Key Insights

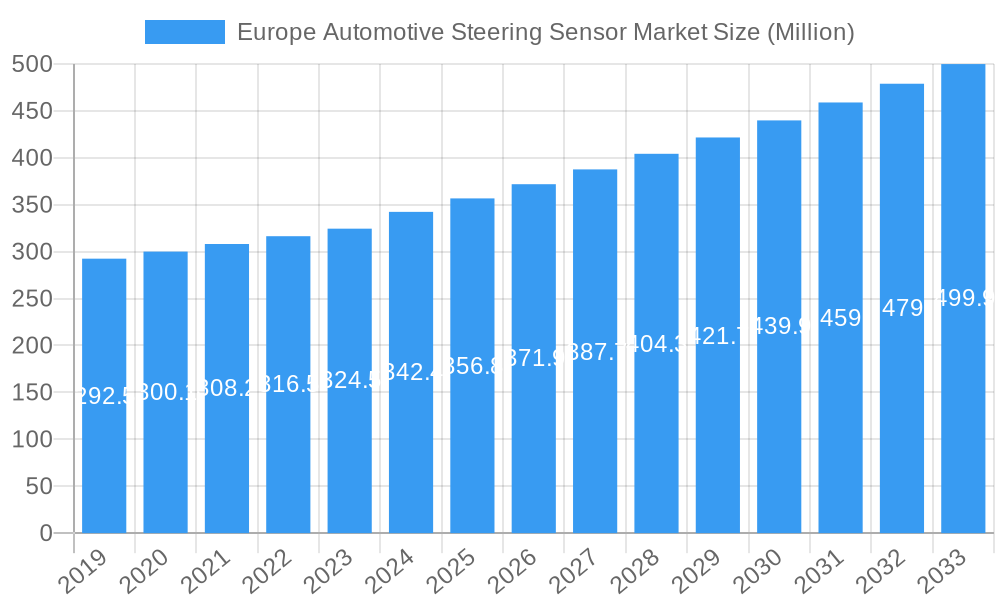

The European Automotive Steering Sensor Market is projected for substantial growth, expected to reach $329.4 million by 2024. Driven by a Compound Annual Growth Rate (CAGR) of 4.1%, the market's trajectory is set through 2033. Key growth catalysts include the increasing demand for Advanced Driver-Assistance Systems (ADAS) and autonomous driving technologies, which necessitate precise steering control. The proliferation of Electric Vehicles (EVs) also contributes significantly, requiring sophisticated steering management systems. Stringent safety regulations mandating enhanced vehicle stability and maneuverability, coupled with a rising consumer preference for vehicles with advanced comfort and safety features, are further propelling market expansion. Significant adoption is anticipated for health monitoring systems and torque and angle sensors, vital for advanced steering feedback and predictive maintenance in the automotive sector.

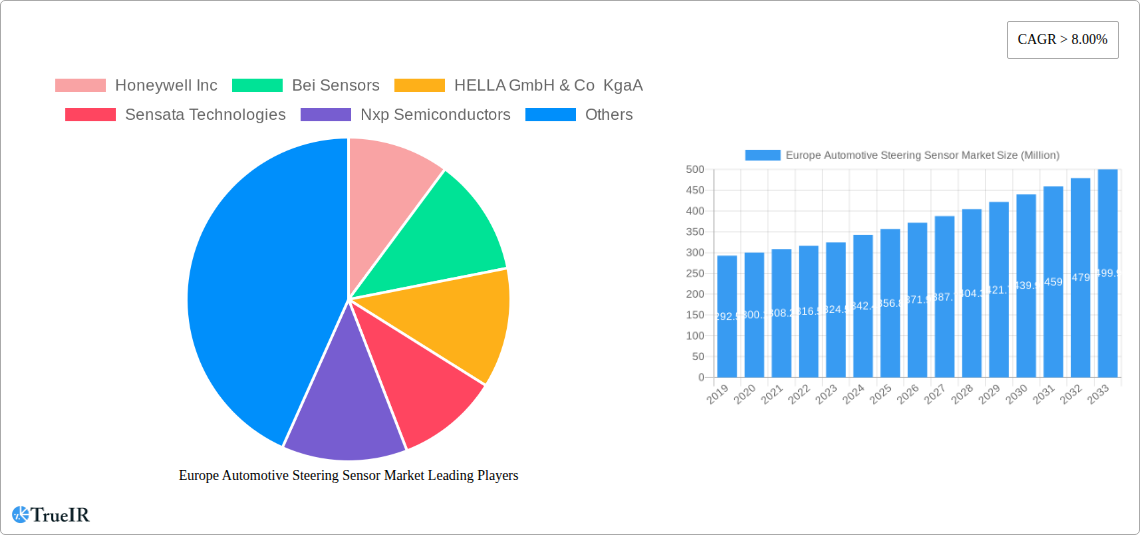

Europe Automotive Steering Sensor Market Market Size (In Million)

Market segmentation reveals diverse applications for automotive steering sensors. Passenger cars are anticipated to lead market share, driven by high new vehicle production volumes and widespread ADAS adoption. Commercial vehicles represent substantial growth opportunities as manufacturers integrate advanced steering technologies to enhance fleet safety and operational efficiency. In terms of technology, magnetic sensors are expected to gain prominence due to their accuracy and reliability in detecting precise steering movements. The competitive landscape features established global players such as Robert Bosch GmbH, Continental AG, and DENSO Corporation, actively investing in research and development for innovation and market share expansion. Europe, with its robust automotive manufacturing base and progressive regulatory environment, serves as a central hub for these developments, with Germany, France, and the UK spearheading the adoption of advanced sensor technologies.

Europe Automotive Steering Sensor Market Company Market Share

This comprehensive report offers a detailed analysis of the European Automotive Steering Sensor Market, covering market structure, key trends, emerging opportunities, and competitive dynamics. Optimized for search engines with high-volume keywords such as "automotive steering sensors Europe," "torque sensors," "angle sensors," "ADAS steering sensors," and "electric vehicle steering systems," this report aims to provide actionable insights for industry stakeholders. The study encompasses the period from 2019 to 2033, with the base year set at 2024 and a forecast period from 2024 to 2033, building upon historical data from 2019 to 2024.

Europe Automotive Steering Sensor Market Market Structure & Competitive Landscape

The Europe automotive steering sensor market exhibits a moderately consolidated structure, characterized by the presence of both established global players and emerging regional manufacturers. Innovation drivers are primarily fueled by the increasing demand for advanced driver-assistance systems (ADAS), autonomous driving capabilities, and enhanced vehicle safety features. Regulatory impacts, such as evolving Euro NCAP safety ratings and emissions standards, are compelling automakers to integrate sophisticated steering sensor technologies. Product substitutes, while present in simpler mechanical steering systems, are rapidly being displaced by the superior performance and safety offered by electronic steering solutions. End-user segmentation highlights a strong preference for advanced steering feedback in passenger cars, driven by comfort and performance expectations. Commercial vehicles are increasingly adopting these technologies for improved maneuverability and driver fatigue reduction. Mergers and acquisitions (M&A) trends reveal strategic consolidations aimed at acquiring innovative technologies, expanding market reach, and achieving economies of scale. The estimated M&A volume in the past five years is in the hundreds of millions, with key players actively pursuing bolt-on acquisitions to bolster their product portfolios. Concentration ratios are estimated to be around 45-55%, indicating a significant market share held by the top five players.

Europe Automotive Steering Sensor Market Market Trends & Opportunities

The Europe automotive steering sensor market is poised for substantial growth, projected to reach a valuation exceeding xx million Euros by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately xx% during the forecast period. This robust expansion is intricately linked to the escalating integration of Advanced Driver-Assistance Systems (ADAS) across all vehicle segments. The relentless pursuit of enhanced vehicle safety and the drive towards autonomous driving are significant catalysts, demanding precise and reliable steering feedback. Technological shifts are predominantly steering towards non-contact magnetic sensors, offering superior durability, accuracy, and reduced wear compared to traditional contacting methods. The increasing electrification of vehicles also presents a unique opportunity; electric power steering (EPS) systems, which rely heavily on sophisticated steering sensors, are becoming the standard, further propelling market demand. Consumer preferences are evolving to prioritize not just safety but also driving dynamics and comfort, making advanced steering feel and responsiveness critical selling points. This trend is particularly evident in the passenger car segment, where performance and handling are highly valued. Competitive dynamics are intensifying, with significant investments in research and development by leading automotive suppliers. The market penetration rate for advanced steering sensors in new vehicle production is estimated to reach xx% by 2030, a significant increase from xx% in 2024. The growing adoption of sophisticated torque and angle sensors for precise steering control in vehicles equipped with lane-keeping assist and automatic parking systems is a defining trend. Furthermore, the development of steering health monitoring systems, which proactively detect potential issues and alert drivers or service centers, is gaining traction. The increasing complexity of vehicle architectures, integrating steering systems with other ADAS functionalities, is creating new avenues for sensor innovation and market expansion. The push towards sustainable mobility and the burgeoning electric vehicle (EV) market are intrinsically linked to the growth of EPS, which in turn drives the demand for advanced steering sensors. Opportunities also lie in developing sensor solutions that can adapt to various driving conditions and offer personalized steering feedback, catering to diverse driver preferences. The evolving regulatory landscape, with its increasing emphasis on vehicle safety standards, acts as a constant impetus for technological advancements in steering sensor technology. The market's trajectory indicates a continued upward trend, driven by innovation and the unwavering commitment to safer, more autonomous, and enjoyable driving experiences across Europe.

Dominant Markets & Segments in Europe Automotive Steering Sensor Market

Within the Europe automotive steering sensor market, Passenger Cars represent the dominant vehicle type segment, driven by widespread adoption and consumer demand for enhanced driving experiences and safety features. The Torque and Angle Sensors segment is experiencing significant growth due to its critical role in enabling ADAS functionalities such as lane-keeping assist, adaptive cruise control, and parking assistance.

- Leading Region: Germany stands as the leading country in the European automotive steering sensor market, owing to its robust automotive manufacturing base, high concentration of premium vehicle production, and strong emphasis on technological innovation.

- Dominant Vehicle Type: Passenger Cars dominate the market, accounting for an estimated xx% of the total market share. The increasing sophistication of features in mid-range and luxury passenger vehicles necessitates advanced steering sensor integration.

- Dominant Sensor Type: Torque and Angle Sensors are the primary growth drivers within the sensor type segment, capturing an estimated xx% of the market. Their indispensable role in ADAS and increasingly in electric power steering (EPS) systems fuels this dominance.

- Dominant Technology Type: Magnetic technology is steadily gaining prominence, representing an estimated xx% of the market share. Its inherent advantages in durability, precision, and resistance to environmental factors make it a preferred choice over contacting sensors for next-generation automotive applications.

- Key Growth Drivers in Passenger Cars:

- Increasing consumer preference for comfort, performance, and safety features.

- Stringent safety regulations mandating ADAS integration.

- The rapid growth of premium and luxury vehicle segments.

- Advancements in electric power steering (EPS) systems.

- Key Growth Drivers in Torque and Angle Sensors:

- Ubiquitous integration of ADAS features across vehicle models.

- The demand for precise steering input for autonomous driving functions.

- Development of advanced steering feel and feedback systems.

- Retrofitting and aftermarket demand for performance enhancements.

- Key Growth Drivers in Magnetic Technology:

- Superior reliability and longevity compared to contacting sensors.

- Increased precision and resolution in sensor measurements.

- Reduced maintenance requirements and operational costs.

- Suitability for harsh automotive environments.

The dominance of these segments is further reinforced by substantial investments in research and development by European automakers and their tier-one suppliers, focusing on creating more intuitive, safer, and technologically advanced steering systems.

Europe Automotive Steering Sensor Market Product Analysis

The Europe automotive steering sensor market is characterized by continuous product innovation focused on enhancing accuracy, reliability, and integration capabilities. Key product advancements include the development of highly precise Hall effect and magnetoresistive sensors for accurate torque and angle measurement, crucial for ADAS and autonomous driving. Innovations in miniaturization and modular design are enabling seamless integration into increasingly compact steering column architectures. Competitive advantages are being carved out through superior sensor resolution, faster response times, and enhanced robustness against electromagnetic interference and environmental factors. Applications range from basic power steering assist to sophisticated active steering systems that can actively alter steering ratios.

Key Drivers, Barriers & Challenges in Europe Automotive Steering Sensor Market

Key Drivers: The primary forces propelling the Europe automotive steering sensor market include the accelerating adoption of ADAS technologies, driven by safety regulations and consumer demand for enhanced driver assistance. The ongoing transition to electric vehicles (EVs), which predominantly utilize electric power steering (EPS) systems reliant on sophisticated sensors, is a significant growth catalyst. Technological advancements in sensor accuracy, durability, and miniaturization are further fueling market expansion. Economic factors such as increasing disposable income and automotive sales in key European countries also contribute to market growth.

Key Barriers & Challenges: Significant challenges include the high cost of advanced sensor technologies, which can impact the affordability of ADAS features in lower-tier vehicles. Evolving and sometimes fragmented regulatory landscapes across different European countries can create complexities for manufacturers. Supply chain vulnerabilities, particularly for specialized electronic components, can lead to production delays and increased costs. Intense competition among established players and the threat of new entrants with disruptive technologies also pose challenges. Furthermore, the need for rigorous testing and validation to meet automotive safety standards adds to development timelines and costs.

Growth Drivers in the Europe Automotive Steering Sensor Market Market

The Europe automotive steering sensor market is experiencing robust growth driven by several key factors. The relentless push for enhanced vehicle safety, particularly through the widespread adoption of Advanced Driver-Assistance Systems (ADAS), is a primary catalyst. Features like lane-keeping assist, automatic emergency braking, and parking assist systems are directly dependent on accurate steering sensor data. The burgeoning electric vehicle (EV) market is another significant growth engine, as EVs predominantly employ Electric Power Steering (EPS) systems, which necessitate advanced torque and angle sensors for optimal performance and efficiency. Furthermore, increasing consumer demand for a more engaging and comfortable driving experience, coupled with advancements in sensor technology offering higher precision and reliability, are contributing factors. Government initiatives promoting road safety and the development of autonomous driving technologies also play a crucial role in shaping the market's upward trajectory.

Challenges Impacting Europe Automotive Steering Sensor Market Growth

Despite the promising growth prospects, the Europe automotive steering sensor market faces several significant challenges. The high cost associated with advanced sensor technologies and their integration into vehicle systems can be a barrier to widespread adoption, especially in budget-conscious vehicle segments. Regulatory complexities and the need to comply with diverse and evolving safety standards across different European nations can pose hurdles for manufacturers. Supply chain disruptions and the potential for component shortages, particularly for specialized semiconductors, can impact production timelines and increase manufacturing costs. Intense competition among established players, alongside the threat of new market entrants with innovative solutions, necessitates continuous investment in research and development to maintain a competitive edge. Additionally, the ongoing development and validation of autonomous driving technologies require extensive testing and certification, adding to the overall development lifecycle and associated expenses.

Key Players Shaping the Europe Automotive Steering Sensor Market Market

- Honeywell Inc

- Bei Sensors

- HELLA GmbH & Co KgaA

- Sensata Technologies

- Nxp Semiconductors

- Continental AG

- Infineon Technology

- Asahi Kase

- Robert Bosch GmbH

- Valeo SA

- DENSO Corporation

Significant Europe Automotive Steering Sensor Market Industry Milestones

- 2019: Increased focus on sensor fusion for enhanced ADAS performance.

- 2020: Introduction of more robust and compact magnetic steering sensors for EV applications.

- 2021: Major automotive suppliers invest heavily in R&D for Level 3 and Level 4 autonomous driving steering systems.

- 2022: Growing adoption of steering health monitoring systems for proactive maintenance.

- 2023: Launch of next-generation torque sensors with improved accuracy and reduced latency.

- Early 2024: Continued consolidation and strategic partnerships aimed at securing supply chains and accelerating innovation.

Future Outlook for Europe Automotive Steering Sensor Market Market

The future outlook for the Europe automotive steering sensor market is exceptionally bright, driven by the relentless advancement of automotive technology. Growth catalysts include the accelerating integration of ADAS and the widespread transition to electric and autonomous vehicles, which inherently rely on sophisticated steering sensor systems. The market is expected to witness further innovation in sensor accuracy, miniaturization, and integration capabilities, paving the way for more intuitive and safer driving experiences. Strategic opportunities lie in developing cost-effective solutions for mass-market adoption, enhancing cybersecurity of steering systems, and exploring new applications in vehicle-to-everything (V2X) communication. The market holds immense potential for companies that can deliver reliable, high-performance, and scalable steering sensor solutions, meeting the evolving demands of European automakers and consumers alike.

Europe Automotive Steering Sensor Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Cars

- 1.2. Commercial Vehicles

-

2. Sensor Type

- 2.1. Health Monitoring Systems

- 2.2. Torque and Angle Sensors

- 2.3. Position Sensors

- 2.4. Others

-

3. Technology Type

- 3.1. Contacting

- 3.2. Magnetic

Europe Automotive Steering Sensor Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

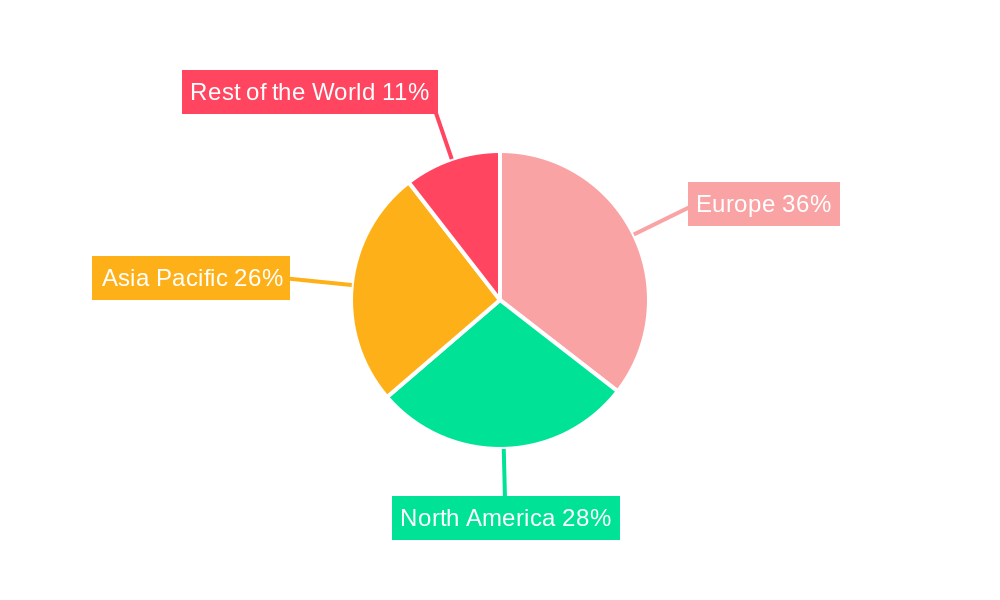

Europe Automotive Steering Sensor Market Regional Market Share

Geographic Coverage of Europe Automotive Steering Sensor Market

Europe Automotive Steering Sensor Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Electrification of Vehicles

- 3.3. Market Restrains

- 3.3.1. Precise Testing and Validation

- 3.4. Market Trends

- 3.4.1. Position Sensors is expected to hold the major share in the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Automotive Steering Sensor Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Cars

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Sensor Type

- 5.2.1. Health Monitoring Systems

- 5.2.2. Torque and Angle Sensors

- 5.2.3. Position Sensors

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Technology Type

- 5.3.1. Contacting

- 5.3.2. Magnetic

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Honeywell Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bei Sensors

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 HELLA GmbH & Co KgaA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sensata Technologies

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nxp Semiconductors

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Continental AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Infineon Technology

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Asahi Kase

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Robert Bosch GmbH

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Valeo SA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 DENSO Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Honeywell Inc

List of Figures

- Figure 1: Europe Automotive Steering Sensor Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Automotive Steering Sensor Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Automotive Steering Sensor Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Europe Automotive Steering Sensor Market Revenue million Forecast, by Sensor Type 2020 & 2033

- Table 3: Europe Automotive Steering Sensor Market Revenue million Forecast, by Technology Type 2020 & 2033

- Table 4: Europe Automotive Steering Sensor Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Europe Automotive Steering Sensor Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 6: Europe Automotive Steering Sensor Market Revenue million Forecast, by Sensor Type 2020 & 2033

- Table 7: Europe Automotive Steering Sensor Market Revenue million Forecast, by Technology Type 2020 & 2033

- Table 8: Europe Automotive Steering Sensor Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Automotive Steering Sensor Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Automotive Steering Sensor Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: France Europe Automotive Steering Sensor Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Automotive Steering Sensor Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Automotive Steering Sensor Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Automotive Steering Sensor Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Automotive Steering Sensor Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Automotive Steering Sensor Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Automotive Steering Sensor Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Automotive Steering Sensor Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Automotive Steering Sensor Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Automotive Steering Sensor Market?

The projected CAGR is approximately 4.1%.

2. Which companies are prominent players in the Europe Automotive Steering Sensor Market?

Key companies in the market include Honeywell Inc, Bei Sensors, HELLA GmbH & Co KgaA, Sensata Technologies, Nxp Semiconductors, Continental AG, Infineon Technology, Asahi Kase, Robert Bosch GmbH, Valeo SA, DENSO Corporation.

3. What are the main segments of the Europe Automotive Steering Sensor Market?

The market segments include Vehicle Type, Sensor Type, Technology Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 329.4 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Electrification of Vehicles.

6. What are the notable trends driving market growth?

Position Sensors is expected to hold the major share in the market.

7. Are there any restraints impacting market growth?

Precise Testing and Validation.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Automotive Steering Sensor Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Automotive Steering Sensor Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Automotive Steering Sensor Market?

To stay informed about further developments, trends, and reports in the Europe Automotive Steering Sensor Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence