Key Insights

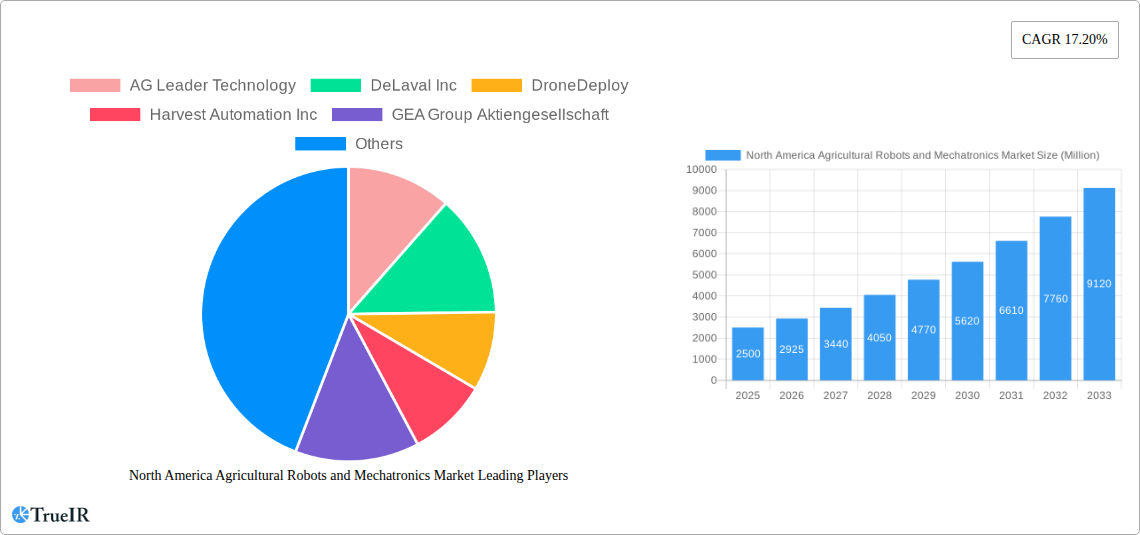

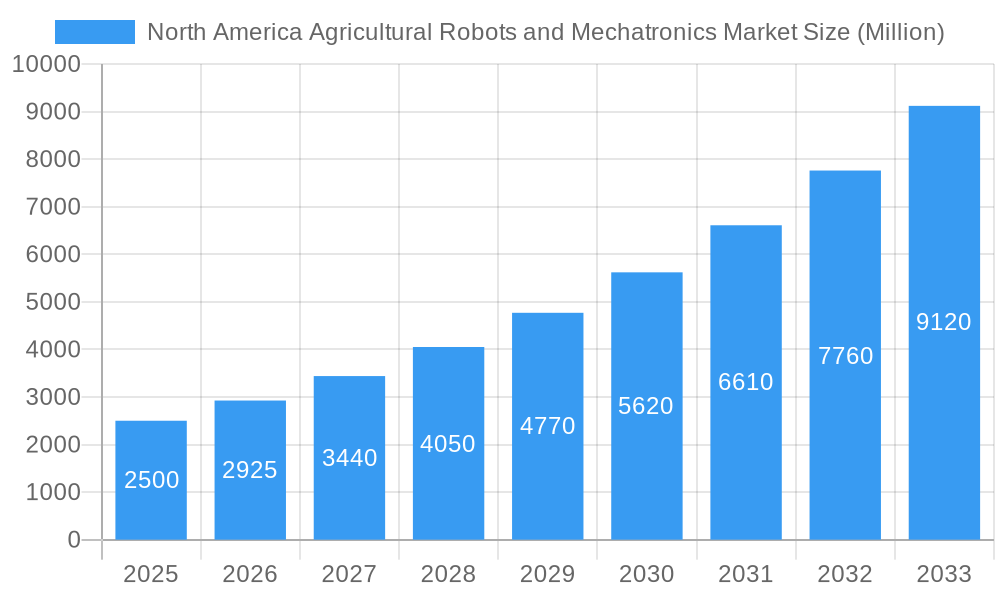

The North American agricultural robots and mechatronics market is poised for significant expansion. Driven by the imperative for farming automation to combat labor shortages, boost operational efficiency, and optimize crop yields, the market is projected to reach $4.5 billion by 2025. This growth trajectory is underpinned by a Compound Annual Growth Rate (CAGR) of 17.2%, forecasted between 2025 and 2033. Key catalysts include rapid advancements in robotics, artificial intelligence (AI), and precision agriculture. Leading the charge are autonomous tractors, unmanned aerial vehicles (UAVs) for crop monitoring and application, and automated milking systems. These technologies are seeing widespread adoption across crop production and animal husbandry sectors. The United States represents the largest market in North America, followed by Canada and Mexico, primarily due to extensive farming operations and high technology adoption rates in the US. While initial investment costs and infrastructure requirements present challenges, ongoing technological innovation and declining production expenses are mitigating these barriers.

North America Agricultural Robots and Mechatronics Market Market Size (In Billion)

Market segmentation by robot type (e.g., autonomous tractors, UAVs, milking robots) and application (e.g., crop production, animal husbandry) underscores the technology's versatility. Future growth avenues include developing advanced robots with enhanced functionalities, seamless integration with farm management systems, and specialized solutions for specific crops and livestock. Continued progress in AI and machine learning will further refine robot precision and operational efficiency. Strategic investments in research and development by industry players are driving the creation of novel farmer-centric solutions, propelling market growth. The integration of these advanced technologies is set to revolutionize North American agriculture, fostering a more sustainable and productive food ecosystem.

North America Agricultural Robots and Mechatronics Market Company Market Share

North America Agricultural Robots and Mechatronics Market: A Comprehensive Report (2019-2033)

This dynamic report provides a detailed analysis of the North American agricultural robots and mechatronics market, offering invaluable insights for industry stakeholders, investors, and researchers. Covering the period from 2019 to 2033, with a focus on 2025, this comprehensive study delves into market size, growth drivers, challenges, competitive dynamics, and future outlook. The report utilizes robust data analysis and qualitative insights to present a clear and actionable understanding of this rapidly evolving market.

North America Agricultural Robots and Mechatronics Market Market Structure & Competitive Landscape

The North American agricultural robots and mechatronics market exhibits a moderately concentrated structure, with a Herfindahl-Hirschman Index (HHI) estimated at xx in 2025. Key players, including AG Leader Technology, DeLaval Inc, and others, dominate specific segments, while numerous smaller companies contribute to innovation and niche applications. The market is characterized by significant M&A activity, with an estimated xx Million in deal value recorded between 2019 and 2024. This consolidation reflects the strategic importance of the sector and the desire for larger players to expand their product portfolios and market reach.

Innovation is a crucial driver, with continuous advancements in areas such as AI, robotics, and sensor technologies leading to the development of more sophisticated and efficient agricultural robots. Regulatory frameworks, particularly those related to data privacy and environmental impact, play a significant role in shaping market dynamics. Product substitution is a relatively low threat currently, but alternative technologies like precision agriculture techniques could emerge as competitors in the long term. End-user segmentation is primarily driven by farm size, crop type, and animal production methods.

- Market Concentration: HHI estimated at xx in 2025.

- M&A Activity: Estimated xx Million in deal value (2019-2024).

- Innovation Drivers: AI, robotics, sensor technology.

- Regulatory Impacts: Data privacy, environmental regulations.

- End-User Segmentation: Farm size, crop type, animal production.

North America Agricultural Robots and Mechatronics Market Market Trends & Opportunities

The North American agricultural robots and mechatronics market is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. This expansion is fueled by several factors, including increasing labor costs, the growing demand for higher crop yields, and the rising adoption of precision agriculture techniques. Technological advancements, such as the integration of AI and machine learning, are leading to more autonomous and efficient robots, further enhancing market appeal. Consumer preferences are shifting towards sustainable and technologically advanced farming practices, creating a favorable environment for the adoption of agricultural robots. Intense competition among key players is driving innovation and pushing prices down, making these technologies more accessible to a wider range of farmers. Market penetration rates are expected to increase significantly, particularly in high-value crop production and livestock management sectors. The market size in 2025 is estimated at xx Million and is projected to reach xx Million by 2033.

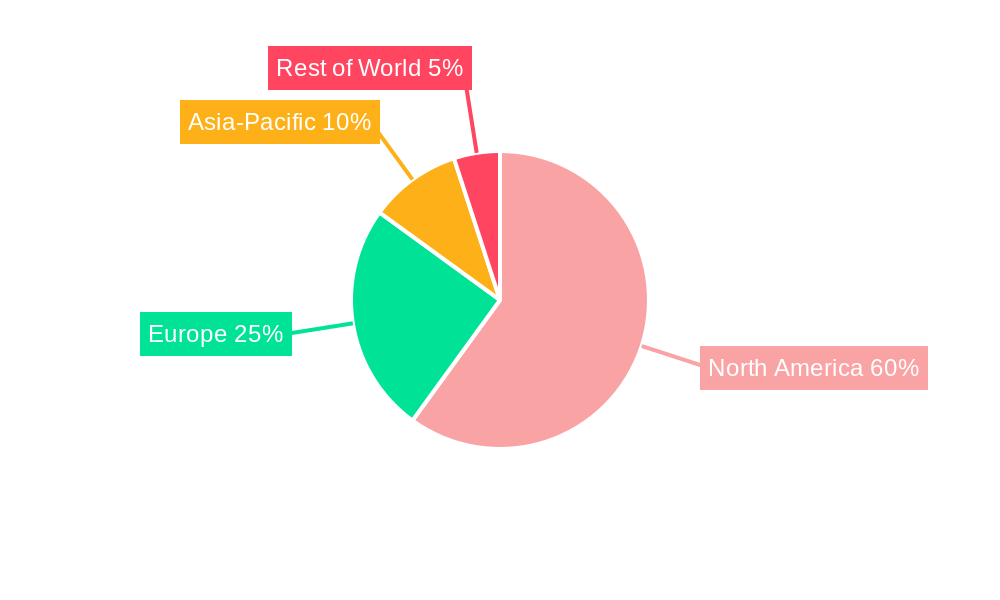

Dominant Markets & Segments in North America Agricultural Robots and Mechatronics Market

The United States represents the largest market segment within North America, driven by its significant agricultural output and early adoption of technological advancements. Canada and Mexico are also experiencing substantial growth, albeit at a slightly slower pace. Within the product segments, autonomous tractors and unmanned aerial vehicles (UAVs) are witnessing the most rapid expansion, fueled by their versatility and efficiency in various agricultural applications. Milking robots are experiencing a steady increase in demand, primarily driven by the labor-intensive nature of dairy farming.

- Leading Region: United States

- Key Growth Drivers:

- Increasing labor costs

- Demand for higher crop yields

- Adoption of precision agriculture

- Technological advancements (AI, ML)

- Dominant Segments: Autonomous Tractors, UAVs, Milking Robots

Within applications, crop production accounts for the largest share, followed by animal husbandry. Forest control and other applications are emerging segments with significant growth potential. Infrastructure development, particularly in rural areas, and supportive government policies are crucial factors accelerating market growth across all segments.

North America Agricultural Robots and Mechatronics Market Product Analysis

Technological advancements are significantly impacting product innovation in the agricultural robots and mechatronics market. Autonomous tractors equipped with advanced GPS and AI capabilities are becoming more precise and efficient. UAVs are integrated with high-resolution cameras and sensors to provide real-time data on crop health and soil conditions. Milking robots are incorporating automated cleaning and disease detection systems. These advancements, coupled with improved user interfaces and reduced operational costs, are enhancing the market fit of these products.

Key Drivers, Barriers & Challenges in North America Agricultural Robots and Mechatronics Market

Key Drivers: Technological advancements, rising labor costs, increasing demand for food production, government incentives for precision agriculture, and improved access to financing are propelling market growth. The decreasing cost of robotic components and increasing availability of skilled labor further accelerates this trend.

Key Barriers & Challenges: High initial investment costs, lack of awareness among farmers, concerns about technological reliability, and limited access to repair and maintenance services represent significant hurdles. Regulatory complexities surrounding data privacy and environmental impact also pose challenges. Supply chain disruptions can affect the availability of critical components, impacting production and sales. These challenges, if not addressed effectively, could hamper market expansion.

Growth Drivers in the North America Agricultural Robots and Mechatronics Market Market

Several key drivers are fueling the growth of this market:

- Technological Advancements: Continuous innovations in AI, robotics, and sensor technology are leading to more efficient and sophisticated agricultural robots.

- Rising Labor Costs: The increasing cost of farm labor is incentivizing farmers to adopt automation solutions.

- Government Support: Government policies and subsidies promote the adoption of precision agriculture and automation technologies.

Challenges Impacting North America Agricultural Robots and Mechatronics Market Growth

Key challenges hindering market growth include:

- High Initial Investment Costs: The high upfront cost of purchasing and implementing agricultural robots can be a barrier for smaller farms.

- Lack of Skilled Labor: The need for specialized expertise to operate and maintain these robots is a potential constraint.

- Regulatory Hurdles: Complex regulations and compliance requirements can slow down market expansion.

Key Players Shaping the North America Agricultural Robots and Mechatronics Market Market

- AG Leader Technology

- DeLaval Inc

- DroneDeploy

- Harvest Automation Inc

- GEA Group Aktiengesellschaft

- Blue River Technology

- EcoRobotix Ltd

- Agrobotix LLC

- Lely Industries NV

- Autonomous Solutions (ASI)

- Autonomous Tractor Corporation

Significant North America Agricultural Robots and Mechatronics Market Industry Milestones

- 2020: Blue River Technology acquired by John Deere, signaling increasing industry consolidation.

- 2021: Several new models of autonomous tractors launched, enhancing market offerings.

- 2022: Increased investment in UAV technology for precision agriculture applications.

- 2023: Significant advancements in AI-powered weed detection and removal systems.

Future Outlook for North America Agricultural Robots and Mechatronics Market Market

The North American agricultural robots and mechatronics market is poised for continued strong growth, driven by technological innovation, supportive government policies, and the increasing demand for efficient and sustainable farming practices. Strategic partnerships between technology companies and agricultural producers are expected to accelerate market adoption. The market presents significant opportunities for both established players and new entrants to capitalize on the growing demand for automated agricultural solutions. Further development of advanced sensing and AI capabilities will continue to drive innovation and unlock new applications for agricultural robotics.

North America Agricultural Robots and Mechatronics Market Segmentation

-

1. Type

- 1.1. Autonomous Tractors

- 1.2. Unmanned Aerial Vehicles (UAVs)

- 1.3. Milking Robots

- 1.4. Other Types

-

2. Application

- 2.1. Crop Production

- 2.2. Animal Husbandry

- 2.3. Forest Control

- 2.4. Other Applications

-

3. North America

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest Of North America

-

4. Type

- 4.1. Autonomous Tractors

- 4.2. Unmanned Aerial Vehicles (UAVs)

- 4.3. Milking Robots

- 4.4. Other Types

-

5. Application

- 5.1. Crop Production

- 5.2. Animal Husbandry

- 5.3. Forest Control

- 5.4. Other Applications

-

6. North America

- 6.1. United States

- 6.2. Canada

- 6.3. Mexico

- 6.4. Rest Of North America

North America Agricultural Robots and Mechatronics Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Agricultural Robots and Mechatronics Market Regional Market Share

Geographic Coverage of North America Agricultural Robots and Mechatronics Market

North America Agricultural Robots and Mechatronics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 17.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support

- 3.3. Market Restrains

- 3.3.1 Increasing Loses due to Physiological Disorder

- 3.3.2 Pest and Disease; Unfavourable Climatic Condition

- 3.4. Market Trends

- 3.4.1. Growing Practice of Precision Farming

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Agricultural Robots and Mechatronics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Autonomous Tractors

- 5.1.2. Unmanned Aerial Vehicles (UAVs)

- 5.1.3. Milking Robots

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Crop Production

- 5.2.2. Animal Husbandry

- 5.2.3. Forest Control

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by North America

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest Of North America

- 5.4. Market Analysis, Insights and Forecast - by Type

- 5.4.1. Autonomous Tractors

- 5.4.2. Unmanned Aerial Vehicles (UAVs)

- 5.4.3. Milking Robots

- 5.4.4. Other Types

- 5.5. Market Analysis, Insights and Forecast - by Application

- 5.5.1. Crop Production

- 5.5.2. Animal Husbandry

- 5.5.3. Forest Control

- 5.5.4. Other Applications

- 5.6. Market Analysis, Insights and Forecast - by North America

- 5.6.1. United States

- 5.6.2. Canada

- 5.6.3. Mexico

- 5.6.4. Rest Of North America

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 AG Leader Technology

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DeLaval Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DroneDeploy

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Harvest Automation Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 GEA Group Aktiengesellschaft

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Blue River Technology

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 EcoRobotix Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Agrobotix LLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Lely Industries NV

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Autonomous Solutions (ASI)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Autonomous Tractor Corporatio

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 AG Leader Technology

List of Figures

- Figure 1: North America Agricultural Robots and Mechatronics Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Agricultural Robots and Mechatronics Market Share (%) by Company 2025

List of Tables

- Table 1: North America Agricultural Robots and Mechatronics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: North America Agricultural Robots and Mechatronics Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: North America Agricultural Robots and Mechatronics Market Revenue billion Forecast, by North America 2020 & 2033

- Table 4: North America Agricultural Robots and Mechatronics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: North America Agricultural Robots and Mechatronics Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: North America Agricultural Robots and Mechatronics Market Revenue billion Forecast, by North America 2020 & 2033

- Table 7: North America Agricultural Robots and Mechatronics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: North America Agricultural Robots and Mechatronics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 9: North America Agricultural Robots and Mechatronics Market Revenue billion Forecast, by Application 2020 & 2033

- Table 10: North America Agricultural Robots and Mechatronics Market Revenue billion Forecast, by North America 2020 & 2033

- Table 11: North America Agricultural Robots and Mechatronics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 12: North America Agricultural Robots and Mechatronics Market Revenue billion Forecast, by Application 2020 & 2033

- Table 13: North America Agricultural Robots and Mechatronics Market Revenue billion Forecast, by North America 2020 & 2033

- Table 14: North America Agricultural Robots and Mechatronics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United States North America Agricultural Robots and Mechatronics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Canada North America Agricultural Robots and Mechatronics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Mexico North America Agricultural Robots and Mechatronics Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Agricultural Robots and Mechatronics Market?

The projected CAGR is approximately 17.2%.

2. Which companies are prominent players in the North America Agricultural Robots and Mechatronics Market?

Key companies in the market include AG Leader Technology, DeLaval Inc, DroneDeploy, Harvest Automation Inc, GEA Group Aktiengesellschaft, Blue River Technology, EcoRobotix Ltd, Agrobotix LLC, Lely Industries NV, Autonomous Solutions (ASI), Autonomous Tractor Corporatio.

3. What are the main segments of the North America Agricultural Robots and Mechatronics Market?

The market segments include Type, Application, North America, Type, Application, North America.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.5 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support.

6. What are the notable trends driving market growth?

Growing Practice of Precision Farming.

7. Are there any restraints impacting market growth?

Increasing Loses due to Physiological Disorder. Pest and Disease; Unfavourable Climatic Condition.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Agricultural Robots and Mechatronics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Agricultural Robots and Mechatronics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Agricultural Robots and Mechatronics Market?

To stay informed about further developments, trends, and reports in the North America Agricultural Robots and Mechatronics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence