Key Insights

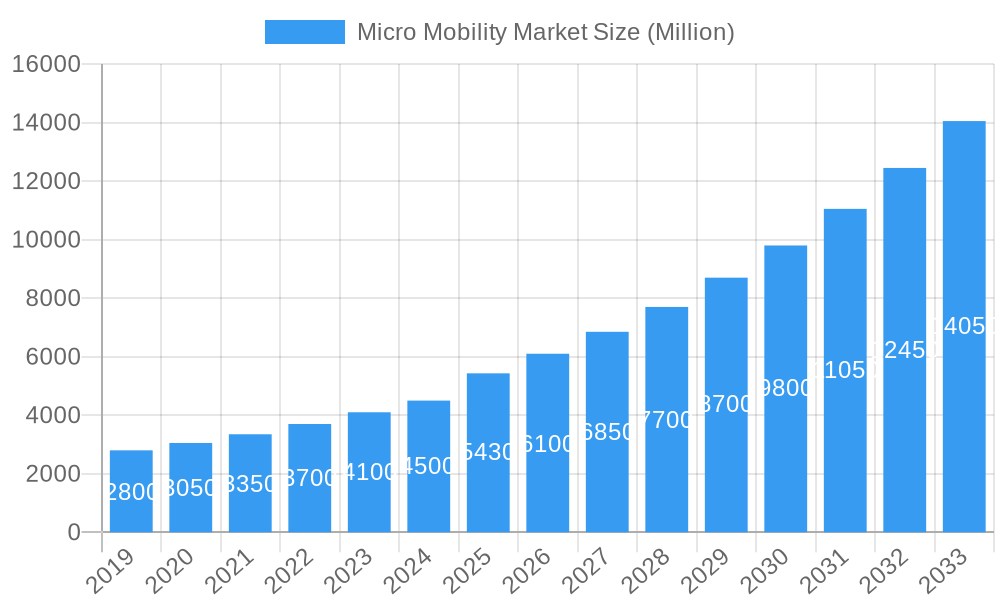

The global Micro Mobility Market is poised for robust expansion, projected to reach USD 5,430.00 Million by 2025 and continue its upward trajectory with a Compound Annual Growth Rate (CAGR) exceeding 12.00% through 2033. This significant growth is propelled by a confluence of factors, including increasing urbanization, growing environmental consciousness, and a demand for convenient and cost-effective short-distance transportation solutions. The surge in electric kick scooters, electric mopeds, and electric bicycles, driven by their eco-friendly nature and ease of use in congested urban areas, forms a core pillar of this market expansion. Furthermore, advancements in battery technology, particularly the widespread adoption of more efficient and longer-lasting Li-ion batteries, are addressing previous limitations and enhancing the overall appeal of micro mobility options. The evolution of sharing models, with a notable shift towards flexible dockless systems, is further democratizing access and fueling adoption across diverse user demographics.

Micro Mobility Market Market Size (In Billion)

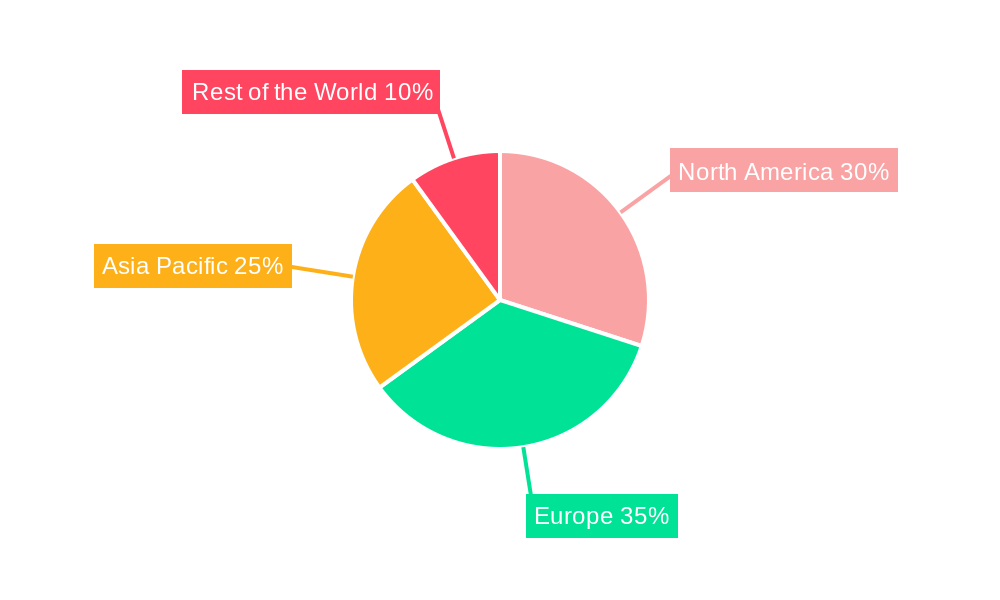

The market's dynamism is further underscored by evolving consumer preferences and strategic investments by key players. The increasing integration of smart features, such as GPS tracking and app-based booking, enhances user experience and operational efficiency for sharing platforms. While the market presents immense opportunities, it also faces certain challenges, including regulatory hurdles in some regions, concerns regarding pedestrian safety, and the need for robust charging infrastructure. However, ongoing innovation in vehicle design, battery management, and urban planning initiatives are actively addressing these restraints. Geographically, North America and Europe are expected to remain dominant markets, driven by supportive government policies and high adoption rates of sustainable transportation. The Asia Pacific region, particularly China and India, is emerging as a critical growth engine due to its massive urban populations and increasing disposable incomes, further solidifying the micro mobility market's position as a transformative force in urban transportation.

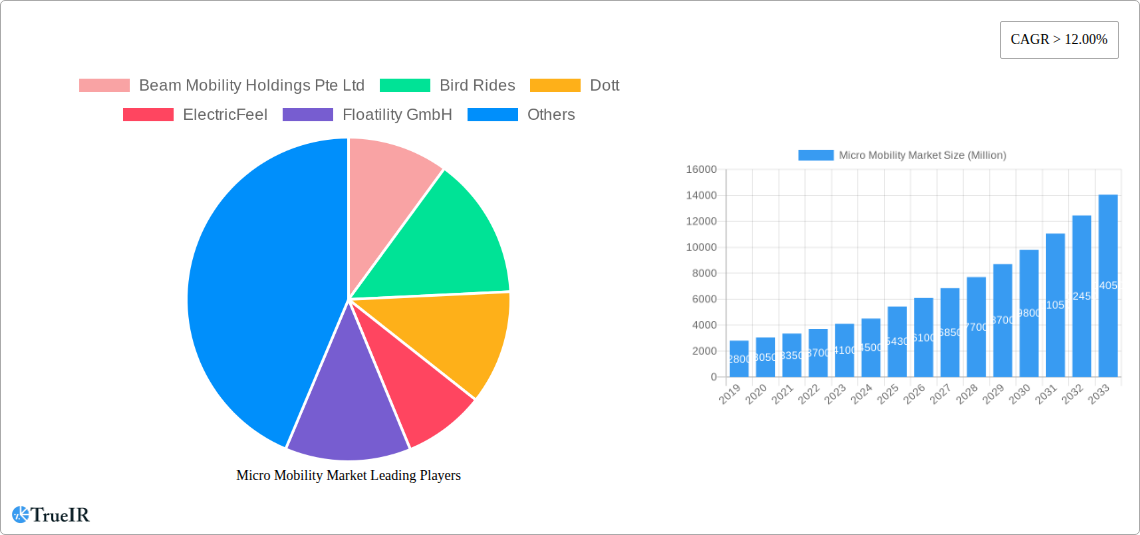

Micro Mobility Market Company Market Share

This comprehensive report provides an in-depth analysis of the global Micro Mobility Market, forecasting its growth from 2025 to 2033. Leveraging high-volume keywords such as "electric scooters," "e-bikes," "urban mobility," "shared mobility," and "last-mile transportation," this report is meticulously designed for SEO optimization and to engage industry stakeholders seeking critical market intelligence. The study covers the historical period of 2019-2024, with the base year set at 2025 and the forecast period extending to 2033.

Micro Mobility Market Market Structure & Competitive Landscape

The Micro Mobility Market exhibits a dynamic and evolving market structure characterized by moderate to high concentration in specific regions, driven by significant innovation and increasing regulatory influence. The presence of major players like Lime, Bird Rides, and Dott indicates a competitive landscape where strategic partnerships and technological advancements are key differentiators. Innovation drivers are primarily focused on battery technology, vehicle durability, and user experience, pushing the boundaries of electric kick scooters, electric mopeds, and electric bicycles. Regulatory impacts are substantial, with cities worldwide implementing frameworks for speed limits, parking, and operational permits, directly influencing market entry and expansion strategies. Product substitutes, while present in the form of traditional public transport and personal vehicles, are increasingly being displaced by the convenience and affordability of micro-mobility solutions. End-user segmentation highlights a strong presence among urban commuters, students, and tourists seeking efficient last-mile transportation. Mergers and acquisitions (M&A) are a significant trend, with companies consolidating to gain market share and operational efficiencies. For instance, the acquisition of Spin by Bird Mobility for USD 19 million in September 2023 underscores this consolidation. Concentration ratios are estimated to be in the range of 0.6-0.8 for the top five players in key urban markets, signifying a consolidated yet competitive environment.

Micro Mobility Market Market Trends & Opportunities

The global Micro Mobility Market is poised for substantial growth, projected to witness a Compound Annual Growth Rate (CAGR) of approximately 18% to 22% during the forecast period of 2025-2033. This robust expansion is fueled by a confluence of favorable market trends and emerging opportunities, fundamentally reshaping urban transportation paradigms. The increasing urbanization rate, coupled with growing environmental consciousness, is driving the demand for sustainable and efficient personal mobility solutions. As cities grapple with traffic congestion and pollution, micro-mobility vehicles, particularly electric kick scooters, electric mopeds, and electric bicycles, are emerging as vital components of integrated transportation networks, offering a compelling alternative to traditional short-distance travel.

Technological advancements continue to be a significant catalyst. The evolution of battery technology, with a strong shift towards Li-ion batteries due to their enhanced energy density, longer lifespan, and faster charging capabilities, is crucial. This innovation not only improves vehicle performance and operational efficiency for service providers but also enhances the user experience through greater range and reduced downtime. Furthermore, advancements in IoT integration and data analytics are enabling fleet management optimization, predictive maintenance, and personalized user services, creating new revenue streams and improving profitability.

Consumer preferences are rapidly aligning with the benefits offered by micro-mobility. The demand for on-demand, flexible, and cost-effective transportation options for short trips, often referred to as "last-mile" or "first-mile" solutions, is soaring. The convenience of unlocking and riding a shared vehicle via a smartphone application resonates strongly with digitally native populations, including millennials and Gen Z. This has led to increased market penetration rates in densely populated urban areas, with penetration expected to exceed 35% in major metropolitan centers by 2030.

The competitive dynamics within the market are intensifying. Key players are focusing on expanding their service areas, optimizing fleet deployment, and developing proprietary technologies to gain a competitive edge. Partnerships with city governments, real estate developers, and public transportation agencies are becoming increasingly important for securing operational permits and integrating micro-mobility services into broader urban planning initiatives. The opportunity lies in bridging the gap between public transit hubs and final destinations, thereby enhancing overall urban mobility efficiency. Furthermore, the growing adoption of electric bicycles, driven by their versatility for longer distances and their appeal to a broader demographic, presents a significant growth avenue. The emergence of subscription models and corporate fleet services also offers new avenues for revenue generation and market expansion, catering to businesses seeking sustainable transportation solutions for their employees. The persistent focus on improving vehicle safety features and rider education is also a critical trend, aimed at addressing regulatory concerns and fostering long-term public acceptance.

Dominant Markets & Segments in Micro Mobility Market

The Micro Mobility Market is experiencing robust growth across various segments and regions, with certain areas and vehicle types demonstrating exceptional dominance.

Dominant Vehicle Types:

- Electric Kick Scooters: These remain a cornerstone of the micro-mobility revolution, particularly in dense urban environments. Their ease of use, compact nature, and relatively low cost make them ideal for short-distance travel and last-mile connectivity. The market dominance is driven by their widespread availability through sharing platforms and their adoption by individuals for personal use.

- Electric Bicycles: With increasing focus on longer commutes and recreational use, electric bicycles are emerging as a significant growth segment. They offer a greater range and a more comfortable riding experience compared to kick scooters, appealing to a broader demographic. Favorable government incentives and the growing popularity of cycling infrastructure contribute to their market penetration.

- Electric Mopeds: While currently a smaller segment, electric mopeds are gaining traction in markets where speed and range are more critical. They offer a viable alternative for longer urban commutes and are increasingly being adopted by delivery services.

Dominant Battery Types:

- Li-ion Batteries: This segment is experiencing exponential growth and is projected to dominate the market. Their superior energy density, longer lifespan, faster charging capabilities, and reduced weight compared to older technologies make them the preferred choice for manufacturers and operators seeking optimal performance and operational efficiency. The decreasing cost of Li-ion battery production further fuels their adoption.

Dominant Voltage Segments:

- 36V and 48V: These voltage ranges are the most prevalent in the current micro-mobility market, offering a balance of power, range, and safety for electric kick scooters and electric bicycles. They are well-suited for typical urban commuting needs and are supported by a mature charging infrastructure.

Dominant Sharing Types:

- Dockless Sharing: The dockless model has been a key enabler of the micro-mobility boom, offering unparalleled flexibility and accessibility to users. The ability to pick up and drop off vehicles anywhere within designated operational zones has significantly lowered the barrier to entry for users and facilitated rapid fleet deployment for operators. This model's dominance is driven by its convenience and scalability.

Dominant Regions and Countries:

- North America and Europe: These regions represent the largest and most developed markets for micro-mobility. Cities like New York, Los Angeles, Paris, Berlin, and London have seen substantial investment and adoption of shared electric scooters and bikes. Favorable government policies, robust public transportation networks, and a high concentration of tech-savvy urban populations are key growth drivers. The ongoing development of cycling infrastructure and increasing environmental awareness in these regions further bolster market expansion.

- Asia-Pacific: This region is emerging as a significant growth frontier, driven by rapid urbanization, a burgeoning middle class, and a growing demand for affordable transportation solutions. Countries like China, India, and Southeast Asian nations are witnessing a surge in micro-mobility adoption, with a particular focus on electric bicycles and electric scooters for personal use and ride-sharing services. Government initiatives promoting electric vehicles and sustainable urban development are also playing a crucial role.

Key Growth Drivers for Dominance:

- Infrastructure Development: Expansion of dedicated bike lanes, micromobility parking zones, and charging infrastructure.

- Supportive Government Policies: Regulations that facilitate operations, provide incentives for EV adoption, and integrate micro-mobility into public transport.

- Technological Advancements: Improvements in battery technology, vehicle durability, GPS tracking, and user-friendly mobile applications.

- Environmental Consciousness: Growing public awareness of climate change and a desire for sustainable transportation alternatives.

- Urban Congestion: The need for efficient and convenient solutions to navigate increasingly congested urban areas.

Micro Mobility Market Product Analysis

Micro mobility products, primarily electric kick scooters, electric mopeds, and electric bicycles, are undergoing continuous innovation driven by the demand for sustainable, efficient, and user-friendly urban transportation. Key advancements include lighter and more durable frame materials, enhanced battery technology for extended range and faster charging (with a strong leaning towards Li-ion), and integrated smart features like GPS tracking, anti-theft systems, and real-time diagnostics. The focus is on improving rider safety through better braking systems, improved suspension, and enhanced lighting. Competitive advantages are being carved out through superior battery management systems, robust fleet management software for shared services, and aesthetically pleasing, ergonomic designs that cater to diverse user needs.

Key Drivers, Barriers & Challenges in Micro Mobility Market

Key Drivers:

The Micro Mobility Market is propelled by several interconnected drivers. Technological innovation, particularly in battery efficiency and vehicle design, is paramount, enabling longer ranges and more robust vehicles. Growing environmental awareness and the urgent need to combat climate change are pushing consumers and policymakers towards sustainable transport options. Urbanization and increasing traffic congestion create a clear demand for efficient last-mile solutions. Supportive government initiatives, including subsidies for electric vehicles and the development of dedicated infrastructure, are also crucial. Finally, the affordability and convenience offered by shared micro-mobility services make them highly attractive to a broad user base.

Barriers & Challenges:

Despite its growth, the market faces significant barriers. Regulatory complexities and inconsistent legislation across different cities and countries pose a major hurdle for operators seeking to scale. Infrastructure limitations, such as the lack of dedicated lanes and safe parking areas, can hinder adoption and lead to public nuisance. Safety concerns related to rider behavior and vehicle stability remain a challenge, impacting public perception and leading to stricter regulations. Supply chain disruptions, particularly for critical components like batteries and microchips, can affect production and fleet availability. Furthermore, fierce competition and the race to achieve profitability in a capital-intensive industry present ongoing financial challenges.

Growth Drivers in the Micro Mobility Market Market

The Micro Mobility Market's growth is underpinned by a strong foundation of enabling factors. Technological advancements, especially in battery technology and vehicle connectivity, are continuously improving performance and user experience. Rising environmental consciousness among consumers and governments is a significant impetus, driving demand for greener transportation. Increasing urban population density and traffic congestion create a palpable need for efficient, space-saving mobility solutions. Supportive government policies, such as tax incentives for electric vehicles and investments in cycling infrastructure, further accelerate adoption. The growing trend of shared economy models has also made micro-mobility services accessible and cost-effective for a wider audience.

Challenges Impacting Micro Mobility Market Growth

The expansion of the Micro Mobility Market is not without its obstacles. Navigating fragmented and evolving regulatory frameworks across different municipalities remains a primary challenge for operators aiming for widespread deployment. Inadequate or unsafe infrastructure, including the lack of dedicated lanes and designated parking areas, can compromise user safety and lead to public opposition. Public perception issues, often stemming from concerns about safety, sidewalk clutter, and rider behavior, require continuous effort in education and responsible operational practices. Supply chain vulnerabilities, particularly concerning the sourcing of lithium-ion batteries and semiconductor components, can lead to production delays and increased costs. Moreover, the intense competition and the pressure to achieve profitability in a capital-intensive market can strain resources and impact long-term sustainability.

Key Players Shaping the Micro Mobility Market Market

- Beam Mobility Holdings Pte Ltd

- Bird Rides

- Dott

- ElectricFeel

- Floatility GmbH

- Lime

- Yulu Bikes Pvt Ltd

- Voi

- Superpedestrian Inc

Significant Micro Mobility Market Industry Milestones

- March 2023: Voi Technology secured an additional USD 22.8 million in funding to extend its e-scooter services across Europe. This investment will support Voi's plan to increase its fleet and enhance its offerings in urban mobility solutions, demonstrating continued investor confidence in the European micro-mobility sector.

- September 2023: Bird expanded its market presence in the electric scooter rental industry by acquiring Spin from Tier Mobility for USD 19 million. This strategic acquisition is intended to strengthen Bird’s operational capabilities and market reach, consolidating market share and expanding its geographic footprint.

Future Outlook for Micro Mobility Market Market

The future outlook for the Micro Mobility Market is exceptionally bright, driven by a sustained demand for sustainable and efficient urban transportation. Strategic opportunities lie in the integration of micro-mobility services with existing public transit networks, creating seamless multimodal journeys. Further innovation in battery technology, leading to enhanced range and faster charging, will be critical for expanding service areas and reducing operational costs. The continued development of smart city initiatives and the adoption of data analytics will enable operators to optimize fleet management, enhance user experience, and foster safer riding environments. As regulatory landscapes mature and urban planning increasingly incorporates micro-mobility solutions, market penetration is expected to deepen significantly, making these services an indispensable part of daily urban life. The segment of electric bicycles, in particular, is poised for substantial growth due to their versatility and broader appeal.

Micro Mobility Market Segmentation

-

1. Vehicle Type

- 1.1. Electric Kick Scooters

- 1.2. Electric Mopeds

- 1.3. Electric Bicycles

-

2. Battery

- 2.1. Sealed Lead Acid

- 2.2. NiMH

- 2.3. Li-ion

-

3. Voltage

- 3.1. Below 24V

- 3.2. 36V

- 3.3. 48V

- 3.4. Greater than 48V

-

4. Sharing Type

- 4.1. Docked

- 4.2. Dockless

Micro Mobility Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Micro Mobility Market Regional Market Share

Geographic Coverage of Micro Mobility Market

Micro Mobility Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 12.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Urban Congestion and a Shift Toward Sustainable Transportation Solutions to Drive Market Growth

- 3.3. Market Restrains

- 3.3.1. Increasing Urban Congestion and a Shift Toward Sustainable Transportation Solutions to Drive Market Growth

- 3.4. Market Trends

- 3.4.1. Docked Micromobility Paving the Way for Sustainable Urban Transportation

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Micro Mobility Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Electric Kick Scooters

- 5.1.2. Electric Mopeds

- 5.1.3. Electric Bicycles

- 5.2. Market Analysis, Insights and Forecast - by Battery

- 5.2.1. Sealed Lead Acid

- 5.2.2. NiMH

- 5.2.3. Li-ion

- 5.3. Market Analysis, Insights and Forecast - by Voltage

- 5.3.1. Below 24V

- 5.3.2. 36V

- 5.3.3. 48V

- 5.3.4. Greater than 48V

- 5.4. Market Analysis, Insights and Forecast - by Sharing Type

- 5.4.1. Docked

- 5.4.2. Dockless

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America Micro Mobility Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Electric Kick Scooters

- 6.1.2. Electric Mopeds

- 6.1.3. Electric Bicycles

- 6.2. Market Analysis, Insights and Forecast - by Battery

- 6.2.1. Sealed Lead Acid

- 6.2.2. NiMH

- 6.2.3. Li-ion

- 6.3. Market Analysis, Insights and Forecast - by Voltage

- 6.3.1. Below 24V

- 6.3.2. 36V

- 6.3.3. 48V

- 6.3.4. Greater than 48V

- 6.4. Market Analysis, Insights and Forecast - by Sharing Type

- 6.4.1. Docked

- 6.4.2. Dockless

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Europe Micro Mobility Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Electric Kick Scooters

- 7.1.2. Electric Mopeds

- 7.1.3. Electric Bicycles

- 7.2. Market Analysis, Insights and Forecast - by Battery

- 7.2.1. Sealed Lead Acid

- 7.2.2. NiMH

- 7.2.3. Li-ion

- 7.3. Market Analysis, Insights and Forecast - by Voltage

- 7.3.1. Below 24V

- 7.3.2. 36V

- 7.3.3. 48V

- 7.3.4. Greater than 48V

- 7.4. Market Analysis, Insights and Forecast - by Sharing Type

- 7.4.1. Docked

- 7.4.2. Dockless

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Asia Pacific Micro Mobility Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Electric Kick Scooters

- 8.1.2. Electric Mopeds

- 8.1.3. Electric Bicycles

- 8.2. Market Analysis, Insights and Forecast - by Battery

- 8.2.1. Sealed Lead Acid

- 8.2.2. NiMH

- 8.2.3. Li-ion

- 8.3. Market Analysis, Insights and Forecast - by Voltage

- 8.3.1. Below 24V

- 8.3.2. 36V

- 8.3.3. 48V

- 8.3.4. Greater than 48V

- 8.4. Market Analysis, Insights and Forecast - by Sharing Type

- 8.4.1. Docked

- 8.4.2. Dockless

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Rest of the World Micro Mobility Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Electric Kick Scooters

- 9.1.2. Electric Mopeds

- 9.1.3. Electric Bicycles

- 9.2. Market Analysis, Insights and Forecast - by Battery

- 9.2.1. Sealed Lead Acid

- 9.2.2. NiMH

- 9.2.3. Li-ion

- 9.3. Market Analysis, Insights and Forecast - by Voltage

- 9.3.1. Below 24V

- 9.3.2. 36V

- 9.3.3. 48V

- 9.3.4. Greater than 48V

- 9.4. Market Analysis, Insights and Forecast - by Sharing Type

- 9.4.1. Docked

- 9.4.2. Dockless

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Beam Mobility Holdings Pte Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Bird Rides

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Dott

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 ElectricFeel

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Floatility GmbH

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Lime

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Yulu Bikes Pvt Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Voi

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Superpedestrian Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Beam Mobility Holdings Pte Ltd

List of Figures

- Figure 1: Global Micro Mobility Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Micro Mobility Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Micro Mobility Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 4: North America Micro Mobility Market Volume (Billion), by Vehicle Type 2025 & 2033

- Figure 5: North America Micro Mobility Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 6: North America Micro Mobility Market Volume Share (%), by Vehicle Type 2025 & 2033

- Figure 7: North America Micro Mobility Market Revenue (Million), by Battery 2025 & 2033

- Figure 8: North America Micro Mobility Market Volume (Billion), by Battery 2025 & 2033

- Figure 9: North America Micro Mobility Market Revenue Share (%), by Battery 2025 & 2033

- Figure 10: North America Micro Mobility Market Volume Share (%), by Battery 2025 & 2033

- Figure 11: North America Micro Mobility Market Revenue (Million), by Voltage 2025 & 2033

- Figure 12: North America Micro Mobility Market Volume (Billion), by Voltage 2025 & 2033

- Figure 13: North America Micro Mobility Market Revenue Share (%), by Voltage 2025 & 2033

- Figure 14: North America Micro Mobility Market Volume Share (%), by Voltage 2025 & 2033

- Figure 15: North America Micro Mobility Market Revenue (Million), by Sharing Type 2025 & 2033

- Figure 16: North America Micro Mobility Market Volume (Billion), by Sharing Type 2025 & 2033

- Figure 17: North America Micro Mobility Market Revenue Share (%), by Sharing Type 2025 & 2033

- Figure 18: North America Micro Mobility Market Volume Share (%), by Sharing Type 2025 & 2033

- Figure 19: North America Micro Mobility Market Revenue (Million), by Country 2025 & 2033

- Figure 20: North America Micro Mobility Market Volume (Billion), by Country 2025 & 2033

- Figure 21: North America Micro Mobility Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: North America Micro Mobility Market Volume Share (%), by Country 2025 & 2033

- Figure 23: Europe Micro Mobility Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 24: Europe Micro Mobility Market Volume (Billion), by Vehicle Type 2025 & 2033

- Figure 25: Europe Micro Mobility Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 26: Europe Micro Mobility Market Volume Share (%), by Vehicle Type 2025 & 2033

- Figure 27: Europe Micro Mobility Market Revenue (Million), by Battery 2025 & 2033

- Figure 28: Europe Micro Mobility Market Volume (Billion), by Battery 2025 & 2033

- Figure 29: Europe Micro Mobility Market Revenue Share (%), by Battery 2025 & 2033

- Figure 30: Europe Micro Mobility Market Volume Share (%), by Battery 2025 & 2033

- Figure 31: Europe Micro Mobility Market Revenue (Million), by Voltage 2025 & 2033

- Figure 32: Europe Micro Mobility Market Volume (Billion), by Voltage 2025 & 2033

- Figure 33: Europe Micro Mobility Market Revenue Share (%), by Voltage 2025 & 2033

- Figure 34: Europe Micro Mobility Market Volume Share (%), by Voltage 2025 & 2033

- Figure 35: Europe Micro Mobility Market Revenue (Million), by Sharing Type 2025 & 2033

- Figure 36: Europe Micro Mobility Market Volume (Billion), by Sharing Type 2025 & 2033

- Figure 37: Europe Micro Mobility Market Revenue Share (%), by Sharing Type 2025 & 2033

- Figure 38: Europe Micro Mobility Market Volume Share (%), by Sharing Type 2025 & 2033

- Figure 39: Europe Micro Mobility Market Revenue (Million), by Country 2025 & 2033

- Figure 40: Europe Micro Mobility Market Volume (Billion), by Country 2025 & 2033

- Figure 41: Europe Micro Mobility Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Europe Micro Mobility Market Volume Share (%), by Country 2025 & 2033

- Figure 43: Asia Pacific Micro Mobility Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 44: Asia Pacific Micro Mobility Market Volume (Billion), by Vehicle Type 2025 & 2033

- Figure 45: Asia Pacific Micro Mobility Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 46: Asia Pacific Micro Mobility Market Volume Share (%), by Vehicle Type 2025 & 2033

- Figure 47: Asia Pacific Micro Mobility Market Revenue (Million), by Battery 2025 & 2033

- Figure 48: Asia Pacific Micro Mobility Market Volume (Billion), by Battery 2025 & 2033

- Figure 49: Asia Pacific Micro Mobility Market Revenue Share (%), by Battery 2025 & 2033

- Figure 50: Asia Pacific Micro Mobility Market Volume Share (%), by Battery 2025 & 2033

- Figure 51: Asia Pacific Micro Mobility Market Revenue (Million), by Voltage 2025 & 2033

- Figure 52: Asia Pacific Micro Mobility Market Volume (Billion), by Voltage 2025 & 2033

- Figure 53: Asia Pacific Micro Mobility Market Revenue Share (%), by Voltage 2025 & 2033

- Figure 54: Asia Pacific Micro Mobility Market Volume Share (%), by Voltage 2025 & 2033

- Figure 55: Asia Pacific Micro Mobility Market Revenue (Million), by Sharing Type 2025 & 2033

- Figure 56: Asia Pacific Micro Mobility Market Volume (Billion), by Sharing Type 2025 & 2033

- Figure 57: Asia Pacific Micro Mobility Market Revenue Share (%), by Sharing Type 2025 & 2033

- Figure 58: Asia Pacific Micro Mobility Market Volume Share (%), by Sharing Type 2025 & 2033

- Figure 59: Asia Pacific Micro Mobility Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Asia Pacific Micro Mobility Market Volume (Billion), by Country 2025 & 2033

- Figure 61: Asia Pacific Micro Mobility Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific Micro Mobility Market Volume Share (%), by Country 2025 & 2033

- Figure 63: Rest of the World Micro Mobility Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 64: Rest of the World Micro Mobility Market Volume (Billion), by Vehicle Type 2025 & 2033

- Figure 65: Rest of the World Micro Mobility Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 66: Rest of the World Micro Mobility Market Volume Share (%), by Vehicle Type 2025 & 2033

- Figure 67: Rest of the World Micro Mobility Market Revenue (Million), by Battery 2025 & 2033

- Figure 68: Rest of the World Micro Mobility Market Volume (Billion), by Battery 2025 & 2033

- Figure 69: Rest of the World Micro Mobility Market Revenue Share (%), by Battery 2025 & 2033

- Figure 70: Rest of the World Micro Mobility Market Volume Share (%), by Battery 2025 & 2033

- Figure 71: Rest of the World Micro Mobility Market Revenue (Million), by Voltage 2025 & 2033

- Figure 72: Rest of the World Micro Mobility Market Volume (Billion), by Voltage 2025 & 2033

- Figure 73: Rest of the World Micro Mobility Market Revenue Share (%), by Voltage 2025 & 2033

- Figure 74: Rest of the World Micro Mobility Market Volume Share (%), by Voltage 2025 & 2033

- Figure 75: Rest of the World Micro Mobility Market Revenue (Million), by Sharing Type 2025 & 2033

- Figure 76: Rest of the World Micro Mobility Market Volume (Billion), by Sharing Type 2025 & 2033

- Figure 77: Rest of the World Micro Mobility Market Revenue Share (%), by Sharing Type 2025 & 2033

- Figure 78: Rest of the World Micro Mobility Market Volume Share (%), by Sharing Type 2025 & 2033

- Figure 79: Rest of the World Micro Mobility Market Revenue (Million), by Country 2025 & 2033

- Figure 80: Rest of the World Micro Mobility Market Volume (Billion), by Country 2025 & 2033

- Figure 81: Rest of the World Micro Mobility Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: Rest of the World Micro Mobility Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Micro Mobility Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global Micro Mobility Market Volume Billion Forecast, by Vehicle Type 2020 & 2033

- Table 3: Global Micro Mobility Market Revenue Million Forecast, by Battery 2020 & 2033

- Table 4: Global Micro Mobility Market Volume Billion Forecast, by Battery 2020 & 2033

- Table 5: Global Micro Mobility Market Revenue Million Forecast, by Voltage 2020 & 2033

- Table 6: Global Micro Mobility Market Volume Billion Forecast, by Voltage 2020 & 2033

- Table 7: Global Micro Mobility Market Revenue Million Forecast, by Sharing Type 2020 & 2033

- Table 8: Global Micro Mobility Market Volume Billion Forecast, by Sharing Type 2020 & 2033

- Table 9: Global Micro Mobility Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: Global Micro Mobility Market Volume Billion Forecast, by Region 2020 & 2033

- Table 11: Global Micro Mobility Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 12: Global Micro Mobility Market Volume Billion Forecast, by Vehicle Type 2020 & 2033

- Table 13: Global Micro Mobility Market Revenue Million Forecast, by Battery 2020 & 2033

- Table 14: Global Micro Mobility Market Volume Billion Forecast, by Battery 2020 & 2033

- Table 15: Global Micro Mobility Market Revenue Million Forecast, by Voltage 2020 & 2033

- Table 16: Global Micro Mobility Market Volume Billion Forecast, by Voltage 2020 & 2033

- Table 17: Global Micro Mobility Market Revenue Million Forecast, by Sharing Type 2020 & 2033

- Table 18: Global Micro Mobility Market Volume Billion Forecast, by Sharing Type 2020 & 2033

- Table 19: Global Micro Mobility Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Global Micro Mobility Market Volume Billion Forecast, by Country 2020 & 2033

- Table 21: United States Micro Mobility Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: United States Micro Mobility Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Canada Micro Mobility Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Canada Micro Mobility Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Rest of North America Micro Mobility Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Rest of North America Micro Mobility Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Global Micro Mobility Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 28: Global Micro Mobility Market Volume Billion Forecast, by Vehicle Type 2020 & 2033

- Table 29: Global Micro Mobility Market Revenue Million Forecast, by Battery 2020 & 2033

- Table 30: Global Micro Mobility Market Volume Billion Forecast, by Battery 2020 & 2033

- Table 31: Global Micro Mobility Market Revenue Million Forecast, by Voltage 2020 & 2033

- Table 32: Global Micro Mobility Market Volume Billion Forecast, by Voltage 2020 & 2033

- Table 33: Global Micro Mobility Market Revenue Million Forecast, by Sharing Type 2020 & 2033

- Table 34: Global Micro Mobility Market Volume Billion Forecast, by Sharing Type 2020 & 2033

- Table 35: Global Micro Mobility Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Micro Mobility Market Volume Billion Forecast, by Country 2020 & 2033

- Table 37: Germany Micro Mobility Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Germany Micro Mobility Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: United Kingdom Micro Mobility Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: United Kingdom Micro Mobility Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: France Micro Mobility Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: France Micro Mobility Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 43: Italy Micro Mobility Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Italy Micro Mobility Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 45: Spain Micro Mobility Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Spain Micro Mobility Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 47: Rest of Europe Micro Mobility Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Rest of Europe Micro Mobility Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 49: Global Micro Mobility Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 50: Global Micro Mobility Market Volume Billion Forecast, by Vehicle Type 2020 & 2033

- Table 51: Global Micro Mobility Market Revenue Million Forecast, by Battery 2020 & 2033

- Table 52: Global Micro Mobility Market Volume Billion Forecast, by Battery 2020 & 2033

- Table 53: Global Micro Mobility Market Revenue Million Forecast, by Voltage 2020 & 2033

- Table 54: Global Micro Mobility Market Volume Billion Forecast, by Voltage 2020 & 2033

- Table 55: Global Micro Mobility Market Revenue Million Forecast, by Sharing Type 2020 & 2033

- Table 56: Global Micro Mobility Market Volume Billion Forecast, by Sharing Type 2020 & 2033

- Table 57: Global Micro Mobility Market Revenue Million Forecast, by Country 2020 & 2033

- Table 58: Global Micro Mobility Market Volume Billion Forecast, by Country 2020 & 2033

- Table 59: China Micro Mobility Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: China Micro Mobility Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 61: Japan Micro Mobility Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Japan Micro Mobility Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 63: India Micro Mobility Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: India Micro Mobility Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 65: South Korea Micro Mobility Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: South Korea Micro Mobility Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 67: Rest of Asia Pacific Micro Mobility Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: Rest of Asia Pacific Micro Mobility Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 69: Global Micro Mobility Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 70: Global Micro Mobility Market Volume Billion Forecast, by Vehicle Type 2020 & 2033

- Table 71: Global Micro Mobility Market Revenue Million Forecast, by Battery 2020 & 2033

- Table 72: Global Micro Mobility Market Volume Billion Forecast, by Battery 2020 & 2033

- Table 73: Global Micro Mobility Market Revenue Million Forecast, by Voltage 2020 & 2033

- Table 74: Global Micro Mobility Market Volume Billion Forecast, by Voltage 2020 & 2033

- Table 75: Global Micro Mobility Market Revenue Million Forecast, by Sharing Type 2020 & 2033

- Table 76: Global Micro Mobility Market Volume Billion Forecast, by Sharing Type 2020 & 2033

- Table 77: Global Micro Mobility Market Revenue Million Forecast, by Country 2020 & 2033

- Table 78: Global Micro Mobility Market Volume Billion Forecast, by Country 2020 & 2033

- Table 79: South America Micro Mobility Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: South America Micro Mobility Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 81: Middle East and Africa Micro Mobility Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: Middle East and Africa Micro Mobility Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Micro Mobility Market?

The projected CAGR is approximately > 12.00%.

2. Which companies are prominent players in the Micro Mobility Market?

Key companies in the market include Beam Mobility Holdings Pte Ltd, Bird Rides, Dott, ElectricFeel, Floatility GmbH, Lime, Yulu Bikes Pvt Ltd, Voi, Superpedestrian Inc.

3. What are the main segments of the Micro Mobility Market?

The market segments include Vehicle Type, Battery, Voltage, Sharing Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.43 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Urban Congestion and a Shift Toward Sustainable Transportation Solutions to Drive Market Growth.

6. What are the notable trends driving market growth?

Docked Micromobility Paving the Way for Sustainable Urban Transportation.

7. Are there any restraints impacting market growth?

Increasing Urban Congestion and a Shift Toward Sustainable Transportation Solutions to Drive Market Growth.

8. Can you provide examples of recent developments in the market?

March 2023: Voi Technology secured an additional USD 22.8 million in funding to extend its e-scooter services across Europe. This investment will support Voi's plan to increase its fleet and enhance its offerings in urban mobility solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Micro Mobility Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Micro Mobility Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Micro Mobility Market?

To stay informed about further developments, trends, and reports in the Micro Mobility Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence