Key Insights

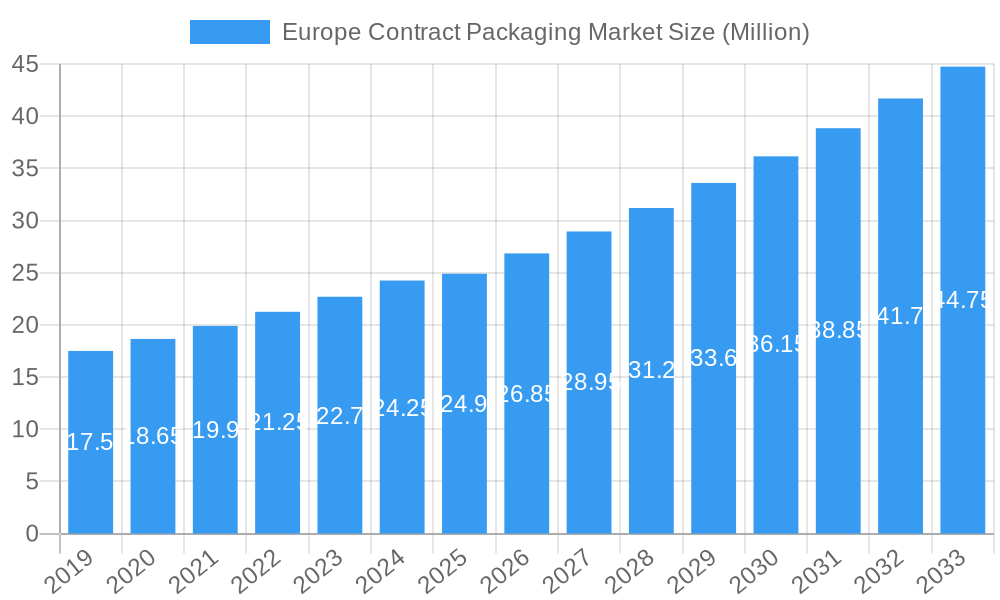

The Europe Contract Packaging Market is poised for significant expansion, projected to reach a substantial market size of EUR 24.90 billion by 2025. This growth is underpinned by an impressive Compound Annual Growth Rate (CAGR) of 8.55% from 2025 to 2033. A primary driver for this upward trajectory is the increasing demand for specialized packaging solutions across key end-user industries. The food and beverage sector, for instance, continuously seeks innovative and convenient packaging that enhances product shelf-life and consumer appeal, thereby fueling the need for contract packaging services. Similarly, the burgeoning pharmaceutical industry relies heavily on specialized, compliant, and secure packaging for its sensitive products, creating a consistent demand. The beauty care segment also contributes to this growth, with brands increasingly outsourcing intricate and aesthetically driven packaging requirements to specialized co-packers to maintain brand identity and quality. Furthermore, the convenience and cost-effectiveness offered by contract packaging providers, allowing companies to focus on core competencies, represent a substantial underlying driver.

Europe Contract Packaging Market Market Size (In Million)

The market's dynamism is further characterized by evolving trends such as a strong emphasis on sustainable and eco-friendly packaging materials, including recyclable, biodegradable, and compostable options. This trend is not only driven by consumer preference but also by stringent environmental regulations across Europe. Contract packagers are investing in new technologies and materials to meet these demands, offering innovative solutions that reduce environmental impact. The market is segmenting into primary, secondary, and tertiary packaging services, with each category experiencing unique growth patterns. While primary packaging focuses on direct product containment, secondary packaging bundles primary units, and tertiary packaging optimizes for shipping and logistics. The home and fabric care industry also presents robust opportunities, with contract packagers adept at handling large volumes and diverse product types. Despite the promising outlook, certain restraints exist, such as potential supply chain disruptions, rising raw material costs, and the need for continuous investment in automation and technology to maintain competitiveness and meet evolving quality standards. However, the strategic advantages of outsourcing, coupled with the specialized expertise offered by market leaders, are expected to largely outweigh these challenges, ensuring sustained market expansion.

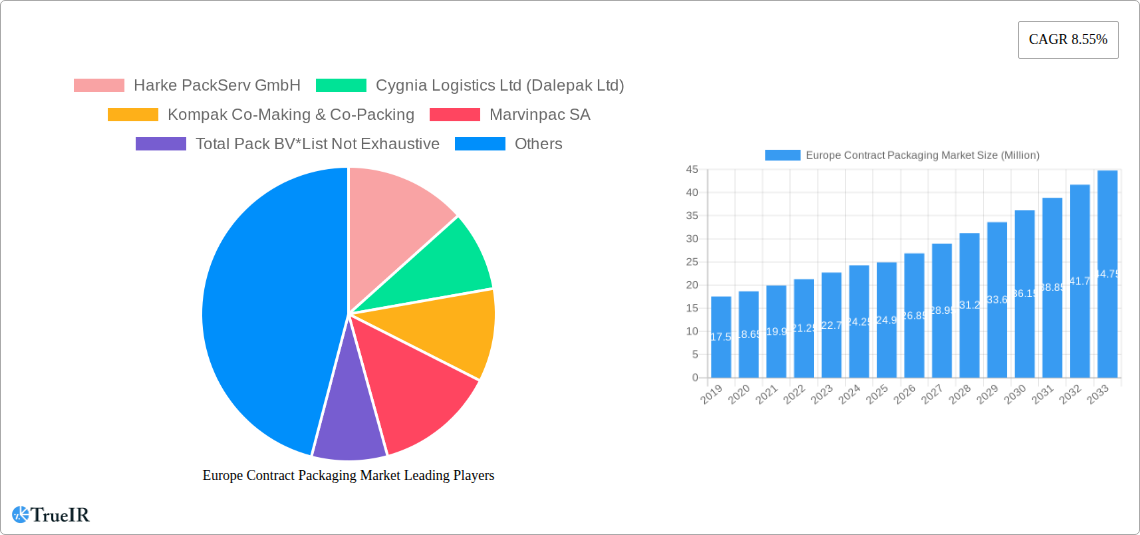

Europe Contract Packaging Market Company Market Share

Europe Contract Packaging Market: Comprehensive Analysis and Forecast (2019-2033)

Gain unparalleled insights into the dynamic Europe Contract Packaging Market, a sector projected to reach XX Million by 2033, driven by increasing demand for specialized outsourcing solutions. This in-depth report, covering the historical period (2019-2024), base year (2025), estimated year (2025), and an extensive forecast period (2025-2033), offers a strategic roadmap for stakeholders navigating this competitive landscape. Explore the intricate details of market structure, dominant segments, emerging trends, and the pivotal role of key players in shaping the future of contract packaging across Europe.

Europe Contract Packaging Market Market Structure & Competitive Landscape

The Europe Contract Packaging Market exhibits a moderately concentrated structure, with a blend of large, established players and niche specialists catering to diverse industry needs. Innovation is a key differentiator, with companies continuously investing in advanced automation, sustainable packaging solutions, and digital integration to enhance efficiency and meet evolving client demands. Regulatory frameworks, particularly concerning food safety, pharmaceutical compliance, and environmental sustainability, exert a significant influence on operational standards and market entry barriers. Product substitutes, while present in some basic packaging functions, are often outpaced by the specialized expertise and scalability offered by contract packaging providers, especially for complex co-packing and co-manufacturing projects. End-user segmentation is diverse, with the Food and Beverages industries representing the largest share, followed by Pharmaceuticals, Home and Fabric Care, and Beauty Care. Mergers and acquisitions (M&A) are a notable trend, with larger entities acquiring smaller, specialized firms to expand service portfolios, geographical reach, and technological capabilities. For instance, recent M&A activities in the region aim to consolidate market share and achieve economies of scale. The competitive intensity is high, compelling companies to focus on value-added services, customization, and building strong client relationships.

Europe Contract Packaging Market Market Trends & Opportunities

The Europe Contract Packaging Market is poised for significant expansion, with market size growth projected to accelerate due to several converging trends. The increasing complexity of supply chains and the growing need for specialized packaging expertise are driving brand owners to outsource these critical functions. Technological advancements are playing a pivotal role, with the adoption of robotics, artificial intelligence, and advanced data analytics enhancing operational efficiency, reducing errors, and enabling greater flexibility in production runs. This technological shift is transforming Primary Packaging, Secondary Packaging, and Tertiary Packaging services, allowing for more intricate designs and customized solutions. Consumer preferences are leaning towards sustainable packaging materials and eco-friendly production processes, creating a substantial opportunity for contract packagers who can offer innovative, environmentally conscious solutions. The rise of e-commerce has further fueled demand for specialized packaging that ensures product integrity during transit and enhances the unboxing experience. Competitive dynamics are characterized by a drive towards specialization, with many providers focusing on specific end-user industries like Beverages, Food, Pharmaceuticals, Home and Fabric Care, and Beauty Care, or particular service offerings such as primary packaging or specialized kitting. This specialization allows for deeper expertise and tailored solutions. Market penetration rates for contract packaging services are expected to increase across all major European economies as more businesses recognize the cost-saving and efficiency benefits. The growing demand for personalized products and smaller batch production runs also presents a significant opportunity for agile contract packagers to cater to evolving consumer demands. Strategic partnerships, like the one between WePack and Nulogy, exemplify the trend towards leveraging software solutions to enhance agility and responsiveness, a key differentiator in this competitive market. The continuous innovation in materials and machinery, coupled with a growing emphasis on regulatory compliance and supply chain resilience, creates a fertile ground for market growth and the emergence of new business models within the contract packaging sector. The ongoing consolidation through M&A also presents opportunities for both acquirers and acquired entities to leverage expanded capabilities and market access.

Dominant Markets & Segments in Europe Contract Packaging Market

The Europe Contract Packaging Market is characterized by regional dominance and segment-specific growth, with Germany and the United Kingdom currently leading in terms of market share and innovation. These regions benefit from a robust industrial base, advanced logistics infrastructure, and a high concentration of manufacturers across key end-user industries.

Leading Regions & Countries:

- Germany: A manufacturing powerhouse, Germany’s strong presence in the automotive, chemical, and pharmaceutical sectors drives significant demand for specialized contract packaging services. Its focus on quality and precision aligns well with the sophisticated requirements of contract packaging.

- United Kingdom: The UK boasts a thriving food and beverage sector, coupled with a growing e-commerce market, both of which are significant consumers of contract packaging. Recent investments in automation and logistics further bolster its position.

- France: With a substantial presence in luxury goods and pharmaceuticals, France offers a strong market for high-value contract packaging.

- Italy: A leader in food and fashion, Italy's contract packaging market is driven by the unique requirements of these consumer-focused industries.

Dominant Segments:

- End-user Industry:

- Food: This segment is the largest contributor to the Europe contract packaging market due to the vast production volumes, diverse product types, and stringent food safety regulations. The demand for specialized packaging, such as modified atmosphere packaging and resealable options, further fuels growth.

- Beverages: The high-volume production of alcoholic and non-alcoholic beverages necessitates efficient and scalable contract packaging solutions, including bottling, canning, and multipack assembly.

- Pharmaceuticals: Driven by strict regulatory compliance, product integrity requirements, and the need for specialized handling (e.g., sterile packaging, cold chain), the pharmaceutical segment represents a high-value, albeit more niche, area for contract packaging.

- Service:

- Secondary Packaging: Services such as cartoning, shrink-wrapping, and bundling are crucial for presenting products at the point of sale and are a core offering for many contract packagers.

- Primary Packaging: This includes direct filling and sealing of products into their immediate containers, demanding highly specialized equipment and stringent hygiene standards, particularly for food and pharmaceutical applications.

- End-user Industry:

Growth in these segments is propelled by factors such as increasing outsourcing by brand owners seeking cost efficiencies and specialized expertise, the growing complexity of product SKUs requiring flexible production, and the continuous demand for innovative and sustainable packaging solutions. The expansion of e-commerce also necessitates specialized secondary and tertiary packaging solutions to ensure product protection during transit and enhance the customer experience.

Europe Contract Packaging Market Product Analysis

Contract packaging in Europe is increasingly defined by advanced product solutions driven by technological innovation. The market is witnessing a surge in demand for automated primary packaging, offering precision filling and sealing for liquids, powders, and solids across various end-user industries like Food, Beverages, and Pharmaceuticals. Secondary packaging innovations focus on shelf-ready packaging (SRP) and customized displays, enhancing retail presence and consumer appeal, particularly in the Beauty Care and Home and Fabric Care sectors. Tertiary packaging solutions are evolving to optimize logistics and reduce shipping damage through advanced void fill technologies and robust construction. Competitive advantages are derived from a provider's ability to offer integrated solutions, incorporating services like labeling, date-coding, kitting, and rework, thereby becoming a one-stop shop for brand owners. The emphasis on sustainability is also driving product development, with an increasing focus on recyclable, biodegradable, and compostable packaging materials.

Key Drivers, Barriers & Challenges in Europe Contract Packaging Market

Key Drivers: The Europe Contract Packaging Market is propelled by several key drivers: the increasing need for operational efficiency and cost reduction by brand owners, the growing complexity of product portfolios demanding specialized manufacturing and packaging expertise, and the rise of e-commerce requiring robust and customized logistics packaging. Technological advancements, such as automation and AI, enhance capabilities, while a strong consumer preference for sustainable packaging solutions creates new market opportunities. Furthermore, supportive regulatory environments for outsourcing and innovation in packaging materials contribute significantly to market growth.

Barriers & Challenges: Significant challenges impacting the Europe Contract Packaging Market include intense price competition, which can pressure profit margins, and the complex and evolving regulatory landscape, particularly concerning food safety, pharmaceutical standards, and environmental mandates. Supply chain disruptions, such as raw material shortages and transportation issues, pose a constant threat to operational continuity. Furthermore, the need for continuous investment in advanced technology and skilled labor to remain competitive represents a substantial financial and operational hurdle. Finding and retaining skilled personnel capable of operating sophisticated machinery and managing complex projects is also a growing concern. The threat of in-house packaging capabilities for some larger corporations can also limit market penetration.

Growth Drivers in the Europe Contract Packaging Market Market

The Europe Contract Packaging Market is experiencing robust growth driven by an escalating demand for specialized outsourcing services from brand owners seeking to streamline operations and reduce costs. Technological advancements, including the adoption of advanced robotics, automation, and AI in packaging lines, are significantly boosting efficiency and flexibility. A key economic driver is the desire for scalability, allowing businesses to adapt quickly to fluctuating market demands without substantial capital investment in internal infrastructure. Regulatory shifts emphasizing sustainability and product safety are also compelling companies to partner with contract packagers who possess the expertise and certifications to meet these stringent requirements. The continuous innovation in packaging materials and designs, spurred by consumer preferences for eco-friendly and convenient options, further fuels the need for specialized contract packaging capabilities.

Challenges Impacting Europe Contract Packaging Market Growth

Several challenges significantly impact the Europe Contract Packaging Market. The highly competitive nature of the market leads to intense price pressure, potentially squeezing profit margins for providers. Stringent and ever-evolving regulatory frameworks across various European countries, particularly concerning food safety, pharmaceutical compliance, and environmental standards, necessitate continuous investment in adherence and specialized knowledge. Supply chain volatility, including raw material price fluctuations and availability issues, can disrupt production schedules and increase operational costs. Furthermore, the rapid pace of technological advancement requires substantial capital investment in new machinery and skilled labor, posing a barrier to entry and growth for smaller players. Ensuring consistent quality and brand integrity across diverse client needs also presents an ongoing operational challenge.

Key Players Shaping the Europe Contract Packaging Market Market

- Harke PackServ GmbH

- Cygnia Logistics Ltd (Dalepak Ltd)

- Kompak Co-Making & Co-Packing

- Marvinpac SA

- Total Pack BV

- NOMI Co-Packing

- Complete Co-Packing Services Ltd

- Boughey Distribution Ltd

- Budelpack Poortvliet BV

- Driessen United Blenders BV

Significant Europe Contract Packaging Market Industry Milestones

- January 2024: Magnavale, a UK-based cold storage provider, significantly expanded its contract packing, labeling, and date-coding lines at its Easton facility. This expansion boosts capacity and enhances flexibility for ambient, chilled, and frozen applications, allowing for increased output and efficient adaptation to peak demand.

- February 2024: WePack, a UK-based contract packaging provider, partnered with software provider Nulogy at Packaging Innovations & Empack 2024. This collaboration aims to enhance WePack's agility and responsiveness through Nulogy’s Shop Floor Solution, benefiting their work with brands across the food, cosmetics, high-end consumer goods, and agriculture sectors, including bottling, sachet and pouch filling, and hand assembly.

Future Outlook for Europe Contract Packaging Market Market

The future outlook for the Europe Contract Packaging Market is exceptionally bright, driven by sustained demand for specialized outsourcing and continuous innovation. Strategic opportunities lie in expanding capabilities in sustainable packaging solutions, which will become increasingly paramount as regulatory pressures and consumer awareness grow. The market will also see further integration of digital technologies, including AI and IoT, to enhance supply chain visibility, optimize production, and offer data-driven insights to clients. Growth catalysts include the ongoing consolidation through strategic mergers and acquisitions, creating larger, more integrated service providers, and the increasing adoption of automation to address labor shortages and improve efficiency. Emerging markets within Eastern Europe also present significant untapped potential. Contract packagers that can offer comprehensive, flexible, and sustainable solutions are well-positioned to capitalize on the projected growth and secure a dominant market position.

Europe Contract Packaging Market Segmentation

-

1. Service

- 1.1. Primary Packaging

- 1.2. Secondary Packaging

- 1.3. Tertiary Packaging

-

2. End-user Industry

- 2.1. Beverages

- 2.2. Food

- 2.3. Pharmaceuticals

- 2.4. Home and Fabric Care

- 2.5. Beauty Care

Europe Contract Packaging Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

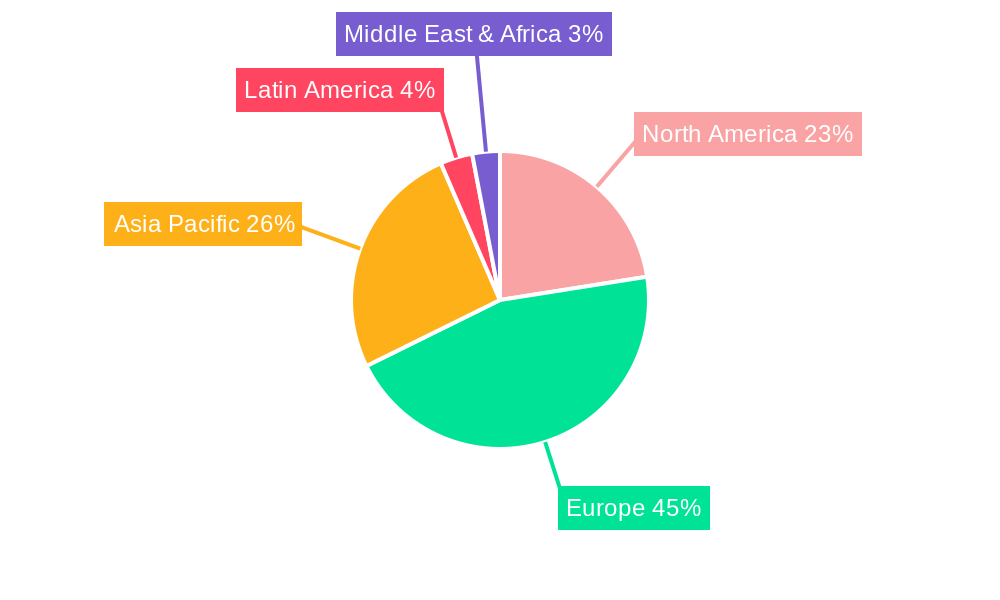

Europe Contract Packaging Market Regional Market Share

Geographic Coverage of Europe Contract Packaging Market

Europe Contract Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.55% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand from the E-commerce Industry; Increasing Need for Latest Technology and Innovative Packaging

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations; Competition from In-house Packaging

- 3.4. Market Trends

- 3.4.1. E-commerce to Show Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Contract Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Primary Packaging

- 5.1.2. Secondary Packaging

- 5.1.3. Tertiary Packaging

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Beverages

- 5.2.2. Food

- 5.2.3. Pharmaceuticals

- 5.2.4. Home and Fabric Care

- 5.2.5. Beauty Care

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Harke PackServ GmbH

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Cygnia Logistics Ltd (Dalepak Ltd)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Kompak Co-Making & Co-Packing

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Marvinpac SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Total Pack BV*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 NOMI Co-Packing

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Complete Co-Packing Services Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Boughey Distribution Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Budelpack Poortvliet BV

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Driessen United Blenders BV

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Harke PackServ GmbH

List of Figures

- Figure 1: Europe Contract Packaging Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Contract Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Contract Packaging Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Europe Contract Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Europe Contract Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Europe Contract Packaging Market Revenue Million Forecast, by Service 2020 & 2033

- Table 5: Europe Contract Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Europe Contract Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: France Europe Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Contract Packaging Market?

The projected CAGR is approximately 8.55%.

2. Which companies are prominent players in the Europe Contract Packaging Market?

Key companies in the market include Harke PackServ GmbH, Cygnia Logistics Ltd (Dalepak Ltd), Kompak Co-Making & Co-Packing, Marvinpac SA, Total Pack BV*List Not Exhaustive, NOMI Co-Packing, Complete Co-Packing Services Ltd, Boughey Distribution Ltd, Budelpack Poortvliet BV, Driessen United Blenders BV.

3. What are the main segments of the Europe Contract Packaging Market?

The market segments include Service, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 24.90 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand from the E-commerce Industry; Increasing Need for Latest Technology and Innovative Packaging.

6. What are the notable trends driving market growth?

E-commerce to Show Significant Growth.

7. Are there any restraints impacting market growth?

Stringent Government Regulations; Competition from In-house Packaging.

8. Can you provide examples of recent developments in the market?

January 2024: Magnavale, a UK-based cold storage provider, announced the expansion of its contract packing, labeling, and date-coding lines at its Easton facility, allowing for a significant boost in capacity. Capable of adapting between ambient, chilled, and frozen applications, these new highly automated lines enable Magnavale Easton to significantly increase packing, labeling, and date-coding output and flexibly adjust to peak-demand periods.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Contract Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Contract Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Contract Packaging Market?

To stay informed about further developments, trends, and reports in the Europe Contract Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence