Key Insights

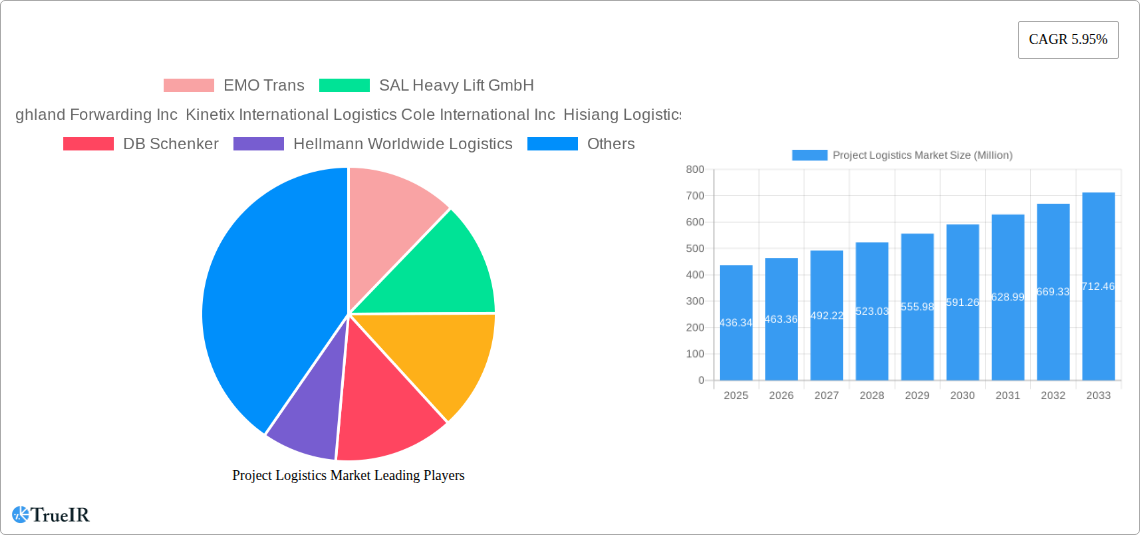

The global project logistics market, valued at $436.34 million in 2025, is projected to experience robust growth, driven by increasing global infrastructure development, particularly in emerging economies. The market's Compound Annual Growth Rate (CAGR) of 5.95% from 2025 to 2033 indicates significant expansion opportunities. Key drivers include the rising demand for specialized transportation and handling of oversized and heavy cargo across various industries like oil and gas, mining, energy, and construction. The growing complexity of global projects and the need for efficient supply chain management further fuel market growth. While challenges exist, such as fluctuating fuel prices and geopolitical uncertainties, the market's resilience is underpinned by the crucial role project logistics plays in facilitating large-scale projects worldwide. Segmentation reveals that transportation and forwarding services dominate, reflecting the core need for reliable and specialized logistics solutions. The Asia-Pacific region, owing to its extensive infrastructure development and industrialization, is expected to hold a significant market share. Leading players, including DB Schenker, Kuehne + Nagel, and DHL, leverage their global networks and technological expertise to capitalize on market opportunities. The competitive landscape is characterized by both established multinational corporations and specialized regional players.

Project Logistics Market Market Size (In Million)

The continued expansion of renewable energy projects, along with government investments in infrastructure modernization globally, will significantly boost demand for project logistics. Growth in e-commerce and the increasing need for just-in-time delivery models also indirectly benefit the sector. The industry's focus is shifting towards digitalization, with companies adopting advanced technologies like blockchain, IoT, and AI to optimize logistics operations, improve transparency, and enhance efficiency. This technological advancement, coupled with a growing emphasis on sustainability and environmentally friendly transportation methods, is reshaping the competitive landscape and driving innovation within the project logistics market. Further market penetration will likely be influenced by the ability of companies to offer customized, cost-effective solutions that address the specific requirements of diverse project needs across different geographical regions.

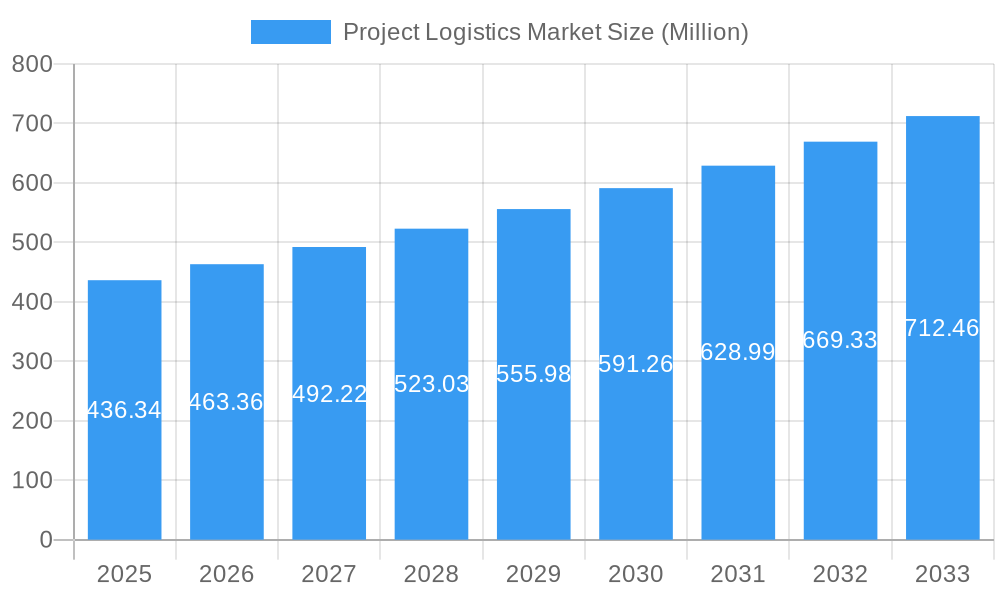

Project Logistics Market Company Market Share

Project Logistics Market: A Comprehensive Report (2019-2033)

This dynamic report provides an in-depth analysis of the Project Logistics Market, encompassing market structure, competitive landscape, trends, opportunities, and future outlook from 2019 to 2033. The study period covers historical data (2019-2024), with 2025 serving as both the base and estimated year, and a forecast extending to 2033. The report leverages extensive primary and secondary research to deliver actionable insights for stakeholders across the project logistics value chain. The global market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Project Logistics Market Structure & Competitive Landscape

The Project Logistics Market is characterized by a moderately concentrated landscape with several major players and numerous smaller niche operators. Key players such as DB Schenker, Kuehne + Nagel International AG, and DHL control significant market share, yet a fragmented landscape provides opportunities for smaller companies specializing in specific services or geographical regions. The Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a moderately consolidated market.

- Market Concentration: The top 5 players account for approximately xx% of the global market share.

- Innovation Drivers: Technological advancements in tracking, optimization software, and specialized equipment are key drivers of innovation.

- Regulatory Impacts: International trade regulations, environmental policies, and safety standards significantly impact market dynamics.

- Product Substitutes: Limited direct substitutes exist, with competition primarily arising from alternative transportation modes and service providers.

- End-User Segmentation: The market is broadly segmented by end-users including Oil & Gas, Mining & Quarrying, Energy & Power, Construction, and Manufacturing, each with unique logistical needs.

- M&A Trends: The market has witnessed a moderate number of mergers and acquisitions (M&A) in recent years, primarily focused on expanding geographical reach and service capabilities. The total M&A volume from 2019-2024 is estimated at xx Million USD. Consolidation is expected to continue, driving further concentration in the coming years.

Project Logistics Market Market Trends & Opportunities

The Project Logistics Market is experiencing robust growth fueled by several factors. The increasing complexity of global projects, coupled with rising demand for specialized logistics solutions, is driving market expansion. Technological advancements like blockchain and IoT are enhancing supply chain transparency and efficiency. Furthermore, evolving consumer preferences towards sustainable and ethical sourcing are impacting the industry.

Market expansion is propelled by a heightened demand for efficient and reliable project logistics solutions across various sectors. The rising complexity of global projects and the need for specialized equipment and expertise are key contributors to this growth. Technological advancements, particularly the integration of digital technologies such as IoT, AI, and blockchain, are streamlining operations and improving visibility throughout the supply chain. This heightened transparency and efficiency enhance speed, reduce costs, and minimize risk for companies involved in global project logistics. Growing emphasis on sustainability and corporate social responsibility within supply chains also presents significant opportunities for logistics providers that can offer environmentally friendly and ethical solutions.

Dominant Markets & Segments in Project Logistics Market

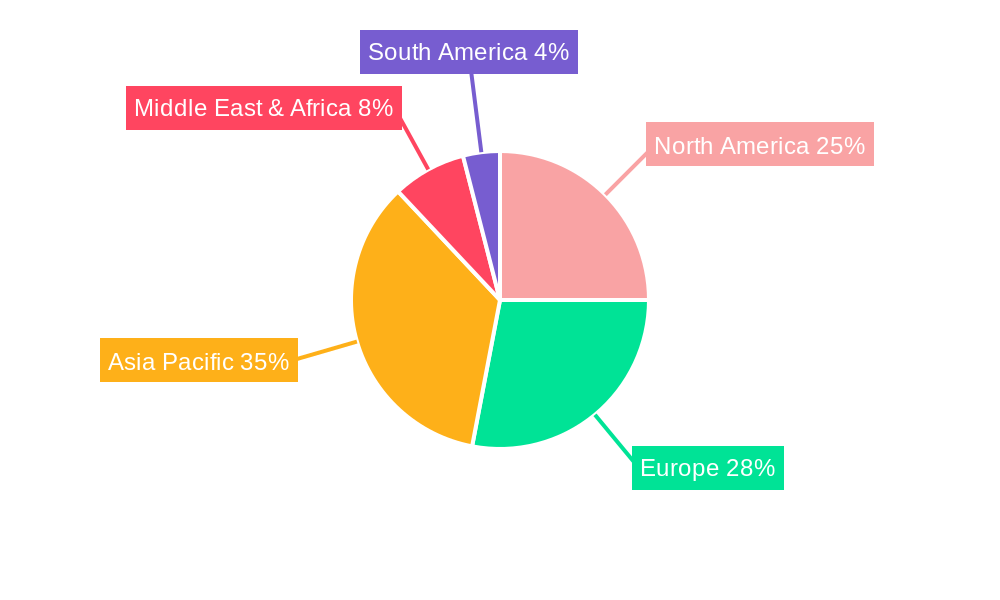

The Asia-Pacific region currently dominates the Project Logistics Market, driven by substantial infrastructure development, particularly in emerging economies such as India and China. North America and Europe follow closely, representing significant market shares. The Oil & Gas sector is a major end-user segment, followed by Construction and Manufacturing.

- Key Growth Drivers in Asia-Pacific: Rapid industrialization, infrastructure investments (e.g., the Belt and Road Initiative), and the growth of renewable energy projects are driving demand.

- Key Growth Drivers in North America: Significant investments in energy infrastructure and expansion in the manufacturing and construction sectors contribute to growth.

- Key Growth Drivers in Europe: Focus on renewable energy projects, industrial automation, and cross-border logistics within the EU drive market expansion.

Within services, Transportation and Forwarding currently hold the largest market shares, while inventory management and other value-added services exhibit significant growth potential.

Project Logistics Market Product Analysis

The market showcases innovative products focusing on enhanced tracking, optimized routing, and specialized handling equipment for oversized and heavy cargo. These products offer improved efficiency, reduced risks, and enhanced visibility throughout the supply chain, catering to the demand for customized and sophisticated solutions within the project logistics sector. Technological integration is increasingly crucial in providing real-time data, predictive analytics, and improved coordination across different stakeholders, leading to higher levels of client satisfaction and overall operational efficiency.

Key Drivers, Barriers & Challenges in Project Logistics Market

Key Drivers:

- Growing global infrastructure projects.

- Increased investment in renewable energy.

- Technological advancements (IoT, AI, blockchain).

- Rising demand for specialized equipment and expertise.

Challenges:

- Geopolitical instability and trade wars disrupt supply chains.

- Fluctuating fuel prices impact transportation costs.

- Stringent environmental regulations necessitate adaptation.

- Intense competition from established players and new entrants. This leads to price pressures and the need for continuous innovation. These competitive pressures could result in reduced profit margins for some market participants.

Growth Drivers in the Project Logistics Market Market

Continued growth in global infrastructure projects and investment in renewable energy projects will fuel market expansion. Advances in technology will increase efficiency and transparency. Government initiatives promoting sustainable logistics solutions will provide additional impetus.

Challenges Impacting Project Logistics Market Growth

Geopolitical uncertainties, fuel price volatility, and the impact of climate change on transportation routes will pose challenges. Stringent regulatory environments and intense competition will require continuous adaptation and innovation.

Key Players Shaping the Project Logistics Market Market

- EMO Trans

- SAL Heavy Lift GmbH

- FLS Transportation Services

- Crowley Logistics

- Highland Forwarding Inc

- Kinetix International Logistics

- Cole International Inc

- Hisiang Logistics Co Ltd

- Sea Cargo Air Cargo Logistics Inc

- Bati Grou

- DB Schenker

- Hellmann Worldwide Logistics

- Ceva Logistics

- Dako Worldwide Transport GmbH

- Deutsche Post DHL

- C.H. Robinson Worldwide Inc

- Rohlig Logistics

- Kuehne + Nagel International AG

- Agility Logistics

- Kerry Logistics

- Bollore Logistics

- Megalift Sdn Bhd

- CKB Logistics Group

- Rhenus Logistics

- Expeditors International of Washington Inc

- NMT Global Project Logistics

- Ryder System Inc

Significant Project Logistics Market Industry Milestones

- August 2023: Aprojects Austria and Antwerp Metal Logistics successfully shipped exceptionally heavy cargo (reactor: 359 tons, condenser: 286 tons, stripper: 243 tons) utilizing direct vessel loading due to lack of suitable shore cranes. This highlights the demand for specialized handling and the challenges posed by oversized cargo.

- August 2023: Huisman secured a contract with Seaway7 for the delivery of a monopile installation spread for the jack-up vessel Seaway Ventus. This showcases advancements in specialized equipment for offshore wind energy projects and illustrates significant investment in this growing sector.

Future Outlook for Project Logistics Market Market

The Project Logistics Market is poised for sustained growth, driven by global infrastructure development, the energy transition, and technological innovation. Strategic partnerships, expansion into emerging markets, and the adoption of sustainable practices will be crucial for success. Opportunities exist for companies that can provide efficient, transparent, and sustainable solutions for complex global projects. The market's potential for growth remains considerable across multiple sectors.

Project Logistics Market Segmentation

-

1. Service

- 1.1. Transportation

- 1.2. Forwarding

- 1.3. Inventory Management and Warehousing

- 1.4. Other Value-added Services

-

2. End User

- 2.1. Oil and Gas, Mining, and Quarrying

- 2.2. Energy and Power

- 2.3. Construction

- 2.4. Manufacturing

- 2.5. Other End Users

Project Logistics Market Segmentation By Geography

- 1. Asia Pacific

- 2. Americas

- 3. Europe

- 4. Middle East and Africa

Project Logistics Market Regional Market Share

Geographic Coverage of Project Logistics Market

Project Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.95% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Demand For Project Logistics From Renewable Energy Projects4.; Increasing Investments In Infrastructure

- 3.3. Market Restrains

- 3.3.1. 4.; High Initial Capital Investment

- 3.4. Market Trends

- 3.4.1. Increasing Usage of Renewable Energies Boosts Opportunities for Project Logistics Companies

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Project Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Transportation

- 5.1.2. Forwarding

- 5.1.3. Inventory Management and Warehousing

- 5.1.4. Other Value-added Services

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Oil and Gas, Mining, and Quarrying

- 5.2.2. Energy and Power

- 5.2.3. Construction

- 5.2.4. Manufacturing

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. Americas

- 5.3.3. Europe

- 5.3.4. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Asia Pacific Project Logistics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Transportation

- 6.1.2. Forwarding

- 6.1.3. Inventory Management and Warehousing

- 6.1.4. Other Value-added Services

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Oil and Gas, Mining, and Quarrying

- 6.2.2. Energy and Power

- 6.2.3. Construction

- 6.2.4. Manufacturing

- 6.2.5. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. Americas Project Logistics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Transportation

- 7.1.2. Forwarding

- 7.1.3. Inventory Management and Warehousing

- 7.1.4. Other Value-added Services

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Oil and Gas, Mining, and Quarrying

- 7.2.2. Energy and Power

- 7.2.3. Construction

- 7.2.4. Manufacturing

- 7.2.5. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Europe Project Logistics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Transportation

- 8.1.2. Forwarding

- 8.1.3. Inventory Management and Warehousing

- 8.1.4. Other Value-added Services

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Oil and Gas, Mining, and Quarrying

- 8.2.2. Energy and Power

- 8.2.3. Construction

- 8.2.4. Manufacturing

- 8.2.5. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. Middle East and Africa Project Logistics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Transportation

- 9.1.2. Forwarding

- 9.1.3. Inventory Management and Warehousing

- 9.1.4. Other Value-added Services

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Oil and Gas, Mining, and Quarrying

- 9.2.2. Energy and Power

- 9.2.3. Construction

- 9.2.4. Manufacturing

- 9.2.5. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 EMO Trans

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 SAL Heavy Lift GmbH

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 FLS Transportation Services Crowley Logistics Highland Forwarding Inc Kinetix International Logistics Cole International Inc Hisiang Logistics Co Ltd Sea Cargo Air Cargo Logistics Inc and Bati Grou

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 DB Schenker

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Hellmann Worldwide Logistics

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Ceva Logistics

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Dako Worldwide Transport GmbH

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Deutsche Post DHL**List Not Exhaustive 6 3 Other Players in the Market

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 C H Robinson Worldwide Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Rohlig Logistics

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Kuehne + Nagel International AG

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Agility Logistics

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Kerry Logistics

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Bollore Logistics

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Megalift Sdn Bhd

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 CKB Logistics Group

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.17 Rhenus Logistics

- 10.2.17.1. Overview

- 10.2.17.2. Products

- 10.2.17.3. SWOT Analysis

- 10.2.17.4. Recent Developments

- 10.2.17.5. Financials (Based on Availability)

- 10.2.18 Expeditors International of Washington Inc

- 10.2.18.1. Overview

- 10.2.18.2. Products

- 10.2.18.3. SWOT Analysis

- 10.2.18.4. Recent Developments

- 10.2.18.5. Financials (Based on Availability)

- 10.2.19 NMT Global Project Logistics

- 10.2.19.1. Overview

- 10.2.19.2. Products

- 10.2.19.3. SWOT Analysis

- 10.2.19.4. Recent Developments

- 10.2.19.5. Financials (Based on Availability)

- 10.2.20 Ryder System Inc

- 10.2.20.1. Overview

- 10.2.20.2. Products

- 10.2.20.3. SWOT Analysis

- 10.2.20.4. Recent Developments

- 10.2.20.5. Financials (Based on Availability)

- 10.2.1 EMO Trans

List of Figures

- Figure 1: Global Project Logistics Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Project Logistics Market Revenue (Million), by Service 2025 & 2033

- Figure 3: Asia Pacific Project Logistics Market Revenue Share (%), by Service 2025 & 2033

- Figure 4: Asia Pacific Project Logistics Market Revenue (Million), by End User 2025 & 2033

- Figure 5: Asia Pacific Project Logistics Market Revenue Share (%), by End User 2025 & 2033

- Figure 6: Asia Pacific Project Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 7: Asia Pacific Project Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Americas Project Logistics Market Revenue (Million), by Service 2025 & 2033

- Figure 9: Americas Project Logistics Market Revenue Share (%), by Service 2025 & 2033

- Figure 10: Americas Project Logistics Market Revenue (Million), by End User 2025 & 2033

- Figure 11: Americas Project Logistics Market Revenue Share (%), by End User 2025 & 2033

- Figure 12: Americas Project Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Americas Project Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Project Logistics Market Revenue (Million), by Service 2025 & 2033

- Figure 15: Europe Project Logistics Market Revenue Share (%), by Service 2025 & 2033

- Figure 16: Europe Project Logistics Market Revenue (Million), by End User 2025 & 2033

- Figure 17: Europe Project Logistics Market Revenue Share (%), by End User 2025 & 2033

- Figure 18: Europe Project Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Project Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Project Logistics Market Revenue (Million), by Service 2025 & 2033

- Figure 21: Middle East and Africa Project Logistics Market Revenue Share (%), by Service 2025 & 2033

- Figure 22: Middle East and Africa Project Logistics Market Revenue (Million), by End User 2025 & 2033

- Figure 23: Middle East and Africa Project Logistics Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Middle East and Africa Project Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East and Africa Project Logistics Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Project Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Global Project Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Global Project Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Project Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 5: Global Project Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global Project Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Project Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 8: Global Project Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 9: Global Project Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Project Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 11: Global Project Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 12: Global Project Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Project Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 14: Global Project Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 15: Global Project Logistics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Project Logistics Market?

The projected CAGR is approximately 5.95%.

2. Which companies are prominent players in the Project Logistics Market?

Key companies in the market include EMO Trans, SAL Heavy Lift GmbH, FLS Transportation Services Crowley Logistics Highland Forwarding Inc Kinetix International Logistics Cole International Inc Hisiang Logistics Co Ltd Sea Cargo Air Cargo Logistics Inc and Bati Grou, DB Schenker, Hellmann Worldwide Logistics, Ceva Logistics, Dako Worldwide Transport GmbH, Deutsche Post DHL**List Not Exhaustive 6 3 Other Players in the Market, C H Robinson Worldwide Inc, Rohlig Logistics, Kuehne + Nagel International AG, Agility Logistics, Kerry Logistics, Bollore Logistics, Megalift Sdn Bhd, CKB Logistics Group, Rhenus Logistics, Expeditors International of Washington Inc, NMT Global Project Logistics, Ryder System Inc.

3. What are the main segments of the Project Logistics Market?

The market segments include Service, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 436.34 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand For Project Logistics From Renewable Energy Projects4.; Increasing Investments In Infrastructure.

6. What are the notable trends driving market growth?

Increasing Usage of Renewable Energies Boosts Opportunities for Project Logistics Companies.

7. Are there any restraints impacting market growth?

4.; High Initial Capital Investment.

8. Can you provide examples of recent developments in the market?

August 2023 - Aprojects Austria, a member of the Project Logistics Alliance, joined forces together with their long-trusted partner, Antwerp Metal Logistics, to ship heavy loads comprising: A reactor weighing 359 tons, a pool condenser weighing 286 tons and a stripper weighing 243 tons. Given the cargo’s weight, the only viable approach was to load it directly onto the ocean vessel using the vessel’s equipment, as no shore crane in Constanța had the capability to lift such heavy loads, even with multiple cranes working in tandem.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Project Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Project Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Project Logistics Market?

To stay informed about further developments, trends, and reports in the Project Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence