Key Insights

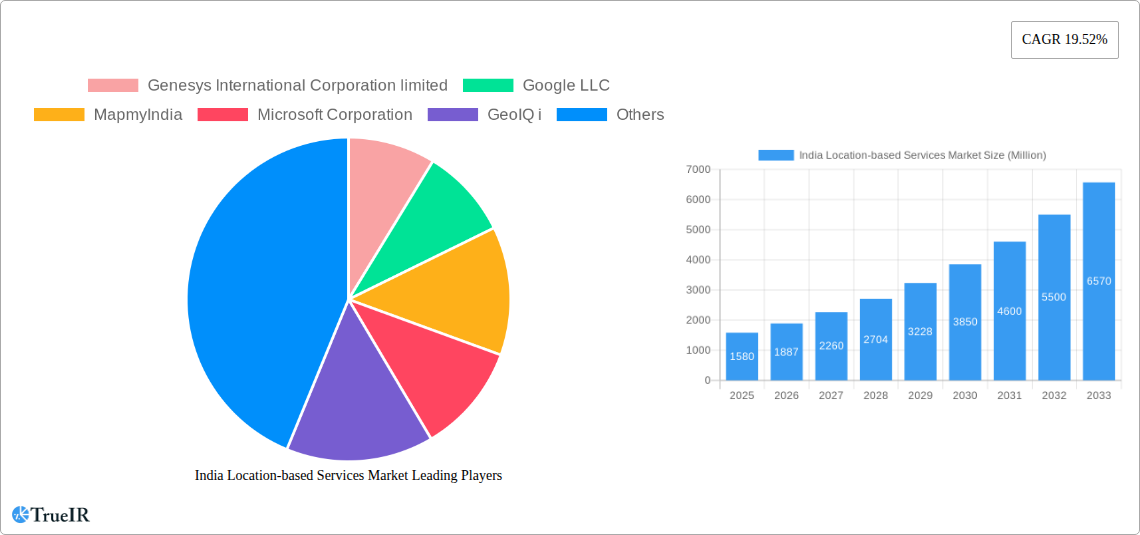

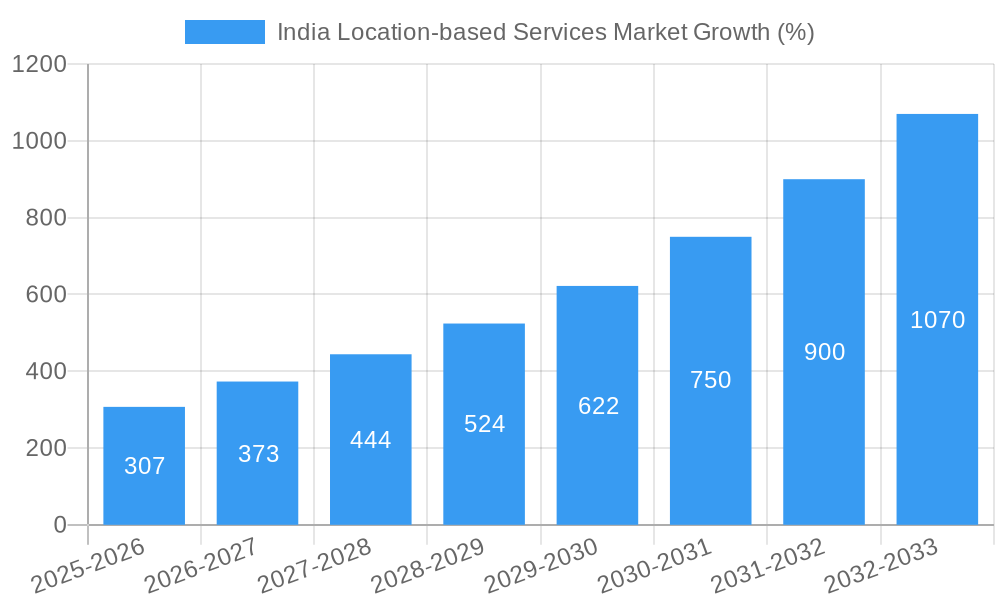

The India Location-based Services (LBS) market is experiencing robust growth, projected to reach \$1.58 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 19.52% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the increasing smartphone penetration and affordable data plans are fueling wider adoption of LBS applications across various sectors. Secondly, the burgeoning e-commerce and on-demand service industries heavily rely on accurate location data for efficient delivery, logistics, and targeted advertising. Government initiatives promoting digitalization and smart city projects further bolster market growth by creating demand for advanced LBS solutions. Finally, the rise of IoT devices and the integration of location intelligence into business analytics are creating new opportunities for market expansion. The market is segmented by end-user (Transportation & Logistics, IT & Telecom, Healthcare, Government, BFSI, Hospitality, Manufacturing, Others), component (Hardware, Software, Services), location (Indoor, Outdoor), and application (Mapping & Navigation, Business Intelligence & Analytics, Location-based Advertising, Social Networking & Entertainment, Others). The diverse applications of LBS across various industries ensure consistent growth, with Transportation & Logistics and IT & Telecom likely to be the largest segments.

The competitive landscape comprises both global giants like Google and Microsoft, and domestic players such as MapmyIndia and Genesys International. While established players benefit from brand recognition and technological expertise, emerging companies are innovating with specialized solutions for niche markets. Regional variations in market penetration exist, with significant growth potential in less-developed regions of India. Challenges remain, however, including concerns regarding data privacy and security, the need for robust infrastructure in rural areas, and the potential for regulatory hurdles. Despite these challenges, the long-term outlook for the India LBS market remains exceptionally positive, fueled by continued technological advancements and increasing digital adoption across the nation. Strategic partnerships between technology providers and businesses will play a crucial role in unlocking the full potential of this rapidly evolving sector.

India Location-Based Services Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the dynamic India location-based services (LBS) market, offering invaluable insights for businesses, investors, and policymakers. We delve into market size, segmentation, key players, growth drivers, and future trends, covering the period from 2019 to 2033. The report leverages extensive research and data analysis, projecting a robust growth trajectory fueled by technological advancements and increasing digital adoption across diverse sectors.

India Location-Based Services Market Structure & Competitive Landscape

The Indian LBS market exhibits a moderately concentrated structure, with a few dominant players and several emerging companies vying for market share. The market is characterized by intense competition, driven by innovation in mapping technologies, data analytics, and mobile applications. Regulatory frameworks, including data privacy and security regulations, significantly impact market operations. Product substitution is relatively low, as LBS solutions often integrate with other core business processes. However, new technologies and business models could lead to disruptions in the future. End-user segmentation is highly diverse, with Transportation & Logistics, IT & Telecom, and Government sectors being significant contributors. The M&A landscape is active, with strategic acquisitions aimed at expanding market reach, acquiring specialized technologies, and strengthening competitive positioning. While precise M&A volume figures are unavailable for public disclosure, a significant number of acquisitions within the last 5 years were observed. The Herfindahl-Hirschman Index (HHI) is estimated to be around xx, indicating a moderately concentrated market.

India Location-Based Services Market Market Trends & Opportunities

The Indian LBS market is experiencing substantial growth, fueled by the rising penetration of smartphones, expanding internet connectivity, and increasing adoption of location-based applications across various sectors. The market size is estimated at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%. Technological advancements, such as the development of advanced mapping technologies (e.g., 3D mapping, high-definition mapping), AI-powered analytics, and improved GPS accuracy, significantly contribute to market growth. Consumer preferences are shifting towards user-friendly, personalized, and data-secure LBS applications. The market is witnessing increased adoption of cloud-based LBS solutions due to their scalability and cost-effectiveness. The competitive dynamics are shaped by constant innovation, strategic partnerships, and the ongoing efforts of both established giants and emerging startups to capture market share. The market penetration rate is expected to increase from xx% in 2025 to xx% by 2033 driven by increased smartphone and internet penetration, along with growing adoption of digital services across the country.

Dominant Markets & Segments in India Location-Based Services Market

The Indian LBS market is witnessing significant growth across various segments.

By End-User:

- Transportation and Logistics: This segment dominates the market due to the widespread adoption of GPS-enabled tracking systems, route optimization solutions, and delivery management applications.

- IT and Telecom: This sector relies heavily on location data for network optimization, infrastructure management, and targeted advertising campaigns.

- Government: Government bodies utilize LBS for public safety, urban planning, resource management, and disaster response.

By Component:

- Software: This segment holds the largest market share owing to the increasing demand for advanced LBS applications and software platforms.

- Services: This is a rapidly growing segment due to the rising need for customized LBS solutions and integration services.

By Location:

- Outdoor: The outdoor segment remains dominant due to the wider adoption of GPS and satellite-based navigation systems.

- Indoor: The indoor segment is gaining traction, driven by the increasing demand for indoor navigation solutions in large buildings and commercial spaces.

By Application:

- Mapping and Navigation: This remains a core application driving the market’s growth.

- Business Intelligence and Analytics: This is a high-growth application leveraging LBS data for insightful business decisions.

Key Growth Drivers:

- Extensive road and infrastructure development projects across India are driving the demand for LBS in various applications, especially in transportation and logistics.

- Government initiatives and policies promoting digital transformation and smart city development are fueling market growth.

- Increased investment in advanced technologies, such as AI and machine learning for LBS applications, is significantly contributing to its expansion.

India Location-Based Services Market Product Analysis

The Indian LBS market showcases a diverse range of products, from basic GPS tracking devices to sophisticated location intelligence platforms. Technological advancements are focused on improving accuracy, enhancing data analytics capabilities, and developing user-friendly interfaces. Products are tailored to specific industry needs, focusing on integration with existing systems and providing customized solutions. Competitive advantages stem from superior accuracy, advanced analytics capabilities, robust data security, and cost-effective solutions. The integration of AI and machine learning is leading the way in improved prediction capabilities and increased automation, enhancing market fit and driving efficiency.

Key Drivers, Barriers & Challenges in India Location-based Services Market

Key Drivers: The market is propelled by the rising adoption of smartphones, increasing internet penetration, the growth of the e-commerce sector, and government initiatives promoting digital infrastructure. Investment in technological innovation and improved GPS accuracy further boosts market growth.

Key Challenges: Data privacy concerns, security risks, and regulatory hurdles associated with data collection and usage pose significant challenges. The need for high-quality data and infrastructure limitations in certain regions hamper wider adoption. Competitive pressures and the need for continuous innovation also pose challenges. For example, the limited availability of reliable high-speed internet in certain rural areas restricts wider LBS adoption.

Growth Drivers in the India Location-Based Services Market

The growth of the Indian LBS market is driven by several factors. Increased smartphone penetration and improved internet connectivity are fundamental drivers. Government initiatives supporting digitalization and smart city development projects create considerable demand. Technological advancements, such as AI-powered location analytics, are also significant growth drivers. Lastly, the rising adoption of LBS across various sectors, particularly logistics and e-commerce, significantly fuels market expansion.

Challenges Impacting India Location-Based Services Market Growth

Challenges to the Indian LBS market include data privacy concerns, infrastructure limitations in remote areas, and varying levels of digital literacy across the population. Regulatory uncertainty surrounding data usage and cybersecurity remain critical. Furthermore, competition from established and emerging players necessitates continuous innovation to maintain a competitive edge.

Key Players Shaping the India Location-Based Services Market

- Genesys International Corporation Limited

- Google LLC

- MapmyIndia

- Microsoft Corporation

- GeoIQ i

- Roam ai

- Aruba Networks

- LocationIQ

- Pert Telecom Solutions Pvt Ltd

- Mapsense Technologies (OPC) Private Limited

Significant India Location-Based Services Market Industry Milestones

- May 2023: ISRO launched NVS-01, India's next-generation navigation satellite, significantly enhancing real-time positioning services across India and a 1,500 km radius. This improved accuracy and broader coverage are expected to significantly boost LBS adoption.

- September 2022: Bentley Systems and Genesys International collaborated to create 3D city digital twins for urban India, leveraging OpenCities 365. This partnership will enhance urban planning, disaster management, and public services, directly impacting the LBS market's growth within the government and smart city sectors.

Future Outlook for India Location-Based Services Market

The Indian LBS market is poised for continued strong growth, driven by sustained increases in smartphone penetration and internet connectivity. The expanding adoption of LBS in various sectors, particularly logistics, e-commerce, and government services, creates significant opportunities. Technological innovation and strategic partnerships will further propel the market forward, resulting in an increasingly sophisticated and integrated LBS ecosystem. Government initiatives focused on digital infrastructure will further contribute to this expansion.

India Location-based Services Market Segmentation

-

1. Component

- 1.1. Hardware

- 1.2. Software

- 1.3. Services

-

2. Location

- 2.1. Indoor

- 2.2. Outdoor

-

3. Application

- 3.1. Mapping and Navigation

- 3.2. Business Intelligence and Analytics

- 3.3. Location-based Advertising

- 3.4. Social Networking and Entertainment

- 3.5. Other Applications

-

4. End-User

- 4.1. Transportation and Logistics

- 4.2. IT and Telecom

- 4.3. Healthcare

- 4.4. Government

- 4.5. BFSI

- 4.6. Hospitality

- 4.7. Manufacturing

- 4.8. Other End-Users

India Location-based Services Market Segmentation By Geography

- 1. India

India Location-based Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 19.52% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Geo-based Marketing; Emerging Use-cases for LBS due to High Penetration of Social Media and Location-based App Adoption

- 3.3. Market Restrains

- 3.3.1. Rise in the privacy and security issues

- 3.4. Market Trends

- 3.4.1. The Increasing Adoption of Smartphones and Other Mobile Devices

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Location-based Services Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. Services

- 5.2. Market Analysis, Insights and Forecast - by Location

- 5.2.1. Indoor

- 5.2.2. Outdoor

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Mapping and Navigation

- 5.3.2. Business Intelligence and Analytics

- 5.3.3. Location-based Advertising

- 5.3.4. Social Networking and Entertainment

- 5.3.5. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by End-User

- 5.4.1. Transportation and Logistics

- 5.4.2. IT and Telecom

- 5.4.3. Healthcare

- 5.4.4. Government

- 5.4.5. BFSI

- 5.4.6. Hospitality

- 5.4.7. Manufacturing

- 5.4.8. Other End-Users

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. India

- 5.1. Market Analysis, Insights and Forecast - by Component

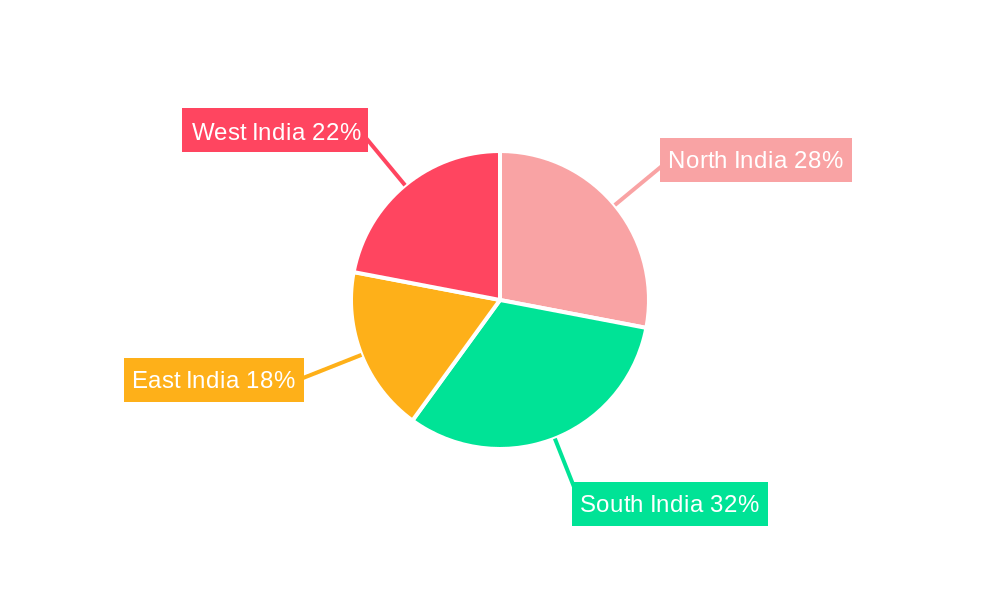

- 6. North India India Location-based Services Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Location-based Services Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Location-based Services Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Location-based Services Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Genesys International Corporation limited

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Google LLC

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 MapmyIndia

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Microsoft Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 GeoIQ i

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Roam ai

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Aruba Networks

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 LocationIQ

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Pert Telecom Solutions Pvt Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Mapsense Technologies (OPC) Private Limited

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Genesys International Corporation limited

List of Figures

- Figure 1: India Location-based Services Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Location-based Services Market Share (%) by Company 2024

List of Tables

- Table 1: India Location-based Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Location-based Services Market Revenue Million Forecast, by Component 2019 & 2032

- Table 3: India Location-based Services Market Revenue Million Forecast, by Location 2019 & 2032

- Table 4: India Location-based Services Market Revenue Million Forecast, by Application 2019 & 2032

- Table 5: India Location-based Services Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 6: India Location-based Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: India Location-based Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: North India India Location-based Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South India India Location-based Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: East India India Location-based Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: West India India Location-based Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: India Location-based Services Market Revenue Million Forecast, by Component 2019 & 2032

- Table 13: India Location-based Services Market Revenue Million Forecast, by Location 2019 & 2032

- Table 14: India Location-based Services Market Revenue Million Forecast, by Application 2019 & 2032

- Table 15: India Location-based Services Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 16: India Location-based Services Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Location-based Services Market?

The projected CAGR is approximately 19.52%.

2. Which companies are prominent players in the India Location-based Services Market?

Key companies in the market include Genesys International Corporation limited, Google LLC, MapmyIndia, Microsoft Corporation, GeoIQ i, Roam ai, Aruba Networks, LocationIQ, Pert Telecom Solutions Pvt Ltd, Mapsense Technologies (OPC) Private Limited.

3. What are the main segments of the India Location-based Services Market?

The market segments include Component, Location, Application, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.58 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Geo-based Marketing; Emerging Use-cases for LBS due to High Penetration of Social Media and Location-based App Adoption.

6. What are the notable trends driving market growth?

The Increasing Adoption of Smartphones and Other Mobile Devices.

7. Are there any restraints impacting market growth?

Rise in the privacy and security issues.

8. Can you provide examples of recent developments in the market?

May 2023: ISRO introduced India's version of GPS with the next-generation navigational satellite NVS-01, which would offer real-time timing and positioning services across India and a region around 1,500 km throughout the mainland. This series primarily incorporates L1 band signals additionally to broaden the services. This would drive the demand for the market's growth significantly.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Location-based Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Location-based Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Location-based Services Market?

To stay informed about further developments, trends, and reports in the India Location-based Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence