Key Insights

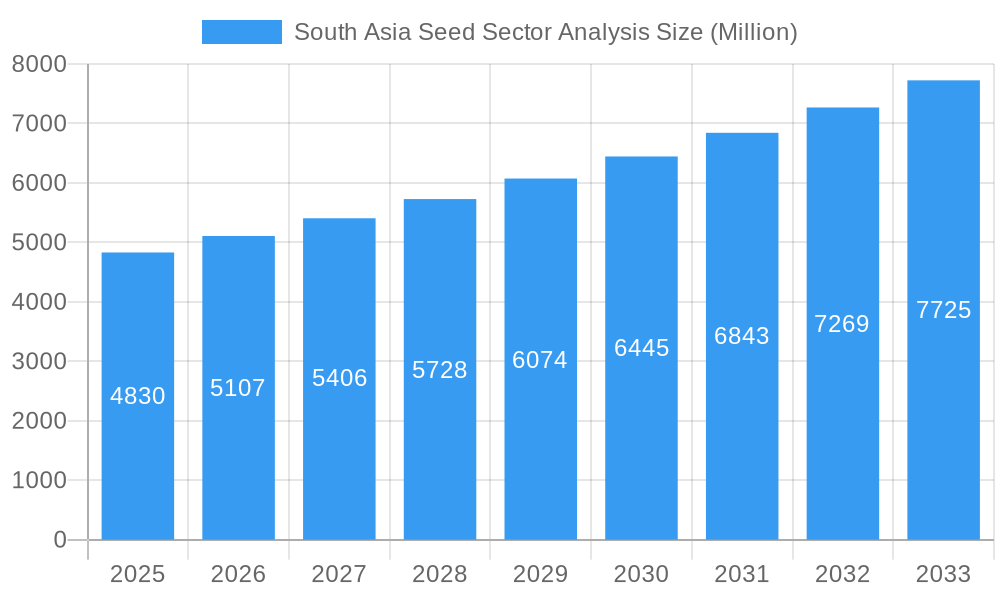

The South Asia seed market, valued at $4.83 billion in 2025, is projected to experience robust growth, driven by factors such as rising demand for high-yielding and disease-resistant crop varieties, increasing adoption of advanced agricultural technologies, and supportive government policies promoting agricultural modernization. The market's Compound Annual Growth Rate (CAGR) of 5.52% from 2019 to 2024 indicates a steady expansion, expected to continue through 2033. Key segments driving this growth include cereals (rice, wheat, maize), oilseeds (soybean, rapeseed, sunflower), and vegetable seeds. The preference for transgenic hybrids is steadily increasing due to their higher yields and pest resistance, although non-transgenic hybrids and open-pollinated varieties remain significant segments. India, with its vast agricultural sector, is the dominant market within South Asia, followed by other significant players like China, Pakistan, and Bangladesh. Competitive pressures are evident with both multinational corporations (Bayer, Syngenta, Corteva) and domestic players (Raas Seeds, Advanta Seeds, Kaveri Seeds) vying for market share. Challenges include climate change impacts on crop yields, fluctuating commodity prices, and the need for improved seed distribution networks, particularly in rural areas. Future growth will depend on investments in research and development of climate-resilient seed varieties, improving farmer access to quality seeds, and enhancing agricultural infrastructure.

South Asia Seed Sector Analysis Market Size (In Billion)

The South Asia seed sector presents substantial opportunities for both established and emerging players. Strategic partnerships, focused on developing and disseminating advanced seed technologies tailored to specific regional needs, are crucial for success. Further development of regional supply chains, emphasizing quality control and traceability, will be essential to build consumer trust and ensure consistent product delivery. Specific focus on improving the yields of key staple crops such as rice and wheat, alongside addressing critical issues like drought tolerance and pest resistance, will drive future demand within the region. The growing awareness of sustainable agricultural practices and environmentally friendly seed production methods is also expected to fuel market growth in the coming years.

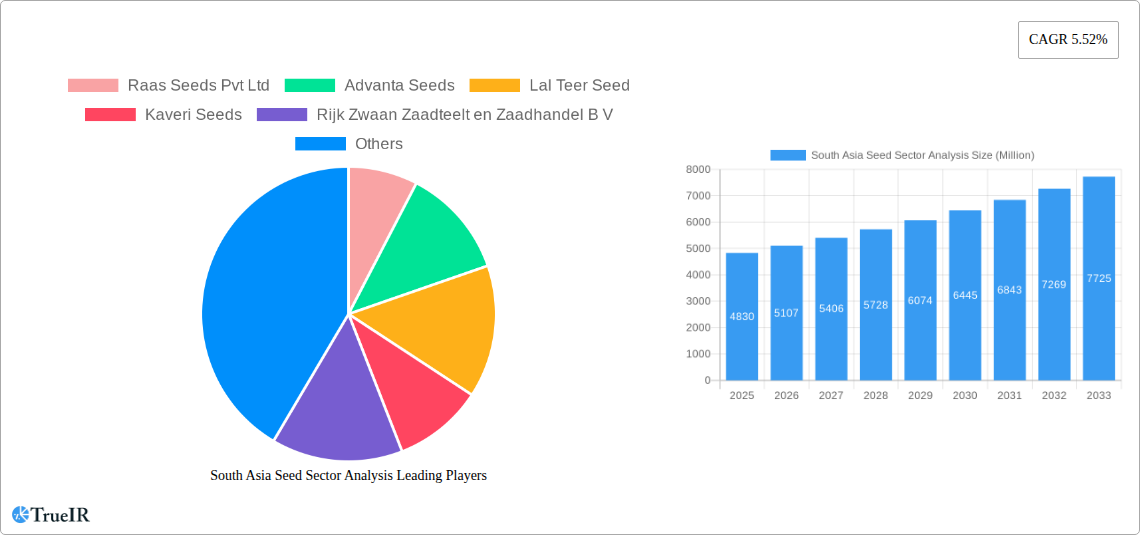

South Asia Seed Sector Analysis Company Market Share

South Asia Seed Sector Analysis: A Comprehensive Market Report (2019-2033)

This dynamic report provides a detailed analysis of the South Asia seed sector, offering invaluable insights for investors, industry stakeholders, and strategic decision-makers. Leveraging extensive data from 2019-2024 (historical period) and incorporating robust forecasting models for 2025-2033 (forecast period), this report unveils the market's current state and future trajectory. The base year for this analysis is 2025 and estimated year is 2025. The study period covers 2019-2033. Expect detailed coverage across key segments, competitive landscapes, and growth drivers, enabling you to make informed decisions in this rapidly evolving market. The market size is predicted to reach xx Million by 2033.

South Asia Seed Sector Analysis Market Structure & Competitive Landscape

The South Asia seed sector exhibits a moderately concentrated market structure, with several multinational and domestic players vying for market share. The Herfindahl-Hirschman Index (HHI) for 2024 is estimated at xx, indicating a moderately concentrated market. This concentration is driven by the economies of scale enjoyed by large players and the high barriers to entry for new entrants. However, the presence of numerous smaller regional players signifies market dynamism and scope for consolidation. Innovation is primarily driven by the need to develop high-yielding, disease-resistant, and climate-resilient varieties catering to the diverse agro-climatic conditions of the region. Government regulations, particularly those relating to seed quality control and intellectual property rights, significantly impact market dynamics. Product substitution occurs mainly within crop categories, with farmers often choosing varieties based on price, yield, and pest resistance. End-user segmentation is primarily defined by farm size and cropping patterns, with large farms often adopting hybrid seeds while smaller farms may prefer open-pollinated varieties. M&A activity in the sector has been moderate in recent years, with a total transaction value of approximately xx Million recorded between 2019 and 2024, driven by the desire of large companies to expand their product portfolio and geographic reach.

- Market Concentration: HHI (2024): xx

- Innovation Drivers: High-yielding varieties, disease resistance, climate resilience.

- Regulatory Impacts: Seed quality control, intellectual property rights.

- M&A Trends: Total transaction value (2019-2024): xx Million

South Asia Seed Sector Analysis Market Trends & Opportunities

The South Asia seed market is experiencing robust growth, driven by factors such as increasing agricultural production, rising disposable incomes, and government initiatives promoting agricultural modernization. The market size is projected to grow at a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, reaching xx Million by 2033. This growth is propelled by a shift towards high-yielding hybrid seeds, particularly in cereals and oilseeds. Technological advancements, such as precision agriculture and biotechnology, are creating new opportunities for seed companies to develop superior varieties and improve farming practices. Changing consumer preferences for healthier and more nutritious food are also influencing seed demand, as farmers are increasingly adopting varieties suited to the growing demand for organic and specialty crops. The competitive landscape is marked by intense competition among both domestic and multinational players, leading to continuous product innovation and marketing efforts. Market penetration rates for hybrid seeds vary across crops and regions, with higher penetration in high-value crops like vegetables and a gradual increase in cereals and oilseeds.

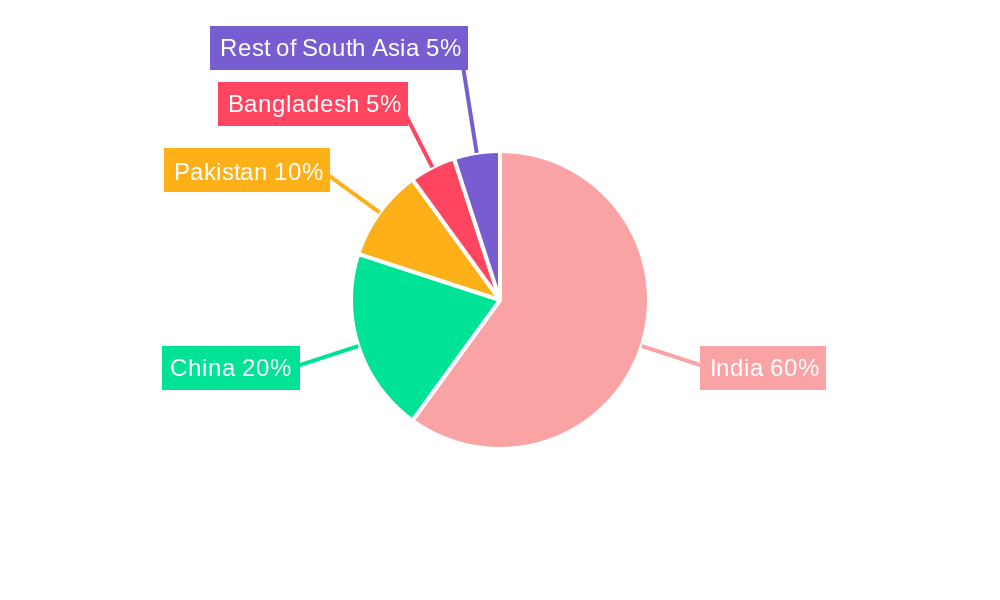

Dominant Markets & Segments in South Asia Seed Sector Analysis

Within South Asia, India dominates the seed market, accounting for approximately xx% of the regional market share in 2024. The cereals segment (rice, wheat, maize) holds the largest share within the by-crop classification, driven by its high acreage and significance in food security. Within product type, hybrid seeds command a significant market share, particularly in high-value crops.

Key Growth Drivers:

- India's dominance: Large agricultural sector, significant government support.

- Cereals segment's strength: High acreage, food security concerns.

- Hybrid seed adoption: Superior yields, improved efficiency.

Detailed Analysis: India's dominance is a consequence of its large agricultural land area, substantial government investments in agricultural research and development, and a sizeable population reliant on agriculture for livelihood. The cereals segment's dominance is primarily attributed to the region's high cereal consumption and the vital role cereals play in food security. The preference for hybrid seeds reflects their superior yield potential, improved disease resistance, and overall efficiency gains. The market for vegetables is also showing significant growth, fueled by rising incomes and changes in consumer dietary habits.

South Asia Seed Sector Analysis Product Analysis

Product innovation in the South Asia seed sector focuses on developing disease-resistant, stress-tolerant, and high-yielding varieties adapted to the region's diverse agro-climatic conditions. This includes advancements in biotechnology, such as the development of transgenic hybrids with enhanced traits. Other innovations involve improved open-pollinated varieties with desirable characteristics like enhanced nutritional content. The competitive advantage lies in superior seed quality, consistent yield performance, and strong distribution networks. The market fit is primarily determined by the specific needs of the target farmers, taking into account factors like local climatic conditions, pest and disease pressures, and market demand for specific crops.

Key Drivers, Barriers & Challenges in South Asia Seed Sector Analysis

Key Drivers:

- Technological advancements: Development of high-yielding hybrid seeds and climate-resilient varieties.

- Government policies: Subsidies and incentives promoting seed adoption and agricultural modernization.

- Rising income levels: Increased purchasing power enabling farmers to invest in better quality seeds.

Key Challenges:

- Supply chain inefficiencies: Difficulties in timely seed distribution and poor storage facilities affecting seed viability.

- Regulatory hurdles: Complex seed certification procedures and intellectual property protection issues.

- Climate change impacts: Adverse weather conditions negatively affect crop yields and seed production. The estimated impact on market growth due to climate change is xx Million by 2033.

Growth Drivers in the South Asia Seed Sector Analysis Market

The South Asia seed market is driven by technological advancements leading to high-yielding and stress-tolerant varieties, supportive government policies including subsidies and agricultural extension services, and rising disposable incomes increasing farmer investment in improved seeds. These factors contribute to a growing demand for high-quality seeds, particularly hybrids, across various crops.

Challenges Impacting South Asia Seed Sector Analysis Growth

Growth is hampered by supply chain bottlenecks, particularly storage and distribution, leading to seed deterioration and inconsistent availability. Stringent regulatory frameworks and Intellectual Property Rights (IPR) protection complexities add to the operational cost. Furthermore, intense competition among established players and the emergence of new entrants pose challenges for market players.

Key Players Shaping the South Asia Seed Sector Analysis Market

- Raas Seeds Pvt Ltd

- Advanta Seeds

- Lal Teer Seed

- Kaveri Seeds

- Rijk Zwaan Zaadteelt en Zaadhandel B V

- Bayer AG

- Hm Clause India Pvt Ltd

- Rallis India Limited

- Corteva Agri Science

- Syngenta AG

- Takii Seed Pvt Ltd

- East-West Seed International

Significant South Asia Seed Sector Analysis Industry Milestones

- 2020: Introduction of a new drought-resistant rice variety by a leading Indian seed company.

- 2021: Merger between two regional seed companies in India, leading to increased market share.

- 2022: Launch of a new precision agriculture platform by a multinational seed company, enhancing seed distribution and farmer engagement.

- 2023: Implementation of stricter seed quality control regulations in several South Asian countries.

Future Outlook for South Asia Seed Sector Analysis Market

The South Asia seed market is poised for continued growth, fueled by technological advancements, favorable government policies, and changing consumer preferences. Strategic opportunities exist for companies investing in research and development, developing innovative seed varieties tailored to the region's specific needs, and building robust supply chains. The market's potential for growth is significant, driven by the region's large and growing agricultural sector and increasing demand for high-quality, high-yielding seeds.

South Asia Seed Sector Analysis Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

South Asia Seed Sector Analysis Segmentation By Geography

-

1. South Asia

- 1.1. India

- 1.2. Pakistan

- 1.3. Bangladesh

- 1.4. Sri Lanka

- 1.5. Nepal

South Asia Seed Sector Analysis Regional Market Share

Geographic Coverage of South Asia Seed Sector Analysis

South Asia Seed Sector Analysis REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.52% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Decreasing Per Capita Arable Land; Increased Demand for Food

- 3.3. Market Restrains

- 3.3.1. High Initial Investments; Requirement of Precision Agriculture

- 3.4. Market Trends

- 3.4.1. Cereal Seeds Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Asia Seed Sector Analysis Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. South Asia

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Raas Seeds Pvt Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Advanta Seeds

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Lal Teer Seed

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kaveri Seeds

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Rijk Zwaan Zaadteelt en Zaadhandel B V

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bayer AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hm Clause India Pvt Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Rallis India Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Corteva Agri Science

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Syngenta AG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Takii Seed Pvt Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 East-West Seed Internationa

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Raas Seeds Pvt Ltd

List of Figures

- Figure 1: South Asia Seed Sector Analysis Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South Asia Seed Sector Analysis Share (%) by Company 2025

List of Tables

- Table 1: South Asia Seed Sector Analysis Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: South Asia Seed Sector Analysis Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: South Asia Seed Sector Analysis Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: South Asia Seed Sector Analysis Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: South Asia Seed Sector Analysis Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: South Asia Seed Sector Analysis Revenue Million Forecast, by Region 2020 & 2033

- Table 7: South Asia Seed Sector Analysis Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: South Asia Seed Sector Analysis Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: South Asia Seed Sector Analysis Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: South Asia Seed Sector Analysis Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: South Asia Seed Sector Analysis Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: South Asia Seed Sector Analysis Revenue Million Forecast, by Country 2020 & 2033

- Table 13: India South Asia Seed Sector Analysis Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Pakistan South Asia Seed Sector Analysis Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Bangladesh South Asia Seed Sector Analysis Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Sri Lanka South Asia Seed Sector Analysis Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Nepal South Asia Seed Sector Analysis Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Asia Seed Sector Analysis?

The projected CAGR is approximately 5.52%.

2. Which companies are prominent players in the South Asia Seed Sector Analysis?

Key companies in the market include Raas Seeds Pvt Ltd, Advanta Seeds, Lal Teer Seed, Kaveri Seeds, Rijk Zwaan Zaadteelt en Zaadhandel B V, Bayer AG, Hm Clause India Pvt Ltd, Rallis India Limited, Corteva Agri Science, Syngenta AG, Takii Seed Pvt Ltd, East-West Seed Internationa.

3. What are the main segments of the South Asia Seed Sector Analysis?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.83 Million as of 2022.

5. What are some drivers contributing to market growth?

Decreasing Per Capita Arable Land; Increased Demand for Food.

6. What are the notable trends driving market growth?

Cereal Seeds Dominate the Market.

7. Are there any restraints impacting market growth?

High Initial Investments; Requirement of Precision Agriculture.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Asia Seed Sector Analysis," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Asia Seed Sector Analysis report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Asia Seed Sector Analysis?

To stay informed about further developments, trends, and reports in the South Asia Seed Sector Analysis, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence