Key Insights

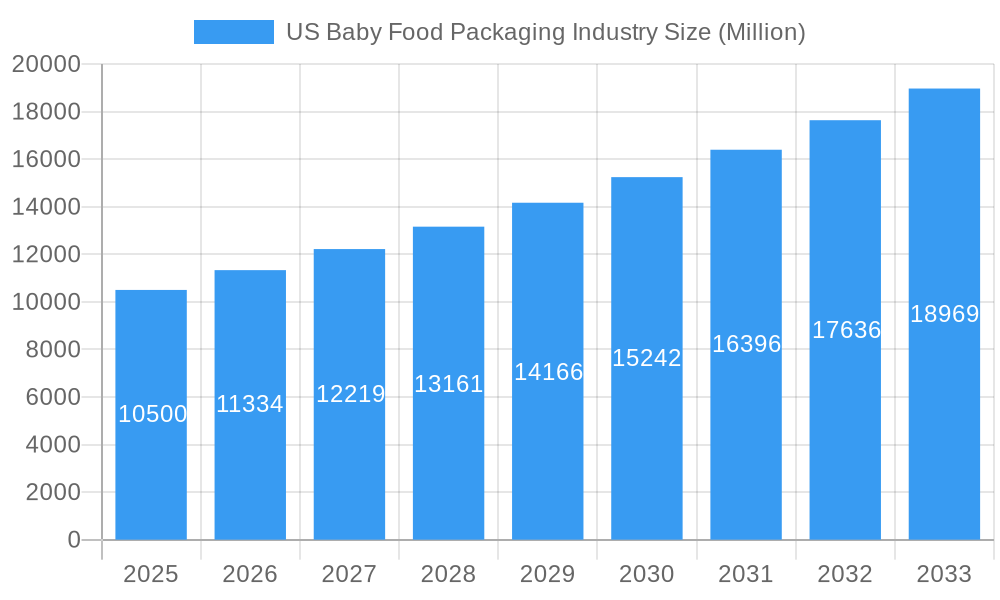

The US baby food packaging market is projected for substantial growth, driven by evolving parental preferences and an increased focus on infant nutrition. With an estimated market size of $77.13 billion in 2025, the industry is expected to expand at a Compound Annual Growth Rate (CAGR) of 7.6% through 2033. This sustained growth is supported by rising birth rates, heightened parental awareness of nutritional quality, and a demand for convenient, safe, and portable packaging. Increasing disposable incomes, particularly in urban areas, further contribute to this upward trajectory as parents invest in premium and specialized baby food options. Innovations in packaging technology, emphasizing extended shelf-life, eco-friendliness, and user-friendliness, are also shaping market dynamics and appealing to contemporary parents.

US Baby Food Packaging Industry Market Size (In Billion)

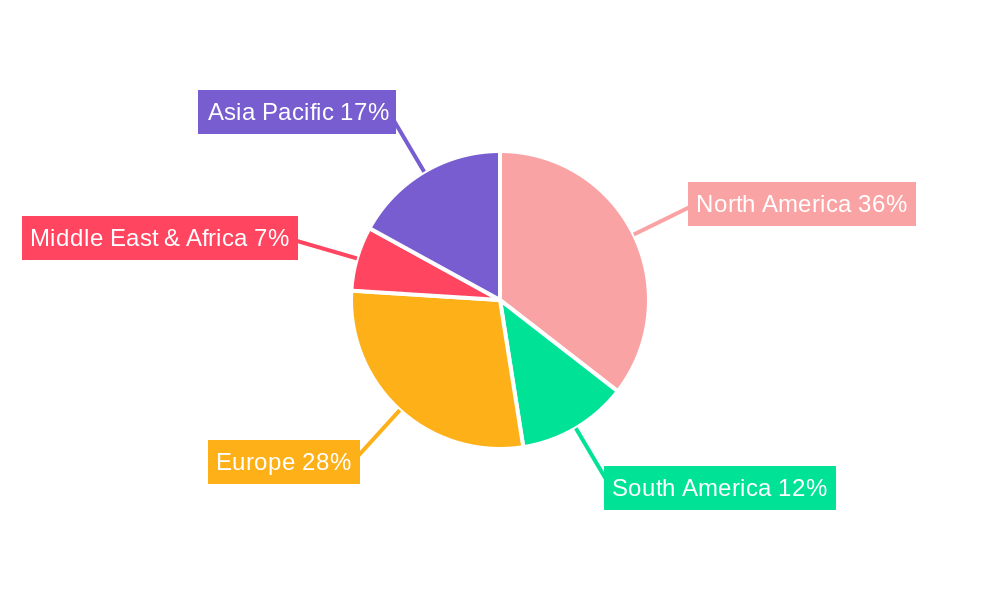

The market's strength is further amplified by the adoption of diverse packaging formats. While glass jars and metal cans remain significant, there is a clear trend towards convenient options like pouches and cartons for ready-to-eat meals and liquid formulas. Plastic packaging is anticipated to retain its dominance due to its lightweight, durable, and cost-effective nature, though environmental concerns are driving innovation in biodegradable and recyclable materials. Paperboard packaging is also gaining traction as a sustainable alternative. Geographically, North America, including the US, Canada, and Mexico, constitutes a major market share, benefiting from advanced healthcare, high consumer spending, and a well-established baby food industry. Leading companies are investing in R&D to deliver innovative, safe, and sustainable packaging solutions that meet stringent industry requirements and evolving consumer demands.

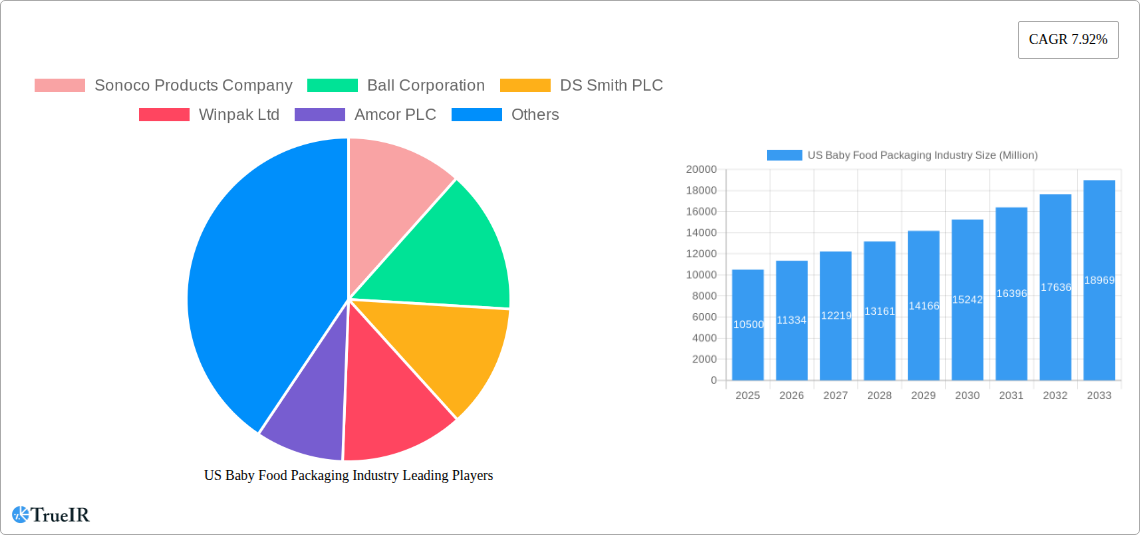

US Baby Food Packaging Industry Company Market Share

US Baby Food Packaging Market Analysis: Size, CAGR, and Forecast (2025-2033)

This report provides a comprehensive analysis of the US Baby Food Packaging industry, offering deep insights for stakeholders. Covering the base year of 2025 and a forecast period to 2033, this study details market evolution, key players, and future trends. The report is optimized for search engines using high-volume keywords such as "baby food packaging solutions," "US baby food market," "sustainable packaging infant nutrition," "plastic baby food containers," "baby food pouches market," and "metal cans baby food."

US Baby Food Packaging Industry Market Structure & Competitive Landscape

The US baby food packaging market exhibits a moderately concentrated structure, with several large-scale players dominating the landscape. Innovation drivers are primarily fueled by evolving consumer demand for convenience, safety, and sustainability, alongside stringent regulatory requirements governing food contact materials. Product substitutes, such as reusable containers and homemade baby food, present a continuous challenge. End-user segmentation reveals a strong reliance on mothers and caregivers as the primary decision-makers, influencing packaging choices based on ease of use and perceived nutritional value. Mergers and acquisitions (M&A) are strategic tools employed by leading companies to expand their market share, diversify product portfolios, and gain access to new technologies. For instance, the last five years have seen an estimated $500 Million in M&A activity within the broader food packaging sector, impacting the baby food segment. Concentration ratios, particularly among top players in plastic and carton packaging, are estimated to be in the range of 60-70%. Key trends shaping the competitive landscape include the increasing adoption of flexible packaging solutions and a growing emphasis on bio-based and recyclable materials.

- Innovation Drivers:

- Demand for shelf-stable and portable packaging.

- Focus on child-safe materials and designs.

- Development of eco-friendly and sustainable packaging options.

- Regulatory Impacts:

- FDA regulations for food contact materials.

- Labeling requirements for allergens and nutritional information.

- Increasing pressure for recyclability and waste reduction.

- M&A Trends:

- Acquisitions aimed at expanding geographical reach.

- Consolidation for economies of scale.

- Strategic partnerships for technological advancements.

US Baby Food Packaging Industry Market Trends & Opportunities

The US baby food packaging market is projected to experience robust growth, driven by a confluence of factors including an increasing birth rate in key demographics and a sustained demand for convenient and safe infant nutrition solutions. Market size is estimated to reach over $7 Billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of approximately 5.5% over the forecast period (2025–2033). Technological shifts are central to this growth, with a significant trend towards the adoption of flexible packaging formats like pouches, which offer superior convenience, extended shelf life, and reduced material usage compared to traditional rigid containers. This shift is further amplified by growing consumer preferences for single-serving portions and on-the-go feeding solutions, directly impacting the demand for innovative pouch designs and associated filling technologies. The competitive dynamics are intensifying, with companies focusing on differentiating through sustainable packaging initiatives, such as the incorporation of post-consumer recycled (PCR) content and the development of compostable or biodegradable materials. Opportunities abound for packaging manufacturers to invest in advanced barrier technologies that enhance product freshness and safety while aligning with environmental consciousness. The market penetration of premium organic baby food products also fuels demand for high-quality, aesthetically pleasing packaging that conveys a sense of naturalness and purity. Furthermore, the increasing adoption of smart packaging solutions, offering features like temperature monitoring or authentication, presents a nascent but promising growth avenue. The sustained focus on child safety, including tamper-evident features and easy-to-open mechanisms, remains a cornerstone of packaging development.

Dominant Markets & Segments in US Baby Food Packaging Industry

The US baby food packaging market is characterized by the dominance of Plastic as the leading material segment. Its versatility, cost-effectiveness, and suitability for various package types, particularly pouches and bottles, contribute significantly to its market leadership. The estimated market share for plastic packaging in the US baby food sector is over 55%. Among package types, Pouches have emerged as the fastest-growing segment, driven by their unparalleled convenience for parents, extended shelf life, and reduced waste. The market for baby food pouches is expected to witness a CAGR of over 6% during the forecast period. Prepared Baby Food holds the largest share within the product segment, reflecting the convenience-oriented lifestyle of modern parents. However, Powder Milk Formula remains a substantial and consistently growing category, necessitating robust and moisture-resistant packaging solutions.

- Leading Region/Country: United States, due to its large population, high disposable income, and developed retail infrastructure.

- Dominant Material Segment: Plastic

- Key Growth Drivers:

- Versatility for various package types (pouches, bottles, jars).

- Cost-effectiveness and lightweight properties.

- Development of advanced barrier plastics for extended shelf life.

- Increasing adoption of PCR content in plastic packaging.

- Key Growth Drivers:

- Dominant Package Type: Pouches

- Key Growth Drivers:

- Exceptional portability and convenience for on-the-go consumption.

- Extended shelf life and preservation of product freshness.

- Reduced material usage and waste generation.

- Growing demand for single-serving formats.

- Key Growth Drivers:

- Dominant Product Segment: Prepared Baby Food

- Key Growth Drivers:

- Convenience and time-saving benefits for busy parents.

- Wide variety of flavors and nutritional options.

- Growing demand for organic and specialty baby food.

- Key Growth Drivers:

- Substantial Product Segment: Powder Milk Formula

- Key Growth Drivers:

- Continued reliance on formula for infant nutrition.

- Need for secure, moisture-resistant, and tamper-evident packaging.

- Innovation in specialized formulas requiring specific packaging attributes.

- Key Growth Drivers:

US Baby Food Packaging Industry Product Analysis

Product innovations in US baby food packaging are largely driven by the pursuit of enhanced convenience, safety, and sustainability. Pouches, a dominant package type, continue to evolve with improved spout designs for easier dispensing and resealability, alongside multi-layer structures offering superior barrier properties. The incorporation of advanced printing technologies allows for vibrant branding and clear nutritional information, crucial for consumer trust. The competitive advantage lies in packaging that not only preserves product integrity but also aligns with parental values, such as eco-friendliness through recycled content or compostable materials. Innovations in plastic formulations are focusing on BPA-free materials and the reduction of virgin plastic usage.

Key Drivers, Barriers & Challenges in US Baby Food Packaging Industry

Key Drivers:

- Technological Advancements: Innovations in materials science, such as advanced barrier films and PCR integration, are crucial. The development of more efficient filling and sealing machinery also drives growth.

- Economic Factors: Rising disposable incomes and a consistent birth rate in the US fuel demand for baby food and its packaging.

- Policy & Regulatory Support: Government initiatives promoting sustainability and food safety indirectly support the demand for compliant and innovative packaging solutions.

Barriers & Challenges:

- Regulatory Hurdles: Stringent food safety regulations and evolving packaging waste legislation (e.g., Extended Producer Responsibility) can increase compliance costs and complexity. For instance, new FDA guidelines on food contact substances require extensive testing.

- Supply Chain Volatility: Fluctuations in raw material prices (e.g., plastics, metals) and global supply chain disruptions can impact production costs and lead times, affecting an estimated 10-15% of manufacturing output.

- Competitive Pressures: Intense competition among packaging manufacturers can lead to price wars and pressure on profit margins, particularly for standard packaging formats. The market faces constant pressure from established players and new entrants.

Growth Drivers in the US Baby Food Packaging Industry Market

Growth in the US baby food packaging market is significantly propelled by technological innovation, particularly in the development of flexible and sustainable packaging solutions. The increasing demand for convenience, such as single-serve pouches and easy-to-open lids, caters to the busy lifestyles of modern parents. Economic factors, including a stable birth rate and rising disposable incomes, directly translate to higher consumer spending on baby food products. Furthermore, evolving consumer preferences for organic, natural, and premium baby food necessitate packaging that conveys these attributes effectively, driving demand for advanced printing and material technologies. Regulatory frameworks that encourage recyclability and the use of post-consumer recycled (PCR) content also act as catalysts for innovation and market expansion.

Challenges Impacting US Baby Food Packaging Industry Growth

The US baby food packaging industry faces considerable challenges, including navigating complex and ever-changing regulatory landscapes concerning food safety and environmental impact. Supply chain disruptions, stemming from global events or material shortages, can significantly impact production costs and timely delivery, affecting an estimated 10-15% of the industry's operational capacity. Intense competitive pressures from a multitude of domestic and international players often lead to price wars and a constant need for differentiation, squeezing profit margins. Consumer demand for truly sustainable packaging, coupled with the technical and economic feasibility of implementing widespread recycling and composting infrastructure, presents a significant hurdle. The cost associated with developing and implementing new, eco-friendly packaging technologies can also be a barrier for smaller manufacturers.

Key Players Shaping the US Baby Food Packaging Industry Market

- Sonoco Products Company

- Ball Corporation

- DS Smith PLC

- Winpak Ltd

- Amcor PLC

- Mondi PLC

- Tetra Pak International (Tetra Laval Group)

- Constantia Flexibles

- Aptar Group

- Berry Global Inc

Significant US Baby Food Packaging Industry Industry Milestones

- May 2022: Sonoco promotes environmentally friendly, flexible packaging, increasing the variety of available options including approaches emphasizing recyclability, composability, and post-consumer recycled content. This development addresses growing consumer and regulatory demand for sustainable solutions.

- April 2022: ProAmpac, a US-based packaging and material science company, introduced retort pouches with improved sustainability for baby and pet food packaging. In response to the rising need for post-consumer recycled (PCR) packaging solutions, new ProActivePCR Retort pouches were introduced. Virgin resin use is restricted by the 30% or more PCR content of these pouches. The company claims that these retort pouches offer the same graphic quality as regular retort pouches, enhancing sustainability without sacrificing brand identity or product freshness. This innovation directly targets the demand for eco-conscious yet high-performance packaging.

Future Outlook for US Baby Food Packaging Industry Market

The future outlook for the US baby food packaging industry is characterized by sustained growth, primarily driven by ongoing innovation in sustainable materials and convenient packaging formats. The increasing consumer demand for eco-friendly products will continue to push manufacturers towards greater adoption of recyclable, compostable, and PCR-based packaging solutions. Technological advancements in barrier properties and shelf-life extension will remain crucial for maintaining product quality and safety. The market will likely see increased investment in flexible packaging solutions, particularly pouches, due to their inherent sustainability advantages and consumer appeal. Strategic collaborations and M&A activities are expected to continue as companies seek to expand their market reach and technological capabilities. Opportunities exist for companies that can effectively balance cost-effectiveness with high-performance, sustainable packaging that meets the evolving needs of parents and regulatory bodies. The market is projected to grow at a CAGR of approximately 5.5% from 2025 to 2033, reaching an estimated market value of over $10 Billion by the end of the forecast period.

US Baby Food Packaging Industry Segmentation

-

1. Material

- 1.1. Plastic

- 1.2. Paperboard

- 1.3. Metal

- 1.4. Glass

-

2. Package Type

- 2.1. Bottles

- 2.2. Metal Cans

- 2.3. Cartons

- 2.4. Jars

- 2.5. Pouches

-

3. Product

- 3.1. Liquid Milk Formula

- 3.2. Dried Baby Food

- 3.3. Powder Milk Formula

- 3.4. Prepared Baby Food

US Baby Food Packaging Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Baby Food Packaging Industry Regional Market Share

Geographic Coverage of US Baby Food Packaging Industry

US Baby Food Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Urbanization Coupled with Busy Lifestyle

- 3.3. Market Restrains

- 3.3.1. Rising Concerns over Eco-friendly Products

- 3.4. Market Trends

- 3.4.1. Plastic is Expected to Hold the Largest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Baby Food Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Plastic

- 5.1.2. Paperboard

- 5.1.3. Metal

- 5.1.4. Glass

- 5.2. Market Analysis, Insights and Forecast - by Package Type

- 5.2.1. Bottles

- 5.2.2. Metal Cans

- 5.2.3. Cartons

- 5.2.4. Jars

- 5.2.5. Pouches

- 5.3. Market Analysis, Insights and Forecast - by Product

- 5.3.1. Liquid Milk Formula

- 5.3.2. Dried Baby Food

- 5.3.3. Powder Milk Formula

- 5.3.4. Prepared Baby Food

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. North America US Baby Food Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. Plastic

- 6.1.2. Paperboard

- 6.1.3. Metal

- 6.1.4. Glass

- 6.2. Market Analysis, Insights and Forecast - by Package Type

- 6.2.1. Bottles

- 6.2.2. Metal Cans

- 6.2.3. Cartons

- 6.2.4. Jars

- 6.2.5. Pouches

- 6.3. Market Analysis, Insights and Forecast - by Product

- 6.3.1. Liquid Milk Formula

- 6.3.2. Dried Baby Food

- 6.3.3. Powder Milk Formula

- 6.3.4. Prepared Baby Food

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. South America US Baby Food Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. Plastic

- 7.1.2. Paperboard

- 7.1.3. Metal

- 7.1.4. Glass

- 7.2. Market Analysis, Insights and Forecast - by Package Type

- 7.2.1. Bottles

- 7.2.2. Metal Cans

- 7.2.3. Cartons

- 7.2.4. Jars

- 7.2.5. Pouches

- 7.3. Market Analysis, Insights and Forecast - by Product

- 7.3.1. Liquid Milk Formula

- 7.3.2. Dried Baby Food

- 7.3.3. Powder Milk Formula

- 7.3.4. Prepared Baby Food

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. Europe US Baby Food Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material

- 8.1.1. Plastic

- 8.1.2. Paperboard

- 8.1.3. Metal

- 8.1.4. Glass

- 8.2. Market Analysis, Insights and Forecast - by Package Type

- 8.2.1. Bottles

- 8.2.2. Metal Cans

- 8.2.3. Cartons

- 8.2.4. Jars

- 8.2.5. Pouches

- 8.3. Market Analysis, Insights and Forecast - by Product

- 8.3.1. Liquid Milk Formula

- 8.3.2. Dried Baby Food

- 8.3.3. Powder Milk Formula

- 8.3.4. Prepared Baby Food

- 8.1. Market Analysis, Insights and Forecast - by Material

- 9. Middle East & Africa US Baby Food Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material

- 9.1.1. Plastic

- 9.1.2. Paperboard

- 9.1.3. Metal

- 9.1.4. Glass

- 9.2. Market Analysis, Insights and Forecast - by Package Type

- 9.2.1. Bottles

- 9.2.2. Metal Cans

- 9.2.3. Cartons

- 9.2.4. Jars

- 9.2.5. Pouches

- 9.3. Market Analysis, Insights and Forecast - by Product

- 9.3.1. Liquid Milk Formula

- 9.3.2. Dried Baby Food

- 9.3.3. Powder Milk Formula

- 9.3.4. Prepared Baby Food

- 9.1. Market Analysis, Insights and Forecast - by Material

- 10. Asia Pacific US Baby Food Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material

- 10.1.1. Plastic

- 10.1.2. Paperboard

- 10.1.3. Metal

- 10.1.4. Glass

- 10.2. Market Analysis, Insights and Forecast - by Package Type

- 10.2.1. Bottles

- 10.2.2. Metal Cans

- 10.2.3. Cartons

- 10.2.4. Jars

- 10.2.5. Pouches

- 10.3. Market Analysis, Insights and Forecast - by Product

- 10.3.1. Liquid Milk Formula

- 10.3.2. Dried Baby Food

- 10.3.3. Powder Milk Formula

- 10.3.4. Prepared Baby Food

- 10.1. Market Analysis, Insights and Forecast - by Material

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Sonoco Products Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ball Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 DS Smith PLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Winpak Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Amcor PLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mondi PLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Tetra Pak international (Tetra Laval Group)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Constantia Flexibles*List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Aptar Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Berry Global Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Sonoco Products Company

List of Figures

- Figure 1: Global US Baby Food Packaging Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America US Baby Food Packaging Industry Revenue (billion), by Material 2025 & 2033

- Figure 3: North America US Baby Food Packaging Industry Revenue Share (%), by Material 2025 & 2033

- Figure 4: North America US Baby Food Packaging Industry Revenue (billion), by Package Type 2025 & 2033

- Figure 5: North America US Baby Food Packaging Industry Revenue Share (%), by Package Type 2025 & 2033

- Figure 6: North America US Baby Food Packaging Industry Revenue (billion), by Product 2025 & 2033

- Figure 7: North America US Baby Food Packaging Industry Revenue Share (%), by Product 2025 & 2033

- Figure 8: North America US Baby Food Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: North America US Baby Food Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America US Baby Food Packaging Industry Revenue (billion), by Material 2025 & 2033

- Figure 11: South America US Baby Food Packaging Industry Revenue Share (%), by Material 2025 & 2033

- Figure 12: South America US Baby Food Packaging Industry Revenue (billion), by Package Type 2025 & 2033

- Figure 13: South America US Baby Food Packaging Industry Revenue Share (%), by Package Type 2025 & 2033

- Figure 14: South America US Baby Food Packaging Industry Revenue (billion), by Product 2025 & 2033

- Figure 15: South America US Baby Food Packaging Industry Revenue Share (%), by Product 2025 & 2033

- Figure 16: South America US Baby Food Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: South America US Baby Food Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe US Baby Food Packaging Industry Revenue (billion), by Material 2025 & 2033

- Figure 19: Europe US Baby Food Packaging Industry Revenue Share (%), by Material 2025 & 2033

- Figure 20: Europe US Baby Food Packaging Industry Revenue (billion), by Package Type 2025 & 2033

- Figure 21: Europe US Baby Food Packaging Industry Revenue Share (%), by Package Type 2025 & 2033

- Figure 22: Europe US Baby Food Packaging Industry Revenue (billion), by Product 2025 & 2033

- Figure 23: Europe US Baby Food Packaging Industry Revenue Share (%), by Product 2025 & 2033

- Figure 24: Europe US Baby Food Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Europe US Baby Food Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa US Baby Food Packaging Industry Revenue (billion), by Material 2025 & 2033

- Figure 27: Middle East & Africa US Baby Food Packaging Industry Revenue Share (%), by Material 2025 & 2033

- Figure 28: Middle East & Africa US Baby Food Packaging Industry Revenue (billion), by Package Type 2025 & 2033

- Figure 29: Middle East & Africa US Baby Food Packaging Industry Revenue Share (%), by Package Type 2025 & 2033

- Figure 30: Middle East & Africa US Baby Food Packaging Industry Revenue (billion), by Product 2025 & 2033

- Figure 31: Middle East & Africa US Baby Food Packaging Industry Revenue Share (%), by Product 2025 & 2033

- Figure 32: Middle East & Africa US Baby Food Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Middle East & Africa US Baby Food Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific US Baby Food Packaging Industry Revenue (billion), by Material 2025 & 2033

- Figure 35: Asia Pacific US Baby Food Packaging Industry Revenue Share (%), by Material 2025 & 2033

- Figure 36: Asia Pacific US Baby Food Packaging Industry Revenue (billion), by Package Type 2025 & 2033

- Figure 37: Asia Pacific US Baby Food Packaging Industry Revenue Share (%), by Package Type 2025 & 2033

- Figure 38: Asia Pacific US Baby Food Packaging Industry Revenue (billion), by Product 2025 & 2033

- Figure 39: Asia Pacific US Baby Food Packaging Industry Revenue Share (%), by Product 2025 & 2033

- Figure 40: Asia Pacific US Baby Food Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Asia Pacific US Baby Food Packaging Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Baby Food Packaging Industry Revenue billion Forecast, by Material 2020 & 2033

- Table 2: Global US Baby Food Packaging Industry Revenue billion Forecast, by Package Type 2020 & 2033

- Table 3: Global US Baby Food Packaging Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 4: Global US Baby Food Packaging Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global US Baby Food Packaging Industry Revenue billion Forecast, by Material 2020 & 2033

- Table 6: Global US Baby Food Packaging Industry Revenue billion Forecast, by Package Type 2020 & 2033

- Table 7: Global US Baby Food Packaging Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 8: Global US Baby Food Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States US Baby Food Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada US Baby Food Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico US Baby Food Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global US Baby Food Packaging Industry Revenue billion Forecast, by Material 2020 & 2033

- Table 13: Global US Baby Food Packaging Industry Revenue billion Forecast, by Package Type 2020 & 2033

- Table 14: Global US Baby Food Packaging Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 15: Global US Baby Food Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Brazil US Baby Food Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Argentina US Baby Food Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America US Baby Food Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global US Baby Food Packaging Industry Revenue billion Forecast, by Material 2020 & 2033

- Table 20: Global US Baby Food Packaging Industry Revenue billion Forecast, by Package Type 2020 & 2033

- Table 21: Global US Baby Food Packaging Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 22: Global US Baby Food Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 23: United Kingdom US Baby Food Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Germany US Baby Food Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: France US Baby Food Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Italy US Baby Food Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Spain US Baby Food Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Russia US Baby Food Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Benelux US Baby Food Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Nordics US Baby Food Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe US Baby Food Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global US Baby Food Packaging Industry Revenue billion Forecast, by Material 2020 & 2033

- Table 33: Global US Baby Food Packaging Industry Revenue billion Forecast, by Package Type 2020 & 2033

- Table 34: Global US Baby Food Packaging Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 35: Global US Baby Food Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Turkey US Baby Food Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Israel US Baby Food Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: GCC US Baby Food Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: North Africa US Baby Food Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: South Africa US Baby Food Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa US Baby Food Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Global US Baby Food Packaging Industry Revenue billion Forecast, by Material 2020 & 2033

- Table 43: Global US Baby Food Packaging Industry Revenue billion Forecast, by Package Type 2020 & 2033

- Table 44: Global US Baby Food Packaging Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 45: Global US Baby Food Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 46: China US Baby Food Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: India US Baby Food Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Japan US Baby Food Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 49: South Korea US Baby Food Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: ASEAN US Baby Food Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 51: Oceania US Baby Food Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific US Baby Food Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Baby Food Packaging Industry?

The projected CAGR is approximately 7.6%.

2. Which companies are prominent players in the US Baby Food Packaging Industry?

Key companies in the market include Sonoco Products Company, Ball Corporation, DS Smith PLC, Winpak Ltd, Amcor PLC, Mondi PLC, Tetra Pak international (Tetra Laval Group), Constantia Flexibles*List Not Exhaustive, Aptar Group, Berry Global Inc.

3. What are the main segments of the US Baby Food Packaging Industry?

The market segments include Material, Package Type, Product.

4. Can you provide details about the market size?

The market size is estimated to be USD 77.13 billion as of 2022.

5. What are some drivers contributing to market growth?

Rapid Urbanization Coupled with Busy Lifestyle.

6. What are the notable trends driving market growth?

Plastic is Expected to Hold the Largest Market Share.

7. Are there any restraints impacting market growth?

Rising Concerns over Eco-friendly Products.

8. Can you provide examples of recent developments in the market?

May 2022 - Sonoco promotes environmentally friendly, flexible packaging. It increased the variety of available options, including approaches emphasizing recyclability, composability, and post-consumer recycled content.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Baby Food Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Baby Food Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Baby Food Packaging Industry?

To stay informed about further developments, trends, and reports in the US Baby Food Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence