Key Insights

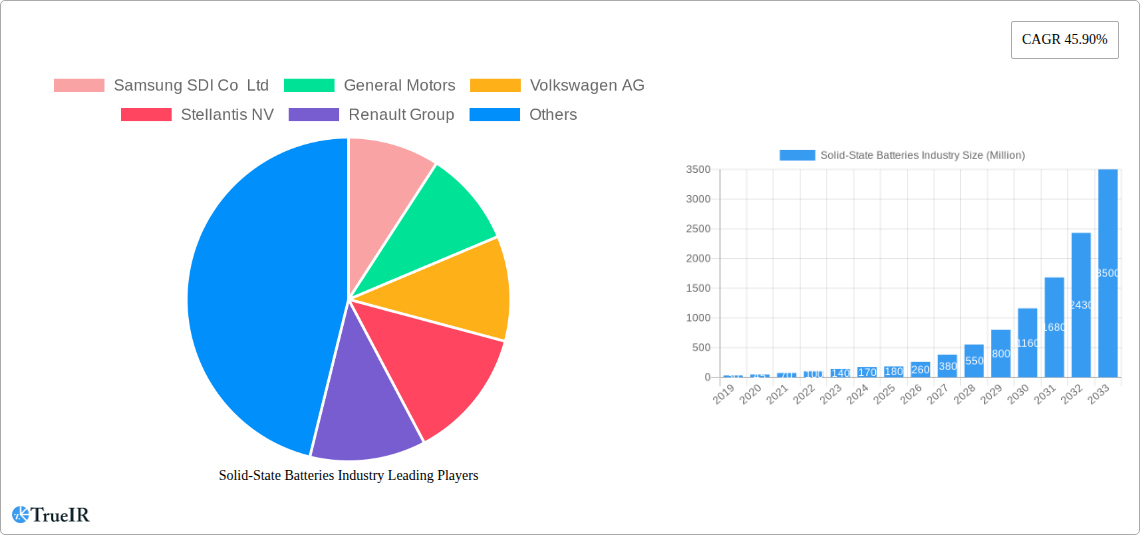

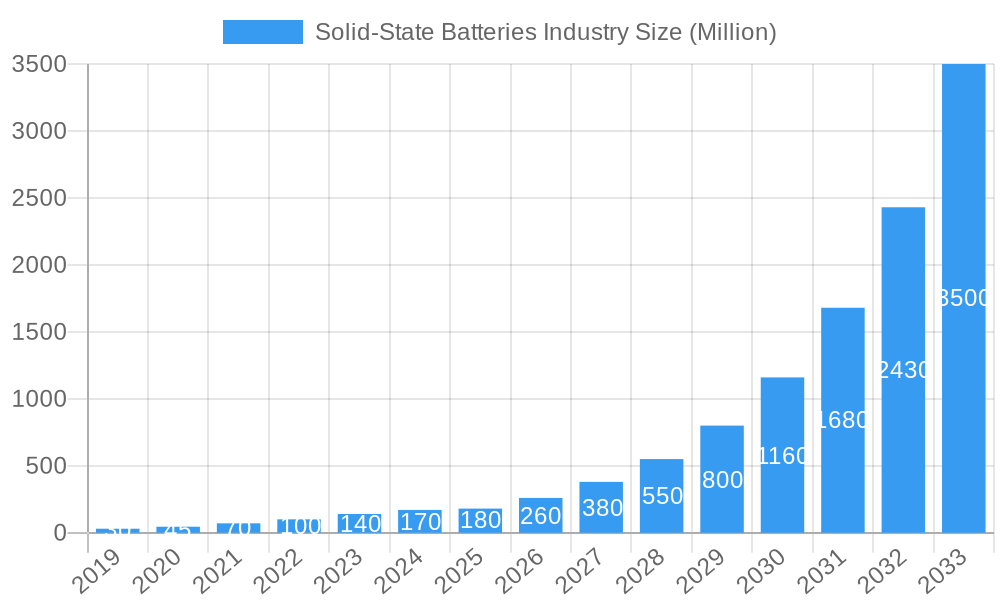

The Solid-State Batteries market is poised for explosive growth, projected to reach a market size of USD 180 million by 2025, with a remarkable Compound Annual Growth Rate (CAGR) of 45.90% through 2033. This exponential trajectory is fundamentally driven by the inherent advantages of solid-state technology over conventional lithium-ion batteries. Key among these are enhanced safety, owing to the elimination of flammable liquid electrolytes, leading to reduced fire risks. Furthermore, solid-state batteries promise significantly higher energy density, enabling longer ranges for electric vehicles and extended operational life for electronic devices. Their faster charging capabilities and longer lifespan also address major consumer pain points, accelerating adoption across various sectors. The expanding electric vehicle (EV) sector, coupled with the increasing demand for advanced portable electronics and grid storage solutions, forms the bedrock of this robust market expansion.

Solid-State Batteries Industry Market Size (In Million)

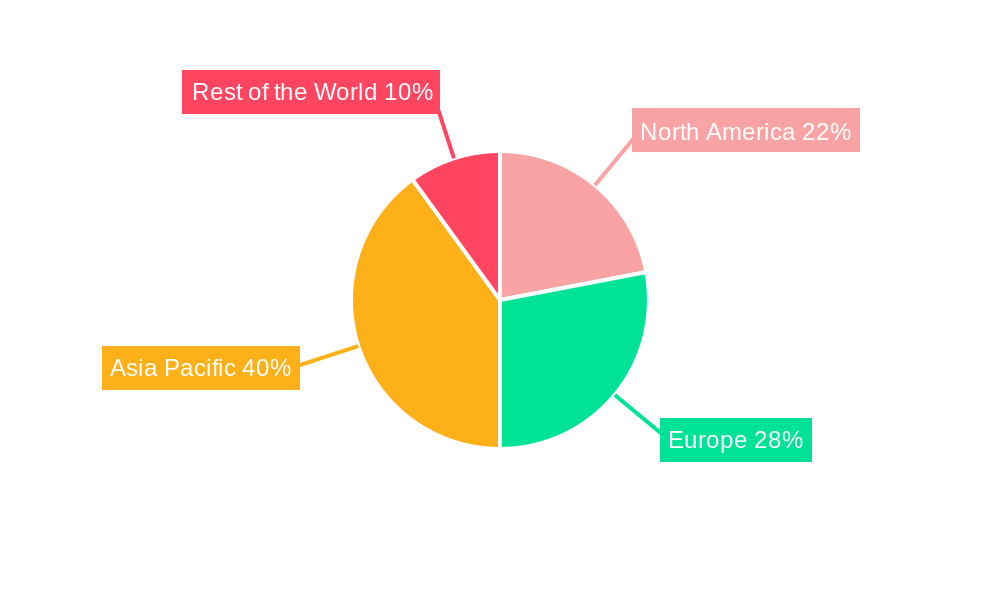

The market segmentation reveals a strong focus on electric vehicles, with both Passenger Cars and Commercial Vehicles being prominent end-users. Within propulsion types, Battery Electric Vehicles (BEVs) are anticipated to be the primary beneficiaries, though Plug-in Hybrid Electric Vehicles (PHEVs) will also contribute to demand. Leading automotive manufacturers like General Motors, Volkswagen AG, Stellantis NV, Renault Group, Hyundai Motor Company, Toyota Motor Corporation, and Ford Motor Company are actively investing in and developing solid-state battery technologies, signaling a significant industry shift. Companies such as Samsung SDI Co Ltd and LG Chem Ltd are at the forefront of innovation in battery manufacturing. Geographically, Asia Pacific, particularly China and South Korea, is expected to lead market expansion due to strong government support for EVs and advanced manufacturing capabilities. North America and Europe are also critical markets, driven by stringent emission regulations and a growing consumer preference for sustainable transportation. Despite the immense potential, challenges such as high manufacturing costs and scaling up production remain key restraints that the industry is actively working to overcome.

Solid-State Batteries Industry Company Market Share

This comprehensive report, Solid-State Batteries Industry: Market Analysis, Trends, and Forecast 2019-2033, offers an in-depth examination of the rapidly evolving global solid-state battery market. Leveraging high-volume keywords such as "solid-state battery technology," "electric vehicle batteries," "lithium-ion battery alternatives," and "battery manufacturing," this SEO-optimized analysis is designed to engage industry professionals, investors, and policymakers. The report covers the historical period of 2019–2024 and forecasts market dynamics through 2033, with a base and estimated year of 2025.

Solid-State Batteries Industry Market Structure & Competitive Landscape

The solid-state battery market is characterized by moderate to high concentration, driven by significant R&D investments and capital expenditure requirements. Innovation is a primary driver, with a strong emphasis on achieving higher energy density, improved safety, and faster charging capabilities compared to traditional lithium-ion batteries. Regulatory impacts are increasingly shaping the landscape, with government incentives for clean energy and stringent safety standards pushing for advanced battery solutions. Product substitutes, predominantly advanced lithium-ion technologies, remain a key competitive factor, although solid-state batteries aim to overcome their inherent limitations. End-user segmentation is heavily influenced by the automotive sector, with passenger cars and commercial vehicles being the dominant applications. Mergers and acquisitions (M&A) trends are on the rise as larger automotive and battery manufacturers seek to secure proprietary technology and production capacity. For instance, several strategic partnerships and R&D collaborations have been observed, indicating a trend towards consolidation and vertical integration in key markets. The market's concentration ratio is estimated to be around 65% among the top five players in the manufacturing segment, with M&A volumes projected to reach hundreds of millions of dollars by 2027 as companies race for market leadership.

Solid-State Batteries Industry Market Trends & Opportunities

The solid-state battery market is poised for explosive growth, driven by the insatiable demand for safer, more efficient, and longer-lasting energy storage solutions, particularly within the burgeoning electric vehicle (EV) sector. The market size is projected to expand from approximately $500 Million in 2025 to well over $30,000 Million by 2033, exhibiting a compound annual growth rate (CAGR) of an impressive 35-40%. This surge is underpinned by significant technological shifts, most notably the transition from liquid electrolytes to solid electrolytes in battery designs. This fundamental change promises to revolutionize battery performance by virtually eliminating the risk of thermal runaway, thereby enhancing safety in consumer electronics, electric vehicles, and grid-scale energy storage applications.

Consumer preferences are increasingly aligning with these advancements. Drivers are demanding EVs with extended driving ranges that rival or surpass internal combustion engine vehicles, coupled with rapid charging capabilities. Solid-state batteries are on track to deliver these very attributes. Companies are investing heavily in scaling up production and refining manufacturing processes to meet the projected market penetration rates, which are expected to climb from single digits in the early forecast period to over 30% by 2033 for new EV deployments.

The competitive dynamics are intensifying, with established battery giants and innovative startups fiercely vying for technological supremacy and market share. Strategic collaborations between battery developers and major automotive OEMs are becoming more frequent, accelerating the pace of commercialization. Opportunities abound for companies that can successfully navigate the challenges of mass production, cost reduction, and supply chain development. The pursuit of higher energy densities, such as achieving 500 Wh/kg and beyond, remains a critical objective, unlocking new possibilities for lighter and more powerful battery packs. Furthermore, the development of novel solid electrolyte materials, including sulfides, oxides, and polymers, continues to be a focal point of research, each offering unique advantages in terms of conductivity, stability, and manufacturability. The successful commercialization of these advanced technologies will be instrumental in driving market penetration and realizing the full potential of solid-state batteries.

Dominant Markets & Segments in Solid-State Batteries Industry

The global solid-state battery market is currently experiencing rapid evolution, with Battery Electric Vehicles (BEVs) emerging as the overwhelmingly dominant segment in terms of market size and growth potential. This dominance is fueled by a confluence of factors including stringent government regulations aimed at curbing emissions, increasing consumer awareness of environmental sustainability, and substantial investments in EV infrastructure. The passenger car segment within BEVs is leading the charge, as automakers prioritize the integration of advanced battery technologies to enhance vehicle performance and appeal to a broader consumer base.

Vehicle Type:

- Passenger Cars: This segment is the primary driver of demand due to the widespread adoption of EVs for personal transportation. Automakers are heavily investing in solid-state battery technology to offer longer ranges and faster charging, directly addressing key consumer concerns and accelerating EV uptake.

- Commercial Vehicles: While currently a smaller segment, the commercial vehicle sector, including electric trucks and buses, presents significant future growth opportunities. The demand for reliable and high-capacity batteries to support longer operational routes and reduce downtime is a key growth catalyst.

Propulsion:

- Battery Electric Vehicle (BEV): This segment is unequivocally the leader. The intrinsic benefits of solid-state batteries—enhanced safety, higher energy density, and faster charging—directly align with the requirements for mainstream BEV adoption. Market penetration rates within BEVs are expected to surge as costs decrease and production scales up.

- Plug-in Hybrid Electric Vehicle (PHEV): PHEVs will also benefit from solid-state battery technology, offering improved electric-only range and performance. However, the long-term trend favors pure BEVs as battery technology matures and charging infrastructure expands.

Geographically, Asia-Pacific, particularly China, is anticipated to remain the dominant market for solid-state batteries, owing to its established position in battery manufacturing, robust EV market, and supportive government policies. North America and Europe are also experiencing significant growth, driven by ambitious EV adoption targets and substantial research and development initiatives. The growth in these regions is further propelled by the development of localized supply chains and the establishment of gigafactories dedicated to advanced battery technologies.

Solid-State Batteries Industry Product Analysis

The solid-state battery industry is characterized by relentless product innovation focused on overcoming the limitations of current lithium-ion technologies. Key advancements revolve around developing novel solid electrolytes—including sulfide, oxide, and polymer-based materials—each offering unique advantages. These innovations aim to deliver significantly higher energy densities (exceeding 400 Wh/kg), enhanced safety by eliminating flammable liquid electrolytes, faster charging capabilities, and longer cycle lives. Applications are expanding beyond electric vehicles to include consumer electronics, aerospace, and grid storage. The competitive advantage lies in achieving cost-effective mass production while maintaining superior performance metrics, thereby unlocking new market segments and applications previously constrained by battery technology.

Key Drivers, Barriers & Challenges in Solid-State Batteries Industry

Key Drivers:

The solid-state battery industry is propelled by a potent combination of technological advancements, economic imperatives, and supportive government policies. The primary technological driver is the inherent superiority of solid-state over liquid electrolyte systems, offering enhanced safety, higher energy density (leading to longer EV ranges), and faster charging. Economically, the escalating demand for electric vehicles and renewable energy storage solutions creates a massive market opportunity. Government policies, including stringent emission standards, EV subsidies, and mandates for clean energy, further accelerate adoption. For instance, the European Union's Green Deal and the US's Inflation Reduction Act are significant policy-driven catalysts.

Barriers & Challenges:

Despite the immense potential, significant barriers and challenges impede widespread adoption. The primary challenge remains the high manufacturing cost of solid-state batteries, largely due to complex material synthesis and intricate manufacturing processes. Supply chain issues, particularly the sourcing and processing of raw materials for solid electrolytes, present another hurdle. Regulatory hurdles, while often supportive, can also create complexities in standardization and certification for novel battery chemistries. Competitive pressures from continuously improving lithium-ion technologies, which benefit from established infrastructure and lower costs, also pose a significant restraint. The development of robust and scalable manufacturing processes is critical, with the cost of production needing to decrease by an estimated 30-40% to achieve mass-market parity.

Growth Drivers in the Solid-State Batteries Industry Market

The solid-state batteries industry market is experiencing robust growth driven by a confluence of critical factors. Technological advancements are paramount, with ongoing breakthroughs in solid electrolyte materials and cell architectures promising enhanced safety, higher energy density, and faster charging. The burgeoning electric vehicle (EV) market represents a massive demand catalyst, as automakers globally are seeking next-generation battery solutions to improve range and reduce charging times. Government initiatives and regulations, such as emission reduction targets and incentives for EV adoption, are further accelerating the transition towards solid-state battery technology. Additionally, the increasing focus on energy security and sustainability is spurring investment in advanced battery solutions for grid storage and other applications.

Challenges Impacting Solid-State Batteries Industry Growth

The growth of the solid-state batteries industry faces several significant challenges. Manufacturing scalability and cost reduction remain the most critical barriers; current production methods are complex and expensive, hindering widespread commercial adoption. Supply chain complexities for novel materials used in solid electrolytes, such as lithium metal and specialized ceramics, can lead to bottlenecks and price volatility. Regulatory hurdles and standardization for new battery chemistries can slow down market entry and adoption. Furthermore, intense competition from continuously improving traditional lithium-ion battery technologies, which benefit from mature supply chains and established infrastructure, poses a persistent challenge. Ensuring the long-term durability and reliability of solid-state batteries in real-world conditions is also an ongoing area of research and development.

Key Players Shaping the Solid-State Batteries Industry Market

- Samsung SDI Co Ltd

- General Motors

- Volkswagen AG

- Stellantis NV

- Renault Group

- Hyundai Motor Company

- Toyota Motor Corporation

- LG Chem Ltd

- Mitsubishi Motors

- Ford Motor Company

Significant Solid-State Batteries Industry Industry Milestones

- June 2023: Basquevolt announced that by the end of 2023, its R&D center will deliver 100% European solid-state battery technology. Since April, they have been testing first multilayer cells, demonstrating the capability for very high energy density (1,000 Wh/L and 450 Wh/kg) and significantly reduced battery pack prices.

- June 2023: ProLogium Technology (PLG) revealed the debut of its next-generation large-footprint lithium ceramic battery (LLCB) at ees Europe in Munich. LLCB samples are scheduled for dispatch to European automakers for testing by the end of 2023.

- June 2023: Toyota Motor Corporation announced plans to install a new onboard battery in next-generation EVs, slated for release in 2026. This battery is designed to double cruising range while lowering costs by 20%. By 2028, Toyota aims to commercialize three new battery types, including bipolar and all-solid-state batteries.

Future Outlook for Solid-State Batteries Industry Market

The future outlook for the solid-state batteries industry is exceptionally bright, marked by sustained high growth driven by ongoing technological advancements and increasing market penetration. Key growth catalysts include the successful scaling of manufacturing processes, leading to significant cost reductions and making solid-state batteries more competitive with traditional lithium-ion technologies. Strategic partnerships between battery developers and major automotive manufacturers will continue to accelerate product commercialization and integration into next-generation EVs. The pursuit of higher energy densities and enhanced safety features will unlock new opportunities in various sectors beyond automotive, including consumer electronics, aerospace, and grid-scale energy storage. Projections indicate that solid-state batteries will capture a substantial share of the advanced battery market by 2033, transforming the landscape of portable power and sustainable energy solutions.

Solid-State Batteries Industry Segmentation

-

1. Vehicle Type

- 1.1. Passenger Cars

- 1.2. Commercial Vehicles

-

2. Propulsion

- 2.1. Plug-in Hybrid Electric Vehicle

- 2.2. Battery Electric Vehicle

Solid-State Batteries Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Solid-State Batteries Industry Regional Market Share

Geographic Coverage of Solid-State Batteries Industry

Solid-State Batteries Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 45.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Sales of Electric Vehicle is Expected to Drive the Market

- 3.3. Market Restrains

- 3.3.1. High Cost of EV Solid-State Battery May Hamper the Growth of the Market

- 3.4. Market Trends

- 3.4.1. Increasing Sales of Electric Vehicle

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Solid-State Batteries Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Cars

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Propulsion

- 5.2.1. Plug-in Hybrid Electric Vehicle

- 5.2.2. Battery Electric Vehicle

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America Solid-State Batteries Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Passenger Cars

- 6.1.2. Commercial Vehicles

- 6.2. Market Analysis, Insights and Forecast - by Propulsion

- 6.2.1. Plug-in Hybrid Electric Vehicle

- 6.2.2. Battery Electric Vehicle

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Europe Solid-State Batteries Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Passenger Cars

- 7.1.2. Commercial Vehicles

- 7.2. Market Analysis, Insights and Forecast - by Propulsion

- 7.2.1. Plug-in Hybrid Electric Vehicle

- 7.2.2. Battery Electric Vehicle

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Asia Pacific Solid-State Batteries Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Passenger Cars

- 8.1.2. Commercial Vehicles

- 8.2. Market Analysis, Insights and Forecast - by Propulsion

- 8.2.1. Plug-in Hybrid Electric Vehicle

- 8.2.2. Battery Electric Vehicle

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Rest of the World Solid-State Batteries Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Passenger Cars

- 9.1.2. Commercial Vehicles

- 9.2. Market Analysis, Insights and Forecast - by Propulsion

- 9.2.1. Plug-in Hybrid Electric Vehicle

- 9.2.2. Battery Electric Vehicle

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Samsung SDI Co Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 General Motors

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Volkswagen AG

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Stellantis NV

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Renault Group

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Hyundai Motor Company

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Toyota Motor Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 LG Chem Ltd*List Not Exhaustive

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Mitsubishi Motors

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Ford Motor Company

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Samsung SDI Co Ltd

List of Figures

- Figure 1: Global Solid-State Batteries Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Solid-State Batteries Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 3: North America Solid-State Batteries Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 4: North America Solid-State Batteries Industry Revenue (Million), by Propulsion 2025 & 2033

- Figure 5: North America Solid-State Batteries Industry Revenue Share (%), by Propulsion 2025 & 2033

- Figure 6: North America Solid-State Batteries Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Solid-State Batteries Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Solid-State Batteries Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 9: Europe Solid-State Batteries Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 10: Europe Solid-State Batteries Industry Revenue (Million), by Propulsion 2025 & 2033

- Figure 11: Europe Solid-State Batteries Industry Revenue Share (%), by Propulsion 2025 & 2033

- Figure 12: Europe Solid-State Batteries Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Solid-State Batteries Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Solid-State Batteries Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 15: Asia Pacific Solid-State Batteries Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 16: Asia Pacific Solid-State Batteries Industry Revenue (Million), by Propulsion 2025 & 2033

- Figure 17: Asia Pacific Solid-State Batteries Industry Revenue Share (%), by Propulsion 2025 & 2033

- Figure 18: Asia Pacific Solid-State Batteries Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Solid-State Batteries Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Solid-State Batteries Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 21: Rest of the World Solid-State Batteries Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 22: Rest of the World Solid-State Batteries Industry Revenue (Million), by Propulsion 2025 & 2033

- Figure 23: Rest of the World Solid-State Batteries Industry Revenue Share (%), by Propulsion 2025 & 2033

- Figure 24: Rest of the World Solid-State Batteries Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World Solid-State Batteries Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Solid-State Batteries Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global Solid-State Batteries Industry Revenue Million Forecast, by Propulsion 2020 & 2033

- Table 3: Global Solid-State Batteries Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Solid-State Batteries Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 5: Global Solid-State Batteries Industry Revenue Million Forecast, by Propulsion 2020 & 2033

- Table 6: Global Solid-State Batteries Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Solid-State Batteries Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Solid-State Batteries Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Rest of North America Solid-State Batteries Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Solid-State Batteries Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 11: Global Solid-State Batteries Industry Revenue Million Forecast, by Propulsion 2020 & 2033

- Table 12: Global Solid-State Batteries Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Germany Solid-State Batteries Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Solid-State Batteries Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: France Solid-State Batteries Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Russia Solid-State Batteries Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Spain Solid-State Batteries Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Solid-State Batteries Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Solid-State Batteries Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 20: Global Solid-State Batteries Industry Revenue Million Forecast, by Propulsion 2020 & 2033

- Table 21: Global Solid-State Batteries Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 22: India Solid-State Batteries Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: China Solid-State Batteries Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Japan Solid-State Batteries Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: South Korea Solid-State Batteries Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Rest of Asia Pacific Solid-State Batteries Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Global Solid-State Batteries Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 28: Global Solid-State Batteries Industry Revenue Million Forecast, by Propulsion 2020 & 2033

- Table 29: Global Solid-State Batteries Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 30: South America Solid-State Batteries Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Middle East and Africa Solid-State Batteries Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Solid-State Batteries Industry?

The projected CAGR is approximately 45.90%.

2. Which companies are prominent players in the Solid-State Batteries Industry?

Key companies in the market include Samsung SDI Co Ltd, General Motors, Volkswagen AG, Stellantis NV, Renault Group, Hyundai Motor Company, Toyota Motor Corporation, LG Chem Ltd*List Not Exhaustive, Mitsubishi Motors, Ford Motor Company.

3. What are the main segments of the Solid-State Batteries Industry?

The market segments include Vehicle Type, Propulsion.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.18 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Sales of Electric Vehicle is Expected to Drive the Market.

6. What are the notable trends driving market growth?

Increasing Sales of Electric Vehicle.

7. Are there any restraints impacting market growth?

High Cost of EV Solid-State Battery May Hamper the Growth of the Market.

8. Can you provide examples of recent developments in the market?

June 2023: Basquevolt declared that by the end of 2023, its research and development center will deliver 100% European solid-state battery technology. Since last April, it has been testing its first multilayer cells, indicating that its method can achieve very high energy density (1,000 Wh/L and 450 Wh/kg) while drastically lowering overall battery pack prices.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Solid-State Batteries Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Solid-State Batteries Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Solid-State Batteries Industry?

To stay informed about further developments, trends, and reports in the Solid-State Batteries Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence