Key Insights

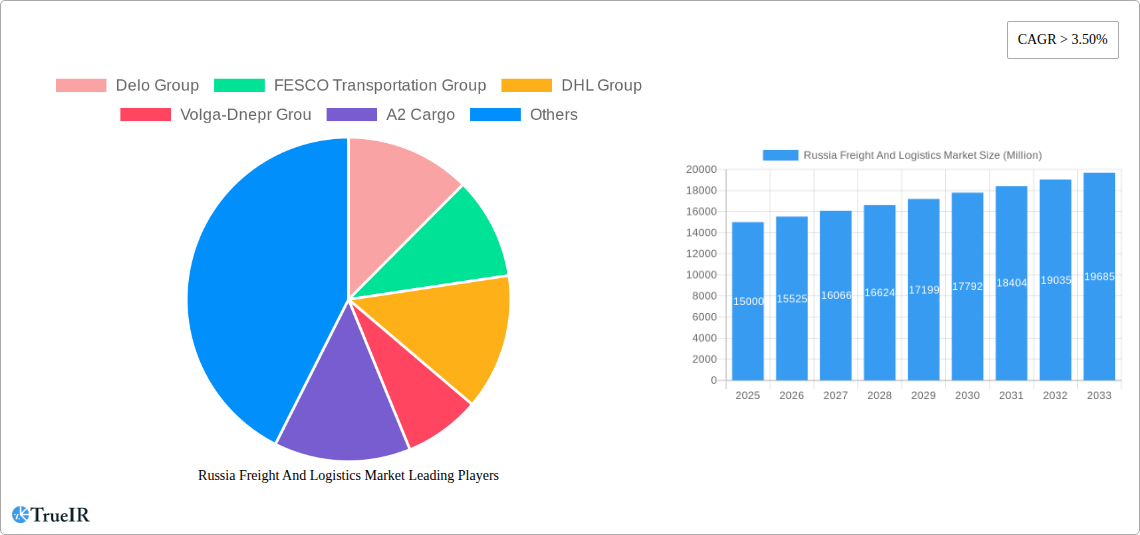

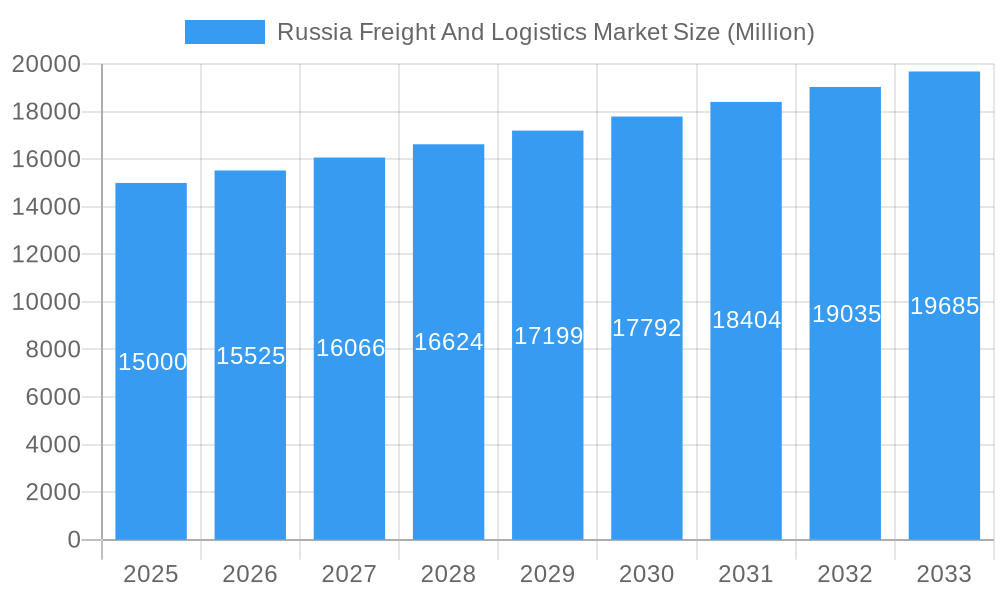

The Russia freight and logistics market is projected to reach $17.96 billion by 2025, demonstrating a compelling Compound Annual Growth Rate (CAGR) of 6.3% through 2033. This expansion is propelled by robust e-commerce growth, demanding advanced delivery solutions, and heightened industrial activity in manufacturing, oil & gas, and construction. Government investments in infrastructure modernization further stimulate the sector. However, geopolitical uncertainties, sanctions, volatile fuel prices, and driver shortages present significant challenges. Key market segments include temperature-controlled logistics for agriculture, pharmaceuticals, and food, alongside strong demand in the courier, express, and parcel (CEP) sector. Prominent players include Delo Group, FESCO Transportation Group, and DHL Group.

Russia Freight And Logistics Market Market Size (In Billion)

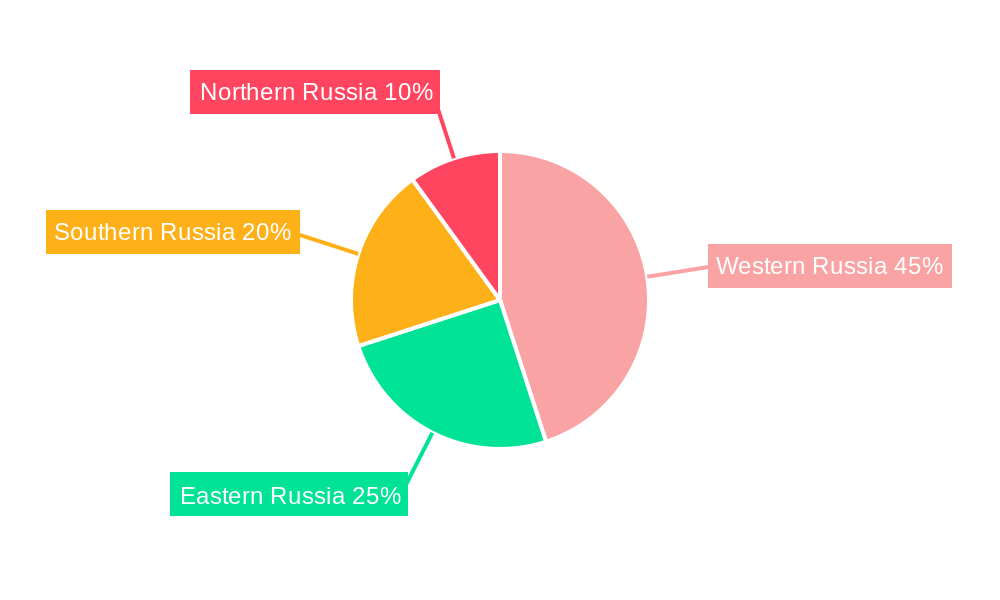

Geographically, Western Russia leads in market share due to industrial concentration and population density, while Eastern Russia, despite resource potential, faces infrastructure constraints. The market is a blend of global corporations and regional enterprises. Future growth hinges on infrastructure development, geopolitical risk mitigation, and the adoption of digital and automated logistics solutions, driven by the sustained expansion of e-commerce.

Russia Freight And Logistics Market Company Market Share

Russia Freight And Logistics Market: A Comprehensive Report (2019-2033)

This dynamic report provides a deep dive into the Russia Freight and Logistics Market, offering a comprehensive analysis of its structure, trends, challenges, and future prospects. Covering the period 2019-2033, with a focus on 2025, this report is an essential resource for industry professionals, investors, and policymakers seeking to understand this crucial market.

Russia Freight And Logistics Market Market Structure & Competitive Landscape

The Russian freight and logistics market exhibits a moderately concentrated structure, with a few dominant players and numerous smaller operators. Delo Group, FESCO Transportation Group, and DHL Group are among the leading players, commanding significant market share. The market's structure is influenced by factors such as government regulations, infrastructure development, and the increasing adoption of technology. Innovation is a key driver, with companies investing in technologies like digital logistics platforms and automation to enhance efficiency and competitiveness. Regulatory changes, including those related to transportation safety and environmental standards, significantly impact market operations. Product substitutes, such as alternative transportation modes or specialized logistics services, exert competitive pressure. The market is segmented across various end-user industries, including agriculture, manufacturing, oil & gas, and retail, with each segment presenting unique characteristics and growth opportunities. M&A activity in the sector remains significant, driven by the need for expansion, diversification, and improved market positioning. In 2024, estimated M&A volume reached xx Million USD, indicating ongoing consolidation within the market. The Herfindahl-Hirschman Index (HHI) for the market is estimated at xx in 2024, suggesting a moderately concentrated landscape.

- Market Concentration: Moderately concentrated, with a few major players dominating.

- Innovation Drivers: Digitalization, automation, and sustainable logistics solutions.

- Regulatory Impacts: Significant influence on safety, environmental standards, and market access.

- Product Substitutes: Alternative transportation modes and specialized services.

- End-User Segmentation: Diversified, with different growth prospects across sectors.

- M&A Trends: Active consolidation, driven by expansion and synergy.

Russia Freight And Logistics Market Market Trends & Opportunities

The Russian freight and logistics market is experiencing robust growth, driven by factors such as expanding e-commerce, increasing industrial production, and the development of new infrastructure. The market size in 2024 is estimated at xx Million USD, and is projected to reach xx Million USD by 2033, registering a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological advancements, such as the Internet of Things (IoT), blockchain, and artificial intelligence (AI), are transforming logistics operations, improving efficiency and transparency. Consumer preferences are shifting towards faster, more reliable, and environmentally friendly delivery options. The competitive landscape is dynamic, with both established players and new entrants vying for market share. Market penetration rates for various segments, such as temperature-controlled logistics, are steadily increasing. The increasing adoption of e-commerce is driving significant growth within the courier, express, and parcel (CEP) segment. This growth also correlates with investment into last-mile delivery infrastructure in rapidly growing urban areas. The successful implementation of sustainable logistics solutions, as exemplified by DHL's work with Grundfos, signals a growing demand for environmentally conscious services within the market.

Dominant Markets & Segments in Russia Freight And Logistics Market

The Russian freight and logistics market shows significant regional variations in growth. The Western and Central regions, thanks to established industrial and economic activity and access to major transportation hubs, lead in terms of market share. However, Eastern and Southern regions, seeing increased investment into infrastructure projects, are catching up at an accelerated rate. Among the segments, the manufacturing, oil and gas, and wholesale and retail trade sectors are the dominant end-user industries, driving a significant portion of logistics demand. The temperature-controlled segment is also experiencing rapid growth, fuelled by the growing demand for food and pharmaceutical products. The courier, express, and parcel (CEP) sector is growing at an even faster pace, propelled by the booming e-commerce market.

Key Growth Drivers:

- Improved Infrastructure: Investments in roads, railways, and ports.

- Government Policies: Support for logistics development and infrastructure investments.

- Technological Advancements: Automation, digitalization and sustainable logistics practices.

- Economic Growth: Expansion of industries such as manufacturing and e-commerce.

Market Dominance Analysis: The manufacturing sector is the dominant end-user due to its substantial volume of goods requiring transport and logistics solutions. Within logistics functions, the CEP segment is expected to show the fastest growth due to the rapid growth of e-commerce and the expanding middle class.

Russia Freight And Logistics Market Product Analysis

Product innovation is a key driver in the Russian freight and logistics market. Companies are continuously developing new technologies and services to improve efficiency, reduce costs, and enhance customer satisfaction. These include specialized transportation solutions for temperature-sensitive goods, advanced tracking systems and technology-based supply chain management systems. These innovations are providing businesses with enhanced visibility, faster transit times, better cost control, and enhanced security. The market fit of these products is strong, driven by the growing demand for sophisticated and customized logistics solutions.

Key Drivers, Barriers & Challenges in Russia Freight And Logistics Market

Key Drivers: Technological advancements (automation, digitalization), economic growth (e-commerce, industrial expansion), and supportive government policies (infrastructure investments).

Challenges: Geopolitical instability, sanctions, infrastructure limitations in certain regions, and the need to improve technological integration across the supply chain. These challenges impose substantial limitations on the market's capacity to meet the constantly increasing demand for logistics services, resulting in lost revenue and increased operational costs for market participants. Regulatory hurdles and complexities, including import/export restrictions, add layers of complexity, particularly concerning international transactions.

Growth Drivers in the Russia Freight And Logistics Market Market

Significant growth is fueled by increasing industrial production, the expansion of e-commerce, and investments in infrastructure. Government policies aimed at improving logistics efficiency also play a critical role. Technological innovations, like the adoption of AI and blockchain, are increasing operational efficiency and reducing costs. Sustainable logistics solutions are also gaining traction.

Challenges Impacting Russia Freight And Logistics Market Growth

Geopolitical uncertainties, sanctions, and infrastructure gaps in certain regions represent key barriers. Regulatory complexities, particularly concerning international trade, impose additional challenges. Intense competition and supply chain disruptions can affect operational stability. These factors cause uncertainty and unpredictability which impact investment decisions and make long-term strategic planning difficult.

Key Players Shaping the Russia Freight And Logistics Market Market

- Delo Group

- FESCO Transportation Group

- DHL Group

- Volga-Dnepr Group

- A2 Cargo

- Sovtransavto Group

- Volga Shipping

- Eurosib Group

- Delko

- STS Logistics

Significant Russia Freight And Logistics Market Industry Milestones

- November 2022: Eurosib Group and EFKO-Cascade CRC LLC signed a service contract, expanding Eurosib's market reach and strengthening its position in the food and beverage sector.

- November 2022: DHL extended its partnership with the BSD, demonstrating its commitment to sponsorships and further strengthening brand recognition.

- February 2023: DHL Global Forwarding implemented sustainable solutions for Grundfos, highlighting the increasing focus on environmentally friendly logistics practices.

Future Outlook for Russia Freight And Logistics Market Market

The Russian freight and logistics market is poised for continued growth, driven by sustained economic expansion and infrastructure development. Strategic investments in technology and sustainable practices will be crucial for success. The market presents opportunities for companies that can adapt to evolving regulatory environments and leverage technological advancements to improve efficiency and meet the growing demands of the e-commerce and industrial sectors. The market's future hinges on the resolution of geopolitical issues and continued investment in infrastructure to unlock the full potential of regional markets.

Russia Freight And Logistics Market Segmentation

-

1. End User Industry

- 1.1. Agriculture, Fishing, and Forestry

- 1.2. Construction

- 1.3. Manufacturing

- 1.4. Oil and Gas, Mining and Quarrying

- 1.5. Wholesale and Retail Trade

- 1.6. Others

-

2. Logistics Function

-

2.1. Courier, Express, and Parcel (CEP)

-

2.1.1. By Destination Type

- 2.1.1.1. Domestic

- 2.1.1.2. International

-

2.1.1. By Destination Type

-

2.2. Freight Forwarding

-

2.2.1. By Mode Of Transport

- 2.2.1.1. Air

- 2.2.1.2. Sea and Inland Waterways

- 2.2.1.3. Others

-

2.2.1. By Mode Of Transport

-

2.3. Freight Transport

- 2.3.1. Pipelines

- 2.3.2. Rail

- 2.3.3. Road

-

2.4. Warehousing and Storage

-

2.4.1. By Temperature Control

- 2.4.1.1. Non-Temperature Controlled

-

2.4.1. By Temperature Control

- 2.5. Other Services

-

2.1. Courier, Express, and Parcel (CEP)

Russia Freight And Logistics Market Segmentation By Geography

- 1. Russia

Russia Freight And Logistics Market Regional Market Share

Geographic Coverage of Russia Freight And Logistics Market

Russia Freight And Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing volume of international trade4.; The rise of trade agreements between nations

- 3.3. Market Restrains

- 3.3.1. 4.; Surge in fuel costs affecting the market4.; Increasing trade tension

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Freight And Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Agriculture, Fishing, and Forestry

- 5.1.2. Construction

- 5.1.3. Manufacturing

- 5.1.4. Oil and Gas, Mining and Quarrying

- 5.1.5. Wholesale and Retail Trade

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Logistics Function

- 5.2.1. Courier, Express, and Parcel (CEP)

- 5.2.1.1. By Destination Type

- 5.2.1.1.1. Domestic

- 5.2.1.1.2. International

- 5.2.1.1. By Destination Type

- 5.2.2. Freight Forwarding

- 5.2.2.1. By Mode Of Transport

- 5.2.2.1.1. Air

- 5.2.2.1.2. Sea and Inland Waterways

- 5.2.2.1.3. Others

- 5.2.2.1. By Mode Of Transport

- 5.2.3. Freight Transport

- 5.2.3.1. Pipelines

- 5.2.3.2. Rail

- 5.2.3.3. Road

- 5.2.4. Warehousing and Storage

- 5.2.4.1. By Temperature Control

- 5.2.4.1.1. Non-Temperature Controlled

- 5.2.4.1. By Temperature Control

- 5.2.5. Other Services

- 5.2.1. Courier, Express, and Parcel (CEP)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Delo Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 FESCO Transportation Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DHL Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Volga-Dnepr Grou

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 A2 Cargo

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sovtransavto Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Volga Shipping

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Eurosib Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Delko

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 STS Logistics

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Delo Group

List of Figures

- Figure 1: Russia Freight And Logistics Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Russia Freight And Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Russia Freight And Logistics Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 2: Russia Freight And Logistics Market Revenue billion Forecast, by Logistics Function 2020 & 2033

- Table 3: Russia Freight And Logistics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Russia Freight And Logistics Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 5: Russia Freight And Logistics Market Revenue billion Forecast, by Logistics Function 2020 & 2033

- Table 6: Russia Freight And Logistics Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Freight And Logistics Market?

The projected CAGR is approximately 6.3%.

2. Which companies are prominent players in the Russia Freight And Logistics Market?

Key companies in the market include Delo Group, FESCO Transportation Group, DHL Group, Volga-Dnepr Grou, A2 Cargo, Sovtransavto Group, Volga Shipping, Eurosib Group, Delko, STS Logistics.

3. What are the main segments of the Russia Freight And Logistics Market?

The market segments include End User Industry, Logistics Function.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.96 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing volume of international trade4.; The rise of trade agreements between nations.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

4.; Surge in fuel costs affecting the market4.; Increasing trade tension.

8. Can you provide examples of recent developments in the market?

February 2023: DHL Global Forwarding, the air and ocean freight specialist division of Deutsche Post DHL Group, successfully implemented sustainable logistics solutions for its customer Grundfos.November 2022: DHL prolonged its partnership with the German Bobsleigh, Luge, and Skeleton Federation (BSD) for another four years. The premium and logistics partnership has been in place since the 2014-2015 winter season, and it includes logistics for all equipment during the seasons, along with the branding of sports equipment and clothing of athletes.November 2022: Eurosib Group and EFKO-Cascade CRC LLC signed a service contract to provide transport logistics to enterprises belonging to the EFKO Group of Companies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Freight And Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Freight And Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Freight And Logistics Market?

To stay informed about further developments, trends, and reports in the Russia Freight And Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence