Key Insights

The United States Electro-Hydraulic Power Steering (EHPS) market is poised for substantial growth, projected to reach an estimated XX million by 2025. This expansion is driven by the increasing adoption of advanced driver-assistance systems (ADAS) and the overarching trend towards vehicle electrification. EHPS technology offers a compelling blend of efficiency and performance, bridging the gap between traditional hydraulic systems and fully electric power steering (EPS). Its ability to provide precise steering control, reduce fuel consumption compared to purely hydraulic systems, and integrate seamlessly with sophisticated electronic control units makes it an attractive option for both passenger and commercial vehicle manufacturers. Key industry players are heavily investing in research and development to enhance EHPS capabilities, focusing on improved responsiveness, reduced energy consumption, and enhanced safety features, all of which will contribute to the market's upward trajectory.

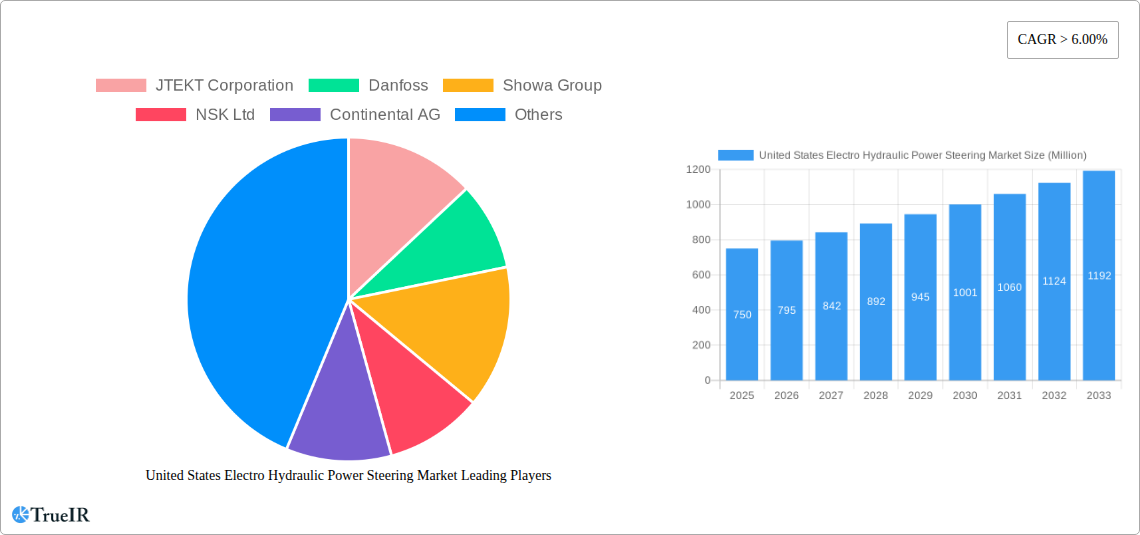

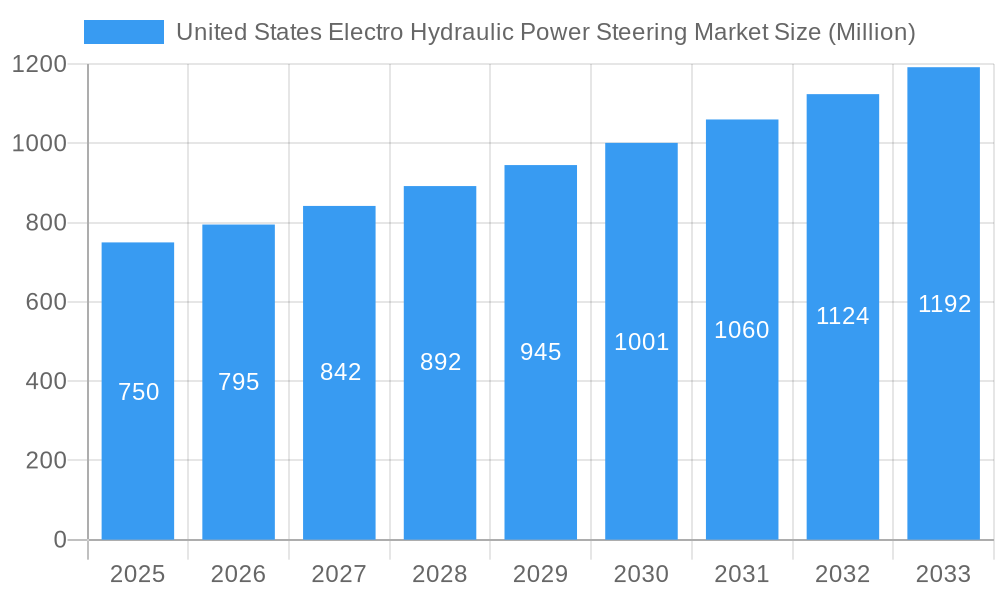

United States Electro Hydraulic Power Steering Market Market Size (In Million)

The market's robust growth, with a Compound Annual Growth Rate (CAGR) exceeding 6.00% during the forecast period of 2025-2033, is further fueled by stringent fuel efficiency regulations and the growing demand for more comfortable and safer driving experiences. While the shift towards fully electric power steering (EPS) presents a competitive dynamic, EHPS continues to hold its ground, particularly in applications where its robust performance and familiarity are valued. The market is segmented by vehicle type, with passenger vehicles expected to be the largest segment, and by component type, with steering motors and sensors being critical drivers. Geographically, the United States represents a significant market due to its large automotive production base and consumer preference for advanced automotive technologies. This sustained demand, coupled with ongoing innovation, positions the US EHPS market for a dynamic and prosperous future.

United States Electro Hydraulic Power Steering Market Company Market Share

United States Electro Hydraulic Power Steering Market: Comprehensive Market Analysis and Future Outlook (2019-2033)

This in-depth report provides a dynamic, SEO-optimized analysis of the United States Electro Hydraulic Power Steering (EHPS) market. Leveraging high-volume keywords and detailed segment breakdowns, this report offers critical insights for industry stakeholders, automotive manufacturers, component suppliers, and investors. Our comprehensive study spans the historical period of 2019-2024, a base year of 2025, and a robust forecast period extending to 2033. Discover market size projections, technological advancements, competitive landscapes, and the key drivers shaping the future of EHPS technology in the US.

United States Electro Hydraulic Power Steering Market Market Structure & Competitive Landscape

The United States Electro Hydraulic Power Steering (EHPS) market is characterized by a moderately concentrated structure, with a few dominant players holding significant market share. Key innovation drivers revolve around advancements in sensor technology, motor efficiency, and integration with advanced driver-assistance systems (ADAS). Regulatory impacts, particularly those related to vehicle safety and emissions, continue to influence product development and adoption. Product substitutes, such as fully electric power steering (EPS), present a growing competitive challenge, pushing EHPS manufacturers to enhance their offerings in terms of performance, fuel efficiency, and cost-effectiveness. End-user segmentation primarily focuses on passenger vehicles, which account for the majority of EHPS installations due to their widespread adoption and demand for enhanced driving comfort and maneuverability. Commercial vehicles, while representing a smaller segment, are increasingly incorporating EHPS for improved handling of heavier loads and operational efficiency. Merger and acquisition (M&A) trends within the automotive component sector are likely to continue, impacting market consolidation and fostering synergistic collaborations. For instance, the recent acquisition activity in the autonomous driving technology space suggests a potential for EHPS manufacturers to integrate their systems with these emerging platforms. The concentration ratio is estimated to be around 65% for the top five players in the base year 2025. M&A volumes are projected to average 2 transactions per year during the forecast period, indicating a dynamic and evolving competitive environment.

United States Electro Hydraulic Power Steering Market Market Trends & Opportunities

The United States Electro Hydraulic Power Steering (EHPS) market is poised for significant expansion, driven by evolving automotive trends and technological innovation. The market size is projected to grow from an estimated $3,500 million in 2025 to a substantial $7,800 million by 2033, reflecting a Compound Annual Growth Rate (CAGR) of approximately 10.5% during the forecast period (2025-2033). This growth is underpinned by several key technological shifts. The increasing integration of ADAS features, such as lane-keeping assist and automated parking, necessitates more precise and responsive steering systems, a domain where EHPS technology offers advantages in terms of feedback and control. Consumer preferences are also shifting towards vehicles that offer enhanced driving comfort, improved fuel efficiency, and a more engaging driving experience. EHPS systems contribute to these preferences by providing variable steering effort, reducing driver fatigue, and optimizing energy consumption compared to traditional hydraulic power steering.

The competitive dynamics within the EHPS market are intensifying as established automotive suppliers invest heavily in research and development to refine EHPS performance and cost-competitiveness. While fully Electric Power Steering (EPS) systems continue to gain traction due to their inherent energy efficiency and simpler architecture, EHPS systems maintain a strong position in certain vehicle segments and applications where their specific characteristics are highly valued. Opportunities for market penetration are emerging in the development of more compact and lightweight EHPS units, as well as in systems that offer advanced diagnostic capabilities and predictive maintenance features. Furthermore, the growing demand for electric and hybrid vehicles presents a unique opportunity for EHPS manufacturers to adapt their technologies to these powertrains, ensuring continued relevance and market share. The market penetration rate for EHPS in new passenger vehicles is expected to reach 45% by 2033, indicating a steady but significant adoption. Innovations in variable fluid flow control and advanced motor management algorithms are crucial for optimizing EHPS performance and energy efficiency, further enhancing its competitive edge. The development of integrated EHPS units that combine steering and braking functionalities is also an area of significant future opportunity.

Dominant Markets & Segments in United States Electro Hydraulic Power Steering Market

Within the United States Electro Hydraulic Power Steering (EHPS) market, Passenger Vehicles emerge as the dominant segment, accounting for an estimated 75% of the total market revenue in the base year 2025. This dominance is fueled by several key growth drivers. The sheer volume of passenger vehicle production and sales in the US significantly outweighs that of commercial vehicles. Moreover, consumer demand for enhanced driving comfort, maneuverability, and the integration of advanced driver-assistance systems (ADAS) directly benefits EHPS technology, which offers superior responsiveness and variable assistance compared to traditional hydraulic systems. The increasing adoption of electric vehicles (EVs) and hybrid electric vehicles (HEVs) also presents a significant opportunity for EHPS, as manufacturers seek to optimize power delivery and reduce parasitic losses, making EHPS a viable alternative to fully electric power steering in certain applications. Policies promoting vehicle safety and fuel efficiency indirectly support the adoption of EHPS, as these systems contribute to both.

In terms of Component Type, the Steering Motor segment is anticipated to be the largest and fastest-growing, representing approximately 50% of the EHPS market value in 2025 and projected to grow at a CAGR of 11.2% during the forecast period. This is directly attributable to the core function of the EHPS system, where the electric motor drives the hydraulic pump. Advancements in motor efficiency, power density, and reliability are critical for enhancing EHPS performance and reducing energy consumption. The Sensors segment, projected to account for 30% of the market in 2025, is also experiencing robust growth due to the increasing complexity of ADAS and the need for precise feedback on steering angle, torque, and vehicle speed. Innovations in sensor accuracy, durability, and cost-effectiveness are crucial. The Other Components segment, encompassing hydraulic pumps, control units, and fluid reservoirs, will constitute the remaining 20% of the market in 2025, with steady growth driven by the overall expansion of the EHPS market. The dominance of the passenger vehicle segment is further reinforced by the fact that the majority of advanced ADAS features are first introduced and widely adopted in this category. Infrastructure development supporting automotive manufacturing and technological innovation also plays a crucial role in bolstering the growth of these dominant segments.

United States Electro Hydraulic Power Steering Market Product Analysis

The United States Electro Hydraulic Power Steering (EHPS) market is witnessing continuous product innovation focused on enhancing performance, efficiency, and integration capabilities. Key advancements include the development of more compact and lightweight EHPS units, reducing overall vehicle weight and improving fuel economy. Manufacturers are also investing in more sophisticated motor control algorithms that optimize power delivery, providing a more refined and responsive steering feel. The integration of EHPS with advanced driver-assistance systems (ADAS) is a major competitive advantage, enabling features like automated parking and lane-keeping assist with greater precision. These technological leaps offer manufacturers a compelling solution that balances the benefits of hydraulic power with the efficiency and control of electric systems.

Key Drivers, Barriers & Challenges in United States Electro Hydraulic Power Steering Market

The United States Electro Hydraulic Power Steering (EHPS) market is propelled by several key drivers, primarily the increasing demand for advanced driver-assistance systems (ADAS) that necessitate precise steering control. The ongoing trend towards improved fuel efficiency and reduced emissions also favors EHPS technology over traditional hydraulic systems. Consumer preference for enhanced driving comfort and maneuverability, especially in urban environments, further fuels adoption.

However, the market faces significant challenges. The primary restraint is the growing popularity and cost-effectiveness of fully Electric Power Steering (EPS) systems, which offer simpler integration and potentially higher energy savings in certain applications. Supply chain disruptions for critical electronic components and raw materials can impact production volumes and costs. Regulatory hurdles related to evolving safety standards and emissions targets, while generally driving innovation, can also present compliance challenges and increase development timelines. The competitive pressure from established EPS manufacturers and the need for continuous investment in R&D to maintain technological parity are also significant challenges.

Growth Drivers in the United States Electro Hydraulic Power Steering Market Market

Key growth drivers in the United States Electro Hydraulic Power Steering (EHPS) market are intrinsically linked to the automotive industry's evolution. The pervasive integration of Advanced Driver-Assistance Systems (ADAS) is a significant catalyst, as EHPS systems provide the necessary precision and feedback for functionalities like lane-keeping assist and automated parking. The persistent drive for improved fuel economy and reduced CO2 emissions continues to push manufacturers towards more efficient steering solutions, where EHPS offers an advantage over traditional hydraulic systems. Furthermore, evolving consumer expectations for a refined and comfortable driving experience, characterized by effortless yet responsive steering, directly supports EHPS adoption. Government policies promoting vehicle safety and electrification indirectly bolster the market by encouraging the development and implementation of advanced automotive technologies.

Challenges Impacting United States Electro Hydraulic Power Steering Market Growth

Several barriers and restraints are impacting the growth trajectory of the United States Electro Hydraulic Power Steering (EHPS) market. The most prominent challenge stems from the robust and increasing market share of fully Electric Power Steering (EPS) systems, which often present a simpler integration path and potentially greater energy efficiency in a wider range of applications. Supply chain vulnerabilities, particularly for crucial electronic components and specialized raw materials, can lead to production delays and cost escalations, impacting the overall competitiveness of EHPS. Stringent regulatory complexities surrounding evolving vehicle safety standards and emission mandates can necessitate significant investment in R&D and extended product development cycles. Intense competitive pressures from established EPS manufacturers and the constant need for technological innovation to maintain relevance in a rapidly advancing automotive landscape also pose significant challenges.

Key Players Shaping the United States Electro Hydraulic Power Steering Market Market

- JTEKT Corporation

- Danfoss

- Showa Group

- NSK Ltd

- Continental AG

- Nexteer Automotive

- Robert Bosch GmbH

- Thyssenkrupp Presta AG

- Mando Corporation

- ZF Friedrichshafen AG

Significant United States Electro Hydraulic Power Steering Market Industry Milestones

- 2021: Increased adoption of EHPS in mid-size SUVs and crossovers driven by enhanced safety features.

- 2022: Advancements in motor efficiency and control software leading to improved fuel economy in EHPS systems.

- 2023: Growing demand for EHPS in hybrid and electric vehicle platforms, focusing on regenerative braking integration.

- 2024: Increased focus on noise, vibration, and harshness (NVH) reduction in EHPS units for a quieter cabin experience.

- 2025 (Projected): Introduction of more compact EHPS designs to accommodate evolving vehicle architectures.

- 2026 (Projected): Enhanced sensor integration for more precise ADAS functionalities in EHPS systems.

- 2028 (Projected): Development of modular EHPS systems for greater adaptability across different vehicle platforms.

- 2030 (Projected): Significant advancements in EHPS power consumption, narrowing the gap with EPS in certain applications.

- 2032 (Projected): Increased integration of EHPS with advanced vehicle dynamics control systems.

- 2033 (Projected): Market maturity with refined EHPS technology offering a strong balance of performance, efficiency, and cost.

Future Outlook for United States Electro Hydraulic Power Steering Market Market

The future outlook for the United States Electro Hydraulic Power Steering (EHPS) market is characterized by continued innovation and strategic adaptation. While facing competition from EPS, EHPS technology is expected to maintain a significant presence, particularly in applications requiring robust performance and precise control. Growth will be fueled by the ongoing integration with ADAS features and the increasing demand for enhanced driving dynamics across a wider range of vehicles. Opportunities lie in developing more energy-efficient EHPS units, miniaturized designs to fit evolving vehicle architectures, and integrated systems that offer advanced functionalities. The market will likely see increased collaboration between EHPS manufacturers and ADAS technology providers to deliver seamless and intelligent steering solutions. The overall market size is projected to reach approximately $7,800 million by 2033, indicating sustained demand and technological evolution.

United States Electro Hydraulic Power Steering Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Vehicles

- 1.2. Commercial Vehicles

-

2. Component Type

- 2.1. Steering Motor

- 2.2. Sensors

- 2.3. Other Components

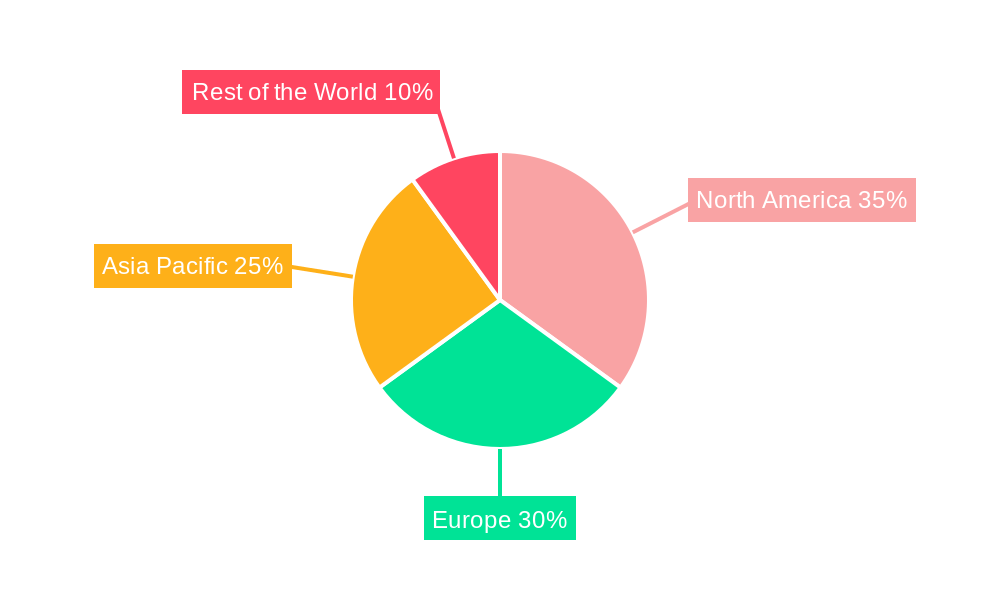

United States Electro Hydraulic Power Steering Market Segmentation By Geography

- 1. United States

United States Electro Hydraulic Power Steering Market Regional Market Share

Geographic Coverage of United States Electro Hydraulic Power Steering Market

United States Electro Hydraulic Power Steering Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 6.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising EV Sales to Fuel Automotive PCB Demand

- 3.3. Market Restrains

- 3.3.1. Complex Design and Integration Challenges

- 3.4. Market Trends

- 3.4.1. Advancements in Electric Power Steering (EPS) Technology Phasing Out the Electro-Hydraulic System

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Electro Hydraulic Power Steering Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Vehicles

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Component Type

- 5.2.1. Steering Motor

- 5.2.2. Sensors

- 5.2.3. Other Components

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 JTEKT Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Danfoss

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Showa Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 NSK Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Continental AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nexteer Automotive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Robert Bosch GmbH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Thyssenkrupp Presta AG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mando Corporatio

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ZF Friedrichshafen AG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 JTEKT Corporation

List of Figures

- Figure 1: United States Electro Hydraulic Power Steering Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Electro Hydraulic Power Steering Market Share (%) by Company 2025

List of Tables

- Table 1: United States Electro Hydraulic Power Steering Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: United States Electro Hydraulic Power Steering Market Revenue Million Forecast, by Component Type 2020 & 2033

- Table 3: United States Electro Hydraulic Power Steering Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: United States Electro Hydraulic Power Steering Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 5: United States Electro Hydraulic Power Steering Market Revenue Million Forecast, by Component Type 2020 & 2033

- Table 6: United States Electro Hydraulic Power Steering Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Electro Hydraulic Power Steering Market?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the United States Electro Hydraulic Power Steering Market?

Key companies in the market include JTEKT Corporation, Danfoss, Showa Group, NSK Ltd, Continental AG, Nexteer Automotive, Robert Bosch GmbH, Thyssenkrupp Presta AG, Mando Corporatio, ZF Friedrichshafen AG.

3. What are the main segments of the United States Electro Hydraulic Power Steering Market?

The market segments include Vehicle Type, Component Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising EV Sales to Fuel Automotive PCB Demand.

6. What are the notable trends driving market growth?

Advancements in Electric Power Steering (EPS) Technology Phasing Out the Electro-Hydraulic System.

7. Are there any restraints impacting market growth?

Complex Design and Integration Challenges.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Electro Hydraulic Power Steering Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Electro Hydraulic Power Steering Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Electro Hydraulic Power Steering Market?

To stay informed about further developments, trends, and reports in the United States Electro Hydraulic Power Steering Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence