Key Insights

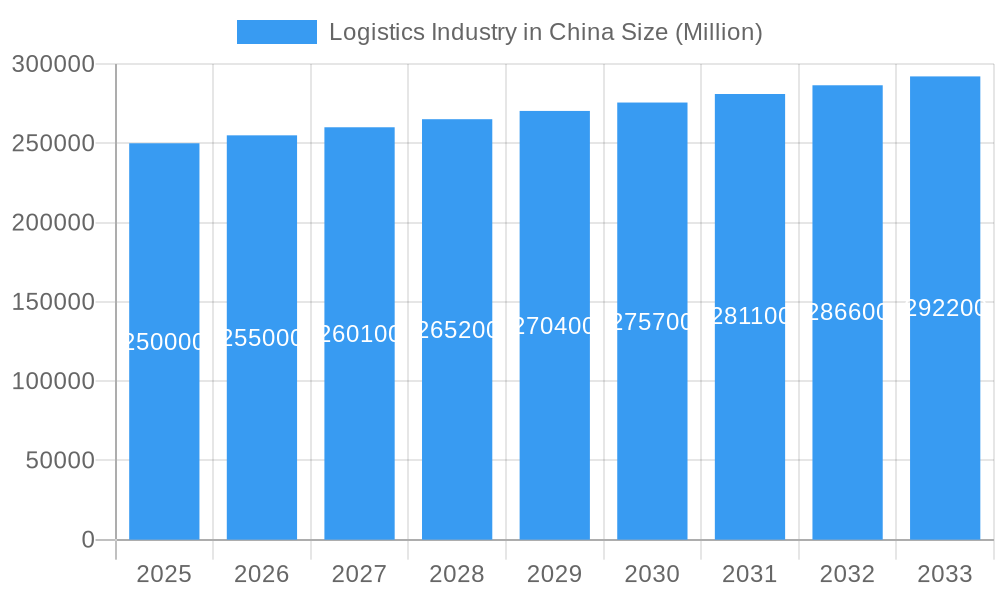

China's logistics market is experiencing substantial growth, driven by burgeoning e-commerce, industrial expansion, and infrastructure development. Projected at a CAGR of 7.5%, the market is estimated to reach $200 billion by 2025. Key growth catalysts include the escalating demand for efficient last-mile delivery solutions from the e-commerce sector, increasing supply chain complexity across industries like Oil & Gas, Petrochemical, and Manufacturing, and government-led infrastructure enhancement initiatives. Emerging trends highlight the adoption of advanced technologies, including automation, big data analytics, and AI, to boost operational efficiency and reduce costs. Despite facing challenges like rising labor expenses and intricate regulatory frameworks, the market is expected to maintain sustained expansion.

Logistics Industry in China Market Size (In Billion)

The market segmentation comprises dominant transportation segments (road, rail, air freight), essential forwarding and warehousing services, and a growing value-added services sector (packaging, labeling, customs clearance). Significant end-user industries include Oil & Gas, Petrochemical, and Manufacturing. Leading players such as Sinotrans, Kuehne + Nagel, and Kerry Logistics Network Limited operate within a dynamic competitive environment marked by consolidation and technological innovation. This robust sector is set for continued expansion, fueled by economic growth and evolving consumer demands.

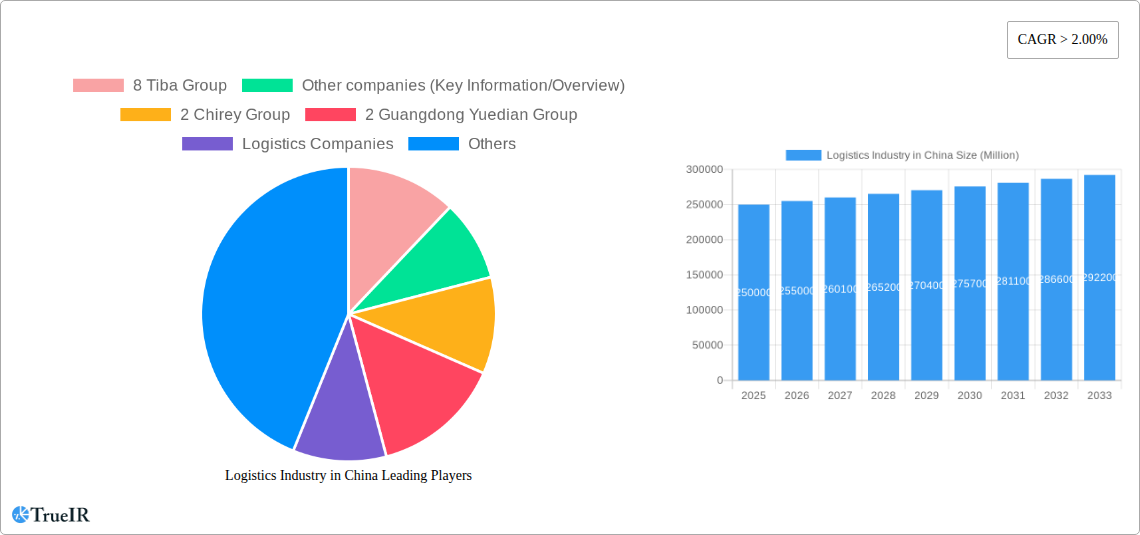

Logistics Industry in China Company Market Share

Logistics Industry in China: A Comprehensive Market Report (2019-2033)

This dynamic report provides a deep dive into the burgeoning logistics industry in China, offering invaluable insights for businesses, investors, and policymakers. Leveraging extensive market research and data analysis spanning from 2019 to 2033 (with a base year of 2025 and forecast period of 2025-2033), this report unravels the intricate market structure, competitive dynamics, and future growth potential of this crucial sector. With a focus on high-impact keywords like "China Logistics Market," "Logistics Industry China," "China Supply Chain," and "Chinese Logistics Companies," this report is meticulously designed for optimal SEO performance and engagement with industry stakeholders. Discover critical market trends, dominant segments, key players, and significant milestones shaping the future of logistics in China. The report features over 2000 million USD worth of investment and over 22 million TEU's worth of capacity.

Logistics Industry in China Market Structure & Competitive Landscape

The Chinese logistics market is characterized by a complex interplay of factors, including high market concentration among leading players, rapid technological innovation, evolving regulatory landscapes, and diverse end-user needs. The market's concentration is moderate, with a Herfindahl-Hirschman Index (HHI) estimated at xx, reflecting the presence of both large multinational corporations and domestic players.

- Market Concentration: The top 10 logistics providers account for approximately xx% of the total market share (2024 data). This indicates a moderately consolidated market with room for both expansion of existing players and entry of new entrants.

- Innovation Drivers: The rapid adoption of e-commerce and the government's "Made in China 2025" initiative are driving innovation in areas such as automation, digitalization, and sustainable logistics solutions.

- Regulatory Impacts: Government policies aimed at improving infrastructure, streamlining logistics processes, and promoting efficient supply chains significantly influence market dynamics. Recent regulatory changes have focused on environmental sustainability and enhancing transparency within the sector.

- Product Substitutes: The emergence of new technologies, such as drone delivery and autonomous vehicles, presents both opportunities and challenges for traditional logistics providers. These technologies offer potential cost savings and efficiency gains but also require significant investments and adaptation.

- End-User Segmentation: The market caters to a diverse range of end-users, including the manufacturing, energy, retail and e-commerce sectors. Each segment presents unique logistical requirements and growth opportunities. Manufacturing accounts for the largest share, followed by e-commerce.

- M&A Trends: The logistics sector in China has witnessed a significant number of mergers and acquisitions (M&As) in recent years, driven by companies seeking to expand their market reach, enhance service offerings, and consolidate market share. The total value of M&A transactions in the period 2019-2024 is estimated at xx million USD.

Logistics Industry in China Market Trends & Opportunities

The Chinese logistics market is experiencing robust growth, driven by several key factors, including the expansion of e-commerce, industrialization, and urbanization. The market size is projected to reach xx million USD by 2033, registering a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This expansion is fueled by increasing consumer demand for faster and more efficient delivery services and a continuous rise in cross-border e-commerce. Technological advancements such as AI, IoT, and blockchain are revolutionizing logistics operations, improving efficiency, and enhancing transparency throughout the supply chain. This technological shift is also driving the adoption of smart warehousing, autonomous vehicles, and sophisticated route optimization systems. Furthermore, evolving consumer preferences towards same-day and next-day delivery are pushing logistics companies to adopt innovative solutions to meet these expectations. Competitive dynamics are intensifying as companies compete on price, speed, reliability, and service quality. Market penetration rates for various logistics services are continuously increasing, particularly in less-developed regions, driven by infrastructural improvements and increased access to technology.

Dominant Markets & Segments in Logistics Industry in China

The eastern coastal regions of China, particularly the Yangtze River Delta and the Pearl River Delta, currently dominate the logistics market. These regions benefit from established infrastructure, strong manufacturing bases, and proximity to major ports.

- By Service: Transportation (road, rail, air, sea) accounts for the largest share of the market, followed by forwarding and warehousing. Other value-added services such as customs brokerage and supply chain management are also witnessing rapid growth.

- By End-user: The manufacturing sector, driven by both domestic and export-oriented production, represents the largest end-user segment. The energy and power sector, owing to the ongoing expansion of infrastructure projects, demonstrates substantial growth potential.

Key Growth Drivers:

- Robust Infrastructure Development: Continuous investment in transportation networks (high-speed rail, expressways, ports) is enhancing connectivity and logistics efficiency.

- Government Support: Supportive government policies promoting efficient supply chains and attracting foreign investment are crucial catalysts for market expansion.

- E-commerce Boom: The rapid growth of e-commerce is driving demand for last-mile delivery and efficient warehousing solutions.

The dominance of these regions and segments is expected to continue in the coming years, although growth in less-developed regions of central and western China is expected to accelerate due to infrastructure investment and government initiatives to support regional development.

Logistics Industry in China Product Analysis

The Chinese logistics market showcases a wide array of services and solutions. Technological advancements are leading to the development of sophisticated supply chain management systems, incorporating AI-powered route optimization, real-time tracking, and predictive analytics. The integration of IoT devices into warehousing and transportation allows for better inventory management, enhanced security, and improved operational efficiency. These technological innovations, combined with the expansion of e-commerce, are driving demand for specialized services such as last-mile delivery solutions and cold chain logistics. The competitive advantage hinges on speed, efficiency, reliability, and technological sophistication. Companies that effectively integrate technology and provide customized solutions to meet the specific needs of different end-user segments are better positioned for success.

Key Drivers, Barriers & Challenges in Logistics Industry in China

Key Drivers: The expansion of e-commerce, government infrastructure investments, and technological advancements are primarily propelling growth. The government's focus on improving supply chain efficiency, along with supportive regulatory policies, further fuels market expansion.

Challenges and Restraints: Supply chain disruptions, particularly those experienced during the COVID-19 pandemic, have highlighted the vulnerability of the logistics sector to unforeseen events. Regulatory complexities, including customs procedures and licensing requirements, can create barriers to entry and operational efficiency. Intense competition among players, particularly in the last-mile delivery space, keeps profit margins under pressure. The estimated cost of these challenges in lost revenue and operational inefficiencies is xx million USD annually.

Growth Drivers in the Logistics Industry in China Market

The industry is being driven by e-commerce expansion requiring efficient last-mile delivery solutions, continuous infrastructure improvements (high-speed rail, expressways), supportive government policies aiming at streamlined supply chains and efficient logistics processes, and the adoption of cutting-edge technologies like AI, IoT, and blockchain for increased efficiency and transparency.

Challenges Impacting Logistics Industry in China Growth

The industry faces challenges such as regulatory complexities, leading to delays and increased costs, supply chain vulnerabilities exposed by recent global events, and intense competition within the market leading to price pressure and reduced profit margins.

Key Players Shaping the Logistics Industry in China Market

- 8 Tiba Group

- 2 Chirey Group

- 2 Guangdong Yuedian Group

- 14 Kuehne + Nagel Kuehne + Nagel

- 12 Global Star Logistics (China) Co Ltd

- 1 China Gezhouba Group Corporation International Engineering Company

- 3 China National Chemical Engineering Group

- 7 CJ Smart Cargo

- 15 Agility Logistics Pvt Ltd Agility Logistics

- 1 Broekman Logistics

- Rhenus Logistics

- Trans Global Projects Group (TGP)

- S F Systems(Group)Ltd

- Ziegler Group

- Dextrans Worldwide Group

- GEFCO S A

- Keyun Group

- Dolphin Logistcis Co Ltd

- TPL Project Stock Company

- Shanghai Beetle Supply Chain Management Company Limited

- 6 Sinotrans (HK) Logistics Ltd Sinotrans

- 4 Kerry Logistics Network Limited Kerry Logistics

- 13 Sunshine Int'l Logistics Co ltd

- 10 InterMax Logistics Solution Limited

- 5 Trans Global Projects Group (TGP)

- 5 China Civil Engineering Construction Corporation

- 9 Mitsubishi Logistics Corporation Mitsubishi Logistics

- 1 COSCO Shipping Logistics Co Ltd COSCO Shipping

- 4 China Railway Construction Corporation

- 3 Translink International Logistics Group

- 11 Wangfoong Transportation Ltd

Significant Logistics Industry in China Industry Milestones

- January 2023: Maersk's groundbreaking agreement to establish a green and smart flagship logistics center in Shanghai's Lin-gang new area, signaling a significant investment in sustainable logistics infrastructure (174 million USD).

- January 2022: The Ocean Alliance's launch of the Day 7 Product, introducing 26 dual-fuel LNG-powered ships and significantly increasing capacity (22.4 million TEUs annually), showcasing a move towards environmentally friendly shipping.

Future Outlook for Logistics Industry in China Market

The Chinese logistics market is poised for sustained growth, driven by ongoing infrastructure development, technological innovation, and rising e-commerce activity. Strategic opportunities exist for companies that can offer efficient, technologically advanced, and sustainable logistics solutions tailored to the specific needs of various end-user segments. The market's expansion presents significant potential for both domestic and international players, particularly those capable of navigating the complexities of the regulatory landscape and adapting to evolving consumer preferences.

Logistics Industry in China Segmentation

-

1. Service

- 1.1. Transportation

- 1.2. Forwarding

- 1.3. Warehousing

- 1.4. Other Value-added Services

-

2. End-user

- 2.1. Oil and Gas, Petrochemical

- 2.2. Mining and Quarrying

- 2.3. Energy and Power

- 2.4. Construction

- 2.5. Manufacturing

- 2.6. Other En

Logistics Industry in China Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Logistics Industry in China Regional Market Share

Geographic Coverage of Logistics Industry in China

Logistics Industry in China REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Usage of Renewable Energies Boosts Opportunities for Project Logistics Companies4.; Growth of E-commerce

- 3.3. Market Restrains

- 3.3.1. 4.; Cost - Intensive4.; Lack of Skilled Labor

- 3.4. Market Trends

- 3.4.1. Wind power is expected to propel the demand for project logistics services through the forecast period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Logistics Industry in China Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Transportation

- 5.1.2. Forwarding

- 5.1.3. Warehousing

- 5.1.4. Other Value-added Services

- 5.2. Market Analysis, Insights and Forecast - by End-user

- 5.2.1. Oil and Gas, Petrochemical

- 5.2.2. Mining and Quarrying

- 5.2.3. Energy and Power

- 5.2.4. Construction

- 5.2.5. Manufacturing

- 5.2.6. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. North America Logistics Industry in China Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Transportation

- 6.1.2. Forwarding

- 6.1.3. Warehousing

- 6.1.4. Other Value-added Services

- 6.2. Market Analysis, Insights and Forecast - by End-user

- 6.2.1. Oil and Gas, Petrochemical

- 6.2.2. Mining and Quarrying

- 6.2.3. Energy and Power

- 6.2.4. Construction

- 6.2.5. Manufacturing

- 6.2.6. Other En

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. South America Logistics Industry in China Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Transportation

- 7.1.2. Forwarding

- 7.1.3. Warehousing

- 7.1.4. Other Value-added Services

- 7.2. Market Analysis, Insights and Forecast - by End-user

- 7.2.1. Oil and Gas, Petrochemical

- 7.2.2. Mining and Quarrying

- 7.2.3. Energy and Power

- 7.2.4. Construction

- 7.2.5. Manufacturing

- 7.2.6. Other En

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Europe Logistics Industry in China Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Transportation

- 8.1.2. Forwarding

- 8.1.3. Warehousing

- 8.1.4. Other Value-added Services

- 8.2. Market Analysis, Insights and Forecast - by End-user

- 8.2.1. Oil and Gas, Petrochemical

- 8.2.2. Mining and Quarrying

- 8.2.3. Energy and Power

- 8.2.4. Construction

- 8.2.5. Manufacturing

- 8.2.6. Other En

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. Middle East & Africa Logistics Industry in China Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Transportation

- 9.1.2. Forwarding

- 9.1.3. Warehousing

- 9.1.4. Other Value-added Services

- 9.2. Market Analysis, Insights and Forecast - by End-user

- 9.2.1. Oil and Gas, Petrochemical

- 9.2.2. Mining and Quarrying

- 9.2.3. Energy and Power

- 9.2.4. Construction

- 9.2.5. Manufacturing

- 9.2.6. Other En

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. Asia Pacific Logistics Industry in China Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service

- 10.1.1. Transportation

- 10.1.2. Forwarding

- 10.1.3. Warehousing

- 10.1.4. Other Value-added Services

- 10.2. Market Analysis, Insights and Forecast - by End-user

- 10.2.1. Oil and Gas, Petrochemical

- 10.2.2. Mining and Quarrying

- 10.2.3. Energy and Power

- 10.2.4. Construction

- 10.2.5. Manufacturing

- 10.2.6. Other En

- 10.1. Market Analysis, Insights and Forecast - by Service

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 8 Tiba Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Other companies (Key Information/Overview)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 2 Chirey Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 2 Guangdong Yuedian Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Logistics Companies

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 14 Kuehne + Nagel

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 12 Global Star Logistics (China) Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 1 China Gezhouba Group Corporation International Engineering Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 3 China National Chemical Engineering Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 7 CJ Smart Cargo

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 15 Agility Logistics Pvt Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 1 Broekman Logistics Rhenus Logistics Trans Global Projects Group (TGP) S F Systems(Group)Ltd Ziegler Group Dextrans Worldwide Group GEFCO S A Keyun Group Dolphin Logistcis Co Ltd TPL Project Stock Company Shanghai Beetle Supply Chain Management Company Limited

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 6 Sinotrans (HK) Logistics Ltd

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Engineering/EPC Companies

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 4 Kerry Logistics Network Limited

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 13 Sunshine Int'l Logistics Co ltd

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 10 InterMax Logistics Solution Limited

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 5 Trans Global Projects Group (TGP)

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 5 China Civil Engineering Construction Corporation*

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 9 Mitsubishi Logistics Corporation

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 1 COSCO Shipping Logistics Co Ltd

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 4 China Railway Construction Corporation

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 3 Translink International Logistics Group

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 11 Wangfoong Transportation Ltd

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.1 8 Tiba Group

List of Figures

- Figure 1: Global Logistics Industry in China Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Logistics Industry in China Revenue (billion), by Service 2025 & 2033

- Figure 3: North America Logistics Industry in China Revenue Share (%), by Service 2025 & 2033

- Figure 4: North America Logistics Industry in China Revenue (billion), by End-user 2025 & 2033

- Figure 5: North America Logistics Industry in China Revenue Share (%), by End-user 2025 & 2033

- Figure 6: North America Logistics Industry in China Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Logistics Industry in China Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Logistics Industry in China Revenue (billion), by Service 2025 & 2033

- Figure 9: South America Logistics Industry in China Revenue Share (%), by Service 2025 & 2033

- Figure 10: South America Logistics Industry in China Revenue (billion), by End-user 2025 & 2033

- Figure 11: South America Logistics Industry in China Revenue Share (%), by End-user 2025 & 2033

- Figure 12: South America Logistics Industry in China Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Logistics Industry in China Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Logistics Industry in China Revenue (billion), by Service 2025 & 2033

- Figure 15: Europe Logistics Industry in China Revenue Share (%), by Service 2025 & 2033

- Figure 16: Europe Logistics Industry in China Revenue (billion), by End-user 2025 & 2033

- Figure 17: Europe Logistics Industry in China Revenue Share (%), by End-user 2025 & 2033

- Figure 18: Europe Logistics Industry in China Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Logistics Industry in China Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Logistics Industry in China Revenue (billion), by Service 2025 & 2033

- Figure 21: Middle East & Africa Logistics Industry in China Revenue Share (%), by Service 2025 & 2033

- Figure 22: Middle East & Africa Logistics Industry in China Revenue (billion), by End-user 2025 & 2033

- Figure 23: Middle East & Africa Logistics Industry in China Revenue Share (%), by End-user 2025 & 2033

- Figure 24: Middle East & Africa Logistics Industry in China Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Logistics Industry in China Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Logistics Industry in China Revenue (billion), by Service 2025 & 2033

- Figure 27: Asia Pacific Logistics Industry in China Revenue Share (%), by Service 2025 & 2033

- Figure 28: Asia Pacific Logistics Industry in China Revenue (billion), by End-user 2025 & 2033

- Figure 29: Asia Pacific Logistics Industry in China Revenue Share (%), by End-user 2025 & 2033

- Figure 30: Asia Pacific Logistics Industry in China Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Logistics Industry in China Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Logistics Industry in China Revenue billion Forecast, by Service 2020 & 2033

- Table 2: Global Logistics Industry in China Revenue billion Forecast, by End-user 2020 & 2033

- Table 3: Global Logistics Industry in China Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Logistics Industry in China Revenue billion Forecast, by Service 2020 & 2033

- Table 5: Global Logistics Industry in China Revenue billion Forecast, by End-user 2020 & 2033

- Table 6: Global Logistics Industry in China Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Logistics Industry in China Revenue billion Forecast, by Service 2020 & 2033

- Table 11: Global Logistics Industry in China Revenue billion Forecast, by End-user 2020 & 2033

- Table 12: Global Logistics Industry in China Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Logistics Industry in China Revenue billion Forecast, by Service 2020 & 2033

- Table 17: Global Logistics Industry in China Revenue billion Forecast, by End-user 2020 & 2033

- Table 18: Global Logistics Industry in China Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Logistics Industry in China Revenue billion Forecast, by Service 2020 & 2033

- Table 29: Global Logistics Industry in China Revenue billion Forecast, by End-user 2020 & 2033

- Table 30: Global Logistics Industry in China Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Logistics Industry in China Revenue billion Forecast, by Service 2020 & 2033

- Table 38: Global Logistics Industry in China Revenue billion Forecast, by End-user 2020 & 2033

- Table 39: Global Logistics Industry in China Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Logistics Industry in China Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Logistics Industry in China?

The projected CAGR is approximately 7.5%.

2. Which companies are prominent players in the Logistics Industry in China?

Key companies in the market include 8 Tiba Group, Other companies (Key Information/Overview), 2 Chirey Group, 2 Guangdong Yuedian Group, Logistics Companies, 14 Kuehne + Nagel, 12 Global Star Logistics (China) Co Ltd, 1 China Gezhouba Group Corporation International Engineering Company, 3 China National Chemical Engineering Group, 7 CJ Smart Cargo, 15 Agility Logistics Pvt Ltd, 1 Broekman Logistics Rhenus Logistics Trans Global Projects Group (TGP) S F Systems(Group)Ltd Ziegler Group Dextrans Worldwide Group GEFCO S A Keyun Group Dolphin Logistcis Co Ltd TPL Project Stock Company Shanghai Beetle Supply Chain Management Company Limited, 6 Sinotrans (HK) Logistics Ltd, Engineering/EPC Companies, 4 Kerry Logistics Network Limited, 13 Sunshine Int'l Logistics Co ltd, 10 InterMax Logistics Solution Limited, 5 Trans Global Projects Group (TGP), 5 China Civil Engineering Construction Corporation*, 9 Mitsubishi Logistics Corporation, 1 COSCO Shipping Logistics Co Ltd, 4 China Railway Construction Corporation, 3 Translink International Logistics Group, 11 Wangfoong Transportation Ltd.

3. What are the main segments of the Logistics Industry in China?

The market segments include Service, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD 200 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Usage of Renewable Energies Boosts Opportunities for Project Logistics Companies4.; Growth of E-commerce.

6. What are the notable trends driving market growth?

Wind power is expected to propel the demand for project logistics services through the forecast period.

7. Are there any restraints impacting market growth?

4.; Cost - Intensive4.; Lack of Skilled Labor.

8. Can you provide examples of recent developments in the market?

January 2023: Maersk and the administrative body of the Shanghai Free Trade Zone signed a land grant agreement late in December 2022 for the Lin-gang new area. This is the first green and smart flagship logistics center from Maersk to open in China. It has low or very low greenhouse gas emissions. The project will begin in the third quarter of 2024 and cost 174 million US dollars.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Logistics Industry in China," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Logistics Industry in China report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Logistics Industry in China?

To stay informed about further developments, trends, and reports in the Logistics Industry in China, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence