Key Insights

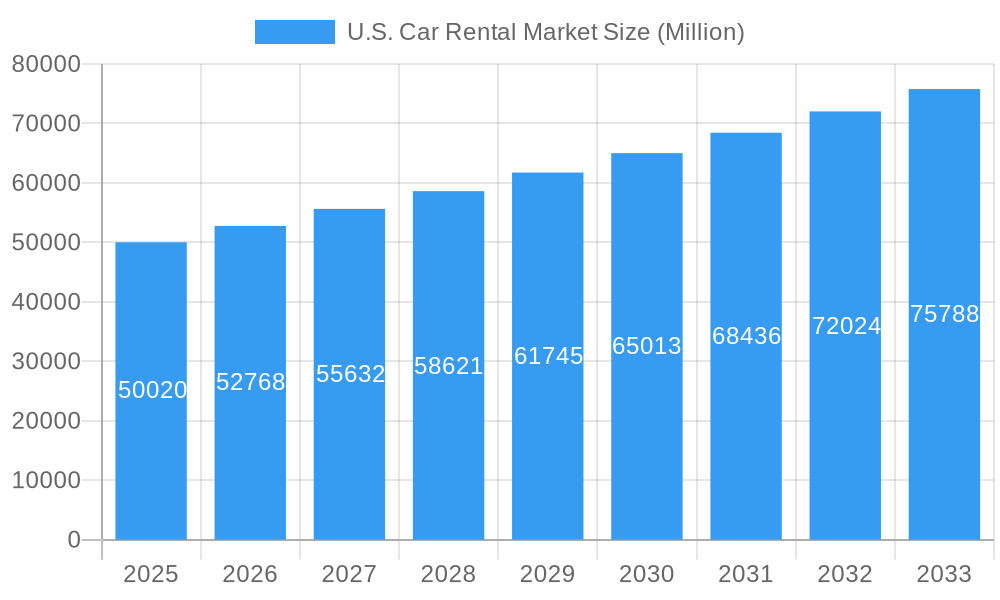

The U.S. car rental market is poised for significant expansion, projected to reach an estimated $50.02 billion in 2025. This growth is fueled by a robust compound annual growth rate (CAGR) of 5.45% through 2033. A primary driver for this surge is the resurgent demand in the leisure and tourism sectors, as travel restrictions ease and consumer confidence in domestic and international travel strengthens. This rebound is particularly evident in the increased booking activity for leisure trips, where individuals and families are opting for rental cars to enhance their travel flexibility and convenience. Furthermore, the business segment continues to contribute steadily, driven by corporate travel needs and the demand for reliable transportation for professionals on assignment. The preference for both luxury and premium vehicles, as well as the enduring demand for economy and budget car options, caters to a diverse customer base with varying financial considerations and travel purposes.

U.S. Car Rental Market Market Size (In Billion)

The market's evolution is also shaped by significant trends such as the increasing adoption of online booking platforms, offering unparalleled convenience and competitive pricing. This digital shift has empowered consumers to compare options and secure rentals with ease, further stimulating demand. While the market is experiencing healthy growth, it also faces certain restraints, including potential economic downturns that could impact discretionary spending on travel and transportation. Moreover, the ongoing supply chain challenges affecting the automotive industry can influence fleet availability and rental prices, requiring strategic management from key players. Companies like Enterprise Holdings Inc., Avis Budget Group Inc., and Sixt SE are actively navigating these dynamics, investing in fleet modernization, digital service enhancements, and diversified offerings to maintain their competitive edge and capitalize on the market's upward trajectory.

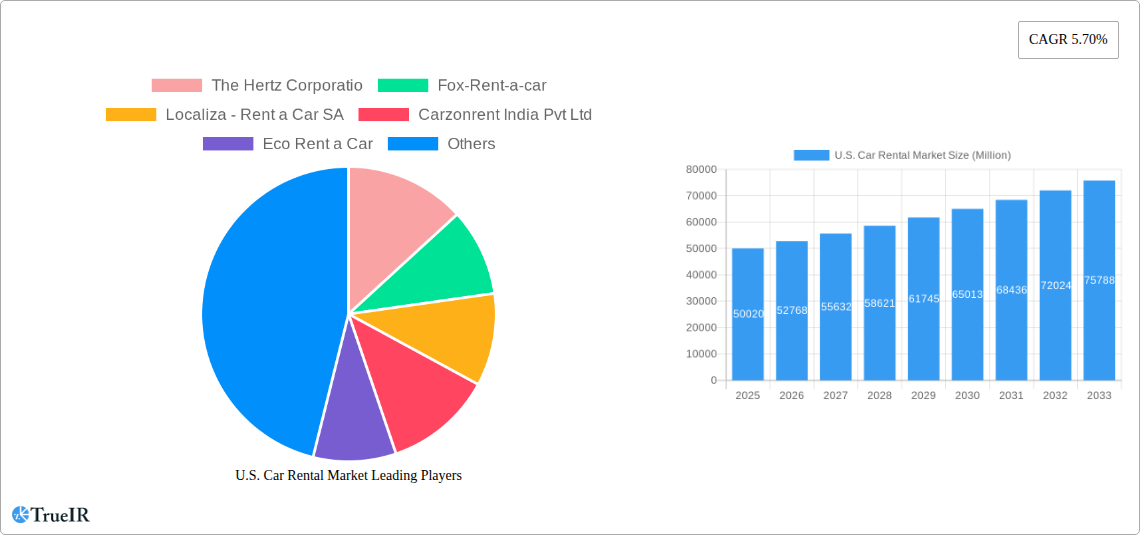

U.S. Car Rental Market Company Market Share

This in-depth report delivers critical insights into the dynamic U.S. Car Rental Market. Covering the historical period of 2019-2024 and projecting growth through 2033, this analysis provides a foundational understanding for industry stakeholders. The base year for estimation is 2025.

U.S. Car Rental Market Market Structure & Competitive Landscape

The U.S. Car Rental Market exhibits a moderately concentrated structure, with a few dominant players controlling a significant market share, estimated at over 70% by the base year of 2025. Innovation drivers are largely focused on enhancing customer experience through digital platforms, fleet modernization with electric and hybrid vehicles, and integrated mobility solutions. Regulatory impacts, while present, are generally supportive of market growth, primarily concerning safety standards and consumer protection. Product substitutes, such as ride-sharing services and public transportation, present a constant competitive pressure, forcing rental companies to continually adapt their value propositions. End-user segmentation reveals a strong reliance on both leisure/tourism and business travelers, each with distinct rental needs and preferences. Mergers & Acquisitions (M&A) trends have historically been driven by consolidation efforts aimed at increasing market share, expanding geographic reach, and achieving operational efficiencies. For instance, in the historical period, there were approximately 5-10 significant M&A deals annually, involving both large-scale acquisitions and strategic smaller company integrations. The market concentration ratio (CR4) is projected to remain high, around 75% by 2033, reflecting continued industry consolidation and the strategic importance of scale.

U.S. Car Rental Market Market Trends & Opportunities

The U.S. Car Rental Market is poised for significant expansion, with an estimated market size projected to reach over $70 billion by 2033. This growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period of 2025-2033. Technological shifts are profoundly reshaping the industry, with the increasing adoption of online booking platforms, mobile applications, and contactless pick-up/drop-off services becoming standard. The penetration of digital booking channels has surged, reaching an estimated 85% by 2025, and is expected to climb further as consumers prioritize convenience and real-time access. Electric Vehicle (EV) integration into rental fleets is another burgeoning trend, driven by environmental consciousness and government incentives. Companies are investing heavily in diversifying their fleets to cater to evolving consumer preferences, which increasingly favor sustainable and technologically advanced vehicles.

Consumer preferences are leaning towards flexible rental options, personalized services, and bundled packages that combine accommodation, activities, and transportation. The resurgence of travel post-pandemic, particularly for leisure and tourism, is a major growth catalyst, with pent-up demand driving rental volumes. Business travel is also recovering, albeit at a more measured pace, creating sustained demand for corporate rentals and fleet management solutions. Competitive dynamics are intensifying, with established players fiercely competing on price, fleet availability, and customer service, while new entrants and mobility service providers introduce innovative offerings. The market penetration rate of car-sharing and subscription models is gradually increasing, pushing traditional rental companies to explore similar flexible solutions. The trend towards connected cars, offering features like GPS navigation, in-car entertainment, and remote diagnostics, is also enhancing the overall rental experience and creating opportunities for value-added services. The market is also witnessing a growing demand for specialized vehicles, including SUVs and minivans, catering to family vacations and group travel.

Dominant Markets & Segments in U.S. Car Rental Market

The Leisure/Tourism segment is expected to remain the dominant application within the U.S. Car Rental Market, contributing an estimated 60% of total rental revenues by 2025. This dominance is fueled by the robust travel and tourism industry, with consistent demand from vacationers, weekend travelers, and tourists exploring domestic and international destinations. Key growth drivers in this segment include expanding airline connectivity, the growth of the experience economy, and the increasing disposable income of consumers. Infrastructure development, such as improved airport facilities and road networks, further facilitates travel and, consequently, car rentals.

Within vehicle types, Economy/Budget Cars are projected to hold the largest market share, driven by their affordability and suitability for a wide range of travel needs. However, Luxury/Premium Cars are witnessing substantial growth, catering to discerning travelers and business executives seeking comfort, prestige, and advanced features. The increasing availability of premium EVs is also contributing to this upward trend.

Online Access for booking is overwhelmingly the preferred channel, accounting for approximately 85% of all bookings by 2025. This dominance is attributed to the convenience, speed, and competitive pricing offered through online platforms and mobile applications. Growth drivers for online booking include widespread internet penetration, the proliferation of smartphones, and the ease of comparing options and making reservations anytime, anywhere. Policies promoting digital transformation and e-commerce have also played a crucial role.

The Business segment, while secondary to leisure, represents a stable and significant revenue stream. Corporate travel, business meetings, and project-related assignments consistently drive demand for rental vehicles. Key growth drivers here include economic recovery, the expansion of corporate sectors, and the need for flexible transportation solutions for employees on business trips. Policies supporting business growth and trade agreements can indirectly influence this segment.

U.S. Car Rental Market Product Analysis

The U.S. Car Rental Market is characterized by a continuous stream of product innovations aimed at enhancing customer experience and operational efficiency. The integration of advanced telematics and IoT devices in rental vehicles provides real-time tracking, diagnostic information, and personalized in-car services. The growing availability of electric and hybrid vehicles in rental fleets addresses the increasing demand for sustainable transportation options, offering a competitive advantage to companies that embrace this shift. Furthermore, the development of user-friendly mobile applications for booking, vehicle selection, and contactless pick-up/drop-off streamlines the rental process, offering significant convenience to end-users. These technological advancements and the strategic alignment of vehicle offerings with evolving consumer and business needs are pivotal for maintaining competitive advantages in this evolving market.

Key Drivers, Barriers & Challenges in U.S. Car Rental Market

Key Drivers:

- Resurgent Travel & Tourism: Post-pandemic recovery in leisure and business travel significantly boosts demand.

- Technological Advancements: Online booking platforms, mobile apps, and connected car features enhance customer experience and operational efficiency.

- Fleet Modernization: Introduction of Electric Vehicles (EVs) and hybrid options caters to sustainability demands and regulatory shifts.

- Economic Growth: Expansion of industries and increasing disposable incomes support both leisure and business rental needs.

Barriers & Challenges:

- Competition from Ride-Sharing & Mobility Services: Services like Uber and Lyft offer alternative transportation solutions, particularly for short-distance travel.

- Supply Chain Disruptions: Vehicle manufacturing delays and component shortages can impact fleet availability and increase acquisition costs. For example, the global chip shortage in the historical period led to significant fleet limitations.

- Regulatory Complexities: Evolving regulations concerning emissions, vehicle safety, and data privacy can add compliance costs and operational challenges.

- Pricing Sensitivity: The market is highly price-sensitive, with constant pressure to offer competitive rates, impacting profit margins.

Growth Drivers in the U.S. Car Rental Market Market

The U.S. Car Rental Market is propelled by several key drivers. Technologically, the increasing adoption of digital platforms and mobile applications is revolutionizing the booking and rental experience, offering unparalleled convenience. Economically, the sustained recovery of both leisure and business travel, coupled with rising disposable incomes, directly translates to higher rental demand. Policy-wise, government initiatives promoting sustainable transportation, such as tax incentives for EVs, are encouraging rental companies to expand their eco-friendly fleets. Furthermore, the expansion of the tourism sector and the growth of the sharing economy create complementary opportunities for car rental services. The introduction of innovative business models, including flexible subscription services, is also contributing to market expansion by appealing to a broader customer base.

Challenges Impacting U.S. Car Rental Market Growth

Several challenges temper the growth trajectory of the U.S. Car Rental Market. Regulatory complexities, including evolving environmental standards and consumer protection laws, necessitate continuous adaptation and can increase compliance costs. Supply chain issues, particularly concerning vehicle manufacturing and component availability, directly impact fleet replenishment and overall service capacity. Competitive pressures from ride-sharing giants and emerging mobility solutions demand constant innovation and strategic differentiation. Furthermore, the inherent price sensitivity of the market can lead to margin erosion, requiring efficient operational management. Fluctuations in fuel prices and geopolitical events can also introduce volatility, impacting travel demand and operational costs.

Key Players Shaping the U.S. Car Rental Market Market

- The Hertz Corporation

- Fox-Rent-a-car

- Localiza - Rent a Car SA

- Carzonrent India Pvt Ltd

- Eco Rent a Car

- Alamo

- Enterprise Holdings Inc

- Advantage Rent-a-car

- USCARS

- Sixt SE

- Ace Rent-a-car

- Avis Budget Group Inc

Significant U.S. Car Rental Market Industry Milestones

- 2019: Increased investment in fleet electrification by major players in anticipation of future demand.

- 2020: Significant dip in rental volumes due to global pandemic restrictions, followed by a gradual recovery driven by domestic tourism.

- 2021: Accelerated adoption of contactless rental solutions and digital check-in/out processes to ensure passenger safety.

- 2022: Resumption of international travel and strong rebound in business travel, boosting overall market activity.

- 2023: Growing consumer demand for larger vehicles like SUVs and minivans for family trips and outdoor adventures.

- 2024: Strategic partnerships between car rental companies and ride-sharing platforms to offer integrated mobility solutions.

Future Outlook for U.S. Car Rental Market Market

The future outlook for the U.S. Car Rental Market is exceptionally promising, driven by sustained growth catalysts. Continued technological integration, particularly in AI-powered personalization and autonomous vehicle readiness, will redefine customer experiences and operational efficiencies. The increasing consumer preference for sustainable mobility will fuel further adoption of electric and hybrid fleets, presenting a significant market opportunity. Strategic expansion into emerging markets and the development of comprehensive mobility-as-a-service (MaaS) offerings will unlock new revenue streams. The market is projected to witness enhanced collaboration between traditional rental companies and tech-driven mobility providers, fostering innovation and offering integrated travel solutions that cater to diverse consumer needs and evolving lifestyle trends.

U.S. Car Rental Market Segmentation

-

1. Application

- 1.1. Leisure/Tourism

- 1.2. Business

-

2. Vehicle

- 2.1. Luxury/Premium Cars

- 2.2. Economy/Budget Cars

-

3. Booking

- 3.1. Online Access

- 3.2. Offline Access

U.S. Car Rental Market Segmentation By Geography

- 1. U.S.

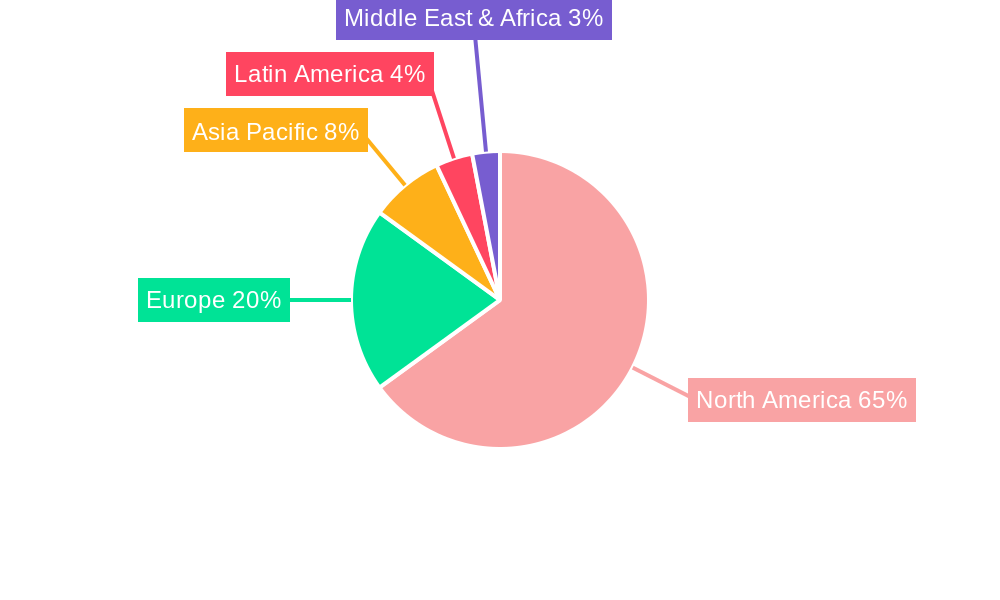

U.S. Car Rental Market Regional Market Share

Geographic Coverage of U.S. Car Rental Market

U.S. Car Rental Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Exponential Increase in Automotive Sector

- 3.3. Market Restrains

- 3.3.1. Digitization of R&D Operations in Automotive Sector

- 3.4. Market Trends

- 3.4.1. Rise in Tourism Industry Driving the Vehicle Rental Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. U.S. Car Rental Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Leisure/Tourism

- 5.1.2. Business

- 5.2. Market Analysis, Insights and Forecast - by Vehicle

- 5.2.1. Luxury/Premium Cars

- 5.2.2. Economy/Budget Cars

- 5.3. Market Analysis, Insights and Forecast - by Booking

- 5.3.1. Online Access

- 5.3.2. Offline Access

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. U.S.

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 The Hertz Corporatio

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Fox-Rent-a-car

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Localiza - Rent a Car SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Carzonrent India Pvt Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Eco Rent a Car

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Alamo

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Enterprise Holdings Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Advantage Rent-a-car

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 USCARS

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sixt SE

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Ace Rent-a-car

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Avis Budget Group Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 The Hertz Corporatio

List of Figures

- Figure 1: U.S. Car Rental Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: U.S. Car Rental Market Share (%) by Company 2025

List of Tables

- Table 1: U.S. Car Rental Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: U.S. Car Rental Market Revenue undefined Forecast, by Vehicle 2020 & 2033

- Table 3: U.S. Car Rental Market Revenue undefined Forecast, by Booking 2020 & 2033

- Table 4: U.S. Car Rental Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: U.S. Car Rental Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: U.S. Car Rental Market Revenue undefined Forecast, by Vehicle 2020 & 2033

- Table 7: U.S. Car Rental Market Revenue undefined Forecast, by Booking 2020 & 2033

- Table 8: U.S. Car Rental Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the U.S. Car Rental Market?

The projected CAGR is approximately 6.2%.

2. Which companies are prominent players in the U.S. Car Rental Market?

Key companies in the market include The Hertz Corporatio, Fox-Rent-a-car, Localiza - Rent a Car SA, Carzonrent India Pvt Ltd, Eco Rent a Car, Alamo, Enterprise Holdings Inc, Advantage Rent-a-car, USCARS, Sixt SE, Ace Rent-a-car, Avis Budget Group Inc.

3. What are the main segments of the U.S. Car Rental Market?

The market segments include Application, Vehicle, Booking.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Exponential Increase in Automotive Sector.

6. What are the notable trends driving market growth?

Rise in Tourism Industry Driving the Vehicle Rental Market.

7. Are there any restraints impacting market growth?

Digitization of R&D Operations in Automotive Sector.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "U.S. Car Rental Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the U.S. Car Rental Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the U.S. Car Rental Market?

To stay informed about further developments, trends, and reports in the U.S. Car Rental Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence