Key Insights

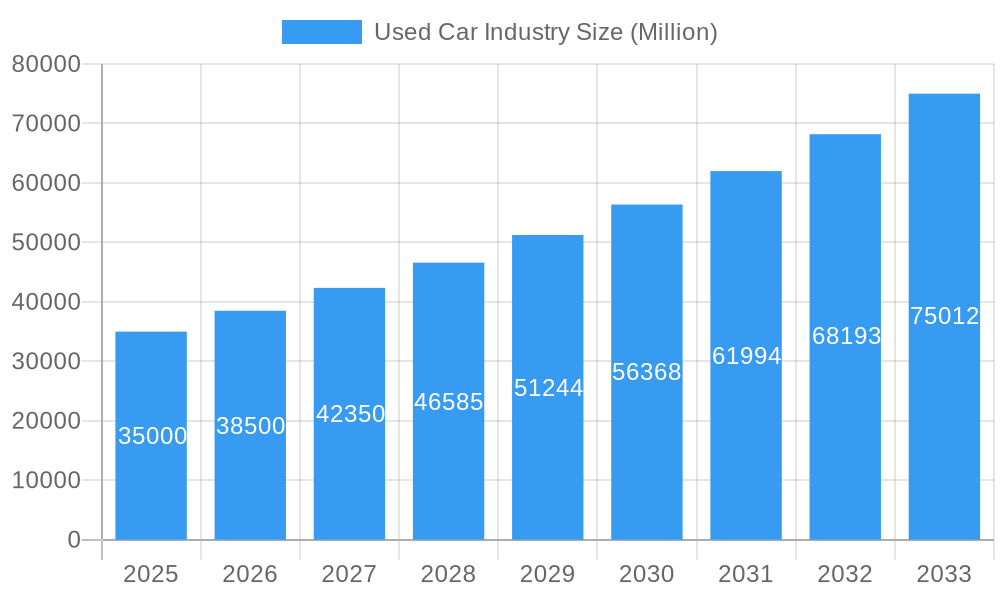

The global used car market is projected to reach $1442.95 billion by 2025, expanding at a compound annual growth rate (CAGR) of 4.3% from 2025 to 2033. This growth is driven by increasing affordability of pre-owned vehicles, the rise of online sales platforms enhancing convenience and transparency, and economic factors including rising disposable incomes in emerging markets. Extended vehicle lifespans also contribute to a robust supply of quality used cars.

Used Car Industry Market Size (In Million)

Market challenges include consumer concerns regarding vehicle condition authenticity and mileage discrepancies. Regulatory complexities and variations in inspection standards can also pose hurdles. While the organized sector offers enhanced trust, higher operational costs may impact pricing. However, digital transformation and certified pre-owned programs are actively addressing these issues, fostering market growth.

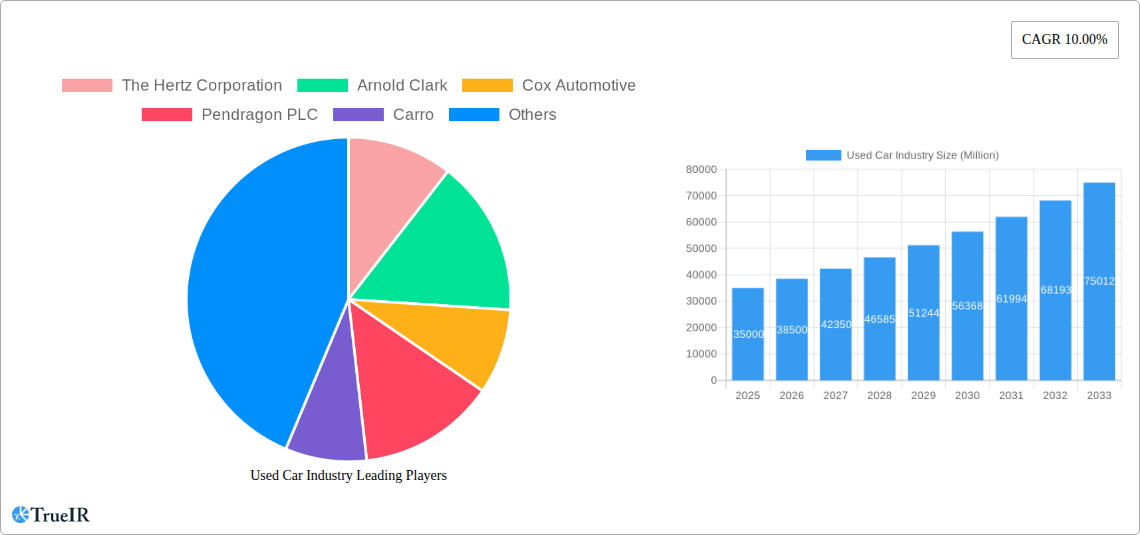

Used Car Industry Company Market Share

Unlocking the Used Car Industry: A Comprehensive Market Analysis (2019-2033)

This in-depth report provides a dynamic, SEO-optimized analysis of the global used car industry, leveraging high-volume keywords to enhance search rankings and deliver critical insights for industry stakeholders. Covering a study period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period spanning 2025-2033, this report delves into market structure, trends, dominant segments, product analysis, key drivers, challenges, and future outlook. It examines the competitive landscape featuring major players and significant industry milestones, offering a holistic view for strategic decision-making.

Used Car Industry Market Structure & Competitive Landscape

The used car industry is characterized by a dynamic market structure, influenced by a complex interplay of innovation drivers, evolving regulatory impacts, and the constant threat of product substitutes. Market concentration varies significantly across regions, with organized vendors often exhibiting higher concentration ratios due to economies of scale and brand recognition. Innovation is a key differentiator, driven by the demand for transparent pricing, enhanced vehicle inspection processes, and seamless online purchasing experiences. Regulatory frameworks, though often fragmented, play a crucial role in shaping consumer trust and fair trade practices. The presence of unorganized vendors, particularly in emerging markets, adds a layer of competitive intensity. End-user segmentation by vehicle type – Hatchbacks, Sedans, Sports Utility Vehicles (SUVs), and Multi-Purpose Vehicles (MPVs) – reveals distinct purchasing patterns and preferences. Mergers and acquisitions (M&A) trends are actively reshaping the landscape, with significant M&A volumes observed as larger players consolidate their market positions and acquire technological capabilities. For instance, an estimated volume of over 50 M&A deals have been recorded in the last five years.

- Market Concentration: Moderate to high, with consolidation expected.

- Innovation Drivers: Digitalization, transparency, vehicle diagnostics, financing solutions.

- Regulatory Impacts: Consumer protection laws, emissions standards, licensing requirements.

- Product Substitutes: New vehicle sales, car-sharing services, public transportation.

- End-User Segmentation: Differentiated demand across vehicle types and buyer demographics.

- M&A Trends: Strategic acquisitions for market expansion and technological integration.

Used Car Industry Market Trends & Opportunities

The global used car market is projected to experience robust growth, with an estimated market size reaching over 2.5 Trillion by 2025 and expanding to over 3.5 Trillion by 2033. This significant expansion is fueled by a confluence of evolving consumer preferences, technological advancements, and a dynamic competitive environment. The increasing affordability of used vehicles compared to their new counterparts remains a primary driver, especially in economically sensitive periods. Technological shifts are revolutionizing the industry, with the proliferation of online marketplaces and digital inspection tools enhancing convenience and transparency for buyers. These platforms are not only simplifying the buying and selling process but also extending reach to a wider consumer base. Consumer preferences are increasingly shifting towards value-driven purchases, with a growing appreciation for certified pre-owned (CPO) vehicles that offer a balance of affordability and reliability. The competitive landscape is intensifying, with both organized and unorganized players vying for market share. Organized vendors are investing heavily in digital infrastructure and customer experience, while unorganized players often compete on price and localized reach. The market penetration rate for online used car sales is projected to reach over 60% by 2033, indicating a significant digital transformation. The compound annual growth rate (CAGR) is estimated at a healthy 7.8% during the forecast period. Opportunities abound for businesses that can effectively leverage data analytics to understand consumer behavior, personalize offerings, and streamline the entire ownership lifecycle, from purchase to potential resale. The rise of subscription models and innovative financing options further presents avenues for market growth and customer engagement.

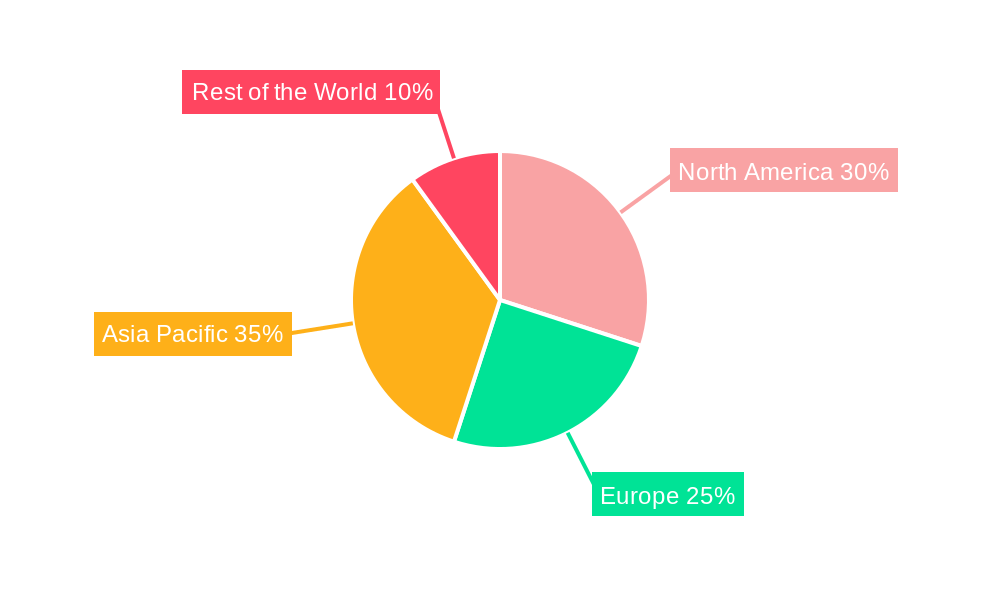

Dominant Markets & Segments in Used Car Industry

North America and Europe currently represent the dominant regional markets for used cars, driven by established automotive infrastructure, higher disposable incomes, and a mature consumer base. Within these regions, the Sports Utility Vehicle (SUV) segment demonstrates exceptional growth, propelled by changing lifestyle preferences and the versatility offered by these vehicles. The Organized vendor segment is increasingly dominating the market, a trend fueled by consumer demand for trust, warranty assurances, and a more streamlined purchasing experience. This dominance is further reinforced by significant investments in digital platforms and customer service by major organized players. In emerging markets, while the Unorganized vendor segment still holds considerable sway, the organized sector is steadily gaining traction due to increasing urbanization and a growing middle class. The Sedan segment, while consistently popular, is facing increased competition from SUVs and Hatchbacks in certain demographics. The Hatchback segment continues to be a strong performer, particularly among younger buyers and in urban environments where maneuverability and fuel efficiency are prioritized. The Multi-Purpose Vehicle (MPV) segment caters to a niche but consistent demand for family-oriented transport. Key growth drivers in dominant markets include supportive government policies, a well-developed road network, and a robust aftermarket service ecosystem. The penetration of digital channels is also a critical factor, enabling wider reach and improved accessibility for both buyers and sellers. The market is projected to see a shift towards a more balanced distribution of market share between organized and unorganized vendors in the next decade.

- Dominant Regions: North America, Europe.

- Emerging Markets: Asia-Pacific, Latin America showing significant growth potential.

- Dominant Vehicle Type: Sports Utility Vehicles (SUVs) experiencing highest growth.

- Dominant Vendor Type: Organized vendors leading due to trust and structured services.

- Key Growth Drivers (Organized Vendors): Digital transformation, brand reputation, financing options, certified pre-owned programs.

- Key Growth Drivers (Emerging Markets): Increasing disposable income, urbanization, growing automotive culture.

- Segment Performance: Sedans and Hatchbacks remain stable, while SUVs show rapid expansion.

Used Car Industry Product Analysis

Product innovation in the used car industry centers around enhancing transparency, reliability, and the overall customer experience. Advanced vehicle inspection technologies, including AI-powered diagnostics and detailed digital condition reports, are becoming standard, offering buyers greater confidence. Certified Pre-Owned (CPO) programs, backed by manufacturer warranties, provide a significant competitive advantage by mitigating perceived risks associated with used vehicle purchases. The integration of digital platforms for online browsing, financing applications, and even virtual test drives streamlines the buying process. Competitive advantages are increasingly derived from superior online user interfaces, comprehensive vehicle histories, and flexible after-sales support services. The focus is on making the used car buying journey as convenient and secure as purchasing a new vehicle.

Key Drivers, Barriers & Challenges in Used Car Industry

The used car industry is propelled by several key drivers, including the persistent demand for affordable mobility, especially in the wake of economic fluctuations, and the growing acceptance of digital platforms for transactions. Technological advancements in vehicle diagnostics and online sales infrastructure are reducing perceived risks and increasing convenience. Government incentives for vehicle scrappage programs can also indirectly boost the used car market. However, significant barriers and challenges exist. Supply chain disruptions, as seen in recent years, can impact the availability of both new and used inventory, leading to price volatility. Regulatory complexities and varying standards across different jurisdictions can create hurdles for cross-border trade and consistent operational practices. Intense competition from both established dealerships and agile online retailers necessitates continuous innovation and efficient cost management.

Growth Drivers in the Used Car Industry Market

The used car industry is experiencing significant growth driven by several interconnected factors. Economically, the affordability of pre-owned vehicles continues to be a primary attraction for a broad spectrum of consumers. Technological advancements are revolutionizing the sector; digital marketplaces and advanced vehicle inspection tools enhance transparency and buyer confidence, making online purchases increasingly viable. Furthermore, the expansion of certified pre-owned programs by manufacturers and dealerships offers greater assurance of quality and reliability. Policy-driven factors, such as the increasing focus on sustainability and the circular economy, indirectly support the used car market as an environmentally conscious choice. The growing adoption of flexible financing and leasing options also makes used cars more accessible.

Challenges Impacting Used Car Industry Growth

Despite robust growth, the used car industry faces considerable challenges. Supply chain volatility, particularly the global shortage of microchips, has significantly impacted new car production, subsequently increasing demand and prices for used vehicles, but also creating inventory management complexities for dealers. Regulatory hurdles, including differing consumer protection laws and evolving emissions standards, can complicate operations and cross-border sales. Intense competition from both traditional dealerships and disruptive online platforms necessitates constant adaptation and investment in digital capabilities. Furthermore, building and maintaining consumer trust, especially in the unorganized sector, remains an ongoing challenge. The industry also grapples with the potential for fraud and the need for robust verification processes.

Key Players Shaping the Used Car Industry Market

- The Hertz Corporation

- Arnold Clark

- Cox Automotive

- Pendragon PLC

- Carro

- AutoNation

- Asbury Automotive Group

- Mahindra First Choice Wheels

- Penske Cars

- CarMax Inc

- Maruti Suzuki True Value

- Emil Frey AG

Significant Used Car Industry Industry Milestones

- March 2022: TrueCar Inc. launched TrueCar+, a new online car-buying marketplace designed to offer consumers a more flexible and personalized experience for purchasing both new and used vehicles.

- January 2022: General Motors introduced CarBravo, a new online retail platform aimed at capitalizing on the inflated used car market by drawing from GM's extensive pool of available used vehicles and those from its franchised dealerships.

- September 2021: Mobil88 launched the Mo88i application, a digital platform designed to simplify the process of buying and selling used cars by offering trusted, easy, fast, and efficient services, including car inspections, estimated bid prices, and seamless financing and insurance submissions.

- March 2021: Penske Automotive Group Inc. announced the adoption of CarShop as its global brand for its used vehicle SuperCenters, rebranding its six US-based CarSense SuperCenters to CarShop.

Future Outlook for Used Car Industry Market

The future outlook for the used car industry is exceptionally promising, with sustained growth anticipated. Strategic opportunities lie in further embracing digital transformation, enhancing customer personalization through data analytics, and developing innovative financing and after-sales services. The growing emphasis on sustainability will continue to favor the used car market as a more environmentally conscious choice. Market potential is immense, particularly in emerging economies where the demand for affordable personal transportation is rapidly increasing. The industry is poised for continued innovation in vehicle valuation, online sales platforms, and the integration of electric and hybrid used vehicles into the market, further broadening appeal and accessibility.

Used Car Industry Segmentation

-

1. Vehicle Type

- 1.1. Hatchbacks

- 1.2. Sedan

- 1.3. Sports Utility Vehicles and Multi-Purpose Vehicles

-

2. Vendor

- 2.1. Organized

- 2.2. Unorganized

Used Car Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Spain

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Brazil

- 4.2. United Arab Emirates

- 4.3. South Africa

- 4.4. Other Countries

Used Car Industry Regional Market Share

Geographic Coverage of Used Car Industry

Used Car Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand For Electric School Buses

- 3.3. Market Restrains

- 3.3.1. Uncertainty of The Global Pandemic

- 3.4. Market Trends

- 3.4.1. Strengthening of Online Infrastructure Positively Affecting the Used Cars Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Used Car Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Hatchbacks

- 5.1.2. Sedan

- 5.1.3. Sports Utility Vehicles and Multi-Purpose Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Vendor

- 5.2.1. Organized

- 5.2.2. Unorganized

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America Used Car Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Hatchbacks

- 6.1.2. Sedan

- 6.1.3. Sports Utility Vehicles and Multi-Purpose Vehicles

- 6.2. Market Analysis, Insights and Forecast - by Vendor

- 6.2.1. Organized

- 6.2.2. Unorganized

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Europe Used Car Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Hatchbacks

- 7.1.2. Sedan

- 7.1.3. Sports Utility Vehicles and Multi-Purpose Vehicles

- 7.2. Market Analysis, Insights and Forecast - by Vendor

- 7.2.1. Organized

- 7.2.2. Unorganized

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Asia Pacific Used Car Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Hatchbacks

- 8.1.2. Sedan

- 8.1.3. Sports Utility Vehicles and Multi-Purpose Vehicles

- 8.2. Market Analysis, Insights and Forecast - by Vendor

- 8.2.1. Organized

- 8.2.2. Unorganized

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Rest of the World Used Car Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Hatchbacks

- 9.1.2. Sedan

- 9.1.3. Sports Utility Vehicles and Multi-Purpose Vehicles

- 9.2. Market Analysis, Insights and Forecast - by Vendor

- 9.2.1. Organized

- 9.2.2. Unorganized

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 The Hertz Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Arnold Clark

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Cox Automotive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Pendragon PLC

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Carro

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 AutoNation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Asbury Automotive Grou

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Mahindra First Choice Wheels

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Penske Cars

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 CarMax Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Maruti Suzuki True Value

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Emil Frey AG

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 The Hertz Corporation

List of Figures

- Figure 1: Global Used Car Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Used Car Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 3: North America Used Car Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 4: North America Used Car Industry Revenue (billion), by Vendor 2025 & 2033

- Figure 5: North America Used Car Industry Revenue Share (%), by Vendor 2025 & 2033

- Figure 6: North America Used Car Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Used Car Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Used Car Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 9: Europe Used Car Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 10: Europe Used Car Industry Revenue (billion), by Vendor 2025 & 2033

- Figure 11: Europe Used Car Industry Revenue Share (%), by Vendor 2025 & 2033

- Figure 12: Europe Used Car Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Used Car Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Used Car Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 15: Asia Pacific Used Car Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 16: Asia Pacific Used Car Industry Revenue (billion), by Vendor 2025 & 2033

- Figure 17: Asia Pacific Used Car Industry Revenue Share (%), by Vendor 2025 & 2033

- Figure 18: Asia Pacific Used Car Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Used Car Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Used Car Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 21: Rest of the World Used Car Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 22: Rest of the World Used Car Industry Revenue (billion), by Vendor 2025 & 2033

- Figure 23: Rest of the World Used Car Industry Revenue Share (%), by Vendor 2025 & 2033

- Figure 24: Rest of the World Used Car Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Rest of the World Used Car Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Used Car Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global Used Car Industry Revenue billion Forecast, by Vendor 2020 & 2033

- Table 3: Global Used Car Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Used Car Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 5: Global Used Car Industry Revenue billion Forecast, by Vendor 2020 & 2033

- Table 6: Global Used Car Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Used Car Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Used Car Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Rest of North America Used Car Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Used Car Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 11: Global Used Car Industry Revenue billion Forecast, by Vendor 2020 & 2033

- Table 12: Global Used Car Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Germany Used Car Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Used Car Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: France Used Car Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Spain Used Car Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Rest of Europe Used Car Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Global Used Car Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 19: Global Used Car Industry Revenue billion Forecast, by Vendor 2020 & 2033

- Table 20: Global Used Car Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: China Used Car Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: India Used Car Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Japan Used Car Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: South Korea Used Car Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Rest of Asia Pacific Used Car Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Global Used Car Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 27: Global Used Car Industry Revenue billion Forecast, by Vendor 2020 & 2033

- Table 28: Global Used Car Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 29: Brazil Used Car Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: United Arab Emirates Used Car Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: South Africa Used Car Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Other Countries Used Car Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Used Car Industry?

The projected CAGR is approximately 4.3%.

2. Which companies are prominent players in the Used Car Industry?

Key companies in the market include The Hertz Corporation, Arnold Clark, Cox Automotive, Pendragon PLC, Carro, AutoNation, Asbury Automotive Grou, Mahindra First Choice Wheels, Penske Cars, CarMax Inc, Maruti Suzuki True Value, Emil Frey AG.

3. What are the main segments of the Used Car Industry?

The market segments include Vehicle Type, Vendor.

4. Can you provide details about the market size?

The market size is estimated to be USD 1442.95 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand For Electric School Buses.

6. What are the notable trends driving market growth?

Strengthening of Online Infrastructure Positively Affecting the Used Cars Market.

7. Are there any restraints impacting market growth?

Uncertainty of The Global Pandemic.

8. Can you provide examples of recent developments in the market?

March 2022: TrueCar Inc. launched a new online car-buying marketplace called TrueCar+. TrueCar+ will provide consumers with a more flexible and personalized car buying experience for new and used vehicles.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Used Car Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Used Car Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Used Car Industry?

To stay informed about further developments, trends, and reports in the Used Car Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence