Key Insights

The Europe Biodegradable Plastic Packaging market is projected to reach $112.49 billion by 2025, exhibiting a compound annual growth rate (CAGR) of 8.4%. This growth is driven by increasing consumer demand for sustainable solutions and supportive environmental regulations across Europe. Heightened awareness of conventional plastic pollution is encouraging businesses to adopt eco-friendly alternatives. Advances in bioplastic materials, offering improved performance and cost-efficiency, are further accelerating market adoption. Key industries, including food & beverage, pharmaceuticals, and personal care, are investing in biodegradable packaging to meet corporate social responsibility objectives and attract environmentally conscious consumers.

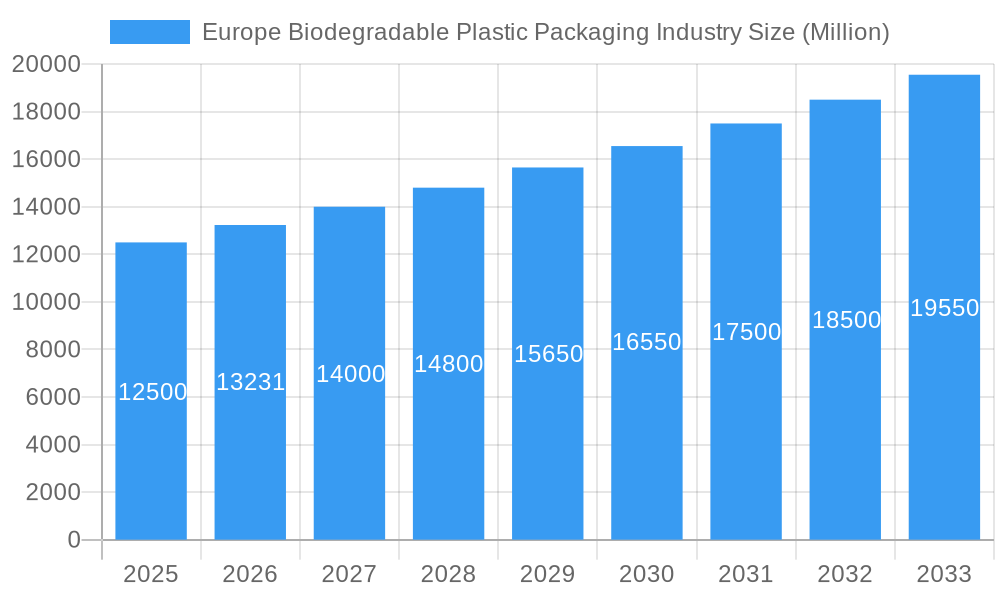

Europe Biodegradable Plastic Packaging Industry Market Size (In Billion)

Emerging trends such as enhanced barrier properties in novel biodegradable polymers, increased use of bio-based feedstocks, and the integration of circular economy principles are shaping market dynamics. Innovations in composting infrastructure and consumer education on proper disposal are also boosting the acceptance and effectiveness of biodegradable packaging. Potential challenges include higher production costs compared to conventional plastics and regional raw material availability constraints. Nevertheless, strategic investments by major players and robust demand from key markets like Germany, France, and the UK indicate a positive outlook for the Europe Biodegradable Plastic Packaging industry. Continuous innovation and policy support will reinforce Europe's leadership in sustainable packaging adoption.

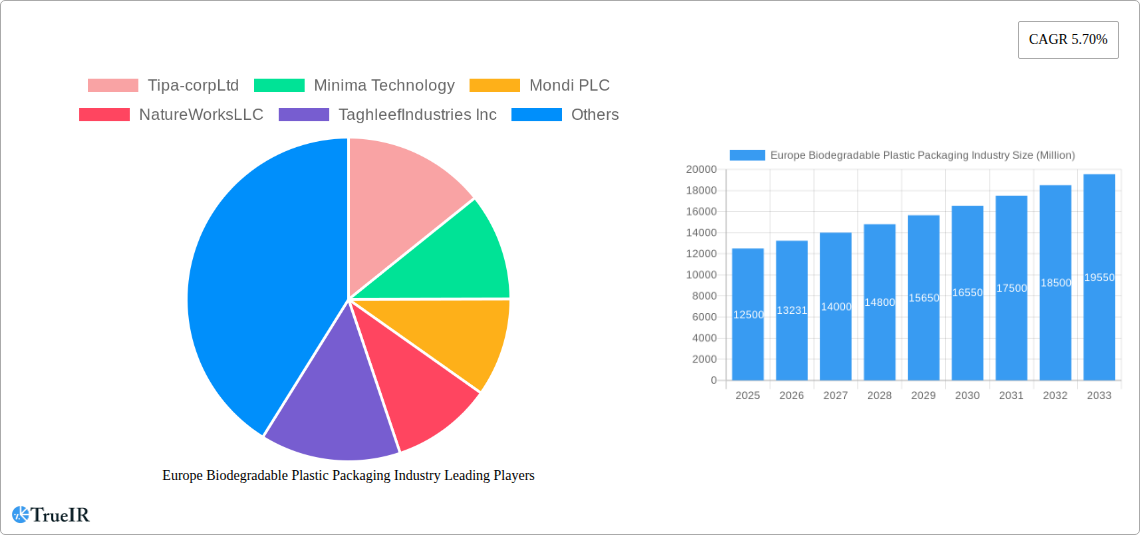

Europe Biodegradable Plastic Packaging Industry Company Market Share

Europe Biodegradable Plastic Packaging Industry Market Structure & Competitive Landscape

The Europe biodegradable plastic packaging market exhibits a moderately consolidated structure, with a blend of large multinational corporations and a growing number of innovative, specialized players. Key companies like Mondi PLC, Amcor Limited, and Tetra Pak International SA command significant market share due to their established distribution networks, extensive product portfolios, and strong brand recognition in the broader packaging sector. Their strategic focus often involves integrating biodegradable solutions within their existing offerings and investing in R&D for sustainable materials.

However, the landscape is increasingly shaped by agile innovators such as Tipa-corpLtd, Minima Technology, and Biogreen, who are pushing the boundaries of material science and compostability. These companies often specialize in specific biodegradable polymers or end-use applications, fostering a dynamic competitive environment. NatureWorks LLC and Taghleef Industries Inc. also play crucial roles, contributing specialized biodegradable resins and advanced film technologies, respectively.

Innovation remains a primary driver, fueled by increasing environmental awareness and stringent regulatory mandates across European nations. Companies are investing heavily in research and development to enhance the performance, cost-effectiveness, and end-of-life options for biodegradable plastics. Regulatory impacts, particularly the EU's circular economy action plan and single-use plastic directives, are profoundly shaping market entry and product development strategies. These policies favor materials with demonstrable biodegradability and compostability, influencing investment decisions and R&D priorities.

The threat of product substitutes is multifaceted. While traditional plastics continue to hold a cost advantage, they face increasing regulatory pressure and consumer backlash. Reusable packaging solutions and innovative paper-based alternatives also present competition, especially in certain food and beverage applications. However, the unique properties of biodegradable plastics, such as their ability to break down in specific environments, offer distinct advantages for applications where collection and recycling infrastructure for traditional plastics are challenging.

End-user segmentation is diverse, with significant adoption in food and beverage, cosmetics and personal care, and agricultural sectors. The growth of e-commerce has also spurred demand for sustainable shipping and product packaging. Mergers and acquisitions (M&A) are an emerging trend, as larger packaging conglomerates seek to acquire innovative biodegradable material companies to expand their sustainable product offerings and secure a competitive edge in this rapidly evolving market. Quantifiable data on M&A volumes is projected to reach €1,500 Million by 2025, indicating strategic consolidation. Concentration ratios remain moderate, with the top five players estimated to hold approximately 55% of the market share.

Europe Biodegradable Plastic Packaging Industry Market Trends & Opportunities

The Europe biodegradable plastic packaging market is experiencing robust growth, driven by a confluence of escalating environmental consciousness, stringent regulatory frameworks, and evolving consumer preferences. This dynamic market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 9.5% over the study period from 2019 to 2033, with the base year 2025 estimated to represent a market size of €25,000 Million. The forecast period (2025–2033) is expected to see continued expansion, fueled by increasing demand for sustainable alternatives to conventional plastics.

Technological shifts are playing a pivotal role in this evolution. Innovations in material science are leading to the development of novel biodegradable polymers with improved performance characteristics, such as enhanced barrier properties, increased strength, and better heat resistance. This includes advancements in polylactic acid (PLA), polyhydroxyalkanoates (PHAs), and starch-based plastics, making them viable for a wider array of packaging applications. The research and development efforts are focusing on achieving full biodegradability in various environmental conditions, including industrial composting, home composting, and even marine environments, thereby addressing a critical aspect of the circular economy. The market penetration rate for advanced biodegradable materials is expected to reach 40% by 2030.

Consumer preferences are demonstrably shifting towards environmentally responsible products. Consumers are increasingly scrutinizing product packaging and actively seeking out brands that align with their sustainability values. This growing demand is compelling manufacturers and retailers to adopt biodegradable packaging solutions to maintain brand loyalty and attract environmentally conscious buyers. The "green premium" associated with sustainable packaging is becoming less of a barrier and more of an expectation, particularly in premium product segments.

Competitive dynamics within the Europe biodegradable plastic packaging industry are intensifying. Established players like Mondi PLC, Amcor Limited, and Tetra Pak International SA are actively investing in expanding their biodegradable product lines and forming strategic partnerships. Simultaneously, a surge of innovative startups, including Tipa-corpLtd and Minima Technology, are disrupting the market with their specialized bio-based solutions and agile business models. Companies like NatureWorks LLC are crucial for their supply of high-quality biodegradable resins, while Taghleef Industries Inc. contributes advanced biodegradable film technologies. The strategic importance of companies such as Biogreen is also growing as they focus on niche applications and localized production.

The European Union's commitment to a circular economy and its ambitious targets for plastic waste reduction are creating significant opportunities. Policies aimed at phasing out single-use plastics and promoting the use of sustainable materials are providing a strong regulatory push for the adoption of biodegradable packaging. The availability of public and private funding for research and development in bio-based materials further fuels innovation and market expansion. The overall market size is projected to reach €50,000 Million by 2033.

Opportunities also lie in the development of innovative end-of-life solutions. While biodegradability is key, ensuring efficient collection and composting infrastructure is crucial for realizing the full environmental benefits. Collaborations between packaging manufacturers, waste management companies, and municipalities are vital to establish effective circular systems. The increasing focus on food waste reduction also presents an opportunity for biodegradable packaging that can extend shelf life and provide enhanced product protection. The integration of smart technologies, such as RFID tags embedded in biodegradable packaging for improved traceability and waste sorting, is another emerging trend. The market size for biodegradable plastic packaging for food and beverages alone is estimated to be €18,000 Million in 2025.

Dominant Markets & Segments in Europe Biodegradable Plastic Packaging Industry

The Europe biodegradable plastic packaging industry is characterized by distinct regional and segment dominance, driven by a combination of policy, infrastructure, and market demand. Germany consistently emerges as a leading market, accounting for approximately 25% of the total European consumption. This dominance is underpinned by strong government initiatives promoting sustainable packaging, a well-developed recycling and composting infrastructure, and a highly environmentally conscious consumer base. The German market benefits from clear regulatory frameworks that incentivize the use of biodegradable materials, making it a prime location for investment and innovation. The total market value in Germany is projected to reach €12,500 Million by 2025.

In terms of Production Analysis, Western European countries, particularly Germany, France, and the Netherlands, are the primary production hubs. These regions benefit from advanced manufacturing capabilities, access to raw materials for bioplastics, and a supportive industrial ecosystem. The production volume is estimated to reach 8 Million Metric Tons in 2025, with a projected growth of 7.2% annually. Key growth drivers in production include government subsidies for bioplastic manufacturing, the availability of skilled labor, and proximity to major consumption markets. Companies like Mondi PLC and NatureWorks LLC have significant production facilities in these regions, leveraging economies of scale and technological expertise.

The Consumption Analysis reveals a strong demand across multiple end-use sectors. The food and beverage industry is the largest consumer, accounting for an estimated 50% of the market. This is driven by the need for packaging that can ensure food safety and extend shelf life while meeting sustainability goals. Applications include flexible packaging for snacks, rigid containers for dairy and ready-to-eat meals, and films for produce. The cosmetics and personal care sector represents another significant segment, valued at €4,000 Million in 2025, due to consumer preference for eco-friendly products. The agricultural sector also contributes substantially through the use of biodegradable mulching films and packaging for fertilizers.

The Import Market Analysis shows significant trade flows, with the value of imports estimated at €3,000 Million in 2025 and a volume of 1.5 Million Metric Tons. Key import origins include countries with specialized bioplastic production capabilities or competitive pricing. The volume of imports is projected to grow at a CAGR of 8.8% from 2025 to 2033. Major importing countries often have sophisticated downstream processing industries that utilize imported raw materials or specialized biodegradable films. Challenges in the import market include fluctuating raw material prices and the need for compliance with stringent European biodegradability standards.

The Export Market Analysis indicates that Europe is also a significant exporter of biodegradable plastic packaging, with an estimated value of €2,500 Million and a volume of 1.2 Million Metric Tons in 2025. The growth in exports is driven by the increasing global demand for sustainable packaging solutions and Europe's reputation for high-quality, certified biodegradable products. Key export destinations include North America and parts of Asia, where environmental regulations are also becoming more stringent. The export market is expected to grow at a CAGR of 9.1% over the forecast period.

Price Trend Analysis reveals a gradual convergence between the prices of biodegradable plastics and conventional plastics, driven by economies of scale in production and technological advancements. While biodegradable options historically carried a premium, this gap is narrowing, making them more accessible for mass market applications. The average price of biodegradable plastic resins is estimated at €2.5 per kilogram in 2025, with a projected decrease to €2.1 per kilogram by 2033. Factors influencing price trends include the cost of feedstock (such as corn starch or sugarcane), energy prices, and the overall supply-demand balance. Government incentives and subsidies also play a role in moderating prices.

Europe Biodegradable Plastic Packaging Industry Product Analysis

Product innovation in the Europe biodegradable plastic packaging industry is rapidly expanding the applications for sustainable materials. Key advancements focus on developing polymers with tailored properties, such as enhanced barrier protection for food preservation, increased flexibility for pouches, and improved puncture resistance for industrial packaging. Materials like Polylactic Acid (PLA), Polyhydroxyalkanoates (PHAs), and starch-based blends are continuously being refined to match or exceed the performance of conventional plastics in areas like food wraps, coffee capsules, and disposable cutlery. For instance, innovative bioplastic films from companies like Tipa-corpLtd are offering compostability without compromising on product integrity. The competitive advantage lies in offering certified biodegradability and compostability, aligning with stringent EU regulations and growing consumer demand for eco-friendly solutions across various sectors including food and beverage, cosmetics, and pharmaceuticals.

Key Drivers, Barriers & Challenges in Europe Biodegradable Plastic Packaging Industry

Key Drivers: The Europe biodegradable plastic packaging industry is propelled by a strong regulatory push from the European Union, which mandates reduced plastic waste and promotes circular economy principles. Growing consumer awareness and demand for sustainable products are significant market drivers, influencing purchasing decisions and pressuring brands to adopt eco-friendly packaging. Technological advancements in biopolymer production are leading to improved material performance and cost-effectiveness, making biodegradable plastics more competitive. Government incentives and subsidies for bioplastic research, development, and manufacturing further bolster market growth. The established presence of major players like Mondi PLC and Amcor Limited, coupled with the innovation from specialized firms like NatureWorks LLC, ensures continued investment and product development.

Barriers & Challenges: Despite the positive outlook, the industry faces significant challenges. The higher initial cost of biodegradable plastics compared to conventional counterparts remains a barrier, although this gap is narrowing. Ensuring adequate and accessible composting infrastructure across all member states is crucial for realizing the full benefits of biodegradability, but this infrastructure is still developing. Supply chain volatility and the availability of sustainable feedstock can impact production costs and consistency. Regulatory complexities and differing national standards within the EU can create hurdles for market entry and product certification. Intense competition from both traditional plastics, which still benefit from established infrastructure and lower costs, and other sustainable alternatives like paper and reusable packaging, also poses a challenge. Supply chain issues, including the sourcing of agricultural feedstocks, could lead to price fluctuations estimated at 10-15% annually.

Growth Drivers in the Europe Biodegradable Plastic Packaging Industry Market

Several key drivers are fueling the growth of the Europe biodegradable plastic packaging market. Foremost is the European Union's strong regulatory framework, which actively discourages single-use plastics and promotes the adoption of sustainable alternatives through directives and ambitious waste reduction targets. This legislative push is creating a predictable and supportive environment for investment in biodegradable packaging solutions.

Secondly, escalating consumer demand for eco-friendly products is a powerful market force. Consumers are increasingly aware of the environmental impact of plastic waste and are actively seeking out brands that offer sustainable packaging options. This conscious consumerism is compelling manufacturers and retailers to prioritize biodegradable materials to maintain brand image and market share.

Thirdly, technological advancements in biopolymer science are crucial. Continuous innovation is leading to the development of biodegradable plastics with enhanced performance characteristics, such as improved barrier properties, increased strength, and better heat resistance, making them suitable for a wider range of applications previously dominated by conventional plastics. Companies like NatureWorks LLC are at the forefront of these material innovations.

Challenges Impacting Europe Biodegradable Plastic Packaging Industry Growth

Despite the promising growth trajectory, the Europe biodegradable plastic packaging industry grapples with several challenges. A primary concern is the higher cost of production for many biodegradable plastics compared to their petrochemical-based counterparts, which can hinder widespread adoption, particularly in price-sensitive markets.

Furthermore, the fragmented and often inadequate composting infrastructure across European member states poses a significant hurdle. For biodegradable plastics to fulfill their environmental promise, they require access to industrial composting facilities, which are not universally available, leading to disposal issues and potential greenwashing perceptions.

Supply chain complexities, including the availability and sustainability of feedstock for bioplastics, can lead to price volatility and affect production scalability. The competition from established conventional plastics, which benefit from existing infrastructure and lower production costs, remains intense. Additionally, navigating the diverse and evolving regulatory landscape within different European countries can present compliance challenges for manufacturers.

Key Players Shaping the Europe Biodegradable Plastic Packaging Industry Market

- Tipa-corpLtd

- Minima Technology

- Mondi PLC

- NatureWorks LLC

- Taghleef Industries Inc

- Amcor Limited

- Tetra Pak International SA

- Biogreen

Significant Europe Biodegradable Plastic Packaging Industry Industry Milestones

- 2019: European Union adopts the Circular Economy Action Plan, setting ambitious targets for plastic waste reduction and promoting sustainable packaging.

- 2020: NatureWorks LLC announces significant capacity expansion for its Ingeo PLA biopolymer, addressing growing market demand.

- 2021: Mondi PLC invests heavily in developing innovative biodegradable packaging solutions for the food and beverage sector.

- 2022: Tipa-corpLtd launches a new range of home-compostable films, expanding the range of accessible end-of-life options.

- 2023: Biogreen introduces novel biodegradable packaging for agricultural applications, enhancing soil health and reducing plastic pollution.

- January 2024: Amcor Limited acquires a leading bioplastic film manufacturer, strengthening its sustainable packaging portfolio.

- February 2024: Taghleef Industries Inc. develops advanced biodegradable barrier films for flexible packaging, improving product protection.

- March 2024: Tetra Pak International SA announces a pilot program for fully biodegradable carton packaging in select European markets.

Future Outlook for Europe Biodegradable Plastic Packaging Industry Market

The future outlook for the Europe biodegradable plastic packaging industry is exceptionally bright, characterized by sustained growth and innovation. Strategic opportunities lie in bridging the gap between material development and widespread infrastructure deployment for composting and anaerobic digestion. Increased collaboration between packaging manufacturers, waste management entities, and governmental bodies will be crucial to establish robust circular economy systems. The market is poised for further integration of advanced biopolymers with superior performance characteristics, catering to a broader range of demanding applications. Continued investment in R&D by key players like Mondi PLC, Amcor Limited, and specialized innovators will drive product diversification and cost competitiveness, ultimately accelerating the transition away from conventional plastics and solidifying the dominance of sustainable packaging solutions across the continent. The market is expected to reach €50,000 Million by 2033.

Europe Biodegradable Plastic Packaging Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

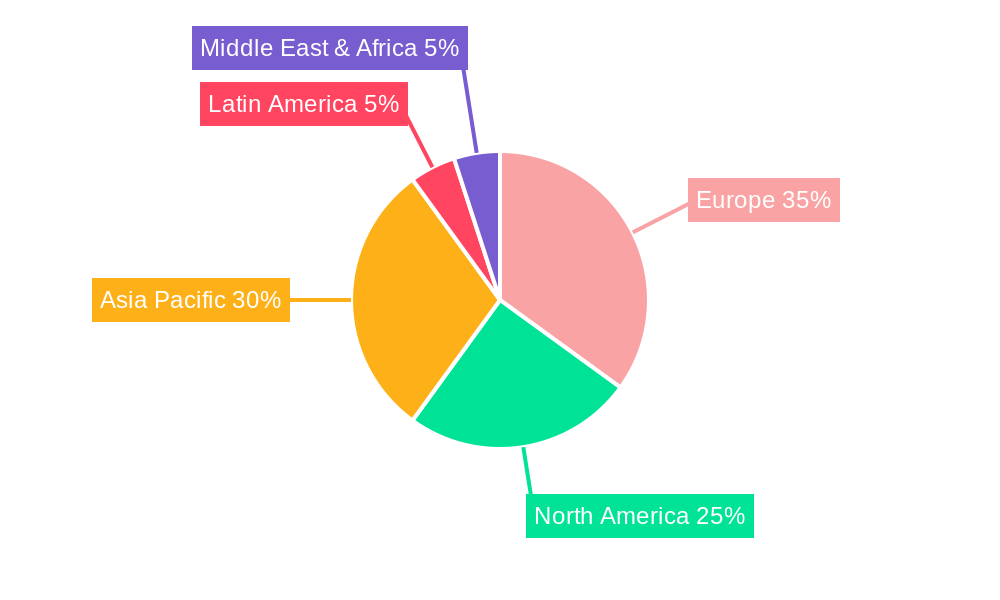

Europe Biodegradable Plastic Packaging Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Biodegradable Plastic Packaging Industry Regional Market Share

Geographic Coverage of Europe Biodegradable Plastic Packaging Industry

Europe Biodegradable Plastic Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing demand for Sustainable Products; Stringent government Regulations

- 3.3. Market Restrains

- 3.3.1. Manufacturing Complications & Lower ROI

- 3.4. Market Trends

- 3.4.1. Starch Blend Material to Witness Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Biodegradable Plastic Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Tipa-corpLtd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Minima Technology

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Mondi PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 NatureWorksLLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 TaghleefIndustries Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Amcor Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Tetra Pak International SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Biogreen

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Tipa-corpLtd

List of Figures

- Figure 1: Europe Biodegradable Plastic Packaging Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Biodegradable Plastic Packaging Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Biodegradable Plastic Packaging Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Europe Biodegradable Plastic Packaging Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Europe Biodegradable Plastic Packaging Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Europe Biodegradable Plastic Packaging Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Europe Biodegradable Plastic Packaging Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Europe Biodegradable Plastic Packaging Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Europe Biodegradable Plastic Packaging Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: Europe Biodegradable Plastic Packaging Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Europe Biodegradable Plastic Packaging Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Europe Biodegradable Plastic Packaging Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Europe Biodegradable Plastic Packaging Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Europe Biodegradable Plastic Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Biodegradable Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Germany Europe Biodegradable Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: France Europe Biodegradable Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Italy Europe Biodegradable Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Spain Europe Biodegradable Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Netherlands Europe Biodegradable Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Belgium Europe Biodegradable Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Sweden Europe Biodegradable Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Norway Europe Biodegradable Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Poland Europe Biodegradable Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Denmark Europe Biodegradable Plastic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Biodegradable Plastic Packaging Industry?

The projected CAGR is approximately 8.4%.

2. Which companies are prominent players in the Europe Biodegradable Plastic Packaging Industry?

Key companies in the market include Tipa-corpLtd, Minima Technology, Mondi PLC, NatureWorksLLC, TaghleefIndustries Inc, Amcor Limited, Tetra Pak International SA, Biogreen.

3. What are the main segments of the Europe Biodegradable Plastic Packaging Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 112.49 billion as of 2022.

5. What are some drivers contributing to market growth?

; Growing demand for Sustainable Products; Stringent government Regulations.

6. What are the notable trends driving market growth?

Starch Blend Material to Witness Significant Market Share.

7. Are there any restraints impacting market growth?

Manufacturing Complications & Lower ROI.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Biodegradable Plastic Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Biodegradable Plastic Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Biodegradable Plastic Packaging Industry?

To stay informed about further developments, trends, and reports in the Europe Biodegradable Plastic Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence