Key Insights

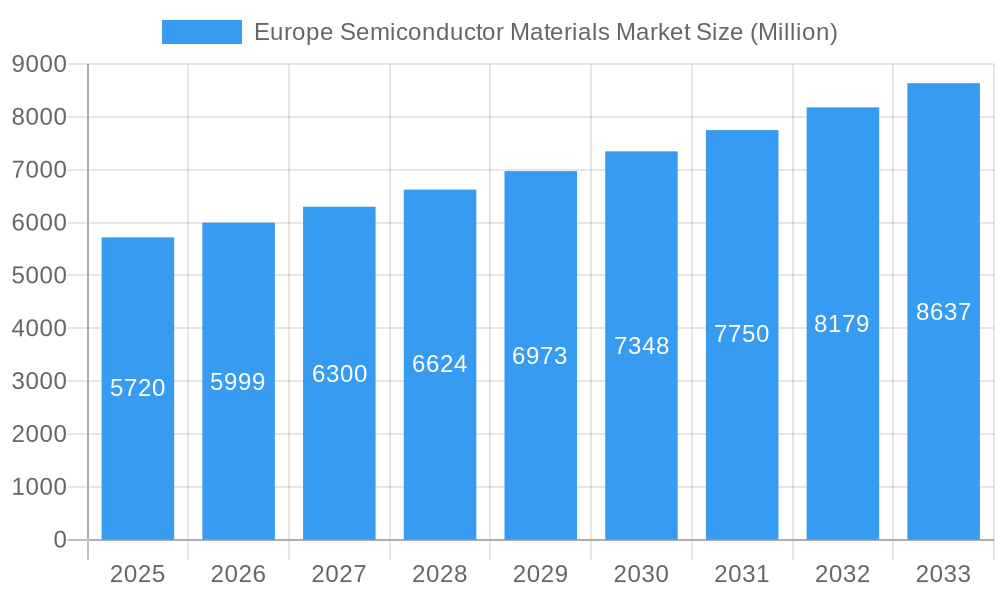

The European semiconductor materials market, valued at €5.72 billion in 2025, is projected to experience robust growth, driven by the increasing demand for advanced semiconductor devices across diverse end-user industries. A Compound Annual Growth Rate (CAGR) of 4.94% from 2025 to 2033 indicates a significant expansion of this market, fueled primarily by the burgeoning consumer electronics sector, particularly in smartphones and high-performance computing. The automotive industry’s ongoing integration of advanced driver-assistance systems (ADAS) and electric vehicles (EVs) also contributes substantially to market growth, demanding high-performance materials for efficient power management and sensor technology. Furthermore, the telecommunications industry’s continuous development of 5G and future generation wireless networks creates a substantial need for advanced semiconductor materials with improved performance and miniaturization capabilities. While the manufacturing sector contributes significantly to overall demand, the energy and utility sector is an emerging area of growth, with opportunities arising from the development of smart grids and renewable energy technologies. Growth will be bolstered by technological advancements in materials science, leading to enhanced material properties, improved manufacturing processes, and better performance characteristics.

Europe Semiconductor Materials Market Market Size (In Billion)

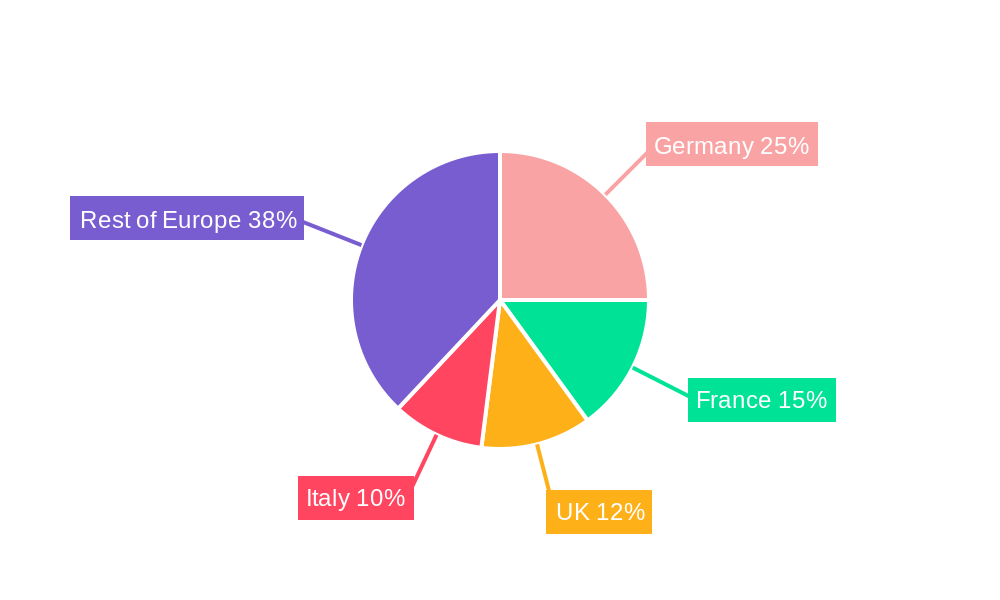

However, the market's growth trajectory is not without challenges. Potential restraints include fluctuations in raw material prices, geopolitical uncertainties influencing supply chains, and the competitive landscape characterized by the presence of established players such as Henkel, BASF, and Solvay alongside emerging innovative companies. The ongoing need for substantial capital investment in research and development to support advancements in semiconductor technology could also pose a challenge for smaller players. Effective strategic partnerships and a focus on innovation in material science and manufacturing processes are crucial for companies to maintain a competitive edge and successfully navigate the complexities of this dynamic market. Segmentation by application (fabrication, packaging) and end-user industry allows for a deeper understanding of specific market drivers and helps tailor strategies to meet the diverse needs of different sectors. The European region, particularly Germany, France, and the UK, are expected to be major contributors to market growth, given their established semiconductor manufacturing hubs and robust research infrastructure.

Europe Semiconductor Materials Market Company Market Share

Europe Semiconductor Materials Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Semiconductor Materials Market, offering invaluable insights for businesses, investors, and stakeholders seeking to understand and navigate this dynamic industry. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages extensive data analysis to deliver actionable intelligence. The market is segmented by application (Fabrication, Packaging), end-user industry (Consumer Electronics, Telecommunication, Manufacturing, Automotive, Energy & Utility, Others), and leading players like Henkel AG & Co KGaA, Compugraphics (MacDermid Alpha Electronics Solutions), BASF SE, Caplinq Europe B, International Quantum Epitaxy PLC (IQE PLC), Solvay SA, Air Liquide SA, and Messer SE & Co KGaA. The report's value extends beyond market sizing to encompass detailed competitive landscapes, emerging trends, and growth projections. Expect detailed analysis across all segments, supported by quantitative data and qualitative insights, projecting a xx Million market value by 2033.

Europe Semiconductor Materials Market Market Structure & Competitive Landscape

The European semiconductor materials market exhibits a moderately consolidated structure, with a few major players holding significant market share. The Herfindahl-Hirschman Index (HHI) for 2024 is estimated at xx, indicating a xx level of concentration. Innovation is a key driver, with companies investing heavily in R&D to develop advanced materials with improved performance characteristics. Stringent environmental regulations are impacting the industry, pushing companies to adopt sustainable manufacturing practices. Product substitution is a potential threat, with the emergence of alternative materials challenging the dominance of established products. The market is segmented by various end-user industries, with the automotive and consumer electronics sectors being particularly significant. Mergers and acquisitions (M&A) activity has been moderate in recent years, with a total M&A volume of approximately xx Million in 2024.

- Market Concentration: Moderate, with an HHI of xx in 2024.

- Innovation Drivers: R&D investments in advanced materials.

- Regulatory Impacts: Stringent environmental regulations driving sustainable practices.

- Product Substitutes: Emergence of alternative materials poses a threat.

- End-User Segmentation: Automotive and consumer electronics are key segments.

- M&A Trends: Moderate activity, with a volume of approximately xx Million in 2024.

Europe Semiconductor Materials Market Market Trends & Opportunities

The Europe Semiconductor Materials Market is experiencing robust growth, driven by factors such as the increasing demand for electronics across various sectors, technological advancements in semiconductor manufacturing, and government initiatives aimed at boosting domestic chip production. The market size is projected to expand at a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, reaching a value of xx Million by 2033. The increasing adoption of 5G technology, the growth of the automotive industry, and the expansion of the renewable energy sector are creating significant opportunities for market players. However, challenges such as supply chain disruptions and geopolitical uncertainties present potential headwinds. Market penetration rates for advanced materials are steadily increasing, driven by improvements in performance and cost-effectiveness. Competitive dynamics are intense, with companies vying for market share through product innovation, strategic partnerships, and mergers & acquisitions.

Dominant Markets & Segments in Europe Semiconductor Materials Market

Germany and France currently represent the largest national markets within Europe's semiconductor materials sector, collectively accounting for approximately xx% of the total market value in 2024. The Fabrication segment holds the largest share within the application segment, driven by continuous expansion of the semiconductor industry. The Automotive end-user industry is showing significant growth, fuelled by the increasing electrification of vehicles.

- Key Growth Drivers in Germany: Well-established automotive and manufacturing industries, strong R&D infrastructure.

- Key Growth Drivers in France: Government support for technology innovation and a skilled workforce.

- Key Growth Drivers in Fabrication Segment: Continuous expansion of the semiconductor industry.

- Key Growth Drivers in Automotive Segment: Electrification of vehicles and autonomous driving technology.

Europe Semiconductor Materials Market Product Analysis

The semiconductor materials market is characterized by continuous innovation in materials science, leading to products with enhanced performance, reliability, and cost-effectiveness. Key advancements include the development of advanced packaging materials, improved substrate technologies, and high-purity chemicals. These innovations are crucial for enabling the production of smaller, faster, and more energy-efficient semiconductor devices, meeting the demands of rapidly evolving electronics applications. The competitive advantage lies in achieving superior material properties, delivering cost-effective solutions, and building robust supply chains.

Key Drivers, Barriers & Challenges in Europe Semiconductor Materials Market

Key Drivers:

- Technological advancements: Miniaturization and high-performance demands drive the need for advanced materials.

- Economic growth: Expansion of consumer electronics, automotive, and telecommunication sectors fuels market demand.

- Government support: EU initiatives to boost domestic semiconductor production.

Challenges:

- Supply chain disruptions: Geopolitical factors and pandemic-related disruptions impact raw material availability.

- Regulatory hurdles: Environmental regulations and trade restrictions create complexities.

- Competitive pressures: Intense rivalry among major players limits profit margins. xx% of market players faced significant pricing pressure in 2024, impacting profitability.

Growth Drivers in the Europe Semiconductor Materials Market Market

The market is primarily driven by rising demand for electronics across various sectors, technological advancements leading to the need for advanced materials, and substantial government investments in semiconductor production capabilities within Europe. These factors contribute to the market's growth trajectory and overall expansion.

Challenges Impacting Europe Semiconductor Materials Market Growth

Major barriers hindering growth include supply chain vulnerabilities, stringent environmental regulations, and intensifying competition. These factors present considerable obstacles for market participants and influence the overall growth trajectory.

Key Players Shaping the Europe Semiconductor Materials Market Market

- Henkel AG & Co KGaA

- Compugraphics (MacDermid Alpha Electronics Solutions)

- BASF SE

- Caplinq Europe B

- International Quantum Epitaxy PLC (IQE PLC)

- Solvay SA

- Air Liquide SA

- Messer SE & Co KGaA

Significant Europe Semiconductor Materials Market Industry Milestones

- October 2022: STMicroelectronics announces a EUR 730 Million (USD 728 Million) silicon carbide wafer plant in Italy, supported by EU initiatives.

- June 2022: BASF plans a commercial-scale battery recycling plant in Germany, boosting its CAM production and recycling hub.

Future Outlook for Europe Semiconductor Materials Market Market

The Europe Semiconductor Materials Market is poised for continued growth, driven by increasing demand for advanced electronics and ongoing technological innovation. Strategic partnerships and investments in R&D will be crucial for market players to maintain competitiveness and capitalize on emerging opportunities in sectors such as electric vehicles and renewable energy. The market's potential is significant, with further expansion expected throughout the forecast period.

Europe Semiconductor Materials Market Segmentation

-

1. Application

-

1.1. Fabrication

- 1.1.1. Process Chemicals

- 1.1.2. Photomasks

- 1.1.3. Electronic Gases

- 1.1.4. Photoresists Ancillaries

- 1.1.5. Sputtering Targets

- 1.1.6. Silicon

- 1.1.7. Other Fabrication Applications

-

1.2. Packaging

- 1.2.1. Substrates

- 1.2.2. Lead Frames

- 1.2.3. Ceramic Packages

- 1.2.4. Bonding Wire

- 1.2.5. Encapsulation Resins (Liquid)

- 1.2.6. Die Attach Materials

- 1.2.7. Other Packaging Applications

-

1.1. Fabrication

-

2. End-user Industry

- 2.1. Consumer Electronics

- 2.2. Telecommunication

- 2.3. Manufacturing

- 2.4. Automotive

- 2.5. Energy and Utility

- 2.6. Other End-User Industries

Europe Semiconductor Materials Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Semiconductor Materials Market Regional Market Share

Geographic Coverage of Europe Semiconductor Materials Market

Europe Semiconductor Materials Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.94% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technical Advancement and Product Innovation of the Semiconductor Materials; Rising Demand for Consumer Electronics Goods; Increased Demand from OSAT/Packaging Companies

- 3.3. Market Restrains

- 3.3.1. Complexity in the Manufacturing Process

- 3.4. Market Trends

- 3.4.1. Technical Advancement and Product Innovation of the Semiconductor Materials

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Semiconductor Materials Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Fabrication

- 5.1.1.1. Process Chemicals

- 5.1.1.2. Photomasks

- 5.1.1.3. Electronic Gases

- 5.1.1.4. Photoresists Ancillaries

- 5.1.1.5. Sputtering Targets

- 5.1.1.6. Silicon

- 5.1.1.7. Other Fabrication Applications

- 5.1.2. Packaging

- 5.1.2.1. Substrates

- 5.1.2.2. Lead Frames

- 5.1.2.3. Ceramic Packages

- 5.1.2.4. Bonding Wire

- 5.1.2.5. Encapsulation Resins (Liquid)

- 5.1.2.6. Die Attach Materials

- 5.1.2.7. Other Packaging Applications

- 5.1.1. Fabrication

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Consumer Electronics

- 5.2.2. Telecommunication

- 5.2.3. Manufacturing

- 5.2.4. Automotive

- 5.2.5. Energy and Utility

- 5.2.6. Other End-User Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Henkel AG & Co KGaA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Compugraphics (MacDermid Alpha Electronics Solutions)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BASF SE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Caplinq Europe B

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 International Quantum Epitaxy PLC (IQE PLC)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Solvay SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Air Liquide SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Messer SE & Co KGaA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Henkel AG & Co KGaA

List of Figures

- Figure 1: Europe Semiconductor Materials Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Semiconductor Materials Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Semiconductor Materials Market Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Europe Semiconductor Materials Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Europe Semiconductor Materials Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Europe Semiconductor Materials Market Revenue Million Forecast, by Application 2020 & 2033

- Table 5: Europe Semiconductor Materials Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Europe Semiconductor Materials Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Semiconductor Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Semiconductor Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: France Europe Semiconductor Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Semiconductor Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Semiconductor Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Semiconductor Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Semiconductor Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Semiconductor Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Semiconductor Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Semiconductor Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Semiconductor Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Semiconductor Materials Market?

The projected CAGR is approximately 4.94%.

2. Which companies are prominent players in the Europe Semiconductor Materials Market?

Key companies in the market include Henkel AG & Co KGaA, Compugraphics (MacDermid Alpha Electronics Solutions), BASF SE, Caplinq Europe B, International Quantum Epitaxy PLC (IQE PLC), Solvay SA, Air Liquide SA, Messer SE & Co KGaA.

3. What are the main segments of the Europe Semiconductor Materials Market?

The market segments include Application, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.72 Million as of 2022.

5. What are some drivers contributing to market growth?

Technical Advancement and Product Innovation of the Semiconductor Materials; Rising Demand for Consumer Electronics Goods; Increased Demand from OSAT/Packaging Companies.

6. What are the notable trends driving market growth?

Technical Advancement and Product Innovation of the Semiconductor Materials.

7. Are there any restraints impacting market growth?

Complexity in the Manufacturing Process.

8. Can you provide examples of recent developments in the market?

October 2022 - STMicroelectronics (ST) declared that it would construct a EUR 730 million (USD 728 million) silicon carbide wafer plant in Italy. This project is the first approved as part of an EU initiative to move chip production closer to consumers' homes. With the switch to electrification, the new integrated silicon carbide (SiC) substrate manufacturing plant would be able to handle the rising demand from automotive and industrial clients.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Semiconductor Materials Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Semiconductor Materials Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Semiconductor Materials Market?

To stay informed about further developments, trends, and reports in the Europe Semiconductor Materials Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence