Key Insights

The Automotive HMI (Human-Machine Interface) market is poised for significant expansion. Projected to reach $25.5 billion by 2024, with a Compound Annual Growth Rate (CAGR) of 10.6%, this growth is fueled by escalating consumer demand for advanced in-car connectivity, sophisticated infotainment systems, and enhanced driver assistance features. The progression of autonomous driving technology further emphasizes the need for intuitive and integrated HMI solutions, creating substantial market opportunities. Rising disposable incomes in emerging economies, stringent safety regulations, and continuous innovation in display technologies such as OLED and augmented reality heads-up displays are key drivers. Voice control systems are becoming standard, offering a safer and more convenient driver interaction method for navigation, climate control, and entertainment. Central displays are evolving into larger, interactive touchscreens, serving as the central hub for vehicle information and entertainment.

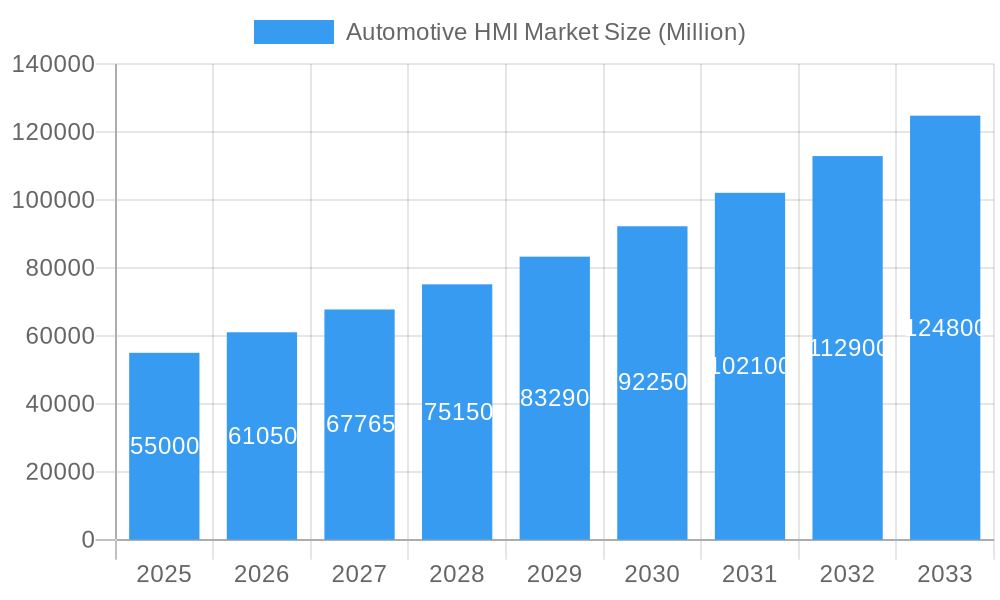

Automotive HMI Market Market Size (In Billion)

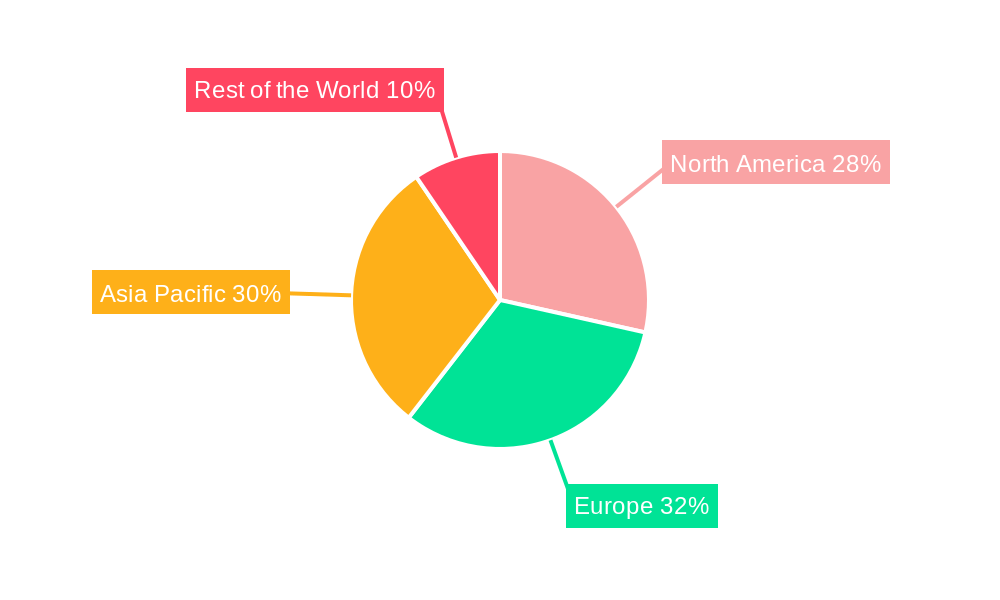

Key market segments include Voice Control Systems and Central Displays, anticipated to lead in adoption due to their direct impact on user experience and safety. Heads-Up Displays (HUDs) are also gaining prominence, especially in premium vehicle segments, by delivering critical information without driver distraction. While luxury passenger cars have historically led HMI adoption, mid-price and economy segments are increasingly integrating advanced HMI features to maintain competitiveness. Geographically, North America and Europe represent mature markets with high adoption, while the Asia Pacific region, particularly China and India, is the fastest-growing market due to rapid vehicle sales, technological advancements, and a growing middle class. Leading companies are investing heavily in R&D to develop next-generation HMI solutions, focusing on personalization, seamless smart device integration, and AI-driven functionalities. Addressing challenges like high development costs and cybersecurity concerns will be crucial for sustained market expansion.

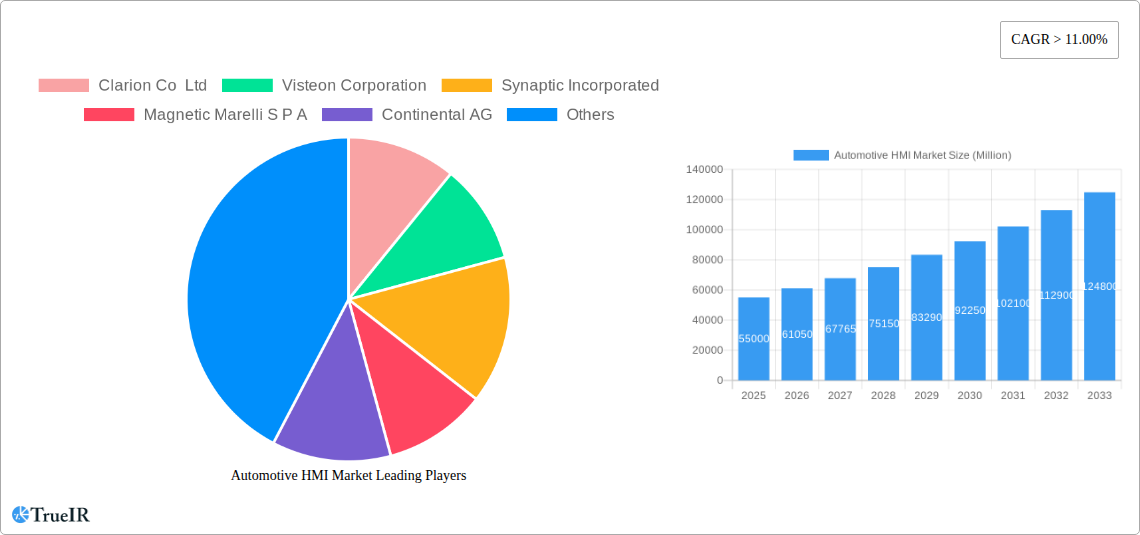

Automotive HMI Market Company Market Share

Automotive HMI Market: Comprehensive Market Analysis and Future Projections (2019-2033)

This in-depth report provides a dynamic, SEO-optimized analysis of the global Automotive HMI (Human-Machine Interface) Market, leveraging high-volume keywords to enhance search rankings and engage industry professionals. Covering the period from 2019 to 2033, with a base year of 2025, this report offers a comprehensive understanding of market structure, trends, opportunities, dominant segments, product innovations, key players, and future outlook.

Automotive HMI Market Market Structure & Competitive Landscape

The Automotive HMI Market exhibits a moderately concentrated structure, with a blend of established Tier-1 suppliers and emerging technology innovators. Key players like Continental AG, Visteon Corporation, and Harman International Industries hold significant market share, driven by extensive R&D investments and long-standing relationships with major OEMs. Innovation drivers are heavily influenced by advancements in artificial intelligence (AI), augmented reality (AR), and the increasing demand for personalized in-car experiences. Regulatory impacts, particularly concerning driver distraction and cybersecurity, are shaping interface designs and feature implementations. Product substitutes, such as aftermarket infotainment systems, exist but struggle to match the seamless integration and advanced functionalities offered by OEM-supplied HMIs. End-user segmentation reveals a growing preference for intuitive, voice-activated, and context-aware interfaces across all vehicle types, from economy to luxury. Merger and acquisition (M&A) trends indicate a consolidation driven by the need for specialized software capabilities and broader technological portfolios. In the historical period (2019-2024), the market saw approximately 10 significant M&A activities, with average deal values in the hundreds of millions. The concentration ratio among the top 5 players is estimated to be around 55% in 2025.

Automotive HMI Market Market Trends & Opportunities

The global Automotive HMI Market is experiencing robust growth, projected to reach a value exceeding $45,000 Million by 2033, with a Compound Annual Growth Rate (CAGR) of approximately 12.5% between 2025 and 2033. This expansion is fueled by the accelerating integration of advanced technologies within vehicles, including sophisticated infotainment systems, advanced driver-assistance systems (ADAS), and the burgeoning autonomous driving landscape. Consumers are increasingly demanding intuitive, personalized, and safe in-car digital experiences, pushing automakers to invest heavily in next-generation HMIs. Technological shifts are characterized by the widespread adoption of large, high-resolution central displays, immersive Heads-Up Displays (HUDs) with AR capabilities, and natural language voice control systems that offer seamless interaction. The move towards software-defined vehicles further amplifies the importance of HMI as the primary point of user interaction.

Consumer preferences are evolving rapidly, with a strong emphasis on seamless connectivity, personalized content delivery, and simplified navigation. This trend is evident in the growing penetration of smartphone-like interfaces and gesture control technologies. The competitive dynamics are intensifying, with traditional automotive suppliers facing increased competition from tech giants and specialized software developers vying for a significant stake in the automotive HMI ecosystem. Opportunities abound in the development of predictive HMI systems that anticipate driver needs, enhance safety through intelligent alerts and interventions, and provide a more engaging and less distracting driving experience. The integration of biometric authentication for personalized settings and enhanced security also presents a significant growth avenue. Furthermore, the demand for customizable and adaptable HMIs that can evolve with software updates will be a key differentiator. The market penetration of advanced HMI features, such as integrated AR HUDs, is expected to climb from 15% in 2025 to over 50% by 2033. The overall market size for Automotive HMIs was approximately $22,000 Million in 2025.

Dominant Markets & Segments in Automotive HMI Market

The Automotive HMI Market demonstrates significant regional dominance and segment-specific growth. North America and Europe are leading regions, driven by early adoption of advanced automotive technologies, stringent safety regulations, and a high disposable income that supports the purchase of premium vehicles equipped with sophisticated HMIs. Within these regions, Germany, the United States, and China are key countries spearheading HMI innovation and market penetration.

From a Product Type perspective:

- Central Displays: These dominate the market due to their versatility in integrating infotainment, navigation, and vehicle settings. Their size and functionality are continuously increasing, offering a rich user experience.

- Heads-Up Display (HUD): HUDs, especially those incorporating Augmented Reality (AR), are witnessing rapid growth. They are crucial for enhancing driver safety by projecting vital information directly into the driver's line of sight, minimizing distraction. AR HUDs are projected to experience a CAGR of over 15% during the forecast period.

- Voice Control System: The demand for intuitive and responsive voice control is surging as drivers seek hands-free operation for various vehicle functions. Advancements in AI and natural language processing are making these systems more capable and user-friendly.

- Others: This category includes technologies like gesture control, digital instrument clusters, and advanced haptic feedback systems, which are gaining traction, particularly in luxury segments.

From a Vehicle Type perspective:

- Luxury Passenger Cars: These vehicles have consistently been early adopters of cutting-edge HMI technologies, setting trends for the broader market. Features like large OLED displays, advanced AR HUDs, and personalized AI assistants are standard in this segment.

- Mid-Price Passenger Cars: This segment is experiencing significant growth in HMI adoption as automakers democratize advanced features, making them more accessible to a wider consumer base.

- Economy Passenger Cars: While historically lagging, economy cars are increasingly incorporating essential HMI functionalities, driven by consumer demand and competitive pressures. This segment presents a substantial untapped opportunity for cost-effective, yet feature-rich HMI solutions.

The dominance of central displays is underscored by their presence in over 90% of new vehicles in 2025, while AR HUD penetration is expected to grow from approximately 15% in 2025 to over 50% by 2033. The luxury segment alone accounted for nearly 35% of the total Automotive HMI market revenue in 2025.

Automotive HMI Market Product Analysis

The Automotive HMI market is characterized by rapid product innovation focused on enhancing user experience, safety, and connectivity. Key product advancements include the development of larger, higher-resolution central displays with superior touch sensitivity and improved graphical interfaces. Augmented Reality Heads-Up Displays (AR HUDs) are a significant innovation, projecting navigation, speed, and ADAS alerts directly onto the windshield, offering unparalleled driver awareness. Voice control systems are evolving from basic command recognition to sophisticated natural language understanding, enabling more intuitive interaction with vehicle functions. Furthermore, the integration of AI and machine learning is enabling personalized HMI experiences, adapting to individual driver preferences and habits. Competitive advantages lie in seamless integration with existing vehicle systems, robust cybersecurity features, and the ability to deliver over-the-air (OTA) software updates.

Key Drivers, Barriers & Challenges in Automotive HMI Market

Key Drivers: The primary forces propelling the Automotive HMI Market are technological advancements, notably the integration of AI, AR, and sophisticated infotainment systems. The increasing consumer demand for intuitive, connected, and personalized in-car experiences is a significant economic driver. Furthermore, government regulations promoting driver safety and reducing distraction, such as those mandating advanced driver-assistance systems (ADAS) with clear visual interfaces, are critical policy-driven factors. For example, the push for ADAS has directly led to increased demand for sophisticated HUDs and central display functionalities.

Challenges and Restraints: Key challenges include the high cost of developing and integrating advanced HMI technologies, particularly for mass-market vehicles. Supply chain complexities, especially for specialized semiconductor components, can lead to production delays and increased costs. Regulatory hurdles related to driver distraction and cybersecurity are also significant, requiring continuous adaptation and robust solutions. Competitive pressures from both established players and emerging tech companies drive innovation but also lead to market fragmentation and potential price erosion. Quantifiable impacts include an estimated 5-10% increase in vehicle manufacturing costs attributed to advanced HMI integration.

Growth Drivers in the Automotive HMI Market Market

The Automotive HMI Market is propelled by several key growth drivers. Technologically, the exponential advancement in AI, machine learning, and augmented reality is enabling more intuitive, personalized, and safer interfaces. Economically, rising consumer expectations for seamless connectivity and sophisticated digital experiences within vehicles are creating strong demand across all vehicle segments. Regulatory landscapes are also playing a crucial role, with governments increasingly mandating features that enhance driver safety and reduce distraction, thereby necessitating advanced HMI solutions. The transition towards electric vehicles (EVs) and autonomous driving further fuels this growth, as these technologies rely heavily on sophisticated and user-friendly HMI systems for their operation and user interaction.

Challenges Impacting Automotive HMI Market Growth

Several challenges can impact the growth of the Automotive HMI Market. Regulatory complexities surrounding driver distraction and data privacy require constant vigilance and adherence to evolving standards. Supply chain disruptions, particularly for critical electronic components, can lead to production delays and increased manufacturing costs. Intense competitive pressures from both traditional Tier-1 suppliers and agile technology companies necessitate continuous innovation and cost optimization, potentially leading to price erosion. Furthermore, the high development costs associated with cutting-edge HMI technologies can pose a barrier to adoption, especially in the cost-sensitive segments of the automotive market. Ensuring the cybersecurity of connected HMI systems against evolving threats is another paramount concern, requiring substantial investment in robust security protocols.

Key Players Shaping the Automotive HMI Market Market

- Clarion Co Ltd

- Visteon Corporation

- Synaptic Incorporated

- Magnetic Marelli S P A

- Continental AG

- Harman International Industries

- Altran Technologie

- Luxoft Technology

- Valeo SA

- Alpine Electronics

Significant Automotive HMI Market Industry Milestones

- 2020: Increased focus on touchless interaction and gesture control technologies due to global health concerns.

- 2021: Major automakers begin integrating advanced AI-powered voice assistants into their vehicle lineups.

- 2022: Significant advancements in Augmented Reality (AR) Heads-Up Display (HUD) technology showcased at major automotive tech expos.

- 2023: Growing adoption of personalized HMI settings linked to driver biometrics and smartphone integration.

- 2024: Enhanced cybersecurity measures become a critical selling point for new vehicle HMI systems.

Future Outlook for Automotive HMI Market Market

The future outlook for the Automotive HMI Market is exceptionally promising, driven by several key growth catalysts. The continued evolution of autonomous driving technology will necessitate increasingly sophisticated and intuitive HMIs for seamless interaction and driver oversight. The pervasive integration of AI and machine learning will lead to highly personalized and predictive user experiences, anticipating driver needs and optimizing vehicle functions. The expansion of connectivity features, including 5G integration, will enable real-time data exchange and enhanced infotainment capabilities. Strategic opportunities lie in developing unified HMI platforms that can adapt across various vehicle types and software generations, offering a consistent yet customizable user experience. The market is poised for substantial growth, with emerging trends like in-car gaming and advanced digital assistants further shaping its trajectory.

Automotive HMI Market Segmentation

-

1. Product Type

- 1.1. Voice Control System

- 1.2. Central Displays

- 1.3. Heads-Up Display

- 1.4. Others

-

2. Vehicle Type

- 2.1. Economy Passenger Cars

- 2.2. Mid-Price Passenger Cars

- 2.3. Luxury Passenger Cars

Automotive HMI Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Brazil

- 4.2. Mexico

- 4.3. United Arab Emirates

- 4.4. Other Countries

Automotive HMI Market Regional Market Share

Geographic Coverage of Automotive HMI Market

Automotive HMI Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand of Electric Vehicles Is Likely To Drive The Market Growth

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Labors Is Anticipated To Restrain The market Growth

- 3.4. Market Trends

- 3.4.1. High cost of Installation is Likely to Hinder the Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive HMI Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Voice Control System

- 5.1.2. Central Displays

- 5.1.3. Heads-Up Display

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Economy Passenger Cars

- 5.2.2. Mid-Price Passenger Cars

- 5.2.3. Luxury Passenger Cars

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Automotive HMI Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Voice Control System

- 6.1.2. Central Displays

- 6.1.3. Heads-Up Display

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.2.1. Economy Passenger Cars

- 6.2.2. Mid-Price Passenger Cars

- 6.2.3. Luxury Passenger Cars

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Automotive HMI Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Voice Control System

- 7.1.2. Central Displays

- 7.1.3. Heads-Up Display

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.2.1. Economy Passenger Cars

- 7.2.2. Mid-Price Passenger Cars

- 7.2.3. Luxury Passenger Cars

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Automotive HMI Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Voice Control System

- 8.1.2. Central Displays

- 8.1.3. Heads-Up Display

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.2.1. Economy Passenger Cars

- 8.2.2. Mid-Price Passenger Cars

- 8.2.3. Luxury Passenger Cars

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of the World Automotive HMI Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Voice Control System

- 9.1.2. Central Displays

- 9.1.3. Heads-Up Display

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.2.1. Economy Passenger Cars

- 9.2.2. Mid-Price Passenger Cars

- 9.2.3. Luxury Passenger Cars

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Clarion Co Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Visteon Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Synaptic Incorporated

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Magnetic Marelli S P A

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Continental AG

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Harman International Industries

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Altran Technologie

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Luxoft Technology

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Valeo SA

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Alpine Electronics

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Clarion Co Ltd

List of Figures

- Figure 1: Global Automotive HMI Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Automotive HMI Market Revenue (billion), by Product Type 2025 & 2033

- Figure 3: North America Automotive HMI Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Automotive HMI Market Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 5: North America Automotive HMI Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 6: North America Automotive HMI Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Automotive HMI Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Automotive HMI Market Revenue (billion), by Product Type 2025 & 2033

- Figure 9: Europe Automotive HMI Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Automotive HMI Market Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 11: Europe Automotive HMI Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 12: Europe Automotive HMI Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Automotive HMI Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Automotive HMI Market Revenue (billion), by Product Type 2025 & 2033

- Figure 15: Asia Pacific Automotive HMI Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Pacific Automotive HMI Market Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 17: Asia Pacific Automotive HMI Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 18: Asia Pacific Automotive HMI Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Automotive HMI Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Automotive HMI Market Revenue (billion), by Product Type 2025 & 2033

- Figure 21: Rest of the World Automotive HMI Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Rest of the World Automotive HMI Market Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 23: Rest of the World Automotive HMI Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 24: Rest of the World Automotive HMI Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Rest of the World Automotive HMI Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive HMI Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Automotive HMI Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 3: Global Automotive HMI Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Automotive HMI Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: Global Automotive HMI Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 6: Global Automotive HMI Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Automotive HMI Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Automotive HMI Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Rest of North America Automotive HMI Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Automotive HMI Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 11: Global Automotive HMI Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 12: Global Automotive HMI Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Germany Automotive HMI Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Automotive HMI Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: France Automotive HMI Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Automotive HMI Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Global Automotive HMI Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 18: Global Automotive HMI Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 19: Global Automotive HMI Market Revenue billion Forecast, by Country 2020 & 2033

- Table 20: India Automotive HMI Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: China Automotive HMI Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Japan Automotive HMI Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: South Korea Automotive HMI Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Automotive HMI Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Global Automotive HMI Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 26: Global Automotive HMI Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 27: Global Automotive HMI Market Revenue billion Forecast, by Country 2020 & 2033

- Table 28: Brazil Automotive HMI Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Mexico Automotive HMI Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: United Arab Emirates Automotive HMI Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Other Countries Automotive HMI Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive HMI Market?

The projected CAGR is approximately 10.6%.

2. Which companies are prominent players in the Automotive HMI Market?

Key companies in the market include Clarion Co Ltd, Visteon Corporation, Synaptic Incorporated, Magnetic Marelli S P A, Continental AG, Harman International Industries, Altran Technologie, Luxoft Technology, Valeo SA, Alpine Electronics.

3. What are the main segments of the Automotive HMI Market?

The market segments include Product Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 25.5 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand of Electric Vehicles Is Likely To Drive The Market Growth.

6. What are the notable trends driving market growth?

High cost of Installation is Likely to Hinder the Growth.

7. Are there any restraints impacting market growth?

Lack of Skilled Labors Is Anticipated To Restrain The market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive HMI Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive HMI Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive HMI Market?

To stay informed about further developments, trends, and reports in the Automotive HMI Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence