Key Insights

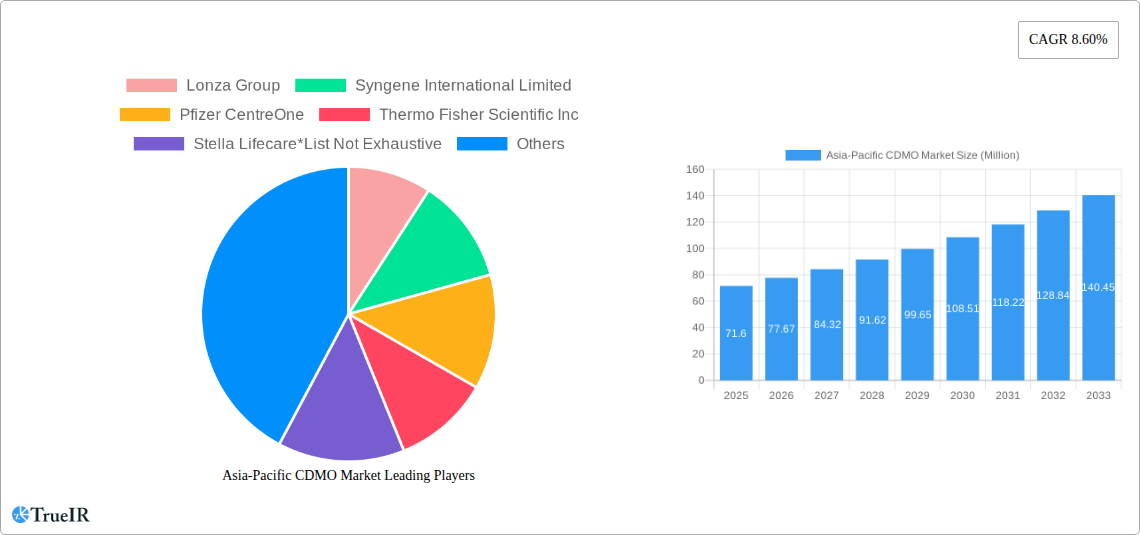

The Asia-Pacific Contract Development and Manufacturing Organization (CDMO) market, valued at $71.60 million in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 8.60% from 2025 to 2033. This expansion is fueled by several key factors. The region's burgeoning pharmaceutical and biotechnology sectors, coupled with increasing outsourcing trends by pharmaceutical companies seeking cost-effective and efficient solutions, are major contributors. Specifically, China and India, with their large and growing populations and expanding healthcare infrastructure, are significant market drivers. The rising demand for innovative therapies, including biologics and advanced drug delivery systems, further stimulates growth within the CDMO space. Growth is also propelled by the increasing prevalence of chronic diseases and the consequent rise in demand for medicines across the Asia-Pacific region. The market segmentation reveals strong growth in API manufacturing and the development and manufacturing of high-potency APIs (HPAPIs), reflecting the increasing complexity of modern drug development. While regulatory hurdles and competition from established players pose challenges, the overall market outlook remains positive, particularly for companies specializing in niche areas such as HPAPI handling and advanced formulation technologies.

Asia-Pacific CDMO Market Market Size (In Million)

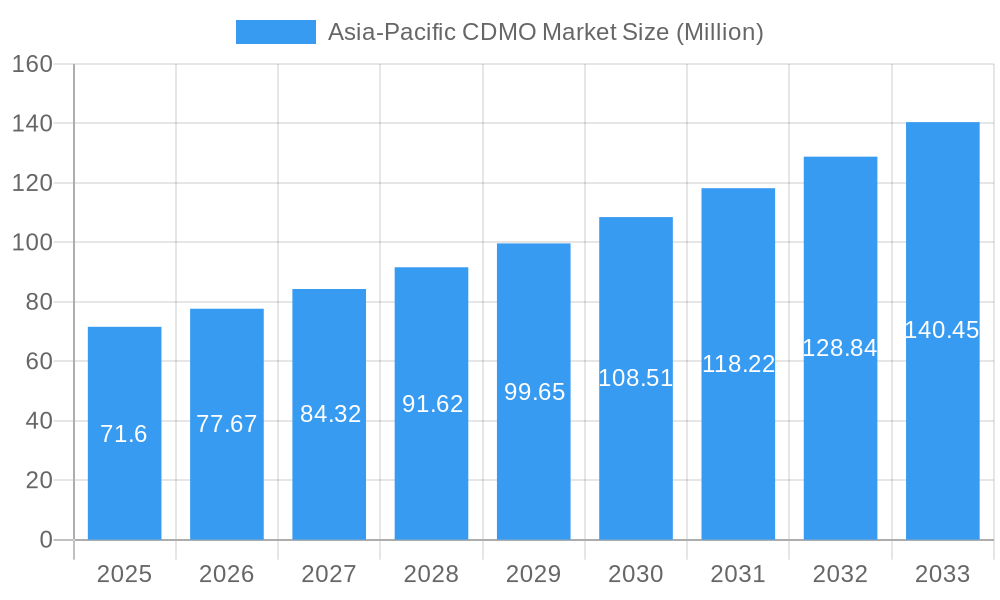

The significant players in the market, including Lonza Group, Syngene International Limited, and WuXi Biologics, are strategically investing in capacity expansion and technological advancements to capitalize on this growth trajectory. The market is also seeing increased activity in the acquisition of smaller CDMOs, demonstrating its consolidation and evolution. The geographical breakdown highlights the dominance of China, Japan, and India, though other countries within the Asia-Pacific region show promising growth potential. Continued investments in research and development, coupled with favorable government policies promoting the pharmaceutical industry, are expected to contribute significantly to the market's future expansion over the forecast period. The diverse service offerings of CDMOs, ranging from pre-clinical to Phase IV trials, further add to the market's resilience and scalability.

Asia-Pacific CDMO Market Company Market Share

Asia-Pacific CDMO Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Asia-Pacific Contract Development and Manufacturing Organization (CDMO) market, covering the period from 2019 to 2033. The report delves into market size, segmentation, competitive landscape, key drivers, challenges, and future outlook, offering invaluable insights for industry stakeholders. It leverages extensive data and analysis to forecast a market expected to reach xx Million by 2033.

Asia-Pacific CDMO Market Market Structure & Competitive Landscape

The Asia-Pacific CDMO market is characterized by a moderately concentrated landscape with several large multinational players and a growing number of regional players. Market concentration is influenced by factors including technological advancements, regulatory changes, and M&A activity. The Herfindahl-Hirschman Index (HHI) for the market is estimated to be xx in 2025, indicating a moderately concentrated market. Innovation, particularly in areas like advanced analytical technologies and process optimization, is a key driver of growth. Stringent regulatory requirements in the region necessitate significant investment in compliance and quality control, shaping the competitive dynamics. Product substitution, driven by the emergence of novel drug delivery systems and biosimilars, presents both opportunities and challenges. End-user segmentation is primarily driven by pharmaceutical and biotechnology companies, with varying needs based on research phase and product type. M&A activity has been robust, with xx deals recorded in the past five years, primarily focused on expanding capabilities and geographical reach. The estimated value of these M&A deals is at xx Million. This dynamic environment necessitates a strategic approach to market penetration and competitive advantage.

Asia-Pacific CDMO Market Market Trends & Opportunities

The Asia-Pacific CDMO market is experiencing robust growth, with a Compound Annual Growth Rate (CAGR) of xx% projected from 2025 to 2033. This growth is fueled by several factors. The increasing prevalence of chronic diseases is driving demand for new drugs and therapies. The region's burgeoning pharmaceutical and biotechnology industries are outsourcing more of their development and manufacturing needs, fueling CDMO market expansion. Technological advancements, such as the adoption of automation, AI, and advanced analytics, are improving efficiency and reducing costs. This is driving significant gains in productivity. Growing consumer awareness and demand for high-quality, affordable medications also contribute to market growth. Competitive dynamics are marked by both collaboration and competition, with established players facing pressure from new entrants and regional CDMOs. The market penetration rate for CDMO services is expected to reach xx% by 2033, indicating significant potential for further expansion.

Dominant Markets & Segments in Asia-Pacific CDMO Market

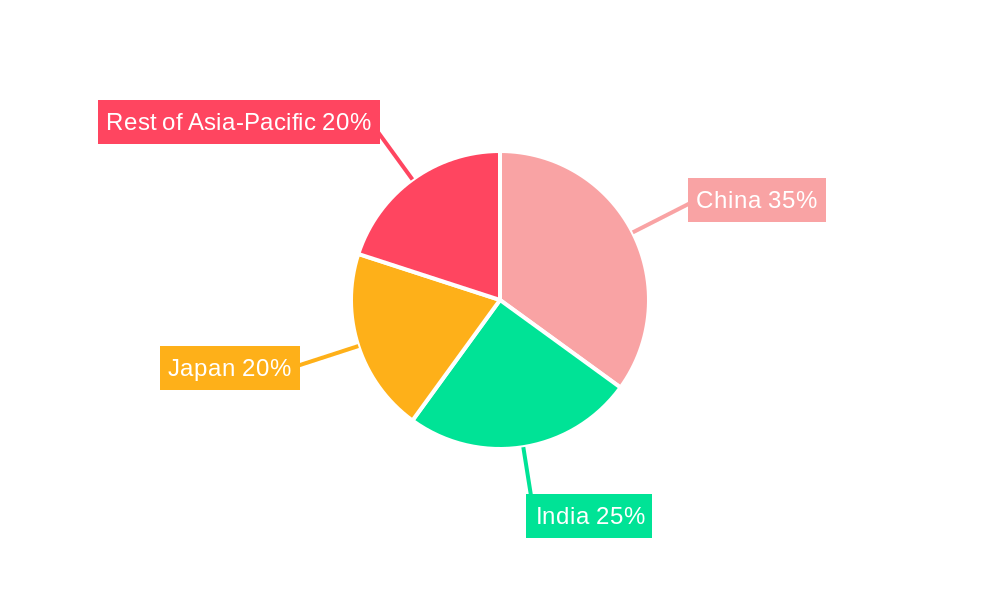

By Country: China dominates the Asia-Pacific CDMO market, driven by its large and growing pharmaceutical industry, supportive government policies, and substantial investment in infrastructure. Japan and India follow as significant markets, with strong R&D capabilities and robust regulatory frameworks. Australia and New Zealand represent smaller but growing markets.

By Service Type (CMO): The Active Pharmaceutical Ingredient (API) manufacturing segment holds the largest market share, reflecting the high demand for APIs in the region. The High Potency API (HPAPI) Finished Dosage Formulation (FDF) segment is experiencing rapid growth due to the increasing prevalence of high-potency drugs. The solid and injectable dose formulation segments are also important, with secondary packaging gaining traction due to the focus on enhancing the value chain for finished products.

By Research Phase (CRO): The Phase III and Phase IV clinical trial segments represent significant portions of the market due to the extensive clinical trial activity in the region. However, there is notable growth in the pre-clinical and early-phase segments, indicative of increased investment in drug discovery and development.

Key Growth Drivers:

- Government support: Favorable government policies and incentives are promoting investments in the CDMO sector across several key countries.

- Infrastructure development: Investments in manufacturing facilities and related infrastructure contribute significantly to overall market capacity.

- Technological advancements: Innovations in API manufacturing, formulation development, and analytical technologies are enhancing market efficiency.

Asia-Pacific CDMO Market Product Analysis

The Asia-Pacific CDMO market showcases a wide range of services, encompassing API manufacturing, formulation development, analytical testing, and packaging. Technological advancements, such as continuous manufacturing, single-use technologies, and process analytical technology (PAT), are driving product innovation and improving efficiency. These technological enhancements are particularly crucial in meeting growing demand and enabling competitive advantages among CDMO firms. This is leading to improved product quality, reduced costs, and faster turnaround times, making CDMO services increasingly attractive to pharmaceutical and biotechnology companies.

Key Drivers, Barriers & Challenges in Asia-Pacific CDMO Market

Key Drivers: The rising prevalence of chronic diseases, the increasing demand for biologics and biosimilars, substantial investments in R&D by pharmaceutical and biotech companies, and favorable government policies are driving growth. Technological advancements leading to improved efficiency and reduced costs are also vital.

Challenges: Stringent regulatory requirements create significant compliance costs and can be a barrier to entry. Supply chain disruptions, intellectual property concerns, and intense competition from both established and emerging CDMOs present significant challenges. For instance, recent supply chain disruptions have increased production costs by approximately xx%, hindering overall growth.

Growth Drivers in the Asia-Pacific CDMO Market Market

The Asia-Pacific CDMO market is propelled by several key factors. Growing demand for innovative therapies coupled with increased outsourcing by pharmaceutical and biotech companies is a prime driver. Government initiatives encouraging domestic manufacturing and investments in the life sciences sector offer further impetus. Technological advancements, including automation, AI, and analytics, enhance efficiency and productivity. Finally, a robust pipeline of novel drug candidates provides continuous market growth potential.

Challenges Impacting Asia-Pacific CDMO Market Growth

Regulatory complexities, including stringent approval processes and varying standards across countries, present significant challenges. Supply chain vulnerabilities, exacerbated by global events, impact both production costs and timelines. Intense competition from both established and new players necessitates continuous innovation and strategic partnerships to remain competitive. These factors collectively impose a dynamic environment demanding flexible, agile, and innovative operational strategies.

Key Players Shaping the Asia-Pacific CDMO Market Market

- Lonza Group

- Syngene International Limited

- Pfizer CentreOne

- Thermo Fisher Scientific Inc

- Stella Lifecare

- WuXi Biologics

- Catalent Inc

- FUJIFILM Diosynth Biotechnologies

- Samsung Biologics

- Jubilant Biosys Ltd

- Boehringer Ingelheim Group

- Recipharm AB

Significant Asia-Pacific CDMO Market Industry Milestones

- September 2023: WuXi Vaccines launched a new standalone vaccines CDMO site in Suzhou, China, significantly expanding its capacity for vaccine production.

- March 2023: Samsung Biologics announced plans for a fifth manufacturing facility, demonstrating significant investment to meet the rising demand.

Future Outlook for Asia-Pacific CDMO Market Market

The Asia-Pacific CDMO market is poised for sustained growth, driven by continuous innovation, increasing outsourcing trends, and favorable regulatory landscapes. Strategic partnerships, technological advancements, and capacity expansions will be crucial for capturing market share. The market presents significant opportunities for CDMOs offering specialized services and catering to the growing demand for complex biologics and advanced therapies. The predicted market value will likely exceed xx Million by 2033, highlighting immense potential for growth and investment in the coming years.

Asia-Pacific CDMO Market Segmentation

-

1. Service Type CMO Segment

-

1.1. Active P

- 1.1.1. Small Molecule

- 1.1.2. Large Molecule

- 1.1.3. High Potency (HPAPI)

-

1.2. Finished

-

1.2.1. Solid Dose Formulation

- 1.2.1.1. Tablets

- 1.2.1.2. Others

- 1.2.2. Liquid Dose Formulation

- 1.2.3. Injectable Dose Formulation

-

1.2.1. Solid Dose Formulation

- 1.3. Secondary Packaging

-

1.1. Active P

-

2. Research Phase CRO Segment

- 2.1. Pre-clinical

- 2.2. Phase I

- 2.3. Phase II

- 2.4. Phase III

- 2.5. Phase IV

Asia-Pacific CDMO Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific CDMO Market Regional Market Share

Geographic Coverage of Asia-Pacific CDMO Market

Asia-Pacific CDMO Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Outsourcing Volume by Big Pharmaceutical Companies4.; Increasing Investment in Research and Development

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Lead Time Owing to Supply Chain Related Constraints in the Region4.; Skilled Labour Shortages Across the Region

- 3.4. Market Trends

- 3.4.1. The Demand For Injectable Dose Formulation is Rising in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific CDMO Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type CMO Segment

- 5.1.1. Active P

- 5.1.1.1. Small Molecule

- 5.1.1.2. Large Molecule

- 5.1.1.3. High Potency (HPAPI)

- 5.1.2. Finished

- 5.1.2.1. Solid Dose Formulation

- 5.1.2.1.1. Tablets

- 5.1.2.1.2. Others

- 5.1.2.2. Liquid Dose Formulation

- 5.1.2.3. Injectable Dose Formulation

- 5.1.2.1. Solid Dose Formulation

- 5.1.3. Secondary Packaging

- 5.1.1. Active P

- 5.2. Market Analysis, Insights and Forecast - by Research Phase CRO Segment

- 5.2.1. Pre-clinical

- 5.2.2. Phase I

- 5.2.3. Phase II

- 5.2.4. Phase III

- 5.2.5. Phase IV

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Service Type CMO Segment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Lonza Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Syngene International Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Pfizer CentreOne

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Thermo Fisher Scientific Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Stella Lifecare*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 WuXi Biologics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Catalent Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 FUJIFILM Diosynth Biotechnologies

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Samsung Biologics

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Jubilant Biosys Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Boehringer Ingelheim Group

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Recipharm AB

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Lonza Group

List of Figures

- Figure 1: Asia-Pacific CDMO Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific CDMO Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific CDMO Market Revenue Million Forecast, by Service Type CMO Segment 2020 & 2033

- Table 2: Asia-Pacific CDMO Market Revenue Million Forecast, by Research Phase CRO Segment 2020 & 2033

- Table 3: Asia-Pacific CDMO Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Asia-Pacific CDMO Market Revenue Million Forecast, by Service Type CMO Segment 2020 & 2033

- Table 5: Asia-Pacific CDMO Market Revenue Million Forecast, by Research Phase CRO Segment 2020 & 2033

- Table 6: Asia-Pacific CDMO Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: China Asia-Pacific CDMO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Japan Asia-Pacific CDMO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: South Korea Asia-Pacific CDMO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: India Asia-Pacific CDMO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Australia Asia-Pacific CDMO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: New Zealand Asia-Pacific CDMO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Indonesia Asia-Pacific CDMO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Malaysia Asia-Pacific CDMO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Singapore Asia-Pacific CDMO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Thailand Asia-Pacific CDMO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Vietnam Asia-Pacific CDMO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Philippines Asia-Pacific CDMO Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific CDMO Market?

The projected CAGR is approximately 8.60%.

2. Which companies are prominent players in the Asia-Pacific CDMO Market?

Key companies in the market include Lonza Group, Syngene International Limited, Pfizer CentreOne, Thermo Fisher Scientific Inc, Stella Lifecare*List Not Exhaustive, WuXi Biologics, Catalent Inc, FUJIFILM Diosynth Biotechnologies, Samsung Biologics, Jubilant Biosys Ltd, Boehringer Ingelheim Group, Recipharm AB.

3. What are the main segments of the Asia-Pacific CDMO Market?

The market segments include Service Type CMO Segment, Research Phase CRO Segment.

4. Can you provide details about the market size?

The market size is estimated to be USD 71.60 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Outsourcing Volume by Big Pharmaceutical Companies4.; Increasing Investment in Research and Development.

6. What are the notable trends driving market growth?

The Demand For Injectable Dose Formulation is Rising in the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Lead Time Owing to Supply Chain Related Constraints in the Region4.; Skilled Labour Shortages Across the Region.

8. Can you provide examples of recent developments in the market?

September 2023: WuXi Vaccines, a key pharmaceutical CDMO firm, introduced a standalone vaccines CDMO site in Suzhou, China. The expansion was expected to introduce enhanced capacity for both drug substances and drug products, offering comprehensive services for a range of vaccines. This move aimed to expedite project timelines for the company's global clients, covering everything from process and drug product development to manufacturing clinical-scale drug substances (DS) and small-to-medium sterile drug products (DP).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific CDMO Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific CDMO Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific CDMO Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific CDMO Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence