Key Insights

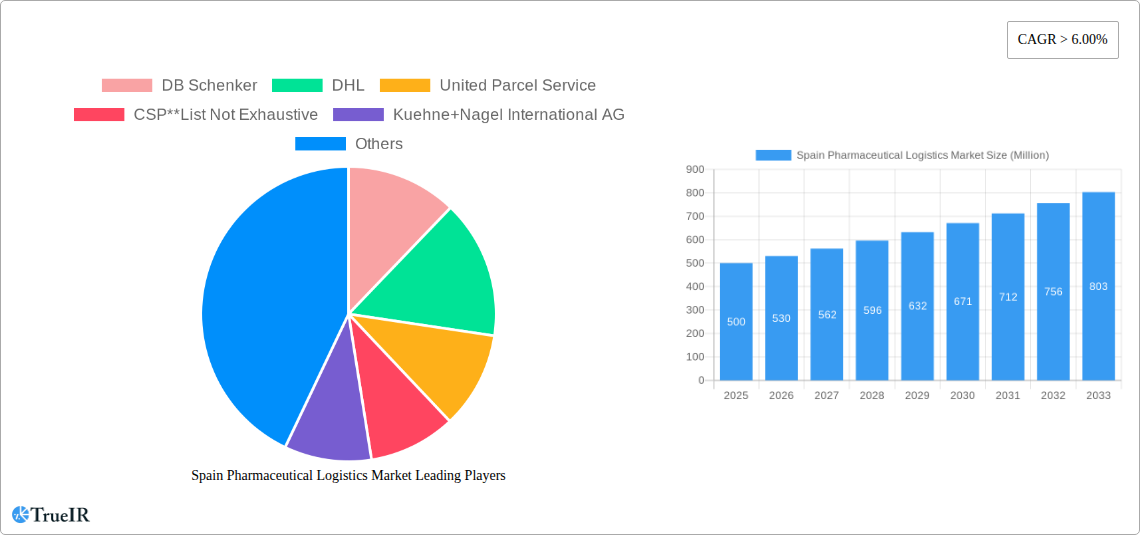

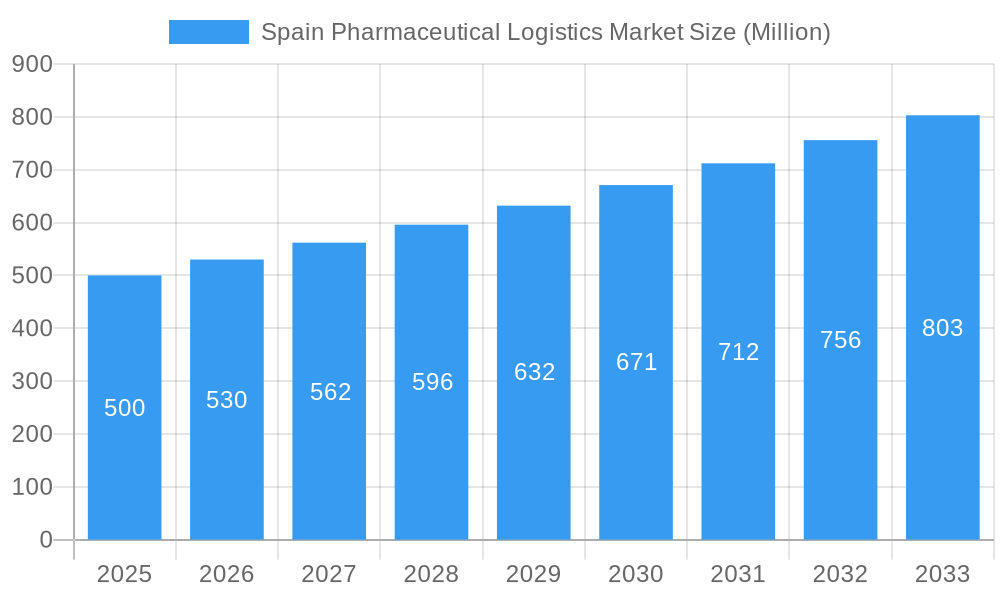

The Spain pharmaceutical logistics market, valued at approximately €500 million in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) exceeding 6% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the increasing prevalence of chronic diseases and the consequent rise in pharmaceutical consumption are fueling demand for efficient and reliable logistics solutions. Secondly, the growing adoption of advanced technologies such as cold chain management and real-time tracking systems enhances supply chain visibility and drug efficacy, thereby stimulating market growth. Furthermore, stringent regulatory compliance requirements within the pharmaceutical sector necessitate specialized logistics providers, leading to market consolidation and increased investment in infrastructure. The market is segmented by mode of transport (air, rail, road, sea), product type (generic and branded drugs), operational mode (cold chain and non-cold chain), and application (biopharma and chemical pharma). The dominance of road shipping reflects the extensive road network in Spain, while air shipping caters to time-sensitive deliveries. Cold chain logistics is a rapidly growing segment, mirroring the increasing demand for temperature-sensitive pharmaceuticals. Key players like DB Schenker, DHL, UPS, and FedEx are actively competing in this market, leveraging their global networks and expertise in pharmaceutical handling.

Spain Pharmaceutical Logistics Market Market Size (In Million)

The projected growth trajectory indicates a significant market opportunity in Spain. While challenges remain, such as fluctuating fuel prices and potential supply chain disruptions, the overall outlook is positive. Market players are focusing on strategic partnerships, technological advancements, and enhanced service offerings to meet the evolving demands of pharmaceutical companies. The market's segmentation offers diverse opportunities for specialized logistics providers catering to specific niches, such as biopharmaceutical cold chain logistics. Continued investment in infrastructure and the implementation of innovative solutions will be crucial for sustained growth in the coming years. The consistent growth in the Spanish pharmaceutical sector and its alignment with global trends indicate a strong and promising future for pharmaceutical logistics in Spain.

Spain Pharmaceutical Logistics Market Company Market Share

This dynamic report provides a deep dive into the burgeoning Spain pharmaceutical logistics market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a comprehensive analysis spanning the period 2019-2033, including a base year of 2025 and forecast period of 2025-2033, this report unveils the market's structure, competitive landscape, key trends, and future outlook. We leverage high-impact keywords like "Spain pharmaceutical logistics," "cold chain logistics," "pharmaceutical supply chain," and "Spanish pharmaceutical market" to ensure maximum search engine visibility. The report is packed with data-driven analysis, projections, and strategic recommendations for navigating this dynamic sector.

Spain Pharmaceutical Logistics Market Market Structure & Competitive Landscape

The Spanish pharmaceutical logistics market exhibits a moderately concentrated structure, with several large multinational players and a number of regional operators. The market's competitive landscape is characterized by intense rivalry, driven by factors such as pricing pressure, increasing demand for specialized services (e.g., cold chain logistics), and continuous technological advancements.

Market Concentration: The Herfindahl-Hirschman Index (HHI) for the market is estimated at xx, indicating a moderately concentrated market. This is largely due to the presence of major global players like DHL, FedEx, and DB Schenker, alongside significant local players such as Movianto and Eurotranspharma.

Innovation Drivers: The market is driven by continuous innovations in temperature-controlled transportation, warehousing, and tracking technologies. The rise of digitalization and the adoption of advanced analytics are further transforming the logistics landscape.

Regulatory Impacts: Stringent regulations concerning drug handling, storage, and transportation significantly impact market operations. Compliance with EU and Spanish regulations is a key success factor for operators.

Product Substitutes: While direct substitutes for pharmaceutical logistics are limited due to the specialized nature of the services, pressure exists from alternative transport modes and from emerging technology that reduces transportation needs.

End-User Segmentation: The market caters primarily to pharmaceutical manufacturers, distributors, wholesalers, and hospitals. The demand from each segment is impacted by differing needs for specialized logistics.

M&A Trends: The market has witnessed several significant M&A activities in recent years, driven by the need for scale, expansion into new markets and technological capabilities. The acquisition of Grupo Fuentes by Lineage Logistics in 2022 is a prime example, reflecting ongoing consolidation trends. The volume of M&A deals in the last 5 years is estimated to be xx.

Spain Pharmaceutical Logistics Market Market Trends & Opportunities

The Spain pharmaceutical logistics market is experiencing robust growth, driven by several key factors. The market size in 2025 is estimated at xx Million, exhibiting a compound annual growth rate (CAGR) of xx% from 2025 to 2033. This growth is fueled by several factors, including the rising demand for pharmaceuticals due to an aging population and increasing prevalence of chronic diseases.

Technological advancements, such as the integration of IoT devices and AI-powered solutions, are streamlining logistics operations, enhancing efficiency, and improving transparency throughout the supply chain. Consumer preferences are shifting toward enhanced traceability, security, and timely delivery of pharmaceutical products. The market is seeing increased adoption of cold chain solutions for temperature-sensitive drugs, representing a significant opportunity for specialized logistics providers. Competitive dynamics are characterized by both rivalry amongst existing players and also the emergence of niche players specializing in specific segments or offering value-added services. Market penetration of advanced logistics technologies like blockchain for tracking and tracing is steadily increasing.

Dominant Markets & Segments in Spain Pharmaceutical Logistics Market

The Spanish pharmaceutical logistics market is geographically diverse, with significant activity across major urban centers and industrial hubs. However, Madrid and Barcelona stand out as dominant regions due to high pharmaceutical manufacturing and distribution concentration.

By Mode of Transport:

- Road Shipping: Dominates the market due to its flexibility and extensive road network.

- Air Shipping: Significant for time-sensitive deliveries and international shipments.

- Rail Shipping: Growing, particularly for longer distances and bulk shipments.

- Sea Shipping: Important for import and export of pharmaceuticals.

By Product:

- Branded Drugs: Account for a larger market share than generic drugs due to higher value and stricter logistics requirements.

By Mode of Operation:

- Cold Chain Logistics: Experiencing rapid growth driven by increasing demand for temperature-sensitive drugs.

By Application:

- Bio Pharma: A high-growth segment with stringent logistics requirements, driving demand for specialized services.

Key Growth Drivers for Dominant Segments:

- Road Shipping: Extensive highway infrastructure and efficient road networks.

- Cold Chain Logistics: Growing demand for temperature-sensitive pharmaceutical products.

- Bio Pharma: Increased R&D investments and approvals of novel biologics.

Spain Pharmaceutical Logistics Market Product Analysis

Technological advancements in pharmaceutical logistics are focused on enhancing efficiency, security, and temperature control. Innovations include real-time tracking systems, advanced temperature monitoring devices, and automated warehousing solutions. These advancements improve supply chain visibility, reduce waste, and enhance patient safety. The market increasingly demands integrated solutions combining transportation, warehousing, and specialized handling capabilities, creating a competitive advantage for providers who can offer comprehensive services.

Key Drivers, Barriers & Challenges in Spain Pharmaceutical Logistics Market

Key Drivers: Factors driving market growth include increasing pharmaceutical consumption, stringent regulatory compliance demands, rising adoption of cold chain logistics, and technological advancements enabling greater efficiency and traceability. The Spanish government’s focus on improving healthcare infrastructure and supply chain efficiency also plays a vital role.

Challenges: Key challenges include the stringent regulatory environment necessitating high compliance costs; the need for significant investments in specialized cold chain infrastructure; and intense competition from established multinational players leading to price pressures. Supply chain disruptions due to global events can also significantly impact market performance. For example, the impact of the COVID-19 pandemic highlighted vulnerabilities in certain aspects of supply chains.

Growth Drivers in the Spain Pharmaceutical Logistics Market Market

Growth is primarily driven by increased pharmaceutical consumption fueled by an aging population and rising prevalence of chronic diseases. Technological advancements like IoT and AI improve efficiency and transparency. Government initiatives focused on improving healthcare infrastructure and supply chain resilience also contribute positively.

Challenges Impacting Spain Pharmaceutical Logistics Market Growth

Regulatory compliance is costly and complex. Investments in cold chain infrastructure require significant capital expenditure. Intense competition from established players creates pressure on pricing, profitability and growth potential. Supply chain disruptions pose a constant threat to operational efficiency.

Key Players Shaping the Spain Pharmaceutical Logistics Market Market

- DB Schenker

- DHL

- United Parcel Service

- CSP

- Kuehne+Nagel International AG

- FedEx

- CEVA Logistics

- Agility Logistics

- C H Robinson

- Movianto

- Eurotranspharma

Significant Spain Pharmaceutical Logistics Market Industry Milestones

- August 2022: Lineage Logistics announced its acquisition of Grupo Fuentes, expanding its cold storage capacity in Spain by 100,000 pallet positions. This significantly boosts cold chain logistics capacity in the region.

- January 2022: Movianto invested 41.88 Million USD in a new, large-scale temperature-controlled facility in Toledo, significantly increasing its storage capacity and strengthening its position in the Spanish market.

Future Outlook for Spain Pharmaceutical Logistics Market Market

The Spain pharmaceutical logistics market is poised for continued growth, driven by rising pharmaceutical consumption, technological advancements, and government initiatives. Strategic opportunities exist for providers offering specialized cold chain solutions, advanced technology integration, and value-added services. The market's future potential is substantial, reflecting both domestic growth and increasing participation in global pharmaceutical supply chains.

Spain Pharmaceutical Logistics Market Segmentation

-

1. Product

- 1.1. Generic Drugs

- 1.2. Branded Drugs

-

2. Mode of Operation

- 2.1. Cold Chain Logistics

- 2.2. Non-cold Chain Logistics

-

3. Application

- 3.1. Bio Pharma

- 3.2. Chemical Pharma

-

4. Mode Of Transport

- 4.1. Air Shipping

- 4.2. Rail Shipping

- 4.3. Road Shipping

- 4.4. Sea Shipping

Spain Pharmaceutical Logistics Market Segmentation By Geography

- 1. Spain

Spain Pharmaceutical Logistics Market Regional Market Share

Geographic Coverage of Spain Pharmaceutical Logistics Market

Spain Pharmaceutical Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Over the Counter Drugs Across the European Region; Growing Manufacture Activity from Pharmaceutical Companies

- 3.3. Market Restrains

- 3.3.1. High Cost Associated with the Transportation Ordered

- 3.4. Market Trends

- 3.4.1. Increase in Pharmaceutical Sales

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Spain Pharmaceutical Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Generic Drugs

- 5.1.2. Branded Drugs

- 5.2. Market Analysis, Insights and Forecast - by Mode of Operation

- 5.2.1. Cold Chain Logistics

- 5.2.2. Non-cold Chain Logistics

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Bio Pharma

- 5.3.2. Chemical Pharma

- 5.4. Market Analysis, Insights and Forecast - by Mode Of Transport

- 5.4.1. Air Shipping

- 5.4.2. Rail Shipping

- 5.4.3. Road Shipping

- 5.4.4. Sea Shipping

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Spain

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DHL

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 United Parcel Service

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CSP**List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kuehne+Nagel International AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 FedEx

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 CEVA Logistics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Agility Logistics

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 C H Robinson

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Movianto

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Eurotranspharma

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: Spain Pharmaceutical Logistics Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Spain Pharmaceutical Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Spain Pharmaceutical Logistics Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 2: Spain Pharmaceutical Logistics Market Revenue undefined Forecast, by Mode of Operation 2020 & 2033

- Table 3: Spain Pharmaceutical Logistics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Spain Pharmaceutical Logistics Market Revenue undefined Forecast, by Mode Of Transport 2020 & 2033

- Table 5: Spain Pharmaceutical Logistics Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Spain Pharmaceutical Logistics Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 7: Spain Pharmaceutical Logistics Market Revenue undefined Forecast, by Mode of Operation 2020 & 2033

- Table 8: Spain Pharmaceutical Logistics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 9: Spain Pharmaceutical Logistics Market Revenue undefined Forecast, by Mode Of Transport 2020 & 2033

- Table 10: Spain Pharmaceutical Logistics Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spain Pharmaceutical Logistics Market?

The projected CAGR is approximately 7%.

2. Which companies are prominent players in the Spain Pharmaceutical Logistics Market?

Key companies in the market include DB Schenker, DHL, United Parcel Service, CSP**List Not Exhaustive, Kuehne+Nagel International AG, FedEx, CEVA Logistics, Agility Logistics, C H Robinson, Movianto, Eurotranspharma.

3. What are the main segments of the Spain Pharmaceutical Logistics Market?

The market segments include Product, Mode of Operation, Application, Mode Of Transport .

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Over the Counter Drugs Across the European Region; Growing Manufacture Activity from Pharmaceutical Companies.

6. What are the notable trends driving market growth?

Increase in Pharmaceutical Sales.

7. Are there any restraints impacting market growth?

High Cost Associated with the Transportation Ordered.

8. Can you provide examples of recent developments in the market?

August 2022: Lineage Logistics, LLC ('Lineage' or the 'Company'), one of the world's leading temperature-controlled industrial REIT and logistics solutions providers, announced its intention to acquire Grupo Fuentes, a major operator of transport and cold storage facilities, headquartered in Murcia, Spain. Grupo Fuentes has a cold storage warehouse in Murcia with 60,000 pallet positions and plans to expand the site with an additional 40,000 pallet positions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spain Pharmaceutical Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spain Pharmaceutical Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spain Pharmaceutical Logistics Market?

To stay informed about further developments, trends, and reports in the Spain Pharmaceutical Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence