Key Insights

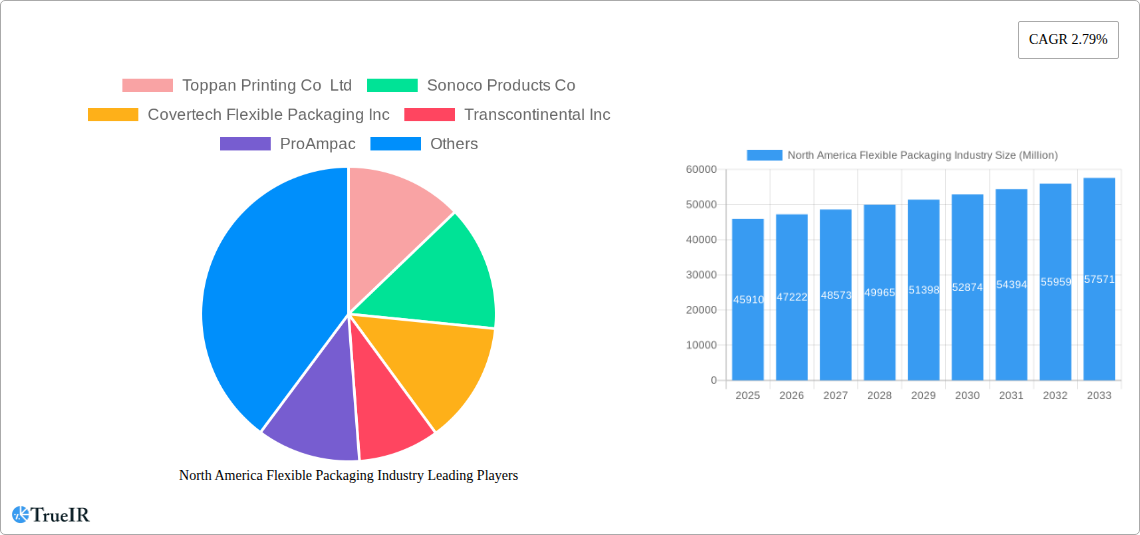

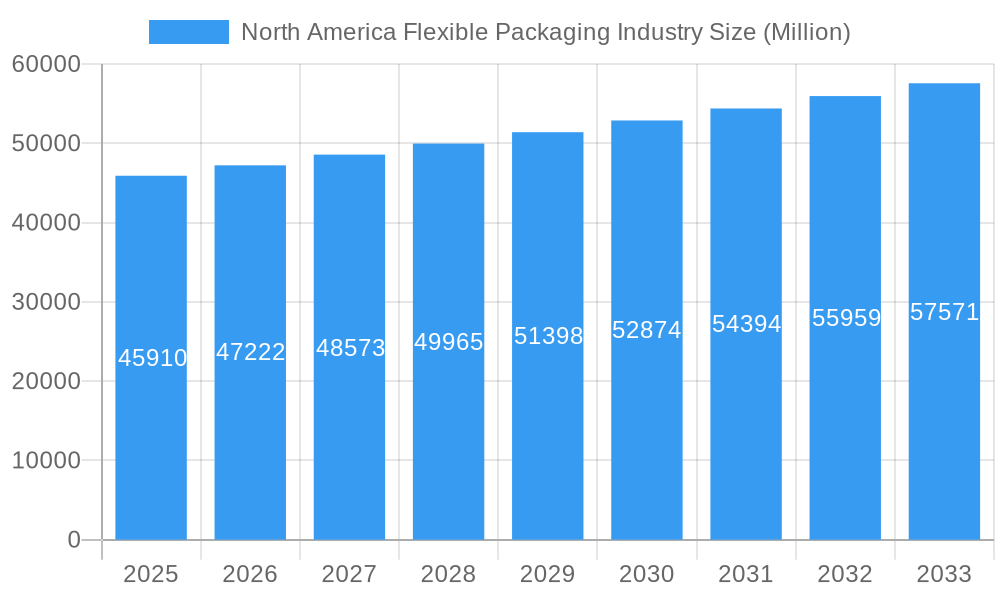

The North American flexible packaging market is poised for steady growth, with an estimated market size of USD 45.91 billion in 2025. This expansion is driven by evolving consumer preferences for convenience, sustainability, and product protection, particularly within the burgeoning food and beverage sectors. Key trends indicate a significant demand for innovative materials and product types. Plastics, particularly Polyethene (PE) and Bi-orientated Polypropylene (BOPP), are expected to remain dominant due to their versatility, cost-effectiveness, and barrier properties. The increasing consumer awareness regarding environmental impact is also fostering innovation in bioplastics and recycled content, aligning with the industry's push towards a circular economy. Pouches and bags are anticipated to lead product type segments, reflecting their widespread use in single-serving portions and everyday consumables. The food industry, encompassing frozen & chilled foods, meat, poultry & fish, and bakery & confectionery, will continue to be the primary end-user, owing to the critical role of flexible packaging in extending shelf life and ensuring food safety. Emerging segments like pet food also show strong growth potential.

North America Flexible Packaging Industry Market Size (In Billion)

The projected Compound Annual Growth Rate (CAGR) of 2.79% from 2025 to 2033 signifies a healthy, albeit moderate, expansion for the North American flexible packaging industry. This growth will be propelled by manufacturers' investments in advanced technologies and sustainable solutions to meet regulatory pressures and consumer demand for eco-friendly packaging. While plastics continue to dominate, paper and aluminum foil are finding niche applications, especially where enhanced barrier properties or perceived sustainability are key. The industry faces challenges, including fluctuating raw material prices and the ongoing complexity of recycling mixed materials. However, these challenges also present opportunities for innovation in material science and packaging design. Key players like Amcor PLC, Mondi PLC, and Sealed Air Corp are actively engaged in research and development, focusing on lightweighting, recyclability, and the integration of smart technologies within their packaging solutions to maintain a competitive edge and address the evolving needs of diverse end-user industries.

North America Flexible Packaging Industry Company Market Share

This report offers an in-depth analysis of the North America flexible packaging industry, encompassing market structure, trends, opportunities, product innovations, key players, and future outlook. Leveraging high-volume keywords, this report is designed to enhance search rankings and engage industry professionals seeking strategic insights into this dynamic market. The study period spans from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033.

North America Flexible Packaging Industry Market Structure & Competitive Landscape

The North America flexible packaging market exhibits a moderately consolidated structure, characterized by the presence of both global giants and specialized regional players. Innovation is a key differentiator, driven by the increasing demand for sustainable solutions, enhanced product functionality, and improved shelf appeal. Regulatory landscapes, particularly concerning food safety and environmental impact, significantly shape market dynamics, influencing material choices and manufacturing processes. Product substitutes, while present, are increasingly challenged by the superior performance and versatility of flexible packaging. End-user segmentation reveals a strong reliance on the food and beverage sectors, with significant growth also observed in personal care and healthcare. Mergers and acquisitions (M&A) activity remains a strategic tool for market players to expand their product portfolios, geographical reach, and technological capabilities. For instance, recent M&A trends indicate a focus on acquiring companies with expertise in sustainable materials and advanced converting technologies. The concentration ratio, while not explicitly stated, is understood to be influenced by the top 10 players holding a substantial market share.

North America Flexible Packaging Industry Market Trends & Opportunities

The North America flexible packaging market is poised for robust growth, projected to reach significant figures by 2033, driven by a confluence of evolving consumer preferences, technological advancements, and a growing emphasis on sustainability. The market size is expected to expand at a Compound Annual Growth Rate (CAGR) of approximately 5.5% during the forecast period. This expansion is fueled by a discernible shift in consumer behavior towards convenience, portion control, and visually appealing packaging, all of which are core strengths of flexible packaging solutions. Technological shifts are profoundly impacting the industry, with continuous innovations in material science leading to the development of lightweight, durable, and barrier-enhanced films. The introduction of advanced printing techniques, such as digital printing, allows for greater customization and shorter lead times, catering to the demands of a dynamic retail environment. Furthermore, the widespread adoption of smart packaging technologies, incorporating features like track-and-trace capabilities and freshness indicators, is opening new avenues for value creation.

The competitive dynamics are intensifying, with companies increasingly differentiating themselves through their commitment to circular economy principles and the development of recyclable and compostable packaging alternatives. The demand for post-consumer recycled (PCR) content in flexible packaging is on a steep upward trajectory, compelling manufacturers to invest in advanced recycling technologies and secure reliable sources of recycled materials. This trend is further bolstered by evolving regulations and corporate sustainability goals. The market penetration rates for specialized flexible packaging formats, such as stand-up pouches and retort pouches, are expected to continue their ascent due to their superior functionality and consumer appeal in the food and beverage sectors. Opportunities abound in the development of bio-based and biodegradable materials that can replace traditional petroleum-based plastics without compromising performance. The expanding e-commerce landscape also presents a significant opportunity for flexible packaging, particularly for its lightweight and protective qualities in shipping and handling. The rising disposable income in emerging economies within North America also contributes to increased demand for packaged goods, thereby stimulating the flexible packaging market. The healthcare sector's growing need for sterile, safe, and tamper-evident packaging further propels market expansion.

Dominant Markets & Segments in North America Flexible Packaging Industry

The North America flexible packaging industry is dominated by the United States, which accounts for a substantial portion of the market share due to its large consumer base and advanced manufacturing infrastructure. Within the Material Type segment, Plastics reigns supreme, with Polyethene (PE), particularly Low-Density Polyethylene (LDPE) and Linear Low-Density Polyethylene (LLDPE), being the most widely utilized due to its versatility, cost-effectiveness, and excellent sealing properties. Bi-orientated Polypropylene (BOPP) also holds a significant share, offering superior stiffness, clarity, and printability. Cast Polypropylene (CPP) finds application in specific areas requiring heat-sealability and good optical properties. The growth of Bioplastics is noteworthy, driven by environmental consciousness.

In terms of Product Type, Pouches are a leading segment, encompassing stand-up pouches, spout pouches, and flat pouches, favored for their convenience, re-sealability, and excellent product display capabilities. Bags, including stand-up bags and gusseted bags, also command a considerable market share, especially for bulk packaging. Films and Wraps remain fundamental, utilized across a broad spectrum of applications, from food overwraps to industrial packaging. The End-User Industry landscape is heavily influenced by the Food sector, which represents the largest consumer of flexible packaging. Within the food segment, Frozen & Chilled Food and Meat, Poultry & Fish are key drivers due to the requirement for enhanced barrier properties to maintain freshness and extend shelf life. Bakery & Confectionary also contribute significantly, demanding visually appealing and protective packaging. The Beverages sector is another major contributor, with flexible pouches and films used for juices, water, and other liquid consumables. The Cosmetics & Personal Care industry increasingly relies on flexible packaging for its aesthetic appeal and functionality.

Key growth drivers include the robust demand for convenient and single-serving packaging formats, particularly in the food and beverage sectors. The continuous innovation in barrier technologies, enabling longer shelf life and reduced food waste, is a significant catalyst. Government policies promoting sustainable packaging and waste reduction further stimulate the adoption of recyclable and compostable flexible packaging solutions. The expanding e-commerce sector, necessitating lightweight and protective shipping solutions, also fuels demand. Investment in advanced manufacturing technologies and research and development for novel materials are critical for market dominance.

North America Flexible Packaging Industry Product Analysis

Product innovations in the North American flexible packaging industry are centered on enhancing sustainability, functionality, and consumer experience. Companies are actively developing advanced barrier films that extend shelf life while reducing material usage. The integration of recycled content, particularly post-consumer recycled (PCR) resins, is a prominent trend, as exemplified by the development of recyclable polyethylene pouches with significant PCR content. Innovations in material science are also leading to the creation of compostable and bio-based flexible packaging solutions, addressing growing environmental concerns. These advancements offer competitive advantages by meeting the stringent demands of eco-conscious consumers and regulatory bodies, while ensuring product integrity and safety across diverse applications, from food preservation to medical device packaging.

Key Drivers, Barriers & Challenges in North America Flexible Packaging Industry

Key Drivers: The North America flexible packaging industry is propelled by a robust demand for convenience and on-the-go consumption, particularly within the food and beverage sectors. Growing consumer awareness and regulatory pressure for sustainable packaging solutions are driving innovation in recyclable, compostable, and bio-based materials. Technological advancements in material science and converting processes enable enhanced barrier properties, extended shelf life, and improved product protection, contributing to reduced food waste. The expanding e-commerce market further fuels demand for lightweight and durable packaging solutions.

Barriers & Challenges: Supply chain disruptions, including volatility in raw material prices and availability, pose a significant challenge. Stringent regulatory hurdles, particularly concerning food contact materials and environmental compliance, can impact product development timelines and costs. Intense competitive pressures from both established players and emerging innovators necessitate continuous investment in R&D and process optimization. The transition to a circular economy for plastics requires substantial investment in recycling infrastructure and consumer education on proper disposal.

Growth Drivers in the North America Flexible Packaging Industry Market

Several key drivers are fueling the growth of the North America flexible packaging industry. Technologically, advancements in material science are enabling the development of sophisticated barrier films that extend product shelf life and reduce spoilage, directly addressing concerns about food waste. Economically, the increasing disposable income of consumers in North America translates to higher demand for packaged goods, a significant portion of which utilizes flexible packaging. Regulatory factors, such as government initiatives promoting sustainability and waste reduction, are compelling manufacturers to adopt more eco-friendly packaging solutions, including recyclable and compostable options. The convenience factor associated with flexible packaging formats like pouches and resealable bags caters to modern, on-the-go lifestyles, further driving adoption.

Challenges Impacting North America Flexible Packaging Industry Growth

The North America flexible packaging industry faces several significant challenges. Regulatory complexities, particularly concerning the varying standards for food contact materials and the evolving landscape of plastic waste management, create uncertainty and can increase compliance costs. Supply chain issues, including fluctuating raw material prices, geopolitical influences, and logistical bottlenecks, can disrupt production and impact profitability. Competitive pressures are intense, with numerous players vying for market share, necessitating continuous innovation and cost optimization. The substantial investment required for transitioning to advanced recycling technologies and developing novel sustainable materials presents a considerable financial hurdle for many companies. Public perception regarding plastic waste, while driving demand for alternatives, also places pressure on manufacturers to demonstrate the environmental responsibility of their products.

Key Players Shaping the North America Flexible Packaging Industry Market

- Toppan Printing Co Ltd

- Sonoco Products Co

- Covertech Flexible Packaging Inc

- Transcontinental Inc

- ProAmpac

- American Packaging Corporation

- Cascades Flexible Packaging

- St Johns Packaging

- Emmerson Packaging

- Amcor PLC

- Novolex Holdings Inc

- Mondi PLC

- Sealed Air Corp

- Constantia Flexibles

- Tetra Pak International SA

- Berry Global Inc

- Printpack Inc

- Winpak Limited

- Sigma Plastics Group Inc

- Sit Group SpA

Significant North America Flexible Packaging Industry Industry Milestones

- December 2022: Amcor PLC, a global leader in developing and producing packaging solutions, announced a five-year contract with ExxonMobil to purchase certified-circular polyethylene material in support of its target to achieve 30% recycled material across its portfolio by 2030. Amcor plans to leverage this material across its global portfolio, focusing on the healthcare and food industries, which are needed to meet stringent safety requirements for recycled plastic.

- October 2022: Berry Global announced its partnership with film converter and manufacturer Printpack, leveraging its independent strengths in film manufacturing and conversion to create packaging solutions that support improved customer demand for more sustainable packaging. The companies introduced the Preserve PE PCR recyclable polyethylene (PE) pouch. The pouch is How2Recycle pre-qualified and contains 30% FDA-compliant post-consumer recycled resin (PCR) content.

Future Outlook for North America Flexible Packaging Industry Market

The future outlook for the North America flexible packaging industry is exceptionally positive, driven by sustained demand for convenience, innovation in sustainable materials, and a growing emphasis on product preservation. Strategic opportunities lie in the continued development of high-performance, recyclable, and compostable flexible packaging solutions that align with circular economy principles. The increasing adoption of advanced printing technologies for enhanced customization and brand visibility will further shape market dynamics. Investments in automation and digitalization of manufacturing processes will enhance efficiency and reduce costs. The growing demand for flexible packaging in emerging end-user industries, such as healthcare and e-commerce, alongside the robust growth in the food and beverage sectors, presents significant market potential for expansion and diversification.

North America Flexible Packaging Industry Segmentation

-

1. Material Type

-

1.1. Plastics

- 1.1.1. Polyethene (PE)

- 1.1.2. Bi-orientated Polypropylene (BOPP)

- 1.1.3. Cast Polypropylene (CPP)

- 1.1.4. Ethylene Vinyl Alcohol (EVOH)

- 1.1.5. Other Types (PVC, PA, Bioplastics)

- 1.2. Paper

- 1.3. Aluminium Foil

-

1.1. Plastics

-

2. Product Type

- 2.1. Pouches

- 2.2. Bags

- 2.3. Films and Wraps

- 2.4. Other Product Types

-

3. End-User Industry

-

3.1. Food

- 3.1.1. Frozen & Chilled Food

- 3.1.2. Meat, Poultry & Fish

- 3.1.3. Fruits & Vegetables

- 3.1.4. Bakery & Confectionary

- 3.1.5. Dried & Ready Meals

- 3.1.6. Pet Food

- 3.1.7. Other Food Products

- 3.2. Beverages

- 3.3. Tobacco

- 3.4. Cosmetics & Personal Care

- 3.5. Other End-user Industries

-

3.1. Food

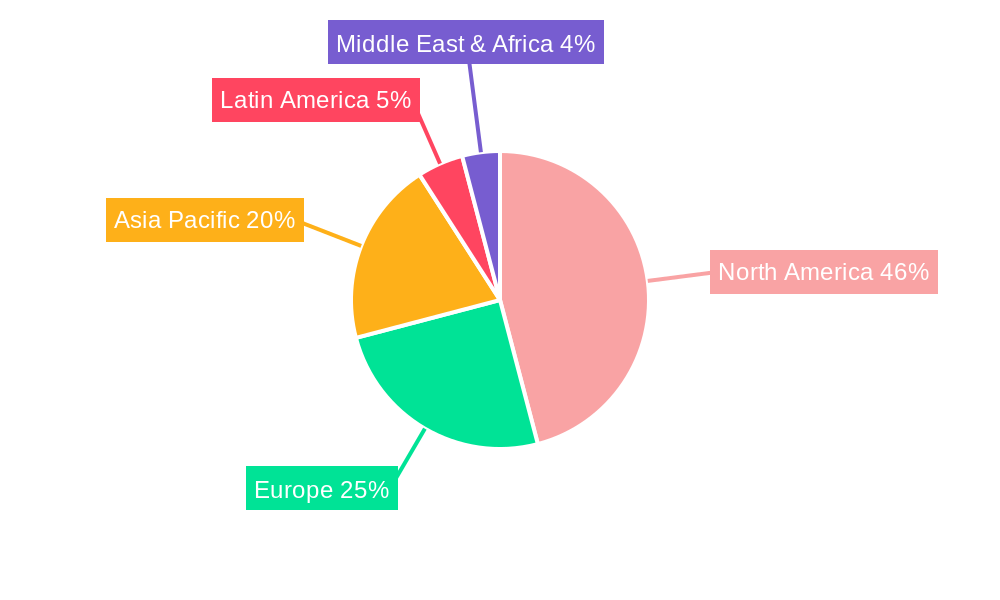

North America Flexible Packaging Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Flexible Packaging Industry Regional Market Share

Geographic Coverage of North America Flexible Packaging Industry

North America Flexible Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.79% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Convenient Packaging; Changing Demographic and Lifestyle Factors

- 3.3. Market Restrains

- 3.3.1. Concerns Regarding the Environment and Recycling

- 3.4. Market Trends

- 3.4.1. The Increased Demand for Convenient Packaging to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Flexible Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Plastics

- 5.1.1.1. Polyethene (PE)

- 5.1.1.2. Bi-orientated Polypropylene (BOPP)

- 5.1.1.3. Cast Polypropylene (CPP)

- 5.1.1.4. Ethylene Vinyl Alcohol (EVOH)

- 5.1.1.5. Other Types (PVC, PA, Bioplastics)

- 5.1.2. Paper

- 5.1.3. Aluminium Foil

- 5.1.1. Plastics

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Pouches

- 5.2.2. Bags

- 5.2.3. Films and Wraps

- 5.2.4. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Food

- 5.3.1.1. Frozen & Chilled Food

- 5.3.1.2. Meat, Poultry & Fish

- 5.3.1.3. Fruits & Vegetables

- 5.3.1.4. Bakery & Confectionary

- 5.3.1.5. Dried & Ready Meals

- 5.3.1.6. Pet Food

- 5.3.1.7. Other Food Products

- 5.3.2. Beverages

- 5.3.3. Tobacco

- 5.3.4. Cosmetics & Personal Care

- 5.3.5. Other End-user Industries

- 5.3.1. Food

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Toppan Printing Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sonoco Products Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Covertech Flexible Packaging Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Transcontinental Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ProAmpac

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 American Packaging Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cascades Flexible Packaging

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 St Johns Packaging*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Emmerson Packaging

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Amcor PLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Novolex Holdings Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Mondi PLC

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Sealed Air Corp

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Constantia Flexibles

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Tetra Pak International SA

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Berry Global Inc

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Printpack Inc

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 Winpak Limited

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 Sigma Plastics Group Inc

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.20 Sit Group SpA

- 6.2.20.1. Overview

- 6.2.20.2. Products

- 6.2.20.3. SWOT Analysis

- 6.2.20.4. Recent Developments

- 6.2.20.5. Financials (Based on Availability)

- 6.2.1 Toppan Printing Co Ltd

List of Figures

- Figure 1: North America Flexible Packaging Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Flexible Packaging Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Flexible Packaging Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 2: North America Flexible Packaging Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 3: North America Flexible Packaging Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 4: North America Flexible Packaging Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: North America Flexible Packaging Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 6: North America Flexible Packaging Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 7: North America Flexible Packaging Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 8: North America Flexible Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States North America Flexible Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Flexible Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico North America Flexible Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Flexible Packaging Industry?

The projected CAGR is approximately 2.79%.

2. Which companies are prominent players in the North America Flexible Packaging Industry?

Key companies in the market include Toppan Printing Co Ltd, Sonoco Products Co, Covertech Flexible Packaging Inc, Transcontinental Inc, ProAmpac, American Packaging Corporation, Cascades Flexible Packaging, St Johns Packaging*List Not Exhaustive, Emmerson Packaging, Amcor PLC, Novolex Holdings Inc, Mondi PLC, Sealed Air Corp, Constantia Flexibles, Tetra Pak International SA, Berry Global Inc, Printpack Inc, Winpak Limited, Sigma Plastics Group Inc, Sit Group SpA.

3. What are the main segments of the North America Flexible Packaging Industry?

The market segments include Material Type, Product Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 45.91 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Convenient Packaging; Changing Demographic and Lifestyle Factors.

6. What are the notable trends driving market growth?

The Increased Demand for Convenient Packaging to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Concerns Regarding the Environment and Recycling.

8. Can you provide examples of recent developments in the market?

December 2022: Amcor PLC, a global leader in developing and producing packaging solutions, has announced a five-year contract with ExxonMobil to purchase certified-circular polyethylene material in support of its target to achieve 30% recycled material across its portfolio by 2030. Amcor plans to leverage this material across its global portfolio, focusing on the healthcare and food industries, which are needed to meet stringent safety requirements for recycled plastic.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Flexible Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Flexible Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Flexible Packaging Industry?

To stay informed about further developments, trends, and reports in the North America Flexible Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence