Key Insights

The Europe Electric Commercial Vehicle Battery Pack Market is projected for substantial growth, expected to reach USD 9.6 billion by 2033, with a Compound Annual Growth Rate (CAGR) of 9.1% from the base year 2024 to 2033. This expansion is driven by stringent environmental regulations, increasing demand for sustainable logistics, and supportive government incentives for commercial EV adoption. Key factors include rising fossil fuel costs and advancements in battery technology, enhancing energy density, charging speed, and durability. Major logistics and transportation companies are electrifying their fleets to meet sustainability targets and consumer preferences for eco-friendly services. Emerging trends like solid-state batteries and advanced battery management systems are anticipated to further boost market efficiency and safety.

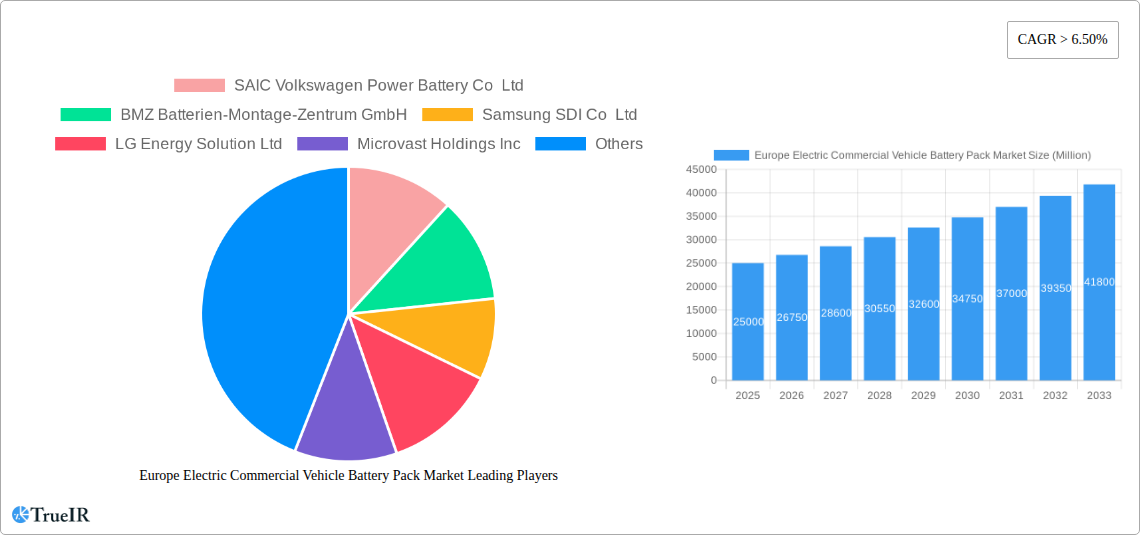

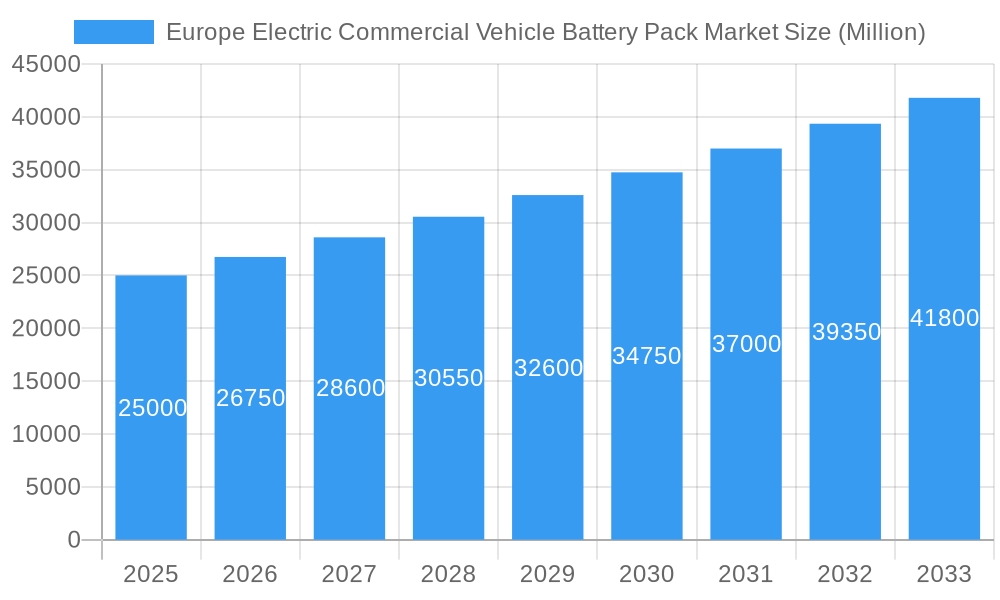

Europe Electric Commercial Vehicle Battery Pack Market Market Size (In Billion)

Market segmentation highlights key battery capacities, with 40 kWh to 80 kWh and Above 80 kWh capacities anticipated to lead demand for Heavy-Duty Trucks (M&HDT) and Buses. Lithium Iron Phosphate (LFP) batteries, due to cost-effectiveness and safety, and Nickel Manganese Cobalt (NCM) for its higher energy density, are expected to see significant adoption. The shift towards Battery Electric Vehicles (BEVs) over Plug-in Hybrid Electric Vehicles (PHEVs) indicates a strong move towards full electrification. Leading players such as Contemporary Amperex Technology Co., Ltd. (CATL), LG Energy Solution Ltd., and BYD Company Ltd. are driving innovation and capacity expansion across key European markets including Germany, France, and the United Kingdom. Initial high costs of electric commercial vehicles and charging infrastructure availability remain moderate influencing factors.

Europe Electric Commercial Vehicle Battery Pack Market Company Market Share

This report offers an in-depth analysis of the Europe Electric Commercial Vehicle (ECV) Battery Pack Market, crucial for the transition to sustainable logistics. Covering the historical period 2019–2024 and a forecast period to 2033, with 2024 as the base year, this study examines market dynamics, trends, segments, and opportunities. Utilizing high-volume keywords such as "electric commercial vehicle battery pack Europe," "ECV battery market share," "BEV battery technology," "commercial truck battery," and "electric bus battery solutions," this analysis targets industry stakeholders, investors, policymakers, and researchers.

The report provides granular segmentation across Body Type (Bus, LCV, M&HDT), Propulsion Type (BEV, PHEV), Battery Chemistry (LFP, NCA, NCM, NMC, Others), Capacity (Less than 15 kWh, 15 kWh to 40 kWh, 40 kWh to 80 kWh, Above 80 kWh), Battery Form (Cylindrical, Pouch, Prismatic), Manufacturing Method (Laser, Wire), Component (Anode, Cathode, Electrolyte, Separator), and Material Type (Cobalt, Lithium, Manganese, Natural Graphite, Nickel, Other Materials). With an estimated market size of 9.6 billion Euros in 2024 and a projected CAGR of 9.1% during the forecast period 2024–2033, the Europe ECV battery pack market is set for significant expansion.

Europe Electric Commercial Vehicle Battery Pack Market Market Structure & Competitive Landscape

The Europe Electric Commercial Vehicle Battery Pack Market is characterized by a [Insert Market Concentration Level, e.g., moderately concentrated] market structure, with several key players vying for dominance. Innovation drivers are primarily fueled by the relentless pursuit of higher energy density, faster charging capabilities, enhanced safety features, and improved cost-efficiency in battery packs. Regulatory impacts, particularly the stringent emissions standards and fleet electrification targets set by the European Union, are profoundly shaping market entry and product development strategies. Product substitutes, while currently limited in performance for heavy-duty applications, are being explored in the form of advanced chemistries and solid-state batteries. End-user segmentation reveals a growing demand from logistics companies, public transportation authorities, and last-mile delivery operators, each with specific battery requirements. Mergers & Acquisitions (M&A) trends indicate strategic consolidations aimed at securing raw material supply chains, expanding manufacturing capacities, and acquiring cutting-edge battery technologies. For instance, [Insert a specific quantitative M&A trend or volume if available, e.g., the past two years saw over 5 significant M&A deals valued at over 500 Million Euros]. This dynamic landscape necessitates a keen understanding of competitive strategies, technological advancements, and partnership formations.

Europe Electric Commercial Vehicle Battery Pack Market Market Trends & Opportunities

The Europe Electric Commercial Vehicle Battery Pack Market is experiencing a transformative growth trajectory, driven by a confluence of factors that are reshaping the transportation and logistics sectors. The overall market size for ECV battery packs is projected to reach [Insert Projected Market Size in Million] Million Euros by 2033, reflecting a substantial increase from its [Insert Estimated Market Size in Million] Million Euros valuation in 2025. This impressive growth is underpinned by a projected Compound Annual Growth Rate (CAGR) of [Insert Projected CAGR]% throughout the forecast period. A significant trend is the accelerated adoption of Battery Electric Vehicles (BEVs) across all commercial vehicle segments, from light commercial vehicles (LCVs) for urban deliveries to heavy-duty trucks and buses for long-haul and public transit operations. This shift is further propelled by increasingly ambitious climate policies and regulations across European nations, encouraging zero-emission fleet renewals.

Technological advancements in battery chemistry, particularly the increasing prevalence of Lithium Iron Phosphate (LFP) batteries due to their enhanced safety, longer lifespan, and reduced reliance on cobalt, are opening new avenues for cost-effective electrification. Simultaneously, ongoing research and development in Nickel Manganese Cobalt (NCM) and Nickel Cobalt Aluminum (NCA) chemistries continue to push the boundaries of energy density and performance, catering to demanding applications. Consumer preferences are evolving, with fleet operators prioritizing lower total cost of ownership (TCO), extended range capabilities, and rapid charging solutions to minimize operational downtime. The competitive dynamics are intensifying, with both established automotive manufacturers and new-age battery technology providers investing heavily in research, development, and production capacity expansion. Opportunities abound for suppliers of critical battery materials, manufacturers of battery components, and integrators of advanced battery management systems. The growing emphasis on circular economy principles and battery recycling is also creating new business models and value chains. Market penetration rates for ECVs are steadily increasing, with projections indicating [Insert Projected Market Penetration Rate]% of new commercial vehicle sales being electric by 2030, further stimulating demand for high-performance battery packs.

Dominant Markets & Segments in Europe Electric Commercial Vehicle Battery Pack Market

The Europe Electric Commercial Vehicle Battery Pack Market is witnessing significant growth and segmentation across various geographical regions and product categories. [Insert Dominant Region/Country, e.g., Germany] currently holds the dominant position, driven by robust government incentives, a strong automotive manufacturing base, and a proactive approach towards EV adoption in commercial fleets. The United Kingdom and France are also emerging as key markets with substantial growth potential.

- Body Type: The Light Commercial Vehicle (LCV) segment is a leading contributor to the current market size, fueled by the increasing demand for last-mile delivery solutions and urban logistics, where smaller battery capacities and frequent charging cycles are more manageable. However, the Bus segment is experiencing rapid expansion, propelled by municipal initiatives to electrify public transportation networks and reduce urban pollution. The Medium and Heavy-Duty Truck (M&HDT) segment, while nascent, presents the largest future growth opportunity as battery technology evolves to meet the range and power demands of long-haul freight.

- Propulsion Type: The Battery Electric Vehicle (BEV) segment overwhelmingly dominates the market, accounting for the vast majority of ECV sales and, consequently, battery pack demand. Plug-in Hybrid Electric Vehicles (PHEVs) are expected to play a transitional role, particularly in segments where range anxiety or charging infrastructure limitations are more pronounced.

- Battery Chemistry: Lithium Iron Phosphate (LFP) chemistry is rapidly gaining traction due to its inherent safety, longevity, and cost-effectiveness, making it a preferred choice for many LCVs and buses. Nickel Manganese Cobalt (NCM) and Nickel Manganese Cobalt Oxide (NMC) chemistries continue to be significant players, offering higher energy density crucial for longer ranges and heavier applications, especially in M&HDTs.

- Capacity: The 40 kWh to 80 kWh capacity range is currently dominant, catering to a wide spectrum of LCVs and buses. However, there is a notable upward trend towards Above 80 kWh capacity packs, driven by the increasing requirements of M&HDTs and the need for extended operational ranges. The 15 kWh to 40 kWh segment remains relevant for smaller LCVs and specialized applications.

- Battery Form: Prismatic and Pouch battery forms are witnessing increasing adoption in ECVs due to their efficient space utilization and scalability, particularly for integrating into vehicle chassis. Cylindrical cells are also utilized, especially in certain pack architectures.

- Method: Laser welding is a prominent manufacturing method for battery pack assembly, recognized for its precision and efficiency. Wire bonding also plays a role in certain connections.

- Component: The Cathode and Anode are critical components driving battery performance and cost. Innovations in these areas, particularly the development of silicon-based anodes and advanced cathode materials, are key focus areas for market players.

- Material Type: Lithium and Nickel are foundational materials, with ongoing efforts to optimize their usage and explore alternatives to reduce costs and environmental impact. Natural Graphite remains a dominant anode material, while research into Cobalt reduction or elimination is a significant trend. Manganese plays a crucial role in certain cathode formulations.

Key growth drivers across these segments include supportive government policies and subsidies for EV adoption, the expanding charging infrastructure network across Europe, and the growing corporate sustainability mandates from fleet operators seeking to reduce their carbon footprint. The declining battery costs, coupled with advancements in battery management systems (BMS), are also making electric commercial vehicles a more economically viable option.

Europe Electric Commercial Vehicle Battery Pack Market Product Analysis

Product innovation in the Europe Electric Commercial Vehicle Battery Pack Market is heavily focused on enhancing energy density, improving charging speeds, and ensuring robust safety standards. Manufacturers are actively developing battery packs with higher kWh capacities to meet the demands of longer-range transportation and heavier payloads for trucks and buses. Advancements in thermal management systems are crucial for optimizing battery performance and longevity, especially under demanding operational conditions. Competitive advantages are being derived from proprietary battery chemistries, modular pack designs for greater flexibility and serviceability, and integrated Battery Management Systems (BMS) that provide intelligent control over charging, discharging, and overall cell health. The integration of advanced materials and manufacturing techniques like laser welding contributes to lighter, more durable, and more efficient battery packs. The market is seeing a trend towards optimized battery solutions tailored for specific commercial vehicle applications, ensuring market fit and addressing the unique operational needs of different fleet types.

Key Drivers, Barriers & Challenges in Europe Electric Commercial Vehicle Battery Pack Market

Key Drivers:

- Supportive Regulatory Frameworks: Ambitious EU emissions targets and national government incentives for EV adoption are compelling fleet operators to transition to electric.

- Declining Battery Costs: Continuous advancements in battery technology and economies of scale are making electric commercial vehicles more cost-competitive.

- Growing Environmental Consciousness: Increasing pressure from consumers and stakeholders for sustainable logistics operations.

- Technological Advancements: Improvements in battery energy density, charging speed, and battery lifespan.

- Expanding Charging Infrastructure: Government and private sector investment in public and private charging networks.

Barriers & Challenges:

- High Upfront Cost: Despite declining prices, the initial investment for electric commercial vehicles remains a significant barrier for some operators.

- Charging Infrastructure Gaps: Uneven distribution and insufficient capacity of charging stations, particularly for heavy-duty vehicles in remote areas.

- Range Anxiety and Payload Concerns: While improving, the range and payload capacity of current battery technology can still be a concern for certain long-haul or high-capacity applications.

- Supply Chain Volatility: Dependence on critical raw materials and potential geopolitical disruptions can impact production and pricing.

- Battery Second Life and Recycling: Developing efficient and scalable solutions for battery reuse and recycling is crucial for long-term sustainability.

- Grid Capacity and Stability: The increased demand for electricity from charging large fleets can strain local power grids.

Growth Drivers in the Europe Electric Commercial Vehicle Battery Pack Market Market

The Europe Electric Commercial Vehicle Battery Pack Market is propelled by a powerful synergy of technological innovation, economic incentives, and stringent environmental policies. Government mandates, such as the EU's fleet emissions targets and various national subsidies for electric vehicle purchases and infrastructure development, are creating a compelling business case for fleet operators. The continuous reduction in battery production costs, driven by manufacturing scale and material science advancements, is making electric commercial vehicles increasingly competitive on a total cost of ownership basis. Furthermore, a growing societal and corporate demand for sustainable supply chains and reduced carbon footprints is pushing logistics companies to electrify their fleets. Technological advancements in battery energy density, faster charging capabilities, and improved battery longevity are addressing previous limitations, making electric options more practical for a wider range of commercial applications. The ongoing expansion of charging infrastructure, both public and private, is also a critical enabler, alleviating range anxiety and facilitating seamless operations for electric fleets.

Challenges Impacting Europe Electric Commercial Vehicle Battery Pack Market Growth

Despite the robust growth drivers, several challenges are impacting the widespread adoption and sustained growth of the Europe Electric Commercial Vehicle Battery Pack Market. The significant upfront purchase price of electric commercial vehicles, even with subsidies, can still be a substantial barrier for small and medium-sized enterprises. The development and widespread availability of adequate charging infrastructure, especially high-power charging stations for heavy-duty trucks and in underserved rural areas, remains a critical bottleneck. Concerns regarding vehicle range and payload capacity, particularly for long-haul operations and applications requiring continuous power, persist, although advancements are rapidly mitigating these issues. The supply chain for key battery raw materials, such as lithium, cobalt, and nickel, is susceptible to geopolitical risks, price volatility, and ethical sourcing concerns, which can affect production costs and availability. Furthermore, establishing efficient and economically viable systems for battery second life applications and end-of-life recycling is crucial for ensuring the long-term environmental sustainability of the electric vehicle ecosystem.

Key Players Shaping the Europe Electric Commercial Vehicle Battery Pack Market Market

- SAIC Volkswagen Power Battery Co Ltd

- BMZ Batterien-Montage-Zentrum GmbH

- Samsung SDI Co Ltd

- LG Energy Solution Ltd

- Microvast Holdings Inc

- TOSHIBA Corp

- Contemporary Amperex Technology Co Ltd (CATL)

- Akasol AG

- BYD Company Ltd

- SK Innovation Co Ltd

- Panasonic Holdings Corporation

- NorthVolt AB

- SVOLT Energy Technology Co Ltd (SVOLT)

Significant Europe Electric Commercial Vehicle Battery Pack Market Industry Milestones

- February 2023: LG Energy Solution announced plans to invest 10 trillion won in 2023, a 50 percent increase from the previous year's 6.3 trillion won, to expand its global production capacity by 50 percent to 300 gigawatt hours (GWh). This significant investment signals a strong commitment to meeting the growing demand for electric vehicle batteries in Europe and beyond.

- February 2023: LG Energy Solution unveiled the world's first battery passport, a pivotal step towards unlocking a more sustainable battery value chain. This initiative aims to enhance transparency and traceability throughout the battery lifecycle, from raw material sourcing to recycling, addressing critical environmental and ethical concerns.

- February 2023: LG Energy Solution entered into a multi-year contract with Freudenberg e-Power Systems for the supply of lithium-ion battery cell modules totaling 19 GWh. This partnership underscores the increasing demand for advanced battery solutions for electric mobility and the strategic collaborations being formed to secure supply.

Future Outlook for Europe Electric Commercial Vehicle Battery Pack Market Market

The future outlook for the Europe Electric Commercial Vehicle Battery Pack Market is exceptionally promising, driven by a confluence of favorable factors and strategic initiatives. The ongoing push towards decarbonization in the transportation sector, amplified by stringent regulatory frameworks and ambitious climate targets, will continue to fuel the demand for electric commercial vehicles and their battery packs. Significant investments in battery technology research and development are expected to yield further improvements in energy density, charging speeds, and cost-effectiveness, making electric options increasingly viable for all commercial vehicle segments, including heavy-duty long-haul trucking. The expansion and enhancement of charging infrastructure across the continent will play a crucial role in overcoming range anxiety and facilitating widespread adoption. Furthermore, the growing emphasis on sustainability and the circular economy will spur innovation in battery recycling and second-life applications, creating new value streams and mitigating environmental concerns. Strategic partnerships between battery manufacturers, vehicle OEMs, and energy providers will be instrumental in developing integrated solutions that optimize fleet operations and grid integration. The market is poised for sustained, robust growth as Europe accelerates its transition to a greener and more sustainable commercial transportation ecosystem.

Europe Electric Commercial Vehicle Battery Pack Market Segmentation

-

1. Body Type

- 1.1. Bus

- 1.2. LCV

- 1.3. M&HDT

-

2. Propulsion Type

- 2.1. BEV

- 2.2. PHEV

-

3. Battery Chemistry

- 3.1. LFP

- 3.2. NCA

- 3.3. NCM

- 3.4. NMC

- 3.5. Others

-

4. Capacity

- 4.1. 15 kWh to 40 kWh

- 4.2. 40 kWh to 80 kWh

- 4.3. Above 80 kWh

- 4.4. Less than 15 kWh

-

5. Battery Form

- 5.1. Cylindrical

- 5.2. Pouch

- 5.3. Prismatic

-

6. Method

- 6.1. Laser

- 6.2. Wire

-

7. Component

- 7.1. Anode

- 7.2. Cathode

- 7.3. Electrolyte

- 7.4. Separator

-

8. Material Type

- 8.1. Cobalt

- 8.2. Lithium

- 8.3. Manganese

- 8.4. Natural Graphite

- 8.5. Nickel

- 8.6. Other Materials

Europe Electric Commercial Vehicle Battery Pack Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Electric Commercial Vehicle Battery Pack Market Regional Market Share

Geographic Coverage of Europe Electric Commercial Vehicle Battery Pack Market

Europe Electric Commercial Vehicle Battery Pack Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand and Sales of Commercial Vehicles is Driving the Market for Hydraulic Systems

- 3.3. Market Restrains

- 3.3.1. Increasing Replacement of Conventional Hydraulic Systems with Fully-electric Hydraulic Systems Acts as a Restraint

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Electric Commercial Vehicle Battery Pack Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Body Type

- 5.1.1. Bus

- 5.1.2. LCV

- 5.1.3. M&HDT

- 5.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.2.1. BEV

- 5.2.2. PHEV

- 5.3. Market Analysis, Insights and Forecast - by Battery Chemistry

- 5.3.1. LFP

- 5.3.2. NCA

- 5.3.3. NCM

- 5.3.4. NMC

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Capacity

- 5.4.1. 15 kWh to 40 kWh

- 5.4.2. 40 kWh to 80 kWh

- 5.4.3. Above 80 kWh

- 5.4.4. Less than 15 kWh

- 5.5. Market Analysis, Insights and Forecast - by Battery Form

- 5.5.1. Cylindrical

- 5.5.2. Pouch

- 5.5.3. Prismatic

- 5.6. Market Analysis, Insights and Forecast - by Method

- 5.6.1. Laser

- 5.6.2. Wire

- 5.7. Market Analysis, Insights and Forecast - by Component

- 5.7.1. Anode

- 5.7.2. Cathode

- 5.7.3. Electrolyte

- 5.7.4. Separator

- 5.8. Market Analysis, Insights and Forecast - by Material Type

- 5.8.1. Cobalt

- 5.8.2. Lithium

- 5.8.3. Manganese

- 5.8.4. Natural Graphite

- 5.8.5. Nickel

- 5.8.6. Other Materials

- 5.9. Market Analysis, Insights and Forecast - by Region

- 5.9.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Body Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SAIC Volkswagen Power Battery Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 BMZ Batterien-Montage-Zentrum GmbH

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Samsung SDI Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 LG Energy Solution Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Microvast Holdings Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 TOSHIBA Corp

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Contemporary Amperex Technology Co Ltd (CATL)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Akasol AG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 BYD Company Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 SK Innovation Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Panasonic Holdings Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 NorthVolt AB

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 SVOLT Energy Technology Co Ltd (SVOLT)

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 SAIC Volkswagen Power Battery Co Ltd

List of Figures

- Figure 1: Europe Electric Commercial Vehicle Battery Pack Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Electric Commercial Vehicle Battery Pack Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Electric Commercial Vehicle Battery Pack Market Revenue billion Forecast, by Body Type 2020 & 2033

- Table 2: Europe Electric Commercial Vehicle Battery Pack Market Revenue billion Forecast, by Propulsion Type 2020 & 2033

- Table 3: Europe Electric Commercial Vehicle Battery Pack Market Revenue billion Forecast, by Battery Chemistry 2020 & 2033

- Table 4: Europe Electric Commercial Vehicle Battery Pack Market Revenue billion Forecast, by Capacity 2020 & 2033

- Table 5: Europe Electric Commercial Vehicle Battery Pack Market Revenue billion Forecast, by Battery Form 2020 & 2033

- Table 6: Europe Electric Commercial Vehicle Battery Pack Market Revenue billion Forecast, by Method 2020 & 2033

- Table 7: Europe Electric Commercial Vehicle Battery Pack Market Revenue billion Forecast, by Component 2020 & 2033

- Table 8: Europe Electric Commercial Vehicle Battery Pack Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 9: Europe Electric Commercial Vehicle Battery Pack Market Revenue billion Forecast, by Region 2020 & 2033

- Table 10: Europe Electric Commercial Vehicle Battery Pack Market Revenue billion Forecast, by Body Type 2020 & 2033

- Table 11: Europe Electric Commercial Vehicle Battery Pack Market Revenue billion Forecast, by Propulsion Type 2020 & 2033

- Table 12: Europe Electric Commercial Vehicle Battery Pack Market Revenue billion Forecast, by Battery Chemistry 2020 & 2033

- Table 13: Europe Electric Commercial Vehicle Battery Pack Market Revenue billion Forecast, by Capacity 2020 & 2033

- Table 14: Europe Electric Commercial Vehicle Battery Pack Market Revenue billion Forecast, by Battery Form 2020 & 2033

- Table 15: Europe Electric Commercial Vehicle Battery Pack Market Revenue billion Forecast, by Method 2020 & 2033

- Table 16: Europe Electric Commercial Vehicle Battery Pack Market Revenue billion Forecast, by Component 2020 & 2033

- Table 17: Europe Electric Commercial Vehicle Battery Pack Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 18: Europe Electric Commercial Vehicle Battery Pack Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Europe Electric Commercial Vehicle Battery Pack Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Europe Electric Commercial Vehicle Battery Pack Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Europe Electric Commercial Vehicle Battery Pack Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Europe Electric Commercial Vehicle Battery Pack Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Europe Electric Commercial Vehicle Battery Pack Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Netherlands Europe Electric Commercial Vehicle Battery Pack Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Belgium Europe Electric Commercial Vehicle Battery Pack Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Sweden Europe Electric Commercial Vehicle Battery Pack Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Norway Europe Electric Commercial Vehicle Battery Pack Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Poland Europe Electric Commercial Vehicle Battery Pack Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Denmark Europe Electric Commercial Vehicle Battery Pack Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Electric Commercial Vehicle Battery Pack Market?

The projected CAGR is approximately 9.1%.

2. Which companies are prominent players in the Europe Electric Commercial Vehicle Battery Pack Market?

Key companies in the market include SAIC Volkswagen Power Battery Co Ltd, BMZ Batterien-Montage-Zentrum GmbH, Samsung SDI Co Ltd, LG Energy Solution Ltd, Microvast Holdings Inc, TOSHIBA Corp, Contemporary Amperex Technology Co Ltd (CATL), Akasol AG, BYD Company Ltd, SK Innovation Co Ltd, Panasonic Holdings Corporation, NorthVolt AB, SVOLT Energy Technology Co Ltd (SVOLT).

3. What are the main segments of the Europe Electric Commercial Vehicle Battery Pack Market?

The market segments include Body Type, Propulsion Type, Battery Chemistry, Capacity, Battery Form, Method, Component, Material Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.6 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand and Sales of Commercial Vehicles is Driving the Market for Hydraulic Systems.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Increasing Replacement of Conventional Hydraulic Systems with Fully-electric Hydraulic Systems Acts as a Restraint.

8. Can you provide examples of recent developments in the market?

February 2023: LG Energy Solution will invest 10 trillion won this year, up 50 percent from 6.3 trillion won a year ago, and expand its global production capacity by 50 percent to 300 gigawatt hours (GWh).February 2023: LG Energy Solution is unlocking more sustainable battery value chain with the world's first battery passport.February 2023: LG Energy Solution and Freudenberg e-Power Systems have signed a multi-year contract for the supply of lithium-ion battery cell modules with a total capacity of 19 GWh.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Electric Commercial Vehicle Battery Pack Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Electric Commercial Vehicle Battery Pack Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Electric Commercial Vehicle Battery Pack Market?

To stay informed about further developments, trends, and reports in the Europe Electric Commercial Vehicle Battery Pack Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence