Key Insights

The Indian automotive thermoplastic polymer composites market is projected for robust expansion, driven by escalating demand for lightweight, fuel-efficient vehicles and the increasing integration of advanced materials in automotive manufacturing. With a current market size of $10.69 billion in 2024, the sector is forecasted to grow at a Compound Annual Growth Rate (CAGR) of 4.9% through 2032. This growth is underpinned by supportive government initiatives like 'Make in India', which foster domestic manufacturing, and stringent emission regulations compelling Original Equipment Manufacturers (OEMs) to adopt lightweight composites for improved fuel economy and reduced environmental impact. The rising popularity of passenger cars, SUVs, and compact vehicles further necessitates the use of these high-performance materials. Advancements in manufacturing technologies such as Resin Transfer Molding (RTM) and Vacuum Infusion Processing are enhancing cost-effectiveness and broadening the application of composites in automotive components, spanning structural assemblies to interior and exterior parts.

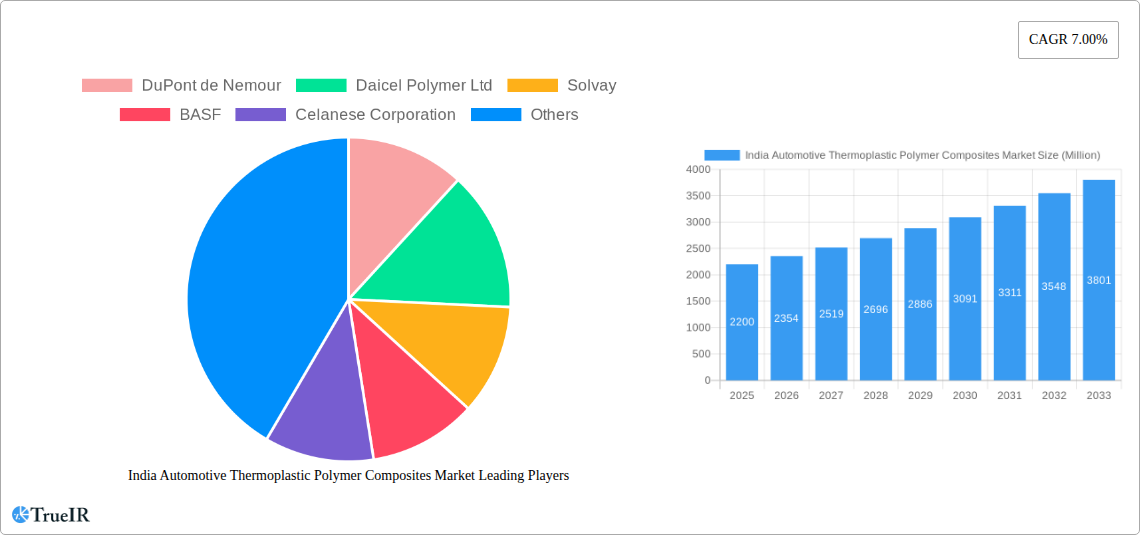

India Automotive Thermoplastic Polymer Composites Market Market Size (In Billion)

Market segmentation reveals diverse applications for thermoplastic polymer composites. Structural assemblies and powertrain components are key segments, prioritizing strength, durability, and weight reduction. Interior applications are also expanding due to the demand for premium finishes and enhanced safety. While significant growth is evident, initial high costs for raw materials and manufacturing equipment may pose a challenge. However, long-term benefits including weight reduction, superior performance, and recyclability are increasingly mitigating these upfront expenses. Leading industry players, including DuPont de Nemours, Solvay, and BASF, are actively investing in research and development to innovate new composite materials and optimize production processes. The Indian automotive industry's pivot towards electrification presents a substantial opportunity, as electric vehicles (EVs) frequently utilize lightweight and high-strength composite materials for battery casings and structural elements.

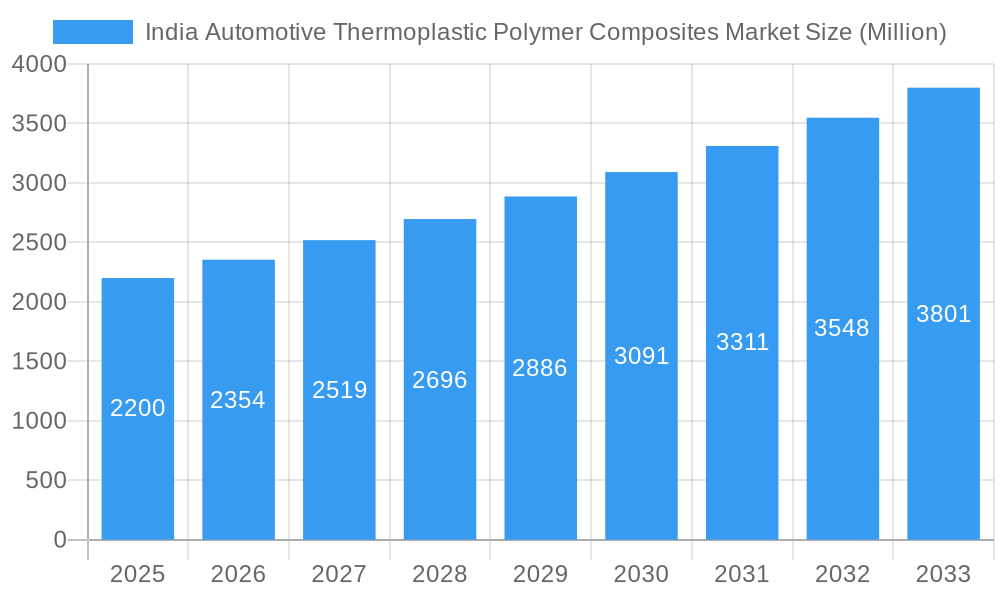

India Automotive Thermoplastic Polymer Composites Market Company Market Share

India Automotive Thermoplastic Polymer Composites Market Report Description

Gain unparalleled insights into the burgeoning India Automotive Thermoplastic Polymer Composites Market with this comprehensive, SEO-optimized report. This in-depth analysis delves into market dynamics, growth trajectories, and competitive strategies, making it an indispensable resource for stakeholders seeking to capitalize on the significant opportunities within India's rapidly expanding automotive sector. Leveraging high-volume keywords such as "India automotive composites," "thermoplastic polymers automotive," "lightweight automotive materials," and "Indian auto industry growth," this report is meticulously crafted to enhance search rankings and engage a sophisticated industry audience.

Study Period: 2019–2033 | Base Year: 2025 | Estimated Year: 2025 | Forecast Period: 2025–2033 | Historical Period: 2019–2024

India Automotive Thermoplastic Polymer Composites Market Market Structure & Competitive Landscape

The India Automotive Thermoplastic Polymer Composites Market is characterized by a moderately consolidated structure, with leading global players like DuPont de Nemours, Solvay, BASF, and Celanese Corporation holding significant market share. Innovation remains a key driver, fueled by the continuous pursuit of lightweight, high-strength materials to meet stringent fuel efficiency and emission norms. Regulatory impacts, particularly government initiatives promoting sustainable mobility and advanced manufacturing, are shaping market entry and product development strategies. The threat of product substitutes, primarily traditional metals like steel and aluminum, is steadily diminishing as the cost-performance benefits of thermoplastic composites become more apparent for applications such as structural assembly and interior components. End-user segmentation reveals a strong reliance on the passenger vehicle segment, followed by commercial vehicles, as OEMs increasingly adopt these advanced materials. Merger and acquisition (M&A) activities, while not as voluminous as in mature markets, are observed as companies seek to expand their regional presence and technological capabilities. For instance, over the historical period 2019-2024, approximately 3-5 strategic acquisitions were noted, primarily focused on technology integration and capacity expansion. The market concentration ratio, estimated at xx for the base year 2025, indicates a competitive yet manageable landscape.

India Automotive Thermoplastic Polymer Composites Market Market Trends & Opportunities

The India Automotive Thermoplastic Polymer Composites Market is poised for substantial expansion, projected to witness a Compound Annual Growth Rate (CAGR) of approximately 12-15% from 2025 to 2033. This robust growth is primarily driven by the escalating demand for lightweight materials to enhance fuel efficiency and reduce carbon emissions, aligning with the Indian government's ambitious environmental targets and the growing consumer preference for eco-friendly vehicles. Technological shifts are central to this trend, with advancements in resin systems and fiber reinforcements enabling the development of composites with superior mechanical properties, improved processability, and cost-effectiveness. The increasing adoption of advanced manufacturing techniques like Injection Molding and Compression Molding for high-volume production of complex automotive parts further fuels market penetration. Consumer preferences are evolving, with a rising awareness and acceptance of the performance benefits offered by advanced materials, leading to their integration in a wider array of vehicle components. Competitive dynamics are intensifying, as both domestic and international players vie for market leadership through product innovation, strategic partnerships, and capacity expansions. Opportunities abound for players who can offer tailored solutions for specific applications, optimize their supply chains to reduce lead times and costs, and develop recyclable or bio-based thermoplastic composites to cater to the growing sustainability imperative. The penetration rate of thermoplastic composites in the Indian automotive sector, currently at an estimated xx% in 2025, is expected to climb significantly as the cost parity with traditional materials is achieved for more applications. Furthermore, the burgeoning electric vehicle (EV) segment presents a significant opportunity, as the need for lightweight components to maximize battery range is paramount.

Dominant Markets & Segments in India Automotive Thermoplastic Polymer Composites Market

The Passenger Vehicle segment is the undisputed dominant market within the India Automotive Thermoplastic Polymer Composites Market, driven by high production volumes and a continuous drive for vehicle optimization. Within this segment, Structural Assembly applications are leading the charge, benefiting from the superior strength-to-weight ratio of thermoplastic composites in areas such as chassis components, body panels, and battery enclosures for EVs. The Injection Molding production type is experiencing remarkable growth, enabling the cost-effective manufacturing of intricate and high-precision parts for mass-produced vehicles. This method's efficiency in producing complex geometries makes it ideal for interior components like dashboards, door panels, and center consoles, as well as exterior elements such as bumpers and spoilers. The Interior application segment also exhibits strong growth, as manufacturers seek to improve cabin aesthetics, reduce noise, vibration, and harshness (NVH), and enhance occupant safety through the use of advanced composite materials.

Key growth drivers for dominance include:

- Government Policies and Incentives: Initiatives like the Faster Adoption and Manufacturing of (Hybrid & Electric) Vehicles in India (FAME) scheme are indirectly bolstering the adoption of lightweight materials for EVs.

- OEM Investments in R&D: Leading automotive manufacturers are actively investing in research and development to integrate thermoplastic composites into their vehicle platforms, thereby driving demand.

- Availability of Local Manufacturing Capabilities: The presence of global and local players establishing manufacturing bases in India facilitates localized production and supply chains.

- Technological Advancements in Composites: Innovations in high-performance thermoplastic resins and reinforcing fibers are making these materials more viable for demanding automotive applications.

The market dominance is further solidified by the increasing adoption of electric vehicles, where weight reduction is critical for extending range. This trend is particularly evident in urban mobility solutions and premium passenger vehicles. The "Others" application category, which includes components like under-hood parts and brackets, is also showing steady progress as the benefits of these materials become more widely recognized.

India Automotive Thermoplastic Polymer Composites Market Product Analysis

The India Automotive Thermoplastic Polymer Composites Market is witnessing a surge in product innovations focused on enhancing performance, reducing weight, and improving sustainability. Key advancements include the development of high-temperature resistant thermoplastic resins suitable for powertrain components, and novel fiber reinforcements that offer superior impact resistance and stiffness for structural applications. The competitive advantage lies in the ability of these composites to be molded into complex shapes with greater design freedom, faster cycle times compared to thermosets, and inherent recyclability, a growing concern for automotive OEMs. Applications are expanding beyond traditional interior trims to encompass critical structural elements, contributing to overall vehicle safety and efficiency.

Key Drivers, Barriers & Challenges in India Automotive Thermoplastic Polymer Composites Market

Key Drivers:

- Stringent Fuel Economy and Emission Standards: Driving the demand for lightweight materials.

- Growth of the Indian Automotive Sector: Increased vehicle production, especially EVs, fuels demand.

- Technological Advancements: Improved material properties and processing techniques enhance usability.

- Government Support for Manufacturing: Initiatives promoting domestic production and adoption of advanced materials.

Barriers & Challenges:

- High Initial Cost of Materials and Tooling: Can be a deterrent for some manufacturers.

- Lack of Skilled Workforce: Expertise in processing and designing with composites is still developing.

- Supply Chain Complexities: Ensuring consistent availability of high-quality raw materials.

- Resistance to Change: Traditional reliance on metals can slow adoption.

- Recycling Infrastructure: Developing robust and efficient recycling processes for automotive composites remains a challenge, estimated to impact xx% of the potential market growth.

Growth Drivers in the India Automotive Thermoplastic Polymer Composites Market Market

The growth of the India Automotive Thermoplastic Polymer Composites Market is propelled by a confluence of technological, economic, and regulatory factors. Foremost is the Indian government's strong push towards electrification and emission reduction, which directly translates to a higher demand for lightweight automotive components. The "Make in India" initiative also encourages domestic manufacturing of advanced materials. Economic growth and a rising disposable income are contributing to increased vehicle sales, further stimulating the need for modern, efficient automobiles. Technological breakthroughs in areas like continuous fiber thermoplastic composites and advanced molding techniques are making these materials more accessible and cost-effective for large-scale automotive production.

Challenges Impacting India Automotive Thermoplastic Polymer Composites Market Growth

Despite the positive outlook, several challenges are impacting the growth of the India Automotive Thermoplastic Polymer Composites Market. The higher upfront cost of thermoplastic composites and the specialized tooling required for their processing can pose a significant barrier for some manufacturers, especially in the cost-sensitive segments of the market. Supply chain disruptions and the availability of a skilled workforce proficient in composite material handling and manufacturing are also critical concerns that can hinder timely production. Furthermore, the lack of standardized recycling infrastructure for automotive composites, while improving, still presents a hurdle in achieving true circularity, potentially limiting the appeal for environmentally conscious consumers and OEMs.

Key Players Shaping the India Automotive Thermoplastic Polymer Composites Market Market

- DuPont de Nemours

- Daicel Polymer Ltd

- Solvay

- BASF

- Celanese Corporation

- Arkema Group

- Gurit

- 3B-Fiberglass

- Cytec Industries Inc

Significant India Automotive Thermoplastic Polymer Composites Market Industry Milestones

- 2023 (Q4): Launch of new high-performance thermoplastic composite grades by Solvay for EV battery enclosures, enhancing safety and weight reduction.

- 2023 (Q2): DuPont de Nemours announces strategic partnerships with Indian Tier-1 suppliers to accelerate the adoption of advanced composites in local automotive manufacturing.

- 2022 (Q4): BASF introduces bio-based thermoplastic composites for automotive interiors, aligning with sustainability trends.

- 2022 (Q1): Arkema Group expands its R&D capabilities in India, focusing on tailored composite solutions for the Indian automotive market.

- 2021 (Q3): Celanese Corporation invests in expanding its production capacity for engineered thermoplastics in India to meet growing automotive demand.

- 2021 (Q1): The Indian government announces enhanced incentives for the manufacturing of electric vehicle components, indirectly benefiting the composites sector.

- 2020 (Q4): Gurit establishes a new technical center in India to support automotive customers with design and application development.

- 2019 (Q2): Cytec Industries Inc. (now part of Solvay) secures significant supply agreements for thermoplastic composites with major Indian automotive OEMs for structural applications.

Future Outlook for India Automotive Thermoplastic Polymer Composites Market Market

The future outlook for the India Automotive Thermoplastic Polymer Composites Market is exceptionally bright, driven by the relentless pursuit of lightweighting, sustainability, and enhanced vehicle performance. The accelerating adoption of electric vehicles will be a paramount growth catalyst, as thermoplastic composites offer an ideal solution for maximizing range and payload. Increased R&D investment by key players, coupled with supportive government policies, will further foster innovation and market penetration. Strategic opportunities lie in developing advanced recycling technologies, expanding local manufacturing capabilities to reduce lead times and costs, and offering customized composite solutions for diverse automotive applications. The market is expected to witness significant growth, transforming the landscape of Indian automotive manufacturing.

India Automotive Thermoplastic Polymer Composites Market Segmentation

-

1. Production Type

- 1.1. Hand Layup

- 1.2. Resin Transfer Molding

- 1.3. Vacuum Infusion Processing

- 1.4. Injection Molding

- 1.5. Compression Molding

-

2. Application Type

- 2.1. Structural Assembly

- 2.2. Power Train Components

- 2.3. Interior

- 2.4. Exterior

- 2.5. Others

India Automotive Thermoplastic Polymer Composites Market Segmentation By Geography

- 1. India

India Automotive Thermoplastic Polymer Composites Market Regional Market Share

Geographic Coverage of India Automotive Thermoplastic Polymer Composites Market

India Automotive Thermoplastic Polymer Composites Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing demand from automobile industry4.; Increased focus on precision products

- 3.3. Market Restrains

- 3.3.1. 4.; The cost of production and transportation4.; Regulations and quality standards

- 3.4. Market Trends

- 3.4.1. Glass Mat Thermoplastic (GMT) is Expected to Grow with a Fast Pace

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Automotive Thermoplastic Polymer Composites Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Type

- 5.1.1. Hand Layup

- 5.1.2. Resin Transfer Molding

- 5.1.3. Vacuum Infusion Processing

- 5.1.4. Injection Molding

- 5.1.5. Compression Molding

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Structural Assembly

- 5.2.2. Power Train Components

- 5.2.3. Interior

- 5.2.4. Exterior

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Production Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DuPont de Nemour

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Daicel Polymer Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Solvay

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BASF

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Celanese Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Arkema Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Gurit

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 3B-Fiberglass

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Cytec Industries Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 DuPont de Nemour

List of Figures

- Figure 1: India Automotive Thermoplastic Polymer Composites Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Automotive Thermoplastic Polymer Composites Market Share (%) by Company 2025

List of Tables

- Table 1: India Automotive Thermoplastic Polymer Composites Market Revenue billion Forecast, by Production Type 2020 & 2033

- Table 2: India Automotive Thermoplastic Polymer Composites Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 3: India Automotive Thermoplastic Polymer Composites Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: India Automotive Thermoplastic Polymer Composites Market Revenue billion Forecast, by Production Type 2020 & 2033

- Table 5: India Automotive Thermoplastic Polymer Composites Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 6: India Automotive Thermoplastic Polymer Composites Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Automotive Thermoplastic Polymer Composites Market?

The projected CAGR is approximately 4.9%.

2. Which companies are prominent players in the India Automotive Thermoplastic Polymer Composites Market?

Key companies in the market include DuPont de Nemour, Daicel Polymer Ltd, Solvay, BASF, Celanese Corporation, Arkema Group, Gurit, 3B-Fiberglass, Cytec Industries Inc.

3. What are the main segments of the India Automotive Thermoplastic Polymer Composites Market?

The market segments include Production Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.69 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing demand from automobile industry4.; Increased focus on precision products.

6. What are the notable trends driving market growth?

Glass Mat Thermoplastic (GMT) is Expected to Grow with a Fast Pace.

7. Are there any restraints impacting market growth?

4.; The cost of production and transportation4.; Regulations and quality standards.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Automotive Thermoplastic Polymer Composites Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Automotive Thermoplastic Polymer Composites Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Automotive Thermoplastic Polymer Composites Market?

To stay informed about further developments, trends, and reports in the India Automotive Thermoplastic Polymer Composites Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence