Key Insights

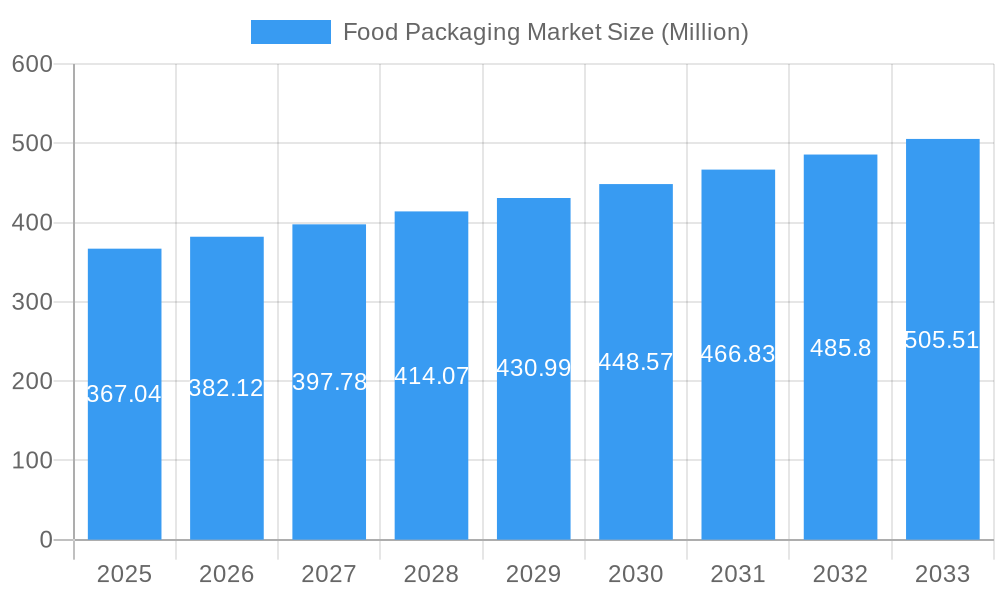

The global Food Packaging Market is projected for robust expansion, currently valued at USD 367.04 million in 2025 and anticipated to grow at a Compound Annual Growth Rate (CAGR) of 4.16% through 2033. This sustained growth is underpinned by several key drivers, including the escalating global demand for processed and convenience foods, a growing consumer preference for visually appealing and informative packaging, and advancements in material science leading to more sustainable and functional packaging solutions. The market's evolution is also significantly shaped by evolving consumer lifestyles, with increased urbanization and busy schedules driving the demand for ready-to-eat meals and on-the-go food options, all of which rely heavily on effective and safe packaging. Furthermore, stringent food safety regulations worldwide are pushing manufacturers to adopt high-quality, hygienic, and tamper-evident packaging, contributing to market value. Innovations in smart packaging, which offer functionalities like shelf-life extension and traceability, are also emerging as significant growth catalysts.

Food Packaging Market Market Size (In Million)

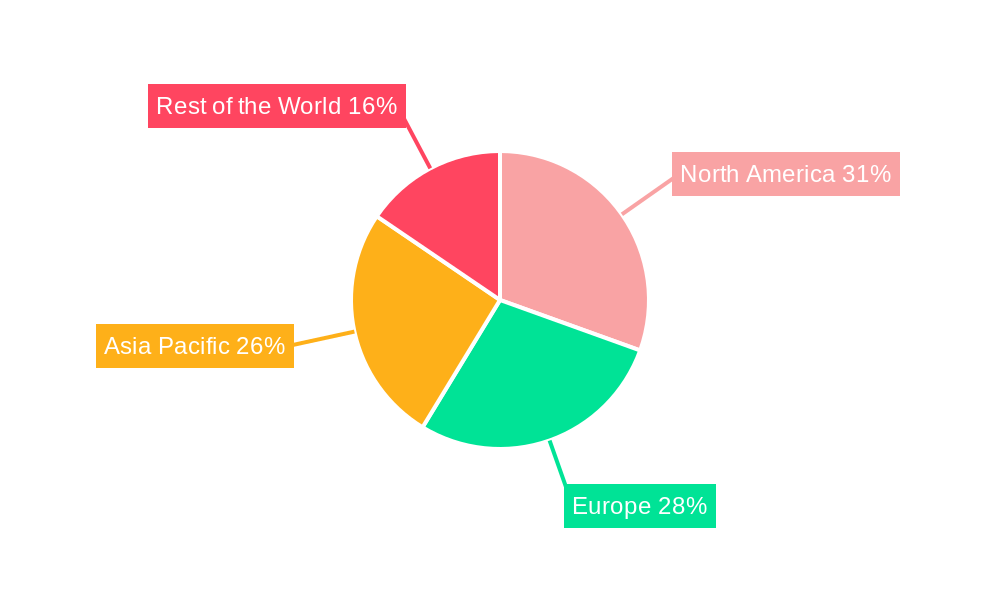

The market segmentation reveals a diverse landscape, with Plastic dominating the "Type of Material" segment due to its versatility, cost-effectiveness, and excellent barrier properties. Rigid packaging continues to hold a substantial share across "Packaging Type," offering superior protection for delicate food items. However, flexible packaging is witnessing dynamic growth, driven by its lightweight nature, reduced material usage, and convenience for consumers. In terms of "Product Type," converted roll stock and corrugated boxes are pivotal for large-scale food production and distribution, while pouches and bottles are gaining traction for individual servings and specialty products. The "Application" segment showcases the broad reach of food packaging, with Dairy Products, Poultry and Meat Products, and Fruits & Vegetables being significant contributors, alongside the burgeoning Bakery & Confectionery sector. Geographically, North America and Europe represent mature markets with a strong focus on sustainability and innovation, while the Asia Pacific region is poised for the most rapid growth due to its expanding middle class, increasing disposable incomes, and a burgeoning food processing industry.

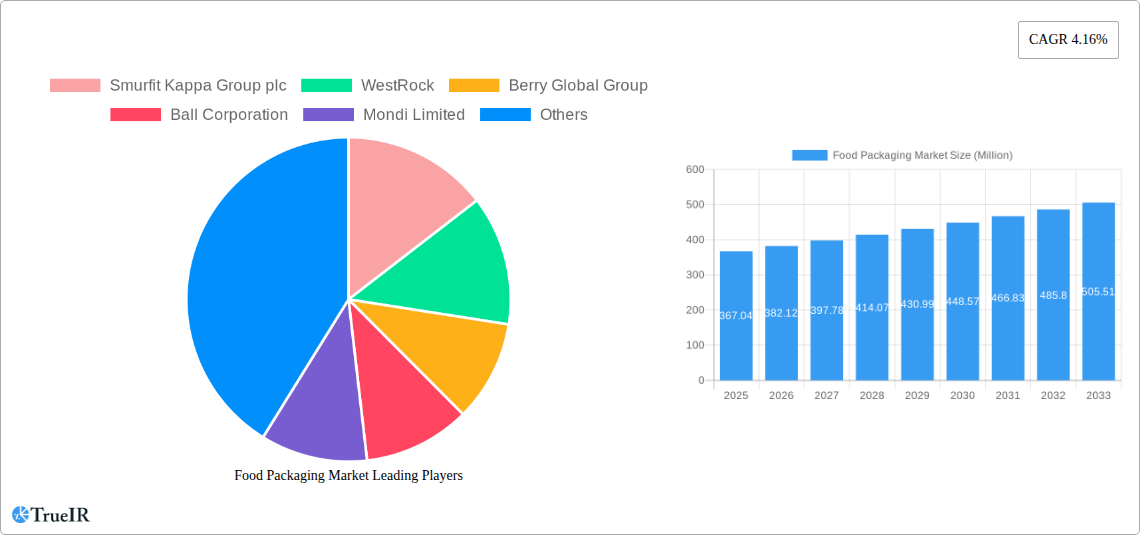

Food Packaging Market Company Market Share

Food Packaging Market: Comprehensive Global Analysis and Forecast 2025-2033

This in-depth report provides a dynamic and SEO-optimized analysis of the global Food Packaging Market, leveraging high-volume keywords to enhance search rankings and engage industry audiences. Our study, spanning the historical period of 2019–2024 and projecting to 2033, with a base and estimated year of 2025, delivers critical insights into market size, trends, opportunities, and competitive dynamics. We delve into the intricate structure and competitive landscape, explore dominant markets and segments, analyze product innovations, and identify key drivers, barriers, and challenges shaping the future of food packaging.

Food Packaging Market Market Structure & Competitive Landscape

The global Food Packaging Market is characterized by a moderate to high degree of concentration, with key players like Amcor Plc, Berry Global Group, and Smurfit Kappa Group plc holding significant market share. Innovation remains a primary driver, fueled by escalating consumer demand for sustainable, convenient, and safe food packaging solutions. Regulatory impacts, particularly concerning single-use plastics and recycling initiatives, are profoundly influencing material choices and product development. The prevalence of product substitutes, ranging from reusable containers to alternative packaging materials, compels manufacturers to continuously innovate. End-user segmentation, spanning dairy, meat, fruits & vegetables, and bakery & confectionery, dictates specific packaging requirements. Mergers and acquisitions (M&A) are a notable trend, with companies strategically acquiring competitors or complementary businesses to expand their product portfolios, geographical reach, and technological capabilities. For instance, the acquisition of Scholle IPN by SIG in June 2022 for USD 1.53 billion underscores the consolidation driving industry growth and the pursuit of advanced, sustainable packaging solutions.

Food Packaging Market Market Trends & Opportunities

The global Food Packaging Market is poised for robust growth, projected to reach substantial market value by 2033. This expansion is driven by a confluence of evolving consumer preferences, technological advancements, and increasing demand for convenience. The shift towards flexible packaging solutions, particularly for single-serve portions and on-the-go consumption, is a significant trend. This is directly linked to a growing millennial and Gen Z population seeking convenience and portion control. Furthermore, the rising global population and the increasing demand for processed and ready-to-eat foods are propelling the need for effective and safe food preservation, directly boosting the demand for various food packaging types.

Technological shifts are playing a pivotal role in shaping the market. The development of advanced barrier materials, active and intelligent packaging, and biodegradable and compostable alternatives are responding to both consumer and regulatory pressures for sustainability. For example, Seal Packaging's introduction of UKCA-marked plastic-free paper cups and compostable bowls in August 2022 exemplifies this innovation. These advancements not only enhance food shelf-life and reduce spoilage but also contribute to a reduced environmental footprint, a key concern for modern consumers.

Competitive dynamics are intensifying, with established players and new entrants vying for market share. Companies are investing heavily in research and development to create innovative packaging that addresses sustainability concerns, enhances product appeal, and ensures food safety and integrity. The market penetration rate for sustainable packaging solutions is steadily increasing, driven by corporate sustainability goals and growing consumer awareness. Opportunities abound for manufacturers that can offer cost-effective, eco-friendly, and high-performance packaging. The rise of e-commerce for food products also presents a significant opportunity, necessitating specialized packaging that can withstand transit and maintain product quality. The increasing demand for aesthetically pleasing packaging, coupled with the need for clear nutritional information and branding, further fuels innovation and differentiation within the market.

Dominant Markets & Segments in Food Packaging Market

The Paper and Paperboard segment, within the Type of Material, is a dominant force in the Food Packaging Market, driven by its recyclability, biodegradability, and increasing adoption for sustainable packaging solutions. This growth is particularly pronounced in regions with stringent environmental regulations and a strong consumer preference for eco-friendly products. The Flexible Packaging segment, under Packaging Type, commands a substantial share due to its versatility, cost-effectiveness, and ability to extend shelf-life, especially for applications like pouches and sachets.

In terms of Product Type, Corrugated Boxes and Converted Roll Stock are leading segments, crucial for the transportation and protection of a wide array of food products, from bulk goods to individual items. The Application segment of Poultry and Meat Products and Dairy Products also exhibits significant dominance, necessitating robust, moisture-resistant, and protective packaging to ensure food safety and prevent spoilage.

Geographically, North America and Europe currently lead the market, propelled by advanced infrastructure, high consumer spending power, and well-established food processing industries. However, the Asia-Pacific region is emerging as a high-growth market, fueled by rapid urbanization, a burgeoning middle class, and increasing disposable incomes that drive demand for packaged foods. Government policies promoting sustainable packaging and waste reduction initiatives are key growth drivers in these regions.

- Type of Material Dominance:

- Paper and Paperboard: Driven by sustainability trends and recyclability.

- Plastic: Continues to hold significant share due to its versatility and cost-effectiveness, with increasing demand for recycled and bio-based plastics.

- Packaging Type Dominance:

- Flexible Packaging: Favored for its lightweight, convenience, and shelf-life extension properties.

- Rigid Packaging: Essential for product protection and premium presentation, particularly for glass bottles and metal cans.

- Product Type Dominance:

- Corrugated Boxes: Critical for logistics and shipping across various food categories.

- Converted Roll Stock: Versatile for a wide range of flexible packaging formats.

- Application Dominance:

- Poultry and Meat Products: Demand for high barrier properties to ensure safety.

- Dairy Products: Requirements for extended shelf-life and product integrity.

The market's dominance is further shaped by continuous innovation in materials science and packaging design, catering to specific end-use requirements and evolving consumer lifestyles.

Food Packaging Market Product Analysis

Product innovations in the Food Packaging Market are primarily focused on sustainability, enhanced functionality, and improved consumer convenience. Companies are developing biodegradable, compostable, and recycled content packaging to meet environmental regulations and consumer demand for eco-friendly options. Examples include Seal Packaging's introduction of plastic-free paper cups and compostable bowls. Furthermore, advancements in active and intelligent packaging are extending food shelf-life, indicating spoilage, and enhancing traceability. These innovations offer significant competitive advantages by differentiating products, meeting stringent food safety standards, and appealing to environmentally conscious consumers. The market fit for these advanced products is expanding rapidly as awareness and adoption rates increase across various food applications.

Key Drivers, Barriers & Challenges in Food Packaging Market

Key Drivers:

- Growing Demand for Packaged Foods: A burgeoning global population and increasing urbanization are driving demand for convenient and preserved food products.

- Sustainability Imperative: Escalating environmental consciousness among consumers and stricter government regulations are pushing for eco-friendly packaging solutions.

- Technological Advancements: Innovations in materials science and packaging technology are creating new opportunities for enhanced functionality and sustainability.

- E-commerce Growth: The rise of online grocery shopping necessitates robust and protective packaging for food delivery.

Barriers & Challenges:

- Regulatory Hurdles: Evolving and fragmented regulations across different regions regarding plastic usage, recyclability, and waste management pose challenges for global manufacturers.

- Supply Chain Disruptions: Volatility in raw material prices and global supply chain issues can impact production costs and availability.

- Cost of Sustainable Materials: While demand is high, the initial cost of certain sustainable packaging alternatives can be higher than traditional options, impacting adoption for price-sensitive segments.

- Consumer Education: The need to educate consumers on proper disposal and recycling of various packaging types remains a persistent challenge.

Growth Drivers in the Food Packaging Market Market

Key growth drivers in the Food Packaging Market are multi-faceted, encompassing technological innovation, economic factors, and evolving regulatory landscapes. The increasing consumer demand for convenience, driven by busy lifestyles and a growing preference for ready-to-eat meals and single-serve portions, is a significant economic catalyst. Technological advancements, such as the development of advanced barrier materials, active packaging that extends shelf-life, and intelligent packaging that provides real-time product information, are creating new market opportunities and enhancing product value. Regulatory frameworks, particularly those promoting circular economy principles and discouraging single-use plastics, are compelling manufacturers to invest in sustainable and recyclable packaging solutions. For instance, government incentives for adopting recycled content are directly influencing material choices and driving market growth in specific segments.

Challenges Impacting Food Packaging Market Growth

Several challenges are impacting the growth of the Food Packaging Market. Regulatory complexities and inconsistencies across different countries and regions create significant hurdles for global harmonization and compliance. The supply chain, marked by price volatility of raw materials like polymers and paper pulp, coupled with logistical disruptions, poses a constant threat to production efficiency and cost-effectiveness. Competitive pressures are intensifying, with both established multinational corporations and agile regional players striving for market share, often leading to price wars and reduced profit margins. Furthermore, the significant investment required for research and development of novel sustainable packaging solutions, coupled with the consumer perception that eco-friendly options may be more expensive, can slow down market adoption in price-sensitive segments.

Key Players Shaping the Food Packaging Market Market

- Smurfit Kappa Group plc

- WestRock

- Berry Global Group

- Ball Corporation

- Mondi Limited

- Tetra Pak

- Amcor Plc

- Crown Holdings Inc

- Schur Flexibles Group

- International Paper

- Sealed Air Corp

- Anchor Packaging Inc

- Graham Packaging Company Inc

Significant Food Packaging Market Industry Milestones

- August 2022: Seal Packaging introduced fresh eco-friendly packaging options, including UKCA-marked plastic-free paper cups, the "It's Not Paper" bag collection, and the Compostabowl. These innovations aim to provide workable and ecological alternatives to conventional packaging, addressing the growing demand for sustainable solutions.

- June 2022: SIG completed the acquisition of Scholle IPN, a flexible packaging solution provider, with an enterprise value of USD 1.53 billion. This strategic move enables SIG to expand its offering of sustainable, low-carbon packaging solutions across a broader range of product categories and sizes, enhancing its competitive position in the flexible packaging segment.

Future Outlook for Food Packaging Market Market

The future outlook for the Food Packaging Market is exceptionally promising, driven by a sustained demand for food products and an accelerating global commitment to sustainability. Strategic opportunities lie in the continued development and widespread adoption of advanced, eco-friendly packaging materials such as biodegradable polymers, compostable alternatives, and high-performance recycled content. The integration of smart packaging technologies, offering enhanced traceability, shelf-life monitoring, and consumer engagement, presents significant growth potential. Furthermore, the increasing penetration of e-commerce for grocery shopping will continue to fuel the demand for robust, safe, and efficient packaging solutions designed for transit. Market players that can effectively navigate regulatory landscapes, invest in innovation, and align their offerings with evolving consumer preferences for health, safety, and environmental responsibility will be well-positioned for sustained growth and market leadership in the coming years.

Food Packaging Market Segmentation

-

1. Type of Material

- 1.1. Plastic

- 1.2. Metal

- 1.3. Glass

- 1.4. Paper and Paperboard

-

2. Packaging Type

- 2.1. Rigid

- 2.2. Semi Rigid

- 2.3. Flexible

-

3. Product Type

- 3.1. Cans

- 3.2. Converted Roll Stock

- 3.3. Gusseted Box

- 3.4. Corrugated Box

- 3.5. Boxboard

- 3.6. Other Packaging Types (Pouches and bottles)

-

4. Application

- 4.1. Dairy Products

- 4.2. Poultry and Meat Products

- 4.3. Fruits & Vegetables

- 4.4. Bakery & Confectionery

- 4.5. Other Ap

Food Packaging Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. France

- 2.3. United Kingdom

- 2.4. Spain

- 2.5. Italy

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

- 4. Rest of the World

Food Packaging Market Regional Market Share

Geographic Coverage of Food Packaging Market

Food Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.16% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for Convenience Foods in Developing Economies; Increasing Demand for Shelf-Life Extension of Foods Accelerating the Food Packaging Market; Trend of Small Households

- 3.3. Market Restrains

- 3.3.1. Stringent Regulations Pertaining to Food Packaging

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Shelf-Life Extension of Foods Accelerating the Food Packaging Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Food Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Material

- 5.1.1. Plastic

- 5.1.2. Metal

- 5.1.3. Glass

- 5.1.4. Paper and Paperboard

- 5.2. Market Analysis, Insights and Forecast - by Packaging Type

- 5.2.1. Rigid

- 5.2.2. Semi Rigid

- 5.2.3. Flexible

- 5.3. Market Analysis, Insights and Forecast - by Product Type

- 5.3.1. Cans

- 5.3.2. Converted Roll Stock

- 5.3.3. Gusseted Box

- 5.3.4. Corrugated Box

- 5.3.5. Boxboard

- 5.3.6. Other Packaging Types (Pouches and bottles)

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Dairy Products

- 5.4.2. Poultry and Meat Products

- 5.4.3. Fruits & Vegetables

- 5.4.4. Bakery & Confectionery

- 5.4.5. Other Ap

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type of Material

- 6. North America Food Packaging Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type of Material

- 6.1.1. Plastic

- 6.1.2. Metal

- 6.1.3. Glass

- 6.1.4. Paper and Paperboard

- 6.2. Market Analysis, Insights and Forecast - by Packaging Type

- 6.2.1. Rigid

- 6.2.2. Semi Rigid

- 6.2.3. Flexible

- 6.3. Market Analysis, Insights and Forecast - by Product Type

- 6.3.1. Cans

- 6.3.2. Converted Roll Stock

- 6.3.3. Gusseted Box

- 6.3.4. Corrugated Box

- 6.3.5. Boxboard

- 6.3.6. Other Packaging Types (Pouches and bottles)

- 6.4. Market Analysis, Insights and Forecast - by Application

- 6.4.1. Dairy Products

- 6.4.2. Poultry and Meat Products

- 6.4.3. Fruits & Vegetables

- 6.4.4. Bakery & Confectionery

- 6.4.5. Other Ap

- 6.1. Market Analysis, Insights and Forecast - by Type of Material

- 7. Europe Food Packaging Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type of Material

- 7.1.1. Plastic

- 7.1.2. Metal

- 7.1.3. Glass

- 7.1.4. Paper and Paperboard

- 7.2. Market Analysis, Insights and Forecast - by Packaging Type

- 7.2.1. Rigid

- 7.2.2. Semi Rigid

- 7.2.3. Flexible

- 7.3. Market Analysis, Insights and Forecast - by Product Type

- 7.3.1. Cans

- 7.3.2. Converted Roll Stock

- 7.3.3. Gusseted Box

- 7.3.4. Corrugated Box

- 7.3.5. Boxboard

- 7.3.6. Other Packaging Types (Pouches and bottles)

- 7.4. Market Analysis, Insights and Forecast - by Application

- 7.4.1. Dairy Products

- 7.4.2. Poultry and Meat Products

- 7.4.3. Fruits & Vegetables

- 7.4.4. Bakery & Confectionery

- 7.4.5. Other Ap

- 7.1. Market Analysis, Insights and Forecast - by Type of Material

- 8. Asia Pacific Food Packaging Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type of Material

- 8.1.1. Plastic

- 8.1.2. Metal

- 8.1.3. Glass

- 8.1.4. Paper and Paperboard

- 8.2. Market Analysis, Insights and Forecast - by Packaging Type

- 8.2.1. Rigid

- 8.2.2. Semi Rigid

- 8.2.3. Flexible

- 8.3. Market Analysis, Insights and Forecast - by Product Type

- 8.3.1. Cans

- 8.3.2. Converted Roll Stock

- 8.3.3. Gusseted Box

- 8.3.4. Corrugated Box

- 8.3.5. Boxboard

- 8.3.6. Other Packaging Types (Pouches and bottles)

- 8.4. Market Analysis, Insights and Forecast - by Application

- 8.4.1. Dairy Products

- 8.4.2. Poultry and Meat Products

- 8.4.3. Fruits & Vegetables

- 8.4.4. Bakery & Confectionery

- 8.4.5. Other Ap

- 8.1. Market Analysis, Insights and Forecast - by Type of Material

- 9. Rest of the World Food Packaging Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type of Material

- 9.1.1. Plastic

- 9.1.2. Metal

- 9.1.3. Glass

- 9.1.4. Paper and Paperboard

- 9.2. Market Analysis, Insights and Forecast - by Packaging Type

- 9.2.1. Rigid

- 9.2.2. Semi Rigid

- 9.2.3. Flexible

- 9.3. Market Analysis, Insights and Forecast - by Product Type

- 9.3.1. Cans

- 9.3.2. Converted Roll Stock

- 9.3.3. Gusseted Box

- 9.3.4. Corrugated Box

- 9.3.5. Boxboard

- 9.3.6. Other Packaging Types (Pouches and bottles)

- 9.4. Market Analysis, Insights and Forecast - by Application

- 9.4.1. Dairy Products

- 9.4.2. Poultry and Meat Products

- 9.4.3. Fruits & Vegetables

- 9.4.4. Bakery & Confectionery

- 9.4.5. Other Ap

- 9.1. Market Analysis, Insights and Forecast - by Type of Material

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Smurfit Kappa Group plc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 WestRock

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Berry Global Group

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Ball Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Mondi Limited

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Tetra Pak

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Amcor Plc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Crown Holdings Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Schur Flexibles Group

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 International Papers

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Sealed Air Corp

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Anchor Packaging Inc

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Graham Packaging Company Inc *List Not Exhaustive

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.1 Smurfit Kappa Group plc

List of Figures

- Figure 1: Global Food Packaging Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Food Packaging Market Revenue (Million), by Type of Material 2025 & 2033

- Figure 3: North America Food Packaging Market Revenue Share (%), by Type of Material 2025 & 2033

- Figure 4: North America Food Packaging Market Revenue (Million), by Packaging Type 2025 & 2033

- Figure 5: North America Food Packaging Market Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 6: North America Food Packaging Market Revenue (Million), by Product Type 2025 & 2033

- Figure 7: North America Food Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 8: North America Food Packaging Market Revenue (Million), by Application 2025 & 2033

- Figure 9: North America Food Packaging Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Food Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 11: North America Food Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Food Packaging Market Revenue (Million), by Type of Material 2025 & 2033

- Figure 13: Europe Food Packaging Market Revenue Share (%), by Type of Material 2025 & 2033

- Figure 14: Europe Food Packaging Market Revenue (Million), by Packaging Type 2025 & 2033

- Figure 15: Europe Food Packaging Market Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 16: Europe Food Packaging Market Revenue (Million), by Product Type 2025 & 2033

- Figure 17: Europe Food Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 18: Europe Food Packaging Market Revenue (Million), by Application 2025 & 2033

- Figure 19: Europe Food Packaging Market Revenue Share (%), by Application 2025 & 2033

- Figure 20: Europe Food Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Europe Food Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Food Packaging Market Revenue (Million), by Type of Material 2025 & 2033

- Figure 23: Asia Pacific Food Packaging Market Revenue Share (%), by Type of Material 2025 & 2033

- Figure 24: Asia Pacific Food Packaging Market Revenue (Million), by Packaging Type 2025 & 2033

- Figure 25: Asia Pacific Food Packaging Market Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 26: Asia Pacific Food Packaging Market Revenue (Million), by Product Type 2025 & 2033

- Figure 27: Asia Pacific Food Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Asia Pacific Food Packaging Market Revenue (Million), by Application 2025 & 2033

- Figure 29: Asia Pacific Food Packaging Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Asia Pacific Food Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Food Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Rest of the World Food Packaging Market Revenue (Million), by Type of Material 2025 & 2033

- Figure 33: Rest of the World Food Packaging Market Revenue Share (%), by Type of Material 2025 & 2033

- Figure 34: Rest of the World Food Packaging Market Revenue (Million), by Packaging Type 2025 & 2033

- Figure 35: Rest of the World Food Packaging Market Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 36: Rest of the World Food Packaging Market Revenue (Million), by Product Type 2025 & 2033

- Figure 37: Rest of the World Food Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 38: Rest of the World Food Packaging Market Revenue (Million), by Application 2025 & 2033

- Figure 39: Rest of the World Food Packaging Market Revenue Share (%), by Application 2025 & 2033

- Figure 40: Rest of the World Food Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Rest of the World Food Packaging Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Food Packaging Market Revenue Million Forecast, by Type of Material 2020 & 2033

- Table 2: Global Food Packaging Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 3: Global Food Packaging Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 4: Global Food Packaging Market Revenue Million Forecast, by Application 2020 & 2033

- Table 5: Global Food Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Food Packaging Market Revenue Million Forecast, by Type of Material 2020 & 2033

- Table 7: Global Food Packaging Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 8: Global Food Packaging Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 9: Global Food Packaging Market Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Global Food Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United States Food Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada Food Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Food Packaging Market Revenue Million Forecast, by Type of Material 2020 & 2033

- Table 14: Global Food Packaging Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 15: Global Food Packaging Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 16: Global Food Packaging Market Revenue Million Forecast, by Application 2020 & 2033

- Table 17: Global Food Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Germany Food Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: France Food Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: United Kingdom Food Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Spain Food Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Food Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Food Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Food Packaging Market Revenue Million Forecast, by Type of Material 2020 & 2033

- Table 25: Global Food Packaging Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 26: Global Food Packaging Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 27: Global Food Packaging Market Revenue Million Forecast, by Application 2020 & 2033

- Table 28: Global Food Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 29: China Food Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Japan Food Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: India Food Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Australia Food Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Rest of Asia Pacific Food Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Global Food Packaging Market Revenue Million Forecast, by Type of Material 2020 & 2033

- Table 35: Global Food Packaging Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 36: Global Food Packaging Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 37: Global Food Packaging Market Revenue Million Forecast, by Application 2020 & 2033

- Table 38: Global Food Packaging Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Food Packaging Market?

The projected CAGR is approximately 4.16%.

2. Which companies are prominent players in the Food Packaging Market?

Key companies in the market include Smurfit Kappa Group plc, WestRock, Berry Global Group, Ball Corporation, Mondi Limited, Tetra Pak, Amcor Plc, Crown Holdings Inc, Schur Flexibles Group, International Papers, Sealed Air Corp, Anchor Packaging Inc, Graham Packaging Company Inc *List Not Exhaustive.

3. What are the main segments of the Food Packaging Market?

The market segments include Type of Material, Packaging Type, Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 367.04 Million as of 2022.

5. What are some drivers contributing to market growth?

Demand for Convenience Foods in Developing Economies; Increasing Demand for Shelf-Life Extension of Foods Accelerating the Food Packaging Market; Trend of Small Households.

6. What are the notable trends driving market growth?

Increasing Demand for Shelf-Life Extension of Foods Accelerating the Food Packaging Market.

7. Are there any restraints impacting market growth?

Stringent Regulations Pertaining to Food Packaging.

8. Can you provide examples of recent developments in the market?

August 2022: Seal Packaging introduced fresh eco-friendly packaging options. The first UKCA-marked plastic-free paper cups, the It's Not Paper bag collection, a workable and ecological replacement for conventional paper bags, and the Compostabowl are just a few of the new, creative goods now being introduced.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Food Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Food Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Food Packaging Market?

To stay informed about further developments, trends, and reports in the Food Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence