Key Insights

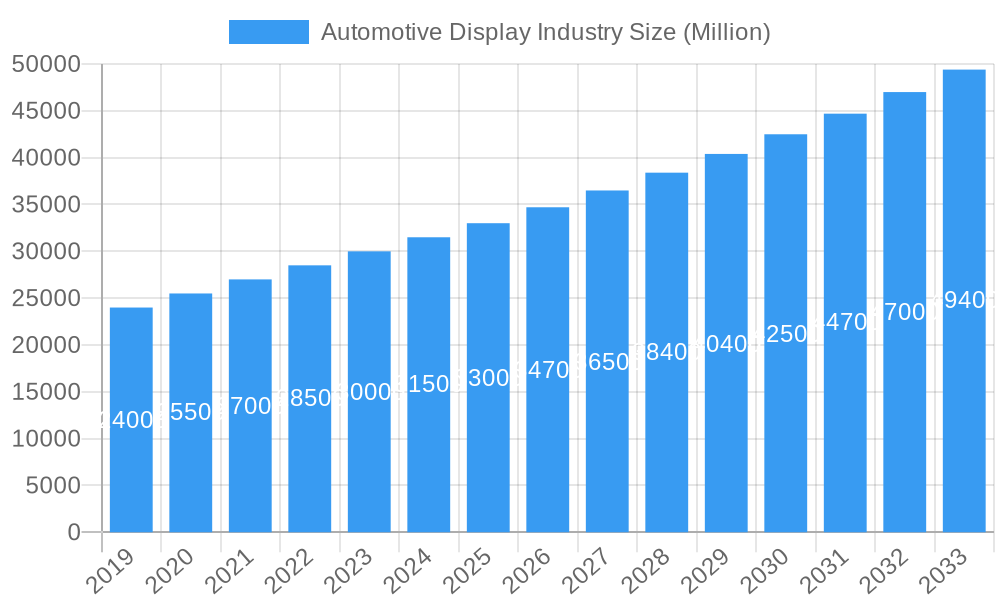

The global Automotive Display Industry is projected for significant expansion, with an estimated market size of $38.23 billion by 2025 and a Compound Annual Growth Rate (CAGR) of 5% through 2033. Key growth catalysts include rising demand for Advanced Driver-Assistance Systems (ADAS), increasing integration of infotainment and connectivity, and advancements in display technologies like OLED. Consumer preference for sophisticated in-cabin experiences and regulatory mandates for enhanced safety are accelerating adoption. The growth of electric vehicles (EVs) and autonomous driving technologies further fuels the need for advanced display solutions.

Automotive Display Industry Market Size (In Billion)

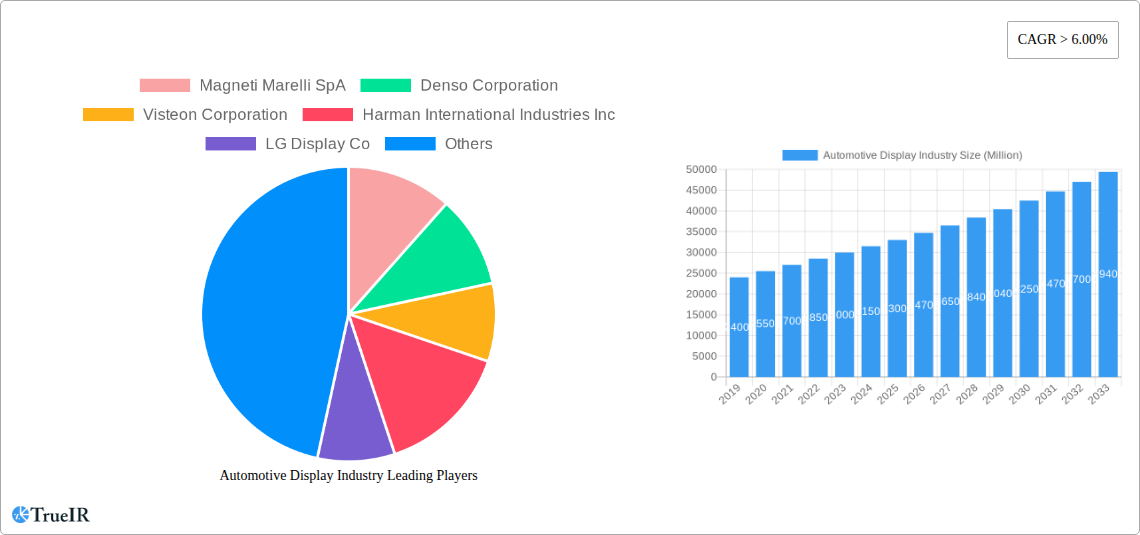

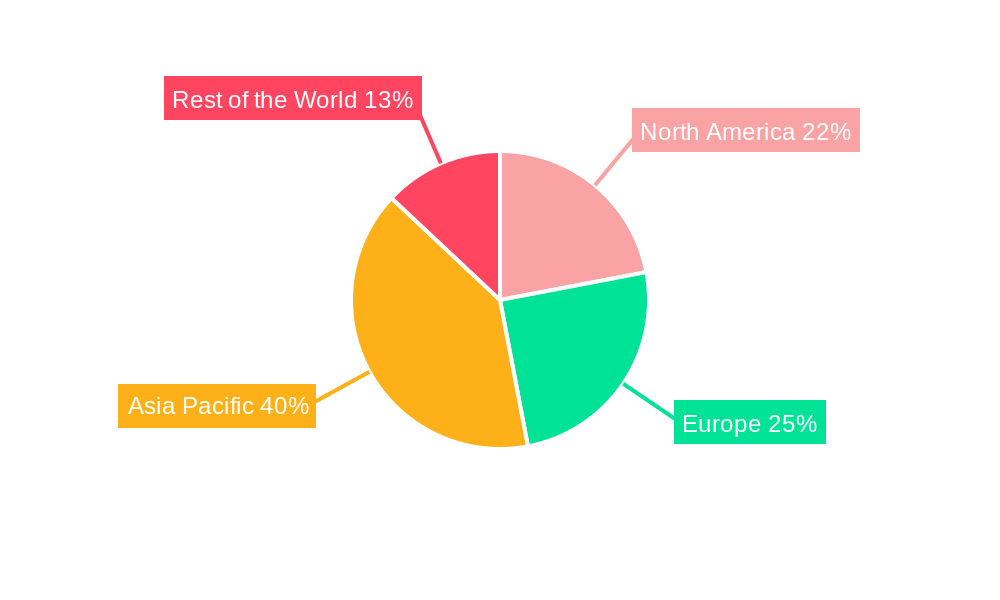

Center Stack Displays and Instrument Cluster Displays are leading market segments, central to the in-car user experience. While LCD technology remains significant due to cost-effectiveness, OLED is gaining traction for its superior contrast, vibrant colors, and flexibility. Geographically, Asia Pacific, particularly China, dominates due to high automotive production and consumption. North America and Europe are substantial markets with high adoption rates of premium vehicles featuring advanced displays. Leading players like Continental AG, Robert Bosch GmbH, and LG Display Co. are investing in R&D for next-generation automotive displays, focusing on safety, comfort, and driving experience, while addressing cost optimization and supply chain stability.

Automotive Display Industry Company Market Share

This report provides an in-depth analysis of the dynamic Automotive Display Industry, covering market structure, key trends, dominant segments, product innovations, growth drivers, challenges, and key players. The forecast period from 2025 to 2033 offers strategic insights into the projected trajectory of this multi-billion dollar market. Explore advancements in Center Stack Displays, Instrument Cluster Displays, Head-Up Displays (HUDs), and Rear Seat Entertainment Displays, powered by LCD and OLED technologies. This comprehensive analysis leverages high-volume keywords for maximum visibility and provides actionable intelligence for stakeholders.

Automotive Display Industry Market Structure & Competitive Landscape

The automotive display market exhibits a moderately concentrated structure, characterized by the presence of a few dominant global players alongside a growing number of specialized technology providers. Innovation drivers are paramount, with constant R&D focused on enhancing display resolution, brightness, touch sensitivity, and integration of advanced functionalities like augmented reality and gesture control. Regulatory impacts, particularly concerning safety standards and in-vehicle information display guidelines, play a crucial role in shaping product development and market entry strategies. Product substitutes, while evolving, are largely confined to different display technologies within the same segment, rather than entirely different interface paradigms for core driver information. End-user segmentation is primarily driven by vehicle class (luxury, mass-market), vehicle type (passenger, commercial), and geographic region. Mergers and acquisitions (M&A) trends are evident as companies seek to broaden their technological portfolios, secure supply chains, and gain market share. For instance, strategic partnerships and smaller acquisitions to gain access to niche technologies, like advanced touch sensing or unique UI/UX solutions, are becoming increasingly common. The total market value is projected to exceed $XX Billion by 2025, with a concentration ratio of approximately XX% held by the top five players.

Automotive Display Industry Market Trends & Opportunities

The automotive display industry is poised for exceptional growth, driven by the increasing sophistication of vehicle interiors and the proliferation of in-car digital experiences. The market size is projected to experience a robust compound annual growth rate (CAGR) of approximately XX% from 2025 to 2033, reaching an estimated value of over $XX Billion by the end of the forecast period. This surge is fueled by several key trends. Firstly, the demand for larger, higher-resolution displays that integrate seamlessly into the dashboard and offer intuitive user interfaces is rapidly increasing. This includes a significant push towards multi-display configurations, where separate screens cater to specific functions, enhancing driver and passenger engagement. Secondly, technological advancements are revolutionizing display capabilities. The adoption of OLED technology is gaining traction due to its superior contrast ratios, deeper blacks, and flexibility, enabling more immersive and visually appealing dashboards. Furthermore, the integration of advanced features such as augmented reality-enabled Head-Up Displays (HUDs), personalized user profiles, and sophisticated infotainment systems are becoming standard, particularly in premium and electric vehicles. Consumer preferences are shifting towards a more connected and personalized in-car environment, mirroring the digital experiences they encounter in their daily lives. This translates into a demand for displays that offer seamless connectivity, advanced navigation, and entertainment options. The competitive dynamics are intensifying, with established automotive suppliers and display manufacturers investing heavily in R&D to stay ahead. Opportunities lie in developing innovative display solutions that enhance safety, improve user experience, and contribute to the overall aesthetic and technological appeal of vehicles. The market penetration rate for advanced display technologies, particularly large-format and flexible displays, is expected to see a significant upward trend, moving from approximately XX% in 2025 to over XX% by 2033. The rise of autonomous driving is also a significant trend, necessitating sophisticated visual communication systems to convey information to drivers and passengers effectively.

Dominant Markets & Segments in Automotive Display Industry

The Center Stack Display segment is currently the dominant force within the automotive display industry, driven by its central role in infotainment, navigation, and vehicle controls. In 2025, this segment is estimated to command a market share of over XX%. The widespread adoption of large, touchscreen-enabled center stack displays across all vehicle classes, from entry-level to luxury, underscores its significance. Key growth drivers in this segment include the increasing demand for advanced infotainment systems, the integration of connected car services, and the development of intuitive user interfaces that consolidate multiple functions into a single display. The Instrument Cluster Display segment also holds substantial importance, evolving from traditional analog gauges to fully digital, customizable screens. Projected to capture approximately XX% of the market by 2025, this segment is propelled by the need for enhanced driver information delivery, including advanced driver-assistance systems (ADAS) visualizations and personalized driving modes. The growing trend towards electric vehicles (EVs) also contributes significantly, as these vehicles often feature advanced instrument clusters displaying crucial information like battery status and regenerative braking.

The Head-Up Display (HUD) segment is experiencing the most rapid growth, with an impressive CAGR of over XX% projected throughout the forecast period. While currently holding a smaller market share, its penetration is rapidly increasing, especially in premium vehicles, due to its ability to project vital information directly into the driver's line of sight, enhancing safety and convenience. Key growth drivers for HUDs include advancements in projection technology, the integration of augmented reality overlays, and the increasing focus on driver distraction reduction. The market share for HUDs is expected to climb to approximately XX% by 2033. The Rear Seat Entertainment Display segment, though less dominant, is a growing niche, particularly in minivans, SUVs, and premium sedans, catering to families and long-distance travelers. Its market share is expected to remain relatively stable, around XX% by 2025, but with opportunities for innovation in connectivity and interactive features.

In terms of display technology, LCD continues to dominate due to its cost-effectiveness and established manufacturing infrastructure, holding an estimated XX% market share in 2025. However, OLED technology is rapidly gaining ground, especially in premium applications, owing to its superior visual quality, including higher contrast ratios and deeper blacks. The OLED market share is projected to grow significantly, reaching approximately XX% by 2033, driven by advancements in manufacturing efficiency and declining costs.

Geographically, Asia-Pacific is the largest and fastest-growing market, driven by the robust automotive production in countries like China, Japan, and South Korea, coupled with a strong demand for advanced vehicle technologies. North America and Europe are also significant markets, characterized by a high adoption rate of premium features and a strong focus on safety and connectivity.

Automotive Display Industry Product Analysis

Product innovation in the automotive display industry centers on enhancing user experience, safety, and integration. Key advancements include the development of ultra-wide and curved displays for a more immersive cockpit, personalized digital dashboards with customizable layouts, and transparent displays for HUDs that blend seamlessly with the environment. The integration of haptic feedback and advanced gesture recognition is revolutionizing touchless control, offering a more intuitive and hygienic interaction. Competitive advantages are derived from superior display quality (brightness, contrast, color accuracy), energy efficiency, durability under demanding automotive conditions, and seamless integration with vehicle software and hardware. The market is witnessing a trend towards integrated display solutions, where multiple screens are managed by a single processing unit, optimizing performance and reducing complexity.

Key Drivers, Barriers & Challenges in Automotive Display Industry

Key Drivers, Barriers & Challenges in Automotive Display Industry

Key Drivers:

- Technological Advancements: Continuous innovation in display technologies like OLED, micro-LED, and flexible screens is enabling more sophisticated and engaging in-vehicle experiences.

- Increasing Demand for Connectivity and Infotainment: Consumers expect advanced infotainment systems, seamless smartphone integration, and rich multimedia content, driving the need for larger and higher-resolution displays.

- Growth of Electric and Autonomous Vehicles: EVs and AVs often incorporate advanced digital interfaces for battery management, autonomous driving status, and enhanced safety features, requiring sophisticated display solutions.

- Safety Regulations and ADAS Integration: The increasing implementation of Advanced Driver-Assistance Systems (ADAS) necessitates clear and intuitive visual feedback for drivers, boosting the adoption of advanced instrument clusters and HUDs.

Key Barriers & Challenges:

- High Cost of Advanced Technologies: Cutting-edge display technologies like high-resolution OLED panels can significantly increase vehicle manufacturing costs, impacting affordability for mass-market segments.

- Supply Chain Disruptions: The automotive industry is susceptible to global supply chain issues, including shortages of critical components like semiconductors, which can disrupt display production and delivery.

- Stringent Automotive Standards and Regulations: Displays must meet rigorous automotive standards for durability, reliability, temperature resistance, and electromagnetic compatibility, requiring extensive testing and certification.

- Cybersecurity Concerns: As displays become more integrated with vehicle networks, ensuring robust cybersecurity to prevent data breaches and malicious attacks is a critical challenge.

- Driver Distraction: While displays enhance functionality, poor design or excessive information can lead to driver distraction, necessitating careful UI/UX development and adherence to safety guidelines. The market value of display components susceptible to such issues is estimated at $XX Billion.

Growth Drivers in the Automotive Display Industry Market

The automotive display industry's growth is propelled by a confluence of factors. Technological innovation is paramount, with advancements in display materials and manufacturing processes enabling higher resolutions, improved brightness, and greater flexibility, leading to more immersive and visually appealing in-car experiences. The escalating demand for integrated infotainment systems and connected car services, driven by consumer desire for seamless digital integration, fuels the need for sophisticated dashboard displays. Furthermore, the accelerating transition to electric vehicles (EVs) and the gradual rollout of autonomous driving technologies necessitate advanced digital interfaces for critical information display, including battery management, charging status, and ADAS visualization. The increasing emphasis on driver safety, spurred by regulatory mandates and consumer awareness, is driving the adoption of Head-Up Displays (HUDs) and advanced instrument clusters that provide crucial information without diverting the driver's attention from the road. These factors collectively contribute to a robust market expansion, with an estimated market value of $XX Billion in 2025.

Challenges Impacting Automotive Display Industry Growth

Several challenges temper the growth trajectory of the automotive display industry. The high cost associated with cutting-edge display technologies, particularly OLED and micro-LED, presents a significant barrier to widespread adoption in mass-market vehicles, limiting their initial penetration to premium segments. The automotive industry's reliance on a complex global supply chain, especially for semiconductor components, makes it vulnerable to disruptions and shortages, impacting production volumes and lead times. Furthermore, displays must adhere to stringent automotive-grade standards for durability, reliability, and safety under extreme environmental conditions, necessitating substantial investment in research, development, and rigorous testing. The ever-evolving cybersecurity landscape poses a critical threat, as increasingly connected vehicle displays become potential targets for cyberattacks, requiring robust security measures. The potential for driver distraction due to poorly designed or overly complex display interfaces is another significant concern, necessitating careful UI/UX design and adherence to evolving safety regulations. The estimated impact of supply chain constraints on market growth is a potential reduction of XX% in 2025.

Key Players Shaping the Automotive Display Industry Market

- Magneti Marelli SpA

- Denso Corporation

- Visteon Corporation

- Harman International Industries Inc

- LG Display Co

- Nippon Seiki Co Lt

- Continental AG

- Robert Bosch GmbH

- Yazaki Corporation

- Panasonic Corporation

Significant Automotive Display Industry Industry Milestones

- April 2022: TouchNetix announced fully integrated aXiom touchscreen chips that offer new 3D sensing capabilities by detecting air gestures allowing touchless functions in automotive, industrial, and consumer environments, among others. aXiom provides more than 100 times higher Signal-to-Noise Ratio (SNR) than the traditional touchscreen controllers on the market. This development signifies a leap forward in human-machine interaction within vehicles.

- May 2022: Nippon Seiki Co., Ltd. announced on May 9 that it had started production of head-up displays (HUDs) at its new plant in Poland. The plant will first manufacture HUDs for the BMW Group. Vehicles are increasingly equipped with HUDs in Europe, the United States, and China, and the HUD market is rapidly expanding. Nippon Seiki established the new plant to deal with the increasing demand for HUDs from European automakers. This expansion highlights the growing market demand and strategic investment in HUD technology.

- May 2022: Faurecia announced introducing its newest perceptual image processing and immersive user experience solutions to the market during SID Display Week in California. Faurecia will also present MyDisplay, a platform solution that creates a personalized, enhanced visual experience. MyDisplay incorporates physiological algorithms that mimic how our eyes work to enhance the screen's 3D, color, and brightness in one seamless process. This showcases innovation in personalized visual experiences and advanced image processing.

- June 2021: Visteon Company announced a new business win with a North American OEM for its microZone™ display technology. The award is for a multi-display system that will be featured in multiple premium and performance vehicles expected to launch in 2024. This significant business win underscores the market's adoption of Visteon's advanced multi-display solutions.

Future Outlook for Automotive Display Industry Market

The future outlook for the automotive display industry is exceptionally bright, characterized by sustained innovation and increasing market penetration. Growth catalysts include the continued advancements in OLED and micro-LED technologies, promising even higher visual fidelity and energy efficiency. The growing prevalence of electric vehicles and the ongoing development of autonomous driving systems will further fuel the demand for sophisticated, integrated display solutions that provide comprehensive information and enhance user experience. Opportunities abound in developing advanced HUDs with augmented reality capabilities, personalized cabin environments, and seamless integration with smart devices and cloud-based services. The industry will likely see increased focus on sustainability, with manufacturers exploring eco-friendly materials and energy-efficient display designs. Strategic partnerships and collaborations between display manufacturers, automotive OEMs, and technology providers will be crucial in navigating the complex technological landscape and bringing innovative solutions to market, projecting a market value exceeding $XX Billion by 2033.

Automotive Display Industry Segmentation

-

1. Product Type

- 1.1. Center Stack Display

- 1.2. Instrument Cluster Display

- 1.3. Head-Up Display

- 1.4. Rear Seat Entertainment Display

-

2. Display Technology

- 2.1. LCD

- 2.2. OLED

Automotive Display Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Automotive Display Industry Regional Market Share

Geographic Coverage of Automotive Display Industry

Automotive Display Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand For Electric School Buses

- 3.3. Market Restrains

- 3.3.1. Uncertainty of The Global Pandemic

- 3.4. Market Trends

- 3.4.1. Increasing Demand of OLED Displays in the Luxury Vehicle is Expected to Witness Faster Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Display Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Center Stack Display

- 5.1.2. Instrument Cluster Display

- 5.1.3. Head-Up Display

- 5.1.4. Rear Seat Entertainment Display

- 5.2. Market Analysis, Insights and Forecast - by Display Technology

- 5.2.1. LCD

- 5.2.2. OLED

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Automotive Display Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Center Stack Display

- 6.1.2. Instrument Cluster Display

- 6.1.3. Head-Up Display

- 6.1.4. Rear Seat Entertainment Display

- 6.2. Market Analysis, Insights and Forecast - by Display Technology

- 6.2.1. LCD

- 6.2.2. OLED

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Automotive Display Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Center Stack Display

- 7.1.2. Instrument Cluster Display

- 7.1.3. Head-Up Display

- 7.1.4. Rear Seat Entertainment Display

- 7.2. Market Analysis, Insights and Forecast - by Display Technology

- 7.2.1. LCD

- 7.2.2. OLED

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Automotive Display Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Center Stack Display

- 8.1.2. Instrument Cluster Display

- 8.1.3. Head-Up Display

- 8.1.4. Rear Seat Entertainment Display

- 8.2. Market Analysis, Insights and Forecast - by Display Technology

- 8.2.1. LCD

- 8.2.2. OLED

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of the World Automotive Display Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Center Stack Display

- 9.1.2. Instrument Cluster Display

- 9.1.3. Head-Up Display

- 9.1.4. Rear Seat Entertainment Display

- 9.2. Market Analysis, Insights and Forecast - by Display Technology

- 9.2.1. LCD

- 9.2.2. OLED

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Magneti Marelli SpA

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Denso Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Visteon Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Harman International Industries Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 LG Display Co

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Nippon Seiki Co Lt

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Continental AG

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Robert Bosch GmbH

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Yazaki Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Panasonic Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Magneti Marelli SpA

List of Figures

- Figure 1: Global Automotive Display Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Automotive Display Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 3: North America Automotive Display Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Automotive Display Industry Revenue (billion), by Display Technology 2025 & 2033

- Figure 5: North America Automotive Display Industry Revenue Share (%), by Display Technology 2025 & 2033

- Figure 6: North America Automotive Display Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Automotive Display Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Automotive Display Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 9: Europe Automotive Display Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Automotive Display Industry Revenue (billion), by Display Technology 2025 & 2033

- Figure 11: Europe Automotive Display Industry Revenue Share (%), by Display Technology 2025 & 2033

- Figure 12: Europe Automotive Display Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Automotive Display Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Automotive Display Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 15: Asia Pacific Automotive Display Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Pacific Automotive Display Industry Revenue (billion), by Display Technology 2025 & 2033

- Figure 17: Asia Pacific Automotive Display Industry Revenue Share (%), by Display Technology 2025 & 2033

- Figure 18: Asia Pacific Automotive Display Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Automotive Display Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Automotive Display Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 21: Rest of the World Automotive Display Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Rest of the World Automotive Display Industry Revenue (billion), by Display Technology 2025 & 2033

- Figure 23: Rest of the World Automotive Display Industry Revenue Share (%), by Display Technology 2025 & 2033

- Figure 24: Rest of the World Automotive Display Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Rest of the World Automotive Display Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Display Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Automotive Display Industry Revenue billion Forecast, by Display Technology 2020 & 2033

- Table 3: Global Automotive Display Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Automotive Display Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: Global Automotive Display Industry Revenue billion Forecast, by Display Technology 2020 & 2033

- Table 6: Global Automotive Display Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Automotive Display Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Automotive Display Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Rest of North America Automotive Display Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Automotive Display Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 11: Global Automotive Display Industry Revenue billion Forecast, by Display Technology 2020 & 2033

- Table 12: Global Automotive Display Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Germany Automotive Display Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Automotive Display Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: France Automotive Display Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Automotive Display Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Global Automotive Display Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 18: Global Automotive Display Industry Revenue billion Forecast, by Display Technology 2020 & 2033

- Table 19: Global Automotive Display Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 20: China Automotive Display Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Japan Automotive Display Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: India Automotive Display Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: South Korea Automotive Display Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Automotive Display Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Global Automotive Display Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 26: Global Automotive Display Industry Revenue billion Forecast, by Display Technology 2020 & 2033

- Table 27: Global Automotive Display Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 28: South America Automotive Display Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Middle East and Africa Automotive Display Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Display Industry?

The projected CAGR is approximately 5%.

2. Which companies are prominent players in the Automotive Display Industry?

Key companies in the market include Magneti Marelli SpA, Denso Corporation, Visteon Corporation, Harman International Industries Inc, LG Display Co, Nippon Seiki Co Lt, Continental AG, Robert Bosch GmbH, Yazaki Corporation, Panasonic Corporation.

3. What are the main segments of the Automotive Display Industry?

The market segments include Product Type, Display Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD 38.23 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand For Electric School Buses.

6. What are the notable trends driving market growth?

Increasing Demand of OLED Displays in the Luxury Vehicle is Expected to Witness Faster Growth Rate.

7. Are there any restraints impacting market growth?

Uncertainty of The Global Pandemic.

8. Can you provide examples of recent developments in the market?

April 2022: TouchNetix announced fully integrated aXiom touchscreen chips that offer new 3D sensing capabilities by detecting air gestures allowing touchless functions in automotive, industrial, and consumer environments, among others. aXiom provides more than 100 times higher Signal-to-Noise Ratio (SNR) than the traditional touchscreen controllers on the market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Display Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Display Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Display Industry?

To stay informed about further developments, trends, and reports in the Automotive Display Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence