Key Insights

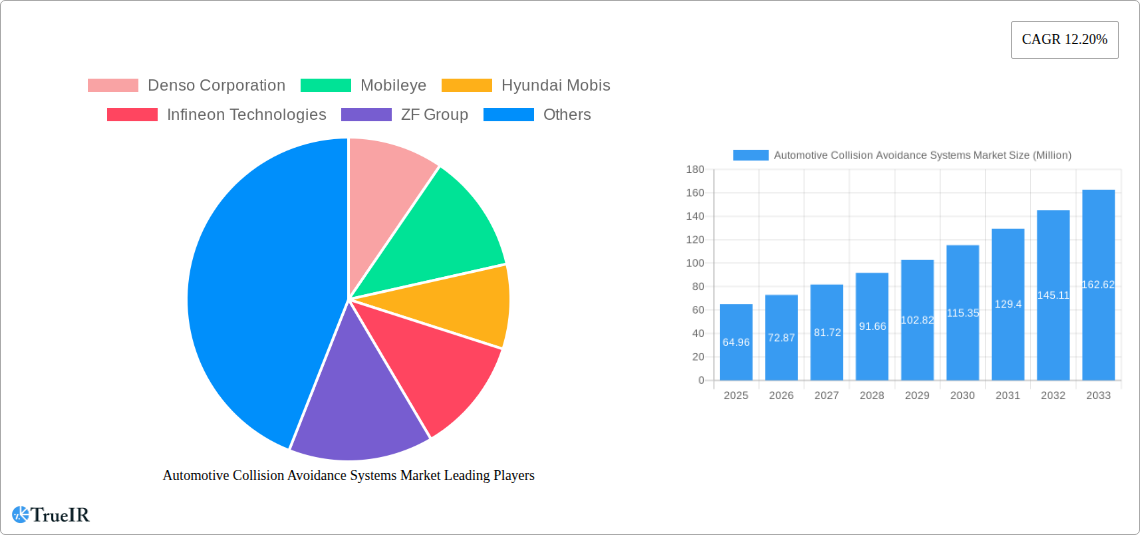

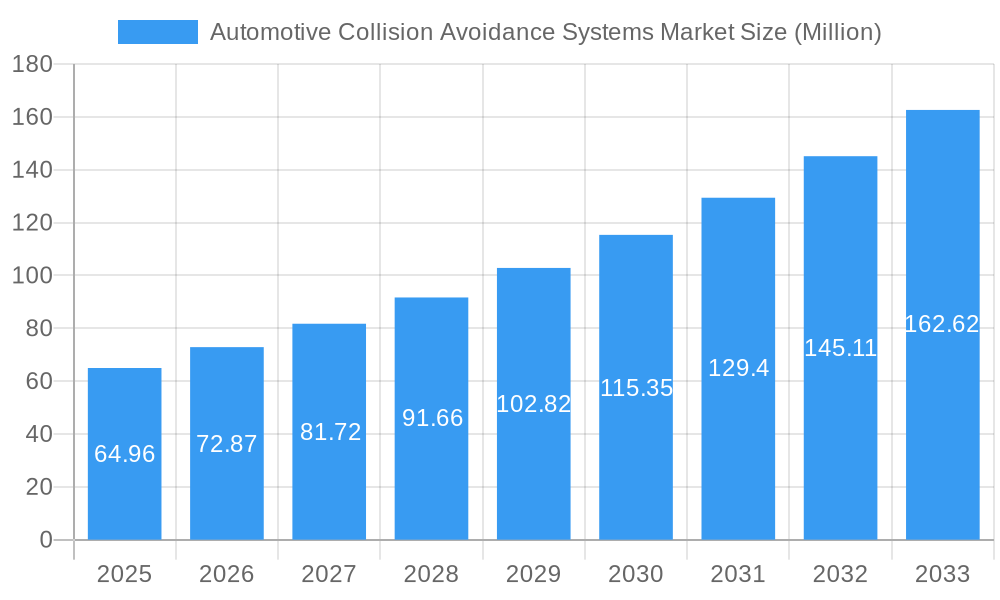

The global Automotive Collision Avoidance Systems (CAS) market is poised for substantial growth, projected to reach approximately USD 64.96 million in 2025, with an impressive Compound Annual Growth Rate (CAGR) of 12.20% during the forecast period of 2025-2033. This robust expansion is fueled by escalating consumer demand for enhanced vehicle safety features, stringent government regulations mandating advanced driver-assistance systems (ADAS), and continuous technological advancements in sensors and AI. Key drivers include the increasing adoption of sophisticated technologies like Radar, Lidar, and Cameras, which enable a range of functions from basic monitoring and warning systems to fully automated collision avoidance. The market is segmented by Function Type, with Automated and Adaptive systems gaining significant traction as vehicle autonomy progresses. Similarly, advancements in sensor technology are enabling more precise and comprehensive environmental perception, further propelling market growth. The rising global production of both passenger vehicles and commercial vehicles also contributes directly to the expanding market for CAS.

Automotive Collision Avoidance Systems Market Market Size (In Million)

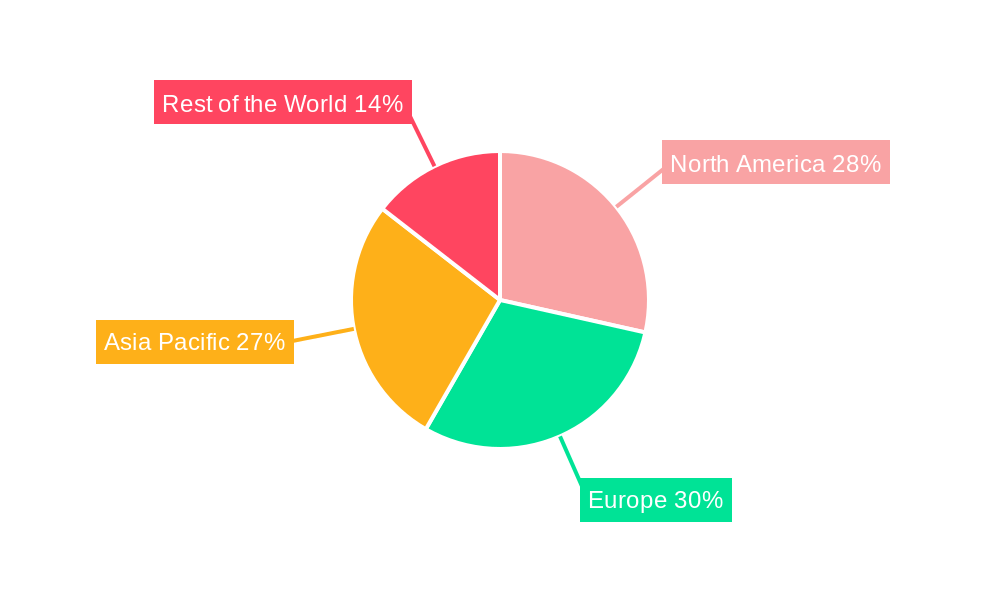

Geographically, North America and Europe are anticipated to lead the market, driven by early adoption of ADAS technologies and strong regulatory frameworks promoting vehicle safety. The Asia Pacific region, particularly China and South Korea, is emerging as a high-growth area due to rapid vehicle electrification, increasing disposable incomes, and a burgeoning automotive manufacturing base that is quick to integrate advanced safety features. While the market benefits from these strong growth drivers, certain restraints such as the high cost of initial implementation and consumer awareness regarding the reliability and effectiveness of these systems may temper growth in specific segments. However, ongoing research and development, coupled with increasing economies of scale, are expected to mitigate these challenges, paving the way for widespread adoption of advanced collision avoidance technologies across the automotive landscape.

Automotive Collision Avoidance Systems Market Company Market Share

Unlock Unprecedented Safety: The Automotive Collision Avoidance Systems Market Deep Dive (2019-2033)

This comprehensive report provides an in-depth analysis of the global Automotive Collision Avoidance Systems (ACAS) market, projecting significant growth and evolution. With an estimated market size of $xx Billion in 2025, expected to surge to $xx Billion by 2033, this study is essential for stakeholders seeking to capitalize on the rapidly expanding ADAS landscape. We cover the historical period of 2019-2024 and provide detailed forecasts for 2025-2033, with a base year of 2025. Leveraging high-volume keywords such as "ADAS," "autonomous driving," "vehicle safety," "LiDAR," "Radar," and "Automotive Safety Systems," this report is optimized for maximum SEO impact, attracting industry professionals, investors, and researchers alike.

Automotive Collision Avoidance Systems Market Market Structure & Competitive Landscape

The Automotive Collision Avoidance Systems (ACAS) market is characterized by a dynamic and evolving competitive landscape, driven by intense innovation and strategic collaborations. Market concentration is moderate, with a few dominant players alongside a growing number of specialized technology providers. Key innovation drivers include the relentless pursuit of enhanced vehicle safety, reduction in road accidents, and the advancement towards autonomous driving capabilities. Regulatory mandates and evolving consumer demand for advanced safety features are further accelerating this innovation. Product substitutes are limited due to the specialized nature of ACAS, though advancements in AI and sensor fusion are continuously pushing the boundaries of existing solutions. End-user segmentation reveals a strong preference for these systems in passenger vehicles, while their adoption in commercial vehicles is rapidly gaining traction due to operational efficiency and safety compliance requirements. Mergers and acquisitions (M&A) trends are evident as larger Tier-1 suppliers integrate specialized ADAS startups to bolster their product portfolios and technological expertise. The historical period of 2019-2024 has witnessed a steady increase in R&D investments and strategic partnerships, setting the stage for sustained market expansion.

Automotive Collision Avoidance Systems Market Market Trends & Opportunities

The Automotive Collision Avoidance Systems (ACAS) market is poised for substantial expansion, driven by an overarching trend towards enhanced vehicle safety and the inexorable march towards autonomous driving. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately xx% between 2025 and 2033, a testament to its burgeoning potential. This growth is underpinned by a confluence of factors, including stringent government regulations mandating advanced safety features, a growing consumer awareness and demand for accident prevention technologies, and significant technological advancements in sensor technology, artificial intelligence, and data processing.

Technological shifts are at the forefront of market evolution. The integration of sophisticated sensors such as radar, lidar, cameras, and ultrasonic sensors is becoming standard, providing vehicles with a comprehensive 360-degree view and the ability to perceive their surroundings with remarkable accuracy. The development of advanced algorithms for object detection, tracking, and prediction is further enhancing the efficacy of these systems, enabling them to react proactively to potential hazards. Consumer preferences are increasingly skewed towards vehicles equipped with advanced driver-assistance systems (ADAS), as they offer peace of mind and a demonstrable reduction in the risk of accidents. This is creating a significant market pull for ACAS technologies.

The competitive dynamics within the market are characterized by intense innovation and strategic alliances. Established automotive suppliers are heavily investing in R&D and collaborating with technology firms to develop next-generation ACAS solutions. The opportunity lies not only in the mass adoption of existing technologies but also in the development of more sophisticated and integrated systems that can handle complex driving scenarios and pave the way for higher levels of automation. Emerging opportunities also include the expansion of ACAS into niche vehicle segments and the development of aftermarket solutions. The increasing penetration rate of these systems in new vehicle sales signifies a transformative shift in automotive safety paradigms.

Dominant Markets & Segments in Automotive Collision Avoidance Systems Market

The global Automotive Collision Avoidance Systems (ACAS) market exhibits significant dominance across specific regions and vehicle segments, driven by regulatory frameworks, consumer demand, and technological infrastructure.

Leading Region: North America and Europe currently lead the ACAS market due to stringent safety regulations, high disposable incomes, and a well-established automotive industry with a strong focus on advanced technologies. The push for greater vehicle safety and the increasing adoption of autonomous driving features are key growth drivers in these regions. Asia Pacific is emerging as a rapidly growing market, fueled by increasing vehicle production, rising consumer awareness of safety features, and supportive government initiatives promoting automotive innovation.

Dominant Technology Type:

- Radar: Continues to be a cornerstone technology, offering robust performance in various weather conditions and a cost-effective solution for applications like adaptive cruise control and blind-spot detection.

- Camera: Essential for object recognition, lane keeping assist, and traffic sign recognition, its adoption is rapidly increasing due to advancements in image processing and AI.

- Lidar: Though historically more expensive, Lidar is gaining significant traction, particularly for higher levels of automation and complex perception tasks, with ongoing efforts to reduce costs and improve performance.

- Ultrasonic: Primarily used for short-range detection, crucial for parking assist and low-speed maneuvering.

Dominant Function Type:

- Monitoring: Systems like blind-spot monitoring and rear cross-traffic alert are widely adopted due to their immediate safety benefits and relatively lower cost of integration.

- Warning: Technologies such as forward collision warning and lane departure warning are fundamental in alerting drivers to potential hazards, contributing significantly to accident reduction.

- Adaptive: Adaptive cruise control and automatic emergency braking are gaining rapid popularity as they offer proactive assistance, enhancing driving comfort and safety.

- Automated: While full automation is still nascent, systems like automated emergency braking and steering assist represent the leading edge and are critical for the future of ACAS.

Dominant Vehicle Type:

- Passenger Vehicle: The largest segment by volume, driven by consumer demand for safety and comfort features, as well as the integration of ACAS as standard equipment in many new models.

- Commercial Vehicle: This segment is experiencing accelerated growth due to regulatory mandates for fleet safety, the potential for reduced operational costs through accident prevention, and the increasing sophistication of heavy-duty vehicle applications.

The interplay of these segments creates a robust market for ACAS, with ongoing research and development focused on enhancing the performance, affordability, and integration of these critical safety systems.

Automotive Collision Avoidance Systems Market Product Analysis

The Automotive Collision Avoidance Systems (ACAS) market is defined by continuous product innovation, focusing on enhancing the accuracy, reliability, and scope of safety interventions. Key product advancements include the development of higher-resolution sensors, more sophisticated sensor fusion algorithms, and AI-powered decision-making modules. These innovations lead to more effective systems for adaptive cruise control, automatic emergency braking, lane keeping assist, and blind-spot detection. Competitive advantages are increasingly derived from the seamless integration of multiple sensor types (radar, lidar, camera, ultrasonic) and the ability of systems to operate effectively in diverse environmental conditions. The market fit is driven by stringent safety regulations, consumer demand for enhanced protection, and the overarching trend towards semi-autonomous and autonomous driving.

Key Drivers, Barriers & Challenges in Automotive Collision Avoidance Systems Market

Key Drivers:

- Technological Advancements: Continuous improvements in sensor technology (LiDAR, Radar, Cameras), AI algorithms, and processing power are enabling more sophisticated and effective collision avoidance functionalities.

- Regulatory Mandates: Growing government regulations worldwide, mandating the inclusion of advanced safety features in vehicles, are a significant growth catalyst.

- Consumer Demand: Increasing awareness and demand for enhanced vehicle safety features among consumers are driving adoption rates.

- Reduction in Accident Rates: The proven efficacy of these systems in reducing accidents and mitigating their severity creates a strong business case for manufacturers and insurers.

Key Barriers & Challenges:

- Cost of Implementation: The high cost of advanced sensors and computing hardware can be a significant barrier to widespread adoption, particularly in budget-conscious vehicle segments.

- System Complexity and Integration: Integrating multiple sensor systems and complex software algorithms requires significant engineering expertise and can lead to development challenges.

- Performance Limitations in Adverse Conditions: While improving, current systems can still face performance limitations in extreme weather conditions (heavy rain, snow, fog) or complex urban environments.

- Regulatory Harmonization: Lack of uniform global regulations and testing standards can create complexities for global automotive manufacturers.

- Cybersecurity Concerns: As systems become more connected, ensuring robust cybersecurity against potential threats is paramount and presents an ongoing challenge.

- Supply Chain Disruptions: Geopolitical events and manufacturing challenges can impact the availability and cost of critical components, as witnessed in recent years.

Growth Drivers in the Automotive Collision Avoidance Systems Market Market

The Automotive Collision Avoidance Systems (ACAS) market is propelled by a potent combination of technological innovation, evolving consumer expectations, and increasing regulatory pressure. The relentless advancements in sensor fusion, artificial intelligence, and vehicle-to-everything (V2X) communication are enabling more robust and comprehensive safety functionalities. Governments worldwide are playing a crucial role by implementing stricter safety standards and mandating the inclusion of ADAS features in new vehicles, thereby creating a predictable demand. Furthermore, a growing consumer consciousness regarding road safety, coupled with the desire for a more comfortable and less stressful driving experience, is directly translating into higher demand for ACAS. The potential for significant reductions in accident-related fatalities and injuries further strengthens the market's growth trajectory.

Challenges Impacting Automotive Collision Avoidance Systems Market Growth

Despite the robust growth prospects, the Automotive Collision Avoidance Systems (ACAS) market faces several hurdles. The substantial cost associated with advanced sensor technologies like LiDAR and sophisticated computing platforms remains a significant barrier, particularly for entry-level and mid-range vehicles. Integrating these complex systems reliably and ensuring their seamless operation across diverse driving scenarios and environmental conditions presents ongoing engineering challenges. Regulatory complexities, including the lack of global harmonization in testing and certification standards, can slow down development and deployment. Additionally, supply chain vulnerabilities, as highlighted by recent global events, can lead to component shortages and price volatility, impacting production timelines and costs. Finally, the critical need for robust cybersecurity measures to protect these increasingly connected systems from malicious attacks adds another layer of complexity and development investment.

Key Players Shaping the Automotive Collision Avoidance Systems Market Market

- Denso Corporation

- Mobileye

- Hyundai Mobis

- Infineon Technologies

- ZF Group

- Siemens AG

- Delphi Automotive

- Fujitsu Laboratories Ltd

- Continental AG

- Autoliv Inc

- Robert Bosch GmbH

- Magna International

- Bendix Commercial Vehicle Systems LLC

- Hella KGaA Hueck & Co

- WABCO Vehicle Control Services

- National Instruments Corp

- Panasonic Corporation

- Toyota

Significant Automotive Collision Avoidance Systems Market Industry Milestones

- Aug 2023: Innoviz Technologies and the BMW Group announced a collaboration by starting a B-sample development phase on a new generation of LiDAR. Under the new development agreement, Innoviz will develop B-Samples based on its second-generation InnovizTwo LiDAR sensor, signaling a major step forward in automotive-grade LiDAR for advanced ADAS and autonomous driving.

- Sept 2023: Innoviz Technologies announced a distribution agreement with Ask Co. Ltd to sell LiDAR products in Japan, expanding its global reach and market penetration for its advanced sensing solutions.

- Jun 2022: In India, ZF Group inaugurated its new Tech center facility in Hyderabad. The Tech Center India is critical for ZF Group in the technology domains of e-mobility, ADAS, integrated safety, vehicle motion control, and digitalization, underscoring its commitment to R&D in key automotive safety areas.

- Apr 2022: Hesai Technology announced a new strategic cooperation agreement with WeRide. According to the agreement, the two companies will promote the autonomous vehicle application of automotive grade, hybrid solid-state lidar, empowering scale deployment, and commercial application of WeRide’s autonomous driving technology, a significant step in advancing LiDAR for autonomous mobility.

Future Outlook for Automotive Collision Avoidance Systems Market Market

The future outlook for the Automotive Collision Avoidance Systems (ACAS) market is exceptionally bright, fueled by an unwavering commitment to improving road safety and the accelerating development of autonomous driving technologies. We anticipate continued exponential growth driven by advancements in artificial intelligence, sensor fusion, and the increasing adoption of LiDAR and advanced camera systems. Strategic opportunities lie in the development of highly integrated, cost-effective solutions for a wider range of vehicle segments, including commercial fleets and emerging markets. The ongoing evolution towards Level 3 and Level 4 autonomy will further propel the demand for sophisticated ACAS, making them indispensable components of future mobility. Investments in R&D, strategic partnerships, and the establishment of robust cybersecurity frameworks will be critical for market players to capitalize on this transformative period.

Automotive Collision Avoidance Systems Market Segmentation

-

1. Function Type

- 1.1. Adaptive

- 1.2. Automated

- 1.3. Monitoring

- 1.4. Warning

-

2. Technology Type

- 2.1. Radar

- 2.2. Lidar

- 2.3. Camera

- 2.4. Ultrasonic

-

3. Vehicle Type

- 3.1. Passenger Vehicle

- 3.2. Commercial Vehicle

Automotive Collision Avoidance Systems Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Norway

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Automotive Collision Avoidance Systems Market Regional Market Share

Geographic Coverage of Automotive Collision Avoidance Systems Market

Automotive Collision Avoidance Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Autonomous Vehicle Demand To Propel The Market Growth

- 3.3. Market Restrains

- 3.3.1. High Installation Cost May Hamper The Market Growth

- 3.4. Market Trends

- 3.4.1. LiDAR Segment to Grow Significantly During The Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Collision Avoidance Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Function Type

- 5.1.1. Adaptive

- 5.1.2. Automated

- 5.1.3. Monitoring

- 5.1.4. Warning

- 5.2. Market Analysis, Insights and Forecast - by Technology Type

- 5.2.1. Radar

- 5.2.2. Lidar

- 5.2.3. Camera

- 5.2.4. Ultrasonic

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Passenger Vehicle

- 5.3.2. Commercial Vehicle

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Function Type

- 6. North America Automotive Collision Avoidance Systems Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Function Type

- 6.1.1. Adaptive

- 6.1.2. Automated

- 6.1.3. Monitoring

- 6.1.4. Warning

- 6.2. Market Analysis, Insights and Forecast - by Technology Type

- 6.2.1. Radar

- 6.2.2. Lidar

- 6.2.3. Camera

- 6.2.4. Ultrasonic

- 6.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.3.1. Passenger Vehicle

- 6.3.2. Commercial Vehicle

- 6.1. Market Analysis, Insights and Forecast - by Function Type

- 7. Europe Automotive Collision Avoidance Systems Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Function Type

- 7.1.1. Adaptive

- 7.1.2. Automated

- 7.1.3. Monitoring

- 7.1.4. Warning

- 7.2. Market Analysis, Insights and Forecast - by Technology Type

- 7.2.1. Radar

- 7.2.2. Lidar

- 7.2.3. Camera

- 7.2.4. Ultrasonic

- 7.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.3.1. Passenger Vehicle

- 7.3.2. Commercial Vehicle

- 7.1. Market Analysis, Insights and Forecast - by Function Type

- 8. Asia Pacific Automotive Collision Avoidance Systems Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Function Type

- 8.1.1. Adaptive

- 8.1.2. Automated

- 8.1.3. Monitoring

- 8.1.4. Warning

- 8.2. Market Analysis, Insights and Forecast - by Technology Type

- 8.2.1. Radar

- 8.2.2. Lidar

- 8.2.3. Camera

- 8.2.4. Ultrasonic

- 8.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.3.1. Passenger Vehicle

- 8.3.2. Commercial Vehicle

- 8.1. Market Analysis, Insights and Forecast - by Function Type

- 9. Rest of the World Automotive Collision Avoidance Systems Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Function Type

- 9.1.1. Adaptive

- 9.1.2. Automated

- 9.1.3. Monitoring

- 9.1.4. Warning

- 9.2. Market Analysis, Insights and Forecast - by Technology Type

- 9.2.1. Radar

- 9.2.2. Lidar

- 9.2.3. Camera

- 9.2.4. Ultrasonic

- 9.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.3.1. Passenger Vehicle

- 9.3.2. Commercial Vehicle

- 9.1. Market Analysis, Insights and Forecast - by Function Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Denso Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Mobileye

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Hyundai Mobis

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Infineon Technologies

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 ZF Group

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Siemens AG

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Delphi Automotive

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Fujitsu Laboratories Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Continental AG

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Autoliv Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Robert Bosch GmbH

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Magna International

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Bendix Commercial Vehicle Systems LLC

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Hella KGaA Hueck & Co

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 WABCO Vehicle Control Services

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 National Instruments Corp

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.17 Panasonic Corporation

- 10.2.17.1. Overview

- 10.2.17.2. Products

- 10.2.17.3. SWOT Analysis

- 10.2.17.4. Recent Developments

- 10.2.17.5. Financials (Based on Availability)

- 10.2.18 Toyota

- 10.2.18.1. Overview

- 10.2.18.2. Products

- 10.2.18.3. SWOT Analysis

- 10.2.18.4. Recent Developments

- 10.2.18.5. Financials (Based on Availability)

- 10.2.1 Denso Corporation

List of Figures

- Figure 1: Global Automotive Collision Avoidance Systems Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Automotive Collision Avoidance Systems Market Revenue (Million), by Function Type 2025 & 2033

- Figure 3: North America Automotive Collision Avoidance Systems Market Revenue Share (%), by Function Type 2025 & 2033

- Figure 4: North America Automotive Collision Avoidance Systems Market Revenue (Million), by Technology Type 2025 & 2033

- Figure 5: North America Automotive Collision Avoidance Systems Market Revenue Share (%), by Technology Type 2025 & 2033

- Figure 6: North America Automotive Collision Avoidance Systems Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 7: North America Automotive Collision Avoidance Systems Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 8: North America Automotive Collision Avoidance Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Automotive Collision Avoidance Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Automotive Collision Avoidance Systems Market Revenue (Million), by Function Type 2025 & 2033

- Figure 11: Europe Automotive Collision Avoidance Systems Market Revenue Share (%), by Function Type 2025 & 2033

- Figure 12: Europe Automotive Collision Avoidance Systems Market Revenue (Million), by Technology Type 2025 & 2033

- Figure 13: Europe Automotive Collision Avoidance Systems Market Revenue Share (%), by Technology Type 2025 & 2033

- Figure 14: Europe Automotive Collision Avoidance Systems Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 15: Europe Automotive Collision Avoidance Systems Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 16: Europe Automotive Collision Avoidance Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Automotive Collision Avoidance Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Automotive Collision Avoidance Systems Market Revenue (Million), by Function Type 2025 & 2033

- Figure 19: Asia Pacific Automotive Collision Avoidance Systems Market Revenue Share (%), by Function Type 2025 & 2033

- Figure 20: Asia Pacific Automotive Collision Avoidance Systems Market Revenue (Million), by Technology Type 2025 & 2033

- Figure 21: Asia Pacific Automotive Collision Avoidance Systems Market Revenue Share (%), by Technology Type 2025 & 2033

- Figure 22: Asia Pacific Automotive Collision Avoidance Systems Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 23: Asia Pacific Automotive Collision Avoidance Systems Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 24: Asia Pacific Automotive Collision Avoidance Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Automotive Collision Avoidance Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Automotive Collision Avoidance Systems Market Revenue (Million), by Function Type 2025 & 2033

- Figure 27: Rest of the World Automotive Collision Avoidance Systems Market Revenue Share (%), by Function Type 2025 & 2033

- Figure 28: Rest of the World Automotive Collision Avoidance Systems Market Revenue (Million), by Technology Type 2025 & 2033

- Figure 29: Rest of the World Automotive Collision Avoidance Systems Market Revenue Share (%), by Technology Type 2025 & 2033

- Figure 30: Rest of the World Automotive Collision Avoidance Systems Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 31: Rest of the World Automotive Collision Avoidance Systems Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 32: Rest of the World Automotive Collision Avoidance Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Rest of the World Automotive Collision Avoidance Systems Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Collision Avoidance Systems Market Revenue Million Forecast, by Function Type 2020 & 2033

- Table 2: Global Automotive Collision Avoidance Systems Market Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 3: Global Automotive Collision Avoidance Systems Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 4: Global Automotive Collision Avoidance Systems Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Automotive Collision Avoidance Systems Market Revenue Million Forecast, by Function Type 2020 & 2033

- Table 6: Global Automotive Collision Avoidance Systems Market Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 7: Global Automotive Collision Avoidance Systems Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 8: Global Automotive Collision Avoidance Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Automotive Collision Avoidance Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Automotive Collision Avoidance Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Automotive Collision Avoidance Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Automotive Collision Avoidance Systems Market Revenue Million Forecast, by Function Type 2020 & 2033

- Table 13: Global Automotive Collision Avoidance Systems Market Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 14: Global Automotive Collision Avoidance Systems Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 15: Global Automotive Collision Avoidance Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Automotive Collision Avoidance Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Automotive Collision Avoidance Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Automotive Collision Avoidance Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Norway Automotive Collision Avoidance Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Automotive Collision Avoidance Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Automotive Collision Avoidance Systems Market Revenue Million Forecast, by Function Type 2020 & 2033

- Table 22: Global Automotive Collision Avoidance Systems Market Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 23: Global Automotive Collision Avoidance Systems Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 24: Global Automotive Collision Avoidance Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 25: China Automotive Collision Avoidance Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Japan Automotive Collision Avoidance Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: India Automotive Collision Avoidance Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: South Korea Automotive Collision Avoidance Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Asia Pacific Automotive Collision Avoidance Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Automotive Collision Avoidance Systems Market Revenue Million Forecast, by Function Type 2020 & 2033

- Table 31: Global Automotive Collision Avoidance Systems Market Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 32: Global Automotive Collision Avoidance Systems Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 33: Global Automotive Collision Avoidance Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 34: South America Automotive Collision Avoidance Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Middle East and Africa Automotive Collision Avoidance Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Collision Avoidance Systems Market?

The projected CAGR is approximately 12.20%.

2. Which companies are prominent players in the Automotive Collision Avoidance Systems Market?

Key companies in the market include Denso Corporation, Mobileye, Hyundai Mobis, Infineon Technologies, ZF Group, Siemens AG, Delphi Automotive, Fujitsu Laboratories Ltd, Continental AG, Autoliv Inc, Robert Bosch GmbH, Magna International, Bendix Commercial Vehicle Systems LLC, Hella KGaA Hueck & Co, WABCO Vehicle Control Services, National Instruments Corp, Panasonic Corporation, Toyota.

3. What are the main segments of the Automotive Collision Avoidance Systems Market?

The market segments include Function Type, Technology Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 64.96 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Autonomous Vehicle Demand To Propel The Market Growth.

6. What are the notable trends driving market growth?

LiDAR Segment to Grow Significantly During The Forecast Period.

7. Are there any restraints impacting market growth?

High Installation Cost May Hamper The Market Growth.

8. Can you provide examples of recent developments in the market?

Aug 2023: Innoviz Technologies and the BMW Group announced a collaboration by starting a B-sample development phase on a new generation of LiDAR. Under the new development agreement, Innoviz will develop B-Samples based on its second-generation InnovizTwo LiDAR sensor.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Collision Avoidance Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Collision Avoidance Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Collision Avoidance Systems Market?

To stay informed about further developments, trends, and reports in the Automotive Collision Avoidance Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence