Key Insights

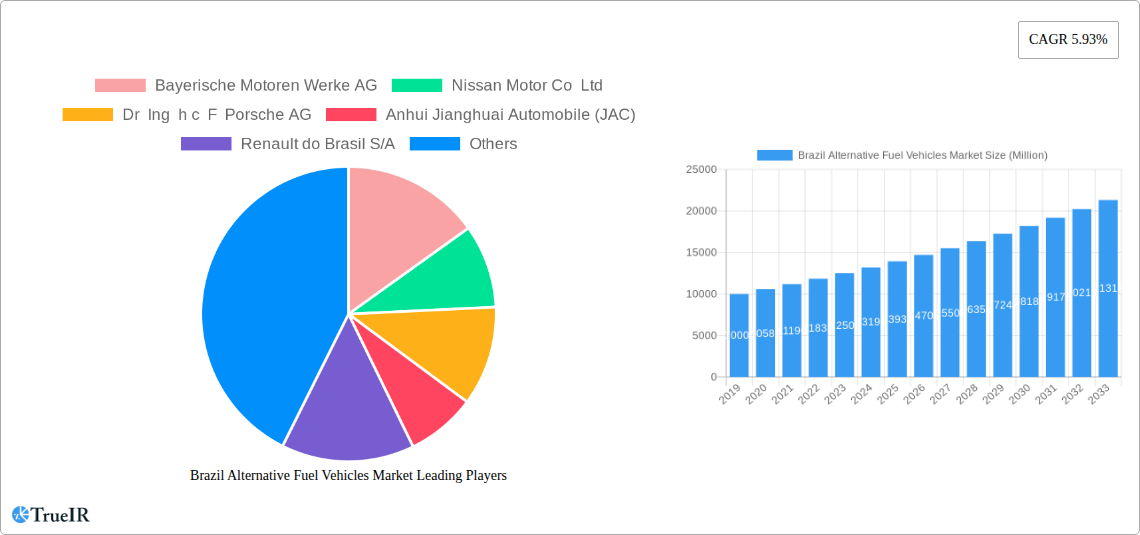

The Brazilian alternative fuel vehicle market is projected to experience substantial growth, reaching a market size of $21.25 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 3.14% through 2033. This expansion is driven by government incentives, favorable policies for emissions reduction, and increasing consumer demand for sustainable transportation. Stricter environmental regulations are accelerating R&D in cleaner powertrains, while heightened environmental awareness encourages adoption of alternatives. Technological advancements in battery technology and expanding charging infrastructure are also key growth drivers, alongside the increasing adoption of hybrid vehicles as a transitional solution.

Brazil Alternative Fuel Vehicles Market Market Size (In Billion)

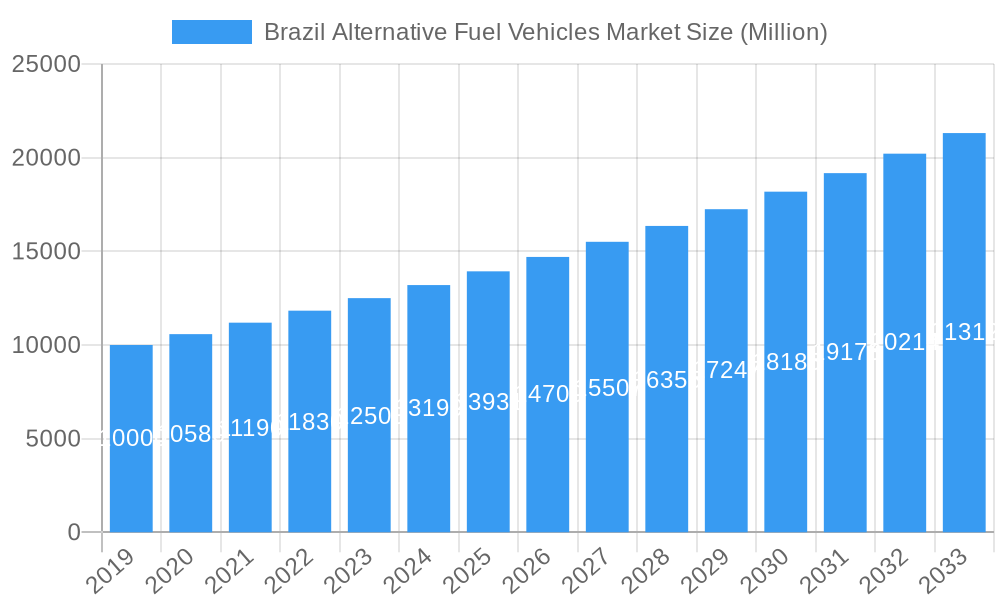

The market segmentation highlights key segments. Commercial vehicles, including buses, heavy-duty trucks, and light commercial vehicles, are anticipated to dominate due to fleet electrification driven by operational cost savings and corporate sustainability targets. Two-wheelers also represent a rapidly growing segment, particularly in urban areas, due to affordability and maneuverability. Battery Electric Vehicles (BEVs) are expected to lead the fuel category, supported by declining battery costs and improved performance. Hybrid Electric Vehicles (HEVs) and Plug-in Hybrid Electric Vehicles (PHEVs) will maintain significant market share, offering consumers a balance. Fuel Cell Electric Vehicles (FCEVs) show long-term potential as hydrogen infrastructure develops. Major automotive manufacturers, including Bayerische Motoren Werke AG, Nissan Motor Co Ltd, BYD Auto Co Ltd, and Toyota Motor Corporation, are actively investing and launching alternative fuel models for the Brazilian market, indicating strong industry commitment.

Brazil Alternative Fuel Vehicles Market Company Market Share

Brazil Alternative Fuel Vehicles Market: Comprehensive Growth Analysis and Future Outlook (2019–2033)

Report Description:

Dive deep into the burgeoning Brazil Alternative Fuel Vehicles Market with our in-depth report, meticulously crafted for industry stakeholders seeking strategic insights. This comprehensive analysis, spanning the study period 2019–2033, with a base year of 2025, provides an unparalleled understanding of market dynamics, technological advancements, and future trajectories. We dissect the intricate landscape of electric vehicles (EVs), hybrid electric vehicles (HEVs), plug-in hybrid electric vehicles (PHEVs), and fuel cell electric vehicles (FCEVs) within Brazil's diverse automotive sector. Our report leverages high-volume keywords such as "Brazil electric car market," "alternative fuel vehicles Brazil," "EV adoption Brazil," "sustainable mobility Brazil," and "Brazilian automotive industry trends" to ensure maximum search visibility and engagement.

This report empowers you with actionable intelligence on market size, growth drivers, competitive strategies, and emerging opportunities. We cover a wide spectrum of vehicle types, including Commercial Vehicles (Buses, Heavy-duty Commercial Trucks, Light Commercial Pick-up Trucks, Light Commercial Vans, Medium-duty Commercial Trucks) and Two-Wheelers, alongside a granular breakdown of fuel categories. Explore innovation drivers, regulatory impacts, product substitutes, end-user segmentation, and M&A trends. Gain clarity on the market structure, competitive landscape, dominant markets, key players, and future outlook of Brazil's rapidly evolving alternative fuel vehicle ecosystem.

Brazil Alternative Fuel Vehicles Market Market Structure & Competitive Landscape

The Brazil Alternative Fuel Vehicles Market is characterized by a dynamic interplay of established automotive giants and emerging EV manufacturers, reflecting a moderate to high level of market concentration. Innovation is primarily driven by advancements in battery technology, charging infrastructure development, and government incentives aimed at promoting sustainable transportation. The regulatory environment, though evolving, plays a crucial role in shaping market dynamics, with policies encouraging local production and the adoption of cleaner fuels. Product substitutes, such as flex-fuel vehicles, continue to pose a challenge, necessitating continuous innovation and cost-effectiveness in alternative fuel offerings. End-user segmentation reveals a growing demand from both individual consumers seeking fuel efficiency and environmental benefits, and commercial entities aiming to reduce operational costs and meet corporate sustainability goals. Mergers and acquisitions (M&A) trends are anticipated to accelerate as larger players consolidate their positions and new entrants seek strategic partnerships. For instance, a notable trend involves legacy automakers investing in EV startups or acquiring advanced battery technologies. Quantitative insights indicate an increasing number of strategic alliances aimed at scaling production and expanding distribution networks. The market is poised for significant transformation as global trends in electrification and decarbonization gain momentum in Brazil.

Brazil Alternative Fuel Vehicles Market Market Trends & Opportunities

The Brazil Alternative Fuel Vehicles Market is experiencing a period of accelerated growth, driven by a confluence of economic, technological, and policy-driven factors. The market size is projected to witness a significant upward trajectory, with an estimated Compound Annual Growth Rate (CAGR) that reflects the increasing consumer and industry adoption of electric and hybrid vehicles. Technological shifts are at the forefront, with continuous improvements in battery energy density, charging speeds, and vehicle efficiency making alternative fuel vehicles more practical and appealing to a wider audience. This includes advancements in battery management systems and the integration of smart technologies for enhanced user experience. Consumer preferences are demonstrably shifting towards eco-friendly and cost-effective mobility solutions, fueled by rising fuel prices and growing environmental consciousness. The desire for lower running costs, reduced emissions, and access to emerging urban charging infrastructure are key motivators. Competitive dynamics are intensifying, with both domestic and international manufacturers vying for market share. This competition is fostering innovation and driving down prices, making alternative fuel vehicles more accessible. Opportunities abound in the development of charging infrastructure, the expansion of battery recycling initiatives, and the localization of EV component manufacturing. The increasing penetration rate of HEVs and PHEVs, which offer a transitional pathway to full electrification, is particularly noteworthy. Furthermore, the robust growth of the commercial vehicle segment, driven by logistics and public transportation needs, presents substantial market expansion potential. The Brazilian government's commitment to sustainability, coupled with the private sector's investment in green technologies, is creating a fertile ground for sustained market growth and innovation in the coming years.

Dominant Markets & Segments in Brazil Alternative Fuel Vehicles Market

The Brazil Alternative Fuel Vehicles Market exhibits a strong and growing dominance within the Commercial Vehicles segment, particularly in Buses and Light Commercial Vans. This dominance is propelled by a combination of factors crucial for sustainable urban development and efficient logistics.

- Buses: The demand for electric buses is escalating, driven by municipal governments seeking to reduce air pollution in urban centers and decrease operational costs for public transportation fleets. Government subsidies, international funding for green transportation projects, and the long-term cost savings associated with electric powertrains are key growth drivers. Cities like São Paulo and Rio de Janeiro are at the forefront of this transition, investing heavily in electric bus fleets.

- Light Commercial Vans: As e-commerce continues to expand, the need for efficient and eco-friendly last-mile delivery solutions has surged. Light commercial vans equipped with electric powertrains offer lower running costs, quieter operation, and reduced emissions, making them highly attractive to logistics companies. The growing urban density and the push for emission-free zones in major cities further bolster this segment's dominance.

- Two-Wheelers: While still a nascent segment compared to commercial vehicles, the Two-Wheelers category, particularly electric scooters and motorcycles, is experiencing rapid growth. This is fueled by urban mobility needs, affordability, and a younger demographic's inclination towards sustainable and technologically advanced personal transport. Government initiatives promoting electric two-wheeler adoption and the increasing availability of charging points are significant catalysts.

Regarding Fuel Categories, Hybrid Electric Vehicles (HEVs) currently hold a significant market share due to their transitional appeal, offering improved fuel efficiency without the range anxiety associated with Battery Electric Vehicles (BEVs). However, Battery Electric Vehicles (BEVs) are projected to witness the most substantial growth in the coming years, driven by advancements in battery technology, decreasing battery costs, and the expansion of charging infrastructure. The increasing availability of BEV models across different vehicle types and price points is a critical factor in their rising market penetration. Plug-in Hybrid Electric Vehicles (PHEVs) also play a crucial role, offering a balance between electric and internal combustion power, catering to a wider range of consumer needs. While Fuel Cell Electric Vehicles (FCEVs) are still in the early stages of development and deployment in Brazil, their potential for zero-emission mobility in heavy-duty applications warrants attention for future market development. The interplay of these vehicle types and fuel categories, within the dominant commercial vehicle segment, will define the future trajectory of Brazil's alternative fuel vehicle market.

Brazil Alternative Fuel Vehicles Market Product Analysis

Product innovations in the Brazil Alternative Fuel Vehicles Market are predominantly focused on enhancing battery performance, extending driving range, and accelerating charging times. Manufacturers are introducing new models with improved energy efficiency and advanced driver-assistance systems (ADAS). The integration of smart connectivity features, intuitive infotainment systems, and sustainable interior materials further enhances the market appeal of alternative fuel vehicles. Competitive advantages are being carved out through unique design aesthetics, superior performance metrics, and comprehensive warranty packages. The development of diverse vehicle types, from compact city cars to robust commercial trucks, caters to a broad spectrum of consumer and business needs, ensuring market fit and driving adoption.

Key Drivers, Barriers & Challenges in Brazil Alternative Fuel Vehicles Market

Key Drivers: The Brazil Alternative Fuel Vehicles Market is propelled by a confluence of strong growth drivers. Government incentives and favorable policies, such as tax reductions and subsidies for EV purchases and manufacturing, are crucial in driving adoption. Rising fuel prices make the lower running costs of electric vehicles increasingly attractive to consumers and businesses. Growing environmental awareness and concerns about air quality are pushing individuals and corporations towards sustainable mobility solutions. Technological advancements in battery technology, leading to longer ranges and faster charging, are addressing key consumer anxieties. Furthermore, the expansion of charging infrastructure, though still developing, is steadily improving the practicality of EV ownership. The increasing commitment from global automakers to electrify their fleets and introduce new models specifically for the Brazilian market also acts as a significant catalyst.

Barriers & Challenges: Despite the positive momentum, several barriers and challenges impede the rapid growth of the Brazil Alternative Fuel Vehicles Market. The high initial cost of alternative fuel vehicles compared to their internal combustion engine counterparts remains a significant deterrent for many consumers. Limited charging infrastructure, especially outside major urban centers, creates range anxiety and logistical hurdles. Supply chain complexities and the dependency on imported battery components can lead to higher costs and potential delays. Regulatory uncertainties and the lack of a consistent, long-term policy framework can create an unstable investment environment. Consumer education and awareness regarding the benefits and practicalities of alternative fuel vehicles still require significant effort. Finally, competition from established flex-fuel vehicles, which are deeply ingrained in the Brazilian automotive culture, presents a persistent challenge. The volume of sales for BEVs is still relatively low compared to the overall market, indicating the scale of these challenges.

Growth Drivers in the Brazil Alternative Fuel Vehicles Market Market

The Brazil Alternative Fuel Vehicles Market is experiencing robust growth driven by several key factors. Government initiatives and supportive policies, including tax incentives and targets for fleet electrification, are playing a pivotal role in stimulating demand and investment. The increasing volatility of fossil fuel prices makes the long-term cost savings associated with electric vehicles more appealing to consumers and commercial operators. Growing environmental consciousness and a rising demand for sustainable transportation solutions are influencing purchasing decisions. Technological advancements in battery technology, leading to improved energy density, faster charging capabilities, and reduced costs, are making EVs more practical and competitive. The expansion of charging infrastructure, supported by both public and private sector investments, is crucial in alleviating range anxiety and improving the overall user experience. The presence of global automotive manufacturers actively introducing and localizing the production of electric and hybrid models further accelerates market penetration.

Challenges Impacting Brazil Alternative Fuel Vehicles Market Growth

Several challenges continue to impact the growth trajectory of the Brazil Alternative Fuel Vehicles Market. The high upfront cost of alternative fuel vehicles remains a significant barrier for price-sensitive consumers, especially when compared to traditional internal combustion engine vehicles. The development of a comprehensive and widely accessible charging infrastructure, particularly in rural areas and smaller cities, is still a work in progress and a major concern for potential buyers. Supply chain disruptions and the reliance on imported battery components can lead to increased manufacturing costs and production delays, impacting vehicle availability. Regulatory complexities and potential policy shifts can create an uncertain investment climate for manufacturers and charging infrastructure providers. Consumer awareness and education about the benefits, maintenance, and charging procedures of alternative fuel vehicles need to be significantly enhanced to build trust and encourage adoption. The entrenched popularity of flex-fuel vehicles also presents a persistent competitive challenge.

Key Players Shaping the Brazil Alternative Fuel Vehicles Market Market

- Bayerische Motoren Werke AG

- Nissan Motor Co Ltd

- Dr Ing h c F Porsche AG

- Anhui Jianghuai Automobile (JAC)

- Renault do Brasil S/A

- Volvo Group

- BYD Auto Co Ltd

- Audi AG

- Toyota Motor Corporation

- Chery Automobile Co Ltd

Significant Brazil Alternative Fuel Vehicles Market Industry Milestones

- August 2023: BYD introduced the new all-electric BYD SEAL D-segment sedan to European consumers, signaling its expanding global EV portfolio and potential future offerings in related markets. Deliveries of the BYD SEAL will commence in Q4 2023, and final prices will be announced later.

- August 2023: Toyota Argentina announced its commitment to expanding its Conversions area, dedicated to designing and producing vehicles adapted to specific customer needs, as it begins production of the Hiace in 2024 at its plant in Zárate. This initiative highlights the growing focus on customized and specialized vehicle solutions, including those potentially incorporating alternative powertrains.

- August 2023: BYD announced its participation in the IAA Mobility 2023, showcasing 6 electric vehicles and new technologies. The company also revealed its intention to present its luxury sub-brand, DENZA, to European audiences for the first time, indicating significant investment and strategic expansion in the global EV market, with potential implications for its presence and offerings in Brazil.

Future Outlook for Brazil Alternative Fuel Vehicles Market Market

The future outlook for the Brazil Alternative Fuel Vehicles Market is exceptionally promising, characterized by sustained growth and transformative shifts. Key growth catalysts include the ongoing development and expansion of charging infrastructure, supported by government and private sector investments, which will significantly enhance the practicality of EV ownership. Continued advancements in battery technology, leading to higher energy densities, faster charging, and reduced costs, will further drive down the total cost of ownership and make EVs more competitive. Government policies, such as evolving tax incentives, stricter emissions regulations, and the promotion of local manufacturing, are expected to create a more favorable ecosystem for alternative fuel vehicles. The increasing product portfolio from both global and emerging manufacturers, offering a wider variety of electric and hybrid models across different segments and price points, will cater to a broader consumer base. Opportunities in fleet electrification for logistics and public transportation will continue to be a major growth engine. The market is poised to witness a substantial increase in market penetration for BEVs and HEVs, solidifying Brazil's position as a significant player in the global sustainable mobility landscape.

Brazil Alternative Fuel Vehicles Market Segmentation

-

1. Vehicle Type

-

1.1. Commercial Vehicles

- 1.1.1. Buses

- 1.1.2. Heavy-duty Commercial Trucks

- 1.1.3. Light Commercial Pick-up Trucks

- 1.1.4. Light Commercial Vans

- 1.1.5. Medium-duty Commercial Trucks

- 1.2. Two-Wheelers

-

1.1. Commercial Vehicles

-

2. Fuel Category

- 2.1. BEV

- 2.2. FCEV

- 2.3. HEV

- 2.4. PHEV

Brazil Alternative Fuel Vehicles Market Segmentation By Geography

- 1. Brazil

Brazil Alternative Fuel Vehicles Market Regional Market Share

Geographic Coverage of Brazil Alternative Fuel Vehicles Market

Brazil Alternative Fuel Vehicles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.14% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasingly Focused On Reducing Vehicle Weight To Improve Fuel Efficiency; Cost-effectiveness

- 3.3. Market Restrains

- 3.3.1. Competitiveness Of Alternative Materials

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Alternative Fuel Vehicles Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Commercial Vehicles

- 5.1.1.1. Buses

- 5.1.1.2. Heavy-duty Commercial Trucks

- 5.1.1.3. Light Commercial Pick-up Trucks

- 5.1.1.4. Light Commercial Vans

- 5.1.1.5. Medium-duty Commercial Trucks

- 5.1.2. Two-Wheelers

- 5.1.1. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Fuel Category

- 5.2.1. BEV

- 5.2.2. FCEV

- 5.2.3. HEV

- 5.2.4. PHEV

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Bayerische Motoren Werke AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nissan Motor Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Dr Ing h c F Porsche AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Anhui Jianghuai Automobile (JAC)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Renault do Brasil S/A

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Volvo Grou

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 BYD Auto Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Audi AG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Toyota Motor Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Chery Automobile Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Bayerische Motoren Werke AG

List of Figures

- Figure 1: Brazil Alternative Fuel Vehicles Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Brazil Alternative Fuel Vehicles Market Share (%) by Company 2025

List of Tables

- Table 1: Brazil Alternative Fuel Vehicles Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 2: Brazil Alternative Fuel Vehicles Market Revenue billion Forecast, by Fuel Category 2020 & 2033

- Table 3: Brazil Alternative Fuel Vehicles Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Brazil Alternative Fuel Vehicles Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 5: Brazil Alternative Fuel Vehicles Market Revenue billion Forecast, by Fuel Category 2020 & 2033

- Table 6: Brazil Alternative Fuel Vehicles Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Alternative Fuel Vehicles Market?

The projected CAGR is approximately 3.14%.

2. Which companies are prominent players in the Brazil Alternative Fuel Vehicles Market?

Key companies in the market include Bayerische Motoren Werke AG, Nissan Motor Co Ltd, Dr Ing h c F Porsche AG, Anhui Jianghuai Automobile (JAC), Renault do Brasil S/A, Volvo Grou, BYD Auto Co Ltd, Audi AG, Toyota Motor Corporation, Chery Automobile Co Ltd.

3. What are the main segments of the Brazil Alternative Fuel Vehicles Market?

The market segments include Vehicle Type, Fuel Category.

4. Can you provide details about the market size?

The market size is estimated to be USD 21.25 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasingly Focused On Reducing Vehicle Weight To Improve Fuel Efficiency; Cost-effectiveness.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Competitiveness Of Alternative Materials.

8. Can you provide examples of recent developments in the market?

August 2023: BYD introduced the new all-electric BYD SEAL D-segment sedan to European consumers. Deliveries of the BYD SEAL will commence in Q4 2023, and final prices will be announced later.August 2023: Toyota Argentina announced that as it begins production of the Hiace in 2024 at its plant in Zárate, it will continue and enlarge the mission of the Conversions area, dedicated to designing and producing vehicles adapted to the specific needs of multiple customers.August 2023: BYD announced that it will present 6 electric vehicles alongside a display of new technologies at the IAA Mobility 2023. It will also present its luxury sub-brand, DENZA, to European audiences for the first time.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Alternative Fuel Vehicles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Alternative Fuel Vehicles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Alternative Fuel Vehicles Market?

To stay informed about further developments, trends, and reports in the Brazil Alternative Fuel Vehicles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence