Key Insights

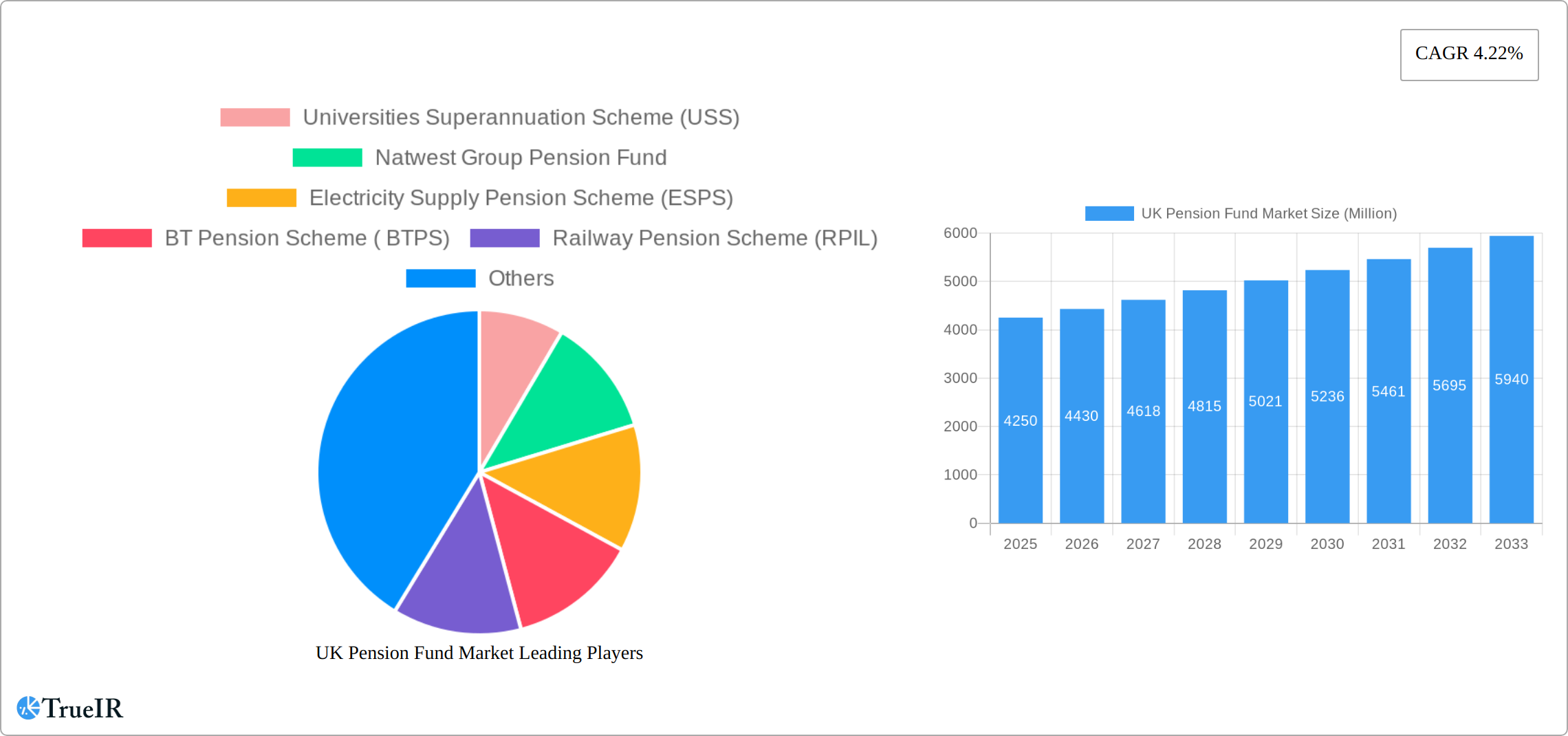

The UK pension fund market, valued at £4.25 billion in 2025, is projected to experience steady growth, exhibiting a compound annual growth rate (CAGR) of 4.22% from 2025 to 2033. This growth is driven by several factors. An aging population necessitates increased retirement savings, fueling demand for pension fund services. Furthermore, increasing government regulations promoting retirement planning and encouraging private sector participation are bolstering the market. The rising awareness of the importance of long-term financial security among individuals, coupled with the increasing availability of diversified investment options within pension funds, also contributes to market expansion. Competitive pressures among fund managers and the ongoing evolution of investment strategies, including greater incorporation of Environmental, Social, and Governance (ESG) factors, are shaping the market landscape. Key players like Universities Superannuation Scheme (USS), NatWest Group Pension Fund, and others are actively vying for market share through innovative product offerings and enhanced customer service. The market is segmented by fund type (defined benefit, defined contribution, etc.), investment strategy, and beneficiary demographics, providing ample opportunities for specialized service providers.

UK Pension Fund Market Market Size (In Billion)

However, the market faces challenges. Fluctuations in global financial markets represent a significant risk factor affecting investment returns and potentially impacting fund performance. Regulatory changes and their interpretation can also present complexities for fund managers. Furthermore, the increasing pressure to meet sustainability and responsible investment targets may necessitate adjustments in investment strategies and potentially lead to higher management costs. Competition among existing players and the potential entry of new entrants add to the dynamic nature of the market, requiring continuous adaptation and innovation for sustained success. Nevertheless, the long-term outlook for the UK pension fund market remains positive, supported by demographic trends and ongoing government initiatives promoting retirement savings.

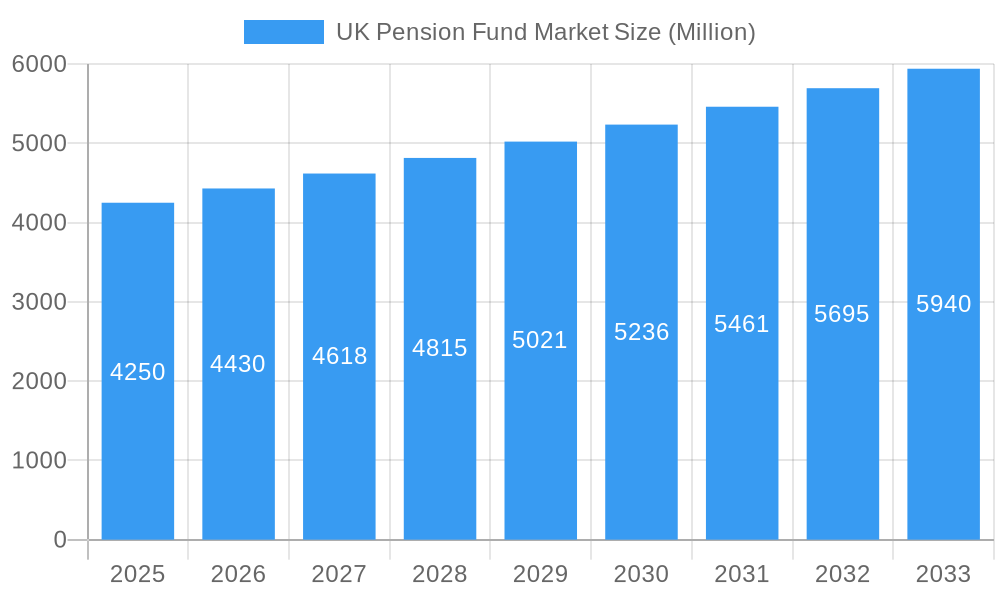

UK Pension Fund Market Company Market Share

UK Pension Fund Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the UK Pension Fund Market, encompassing market size, growth trends, competitive landscape, key players, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This in-depth analysis is crucial for investors, industry professionals, and policymakers seeking to navigate the complexities of this dynamic market. Discover key insights into market segmentation, dominant players, recent M&A activity, and the factors shaping the future of UK pension funds.

UK Pension Fund Market: Market Structure & Competitive Landscape

The UK pension fund market exhibits a moderately concentrated structure, with a handful of large pension schemes dominating the landscape. The Herfindahl-Hirschman Index (HHI) for the market in 2024 was estimated at xx, indicating a relatively consolidated market. However, the increasing participation of smaller, specialized funds is gradually fragmenting the market. Innovation is driven by technological advancements in areas such as digital platforms for member engagement and automated investment management. Regulatory changes, such as those related to auto-enrollment and defined contribution schemes, significantly impact the market structure. While there are no direct substitutes for traditional pension funds, alternative investment vehicles, such as ETFs and individual savings accounts (ISAs), are increasingly competitive.

- Market Concentration: HHI of xx in 2024.

- Innovation Drivers: Digitalization, AI-powered investment management, and personalized retirement planning tools.

- Regulatory Impacts: Auto-enrollment regulations, increased transparency requirements, and solvency regulations.

- Product Substitutes: ETFs, ISAs, and other investment vehicles.

- End-User Segmentation: Defined benefit (DB) and defined contribution (DC) schemes, public sector and private sector funds.

- M&A Trends: Significant M&A activity observed in the past five years, with an estimated xx Million in deal value in 2024. The rise of fintech's further fuels M&A.

UK Pension Fund Market: Market Trends & Opportunities

The UK pension fund market is projected to experience robust growth during the forecast period (2025-2033), with a Compound Annual Growth Rate (CAGR) of xx%. This growth is primarily driven by an aging population, increasing awareness of retirement planning, and government initiatives to improve pension coverage. Technological advancements are transforming the industry, particularly through the adoption of fintech solutions for enhanced efficiency, personalization, and risk management. Consumer preferences are shifting towards greater transparency, control, and customization of retirement plans. The competitive dynamics are influenced by both the established players and emerging fintech companies. Market penetration rates show a consistent increase of xx% annually, indicating increasing adoption and awareness. Further analysis reveals an increased demand for sustainable and ESG-compliant investment strategies within pension funds, shaping investment portfolios accordingly.

Dominant Markets & Segments in UK Pension Fund Market

The largest segment within the UK pension fund market is the defined contribution (DC) segment, accounting for xx% of the total market value in 2024. The rapid growth of DC schemes is largely attributed to the auto-enrollment program, which has significantly expanded the pool of pension savers. The public sector pension schemes, particularly the LGPS (Local Government Pension Scheme), also represent a significant market segment, demonstrating strong and stable growth.

- Key Growth Drivers in DC Segment: Auto-enrollment expansion, increasing awareness of retirement planning, and shift from defined benefit schemes.

- Key Growth Drivers in Public Sector: Government policy support, large participant base, and consistent funding from the public sector.

- Market Dominance: DC segment maintains a leading position fueled by government initiative and increased personal contribution.

UK Pension Fund Market: Product Analysis

The UK pension fund market offers a diverse range of products catering to various needs and risk appetites. Recent product innovations include the integration of digital platforms and AI-driven investment strategies for enhanced personalization and efficiency. These advancements allow for greater transparency and control for savers while optimizing investment returns through advanced analytics. The successful adoption of these technologies hinges on their ability to cater to both the demands of diverse participant demographics, while demonstrating a positive return on investment.

Key Drivers, Barriers & Challenges in UK Pension Fund Market

Key Drivers:

- An aging population significantly increasing the demand for robust and diverse retirement solutions, driving market expansion.

- Government regulations, including auto-enrollment schemes and ongoing policy adjustments, are promoting higher pension coverage and encouraging greater participation.

- Technological advancements, such as AI-driven portfolio optimization, robo-advisors, and enhanced data analytics, are streamlining administration, improving investment management efficiency, and reducing operational costs.

- Growing awareness of the importance of long-term financial planning and retirement security among the population is fostering increased demand for professional financial advice and pension products.

Key Barriers & Challenges:

- Regulatory complexities and the associated compliance costs continue to impose a significant burden on fund managers, necessitating substantial investment in regulatory expertise and technology.

- Market volatility and macroeconomic uncertainty, including inflation and geopolitical events, present significant challenges to investment strategies and portfolio management, requiring robust risk mitigation strategies.

- Increased competitive pressure from Fintech companies offering innovative and disruptive solutions, as well as from alternative investment options, is intensifying the battle for market share. This competitive landscape has resulted in a reported xx% reduction in projected profit margins for some established players in 2024, highlighting the need for adaptation and innovation.

- The need to address the funding gap for defined benefit schemes and ensure their long-term sustainability remains a critical challenge for many UK pension funds.

- Cybersecurity threats and data privacy concerns are growing concerns, requiring significant investment in robust security measures to protect sensitive member data.

Growth Drivers in the UK Pension Fund Market Market

The growth of the UK pension fund market is primarily driven by increasing longevity, government policies promoting pension savings, and technological advancements enhancing accessibility and efficiency. These factors, along with the expanding use of AI in risk management and investment optimization, are fostering substantial growth potential within the market.

Challenges Impacting UK Pension Fund Market Growth

The UK pension fund market faces significant challenges, including complex regulatory environments, rising compliance costs, and intense competition from both traditional and emerging market players. These challenges create substantial headwinds and necessitate strategic adaptation to secure long-term profitability and growth.

Key Players Shaping the UK Pension Fund Market Market

- Universities Superannuation Scheme (USS)

- NatWest Group Pension Fund

- Electricity Supply Pension Scheme (ESPS)

- BT Pension Scheme (BTPS)

- Railway Pension Scheme (RPIL)

- HSBC Bank Pension

- Local Government Pension (LGPS)

- Pension Protection Fund (PPF)

- Barclays Bank UK Retirement Fund

- Lloyds Bank Pension Scheme

- List Not Exhaustive

Significant UK Pension Fund Market Industry Milestones

- June 2023: NatWest Group acquires 85% stake in Cushon for USD 157.37 Million.

- January 2024: Aptia launches, entering the pensions, health, and benefits administration market.

Future Outlook for UK Pension Fund Market Market

The UK pension fund market is poised for continued growth, driven by demographic shifts, technological innovation, and supportive regulatory frameworks. Strategic opportunities lie in leveraging technology to enhance customer experience, expanding into new market segments, and offering personalized retirement solutions. This creates considerable market potential for both established players and innovative newcomers seeking to capitalize on the increasing demand for comprehensive retirement solutions.

UK Pension Fund Market Segmentation

-

1. Plan Type

- 1.1. Defined Contribution (DC)

- 1.2. Defined Benefits (DB)

- 1.3. Hybrid And Others

UK Pension Fund Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

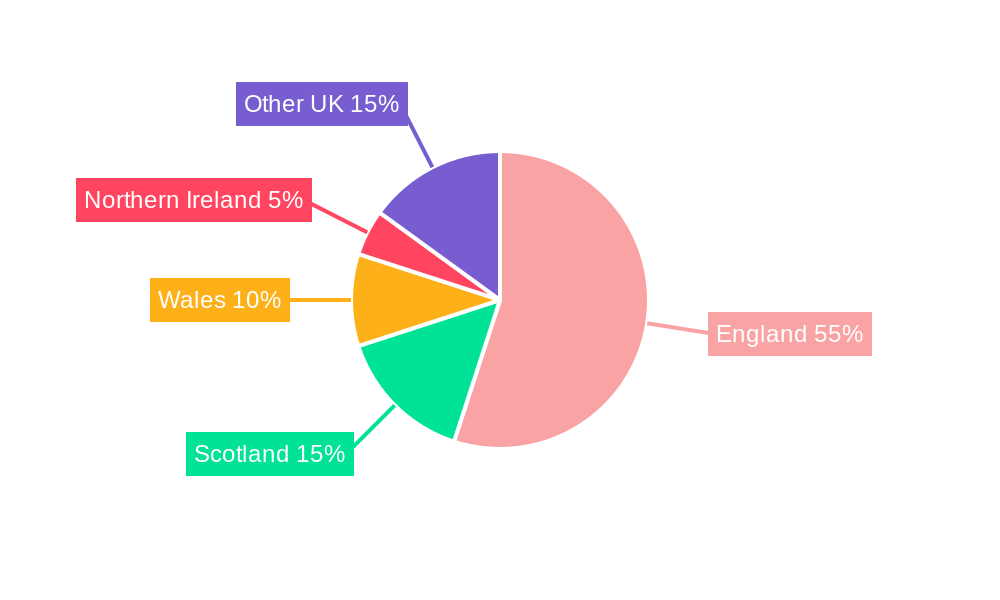

UK Pension Fund Market Regional Market Share

Geographic Coverage of UK Pension Fund Market

UK Pension Fund Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.22% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Shift to Capital Light Products from Traditional Products; A Push for Technology-Led Engagement

- 3.3. Market Restrains

- 3.3.1. Shift to Capital Light Products from Traditional Products; A Push for Technology-Led Engagement

- 3.4. Market Trends

- 3.4.1. Ageing population rate in United Kingdom affecting United Kingdom Pension Funds Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Pension Fund Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Plan Type

- 5.1.1. Defined Contribution (DC)

- 5.1.2. Defined Benefits (DB)

- 5.1.3. Hybrid And Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Plan Type

- 6. North America UK Pension Fund Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Plan Type

- 6.1.1. Defined Contribution (DC)

- 6.1.2. Defined Benefits (DB)

- 6.1.3. Hybrid And Others

- 6.1. Market Analysis, Insights and Forecast - by Plan Type

- 7. South America UK Pension Fund Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Plan Type

- 7.1.1. Defined Contribution (DC)

- 7.1.2. Defined Benefits (DB)

- 7.1.3. Hybrid And Others

- 7.1. Market Analysis, Insights and Forecast - by Plan Type

- 8. Europe UK Pension Fund Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Plan Type

- 8.1.1. Defined Contribution (DC)

- 8.1.2. Defined Benefits (DB)

- 8.1.3. Hybrid And Others

- 8.1. Market Analysis, Insights and Forecast - by Plan Type

- 9. Middle East & Africa UK Pension Fund Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Plan Type

- 9.1.1. Defined Contribution (DC)

- 9.1.2. Defined Benefits (DB)

- 9.1.3. Hybrid And Others

- 9.1. Market Analysis, Insights and Forecast - by Plan Type

- 10. Asia Pacific UK Pension Fund Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Plan Type

- 10.1.1. Defined Contribution (DC)

- 10.1.2. Defined Benefits (DB)

- 10.1.3. Hybrid And Others

- 10.1. Market Analysis, Insights and Forecast - by Plan Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Universities Superannuation Scheme (USS)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Natwest Group Pension Fund

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Electricity Supply Pension Scheme (ESPS)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 BT Pension Scheme ( BTPS)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Railway Pension Scheme (RPIL)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 HSBC Bank Pension

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Local Government Pension (LGPS)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Pension Protection Fund (PPF)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Barclays Bank UK Retirement Fund

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Lloyds Bank Pension Scheme**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Universities Superannuation Scheme (USS)

List of Figures

- Figure 1: Global UK Pension Fund Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global UK Pension Fund Market Volume Breakdown (Trillion, %) by Region 2025 & 2033

- Figure 3: North America UK Pension Fund Market Revenue (Million), by Plan Type 2025 & 2033

- Figure 4: North America UK Pension Fund Market Volume (Trillion), by Plan Type 2025 & 2033

- Figure 5: North America UK Pension Fund Market Revenue Share (%), by Plan Type 2025 & 2033

- Figure 6: North America UK Pension Fund Market Volume Share (%), by Plan Type 2025 & 2033

- Figure 7: North America UK Pension Fund Market Revenue (Million), by Country 2025 & 2033

- Figure 8: North America UK Pension Fund Market Volume (Trillion), by Country 2025 & 2033

- Figure 9: North America UK Pension Fund Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America UK Pension Fund Market Volume Share (%), by Country 2025 & 2033

- Figure 11: South America UK Pension Fund Market Revenue (Million), by Plan Type 2025 & 2033

- Figure 12: South America UK Pension Fund Market Volume (Trillion), by Plan Type 2025 & 2033

- Figure 13: South America UK Pension Fund Market Revenue Share (%), by Plan Type 2025 & 2033

- Figure 14: South America UK Pension Fund Market Volume Share (%), by Plan Type 2025 & 2033

- Figure 15: South America UK Pension Fund Market Revenue (Million), by Country 2025 & 2033

- Figure 16: South America UK Pension Fund Market Volume (Trillion), by Country 2025 & 2033

- Figure 17: South America UK Pension Fund Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: South America UK Pension Fund Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe UK Pension Fund Market Revenue (Million), by Plan Type 2025 & 2033

- Figure 20: Europe UK Pension Fund Market Volume (Trillion), by Plan Type 2025 & 2033

- Figure 21: Europe UK Pension Fund Market Revenue Share (%), by Plan Type 2025 & 2033

- Figure 22: Europe UK Pension Fund Market Volume Share (%), by Plan Type 2025 & 2033

- Figure 23: Europe UK Pension Fund Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe UK Pension Fund Market Volume (Trillion), by Country 2025 & 2033

- Figure 25: Europe UK Pension Fund Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe UK Pension Fund Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Middle East & Africa UK Pension Fund Market Revenue (Million), by Plan Type 2025 & 2033

- Figure 28: Middle East & Africa UK Pension Fund Market Volume (Trillion), by Plan Type 2025 & 2033

- Figure 29: Middle East & Africa UK Pension Fund Market Revenue Share (%), by Plan Type 2025 & 2033

- Figure 30: Middle East & Africa UK Pension Fund Market Volume Share (%), by Plan Type 2025 & 2033

- Figure 31: Middle East & Africa UK Pension Fund Market Revenue (Million), by Country 2025 & 2033

- Figure 32: Middle East & Africa UK Pension Fund Market Volume (Trillion), by Country 2025 & 2033

- Figure 33: Middle East & Africa UK Pension Fund Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East & Africa UK Pension Fund Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific UK Pension Fund Market Revenue (Million), by Plan Type 2025 & 2033

- Figure 36: Asia Pacific UK Pension Fund Market Volume (Trillion), by Plan Type 2025 & 2033

- Figure 37: Asia Pacific UK Pension Fund Market Revenue Share (%), by Plan Type 2025 & 2033

- Figure 38: Asia Pacific UK Pension Fund Market Volume Share (%), by Plan Type 2025 & 2033

- Figure 39: Asia Pacific UK Pension Fund Market Revenue (Million), by Country 2025 & 2033

- Figure 40: Asia Pacific UK Pension Fund Market Volume (Trillion), by Country 2025 & 2033

- Figure 41: Asia Pacific UK Pension Fund Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific UK Pension Fund Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UK Pension Fund Market Revenue Million Forecast, by Plan Type 2020 & 2033

- Table 2: Global UK Pension Fund Market Volume Trillion Forecast, by Plan Type 2020 & 2033

- Table 3: Global UK Pension Fund Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global UK Pension Fund Market Volume Trillion Forecast, by Region 2020 & 2033

- Table 5: Global UK Pension Fund Market Revenue Million Forecast, by Plan Type 2020 & 2033

- Table 6: Global UK Pension Fund Market Volume Trillion Forecast, by Plan Type 2020 & 2033

- Table 7: Global UK Pension Fund Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Global UK Pension Fund Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 9: United States UK Pension Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United States UK Pension Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 11: Canada UK Pension Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada UK Pension Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 13: Mexico UK Pension Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Mexico UK Pension Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 15: Global UK Pension Fund Market Revenue Million Forecast, by Plan Type 2020 & 2033

- Table 16: Global UK Pension Fund Market Volume Trillion Forecast, by Plan Type 2020 & 2033

- Table 17: Global UK Pension Fund Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global UK Pension Fund Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 19: Brazil UK Pension Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Brazil UK Pension Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 21: Argentina UK Pension Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Argentina UK Pension Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 23: Rest of South America UK Pension Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of South America UK Pension Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 25: Global UK Pension Fund Market Revenue Million Forecast, by Plan Type 2020 & 2033

- Table 26: Global UK Pension Fund Market Volume Trillion Forecast, by Plan Type 2020 & 2033

- Table 27: Global UK Pension Fund Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Global UK Pension Fund Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 29: United Kingdom UK Pension Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: United Kingdom UK Pension Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 31: Germany UK Pension Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany UK Pension Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 33: France UK Pension Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: France UK Pension Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 35: Italy UK Pension Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Italy UK Pension Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 37: Spain UK Pension Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Spain UK Pension Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 39: Russia UK Pension Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Russia UK Pension Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 41: Benelux UK Pension Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Benelux UK Pension Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 43: Nordics UK Pension Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Nordics UK Pension Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 45: Rest of Europe UK Pension Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Europe UK Pension Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 47: Global UK Pension Fund Market Revenue Million Forecast, by Plan Type 2020 & 2033

- Table 48: Global UK Pension Fund Market Volume Trillion Forecast, by Plan Type 2020 & 2033

- Table 49: Global UK Pension Fund Market Revenue Million Forecast, by Country 2020 & 2033

- Table 50: Global UK Pension Fund Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 51: Turkey UK Pension Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Turkey UK Pension Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 53: Israel UK Pension Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Israel UK Pension Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 55: GCC UK Pension Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: GCC UK Pension Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 57: North Africa UK Pension Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: North Africa UK Pension Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 59: South Africa UK Pension Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: South Africa UK Pension Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 61: Rest of Middle East & Africa UK Pension Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Rest of Middle East & Africa UK Pension Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 63: Global UK Pension Fund Market Revenue Million Forecast, by Plan Type 2020 & 2033

- Table 64: Global UK Pension Fund Market Volume Trillion Forecast, by Plan Type 2020 & 2033

- Table 65: Global UK Pension Fund Market Revenue Million Forecast, by Country 2020 & 2033

- Table 66: Global UK Pension Fund Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 67: China UK Pension Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: China UK Pension Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 69: India UK Pension Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: India UK Pension Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 71: Japan UK Pension Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Japan UK Pension Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 73: South Korea UK Pension Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: South Korea UK Pension Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 75: ASEAN UK Pension Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: ASEAN UK Pension Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 77: Oceania UK Pension Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 78: Oceania UK Pension Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 79: Rest of Asia Pacific UK Pension Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: Rest of Asia Pacific UK Pension Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Pension Fund Market?

The projected CAGR is approximately 4.22%.

2. Which companies are prominent players in the UK Pension Fund Market?

Key companies in the market include Universities Superannuation Scheme (USS), Natwest Group Pension Fund, Electricity Supply Pension Scheme (ESPS), BT Pension Scheme ( BTPS), Railway Pension Scheme (RPIL), HSBC Bank Pension, Local Government Pension (LGPS), Pension Protection Fund (PPF), Barclays Bank UK Retirement Fund, Lloyds Bank Pension Scheme**List Not Exhaustive.

3. What are the main segments of the UK Pension Fund Market?

The market segments include Plan Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.25 Million as of 2022.

5. What are some drivers contributing to market growth?

Shift to Capital Light Products from Traditional Products; A Push for Technology-Led Engagement.

6. What are the notable trends driving market growth?

Ageing population rate in United Kingdom affecting United Kingdom Pension Funds Market.

7. Are there any restraints impacting market growth?

Shift to Capital Light Products from Traditional Products; A Push for Technology-Led Engagement.

8. Can you provide examples of recent developments in the market?

In January 2024, Aptia, a fresh player in the pensions, health, and benefits administration sector, has been formally introduced. The company's inception follows its initial announcement in June 2023, which came after Bain Capital Insurance acquired the UK pension administration and US health and benefits administration segments of Mercer.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Trillion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Pension Fund Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Pension Fund Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Pension Fund Market?

To stay informed about further developments, trends, and reports in the UK Pension Fund Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence