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the 4D Printing Industry?

To stay informed about further developments, trends, and reports in the 4D Printing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence