Key Insights

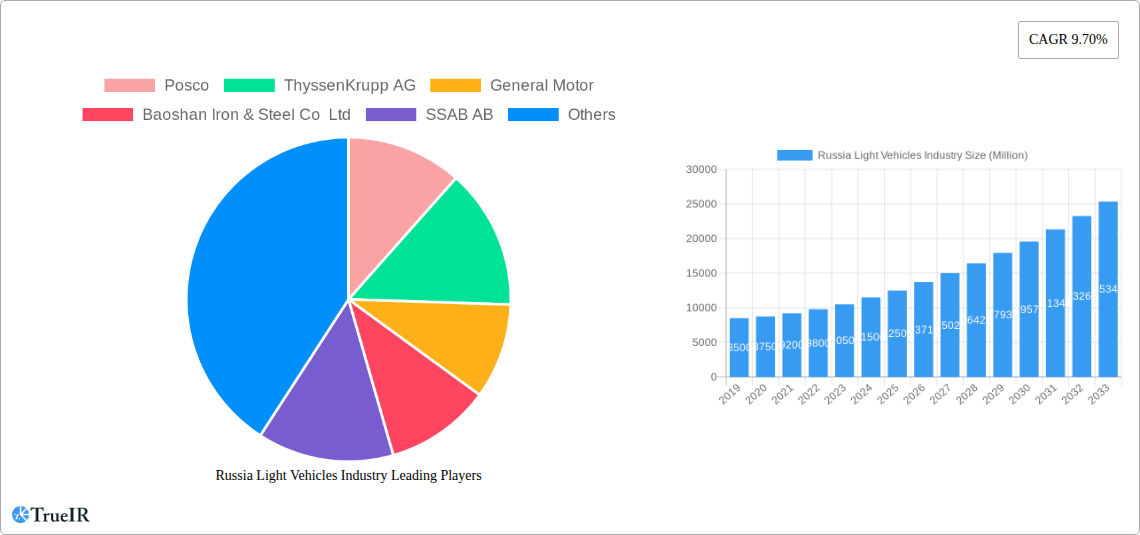

The Russian light vehicle industry is projected for significant expansion, anticipated to grow at a Compound Annual Growth Rate (CAGR) of 9.7%. With a projected market size of $32.3 billion in the base year 2025, the sector is propelled by escalating demand for passenger cars and light commercial vehicles. Key growth drivers include a strengthening middle class, the necessity for fleet modernization in logistics, and supportive government policies promoting domestic automotive manufacturing and sales. Innovations in materials, such as advanced composites and high-strength steel, are enabling the production of lighter, more fuel-efficient, and safer vehicles. Prominent companies like Posco, ThyssenKrupp AG, General Motors, and Toyota Motors are instrumental in shaping the industry through innovation and investment.

Russia Light Vehicles Industry Market Size (In Billion)

Despite a favorable growth trajectory, the Russian light vehicle market faces challenges. Economic instability, geopolitical influences on supply chains, and fluctuations in consumer purchasing power present potential headwinds. However, the ongoing modernization efforts and the burgeoning electric vehicle (EV) segment, though starting from a lower base, are expected to mitigate these constraints. The transition to electric powertrains, bolstered by governmental incentives and expanding charging infrastructure, signifies a critical future growth avenue. The market's adaptability to global automotive trends and domestic economic conditions will be crucial for its resilience.

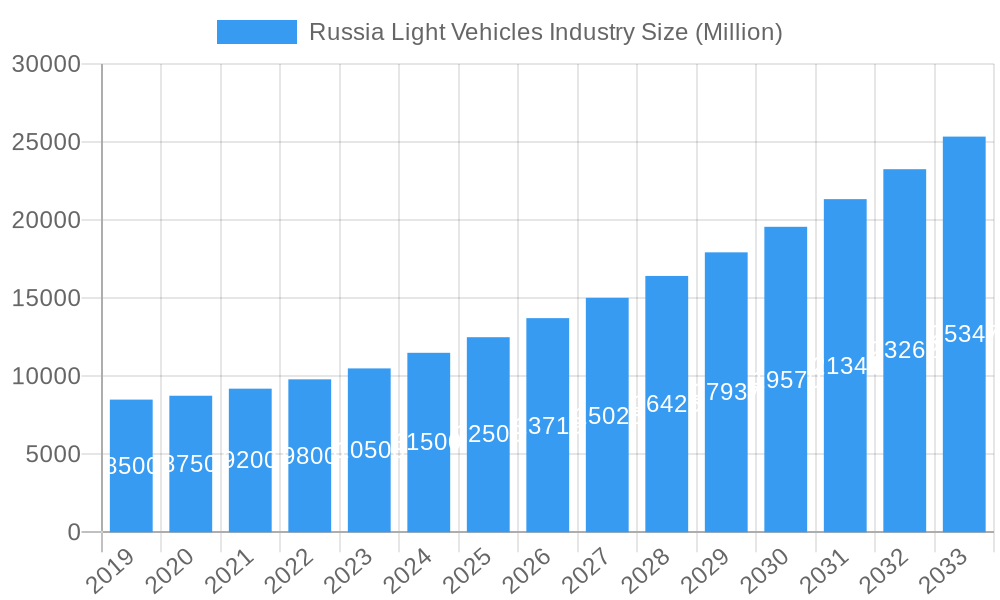

Russia Light Vehicles Industry Company Market Share

Russia Light Vehicles Industry: Market Analysis, Growth Drivers, and Forecast (2024-2033)

This detailed report offers a comprehensive analysis of the Russia Light Vehicles Industry, covering market dynamics, competitive intelligence, and future outlook. Optimized for keywords including "Russia Light Vehicles Market," "Passenger Cars Russia," "Electric Vehicles Russia," "Light Commercial Vehicles Market," and "Automotive Industry Russia," this study provides strategic insights for industry stakeholders. The analysis encompasses a study period from 2019 to 2033, with a base year of 2025, and an estimated market size of $32.3 billion.

Russia Light Vehicles Industry Market Structure & Competitive Landscape

The Russian light vehicles industry exhibits a moderately concentrated market structure, with a significant portion of market share held by key domestic and international players. Innovation drivers are primarily focused on electrification, advanced driver-assistance systems (ADAS), and fuel efficiency improvements. Regulatory impacts, including stringent emissions standards and government incentives for electric vehicles (EVs), play a crucial role in shaping market strategies. Product substitutes, though limited in the direct vehicle segment, can emerge from alternative transportation solutions and shared mobility platforms. End-user segmentation reveals a growing demand for passenger cars driven by personal mobility needs and a steady requirement for light commercial vehicles (LCVs) supporting logistics and business operations. Mergers and acquisitions (M&A) trends, while subject to geopolitical influences, have historically aimed at expanding production capacity, securing supply chains, and gaining market access. For instance, M&A volumes in the historical period (2019-2024) saw an estimated XX Million USD invested in consolidation and strategic partnerships. Concentration ratios, such as the CR4 (Concentration Ratio of the top 4 players), are estimated to be around XX%, indicating a competitive yet consolidated market.

Russia Light Vehicles Industry Market Trends & Opportunities

The Russia Light Vehicles Industry is poised for significant growth and transformation over the forecast period of 2025–2033. The market size growth is projected to be substantial, driven by a confluence of evolving consumer preferences, technological advancements, and supportive governmental policies. We anticipate a Compound Annual Growth Rate (CAGR) of approximately XX% for the total light vehicles market during the forecast period. The technological shifts are particularly pronounced, with a discernible move towards electric vehicles (EVs), fueled by environmental consciousness and increasing infrastructure development for charging stations. The penetration rate of EVs, while starting from a lower base compared to global leaders, is expected to climb from an estimated XX% in 2025 to XX% by 2033.

Consumer preferences are increasingly leaning towards fuel-efficient and technologically advanced vehicles. This includes a rising demand for advanced infotainment systems, connectivity features, and enhanced safety technologies. The competitive dynamics are intensifying, with established automakers vying for market share while new entrants, particularly in the EV segment, seek to disrupt the status quo. Opportunities lie in catering to the growing middle class, urbanizing populations, and the burgeoning e-commerce sector, which drives demand for LCVs. Furthermore, the government's focus on localizing production and fostering domestic technological capabilities presents a fertile ground for investment and collaboration. The potential for hybrid vehicles also remains a key trend, bridging the gap between traditional internal combustion engine (ICE) vehicles and pure EVs. The development of domestic charging infrastructure and battery production will be critical enablers for the widespread adoption of electric mobility.

Dominant Markets & Segments in Russia Light Vehicles Industry

The Russia Light Vehicles Industry is characterized by dominant segments and regions that are driving overall market growth. Within Vehicle Type, Passenger Cars consistently represent the largest segment, accounting for an estimated XX% of total sales in 2025, driven by individual mobility needs and an expanding middle-class consumer base. However, Light Commercial Vehicles (LCVs) are experiencing robust growth, projected at a CAGR of XX% from 2025 to 2033, propelled by the expansion of e-commerce, logistics, and small business enterprises.

Regarding Fuel Type, Gasoline powered vehicles continue to hold a significant market share, estimated at XX% in 2025. However, the landscape is rapidly evolving with a projected surge in Electric vehicles. The market penetration of EVs is expected to increase from an estimated XX% in 2025 to XX% by 2033, driven by government incentives and a growing consumer awareness of environmental sustainability. Diesel vehicles maintain a steady presence, particularly in the LCV segment, due to their efficiency and torque, holding an estimated XX% share in 2025.

In terms of Material Type, High-strength Steel remains the dominant material due to its cost-effectiveness and structural integrity, forming the backbone of most vehicle manufacturing. However, there is a growing adoption of Glass Fiber and Carbon Fiber composites in specific applications to reduce vehicle weight, improve fuel efficiency, and enhance performance, particularly in premium and EV segments. The adoption of these advanced materials is projected to grow by an estimated XX% annually. The Others category, encompassing various specialized materials, also contributes to the innovation in vehicle manufacturing.

Russia Light Vehicles Industry Product Analysis

Product innovation in the Russia Light Vehicles Industry is increasingly focused on enhancing fuel efficiency, safety, and connectivity. The introduction of advanced powertrain technologies, including hybrid and fully electric drivetrains, is a key area of development. For instance, new electric models are emerging with enhanced battery ranges and faster charging capabilities, targeting a broader consumer base. Applications are expanding beyond traditional personal transport to include sophisticated LCVs designed for last-mile delivery and specialized commercial use. Competitive advantages are being forged through superior technological integration, such as advanced infotainment systems, AI-powered driver assistance, and connected car services. The market fit for these innovations is driven by evolving consumer expectations for a more sustainable, safer, and connected driving experience.

Key Drivers, Barriers & Challenges in Russia Light Vehicles Industry

The Russia Light Vehicles Industry is propelled by several key drivers. Technological advancements in EV battery technology and charging infrastructure development are crucial enablers for the transition to sustainable mobility. Government incentives, including tax breaks and subsidies for EV purchases and local manufacturing, are significant growth catalysts. Economic recovery and rising disposable incomes among the population also contribute to increased vehicle demand.

However, the industry faces significant challenges and restraints. Supply chain disruptions, particularly concerning the sourcing of critical components like semiconductors and battery materials, pose a persistent threat. Regulatory complexities and evolving emissions standards require continuous adaptation from manufacturers. Intense competitive pressures from both domestic and international players necessitate ongoing investment in research and development and cost optimization strategies. Geopolitical factors can also impact import/export dynamics and foreign investment.

Growth Drivers in the Russia Light Vehicles Industry Market

Several pivotal factors are driving the growth of the Russia Light Vehicles Industry. Technological advancements in electric vehicle (EV) technology, including improved battery range and faster charging capabilities, are making EVs more viable for a wider consumer base. Governmental support through subsidies, tax incentives for EV adoption, and policies promoting local manufacturing are significantly stimulating market expansion. The economic landscape, marked by a gradual recovery and increasing consumer purchasing power, is also contributing to higher demand for personal transportation. Furthermore, the growing environmental consciousness among consumers is fueling a preference for cleaner and more sustainable mobility solutions, particularly in urban areas.

Challenges Impacting Russia Light Vehicles Industry Growth

The Russia Light Vehicles Industry faces several significant challenges that could impede its growth trajectory. Regulatory complexities and evolving emissions standards necessitate substantial compliance investments from manufacturers. Supply chain vulnerabilities, particularly the availability of critical components like semiconductors and battery raw materials, can lead to production delays and increased costs. Intense competitive pressures from both established global automakers and emerging domestic players require continuous innovation and efficient cost management. The underdeveloped charging infrastructure in many regions of Russia remains a substantial barrier to the widespread adoption of electric vehicles. Economic volatility and fluctuating consumer spending power can also create uncertainty in demand.

Key Players Shaping the Russia Light Vehicles Industry Market

- Posco

- ThyssenKrupp AG

- General Motor

- Baoshan Iron & Steel Co Ltd

- SSAB AB

- AK Steel Holding Corporation

- Arcelor Mittal

- Toyota Motors

Significant Russia Light Vehicles Industry Industry Milestones

- 2019: Introduction of stricter emissions standards impacting powertrain development strategies.

- 2020: Increased government focus on supporting domestic automotive production and localization initiatives.

- 2021: Growing interest and early-stage investments in electric vehicle infrastructure development.

- 2022: Supply chain disruptions, particularly semiconductor shortages, impacting global and Russian production lines.

- 2023: Announcement of new government incentives aimed at boosting domestic EV manufacturing and sales.

- 2024 (Estimated): Expansion of charging network pilot projects in major urban centers.

Future Outlook for Russia Light Vehicles Industry Market

The future outlook for the Russia Light Vehicles Industry is one of dynamic evolution and strategic opportunity. Continued investment in electric vehicle technology and infrastructure will be a primary growth catalyst, supported by ongoing government policies. The increasing adoption of advanced materials for lighter and more efficient vehicles will also shape product development. Opportunities lie in localizing production, fostering innovation in battery technology, and expanding the LCV segment to meet the demands of a growing digital economy. The market is expected to witness a steady shift towards sustainable mobility solutions, presenting significant potential for companies that can adapt to these changing dynamics and cater to evolving consumer preferences for greener and smarter transportation.

Russia Light Vehicles Industry Segmentation

-

1. Vehicle Type

- 1.1. Passenger Cars

- 1.2. Light Commercial Vehicles

-

2. Fuel Type

- 2.1. Gasoline

- 2.2. Diesel

- 2.3. Electric

-

3. Material Type

- 3.1. Glass Fiber

- 3.2. Carbon Fiber

- 3.3. High-strength Steel

- 3.4. Others

Russia Light Vehicles Industry Segmentation By Geography

- 1. Russia

Russia Light Vehicles Industry Regional Market Share

Geographic Coverage of Russia Light Vehicles Industry

Russia Light Vehicles Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Travel and Tourism to Fuel Market Demand

- 3.3. Market Restrains

- 3.3.1. Recreational Vehicle Rental to Affect The Market Over the Long Term

- 3.4. Market Trends

- 3.4.1. Continuous Evolution in automotive AHSS technology

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Light Vehicles Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Cars

- 5.1.2. Light Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Fuel Type

- 5.2.1. Gasoline

- 5.2.2. Diesel

- 5.2.3. Electric

- 5.3. Market Analysis, Insights and Forecast - by Material Type

- 5.3.1. Glass Fiber

- 5.3.2. Carbon Fiber

- 5.3.3. High-strength Steel

- 5.3.4. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Posco

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ThyssenKrupp AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 General Motor

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Baoshan Iron & Steel Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SSAB AB

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 AK Steel Holding Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Arcelor Mittal

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Toyota Motors

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Posco

List of Figures

- Figure 1: Russia Light Vehicles Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Russia Light Vehicles Industry Share (%) by Company 2025

List of Tables

- Table 1: Russia Light Vehicles Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 2: Russia Light Vehicles Industry Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 3: Russia Light Vehicles Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 4: Russia Light Vehicles Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Russia Light Vehicles Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 6: Russia Light Vehicles Industry Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 7: Russia Light Vehicles Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 8: Russia Light Vehicles Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Light Vehicles Industry?

The projected CAGR is approximately 9.7%.

2. Which companies are prominent players in the Russia Light Vehicles Industry?

Key companies in the market include Posco, ThyssenKrupp AG, General Motor, Baoshan Iron & Steel Co Ltd, SSAB AB, AK Steel Holding Corporation, Arcelor Mittal, Toyota Motors.

3. What are the main segments of the Russia Light Vehicles Industry?

The market segments include Vehicle Type, Fuel Type, Material Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 32.3 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Travel and Tourism to Fuel Market Demand.

6. What are the notable trends driving market growth?

Continuous Evolution in automotive AHSS technology.

7. Are there any restraints impacting market growth?

Recreational Vehicle Rental to Affect The Market Over the Long Term.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Light Vehicles Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Light Vehicles Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Light Vehicles Industry?

To stay informed about further developments, trends, and reports in the Russia Light Vehicles Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence