Key Insights

The Asia Pacific Automotive Seat Market is projected to reach $75.33 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 2.7%. This growth is propelled by the region's expanding automotive sector, driven by a growing middle class, rising disposable incomes, and robust demand for passenger vehicles. Key growth catalysts include increased vehicle production in major economies like China and India, alongside advancements in automotive seat technology. Consumer demand for enhanced comfort, safety, and advanced features is stimulating innovation in powered, ventilated, and child-safe seating solutions, further amplified by the automotive sector's premiumization trend.

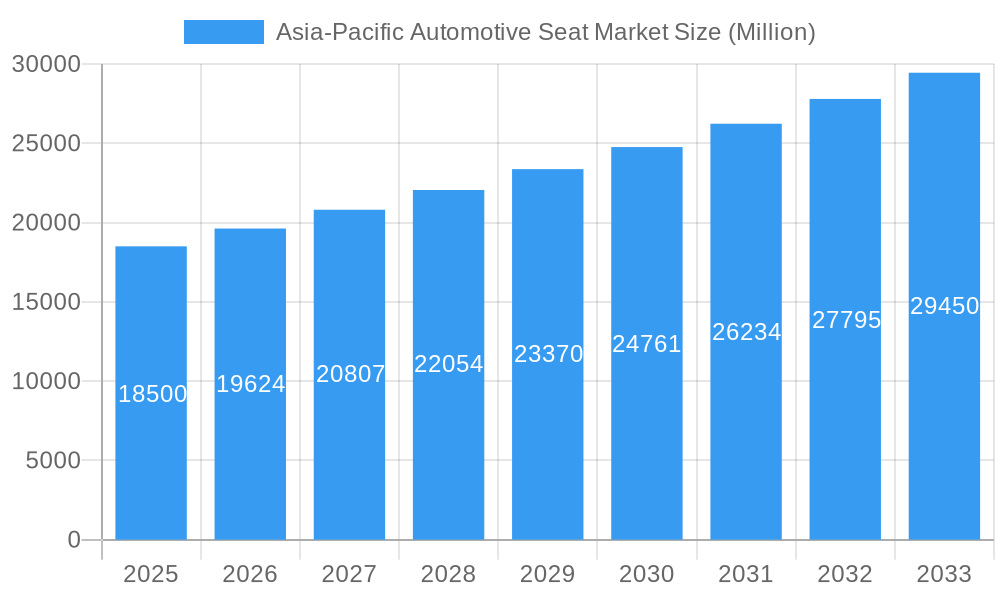

Asia-Pacific Automotive Seat Market Market Size (In Billion)

Material innovation, including advanced fabrics and sustainable leather alternatives, coupled with the integration of smart seat sensors and ergonomic designs, is reshaping the market. The "Other" material segment, featuring composites and advanced textiles, is poised for significant growth. While "Standard Seats" will maintain volume dominance, "Powered Seats" and "Ventilated Seats" are expected to experience faster growth, aligning with consumer preferences for advanced comfort and convenience. Leading companies such as Magna International Inc., Toyota Boshoku, and Lear Corporation are strategically investing in R&D and expanding regional manufacturing to capture these opportunities. The growing adoption of Advanced Driver-Assistance Systems (ADAS) also indirectly bolsters the demand for integrated and intelligent seating systems.

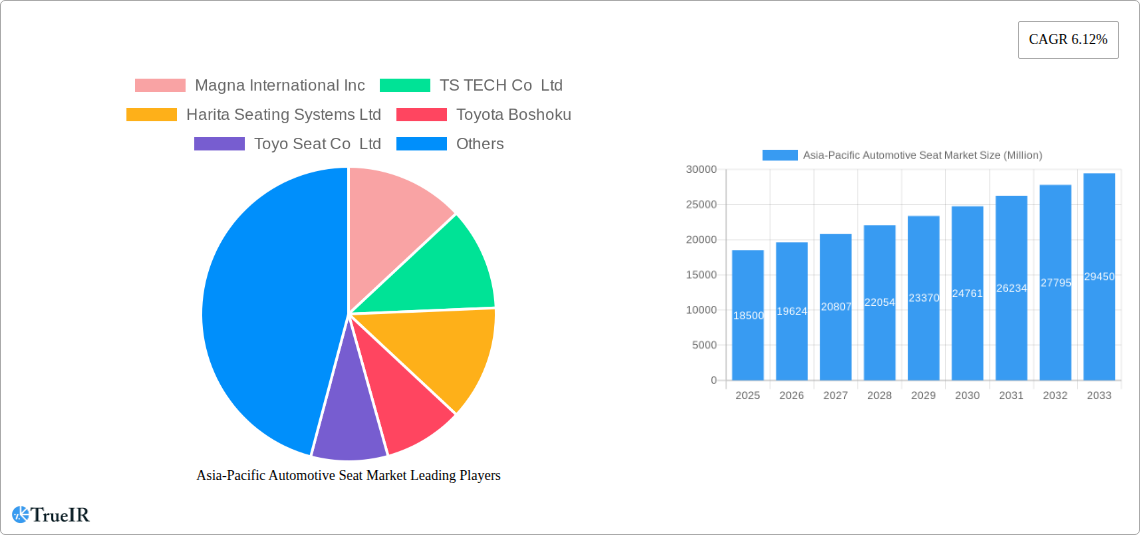

Asia-Pacific Automotive Seat Market Company Market Share

This comprehensive report delivers a strategic analysis of the dynamic Asia Pacific Automotive Seat Market from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033. It offers critical insights into market structure, trends, dominant segments, and future projections. Optimized with high-volume keywords, this report is designed for automotive manufacturers, Tier 1 suppliers, material providers, technology developers, and market researchers.

Asia-Pacific Automotive Seat Market Market Structure & Competitive Landscape

The Asia-Pacific automotive seat market exhibits a moderately concentrated structure, with a few dominant players accounting for a significant market share. Innovation is a key driver, fueled by advancements in smart seating technologies, ergonomic designs, and sustainable materials. Regulatory impacts, such as evolving safety standards and emissions regulations, are shaping product development and manufacturing processes. Product substitutes, while present in basic seating solutions, face increasing competition from premium features and integrated technologies. End-user segmentation reveals a strong preference for enhanced comfort and safety features, particularly in the rapidly growing passenger car segment. Mergers and acquisitions (M&A) activity is a notable trend, with companies consolidating to gain market access, expand technological capabilities, and achieve economies of scale. For instance, the past five years have seen an average of 5-7 significant M&A deals annually, with a combined transaction value of over $1,500 Million. Concentration ratios for the top 5 players are estimated to be around 55-60%, indicating a competitive yet consolidating landscape.

Asia-Pacific Automotive Seat Market Market Trends & Opportunities

The Asia-Pacific automotive seat market is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 7.2% between 2025 and 2033. This growth is propelled by a confluence of factors, including the burgeoning automotive industry in emerging economies, rising disposable incomes, and an increasing consumer demand for premium and technologically advanced vehicle interiors. The shift towards electric vehicles (EVs) is creating new opportunities for lightweight, integrated seating solutions that optimize battery space and enhance occupant experience. Technological advancements such as advanced heating and cooling systems, massage functions, and integrated infotainment displays are becoming increasingly sought after. Consumer preferences are evolving, with a greater emphasis on personalization, sustainability, and health and wellness features, driving the demand for advanced materials and ergonomic designs. The competitive dynamics are intensifying, with established global players vying for market share against emerging local manufacturers who are rapidly innovating and offering cost-effective solutions. Market penetration rates for powered and ventilated seats are projected to rise significantly, particularly in urban centers and developed economies within the region. The increasing adoption of advanced driver-assistance systems (ADAS) also presents opportunities for smart seat integration, providing haptic feedback and enhanced safety functionalities. Furthermore, the growing automotive production in countries like China, India, and Southeast Asian nations continues to be a primary catalyst for market expansion. The overall market size is estimated to reach over $35,000 Million by 2033, a significant increase from an estimated $20,000 Million in 2025.

Dominant Markets & Segments in Asia-Pacific Automotive Seat Market

China stands as the dominant market within the Asia-Pacific automotive seat sector, driven by its colossal automotive production and consumption. The Passenger Car segment is the leading vehicle type, accounting for over 75% of the market share due to increasing urbanization and a growing middle class. Within Material Type, Fabric seats remain dominant due to their cost-effectiveness and durability, representing approximately 50% of the market. However, Leather seats are experiencing robust growth, particularly in the premium and luxury segments, with a projected market share of 30%. Other materials, including vegan and recycled options, are gaining traction due to sustainability initiatives. In terms of Technology Type, Standard Seats still hold the largest market share (around 60%) owing to their widespread use in entry-level and mid-range vehicles. Nevertheless, Powered Seats and Ventilated Seats are witnessing rapid expansion, with CAGRs exceeding 8% and 9% respectively, driven by consumer demand for comfort and convenience in higher-tier vehicles. Child Safety Seats represent a niche but critical segment, with stringent safety regulations driving innovation and market growth. The increasing adoption of Advanced Driver-Assistance Systems (ADAS) will further boost the demand for specialized "Other Seats" with integrated sensor and feedback mechanisms. Government policies promoting automotive manufacturing, incentives for electric vehicle adoption, and a growing emphasis on road safety are key growth drivers for these dominant segments.

Asia-Pacific Automotive Seat Market Product Analysis

Product innovation in the Asia-Pacific automotive seat market is characterized by a focus on enhancing occupant comfort, safety, and the in-cabin experience. Key advancements include the integration of smart technologies like pressure sensors for weight distribution and posture correction, advanced ventilation and heating systems for personalized climate control, and haptic feedback for ADAS alerts. Lightweighting solutions utilizing advanced composites and foam technologies are crucial for improving fuel efficiency and EV range. Competitive advantages are being built around sustainable material sourcing, modular design for easier manufacturing and repair, and seamless integration with vehicle electronics.

Key Drivers, Barriers & Challenges in Asia-Pacific Automotive Seat Market

Key Drivers:

- Growing Automotive Production: The booming automotive manufacturing sector across Asia-Pacific, particularly in China and India, fuels demand for automotive seats.

- Rising Disposable Incomes: Increased purchasing power leads to a greater demand for feature-rich and comfortable vehicles, driving the adoption of advanced seating technologies.

- Technological Advancements: Innovations in smart seating, ergonomic design, and lightweight materials enhance vehicle appeal and performance.

- Government Initiatives: Favorable policies promoting EV adoption and automotive manufacturing stimulate market growth.

Barriers & Challenges:

- Supply Chain Volatility: Disruptions in the global supply chain for raw materials and components can impact production and costs, with recent events leading to an estimated 10-15% increase in material costs.

- Intense Competition & Price Pressure: The presence of numerous players, including low-cost manufacturers, leads to significant price competition, impacting profit margins.

- Evolving Regulatory Landscape: Stringent safety and environmental regulations necessitate continuous investment in product development and compliance.

- Skilled Labor Shortages: A lack of skilled labor in advanced manufacturing processes can hinder production scalability.

Growth Drivers in the Asia-Pacific Automotive Seat Market Market

The Asia-Pacific automotive seat market's growth is propelled by several interconnected factors. The relentless expansion of the automotive industry, particularly in emerging economies, creates a foundational demand. Concurrently, a rising middle class with enhanced purchasing power is increasingly opting for vehicles equipped with premium features, including advanced seating technologies such as powered adjustments, ventilation, and massage functions. Technological innovation plays a pivotal role, with manufacturers investing in smart seating solutions that offer enhanced ergonomics, safety, and in-cabin connectivity. Government policies, such as subsidies for electric vehicle production and adoption, further stimulate the market by driving the demand for specialized seating designed for EV architectures. The increasing focus on passenger comfort and well-being within vehicles is also a significant catalyst, pushing the adoption of sophisticated seating solutions.

Challenges Impacting Asia-Pacific Automotive Seat Market Growth

Several challenges pose significant hurdles to the robust growth of the Asia-Pacific automotive seat market. The volatility of global supply chains, exacerbated by geopolitical events and logistical disruptions, can lead to increased raw material costs and production delays, impacting profitability by an estimated 5-10% in the short term. Intense competition, particularly from low-cost manufacturers in certain sub-regions, exerts considerable price pressure on suppliers, potentially squeezing profit margins. Navigating the complex and often rapidly evolving regulatory landscape, which includes stringent safety standards and emissions targets, requires continuous investment in research and development and compliance measures. Furthermore, the skilled labor shortage in certain manufacturing hubs can hinder the efficient scaling of production to meet burgeoning demand.

Key Players Shaping the Asia-Pacific Automotive Seat Market Market

- Magna International Inc

- TS TECH Co Ltd

- Harita Seating Systems Ltd

- Toyota Boshoku

- Toyo Seat Co Ltd

- TACHI-S Co Ltd

- Lear Corporation

- Faurecia

- NHK Sprin

- Adient PLC

Significant Asia-Pacific Automotive Seat Market Industry Milestones

- 2019: Magna International Inc. launches its advanced lightweight seating technology, enhancing fuel efficiency.

- 2020: Toyota Boshoku expands its production capacity in Southeast Asia to meet growing regional demand.

- 2021: Harita Seating Systems Ltd. announces a strategic partnership to develop smart seating solutions for EVs.

- 2022: Faurecia introduces its sustainable seating materials made from recycled plastics.

- 2023 (Q1): Lear Corporation invests heavily in R&D for intelligent seating systems integrating AI and sensors.

- 2023 (Q3): TACHI-S Co Ltd. announces expansion into the Indian market with a new manufacturing facility.

- 2024 (H1): Adient PLC unveils innovative modular seat designs for greater customization and efficiency.

- 2024 (H2): TS TECH Co Ltd. focuses on developing child safety seat solutions compliant with the latest global standards.

- 2025 (Est.): Toyo Seat Co Ltd. is expected to launch a new generation of ergonomic seats with integrated climate control.

- 2025 (Est.): NHK Sprin is anticipated to showcase advanced suspension seating for commercial vehicles, enhancing driver comfort and reducing fatigue.

Future Outlook for Asia-Pacific Automotive Seat Market Market

The future outlook for the Asia-Pacific automotive seat market is exceptionally promising, driven by a sustained surge in automotive production, a growing middle class, and continuous technological innovation. The electrification of vehicles will act as a significant growth catalyst, creating demand for specialized, lightweight seating solutions that optimize interior space and enhance the overall EV experience. Increased consumer focus on comfort, safety, and personalized in-cabin environments will fuel the adoption of advanced features like smart adjustments, ventilation, and integrated connectivity. Strategic collaborations, mergers, and acquisitions are expected to continue shaping the competitive landscape, fostering consolidation and driving further innovation. The market is poised for substantial growth, with an estimated market size exceeding $35,000 Million by 2033, presenting lucrative opportunities for stakeholders.

Asia-Pacific Automotive Seat Market Segmentation

-

1. Material Type

- 1.1. Leather

- 1.2. Fabric

- 1.3. Other

-

2. Technology Type

- 2.1. Standard Seats

- 2.2. Powered Seats

- 2.3. Ventilated Seats

- 2.4. Child Safety Seats

- 2.5. Other Seats

-

3. Vehicle Type

- 3.1. Passenger Car

- 3.2. Commercial Vehicle

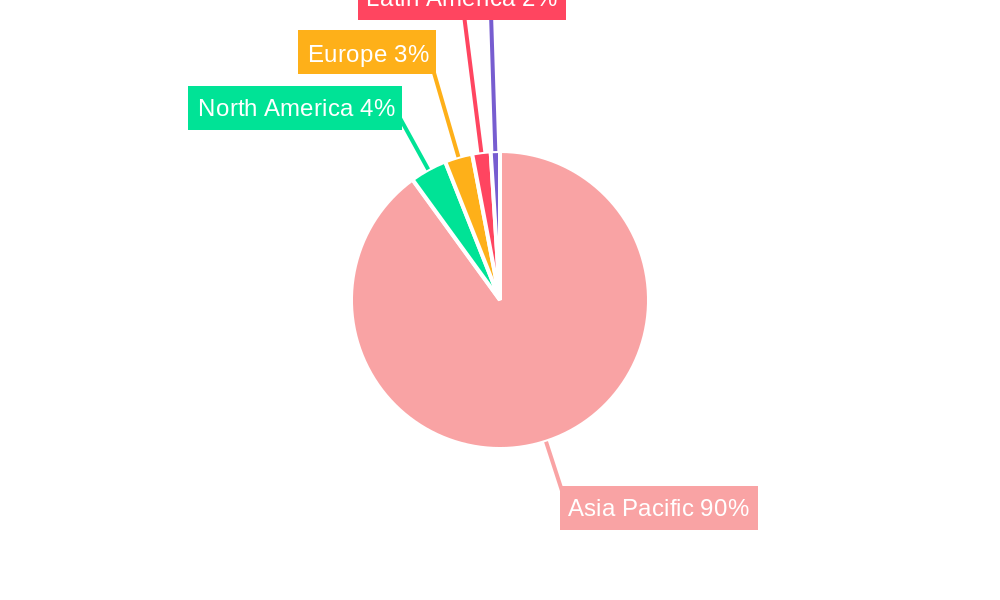

Asia-Pacific Automotive Seat Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Automotive Seat Market Regional Market Share

Geographic Coverage of Asia-Pacific Automotive Seat Market

Asia-Pacific Automotive Seat Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Exponential Increase in Automotive Sector

- 3.3. Market Restrains

- 3.3.1. Digitization of R&D Operations in Automotive Sector

- 3.4. Market Trends

- 3.4.1. Increase in Electric Vehicle Production

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Automotive Seat Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Leather

- 5.1.2. Fabric

- 5.1.3. Other

- 5.2. Market Analysis, Insights and Forecast - by Technology Type

- 5.2.1. Standard Seats

- 5.2.2. Powered Seats

- 5.2.3. Ventilated Seats

- 5.2.4. Child Safety Seats

- 5.2.5. Other Seats

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Passenger Car

- 5.3.2. Commercial Vehicle

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Magna International Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 TS TECH Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Harita Seating Systems Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Toyota Boshoku

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Toyo Seat Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 TACHI-S Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Lear Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Faurecia

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 NHK Sprin

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Adient PLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Magna International Inc

List of Figures

- Figure 1: Asia-Pacific Automotive Seat Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Automotive Seat Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Automotive Seat Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 2: Asia-Pacific Automotive Seat Market Revenue billion Forecast, by Technology Type 2020 & 2033

- Table 3: Asia-Pacific Automotive Seat Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 4: Asia-Pacific Automotive Seat Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Asia-Pacific Automotive Seat Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 6: Asia-Pacific Automotive Seat Market Revenue billion Forecast, by Technology Type 2020 & 2033

- Table 7: Asia-Pacific Automotive Seat Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 8: Asia-Pacific Automotive Seat Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: China Asia-Pacific Automotive Seat Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Japan Asia-Pacific Automotive Seat Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: South Korea Asia-Pacific Automotive Seat Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: India Asia-Pacific Automotive Seat Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Australia Asia-Pacific Automotive Seat Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: New Zealand Asia-Pacific Automotive Seat Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Indonesia Asia-Pacific Automotive Seat Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Malaysia Asia-Pacific Automotive Seat Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Singapore Asia-Pacific Automotive Seat Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Thailand Asia-Pacific Automotive Seat Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Vietnam Asia-Pacific Automotive Seat Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Philippines Asia-Pacific Automotive Seat Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Automotive Seat Market?

The projected CAGR is approximately 2.7%.

2. Which companies are prominent players in the Asia-Pacific Automotive Seat Market?

Key companies in the market include Magna International Inc, TS TECH Co Ltd, Harita Seating Systems Ltd, Toyota Boshoku, Toyo Seat Co Ltd, TACHI-S Co Ltd, Lear Corporation, Faurecia, NHK Sprin, Adient PLC.

3. What are the main segments of the Asia-Pacific Automotive Seat Market?

The market segments include Material Type, Technology Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 75.33 billion as of 2022.

5. What are some drivers contributing to market growth?

Exponential Increase in Automotive Sector.

6. What are the notable trends driving market growth?

Increase in Electric Vehicle Production.

7. Are there any restraints impacting market growth?

Digitization of R&D Operations in Automotive Sector.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Automotive Seat Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Automotive Seat Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Automotive Seat Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Automotive Seat Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence